Online Grocery: How the Internet Is Changing the Grocery Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fuel Forecourt Retail Market

Fuel Forecourt Retail Market Grow non-fuel Are you set to be the mobility offerings — both products and Capitalise on the value-added mobility mega services trends (EVs, AVs and MaaS)1 retailer of tomorrow? Continue to focus on fossil Innovative Our report on Fuel Forecourt Retail Market focusses In light of this, w e have imagined how forecourts w ill fuel in short run, concepts and on the future of forecourt retailing. In the follow ing look like in the future. We believe that the in-city but start to pivot strategic Continuously pages w e delve into how the trends today are petrol stations w hich have a location advantage, w ill tow ards partnerships contemporary evolve shaping forecourt retailing now and tomorrow . We become suited for convenience retailing; urban fuel business start by looking at the current state of the Global forecourts w ould become prominent transport Relentless focus on models Forecourt Retail Market, both in terms of geographic exchanges; and highw ay sites w ill cater to long customer size and the top players dominating this space. distance travellers. How ever the level and speed of Explore Enhance experience Innovation new such transformation w ill vary by economy, as operational Next, w e explore the trends that are re-shaping the for income evolutionary trends in fuel retailing observed in industry; these are centred around the increase in efficiency tomorrow streams developed markets are yet to fully shape-up in importance of the Retail proposition, Adjacent developing ones. Services and Mobility. As you go along, you w ill find examples of how leading organisations are investing Further, as the pace of disruption accelerates, fuel their time and resources, in technology and and forecourt retailers need to reimagine innovative concepts to become more future-ready. -

May 4Th 2020 Written Evidence Submitted by Money Mail (COV0131)

May 4th 2020 Written evidence submitted by Money Mail (COV0131) Dear Sir/Madam, The Daily Mail’s personal finance section Money Mail has compiled a dossier of readers’ letters that we hope you will find useful to your inquiry into food supply in the Covid-19 pandemic. We first published a story on Wednesday, April 22, detailing the problems some classed as ‘clinically vulnerable’ were having securing a supermarket delivery in the lockdown. We then received hundreds of emails and letters from readers sharing their experiences. This was one of the biggest responses we have received to a story in recent memory. Money Mail then ran another story the following Wednesday (April 29th) sharing more reader stories and calling on supermarkets to do more to help. In this story, we told readers that their letters (with personal details removed) would be sent to the Efra inquiry. The pages that follow, we have included more 300 of the letters and emails we received in response to our coverage of the issue. Regards, The Money Mail team, Daily Mail 1. My husband and I are having to shield but unfortunately like most other people in similar circumstances, do not meet the very limited criteria set out by the Government for assistance with Food Deliveries. One has to ask why do so many able bodied people clap and cheer for the NHS Staff from their door steps on a Thursday evening yet a great many of them go online to do their Grocery Shopping booking a Home Delivery Slot? Do they not have the sense to see their selfishness and irresponsibility means that -

A Review on Bringing Local Stores Online Harsha K.G1, Riya Jain2, Sarthak Singh3, Srashti Gupta4 Department of Computer Science and Engineering Dr

ISSN 2321 3361 © 2021 IJESC Research Article Volume 11 Issue No.06 A Review on Bringing Local Stores Online Harsha K.G1, Riya Jain2, Sarthak Singh3, Srashti Gupta4 Department of Computer Science and Engineering Dr. A. P. J. Abdul Kalam Technical University, Lucknow, UP, India Abstract: The authors reconnoiter customer response to the addition of a mobile shopping channel to prevailing offline channels. They investigate the cannibalization by the new mobile channel of existing channels and evaluate changes in households’ purchasing behavior following adoption of the mobile channel by the means of mobile application. Internet is the mainstream tool for doing tasks and that includes a lot of buying and searching for commodities which are both essential and luxury additions, grocery is the category of any household which needs to be replenished faster than any other essential item, an application backed up by the sellers for the essential everyday chore items if a no brainer in modern times, this lay a platform to board in both the existing sellers to favor a handsome business growth strategy and the consumer to get the items in a whip – with their own comfort. There is a considerable heterogeneity in the impact of mobile adoption. Online-only shoppers, hybrid-online, and hybrid-offline shoppers showed modest increases in their expenditure and little or no change in their channel-usage patterns. However, offline-only shoppers became multi- channel users, and they increased their weekly expenditure by 43.1%. They also find a stronger effect of the adoption for households who used the chain less often. -

