WORLD AVIATION Yearbook 2013 EUROPE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Do Regional Airlines in Eastern Europe Have the Right to Survive in the European Single Sky Environment?

AVIATION ISSN 1648-7788 / eISSN 1822-4180 2017 Volume 21(4): 155–161 doi:10.3846/16487788.2017.1415226 DO REGIONAL AIRLINES IN EASTERN EUROPE HAVE THE RIGHT TO SURVIVE IN THE EUROPEAN SINGLE SKY ENVIRONMENT? Sven KUKEMELK1, 2 1Nordic Aviation Group, Sepise 1, Tallinn, 11415, Estonia 2Tallinn University of Technology, Department of Economics and Business Administration, Akadeemia tee 3, Tallinn, 12618, Estonia E-mail: [email protected] Received 15 June 2017; accepted 06 December 2017 Sven KUKEMELK Education: Estonian Aviation Academy (2010), Vilnius Gediminas Technical University (2012), Tallinn University of Technology, PhD studies (since 2013). Experience: 7 years of experience in network planning and aviation business analysis. Research interests: network planning, fleet development, commercial management. Present position: CEO of Nordic Aviation Advisory, Executive Director for Business Development at Nordic Aviation Group. Abstract. The European aviation market can be characterised by extreme growth and turbulence ever since the markets were deregulated and low cost carriers emerged on the continent. Initially the biggest toll was paid by main legacy carriers when low costs emerged on trunk routes, which lead to the bankruptcy of Sabena, Swiss airlines and Spanair. However, once big legacy carriers started merging and creating more alliances, sustainability was once again reached. Despite this, as low cost carriers entered the Eastern-European market and looked to stimulate even smaller regional routes, smaller carriers started to suffer. This article is assessing the status quo of the current European region- al aviation, highlighting the recent trends and ultimately coming to a conclusion that regional airlines can be sustaina- ble provided that certain key criteria have been met. -

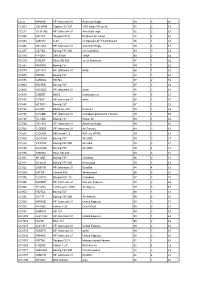

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Download Ralph Anker's CONNECT Presentation

Setting the scene: The European market CONNECT – Vilnius Monday 14 March 2016 Ralph Anker Chief Analyst anna.aero [email protected] What’s coming up … • Developments in Europe 2014-2016 • Passenger demand by country 2015 • European trends in S16 • Baltic states and airBaltic • LCC trends • easyJet, Ryanair and Wizz Air • Exchange rates • GDP forecasts • Conclusions 2 Developments in Europe 2014 • Legacy carriers still struggling for profitability • Etihad’s involvement in European carriers – Aer Lingus, Air Serbia, airberlin, Alitalia (pending) • Ryanair opens new bases including Athens (ATH), Brussels (BRU), Lisbon (LIS) and Rome (FCO) • easyJet opens new bases in Hamburg and Naples • Vueling grows outside of Spain (turns 10 on 1 July) • Norwegian’s long-haul expansion with 787s • germanwings completing Lufthansa network transfer • Wizz Air up to 20 bases (10th birthday celebrated) • Turkish Airlines still growing at IST – Growing secondary hub at SAW (taking on Pegasus) 3 Developments in Europe 2015 • Cheap fuel!!! • Many legacy carriers still struggling for profitability • Alitalia rescue by Etihad Airways approved • Lufthansa/germanwings/Eurowings evolution • IAG trying to acquire Aer Lingus • Gone: Cyprus Airways, eurolot, Air Lituanica, Estonian Air • Mixed response to growth of MEB3 carriers • Ryanair new bases in Berlin SXF, Bratislava, Copenhagen and Ponta Delgado • easyJet new bases in Amsterdam, Porto • Wizz Air new bases in Debrecan, Kosice, Lublin • Turkish Airlines still growing – over 240 routes 4 Developments in Europe -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

