Insights and Additions 3.1.1 Mobile B2C Shopping in Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Opentable Strategic Discussions April 2009

OpenTable Strategic Discussions April 2009 Nicole Campbell Timothy DeGrange Jack Grigoryan Henry Wang Executive Summary OpenTable’s unique SaaS model in conjunction with its customer base and clientele has the potential for immense additional upside in the largely untapped online reservations market 1 OpenTable has a distinct advantage over U.S. competitors due to its deployment of proprietary in restaurant reservation taking technology (Electronic Reservation Book) in addition to its developed network of consumer users. 2 OpenTable currently captures 6% of an estimated 600 million reservations made in the U.S. annually and has the potential to increase to as much as 50%, in line with industries where online reservation usage has mature. 3 Internationally, the UK, Germany and Japan have been slated for international expansion and OpenTable has the opportunity to expand more aggressively into these markets given their large aggregate GDP relative to the U.S. The U.S. equity markets are in recovery in light of QE announcement by the Federal Reserve. Given OpenTable’s dominance in the online reservations market, it is well positioned for an IPO 1 Credit is still relatively expensive and the general decrease in private placement and debt financed deals would come at a discount to valuations sought in the equity markets. OpenTable also has the market share and strength to grow organically. 2 Given improving equity market conditions in the U.S., OpenTable’s inherent market share in the U.S. , competitive barrier and an opportunity to capture greater revenues per restaurant would be attractive to investors. 3 The proceeds of the IPO can be utilized to finance OpenTable’s growth both domestically or abroad through organic growth with its current offering and or acquisitions to diversify its offerings. -

Food and Tech August 13

⚡️ Love our newsletter? Share the ♥️ by forwarding it to a friend! ⚡️ Did a friend forward you this email? Subscribe here. FEATURED Small Farmers Left Behind in Covid Relief, Hospitality Industry Unemployment Remains at Depression-Era Levels + More Our round-up of this week's most popular business, tech, investment and policy news. Pathways to Equity, Diversity + Inclusion: Hiring Resource - Oyster Sunday This Equity, Diversity + Inclusion Hiring Resource aims to help operators to ensure their tables are filled with the best, and most equal representation of talent possible – from drafting job descriptions to onboarding new employees. 5 Steps to Move Your Food, Beverage or Hospitality Business to Equity Jomaree Pinkard, co-founder and CEO of Hella Cocktail Co, outlines concrete steps businesses and investors can take to foster equity in the food, beverage and hospitality industries. Food & Ag Anti-Racism Resources + Black Food & Farm Businesses to Support We've compiled a list of resources to learn about systemic racism in the food and agriculture industries. We also highlight Black food and farm businesses and organizations to support. CPG China Says Frozen Chicken Wings from Brazil Test Positive for Virus - Bloomberg The positive sample appears to have been taken from the surface of the meat, while previously reported positive cases from other Chinese cities have been from the surface of packaging on imported seafood. Upcycled Molecular Coffee Startup Atomo Raises $9m Seed Funding - AgFunder S2G Ventures and Horizons Ventures co-led the round. Funding will go towards bringing the product to market. Diseased Chicken for Dinner? The USDA Is Considering It - Bloomberg A proposed new rule would allow poultry plants to process diseased chickens. -

Career Programs 2020 New York Campus

Culinary Arts Pastry & Baking Arts Health-Supportive Culinary Arts Restaurant & Culinary Management Hospitality & Hotel Management Professional Development CAREER PROGRAMS 2020 NEW YORK CAMPUS PRESIDENT’S LETTER For many, food is the ultimate expression of passion, creativity and happiness. For more than four decades, the Institute of Culinary Education (ICE) has been a leader in this realm, offering a broad and diverse assortment of culinary education opportunities, covering facets throughout the culinary universe. Since our founding in 1975, interest in America's culinary landscape has progressively grown, along with its abundant opportunities and economic value. So has ICE. Today, with campuses in New York City and Los Angeles, ICE is widely recognized as one of America’s leading destinations for anyone who wants to explore their passion for any facet of the culinary arts, from cooking and baking to wine studies and hotel and hospitality management. As a school and community, we are vibrant and focused — and still driven by ideals. ICE students are diverse and have unique talents and individual quests. Our role at ICE is to help our students find and develop their culinary voice. The foundations of ICE are our career programs in Culinary Arts, Pastry & Baking Arts, Restaurant & Culinary Management, and Hospitality & Hotel Management. Whether our students’ goals are to become chefs, restaurateurs, food journalists, artisan bread bakers or hotel general managers, our programs provide a classic and valuable foundation. ICE’s diploma programs are sophisticated, intensive and student-centric What’s Inside and can be completed in less than one year. ICE is one of the only schools in the nation for aspiring culinary entrepreneurs. -

