The ANKER Report 58

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

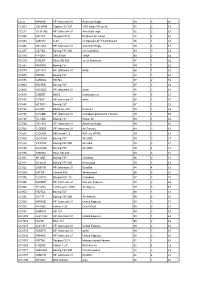

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Airlines Operating in the Pacific Updated 27 October 2020 Company Restrictions Website Air Calin (New Caledonia) See Link

Please note, although we endeavour to provide you with the most up to date information derived from various third parties an d sources, we cannot be held accountable for any inaccuracies or changes to this information. Inclusion of company information in this matrix does not imply any business relationship between the suppli er and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities. Logistics Cluster /WFP maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider. If you have any updates to share, please email them to: [email protected] Airlines Operating in the Pacific Updated 27 October 2020 company restrictions website Air Calin (New Caledonia) See link. https://pf.aircalin.com/en/breaking-news-covid-19 Air Caledonie 24 July: Resumption of all commercial air transport operations https://www.air-caledonie.nc/en/ Air Kiribati See link. http://www.airkiribati.com.ki Air Loyaute (New Caledonia) 24 July: Resumption of all commercial air transport operations https://www.air-loyaute.nc Air Marshall Islands No international flights http://www.airmarshallislands.net Air New Zealand 15 October: Air New Zealand will operate its first flight as part of the Safe Travel Zone with New South Wales on 16 October 2020. https://www.airnewzealand.co.nz/media-releases 26 October: Air Niugini is pleased to announce that it will resume services between Port Moresby and Hong Kong, commencing Wednesday https://www.facebook.com/permalink.php?story_fbid=10164123143590237&id= Air Niuguini 28th October 2020. 88806860236 Air Tahiti 26 October: Rarotonga (Cook Islands): flights suspended due to the border closure www.airtahiti.aero 7 October: Given the continuation of international border entry/exit restrictions following the spread of the viral infection known as COVID- 19, Air Tahiti Nui will need to apply additional flight cancellations. -

Home Airline Info Links Disclaimer Contact About News Detail

SEARCH HOME AIRLINE INFO LINKS DISCLAIMER CONTACT ABOUT NEWS DETAIL Verfasst am: 27.07.09 00:00 AKTUELLE BRITISH AIRWAYS SPECIALS AB WIEN Von: Martin Metzenbauer Wer bis zum 4. August 2009 einen Langstreckenflug zu einer von 33 Auch MAP wendet sich an Brüssel ausgewählten Destinationen auf www.ba.com bucht, kann vom 1. August bis Der österreichische ACMI- und Charterspezialist befürchtet durch den zum 16. August bzw. vom 17. August 2009 bis Zusammenschluss von AUA und Lufthansa eine deutliche Verschlechterung des zum 31. März 2010 zu... mehr » Geschäftsumfeldes. SKYLINK: SONDERBUDGETS, UM KOSTEN ZU DRÜCKEN Wie das Nachrichtenmagazin "profil" in seiner Ausgabe vom 27.07.2009 berichtet, hat der Vorstand der Flughafen Wien AG ab 2007 begonnen, Teile der Skylink-Investitionen in geheime Sonderbudgets auszulagern, um so die offiziellen Baukosten zu... mehr » LAUDA AIR WINTERFLUGPLAN 2009/2010 Das Lauda Air Winterflugprogramm 2009/2010 ist ab sofort buchbar. Neben "Klassikern" wie Antalya, Punta Cana und Funchal stehen auch Sonnenziele in Ägypten und auf den Kanaren am Flugplan. Neu ist ab diesem Winter, dass Kaum ein Thema hat die heimische Luftfahrtlandschaft in den letzten Monaten so bewegt wie es bis zu... mehr » der Verkauf der AUA an die Lufthansa – vielleicht einmal abgesehen von der Diskussion rund um den Skylink. Würden die einen den Deal lieber heute als morgen unter Dach und Fach wissen, sparen andere nicht mit deutlicher Kritik an dem Verkauf. Insbesondere die mögliche NIKI LAUDA WILL OSTSTRECKEN marktbeherrschende Stellung des künftigen AUA-Lufthansa-Konglomerats in Österreich ist so VON AUSTRIAN AIRLINES manchem ein Dorn im Auge. Wie "DerStandard" in der Freitags-Ausgabe So waren in den letzten Monaten vor allem zwei Personen sowohl in den Medien als auch bei meldet, möchte Niki Lauda die Hälfte der der EU-Kommission in Brüssel aktiv unterwegs: Zum einen sorgt sich Robin Hood-Chef Georg Osteuropa-Strecken von der AUA Pommer um den künftigen Bundesländerverkehr, zum anderen will Niki Lauda für seine Airline übernehmen. -