14 Seduta Di Martedì 24 Ottobre 1989

SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 257 14 SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 PRESIDENZA DEL PRESIDENTE DELLA IX COMMISSIONE DELLA CAMERA ANTONIO TESTA SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 259 La seduta comimcia alle 15,45. tenzione degli impianti visivi relativi alla navigazione aerea. (Le Commissioni approvano il processo Nella relazione abbiamo cercato di verbale della seduta precedente). dare un quadro sintetico della situazione concernente la gestione portuale. Il primo dato che emerge è che nel nostro paese Audizione dei rappresentanti dell'Assaero- esistono aeroporti gestiti in forma totale porti e della GESAP. ed altri in cui i gestori aeroportuali hanno solo la responsabilità dei servizi, PRESIDENTE. L'ordine del giorno ma non della gestione complessiva. Si reca il seguito dell'indagine conoscitiva tratta di un primo problema che segna• sulla sicurezza del volo. Nella seduta liamo alla vostra attenzione. In prospet• odierna sono previste le audizioni dei tiva sarebbe di aiuto al miglioramento rappresentanti dell'Assaeroporti e della del sistema complessivo una chiara iden• GESAP, dell'Alisarda, delle compagnie di tificazione, anche in termini di responsa• terzo livello, del presidente dell'Aeroclub bilità, di chi deve gestire l'aeroporto e di d'Italia, dell'ANIGAM e delle associazioni chi deve, invece, svolgere un'azione di co• dei consumatori. ordinamento ed effettuare un'opera di in• Nell'ambito dell'audizione dei rappre• dirizzo e di controllo, anche in relazione sentanti dell'Assaeroporti e della Gesap, ai piani nazionali. partecipano alla seduta odierna il dottor Attualmente, sono solo otto gli aero• Domenico Cempella, l'ingegner Francesco porti a gestione totale, nei quali cioè il Di Martino, l'ingegner Giuseppe Maritano, gestore ha la responsabilità del funziona• il comandante Agostino Ferrari e il dottor mento complessivo dello scalo. -

Aviation Industry Agreed in 2008 to the World’S First Set of Sector-Specific Climate Change Targets

CONTENTS Introduction 2 Executive summary 3 Key facts and figures from the world of air transport A global industry, driving sustainable development 11 Aviation’s global economic, social and environmental profile in 2016 Regional and group analysis 39 Africa 40 Asia-Pacific 42 Europe 44 Latin America and the Caribbean 46 Middle East 48 North America 50 APEC economies 52 European Union 53 Small island states 54 Developing countries 55 OECD countries 56 Least-developed countries 57 Landlocked developing countries 58 National analysis 59 A country-by-country look at aviation’s benefits A growth industry 75 An assessment of the next 20 years of aviation References 80 Methodology 84 1 AVIATION BENEFITS BEYOND BORDERS INTRODUCTION Open skies, open minds The preamble to the Chicago Convention – in many ways aviation’s constitution – says that the “future development of international civil aviation can greatly help to create and preserve friendship and understanding among the nations and peoples of the world”. Drafted in December 1944, the Convention also illustrates a sentiment that underpins the construction of the post-World War Two multilateral economic system: that by trading with one another, we are far less likely to fight one another. This pursuit of peace helped create the United Nations and other elements of our multilateral system and, although these institutions are never perfect, they have for the most part achieved that most basic aim: peace. Air travel, too, played its own important role. If trading with others helps to break down barriers, then meeting and learning from each other surely goes even further. -