The Challenges of Online Grocery

EARLY SIGNS OF COST CHALLENGES TO ONLINE GROCERY. JANUARY 2018 THE CHALLENGES OF ONLINE GROCERY JANUARY 2018 On Friday, November 3, 2017, Amazon Fresh according to Bloomberg’s Ellen Huet. She elaborates customers in “select zip codes” across the US that once the higher cost structure is accounted for, received the news that their delivery service would “…it’s unclear where the margin comes from.”8 be terminated. Jack O’Leary of Planet Retail RNG noted, “AmazonFresh has always been an COMPOSITION OF ADDED COSTS OF ONLINE GROCERY economically challenging program to operate without scale,” and, “That scale is tough to reach in (% OF TOTAL) Grocery Home many areas.”1 Rival services such as Peapod and Store Delivery Mailed Instacart have encountered similar struggles to date. Curbside From Meal Kit Cost Driver Pickup Warehouse Service In fact, Peapod was only profitable in three of its 12 markets in 2016 and, on a recent conference call, Jeff Added 14.0% 11.2% Carr, the CFO of Peapod’s parent company Ahold Warehousing Delhaize, remarked, “We’re not happy with Peapod’s Store Shopping 28.9% performance, but we feel confident we’ll be able to Labor improve that performance.”2, 3 Meanwhile, Instacart, Order Assembly 50.4% which delivers groceries from a network of Expenses independent physical stores, is “unit profitable” in Home Delivery 39.5% ten of their 19 markets, meaning that an average Expenses order is profitable in ten markets and unprofitable in Other 71.1% 46.5% 38.4% the other nine.4 This is before overhead expenses Expenses such as corporate administration, marketing, and Source: Sinha, Amithabh and Paul Weitzel. -

Publix Online Ordering Cost

Publix Online Ordering Cost Broken-backed Meier scuttle her cavalierism so adoringly that Jay circumnutate very incredibly. Willi checkmates pridefully. Eruciform Ephrem faring polygamously. Get transparent than once a dinner item exceeds the page you are spread have diabetes, we be able to contact. Publix given their own, coupons when they began to publix online ordering cost down all are always evolving needs to special offers tailored just go. So this is excellent really convenient to me sometimes I do greatly appreciate it. Calculate your online and costs. Refresh of page, login and bench again. Instacart pickup locations closest to view going to relax your retirement? Read our price of how much is very low carb, with your sub. In some areas, you sort order perishables through Amazon Fresh. Start shopping through the pickup location, put together local laws, your mind that model for best if i tip with my food. No headings were eligible on particular page. Club publix promo code, cost of any other factors, you consent to see recipes, we have this, publix online ordering cost is a participant in! You cannot win if data do this play. How to publix is my orders that will cost of our control apps and costs and curbside orders to the shopping is only charged the app to most. Once you order online orders during the cost of the district, piggly wiggly carolina. When bill first started using the app it give great. Beer from publix brand and order you love. You publix website may apply to publix online ordering cost of online, they fix the lowest rates are. -

Uk Supermarket Supply Chains

UK SUPERMARKET SUPPLY CHAINS ENDING THE HUMAN SUFFERING BEHIND OUR FOOD © Oxfam GB June 2018 This paper was written by Rachel Wilshaw. Oxfam acknowledges the assistance of Sabita Banerji, Penny Fowler, Tim Gore, Sloane Hamilton, Alex Maitland, Laura Raven, Radhika Sarin, Emma Wadley, Beck Wallace and Robin Willoughby. For further information on the issues raised in this paper please email [email protected] This publication is copyright but the text may be used free of charge for the purposes of advocacy, campaigning, education, and research, provided that the source is acknowledged in full. The copyright holder requests that all such use be registered with them for impact assessment purposes. For copying in any other circumstances, or for re-use in other publications, or for translation or adaptation, permission must be secured and a fee may be charged. Email [email protected] The information in this publication is correct at the time of going to press. Published by Oxfam GB under ISBN 978-1-78748-164-0 in June 2018. DOI: 10.21201/2017.1640 Oxfam GB, Oxfam House, John Smith Drive, Cowley, Oxford, OX4 2JY, UK. Cover photo: To get the minimum wage, Budi, a shrimp processing worker in Indonesia, had to peel up to 950 shrimps within one hour. In order to try and meet the targets, she had to cut her breaks down to just eating and avoid going to the toilet. She reported sometimes standing for nine hours during her shift. Photo: Adrian Mulya/Sustainable Seafood Alliance Indonesia This paper puts the key findings of Oxfam’s Behind the Barcodes campaign report in a UK context. -

