The Changing Model of Big Pharma: Impact of Key Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introducing the IMED Biotech Unit What Science Can Do Introduction What Science Can Do

Introducing the IMED Biotech Unit What science can do Introduction What science can do At AstraZeneca, our purpose is to push the Our IMED Biotech Unit applies its research and Our approach to R&D development capabilities and technologies to The IMED Biotech Unit plays a critical boundaries of science to deliver life-changing accelerate the progress of our pipeline. Through role in driving AstraZeneca’s success. Working together with MedImmune, medicines. We achieve this by placing science great collaboration across our three science units, our global biologics arm and Global we are confident that we can deliver the next wave Medicines Development (GMD), our at the centre of everything we do. late-stage development organisation, of innovative medicines to transform the lives of we are ensuring we deliver an innovative patients around the world. and sustainable pipeline. Pancreatic beta cells at different Eosinophil prior to Minute pieces of circulating tumour DNA stages of regeneration apoptosis (ctDNA) in the bloodstream IMED Biotech Unit MedImmune Global Medicines Development Focuses on driving scientific advances Focuses on biologics research and Focuses on late-stage development in small molecules, oligonucleotides and development in therapeutic proteins, of our innovative pipeline, transforming other emerging platforms to push the monoclonal antibodies and other next- exciting science into valued new boundaries of medical science. generation molecules to attack a range medicines and ensuring patients of diseases. around the world can access them. It’s science that compels us to push the boundaries of what is possible. We trust in the potential of ideas and pursue them, alone and with others, until we have transformed the treatment of disease. -

Astrazeneca Plc

6/15/2020 AstraZeneca - Wikipedia AstraZeneca AstraZeneca plc[3] is a British-Swedish multinational pharmaceutical and biopharmaceutical company with its global AstraZeneca plc headquarters in Cambridge, England.[4] Its R&D is concentrated in Cambridge, Gaithersburg, Maryland, and Mölndal in Sweden.[5] AstraZeneca has a portfolio of products for major disease areas including cancer, cardiovascular, gastrointestinal, infection, Type Public limited neuroscience, respiratory and inflammation.[6] company Traded as LSE: AZN (https:// The company was founded in 1999 through the merger of the www.londonstocke [7][8] Swedish Astra AB and the British Zeneca Group (itself formed xchange.com/exch by the demerger of the pharmaceutical operations of Imperial ange/searchengin Chemical Industries in 1993). Since the merger it has been among e/search.html?lang the world's largest pharmaceutical companies and has made =en&x=0&y=0&q= numerous corporate acquisitions, including Cambridge Antibody AZN) Technology (in 2006), MedImmune (in 2007), Spirogen (in 2013) NYSE: AZN (http and Definiens (by MedImmune in 2014). s://www.nyse.com/ quote/XNYS:AZN) AstraZeneca has a primary listing on the London Stock Exchange Nasdaq and is a constituent of the FTSE 100 Index. It has secondary listings Stockholm: AZN (ht on the New York Stock Exchange and the OMX exchange. tp://www.nasdaqom xnordic.com/aktier/ microsite?language Contents Id=1&Instrument=S SE3524) History FTSE 100 2000–06 Component 2007–12: The patent cliff and subsequent acquisitions ISIN GB0009895292 2013 -

Pharmaceuticals in the Environment

Pharmaceuticals in the Environment As a responsible healthcare company, we are committed to the health and safety of our society and planet. We make it a priority to effectively manage the risks associated with pharmaceuticals in the environment (PIE). 1 How do Pharmaceutical Products get into the Environment? Pharmaceuticals enter the environmental mainly as AstraZeneca supports actions based on scientific a result of patient use, where they can pass through evidence to address the challenges presented by PIE. our bodies and into waterways. Drug manufacture and These include: the improper disposal of unused medicines also add • Assessing the environmental risk of our medicines to the trace levels of pharmaceuticals in rivers, lakes, to support drug marketing authorisations soils, and, sometimes, drinking water. AstraZeneca recognises that, even in such low concentrations, • Actively managing the environmental risks resulting the risks associated with Pharmaceuticals in the from our manufacturing Environment (PIE) should be determined, minimised • Supporting industry and government efforts to and managed. improve medicine disposal programs and education • Co-sponsoring research to fill scientific gaps 88% to understand and mitigate the risks of PIE. as a result of patient use To learn more about the risks associated with PIE and what we are doing to manage them please click here. 2% attributed to waste Pharmaceuticals from production in the environment 10% from unused medicines that people don’t dispose of properly 2 Societal Concerns about PIE Trace amounts of pharmaceuticals have been detected in the environment for more than 20 years. As environmental monitoring expands and the methods for measuring pharmaceuticals in the environment become more sophisticated and detection limits get better, the geographical scope and number of pharmaceuticals measured in the environment will grow. -

