Shire Pharmaceuticals Group Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Scientific Organizing Committee Gratefully Acknowledges the Pharmaceutical and Biotechnology Industry for Their Generous Support of WCBP 2019

The Scientific Organizing Committee gratefully acknowledges the pharmaceutical and biotechnology industry for their generous support of WCBP 2019: Strategic Diamond Program Partners F. Hoffmann-La Roche Ltd. Genentech, a Member of the Roche Group Strategic Platinum Program Partners Amgen Inc. Biogen MedImmune, A member of the AstraZeneca Group Strategic Gold Program Partners Eli Lilly and Company Merck & Co., Inc. Novo Nordisk A/S Pfizer, Inc. Strategic Silver Program Partner Sanofi 1 Gold Program Partner Bill and Melinda Gates Foundation Silver Program Partners BioMarin Pharmaceutical Inc. Bristol-Myers Squibb Company GlaxoSmithKline Jazz Pharmaceuticals Bronze Program Partner Seattle Genetics, Inc. Friend of CASSS Janssen R&D, LLC 2 The Scientific Organizing Committee gratefully acknowledges the Program Partners and Exhibitors for their generous support of WCBP 2019: Diamond Program Partners Agilent Technologies Catalent Pharma Solutions Eurofins Pharma Discovery Services ProteinSimple, a Bio-Techne brand Thermo Fisher Scientific Waters Corporation Platinum Program Partners BioAnalytix SCIEX Bronze Program Partner Bruker Corporation 3 The Scientific Organizing Committee gratefully acknowledges the Exhibitors for their generous support of WCBP 2019: Exhibitor Partners 908 Devices Inc. NanoImaging Services Agilent Technologies New England Biolabs Associates of Cape Cod, Inc. Postnova Analytics Inc. BioAnalytix Inc. Pressure BioSciences Inc. Bruker Corporation Protein Metrics, Inc. Catalent Pharma Solutions ProteinSimple, a Bio-Techne brand Charles River Laboratories ProZyme, A part of Agilent Covance, Inc. RedShift BioAnalytics, Inc. Cygnus Technologies Rockland Immunochemicals, Inc. Envigo SCIEX Eurofins BioPharma Product Testing SGS Life Science Services Eurofins Pharma Discovery Services Shimadzu Scientific Instruments, Inc. FortéBio - Biologics by Molecular Devices Thermo Fisher Scientific GE Healthcare Life Sciences U.S. -

In the United States District Court for the District Of

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE FOREST LABORATORIES, LLC and ) FOREST LABORATORIES ) HOLDINGS, LTD., ) ) Plaintiffs, ) ) v. ) Civ.No.14-1119-SLR ) SIGMAPHARM LABORATORIES, LLC, ) et al., ) ) Defendants. ) Jack B. Blumenfeld, Esquire and Maryellen Noreika, Esquire of Morris, Nichols, Arsht & Tunnell LLP, Wilmington, Delaware. Counsel for Plaintiffs. Of Counsel: Howard W. Levine, Esquire, Sanya Sukduang, Esquire, Jonathan R. Davies, Esquire, Courtney B. Gasp, Esquire, and Charles E. Lipsey, Esquire of Finnegan, Henderson, Farabow, Garrett & Dunner LLP. John C. Phillips, Esquire, David A. Bilson, Esquire and Megan C. Haney of Phillips, Goldman, Mclaughlin & Hall, P.A., Wilmington, Delaware. Counsel for Defendant Sigmapharm Laboratories, LLC. Of Counsel: Anthony G. Simon, Esquire, Anthony R. Friedman, Esquire, Benjamin R. Askew, Esquire, and Michael P. Kella, Esquire of The Simon Law Firm, P.C. Karen Elizabeth Keller, Esquire and Jeffrey Thomas Castellano, Esquire of Shaw Keller, LLP, Wilmington, Delaware. Counsel for Defendants Hikma Pharmaceuticals LLC, Hikma Pharmaceuticals PLC, and West-Ward Pharmaceutical Corp. Of Counsel: lmron T. Aly, Esquire, Joel M. Wallace, Esquire, and Helen H. Ji, Esquire of Schiff Hardin LLP. Richard D. Kirk, Esquire, Stephen B. Brauerman, Esquire and Sara E. Bussiere, Esquire of Bayard, P.A., Wilmington, Delaware. Counsel for Defendant Breckenridge Pharmaceutical, Inc. Of Counsel: Beth D. Jacob, Esquire, Clifford Katz, Esquire, and Malavika A. Rao, Esquire of Kelley, Drye & Warren LLP. Karen Pascale, Esquire and Pilar G. Kraman, Esquire of Young, Conaway, Stargatt & Taylor, LLP, Wilmington, Delaware. Counsel for Defendants Alembic Pharmaceuticals Ltd., Alembic Global Holding SA and Alembic Pharmaceuticals, Inc. Of Counsel: Steven J. Lee, Esquire, Michael K. -