Master Thesis

Master Thesis Sustainability reporting in the airline industry: a comparative case study analysis of four selected European passenger airlines and their countries of registration on the basis of the airlines’ annual reports and sustainability report from 2018 Student: Laura Vani Kesore (s2015323) [email protected] Study program: Public Administration M.Sc. First Supervisor: Prof. Dr. René Torenvlied [email protected] Second Supervisor: Dr. Ringo Ossewaarde [email protected] Master Thesis 24 August 2020 University of Twente, Faculty of Behavioural, Management and Social Sciences Drienerlolaan 5 7522 NB Enschede, NL Abstract Sustainability reporting for airlines is becoming more and more important. The driving forces are the external and internal pressures, such as demand from the public and society, from governments, stakeholders and shareholders, as well as from NGOs, activists, and the industry- intern economic competition between the airlines. Within the scope of this research, the main focus was on the research question: How can the variation in the claims of sustainable measures reported in the 2018 annual reports and sustainability reports by four different European airlines be explained from the characteristics of the airlines and of the countries in which the airlines are registered?. The ecosystem for the conducted analyses consists of four airlines from four different countries in the European Union. Seven sustainability parameters were chosen in order to objectively analyze the sustainability reporting of the airlines and of their countries of registrations. The parameters are: (I) alternative fuel, (II) CORSIA, (III) aviation tax, (IV) aircraft age, (V) aircraft design, (VI) Dow Jones Sustainability Index, and (VII) atmosfair Airline Index. -

What Next for Alitalia After Air France-KLM Snub? Is Not a Normal Aircraft,” He Said

ISSN 1718-7966 SEPTEMBER 30, 2013 / VOL. 408 WEEKLY AVIATION HEADLINES Read by thousands of aviation professionals and technical decision-makers every week www.avitrader.com WORLD NEWS Lion Air in CSeries talks Lion Air, the Indonesian budget carrier, is in talks with Canadian airframer Bombardier over a po- Alitalia is facing a cash tential order for up to 100 of its crunch after larger CSeries CS300 jets, with major share- negotiations set to be finalised holder Air at the UK’s Farnborough Airshow France-KLM voted against next July. In meetings with Bom- a capital bardier Commercial Aircraft boss increase Mike Arcamone last week, Lion Air president Rusdi Karana said Alitalia the CSeries was ‘beyond his ex- pectation: “What they’re doing What next for Alitalia after Air France-KLM snub? is not a normal aircraft,” he said. Move to keep carrier under Italian control would be ‘hidden nationalization’ “This one is very special.” It is understood that Export Develop- The future is looking increasingly with its own internal troubles, last Industry minister Flavio Zamonato ment Canada would be involved grim for Italian flag carrier Alita- week announcing that it no long- told reporters that the government in financing the deal. lia after Air France-KLM, its larg- er expected to reach its break- was in talks with banks and other est shareholder, last week voted even target this year and that it investors in the domestic market $15.6bn for Airbus in China against proposals to launch a would slash a further 2,800 jobs. that would keep the company un- capital increase of at Airbus said it won orders worth der Italian control. -