Monoclonals 5/10/06 11:51 Page 17

Monoclonals 5/10/06 11:51 Page 17 Therapeutics MONOCLONALS the billion dollar molecules of the future In 1975, two British scientists thought of creating a mouse antibody that could be replicated or ‘cloned’ to produce identical copies. Identical copies with identical modes of action had the potential to be a drug.They had launched what was to be one of biotechnology’s best ideas. If the pair could mimic the immune system’s ‘seek and destroy’ capability by pre-designing antibodies for all manner of disease targets, it should be possible to block or activate cellular activity to order. It was an elegant concept opening up a raft of therapeutic possibilities, particularly in the area of cancer. Here it might be possible to attach a chemotherapy drug to an antibody.The antibody’s specificity for a particular disease target would guide the chemo drug only to the cancerous cells and not the healthy ones.The concept, therefore, was excellent, but the use of mice monoclonals had drawbacks.The human body did not like antibodies from mice anymore than it liked the flu virus, so the antibodies themselves triggered an immune response and were destroyed.This ‘immunogenicity’ issue was to occupy researchers for another 20 or so years before it became possible to craft a monoclonal antibody (mAb) that would be acceptable to the human immune system. fter rather a long period in the desert, untreatable diseases. A further six lead drugs are in By Dr Martin Wiles monoclonal antibody drugs are once the final stages of clinical trials and approximately and Patrik A again generating a wave of excitement. -

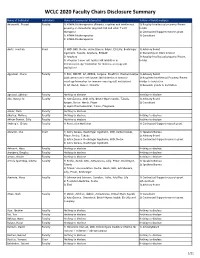

WCLC 2020 Faculty Chairs Disclosure Summary

WCLC 2020 Faculty Chairs Disclosure Summary Name of Individual Individual's Name of Commercial Interest(s) Nature of Relationship(s) Adusumilli, Prasad FacultyRole(s) in Activity 1) ATARA Biotherapeutics (Patents, royalties and intellectual 1) Royalty/Intellectual property/Patent property on mesothelin-targeted CAR and other T-cell holder therapies) 2) Contracted/Support research grant 2) ATARA Biotherapeutics 3) Consultant 3) ATARA Biotherapeutics Aerts, Joachim Chair 1) MSD, BMS, Roche, Astra-Zeneca, BAyer, Eli-Lilly, Boehringer 1) Advisory Board Ingelheim, Takeda, Amphera, BIOCAD 2) Ownership or Stock interest 2) Amphera 3) Royalty/Intellectual property/Patent 3) allogenic tumor cell lysate/JAK inhibition in holder immunooncology/ biomarker for immuno-oncology (all institution) Aggarwal, Charu Faculty 1) BMS, ROCHE, AZ, MERCK, Celgene, BluePrint, Diachaii Sankyo 1) Advisory Board 2)Allogenic tumor cell lysate/JAK inhibition in immuno- 2) Royalties/Intellectual Property/Patent oncology/biomarker for immuno-oncology (all institution) Holder to institution 3) AZ, Merck, Xencor, Novartis 3) Research grants to institution Agrawal, Abhinav Faculty Nothing to disclose Nothing to disclose Ahn, Myung-Ju Faculty 1) AstraZeneca, MSD, Lilly, Bristol-Myers Squibb, Takeda, 1) Advisory Board Amgen, Roche, Merck, Pfizer 2) Consultant 2) Alpha Pharmaceutical, Yuhan, Progenere Aisner, Dara Faculty Nothing to disclose Akerley, Wallace Faculty Nothing to disclose Nothing to disclose Akhtar-Danesh, Gilly Faculty Nothing to disclose Nothing to disclose -

Pharma &Biotech

PHARMA & BIOTECH 1/ 2016 I N Markets & Companies Innovation Manufacturing & Supply Chain Top 10 Brands in the Pharmaceuti- How the Pharma Industry Can Developing New Synthetic Routes, cal Industry, Pharma M&A Update, Bridge the Innovation Gap, Trends High-Potency Manufacturing, Drug Market Reports, Expert Opinions, and Success Factors in Chemical Shortage Prevention, Specialized Company News and Pharmaceutical Research Pharma Logistics Azelis Pharma 2016 advert 240x330_PRINT:Layout 1 02/09/2016 11:38 Page 1 Azelis Pharma – We’re here to add value to your business where it counts In a dynamic pharmaceutical market driven by constant development, changing regulations and evolving healthcare demands, you need a fully compliant partner with proven technical expertise, market knowledge and the capability to keep you more than one step ahead. Azelis serves the human, veterinary health and medical sectors across EMEA, Americas and Asia Pacifi c and represents many of the industry’s top API and excipient manufacturers. Our unrivalled product portfolio is supported by a full package of certifi cations and licenses. APIs – broad therapeutic range includes: cardiovascular, CNS, dermatology, diabetes, infections, nutrition, ophthalmology & pain Excipients – covering all functions: bases, binders, coatings, colours, diluents, fi llers, glidants, lubricants, sorbents, preservatives & sweeteners We work closely with customers to understand their formulation needs, identify new opportunities from patent and therapeutic targeting and proactively add value from product development through to manufacture. Contact us to fi nd out how Azelis can help with quality ingredient sourcing and supply. www.azelis.com · [email protected] Creating value, growing together E DITORIAL Diagnosis: Innovation Insufficiency – Treatment: Combination Therapy Since the beginning of the 21st century, pharma M&A activity has exploded. -

