Presentazione Standard Di Powerpoint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Useful Informatin

How to get Rome from the “Leonardo Da Vinci” Fiumicino Airport The main airport Leonardo da Vinci (Fiumicino) is located about 26 km from the city centre. The centre of city is easily reached: FROM AND TO FIUMICINO AIRPORT BY TRAIN At the airport’s railway station the Shuttle-Train Leonardo Express direct service (without calling at other stations) takes just 31 minutes to get to Termini Station (intersecting with the Metro Lines A & B) and leaves every half hour from 6.36 a.m. to 11.36 p.m. FROM AND TO FIUMICINO BY TAXI Taxis licensed by Rome City Council are white and have a sign bearing the word “TAXI” on their roofs and by the identifying licence number on the doors, on the back and inside the car. The symbol of the Rome City Council is clearly visible on the front doors and the license inside the back left. Other vehicles waiting on exiting the airport may well be driven by unauthorized persons and the fare could therefore be a great deal higher. Taxis for Rome are found at the exits of both the domestic and international arrival terminals. Fares: • to and from Fiumicino Airport – Ostiense Railway Station €45 • to and from Fiumicino Airport – The Aurelian Wall €48 • to and from Fiumicino Airport – Tiburtina Railway Station €55 A maximum fare of €70 has moreover been set for journeys starting from inside the Rome Ring Road (Grande Raccordo Anulare) and heading to Fiumicino airport in the event that the taxi metre should display a higher sum. The number to dial a taxi is: +39 06 0609 / +39 06 3570 Click for further information: http://www.3570.it http://www.agenziamobilita.roma.it/en/app.html http://www.agenziamobilita.roma.it/en/taxi-fares-in-rome.html Events srl Congress&Communication – Via Mantegna 1, 60019 Senigallia (AN) P.I./C.F. -

International Students Guide 2021 2022

Istituzione di Alta Formazione Artistica Musicale autorizzata con D.M. 144 del 1° agosto 2012 Ministero dell’Istruzione, dell’Università e della Ricerca STUDENT GUIDE Useful Information Before your departure and upon your arrival ---------------------------------------------------------------- Saint Louis College of Music Via Baccina, 47 - Via Urbana, 49/a - Via del Boschetto, 106 – Via Cimarra 19/b (00184, Roma) Tel +39 (0)6 4870017 - Fax +39 (0)6 91659362 www.slmc.it / www.saintlouiscollege.eu / [email protected] Sede legale: Via Cimarra 19b Roma Partita IVA 05731131008 – Registro Società del Tribunale di Roma n. 918703 . S i n c e 1 9 7 6 ---------------------------------------------------------------- Welcome to Saint Louis!………………………………………………………………… pag. 3 About Us….……………………………………………………………………………… pag. 3 Academic Programs……………………………………………………………………… pag. 3 Academic Calendar……………………………………………………………………… pag. 4 National Holidays and Breaks…………………………………………………………… pag. 4 Locations ………………………………………………………………………………… pag. 4 International Office ……………………………………………………………………… pag. 4 Orientation day…………………………………………………………………………… pag. 5 Dedicated services for Erasmus+ students ……………………………………………… pag. 5 CFA, ECTS and grading system ………………………………………………………… pag. 5 PRACTICAL INFORMATION Accommodation before arrival...………………………..……………………………… pag. 6 Visa / Residence Permit / Residence Registration ……………………………………… pag. 6 Codice fiscale…………………………………………………………………………… pag. 8 Health insurance ………………………………………………………………………… pag. 9 How to get to Saint Louis ……………………………………………………………… -

DLA Piper. Details of the Member Entities of DLA Piper Are Available on the Website

EUROPEAN PPP REPORT 2009 ACKNOWLEDGEMENTS This Report has been published with particular thanks to: The EPEC Executive and in particular, Livia Dumitrescu, Goetz von Thadden, Mathieu Nemoz and Laura Potten. Those EPEC Members and EIB staff who commented on the country reports. Each of the contributors of a ‘View from a Country’. Line Markert and Mikkel Fritsch from Horten for assistance with the report on Denmark. Andrei Aganimov from Borenius & Kemppinen for assistance with the report on Finland. Maura Capoulas Santos and Alberto Galhardo Simões from Miranda Correia Amendoeira & Associados for assistance with the report on Portugal. Gustaf Reuterskiöld and Malin Cope from DLA Nordic for assistance with the report on Sweden. Infra-News for assistance generally and in particular with the project lists. All those members of DLA Piper who assisted with the preparation of the country reports and finally, Rosemary Bointon, Editor of the Report. Production of Report and Copyright This European PPP Report 2009 ( “Report”) has been produced and edited by DLA Piper*. DLA Piper acknowledges the contribution of the European PPP Expertise Centre (EPEC)** in the preparation of the Report. DLA Piper retains editorial responsibility for the Report. In contributing to the Report neither the European Investment Bank, EPEC, EPEC’s Members, nor any Contributor*** indicates or implies agreement with, or endorsement of, any part of the Report. This document is the copyright of DLA Piper and the Contributors. This document is confidential and personal to you. It is provided to you on the understanding that it is not to be re-used in any way, duplicated or distributed without the written consent of DLA Piper or the relevant Contributor. -