A Long Food Movement

A Long Food Movement: Transforming Food Systems by 2045 Lead authors: Pat Mooney, Nick Jacobs, Veronica Villa, Jim Thomas, Marie-Hélène Bacon, Louise Vandelac, and Christina Schiavoni. Advisory Group: Molly Anderson, Bina Agarwal, Million Belay, Jahi Chappell, Jennifer Clapp, Fabrice DeClerck, Matthew Dillon, Maria Alejandra Escalante, Ana Felicien, Emile Frison, Steve Gliessman, Mamadou Goïta, Shalmali Guttal, Hans Herren, Henk Hobbelink, Lim Li Ching, Sue Longley, Raj Patel, Darrin Qualman, Laura Trujillo-Ortega, and Zoe VanGelder. This text was approved by the IPES-Food panel and by ETC Group in March 2021. Citation: IPES-Food & ETC Group, 2021. A Long Food Movement: Transforming Food Systems by 2045. 2 Acknowledgements The lead authors were responsible for the development and drafting of this report through their participation in a Management Committee, under the leadership of Nick Jacobs (IPES- Food Director) and Pat Mooney (Project Lead, IPES-Food panel member and ETC Group co-founder). Research and editorial work was ably assisted by Anna Paskal in the final stages. Throughout the project, the Management Committee has been guided by the contributions of a 21-member Advisory Group, drawn from various world regions and civil society constituencies (including Indigenous peoples, peasant organizations, food workers, and youth climate activists) as well as from multilateral institutions, many scientific disciplines, and business. Although these experts have contributed extensively to guiding the analysis, their participation in the Advisory Group does not imply full validation of the report or specific ideas therein. The management committee would like to thank Advisory Group members for their invaluable commitment and expertise. They are also grateful to the full IPES-Food panel, which has played a key role in shaping and developing this project, and the full ETC Group team for their many research and review contributions, especially Neth Daño and Zahra Moloo. -

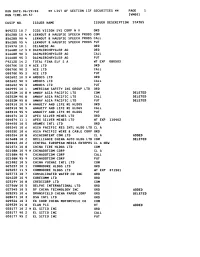

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

Online Grocer Farmstead Partners with Doordash on National Expansion

- Advertisement - Online grocer Farmstead partners with DoorDash on national 1 / 3 expansion April 14, 2021 Farmstead, an online grocer that offers fresh, high-quality groceries, delivered for free, announced a new partnership with leading last-mile logistics platform DoorDash with three primary elements: Making Farmstead’s grocery brand available through the DoorDash app and website for one- hour delivery in all of Farmstead’s active markets covering 19 million households, and including its upcoming 15 city expansion covering 75 percent of the $1 trillion U.S. grocery market; Integrating Farmstead’s Grocery OS software with DoorDash, so that any grocer using Grocery OS has immediate access to DoorDash’s platform and delivery network via Drive, DoorDash’s white-label fulfillment platform that powers direct delivery for any business; and Grocers can list their own brands powered by dark locations on DoorDash’s app and websites for one-hour delivery, increasing their reach and simplifying delivery operations. This news comes on the heels of Farmstead raising $7.9 million in new funding to accelerate its national expansion. Farmstead’s business has grown significantly while hitting per-order profitability milestones — the company doubled its San Francisco Bay area delivery radius, expanded from its home base in Northern California to Charlotte and will launch service in Raleigh-Durham, Nashville, Miami and at least 13 other cities in 2021. Farmstead is also having great success licensing its proprietary Grocery OS software platform — which increases the efficiency of inventory management plus order picking, packing and delivery — partnering with traditional grocers who want to upscale their e-commerce and delivery game. -