Hinge and Opentable Partner to Help Daters Choose the Perfect Date Spot

Dating Just Got Easier: Hinge and OpenTable Partner to Help Daters Choose the Perfect Date Spot October 15, 2019 Survey Reveals Over 86 Percent of Respondents Feel Stressed When Trying to Find a Restaurant for a Date Date Night Matchmaker Feature Offers Personalized Restaurant Recommendations SAN FRANCISCO, Oct. 15, 2019 /PRNewswire/ -- Cuffing season is upon us and to help couples and singles alike prepare, Hinge, the dating app designed to be deleted, part of Match Group Inc. (NASDAQ: MTCH), and OpenTable, the world's leading provider of online restaurant reservations and part of Booking Holdings, Inc. (NASDAQ: BKNG), have partnered to help daters choose the perfect date spot. A new survey commissioned by OpenTable* revealed that over two-thirds of American respondents feel stressed when trying to find a restaurant for a date, and Hinge users agree. 81 percent of Hinge daters wish it were less stressful to find a restaurant for a date night. To take the angst out of planning, Hinge and OpenTable are launching the ultimate Date Night guide. Daters will find fun and useful tools to help plan the perfect date, including lists of the best restaurants for a date and top cafes, plus, the Date Night Matchmaker feature. The recently updated feature, available via desktop and mobile, allows users to simply answer a few questions about their date and dining preferences, and, in turn, receive personalized, bookable date spot recommendations. "As we head into 'cuffing season,' daters are looking to couple up for the winter months and enjoy romantic settings with food, drinks and good company," said Anna Besse, Director of Marketing at OpenTable. -

Inside Marking 50 Years of Gay Rights Protests Innovations in Aging Produce Vouchers Free for Low-Income Seniors ..7 “Apps” for Everything

A publication of Philadelphia Corporation for Aging 2013 July 2015 Free Inside Marking 50 years of gay rights protests Innovations in Aging Produce Vouchers Free for low-income seniors ..7 “Apps” for everything By Marcia Z. Siegal They’re commonly known as “apps,” short for applications, a software tool that allows you to perform specific tasks. They are available on mobile devices, such as smartphones and tablet computers, and you can make use of them to track your blood pressure, pay your bills, check if your train is running on time and connect with your loved ones. Apps bring the world to you, and they’re literally at your fin- gertips. Art from the Heart: “There are so many incredible apps out there, Helps children with grief... 8 and many of them are free,” says Gillian Robbins, librarian in the Business, Science and Industry Department of the Free Library of Philadelphia’s Parkway Central Library. Photo by courtesy of John James of courtesy by Photo Tobey Dichter, CEO of Generations on Line, John James (in suit, left) was one of 39 protesters who picketed Independence Hall on July 4, 1965. which promotes Internet access for seniors, concurs. “Mobile apps can provide instant grat- By Linda L. Riley by the Mattachine Society of Washington, ification,” she says. “Speed, ease and conven- D.C., a group that was dedicated to activism ience of tablet and other mobile technology, In 1965, John James was a 24-year-old in support of gay rights. Mattachine, James • continued on page 17 computer programmer for the National In- explained, means “behind the mask.” stitutes of Health. -

To the Best Restaurant Reservation Software the Ultimate Guide to the Best Restaurant Reservation Systems

The Ultimate Guide to the Best Restaurant Reservation Software The Ultimate Guide to the Best Restaurant Reservation Systems Restaurant reservation systems have become essential to running a successful restaurant. 2 While walk-ins once dominated That’s where this guide comes in. Our on-premise dining, the rise of guide helps you cut through the noise reservations technology has gradually and find the best restaurant reservation shifted the restaurant landscape. system for your specific business. With Now, diners are no longer content reviews of each of the top reservation to wait in line for a table when they systems (including our own), we’ll could simply make a reservation that highlight all the need-to-know information. would guarantee their spot – especially during peak business hours. In each review, you’ll find: A basic overview of each of the At the same time, reservation systems top restaurant reservation systems have allowed restaurants to offer an Each system’s strengths and weaknesses elevated level of customer service, Software pricing and other fees ensuring more customers leave with The ideal reservations solution for a positive dining experience and each type of restaurant servers end up with healthy tips. In addition to reviews of each reservation system, But while it’s clear that there are many we’ve also included: benefits to using a reservation system in A comparison chart featuring all your restaurant, finding the right system the top reservation platforms can be a major challenge. Not only A buyer’s guide that highlights key purchasing considerations are there dozens of different platforms to choose from, but each one comes with a unique set of features, tools, and services. -