GMT Report2012.Qxp

GLOBAL METRO PROJECTS REPORT 2012 Metropolitan railways (metros) are high capacity electric transport systems that operate on dedicated routes, and can thereby achieve high service speed and frequency. Over the last few years, metros (also known as subway, underground or tube) have evolved as an efficient and effective urban mobility solution in addressing the growing concerns of urbanisation and climate change. This is supported by the fact that despite high capital requirements the sector witnessed a compound annual growth rate (CAGR) of 6.7 per cent between 2005 and 2010. In high density urban areas, metros form the backbone of integrated public transport systems and offer proven economic, social and environmental benefits. Given the huge investment requirement and long life span, metro systems have always been a driving force for technological and financial innovations. Government and metro operators are constantly seeking solutions to improve reliability and customer service, lower fuel and maintenance costs, as well as increase efficiency and safety levels in operations. The Global Metro Projects Report provides updated information on the world's top 101 metro projects that present significant capital investment opportunities. These projects have a total existing network length of about 8,900 km and a proposed length of over 8,000 km. The report covers 51 countries representing about 80 per cent of the world’s gross domestic product. It presents the key information required to assess investment opportunities in the development of new lines, extension and upgrade of existing lines, rolling stock procurement and refurbishment, power and communication systems upgrades, fare collection, as well as station construction and refurbishment. -

Final Exploitation Plan

D9.10 – Final Exploitation Plan Jorge Lpez (Atos), Alessandra Tedeschi (DBL), Julian Williams (UDUR), abio Massacci (UNITN), Raminder Ruprai (NGRID), Andreas Schmitz ( raunhofer), Emilio Lpez (URJC), Michael Pellot (TMB), Zden,a Mansfeldov. (ISASCR), Jan J/r0ens ( raunhofer) Pending of approval from the Research Executive Agency - EC Document Number D1.10 Document Title inal e5ploitation plan Version 1.0 Status inal Work Packa e WP 1 Deliverable Type Report Contractual Date of Delivery 31 .01 .20 18 Actual Date of Delivery 31.01.2018 Responsible Unit ATOS Contributors ISASCR, UNIDUR, UNITN, NGRID, DBL, URJC, raunhofer, TMB (eyword List E5ploitation, ramewor,, Preliminary, Requirements, Policy papers, Models, Methodologies, Templates, Tools, Individual plans, IPR Dissemination level PU SECONO.ICS Consortium SECONOMICS ?Socio-Economics meets SecurityA (Contract No. 28C223) is a Collaborative pro0ect) within the 7th ramewor, Programme, theme SEC-2011.E.8-1 SEC-2011.7.C-2 ICT. The consortium members are: UniversitG Degli Studi di Trento (UNITN) Pro0ect Manager: prof. abio Massacci 1 38100 Trento, Italy abio.MassacciHunitn.it www.unitn.it DEEP BLUE Srl (DBL) Contact: Alessandra Tedeschi 2 00113 Roma, Italy Alessandra.tedeschiHdblue.it www.dblue.it raunhofer -Gesellschaft zur Irderung der angewandten Contact: Prof. Jan J/r0ens 3 orschung e.V., Hansastr. 27c, 0an.0uer0ensHisst.fraunhofer.de 80E8E Munich, Germany http://www.fraunhofer.de/ UNIVERSIDAD REL JUAN CARLOS, Contact: Prof. David Rios Insua 8 Calle TulipanS/N, 28133, Mostoles david.riosHur0c.es -