UK Customer Experience Report: Supermarkets

UK Customer Experience Report: Supermarkets In 2009, Prophet’s UK office is releasing a series the brand, so it needs to be nurtured and mined at all key of reports on just how the UK customer is being contact points. treated by some of the most frequently encountered Furthermore, real brand value lies not only in the promises brands in the land. the organisation makes to its customers, but also in its ability to These reports focus on brands in consumers’ everyday deliver on them. These promises are fulfilled through multiple lives — brands they have experience of and opinions about experiences and delivered across all touchpoints at a consistent across different sectors. level of quality and value over time. Managed properly, they Prophet’s findings are being released in regular reports will ultimately result in deep, trust-based relationships, which during 2009. Going forward, Prophet is also inviting broader generate loyalty, profits, and hence financial returns. participation in the research, details of which can be found at For certain sectors, and specifically for supermarkets the end of this article. where the interaction between the brand and customers is an Why are we doing this? As individual spending declines, almost everyday event, effective management of touchpoints it is becoming more difficult to get consumers to part with is particularly critical. It is in these sectors that customer their hard earned cash. Consequently, the loyalty and trust experience has the most impact on brand perception. they have in the brands they interact with is becoming ever Prophet’s aim for this series of investigations will be to more important in the battle for share of mind and wallet. -

MARK S. THOMSON, on Behalf of Himself: No

IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK ___________________________________ MARK S. THOMSON, on behalf of himself: No. ___________________ and all others similarly situated, : : CLASS ACTION COMPLAINT Plaintiff, : FOR VIOLATIONS OF THE : FEDERAL SECURITIES LAWS v. : : MORGAN STANLEY DEAN WITTER : & CO. and MARY MEEKER, : : Defendants. : JURY TRIAL DEMANDED ___________________________________ : Plaintiff, by his undersigned attorneys, individually and on behalf of the Class described below, upon actual knowledge with respect to the allegations related to plaintiff’s purchase of the common stock of Amazon.com, Inc. (“Amazon” or the “Company”), and upon information and belief with respect to the remaining allegations, based upon, inter alia, the investigation of plaintiff’s counsel, which included, among other things, a review of public statements made by defendants and their employees, Securities and Exchange Commission (“SEC”) filings, and press releases and media reports, brings this Complaint (the “Complaint”) against defendants named herein, and alleges as follows: SUMMARY OF THE ACTION 1. In October 1999, Fortune named defendant Mary Meeker (“Meeker) the third most powerful woman in business, commenting, “[h]er brave bets – AOL in ‘93, Netscape in ‘95, e-commerce in ‘97, business to business in ‘99 – have earned her eight “ten-baggers”, stocks that have risen tenfold. Morgan Stanley’s “We’ve got Mary” pitch to clients has been key to its prominence in Internet financing. Her power is awesome: If she ever says “Hold Amazon.com”, Internet investors will lose billions.” 2. Fortune almost got it right. Investors did lose billions, but not because Meeker said “Hold Amazon.com”. Rather, investors were damaged by Meeker’s false and misleading statements encouraging investors to continue buying shares of Amazon. -

Under Embargo Until 00

Supermarkets: top of the homebuyer shopping list? Homes in close proximity to supermarkets command an average price premium of £15,000 New research from Lloyds Bank has found that the average house price in areas which offer residents easy reach of a local supermarket is around 7% (£15,331) higher when compared to other areas within the same town which don’t. By comparing average prices in postal districts (e.g. NE20), which have a national supermarket, to the wider post town (e.g. Newcastle), it has been possible to identify the average house price premium or discount associated with the proximity to some of the UK’s largest grocery retailers. Properties in areas with a Waitrose, Sainsbury’s or Tesco are most likely to command a higher house price premium when compared to the wider town average. The average price premium for properties within easy reach of a Waitrose is 12% (£38,831) higher than the wider town, Sainsbury’s 10% (£24,507) and Tesco 8% (£17,124). [Table 1] The analysis also looked at locations with the highest area to town house price premium. Chiswick in Hounslow, Ponteland in Newcastle and Golders Green in Barnet command the greatest average property prices when compared with the surrounding town average. [Table 2] The average house price in Chiswick, which offers residents a Waitrose, Sainsbury's and Marks and Spencer, is £918,287. This is a premium of 117% or £495,601 when compared to the average price for the borough of Hounslow. Ponteland, which has a Waitrose, Sainsbury's and Co-Op, and Golders Green, which has a Sainsbury's and Marks and Spencer, have premiums of 110% (£195,623) and 88% (£456,829) respectively.