Business Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

13-0399 JBM Journal Special Issue Vol 19.Indd

Jeffrey A. Sonnenfeld 59 Steve Jobs’ Immortal Quest and the Heroic Persona Jeffrey A. Sonnenfeld Yale University October 2011 was a month of historic milestones for Apple. At the end of the prior month, on Tuesday, September 27, Apple sent media invitations for a press event to be held October 4, 2011 at 10:00 am at the Cupertino Headquarters for a major announcement. Several prominent industry analysts proclaimed with hopeful optimism that the firm would announce the return of Apple founder Steve Jobs. Sadly, Steve Jobs did not appear for what turned out to be a product announcement of the iPhone 4S. In fact, Jobs had stepped down as CEO on January 17, 2011, a year and a half after returning from medical leave. He stated that Tim Cook, Apple’s Chief Operating Officer, would run day-to-day operations as he had previously done during Jobs’ 2009 medical leave. The analysts’ wishful thinking had some basis in more than cult like denial of Steve Jobs’ mortality. In fact, despite that medical leave, Jobs had returned for the iPad 2 launch on March 2 and the iCloud introduction on June 6. The analysts were among many constituents around the world who were to be tragically disappointed. Jobs actually had resigned as CEO on August 22, 2011 saying, “I have always said if there ever came a day when I could no longer meet my duties and expectations as Apple’s CEO, I would be the first to let you know. Unfortunately, that day has come” (Isaacson, 2011). Six weeks later, a day after the new iPhone press conference, he died (Isaacson, 2011). -

NASD Notice to Members 99-46

Executive Summary $250, and two or more Market NASD Effective July 1, 1999, the maximum Ma k e r s . Small Order Execution SystemSM (S O E S SM ) order sizes for 336 Nasdaq In accordance with Rule 4710, Nas- Notice to National Market® (NNM) securities daq periodically reviews the maxi- will be revised in accordance with mum SOES order size applicable to National Association of Securities each NNM security to determine if Members Dealers, Inc. (NASD®) Rule 4710(g). the trading characteristics of the issue have changed so as to warrant For more information, please contact an adjustment. Such a review was 99-46 ® Na s d a q Market Operations at conducted using data as of March (203) 378-0284. 31, 1999, pursuant to the aforemen- Maximum SOES Order tioned standards. The maximum Sizes Set To Change SOES order-size changes called for Description by this review are being implemented July 1, 1999 Under Rule 4710, the maximum with three exceptions. SOES order size for an NNM security is 1,000, 500, or 200 shares, • First, issues were not permitted to depending on the trading characteris- move more than one size level. For Suggested Routing tics of the security. The Nasdaq example, if an issue was previously ® Senior Management Workstation II (NWII) indicates the categorized in the 1,000-share maximum SOES order size for each level, it would not be permitted to Ad v e r t i s i n g NNM security. The indicator “NM10,” move to the 200-share level, even if Continuing Education “NM5,” or “NM2” displayed in NWII the formula calculated that such a corresponds to a maximum SOES move was warranted. -

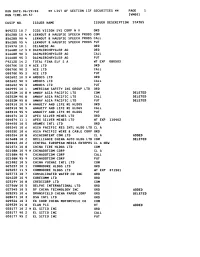

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

Online Grocery: How the Internet Is Changing the Grocery Industry

Graduate School of Business Administration UVA-DRAFT University of Virginia ONLINE GROCERY: HOW THE INTERNET IS CHANGING THE GROCERY INDUSTRY Online grocers ‘must create storefronts as easy to model appealing from an economic standpoint. They use as Amazon’s, build delivery infrastructure as argue that because they don’t need to pay for sound as UPS’ and pick and pack pickles and checkout clerks, display cases, or parking lots, online pineapples better than anyone ever has.’1 grocers can drop prices below those of retail stores and remain profitable.5 Key factors determining --Evie Black Dykema of Forrester Research success for the online grocery model include scalability, membership size, order frequency, and A survey by the University of Michigan order value. ranked 22 favorite household tasks, and found that grocery shopping came in next-to-last, just ahead of 2 Industry Projections and Outlook cleaning. According to the Food Marketing Institute (FMI), the average American household (HH) made Forrester Research segments the industry 2.3 trips to the grocery store a week and spent $87 3 into Full-service and Specialty online grocers (see per week on groceries. Andersen Consulting Figure 1). They predict that the full-service segment estimated that the average grocery trip took 47 will struggle to achieve the necessary economies of minutes, not including time to drive, park and unload 4 scale and to overcome hard-to-change consumer groceries. buying behaviors. Economic factors of the online grocery Full-service online grocers are located in model urban centers where critical volumes can be realized. Streamline.com estimates that the top twenty markets Proponents of the online grocery model point to numerous factors that they say makes the Figure 1: Projected electronic grocery spending of approximately $500 billion total industry (Source: Forrester Research) 1 David Henry, “Online grocers must change buyer habits, keep costs down,” USA Today, March 30, $12,000 2000, p. -