Preclinical Development & IND Filing: Nuts, Bolts, Best Practices

“Preclinical Development & IND Filing: Nuts, Bolts, Best Practices and Regulatory Aspects.” Speakers: Amit Kalgutkar (Pfizer), Chandra Prakash (Agios), Sanjeev Thohan (Novartis), Li- Chun Wang (Takeda), Wei Yin (Biogen) Organizers: Sanjeev Thohan and Chandra Prakash Date: 6/29/2017 Time: 8:30 am – 5.00 pm Location: Boston/Cambridge Area: Marriott Kendall Square, 50 Broadway, Cambridge MA 02142 Fees: $175 - Regular (before June 1st, 2017), $225 - Regular (after June 1st, 2017); $125 - Unemployed & Academic; $2000 - Major Sponsorship; $475 - Vendor Show Registration: www.PBSS.org Workshop Description: An investigational new drug application (IND) is an important milestone that marks the entry of a molecule into clinical development. Knowing the objectives, expectations and processes of assembling an IND is a key to not only successful filing, but also a promising clinical development path forward. Often there are cases where too many of our “nice-to-have” studies crowd the package at the expense of critical study needs/issues. This can lead to significant delays in clinical developments with back-and-forth of Q&A sessions both internally and with regulatory agencies. As we have seen, the regulatory landscape is changing as rapidly as the industry innovates into new therapeutic modalities. Therefore, it is critical to keep up to date on regulatory requirements and the industry’s best practices in different aspects of the IND: non- clinical safety, PK, CMC, and clinical plans. In this workshop, our speakers who bring years of experience with multiple successful IND filings, will discuss systematically the preclinical studies required for small molecule IND’s as well as the nuts and bolts of putting together a high–quality IND package. -

Assessment Report COVID-19 Vaccine Astrazeneca EMA/94907/2021

29 January 2021 EMA/94907/2021 Committee for Medicinal Products for Human Use (CHMP) Assessment report COVID-19 Vaccine AstraZeneca Common name: COVID-19 Vaccine (ChAdOx1-S [recombinant]) Procedure No. EMEA/H/C/005675/0000 Note Assessment report as adopted by the CHMP with all information of a commercially confidential nature deleted. Official address Domenico Scarlattilaan 6 ● 1083 HS Amsterdam ● The Netherlands Address for visits and deliveries Refer to www.ema.europa.eu/how-to-find-us Send us a question Go to www.ema.europa.eu/contact Telephone +31 (0)88 781 6000 An agency of the European Union © European Medicines Agency, 2021. Reproduction is authorised provided the source is acknowledged. Table of contents 1. Background information on the procedure .............................................. 7 1.1. Submission of the dossier ..................................................................................... 7 1.2. Steps taken for the assessment of the product ........................................................ 9 2. Scientific discussion .............................................................................. 12 2.1. Problem statement ............................................................................................. 12 2.1.1. Disease or condition ........................................................................................ 12 2.1.2. Epidemiology and risk factors ........................................................................... 12 2.1.3. Aetiology and pathogenesis ............................................................................. -

Astrazeneca-Oxford Vaccine Approved for Use in the U.K

P2JW366000-6-A00100-17FFFF5178F ****** THURSDAY,DECEMBER 31,2020~VOL. CCLXXVI NO.154 WSJ.com HHHH $4.00 DJIA 30409.56 À 73.89 0.2% NASDAQ 12870.00 À 0.2% STOXX 600 400.25 g 0.3% 10-YR. TREAS. À 3/32 , yield 0.926% OIL $48.40 À $0.40 GOLD $1,891.00 À $10.50 EURO $1.2300 YEN 103.21 Deadly Attack at Airport Targets New Yemen Government U.S. IPO What’s News Market Reaches Business&Finance Record nvestorspiled into IPOs Iat a record rate in 2020, with companies raising Total $167.2 billion via 454 of- ferings on U.S. exchanges this year through Dec. 24. Few see signs of letup Few expect the euphoria after companies raise to wear off soon. A1 more than $167 billion Detenteisending in the global fight over tech taxes, despite pandemic with Franceresuming collec- tion of itsdigital-services tax BY MAUREEN FARRELL and the U.S. poised to retali- atewith tariffs.Other coun- Defying expectations,inves- tries areset to join the fray. A1 S tors piled intoinitial public of- China finished 2020 PRES feringsatarecordrateiN with a 10th consecutive TED 2020, and few expect the eu- month of expansion in its CIA phoria to wear off soon. manufacturing sector. A7 SO Companies raised $167.2 AS TheEUand China agreed TENSIONS HIGH: People fled after an explosion Wednesday at the airport in Aden, Yemen, moments after members of the billion through 454 offerings in principle on an invest- country’s newly sworn-in cabinet arrived. At least 22 people were killed, but all the members of the cabinet were safe. -