CORSIA Aeroplane Operator to State Attributions

CORSIA Aeroplane Operator to State Attributions This is a preliminary version of the ICAO document “CORSIA Aeroplane Operator to State Attributions” that has been prepared to support the timely implementation of CORSIA from 1 January 2019. It contains aeroplane operators with international flights, and to which State they are attributed, based on information reported by States by 30 November 2018 in accordance with the Environmental Technical Manual (Doc 9501), Volume IV – Procedures for Demonstrating Compliance with the CORSIA, Chapter 3, Table 3-1. Terms used in the tables on the following pages are: • Aeroplane Operator Name is the full name of the aeroplane operator as reported by the State; • Attribution Method is one of three options as selected by the State: "ICAO Designator", "Air Operator Certificate" or "Place of Juridical Registration" in accordance with Annex 16 – Environmental Protection, Volume IV – Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), Part II, Chapter 1, 1.2.4; and • Identifier is associated with each Attribution Method as reported by the State: o If the Attribution Method is "ICAO Designator", the Identifier is the aeroplane operator's three-letter designator according to ICAO Doc 8585; o If the Attribution Method is "Air Operator Certificate", the Identifier is the number of the AOC (or equivalent) of the aeroplane operator; o If the Attribution Method is "Place of Juridical Registration", the Identifier is the name of the State where the aeroplane operator is registered as juridical person. Disclaimer: The designations employed and the presentation of the material presented herein do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

Non-Contracted Airline Commissions

Non-Contracted Airline Commissions AIRLINE INFORMATION AND PUBLISHED FARE INCENTIVES: visit www.HickoryTravel.com for more information AIRLINE CODE HOME HUB GDS ACCESS PAYMENT COMM% TELEPHONE EMAIL AEROCON A4 BOLIVIA SRZ S CASH 5% 877 635 2030 [email protected] AEROMAR VW MEXICO MEX A, S, P, V VI/MC/TP/CASH 877 971 0919 [email protected] AIGLE AZUR ZI FRANCE CDG/ORY A, S, P, V VI/MC/AX/CASH 877 915 7234 [email protected] AIR ASTANA KC KAZAKHSTAN TSE A, S, P, V VI/MC/AX/TP/CASH 888 855 1557 [email protected] AIR BOTSWANA BP BOTSWANA GBE A, S VI/MC/CASH 5% 201 526 7614 [email protected] AIR BURKINA 2J BURKINA OUA A, S, P CASH 5% 877 958 2577 [email protected] AIR GREENLAND GL GREENLAND SFJ A,.S, V CASH 877 977 4788 [email protected] AIR MEDITERRANEE ML FRANCE CDG A, P CASH 201 204 5506 [email protected] AIR NAMIBIA SW NAMIBIA WDH A, S, P, V VI/MC/AX/CASH 877 496 9893 [email protected] AIR RAROTONGA GZ COOK ISLANDS RAR S CASH 5% 201 526 7806 [email protected] AIR SEYCHELLES HM SEYCHELLES SEZ A, S, P, V VI/MC/AX/DN/TP/CASH 1% 201 526 7842 [email protected] AIRCALIN SB NEW CALEDONIA NOU A, S, P, V VI/MC/AX/TP/CASH 5% 800 254 7251 [email protected] ANDES LINEAS AEREAS OY ARGENTINA SLA A, S CASH 5% 201 526 7241 [email protected] ANTRAK AIR O4 GHANA ACC CASH 5% 201 526 7241 [email protected] ARKIA IZ ISRAEL TLV A, S, P VI/MC/CASH 7% 201 526 7807 [email protected] ASERCA R7 VENEZUELA CCS A, S TP/CASH 201 526 7620 [email protected] ASKY AIRLINES KP TOGO LFW A, S CASH 5% 201 204 5504 -