MARK S. THOMSON, on Behalf of Himself: No

IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK ___________________________________ MARK S. THOMSON, on behalf of himself: No. ___________________ and all others similarly situated, : : CLASS ACTION COMPLAINT Plaintiff, : FOR VIOLATIONS OF THE : FEDERAL SECURITIES LAWS v. : : MORGAN STANLEY DEAN WITTER : & CO. and MARY MEEKER, : : Defendants. : JURY TRIAL DEMANDED ___________________________________ : Plaintiff, by his undersigned attorneys, individually and on behalf of the Class described below, upon actual knowledge with respect to the allegations related to plaintiff’s purchase of the common stock of Amazon.com, Inc. (“Amazon” or the “Company”), and upon information and belief with respect to the remaining allegations, based upon, inter alia, the investigation of plaintiff’s counsel, which included, among other things, a review of public statements made by defendants and their employees, Securities and Exchange Commission (“SEC”) filings, and press releases and media reports, brings this Complaint (the “Complaint”) against defendants named herein, and alleges as follows: SUMMARY OF THE ACTION 1. In October 1999, Fortune named defendant Mary Meeker (“Meeker) the third most powerful woman in business, commenting, “[h]er brave bets – AOL in ‘93, Netscape in ‘95, e-commerce in ‘97, business to business in ‘99 – have earned her eight “ten-baggers”, stocks that have risen tenfold. Morgan Stanley’s “We’ve got Mary” pitch to clients has been key to its prominence in Internet financing. Her power is awesome: If she ever says “Hold Amazon.com”, Internet investors will lose billions.” 2. Fortune almost got it right. Investors did lose billions, but not because Meeker said “Hold Amazon.com”. Rather, investors were damaged by Meeker’s false and misleading statements encouraging investors to continue buying shares of Amazon. -

John Doerr, Kleiner Perkins Caufield & Byers

006-019 11/30/99 2:31 PM Page 6 Chapter1 Execution Is Everything: John Doerr, Kleiner Perkins Caufield & Byers The writer Wallace Stegner spent a lifetime trying to correct the popular myth of the rugged individualist who settled the American West. He demonstrated how this arid land actually was—and could only be—settled by people who cooperated and worked together. As American CEOs have become celebrated heroes, the same correction is needed in the popular myth of the lone entrepreneur and visionary. Developing something new and sustainable in the harsh and unforgiving environ- ment of business requires the collaborative effort of many peo- ple. The hard work of making visions real takes teamwork. John Doerr has seen this truth while observing and contribut- ing to the visions of Silicon Valley for nearly 20 years. Silicon Valley venture capitalists like Doerr are a unique and powerful force behind visions that have a chance to be- come real. They provide funds to start new companies and they help recruit and nurture the teams who run them. A venture capitalist’s office is often the site of the earliest criti- cal test for people with a vision, especially one based on new 6 006-019 11/30/99 2:31 PM Page 7 Execution Is Everything➤ 7 technology. If they communicate their vision effectively, they can get the funding they need faster and at a better price, and they’ll have a useful ally to help open other doors. If they don’t, they’ll find it much harder to get started. -

E-Commerce Is Changing the Face of Business, and Simon Students Will Be Well-Equipped to Meet the Challenges