Biotechnology and the Economics of Discovery in the Pharmaceutical Industry

BIOTECHNOLOGY AND THE ECONOMICS OF DISCOVERY IN THE PHARMACEUTICAL INDUSTRY HELEN SIMPSON Office of Health Economics 12 Whitehall London SWlA 2DY ©October 1998. Office of Health Economics. Price £7.50 ISBN 1 899040 60 9 Printed by BSC Print Ltd, London. About the Author Helen Simpson is currently a researc~ economist at the Institute for Fiscal Studies and was formerly an economist at the Department of Trade and Industry. However, the opinions expressed here are her own and do not necessarily reflect the views of the IFS or of DTI officials or ministers. Acknowledgements This paper has been developed from my MPhil Economics thesis Scientist Entrepreneurs and the Finance of Biotech Companies. I would like to thank Margaret Meyer, Paul David and Gervas Huxley for their valuable suggestions. I am particularly grateful to Hannah Kettler and Jon Sussex for their advice and editorial inputs to the paper. My thanks also go to Adrian Towse and members of the OHE Editorial Board for their comments, and to the following individuals who gave me their insights into the pharmaceutical industry: Dr Trevor Jones, Director General, ABPI; Dr Janet Dewdney, Chairman, Adprotech; Dr Clive Halliday, Head of Global External Scientific Affairs, Glaxo Wellcome; Mr Alan Galloway, Head of Research Administration, Dr Nick Scott-Ram, Director of Corporate Affairs, and Dr Philip Huxley, all of British Biotech; Christine Soden, Finance Director, Chiroscience; Ian Smith, Lehman Brothers Pharmaceutical Research; and Paul Murray, 31. The Office of Health Economics Terms of Reference The Office of Health Economics (OHE) was founded in 1962. Its terms of reference are to: • commission and undertake research on the economics of health and health care; • collect and analyse health and health care data from the UK and other countries; • disseminate the results of this work and stimulate discussion of them and their policy implications. -

Programme 10.00 Registration 10.20 Welcome from the Host

Leadership Seminar: Respiratory and Inflammatory Diseases 22 September 2016 Penningtons Manches, 125 Wood Street, London EC2V 7AW Sponsored by Hosted by Programme 10.00 Registration 10.20 Welcome from the Host 10.30 Introduction Adrian Dawkes, PharmaVentures 10.45 Keynote presentations and discussion on unmet clinical needs including: 10.45 Symptoms vs Disease Modification Approach Lars Larson, TranScrip 11.05 Prospects for the prevention and treatment of respiratory virus-induced exacerbations in asthma and COPD Garth Rapeport, Pulmocide 11.25 Eosinophil depletion with benralizumab (anti-IL-5R) for the management of Severe Asthma and Chronic Obstructive Pulmonary Disease (COPD) Suzanne Cohen, MedImmune 11.45 Breath Biopsy - Breath Volatile Organic Compounds (VOCs) as Markers for Respiratory Disease Billy Boyle, Owlstone Medical 12.05 Panel discussion and Q&A 12.30 Lunch and networking 14.00 Data Protection and Liability in Respiratory Connected Devices Oliver Bett, Penningtons Manches 14.20 Adaptive Design in Respiratory Clinical Trials – A Sponsor’s Business Case Alethea Wieland, Scope International 14.40 Development of Immunoassays and Point-of-Care Tests for the Measurement of Active Protease Biomarkers of Chronic Respiratory Disease David Ribeiro, ProAxsis 15.00 Aiming for the Lungs - Formulation Strategies for Delivery of Inhaled Biologics Charlotte Yates, Vectura 15.30 Tea, coffee and networking 16.00 Innovative therapeutic options 16.00 The Development of an IL-17BR therapeutic antibody for the treatment of Asthma and IPF David Matthews, MRC Technology 16.20 Mycobacterium Tuberculosis Derived Peptide as a Disease Modifying Therapy for Asthma Nicky Cooper, Peptinnovate 16.40 Closing Remarks and Drinks Reception 18.00 Event closes Speaker Profiles Oliver Bett Associate, Penningtons Manches Oliver is an associate in our IP, IT and commercial team of Penningtons Manches, based in the London office. -

Introducing the IMED Biotech Unit What Science Can Do Introduction What Science Can Do