Industry Overview GEO.Pdf

საქართველოს ტურიზმის ინდუსტრიის მიმოხილვა 2012 საქართველოს ტურიზმის ეროვნული ადმინისტრაცია თბილისი, სანაპიროს ქ. 44; ტელ: +995 32 243699; ელ. ფოსტა: [email protected] 1 1. მოკლე მიმოხილვა ტურიზმი ერთ-ერთი ყველაზე სწრაფად მზარდ წლამდე 0.12%-დან 0.29%-მდე გაიზარდა. ბოლო სამი ინდუსტრიას წარმოადგენს მსოფლიო მასშტაბით. 2011 წლის სტატისტიკა აჩვენებს, რომ საერთაშორისო წელს, ტურიზმის წილმა მსოფლიო მთლიან შიდა მოგზაურების უდიდესი ნაწილი ივლისსა და აგვისტოში პროდუქტში 9% შეადგინა, რაც 6 ტრილიონ დოლარს სტუმრობს საქართველოს. თურქეთი, აზერბაიჯანი და აღემატება. აღნიშნულ სექტორში 255 მილიონზე მეტი სომხეთი მოგზაურთა რაოდენობის მხრივ პირველ ადამიანი მუშაობს, რაც მსოფლიო მასშტაბით დასაქმების სამეულს წარმოადგენს. ამ ქვეყნებზე საქართველოში 8.7%-ს შეადგენს. მოსალოდნელია, რომ ტურიზმის საერთაშორისო მოგზაურების დაახლოებით 76% ინდუსტრიის ზრდა გაგრძელდება საშუალოდ 4%-იანი მოდის. წლიური მატების ტემპით და უახლოეს წლებში სასტუმროების ბაზარზე ამჟამად აჭარის ზღვისპირა მთლიანი შიდა პროდუქტის 10%-ს, ანუ დაახლოებით 10 რეგიონი და თბილისი დომინირებს. სულ საქართველოს ტრილიონ დოლარს გაუტოლდება. საერთაშორისო ტერიტორიაზე 1051 განთავსების საშუალებაა 34 751 მოგზაურების რაოდენობა 2011 წელს 4.6%-ით გაიზარდა საწოლი ადგილით. საწოლების რაოდენობის მხრივ და 980 მილიონი შეადგინა. ამ უკანასკნელი პირველ ადგილზე აჭარის რეგიონია. მათი რაოდენობის მაჩველებლის 2012 წლის მოსალოდნელი ზრდის ტემპი 63% სასტუმროებზე მოდის. შემდეგ არის სასტუმრო 3-დან 4%-მდე მერყეობს და UNWTO-ს ვარაუდით ის 1 სახლები (16%) და საოჯახო სასტუმროები (16%). ბოლო მილიარდს გაუტოლდება. გარდა ამისა, UNWTO პერიოდში მოგზაურების რაოდენობის -

To Readers of the Attached Code-Share List

TO READERS OF THE ATTACHED CODE-SHARE LIST: The U.S. Air Carrier Licensing Division’s code-share list is an informal compilation of code-share relationships between U.S. and foreign air carriers for the sole purpose of transporting passengers, mail and property. As such, it does not represent a complete compilation of all code shares e.g. cargo and mail only. New code-share relationships are continually being negotiated, and the ones reflected in the attached listing may or may not be still in place or be of a continuing nature. Similarly, the list may not reflect all existing code shares of a particular type, or all existing types of code shares. This list is not an official document of the Department of Transportation and, accordingly, should not be relied upon or cited as such. NOTE: THIS LIST IS COMPRISED OF ONLY THOSE CARRIERS WHOSE CODE-SHARE RELATIONSHIPS ARE OF A NEW OR CONTINUING BASIS. DORMANT CODE-SHARE RELATIONSHIPS TO THE EXTENT KNOWN HAVE BEEN DELETED. Block descriptions of certain code-share arrangements approved for the same term may have been compressed into one block description to conserve space. If the authorities are not new or changed, but only compressed, the compressed descriptions will not appear in bold type. Carriers must notify the Department no later than 30-day before they begin any new code-share service under the code-share services authorized. This report is current through March 31, 2019. Changes from the previous reports are noted in bold type. Regional carriers operating for for large carriers (e.g. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Airline Business Daily3