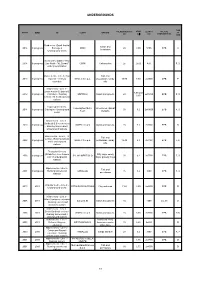

Undergrounds

UNDERGROUNDS TYPE OVERBURDEN max SPAN LENGTH SPECIAL START END JOB CLIENT GROUND OF [m] [m] [m] INTERVENTIONS TASK Ryad metro (Saudi Arabia) Sands and 2014 In progress - Package 2 - IDOM 20 9,00 5000 EPB A limestones Underground works Doha metro (Qatar) - Red 2014 In progress Line North - "AL Diwani" COWI Calcarenites 25 25,00 400 F, D underground station Rome metro - Line C, Fori Tufs and 2013 In progress Imperiali - Venezia Metro C S.c.p.a. pozzolanas, sandy 15-30 8,80 2x3500 EPB P extension silts Milan metro - Line 4 - Linate Airport-S. Babila-S. 6.50 and 2012 In progress Cristoforo - Running METRO 4 Sands and gravels 20 2x15000 EPB F, D 9.15 tunnels and 6 underground stations Copenagnen metro, Copenaghen Metro Limestones, glacial 2011 In progress Cityringen - Underground 30 6.2 2x19000 EPB F, D Team deposits works Milan metro - Line 5 - Garibaldi-S.Siro extension 2010 In progress GARBI Linea 5 Sands and gravels 15 7.3 2x8000 EPB D - Running tunnels and 4 underground stations Rome metro - Line C, T3 Tufs and section - Running tunnels 2008 In progress Metro C S.c.p.a. pozzolanas, sandy 15-30 8.8 2x3198 EPB F,D and 3 underground silts stations Thessaloniki metro (GREECE) - Line tunnels Silty clays, sandy 2006 In progress SALINI-IMPREGILO 30 6.2 2x7700 EPB F, D and 13 underground clays, gravelly clays stations Naples metro - Line 6 - Tufs and 2001 In progress Running tunnels and ANSALDO 15 8.2 3000 EPB F, D pozzolanas stations Warsaw metro - Line 2 - 2010 2013 ASTALDI/GOULERMAK Clay and sand 7-24 6,00 2x4800 EPB D Underground works Milan -

The Impact of Land Use Characteristics for Sustainable Mobility: the Case Study of Rome

Eur. Transp. Res. Rev. (2012) 4:153–166 DOI 10.1007/s12544-012-0077-6 ORIGINAL PAPER The impact of land use characteristics for sustainable mobility: the case study of Rome Stefano Gori & Marialisa Nigro & Marco Petrelli Received: 31 March 2011 /Accepted: 21 February 2012 /Published online: 14 March 2012 # The Author(s) 2012. This article is published with open access at SpringerLink.com Abstract 1 Introduction Background Sustainable mobility requires actions to reduce the need for travel, to promote modal shift, to reduce trip Recently important changes in urban features strongly modi- lengths and to increase efficiency of transport system. Public fied the quantity and the quality of the mobility system: the transport could play an important role to solve part of the continuous spread of residences and activities have increased needs previously reported. Starting from these remarks, the the length of trips and the use of private transport; the usual present paper analyse the role, the importance and the impact mobility habits have been changed by more complex behav- of land use characteristics to develop services able to compete iours (trip chaining). The automobile is often considered the with automobile use. This analysis is carried out by studying only transport mode while transit became less and less used the real world case of the city of Rome in Italy. with strong impacts on environment and sustainability. Results The results of the test carried out highlight the These changes are mainly due to the results of the evolution importance of density of residences and activities, the need of urban areas according to the different stages of develop- for a good quality access system to the transit services stops ment of the transport modes technology: the first stage is and the importance of the configuration of the transit net- known as “urban concentration” with small urban area char- work, identifying the best way to connect the different acterized by high density; the second stage is the “suburban- districts of the urban area. -

Hirenet Networks

Page 1 of 56 Expanded Job Site Broadcast Network “Expanded Network” (As of 2/1/2004) Job opportunities entered in either the AutoHire automated hiring system or the CareerShop.com job board may be distributed to the “Expanded Network” of job sites if you are a subscriber to the Network. While a subscription fee must be paid to distribute jobs to the network there are no added membership or posting fees imposed by the individual job sites. That is, they are provided as “free sites” to network subscribers. Following is a list of the job sites included in the “Expanded Network”. The list of job sites totals over 4,000 according to the following table. Despite the list of 4,000+, we promote the service as a 3,000+ job site service in our marketing because the job site list is forever changing. Not all job posting links are in place at all times (lost links) and not all jobs submitted will be posted (no-post situations). There are many factors that cause “lost links”. The most common of which results from changes in the job site posting specifications. Often these changes are not immediately made known to network administrators. This results in loss of service for such sites until knowledge of the failure is known and the situation is corrected. There are also many factors that cause “no-post situations”. Some of the more common circumstances occur when the job site requires data that is not provided in the job posting, or if the job site eliminates certain job postings based on content provided (i.e. -