How+To+Open+A+Restaurant.Pdf

How to Open a Restaurant The Modern Restaurateur’s Guide to Starting & Growing a Restaurant Business Alison Arth OpenTable - How to Open a Restaurant 1 Table of Contents 50 Introduction 4 How to Create a Brand 55 How to Write a Business Plan 5 How to Design Your Restaurant Construction 55 Why Writing A Business Plan Is Not Optional 5 Kitchen Design 57 What Your Business Plan Should Cover 8 Interior Design Building a Pitch Deck 11 58 62 How to Fund Your Restaurant 14 In the Weeds: Amanda Cohen Setting Up Your Business 14 How to Order and Purchase 64 Overview of Common Business Structures 15 What Do You Need? 64 Figuring Out How Much Money You Need 16 Key Considerations 65 Structuring Investor Payback & Ownership 17 Post-Opening Ordering & Purchasing 67 What to Expect from the Fundraising Process 20 69 More Financing Options 21 How to Build Your Team Recruit the Right People 73 How to Identify Locations, Choose a Interviewing 74 Site & Negotiate Your Lease 27 Assembling Your Team 75 Location vs. Site 27 78 Choosing a Site 29 How to Train Your Team How to Negotiate Your Lease 33 Start Early 78 Classroom Training 79 In the Weeds: Aaron London 40 Prepare Written Materials 82 How to Deal with Legal Regulations 42 Preview Events 83 Licenses, Permits, Inspections & Certificates 45 In the Weeds: Sean Heather 87 TEST CASE: Chez Ruth 46 OpenTable - How to Open a Restaurant 2 Table of Contents cont’d How to Create Your Menu 88 How to Create Buzz 106 Start with Trust 88 Get Your Story Straight 106 Art vs. -

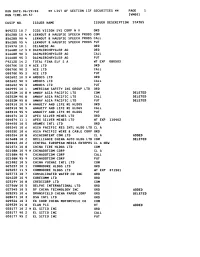

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

Online Grocery: How the Internet Is Changing the Grocery Industry

Graduate School of Business Administration UVA-DRAFT University of Virginia ONLINE GROCERY: HOW THE INTERNET IS CHANGING THE GROCERY INDUSTRY Online grocers ‘must create storefronts as easy to model appealing from an economic standpoint. They use as Amazon’s, build delivery infrastructure as argue that because they don’t need to pay for sound as UPS’ and pick and pack pickles and checkout clerks, display cases, or parking lots, online pineapples better than anyone ever has.’1 grocers can drop prices below those of retail stores and remain profitable.5 Key factors determining --Evie Black Dykema of Forrester Research success for the online grocery model include scalability, membership size, order frequency, and A survey by the University of Michigan order value. ranked 22 favorite household tasks, and found that grocery shopping came in next-to-last, just ahead of 2 Industry Projections and Outlook cleaning. According to the Food Marketing Institute (FMI), the average American household (HH) made Forrester Research segments the industry 2.3 trips to the grocery store a week and spent $87 3 into Full-service and Specialty online grocers (see per week on groceries. Andersen Consulting Figure 1). They predict that the full-service segment estimated that the average grocery trip took 47 will struggle to achieve the necessary economies of minutes, not including time to drive, park and unload 4 scale and to overcome hard-to-change consumer groceries. buying behaviors. Economic factors of the online grocery Full-service online grocers are located in model urban centers where critical volumes can be realized. Streamline.com estimates that the top twenty markets Proponents of the online grocery model point to numerous factors that they say makes the Figure 1: Projected electronic grocery spending of approximately $500 billion total industry (Source: Forrester Research) 1 David Henry, “Online grocers must change buyer habits, keep costs down,” USA Today, March 30, $12,000 2000, p. -