TRACE Case Studies Agenda

ESMAP KNOWLEDGE EXCHANGE FORUM WITH BILATERAL AGENCIES AFD, PARIS, NOVEMBER 27-28, 2012 IVAN JAQUES TRACE Case Studies Agenda WHERE HAS TRACE BEEN DEPLOYED? HOW IS TRACE HELPING IDENTIFY KEY SECTORS AND ACTIONS? WHAT ARE THE KEY ISSUES? WHAT HAVE WE LEARNT? TRACE AS PART OF A COMPREHENSIVE STRATEGY: - Europe and Central Asia: Sustainable Cities Initiative - East Asia and Pacific: Sustainable Energy and Emissions Planning (SUEEP) - Latin America and the Caribbean: Rio Low Carbon Development Program - Africa: Urban Energy Efficiency Development in Sub-Saharan Africa 2 TRACE DEPLOYMENT 3 TRACE deployment Completed In progress 4 5 HOW IS TRACE HELPING IDENTIFY KEY SECTORS AND ACTIONS? EXAMPLES IN ECA 6 Urban Transport Source: ECA Sustainable Cities Initiative Urban Transport Many cities in ECA are faced with widespread deterioration of existent public transport infrastructure and dramatic increase in number of private vehicles Trips in Public Transport in Macedonia Source: Statistical Yearbook of the Republic of Macedonia, 2011 …Tbilisi (Georgia) completely lost its tram network Source: ECA Sustainable Cities Initiative Urban Transport Often, existent public transport infrastructure is old and energy inefficient Public Transport Energy Consumption in Tbilisi Source: ECA Sustainable Cities. 2011. Improving Energy Efficiency in Tbilisi: TRACE Study Source: ECA Sustainable Cities Initiative Urban Transport City streets and sidewalks are increasingly chocked up with private cars Congestion in Tbilisi On-sidewalk Parking in Skopje Source: -

Travel Information Örnsköldsvik Airport

w v TRAVEL INFORMATION TO AND FROM OER ÖRNSKÖLDSVIK AIRPORT // OVERVIEW Two airlines fly to Örnsköldsvik AirLeap fly from Stockholm Arlanda and BRA-Braathens fly from 1 Stockholm Bromma. 32 flights a week on average Many connections possible via 2 Stockholm’s airports. Örnsköldsvik is located 25 km from the airport, only 20 minutes 3 with Airport taxi or rental car. Book your travel via Air Leap (LPA) www.airleap.se BRA-Braathens Regional 4 Airlines (TF) www.flygbra.se CONNECTIONS WITH 2 AIRLINES GOOD CONNECTIONS good flight connections is essential for good business relationships and Örnsköldsvik Airport fulfills that requirement. As of 2 February, two airlines operate the airport, Air Leap and BRA – Braathens Regional Airlines. Air Leap (IATA code LPA) operates between Örnsköldsvik and Stockholm Arlanda Airport (ARN) and BRA (IATA code TF) between Örnsköldsvik och Stockholm Bromma Airport (BMA). Together the airlines offer on average 32 flights per week, in each direction. air leap operate Saab2000 with 50 Finnair is also a member of ”One minutes flight time to Örnsköldsvik. World Alliance” which gives bene- At Arlanda you find Air Leap at Termi- fits for its members and One World nal 3, with walking distance to Termi- members when travelling on flights nal 2 (SkyTeam, One World airlines) connected to the Finnair Network. and to Terminal 5 (Star Alliance air- Enclosed is a list of some of the lines). Tickets for connecting flights more common connections that are need to be purchased separately and currently possible with one ticket checked luggage brought through and checked in baggade to your customs at Arlanda and checked-in final destination. -