Airline Business Daily From NEWS FROM IATA AGM iN SEOUL l MONDAY 3 JUNE 2019 De Juniac sees above IATA to head cost-of-capital returns 3 in 2019, but only just to Amsterdam for 2020 AGM IATA will hold the 76th annual general meeting in Amster- dam in 2020, the association announced yesterday. The AGM will be held from 21-23 June 2020 in the Dutch city. KLM, which in October marks its 100th anniversary, will be the host airline. “For me it is an honour that Amsterdam has been decided to be the place for the IATA AGM in 2020 and at KLM we are proud to be the host air- line,” says KLM chief executive Pieter Elbers. “Hosting the AGM in the year of our 100th anniversary is very special. BillyPix “Having the AGM in Am- sterdam next year provides a great opportunity to embrace co-operation and to work to- PROFITS SQUEEZE gether in the field of sustaina- bility as a licence to operate Outlook for 2019 cut by a fifth to $28 billion as fuel costs and slowing demand take toll and as a licence to grow.” It marks the third time that ATA director general Alexan- also been revised downwards to as the US-China trade war inten- IATA will have held its annual Idre de Juniac warned that the $30 billion. sifies. This primarily impacts the meeting in the Netherlands airline sector’s hard won ability “The business environment for cargo business, but passenger and the first time since to create value for investors is at airlines has deteriorated with traffic could also be impacted as Amsterdam hosted the event risk after downgrading industry rising fuel prices and a substan- tensions rise.” back in 1969. -

Putin's Syrian Gambit: Sharper Elbows, Bigger Footprint, Stickier Wicket

STRATEGIC PERSPECTIVES 25 Putin’s Syrian Gambit: Sharper Elbows, Bigger Footprint, Stickier Wicket by John W. Parker Center for Strategic Research Institute for National Strategic Studies National Defense University Institute for National Strategic Studies National Defense University The Institute for National Strategic Studies (INSS) is National Defense University’s (NDU’s) dedicated research arm. INSS includes the Center for Strategic Research, Center for Complex Operations, Center for the Study of Chinese Military Affairs, and Center for Technology and National Security Policy. The military and civilian analysts and staff who comprise INSS and its subcomponents execute their mission by conducting research and analysis, publishing, and participating in conferences, policy support, and outreach. The mission of INSS is to conduct strategic studies for the Secretary of Defense, Chairman of the Joint Chiefs of Staff, and the unified combatant commands in support of the academic programs at NDU and to perform outreach to other U.S. Government agencies and the broader national security community. Cover: Admiral Kuznetsov aircraft carrier, August, 2012 (Russian Ministry of Defense) Putin's Syrian Gambit Putin's Syrian Gambit: Sharper Elbows, Bigger Footprint, Stickier Wicket By John W. Parker Institute for National Strategic Studies Strategic Perspectives, No. 25 Series Editor: Denise Natali National Defense University Press Washington, D.C. July 2017 Opinions, conclusions, and recommendations expressed or implied within are solely those of the contributors and do not necessarily represent the views of the Defense Department or any other agency of the Federal Government. Cleared for public release; distribution unlimited. Portions of this work may be quoted or reprinted without permission, provided that a standard source credit line is included. -

American Airlines Inflight Magazine November 2018

American airlines inflight magazine november 2018 Continue This article needs additional quotes to verify. Please help improve this article by adding quotes to reliable sources. Non-sources of materials can be challenged and removed. Find sources: Airborne Magazine - News Newspaper Book Scientist JSTOR (February 2012) (Learn how and when to delete this template message) Issue of Navi, Air Canada's onboard business class magazine. An on-board magazine (or flight log) is a free magazine distributed through the airline's seats or in the airport lounge. Review Many airlines or several key content establishment companies produce on-board logs to provide detailed information about their fleet, as well as articles about destinations or other interesting travel information and destinations. Publishing and media are a niche in the world of magazines. Airline names control distribution costs, and readership figures come from existing and ever-increasing passenger traffic. Most airlines use outside publishers to produce their magazines, and ink is now the world's leading company in the sector. In a recent Harris Poll, 94% of business passengers read airline magazines seat in front of them, and readers average about 30 minutes of flying with magazines, according to a 2009 Arbitron study. Despite the challenges facing the publishing industry, it is a healthy sector, and on a large scale, onboard magazines have suffered less than magazines in general. While the quality of magazines on board varies from carrier to carrier, their upscale, valuable and captivating readers appeal to advertisers, in all sectors including luxury manufacturers, car manufacturers, beauty and fashion brands, as well as global destinations.