Pharma International Company Corporate Presentation

Pharma International Company Corporate Presentation January 2017 Version 4.27 Contents • Company Overview • Profile and Financial Performance • MENA Operating Environment • Plan and Focus Areas • Key People and Contacts • Execution Credentials 2 © 2017 Pharma International Company Pharma International Company Overview For the past 22 years, we have dedicated ourselves to helping patients, caregivers, regulators and payers across MEA to improve cost of care and health outcomes by providing affordable, quality generic pharmaceuticals in a broad range of therapeutic areas. Mission Pharma International Company (PIC) is a biopharmaceuticals company dedicated to serving patients, healthcare professionals and payers across the Middle East and Africa region. Vision PIC aspires to become the leading Biopharmaceutical partner for key stakeholders keen on improving health outcomes, cost of care and the wellbeing of patients and their care-givers. PIC aims to achieve $300mn in annual revenue by 2020 through organic growth. 3 © 2017 Pharma International Company Milestones and Progress PIC Has Been Primed To Become A Regional Industry Leader 1994 2000 2003 2009 2015 Pharma Manufacturing PIC Becomes PIC Becomes Acquisition of International plant is licensed ISO 9001-14001 ISO 18001 Manufacturing Company (“PIC”) by JMOH Compliant Compliant site in KSA is incorporated 2001 2002 2006 2012 2014 The company launches The company PIC obtains the PIC Opens its Investors acquire Tidilor® and introduces its first Irish Medicines Injectable majority share in Pharmaxin -

Shire: a Focused Global Pharmaceutical Company Focusing on a Bright Future Shire Pharmaceuticals Group Plc the Shire Mission

Shire Pharmaceuticals Group plc Annual review and summary financial statement 2003 Shire: a focused global pharmaceutical company Focusing on a bright future Shire Pharmaceuticals Group plc The Shire mission Our mission is to become the leading company in meeting the needs of the specialist physician. We want to achieve this by developing and Contents 01 Financial highlights marketing products of the highest quality 02 Chairman’s statement 04 Chief Executive Officer’s review for the treatment of serious diseases, 06 Product portfolio 07 Product development pipeline which are treated by medical specialists. 08 Operating review 22 CSR: Corporate and social responsibility 24 Financial review We aim to provide high quality and effective 28 Board of Directors 30 The Executive Committee products that enhance the health and 32 Directors’ remuneration report 44 Corporate governance quality of life of people around the world statement Financial Statements and contribute to the long-term business 48 Statement of Directors’ responsibilities – Report of success of our Company, to the benefit independent auditors 49 Consolidated balance sheets 50 Consolidated statement of all our stakeholders. of operations 51 Consolidated statements of changes in shareholders’ equity We are driven by the needs of all our 52 Consolidated statements of cash flows stakeholders: patients, their families and 53 Notes to the consolidated financial statements 87 Five-year review caregivers, doctors and medical specialists, 88 Summary financial statement 93 Notes to summary employees and partner companies, the financial statement community in which we live and work and, Other 94 Shire head office and main operating locations of course, our shareholders. -

Sustainability Report 2019 Sustainability Approach Access to Healthcare Environmental Protection Ethics and Transparency Notices

Sustainability Report 2019 Sustainability approach Access to healthcare Environmental protection Ethics and transparency Notices AstraZeneca Sustainability Report 2019 2 About this report Table of contents Sustainability approach 2 Sustainability overview 3 Our approach 4 2019 performance review 5 This report Follow us About us 6 This is our fifth annual sustainability report, LinkedIn Sustainability governance 7 and it describes our progress and challenges Global development contribution 9 from 1 January 2019 to 31 December 2019. Facebook The content of this report is based on those Stakeholder engagement 12 sustainability issues deemed material through Twitter comprehensive stakeholder engagement and Access to healthcare 14 analysis. All our business operations worldwide Glassdoor Access to healthcare overview 15 are in scope regardless of their function, unless otherwise stated. Disease prevention and treatment 16 Instagram Responsible research and development 19 Online resources Environment’s impact on health 22 • AstraZeneca Sustainability webpages: cover Assurance Investments in health systems 25 additional topics of interest to our stakeholders. We seek external review of our performance Affordability 27 to validate that we use the same rigour and • AstraZeneca Sustainability Data Summary: accuracy as we do with regulated reporting. Environmental protection 29 provides performance measures and targets Share your ideas Bureau Veritas has provided independent external with at least three years of data where available. and feedback at Environmental protection overview 30 assurance to a limited level for the sustainability sustainability@ • Infographics: show our processes and practices. key performance indicators shown in the astrazeneca.com Product environmental stewardship 32 Sustainability Data Summary as described in the Greenhouse gas reduction 34 • Policies and company standards: state our sustainability letter of assurance. -