WILLIAM E. SIMON GRADUATE SCHOOL OF BUSINESS ADMINISTRATION EXECUTIVE ADVISORY COMMITTEE Hiring Simon School Summer Associates… William E. Simon, WILLIAM E. SIMON GRADUATE SCHOOL OF BUSINESS ADMINISTRATION / WINTER 2000 Chairman …is the next best thing William Balderston III Harry Keefe to hiring our M.B.A.’s! Charles L. Bartlett Henry A. Kissinger O. T. Berkman Jr. William W. Lanigan, Esq. J. P. Bolduc Donald D. Lennox Paul A. Brands Jane Maas Andrew M. Carter Paul W. MacAvoy Richard G. Couch Louis L. Massaro Frank G. Creamer Jr. J. Richard Munro Ronald H. Fielding James Piereson Barry W. Florescue Robert E. Rich Jr. George J. Gillespie III, Esq. William D. Ryan James S. Gleason Leonard Schutzman Robert B. Goergen George J. Sella Jr. Paul S. Goldner Marilyn R. Seymann Bruce M. Greenwald J. Peter Simon Mark B. Grier William E. Simon Jr., Esq. Join the growing number of leading firms taking a General Alexander M. Haig Jr. Joel M. Stern closer look at what we’ve got to offer! Larry D. Horner Sir John M. Templeton Michael S. Joyce Ralph R. Whitney Jr. For more information, please call the Simon School Office of Career Services at 716-275-4881 David T. Kearns Joseph T. Willett William M. Kearns Jr. We are Committed to Your Success! UNIVERSITY OF ROCHESTER ROCHESTER, NEW YORK 14627 SWIIM L LION A M E. GRADUATE SCHOOL OF BUSINESS ADMINISTRATION Change Service Requested opportunity E-Commerce is changing the face of business, and Simon students will be well-equipped to meet the challenges. SPECIAL FEATURE: DEAN CHARLES PLOSSER’S ECONOMIC FORECAST FOR 2000 simonbusiness William E. -

Report on the Privacy Policies and Practices of Health Web Sites

Preliminary eHealth Ethics Summit Release Privacy Report on the Privacy Policies and Practices of Health Web Sites Sponsored by California HealthCare Foundation Conducted by Janlori Goldman and Zoe Hudson Health Privacy Project, Georgetown University and Richard M. Smith January 2000 TABLE OF CONTENTS Executive Summary . 3 Introduction . 7 Methodology . 11 Findings: Privacy Policies . 15 Findings: Privacy Practices . 25 Conclusions and Next Steps . 39 Appendices Appendix A Summary of Web site charts Appendix B www.altavista.com Appendix C www.cansearch.org Appendix D www.cvs.com Appendix E www.drkoop.com Appendix F www.drugstore.com Appendix G www.excite.com Appendix H www.healthcentral.com Appendix I http://hivinsite.ucsf.edu Appendix J www.intelihealth.com Appendix K www.ivillage.com Appendix L www.mayohealth.org Appendix M www.mediconsult.com Appendix N www.medscape.com Appendix O www.mhnet.org Appendix P www.mothernature.com Appendix Q www.oncolink.com Appendix R www.onhealth.com Appendix S www.planetrx.com Appendix T www.thebody.com Appendix U www.webmd.com Appendix V www.yahoo.com © 2000 California HealthCare Foundation. © 2000 California HealthCare Foundation. Privacy Report on the Privacy Policies and Practices of Health 3 Web Sites EXECUTIVE SUMMARY Consumer health care on the Internet has moved beyond its infancy and childhood, firmly into an awkward adolescence. While it is increasing in reach, scope, capacity, and independence, it is not mature enough to be predictable and reliable. Although health Web sites now provide a wide range of clinical and diagnostic information; opportunities to purchase products and services; interactions among consumers, patients, and health care professionals; and the capability to build a personalized health record, they have not matured enough to guarantee the quality of the information, protect consumers from product fraud or inappropriate prescribing, or guarantee the privacy of individuals’ information. -

Inside the Silicon Valley Money Machine KLEINER PERKINS FUNDED AOL, AMAZON, SUN, AN