Company Profile and Projects

Company Profile and Projects COMPANY PROFILE Infratech Development Holding (IDH) is a trading company founded in 2014 in Floriana (Malta) by italian experts in Project Financing and Public-Private-Partenership. The company has a share of more than $ 60 million and controls two other companies in Belaruss: • ISSE, wich is an engineering servise company; • Infratech, wich is an engineer company. An important italian company in the construction of technological systems (ELEF) is another significant shareholder. IT Transportation Engineering, a leading italian expert in the field of Transport Planning, normally works as a business partner of IDH. The company, trough its expert, over the 25 years, he has worked in the field of Transportation Engineering, with a particular focus in the following area: • Strategicplanning and tactics in the field of transport system and regional development; • Technical feasibility, economic, financial and transport infrastructure; • Design of transport systemand related infrastructure: • Highways; • Railways; • Metropolitan; • Light Rail Train (LRT) • Trams; • Harbors; • Interports; • Public transport service networks; • Interports. In addition, WWI has developed over the years special and important experience in the field of Project Financing (PF) scheme. Its wide range of work experiences has conducted in numerous project both in Italy and in 20 foreign countries (Albania, Bulgaria, Cameroon, Chad, Central African Republic, Ukraine, India, Romania, Venezuela, Czech Republic, Iraq, Kosovo, Serbia, Switzerland, -

Roma Visitors.Indd

INFORMATION FOR VISITORS TO ROME & THE ITALIAN CAMPUS Roma/ LAZIO, ITALIA The Duquesne in Rome is located in a neighborhood of Rome called “Boccea”. The campus is accessible via public transportation. The closest metro stops to campus are Battistini, Cornelia, and Valle Aurelia, the last three stops on Line A. The campus is about a 15-20 minute walk from Battistini. From Cornelia and Valle Aurelia it is possible to catch the 906 Bus which stops right in front of the campus (Le Suore della Sacra Famiglia di Nazareth, Via Nazareth, 400 - Boccea). Once you are on Via Nazareth you will want to hit the stop button on the bus when you see the Yellow Gas Station on your left. The very next stop will let you off just past the Duquesne in Rome walls. See map below. TRAVEL ARRANGEMENTS TO ROME 1) Classic Travel & Tours: Families and friends of students studying at the Italian Campus are welcome to call and consult with Classic Travel and Tours in Pittsburgh, PA. Rick Sicilio and his staff have been helping Italian Campus families and friends for years. They can offer assistance with flights, transfers, hotels and tours based upon budget and personal preference. Give them a call at 724-733-8747 (out of state 800-411-8747) or send an email to [email protected]. 2)We recommend hotels that are located in the area of the Vatican for being close to the center of the city and also within convenient distance of the Duquesne in Rome campus. 3)Families and friends who wish to vacation in Italy sometime during the semester are also welcome to call Classic Travel and Tours, which can provide suggestions and assistance with hotel reservations (5-, 4- and 3- star), transfers (private car or train), and tours in cities such as Rome, Florence, Venice, as well as throughout all of Italy. -

Hotels and Hostels in Santiago 1

Venue The meeting will be at “Centro de Estudios Nucleares la Reina” located at Av. Nueva Bilbao 12501, Las Condes. https://www.google.cl/maps/place/Nueva+Bilbao+12501,+Las+Condes,+Regi%C3%B3 n+Metropolitana/@-33.428484,- 70.542979,14z/data=!4m5!3m4!1s0x9662cdd59c35f75b:0xdc767ba90e2f9036!8m2!3d- 33.428484!4d-70.5254695 Accomodation. Some hotels and hostels in Santiago 1. Hotel Plaza San Francisco (http://www.plazasanfrancisco.cl/ ) Description: This Hotel it is in the downtown area of Santiago, near the main subway line, which is Line Number 1 (Santa Lucia Station), the prices for a single room are around $130USD, and for a double room are around $140USD, for more information please visit the web page, which link it is above. 2. Hotel Pablo Neruda (http://hotelneruda.cl/hoteles/hotel-neruda/ ) Description: This Hotel it is located, in the heart of Providencia, financial, business and cultural center of the city. It is also near the main subway line, which is Line Number 1 (Pedro de Valdivia Station) ), the prices for a single room are around $130USD, and for a double room are around $120 USD, for more information please visit the web page, which link it is above. 3. Hotel Stanford (http://www.hotelstanford.cl/EN/hotel.html ) Description: This Hotel it is located, in the heart of Providencia, financial, business and cultural center of the city. It is also near the main subway line, which is Line Number 1 (Los Leones Station) , the prices for a single room are around $100USD, and for a double room are around $120 USD, for more information please visit the web page, which link it is above. -

The Operator's Story Appendix: Santiago's Story

Railway and Transport Strategy Centre The Operator’s Story Appendix: Santiago’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London 1 The Operator’s Story: Notes from Santiago Case Study Interviews – February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in Santiago. These notes are based upon 11 meetings between 16th and 20th May 2016. This document will form an appendix to the final report for ‘The Operator’s Story’. Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London or the World Bank. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. Comments are not attributed to specific individuals, as agreed with the interviewees and Metro de Santiago. However, in some cases it is noted that a comment was made by an individual external not employed by Metro de Santiago (‘external commentator’), where it is appropriate to draw a distinction between views expressed by Metro de Santiago themselves and those expressed about their organisation. List