Case No COMP/M.1403 - ASTRA / ZENECA

EN Case No COMP/M.1403 - ASTRA / ZENECA Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 26/02/1999 Also available in the CELEX database Document No 399M1403 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 26.02.1999. PUBLIC VERSION In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 MERGER PROCEDURE concerning non-disclosure of business secrets ARTICLE 6(1)(b) DECISION and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying parties Dear Sirs, Subject: Case No IV/M.1403 – ASTRA/ZENECA Notification of 15 January 1999 pursuant to Article 4 of Council Regulation No 4064/89 1. On 15.01.1999, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EEC) No 4064/89, as amended by Council Regulation (EEC) No 1310/97, by which the undertakings Astra AB (Astra) and Zeneca Group Plc (Zeneca) enter into a “merger of equals”, effected through a public bid by Zeneca for all shares in Astra within the meaning of Article 3(1)(b) of the Council Regulation. 2. On 08.02.1999, Astra and Zeneca submitted a proposal for modification of the operation in accordance with the terms of Article 6(2) of the Council Regulation. -

Delivering Our Pipeline Through Scientific Leadership

Delivering our pipeline through scientific leadership Innovative Medicines & Early Development Biotech Unit 2016 – A year in review Delivering our pipeline through scientific leadership 1 Introduction Contents Introduction 02 The next wave of scientific innovation: An introduction from Mene Pangalos 04 IMED Biotech Unit 2016 in numbers Therapy area progress Therapy area progress 06 Oncology 16 Respiratory, Inflammation and Autoimmunity 26 Cardiovascular and Metabolic Diseases 36 Neuroscience IMED functions functions IMED 44 IMED Asia 54 Case Study: NiCoLA-B 56 Discovery Sciences 62 Case Study: Single Molecule Detection 64 Drug Safety and Metabolism 72 Early Clinical Development 82 Pharmaceutical Sciences 90 Case Study: Nucleotide platforms 92 Personalised Healthcare and Biomarkers 102 Case Study: Harnessing the code of life to develop new treatments science innovation Collaborating for Collaborating for science innovation 106 Case Study: Max Planck Institute and AstraZeneca 108 Enterprise leadership through collaboration 112 Collaborating and sharing data to redefine the future of drug discovery 116 Open Innovation 118 Innovation without boundaries 120 Case Study: Foundation Medicine and AstraZeneca where science thrives An environment An environment where science thrives 122 Inspiring great scientists 126 Our strategic science centres 128 Building our future 132 Our reputation for scientific leadership 136 High impact publications in 2016 140 Preparing for the future with our IMED Futures teams 2 IMED Annual Review 2016 Delivering our -

Pharmaceutical Companies M.J

International Dimensions of Ethics Education in Science and Engineering Case Study Series: Access to HIV Treatments in Developing Countries Appendix G: Pharmaceutical Companies M.J. Peterson Version 1, June 2010 Table 1: The 12 Largest Pharmaceutical Companies Fortune US$ % change US$ sales %change Rank Company global assets 2006-08 (millions) 2006-08 500 rank (millions) 1 Johnson&Johnson 107 61,095 15 10,576 -4 2 Pfizer 143 48,148 -8 8,144 -58 3 GlaxoSmithKline 151 45,447 6 10,432 5 4 Roche Group 175 40,315 16 8,135 29 5 Sanofi-Adventis 178 39,977 8 7,204 43 6 Novartis 181 39,800 8 11,946 67 7 AstraZeneca 265 29,559 12 5,595 -7 8 Abbott Laboratories 312 25,914 15 3,606 110 9 Merck 332 24,198 7 3,275 -26 10 Wyeth 381 22,400 10 4,616 10 11 Bristol-Myers Squibb 427 19,977 12 2,165 37 12 Eli Lilly 453 18,364 19 2,953 11 Source: Fortune, 21 July 2008. Access November 17, 2010 from http://money.cnn.com/magazines/fortune/global500/2008/industries/21/index.html. This case was created by the International Dimensions of Ethics Education in Science and Engineering (IDEESE) Project at the University of Massachusetts Amherst with support from the National Science Foundation under grant number 0734887. Any opinions, findings, conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the National Science Foundation. More information about the IDEESE and copies of its modules can be found at http://www.umass.edu/sts/ethics.