Inside the Silicon Valley Money Machine KLEINER PERKINS FUNDED AOL, AMAZON, SUN, AN... Page 1 of 8 The Internet home of: SYMBOL LOOK-UP Ent HOME NEWS MARKETS TECHNOLOGY JOBS & ECONOMY PERSONAL FINANCE AUTOS REAL ESTAT Inside the Silicon Valley Money Machine Top Stories Stock rally picks u KLEINER PERKINS FUNDED AOL, AMAZON, Will Sun shine ag SUN, AND NETSCAPE. HERE'S HOW TECH'S Apple alumni wan MOST POWERFUL FINANCIERS WORK, PLUS 5 stocks we love THE SECRETS THEY DON'T WANT YOU TO U.S. unveils toug KNOW. By Melanie Warner Reporter Associate Jane Hodges October 26, 1998 (FORTUNE Magazine) – For more than three years, Scott Kauffman fended off phone calls from recruiters. This was in the mid-1990s, when Kauffman was known as one of the few executives in the media business who could make sense of this new thing called the World Wide Web. Non-tech companies wanted him as their Internet guru. Media conglomerates wanted him to help figure out how the hell to turn old media into new media. Kauffman, the vice president of online services at CompuServe, wasn't interested. Then one day came a different kind of call. Kauffman remembers it this way: "This guy on the phone sounded like a radio announcer, and it was like his voice was coming through the fog. He said he'd been hired by Kleiner Perkins to recruit me as CEO of one of their companies." Kauffman hung up, turned to his wife, and announced, "Honey, this is it. That was Kleiner Perkins." For people looking to hit it big in the exploding world of high tech, More from FORTUNE the name Kleiner Perkins can have that effect. -

Insights and Additions 3.1.1 Mobile B2C Shopping in Japan

Chapter Three: Retailing in Electronic Commerce: Products and Services 1 Online File W3.1 Some Current Trends in B2C EC Some important trends in B2C EC need to be noted at this point. First, many offline transactions are now heavily influ- enced by research conducted online, with approximately 85 percent of online shoppers now reporting that they used the Internet to research and influence their offline shopping choices (Jupitermedia.com 2006). Furthermore, it is estimated that by 2010, the Internet will influence approximately 50 percent of all retail sales, a significant increase over just 27 percent of all sales in 2005 (Jupitermedia.com 2006). Thus, multichannel retailers, those that have a physical presence and an online presence, seem destined to be the winners. They support the convenience of online research and sales, offer excellent order fulfillment and delivery if the sale is completed online, and enable customers to touch and feel and try on an item in a physical store. The need and opportunity to integrate offerings across all channels and to seek incentives for cross-channel sales is seen as an important development into the future (Mulpuru 2006). This becomes extremely impor- tant as the numbers of online shoppers reaches saturation, and successful e-tailers will be those who are able to increase the spending of existing buyers rather than purely focusing on attracting new buyers (Jupitermedia.com 2006). Another trend in B2C is the use of rich media in online advertising. For example, virtual reality is used in an online mall (Lepouras and Vassilakis 2006). Scene7.com is a leading vendor in the area. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 13F Form 13F COVER PAGE Report for the Calendar Year or Quarter Ended: March 31, 2000 Check here if Amendment [ ]; Amendment Number: _______________ This Amendment (Check only one): [ ] is a restatement [ ] adds new holdings entries. Institutional Investment Manager Filing this Report: Intel Corporation 2200 Mission College Boulevard Santa Clara, CA 95052-8119 Form 13F File Number: 28-5160 Person Signing this Report on Behalf of Reporting Manager: Arvind Sodhani, Vice President and Treasurer (408) 765-1240 --------------------------------------------------------------- ATTENTION--Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a) --------------------------------------------------------------- The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Signature, Place and Date of Signing: /s/Arvind Sodhani Santa Clara, California May 11, 2000 - ------------------- Report Type (Check only one): [X] 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check here if no holdings reported are in this report, -

3Rd Quarter, 2000

RUN DATE:10/06/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:14:34 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT & HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4397 10 8 * APW LTD COM ADDED GO4397 90 8 APW LTD CALL ADDED GO4397 95 8 APW LTD PUT ADDED GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2108N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 9 COMMODORE HLDGS LTD WT EXP 071501 623773 10 7 CONSOLIDATED WATER CO INC ORD G2422R 10 9 * CORECOMM LTD ORD G2422R 90 9 CORECOMM LTD CALL G2422R 95 9 CORECOMM LTD PUT G2519Y 10 8 CREDICORP LTD COM G2706W 10 5 DELPHI INTERNATIONAL LTD ORD 627545 10 5 DF CHINA TECHNOLOGY INC ORD G2759W 10 1 DIGITAL UNITED HOLDINGS LTD ORD ADDED 628471 10 3 DSG INTL LTD ORD 629526 10 3 EK CHOR CHINA MOTORCYCLE CO COM 629539 14 8 ELAN PLC R T 630177 10 2 * EL SIT10 INC ORD 630177 90 2 EL SIT10 INC CALL RUN DATE:10/06/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 2 RUN TIME:14:34 IVMOOl CUSIP NO.