MARK S. THOMSON, on Behalf of Himself: No

IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK ___________________________________ MARK S. THOMSON, on behalf of himself: No. ___________________ and all others similarly situated, : : CLASS ACTION COMPLAINT Plaintiff, : FOR VIOLATIONS OF THE : FEDERAL SECURITIES LAWS v. : : MORGAN STANLEY DEAN WITTER : & CO. and MARY MEEKER, : : Defendants. : JURY TRIAL DEMANDED ___________________________________ : Plaintiff, by his undersigned attorneys, individually and on behalf of the Class described below, upon actual knowledge with respect to the allegations related to plaintiff’s purchase of the common stock of Amazon.com, Inc. (“Amazon” or the “Company”), and upon information and belief with respect to the remaining allegations, based upon, inter alia, the investigation of plaintiff’s counsel, which included, among other things, a review of public statements made by defendants and their employees, Securities and Exchange Commission (“SEC”) filings, and press releases and media reports, brings this Complaint (the “Complaint”) against defendants named herein, and alleges as follows: SUMMARY OF THE ACTION 1. In October 1999, Fortune named defendant Mary Meeker (“Meeker) the third most powerful woman in business, commenting, “[h]er brave bets – AOL in ‘93, Netscape in ‘95, e-commerce in ‘97, business to business in ‘99 – have earned her eight “ten-baggers”, stocks that have risen tenfold. Morgan Stanley’s “We’ve got Mary” pitch to clients has been key to its prominence in Internet financing. Her power is awesome: If she ever says “Hold Amazon.com”, Internet investors will lose billions.” 2. Fortune almost got it right. Investors did lose billions, but not because Meeker said “Hold Amazon.com”. Rather, investors were damaged by Meeker’s false and misleading statements encouraging investors to continue buying shares of Amazon. -

Banking Rewards & Dining

Banking Rewards & Dining: A Changing Landscape Presented by: Sponsored by: INTRODUCTION Banks and financial services companies have used Travel remains dining as a key differentiator for their card products the most impacted for many years. The COVID crisis has accelerated this category, still trend while upending existing usage of cards for other down over 50%... services. Simply put, during the pandemic, travel and Crisis fosters related benefits have become less relevant. Card issuers innovation. are pivoting to where consumers are spending instead, Vasant Prabhu namely: food. Vice Chairman and Chief Financial Officer, Visa Vasant Prabhu, Vice Chairman and CFO, of Visa, noted as much during a July earnings call, stating: “Travel remains the most impacted category, still down over 50%. Within the restaurant category, card-present spend is still declining, while card-not- present spend continues to grow significantly, with quick service restaurants outperforming.…Crisis fosters innovation. There’s a lot going on.”1 Card issuers are innovating. They are experimenting with differing approaches of how to adapt offerings to meet customers’ dining, delivery, and grocery needs during, as well as perhaps after, the pandemic. Background: dining and dining cards 2017 Dining cards have a long and rich heritage, starting Launch of Capital One Savor Card, with the launch of the Diners Club Card in 1950 by the first card catering to food spend businessman Frank McNamara. He founded the company following an incident: he forgot to bring his wallet to a New York restaurant and vowed never to be 2018 similarly embarrassed again.2 Citi Prestige increases earn for dining rewards to 5X points Over the past 5 years credit card companies have recognized dining as a key focus area to attract affluent consumers. -

Marketing Essentials Checklist

TAKE 5 – MARKETING ESSENTIALS CHECKLIST During the COVID-19 Pandemic & for Future Planning Karen Zaniker 410-384-9240 | [email protected] 1-Apr-20 Just a few weeks in, the amazing efforts and ingenuity of our restaurant teams to keep people employed and guests served is astounding. More hard decisions are being made – and tears shed – yet we press on and find new ways to provide. I am reminded daily that many of our toughest restaurant entrepreneurs have creative nurturing souls, and they are on full display right now. At this point, restaurants have made staffing adjustments and are working on support structures for current and displaced team members, as well as the changing needs of guests. Focus remains on cost reduction, strict sanitation and distancing measures to protect employees and guests, and accessing grants and loans as the length of this pandemic remains unknown. I'm a sucker for a good checklist. This one builds on the foundational practices the industry has adopted or emphasized as we begin to expand our focus to adapting the brand experience to this world in crisis. As you consider how these thought-starters relate to your brand, do so through the lens of community-driven, brand-relevant messaging that will be meaningful to the many impacted friends, family members and colleagues. Use this time to restore faith and deepen relationships. We're all in this together! FOOD & BEVERAGE OFFERING Focus menu; package for home & essentials needs. Think about the need your brand fills, and how it's most relevant to Brand-focused signatures today.