551 236 33,43% 3 172 095 29,48% 872 040 52,89% 5 927 313 55,09

Domestic and international scheduled operations - passenger traffic by carriers in the fourth quarter of 2019 and 2020 2020 2019 market market Carrier number passengers share number passengers share LOT Polish Airlines 1 514 194 31,18% 1 3 018 259 28,05% Ryanair 2 490 672 29,76% 2 2 960 873 27,52% Wizz Air 3 351 334 21,31% 3 2 342 228 21,77% KLM Royal Dutch Airlines 4 74 096 4,49% 7 167 647 1,56% Lufthansa 5 62 945 3,82% 4 533 641 4,96% Enter Air 6 36 871 2,24% 8 153 836 1,43% EasyJet 7 12 439 0,75% 5 243 676 2,26% Norwegian Air Shuttle 8 11 388 0,69% 6 201 750 1,88% British Airways 9 11 210 0,68% 12 79 209 0,74% Air France 10 10 186 0,62% 11 84 697 0,79% Belavia 11 10 026 0,61% 30 17 273 0,16% Emirates 12 10 022 0,61% 14 61 242 0,57% SAS 13 9 676 0,59% 9 114 174 1,06% Swiss International Air Lines 14 8 601 0,52% 13 63 360 0,59% Turkish Airlines (THY) 15 8 581 0,52% 26 24 692 0,23% TAP Portugal 16 3 986 0,24% 22 28 676 0,27% Austrian Airlines 17 3 791 0,23% 18 49 944 0,46% Aegean Airlines 18 3 107 0,19% 24 25 665 0,24% Eurowings (Germanwings) 19 2 675 0,16% 21 44 874 0,42% Finnair 20 2 621 0,16% 15 58 297 0,54% Transavia Airlines 21 2 493 0,15% 23 27 163 0,25% Air China 22 2 486 0,15% 33 15 270 0,14% SunExpress 23 1 749 0,11% 37 2 471 0,02% Jet2.com 24 929 0,06% 20 46 394 0,43% Qatar Airways 25 922 0,06% 10 86 279 0,80% Other carriers 1 890 0,11% 307 289 2,86% Polish carriers* 551 236 33,43% 3 172 095 29,48% LCC** 872 040 52,89% 5 927 313 55,09% Total passengers 1 648 890 10 758 879 Source: Civil Aviation Authority of Republic of Poland, data obtained from Polish airports, Warsaw, May 2021 *Polish carriers: LOT Polish Airlines, Enter Air, Smartwings (d. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Vea Un Ejemplo

3 To search aircraft in the registration index, go to page 178 Operator Page Operator Page Operator Page Operator Page 10 Tanker Air Carrier 8 Air Georgian 20 Amapola Flyg 32 Belavia 45 21 Air 8 Air Ghana 20 Amaszonas 32 Bering Air 45 2Excel Aviation 8 Air Greenland 20 Amaszonas Uruguay 32 Berjaya Air 45 748 Air Services 8 Air Guilin 20 AMC 32 Berkut Air 45 9 Air 8 Air Hamburg 21 Amelia 33 Berry Aviation 45 Abu Dhabi Aviation 8 Air Hong Kong 21 American Airlines 33 Bestfly 45 ABX Air 8 Air Horizont 21 American Jet 35 BH Air - Balkan Holidays 46 ACE Belgium Freighters 8 Air Iceland Connect 21 Ameriflight 35 Bhutan Airlines 46 Acropolis Aviation 8 Air India 21 Amerijet International 35 Bid Air Cargo 46 ACT Airlines 8 Air India Express 21 AMS Airlines 35 Biman Bangladesh 46 ADI Aerodynamics 9 Air India Regional 22 ANA Wings 35 Binter Canarias 46 Aegean Airlines 9 Air Inuit 22 AnadoluJet 36 Blue Air 46 Aer Lingus 9 Air KBZ 22 Anda Air 36 Blue Bird Airways 46 AerCaribe 9 Air Kenya 22 Andes Lineas Aereas 36 Blue Bird Aviation 46 Aereo Calafia 9 Air Kiribati 22 Angkasa Pura Logistics 36 Blue Dart Aviation 46 Aero Caribbean 9 Air Leap 22 Animawings 36 Blue Islands 47 Aero Flite 9 Air Libya 22 Apex Air 36 Blue Panorama Airlines 47 Aero K 9 Air Macau 22 Arab Wings 36 Blue Ridge Aero Services 47 Aero Mongolia 10 Air Madagascar 22 ARAMCO 36 Bluebird Nordic 47 Aero Transporte 10 Air Malta 23 Ariana Afghan Airlines 36 Boliviana de Aviacion 47 AeroContractors 10 Air Mandalay 23 Arik Air 36 BRA Braathens Regional 47 Aeroflot 10 Air Marshall Islands 23