Introducing the IMED Biotech Unit What science can do Introduction What science can do At AstraZeneca, our purpose is to push the Our IMED Biotech Unit applies its research and Our approach to R&D development capabilities and technologies to The IMED Biotech Unit plays a critical boundaries of science to deliver life-changing accelerate the progress of our pipeline. Through role in driving AstraZeneca’s success. Working together with MedImmune, medicines. We achieve this by placing science great collaboration across our three science units, our global biologics arm and Global we are confident that we can deliver the next wave Medicines Development (GMD), our at the centre of everything we do. late-stage development organisation, of innovative medicines to transform the lives of we are ensuring we deliver an innovative patients around the world. and sustainable pipeline. Pancreatic beta cells at different Eosinophil prior to Minute pieces of circulating tumour DNA stages of regeneration apoptosis (ctDNA) in the bloodstream IMED Biotech Unit MedImmune Global Medicines Development Focuses on driving scientific advances Focuses on biologics research and Focuses on late-stage development in small molecules, oligonucleotides and development in therapeutic proteins, of our innovative pipeline, transforming other emerging platforms to push the monoclonal antibodies and other next- exciting science into valued new boundaries of medical science. generation molecules to attack a range medicines and ensuring patients of diseases. around the world can access them. It’s science that compels us to push the boundaries of what is possible. We trust in the potential of ideas and pursue them, alone and with others, until we have transformed the treatment of disease. -

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry By: Maitri Punjabi Honors Thesis Economics Department The University of North Carolina at Chapel Hill March 2016 Approved: ______________________________ Dr. Jonathan Williams Punjabi 2 Abstract This paper analyzes the effect of the changing nature of innovation on pharmaceutical firm market value from the years 1987 to 2010 by using U.S. patent and claim data. Over the years, firms have started shifting focus from primary innovation to secondary innovation as new ideas and new compounds become more difficult to generate. In this study, we analyze the impact of this patent portfolio shift on the market capitalization of pharmaceutical firms. After using firm fixed effects and the instrumental variable approach, we find that there exists a strong positive relationship between secondary innovations and the market value of the firm– in fact, we find a stronger relationship than is observed between primary innovation and market value. When focusing on the different levels of innovation within the industry, we find that this relationship is stronger for less-innovative firms (those that have produced fewer patents) than it is for highly- innovative firms. We also find that this relationship is stronger for firms that spend less on research and development, complementing earlier findings that research productivity is declining over time. Punjabi 3 Acknowledgements I would primarily like to thank my adviser, Dr. Jonathan Williams, for his patience and constant support. Without his kind and helpful attitude, this project would have been a much more frustrating process. Through his knowledge of the industry, I have gained valuable insight and have learned a great deal about a unique and growing field. -

Mvx List.Pdf

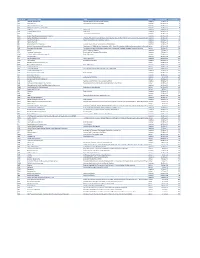

MVX_CODE manufacturer_name Notes status last updated date manufacturer_id AB Abbott Laboratories includes Ross Products Division, Solvay Inactive 16-Nov-17 1 ACA Acambis, Inc acquired by sanofi in sept 2008 Inactive 28-May-10 2 AD Adams Laboratories, Inc. Inactive 16-Nov-17 3 ALP Alpha Therapeutic Corporation Inactive 16-Nov-17 4 AR Armour part of CSL Inactive 28-May-10 5 AVB Aventis Behring L.L.C. part of CSL Inactive 28-May-10 6 AVI Aviron acquired by Medimmune Inactive 28-May-10 7 BA Baxter Healthcare Corporation-inactive Inactive 28-May-10 8 BAH Baxter Healthcare Corporation includes Hyland Immuno, Immuno International AG,and North American Vaccine, Inc./acquired somInactive 16-Nov-17 9 BAY Bayer Corporation Bayer Biologicals now owned by Talecris Inactive 28-May-10 10 BP Berna Products Inactive 28-May-10 11 BPC Berna Products Corporation includes Swiss Serum and Vaccine Institute Berne Inactive 16-Nov-17 12 BTP Biotest Pharmaceuticals Corporation New owner of NABI HB as of December 2007, Does NOT replace NABI Biopharmaceuticals in this codActive 28-May-10 13 MIP Emergent BioSolutions Formerly Emergent BioDefense Operations Lansing and Michigan Biologic Products Institute Active 16-Nov-17 14 CSL bioCSL bioCSL a part of Seqirus Inactive 26-Sep-16 15 CNJ Cangene Corporation Purchased by Emergent Biosolutions Inactive 29-Apr-14 16 CMP Celltech Medeva Pharmaceuticals Part of Novartis Inactive 28-May-10 17 CEN Centeon L.L.C. Inactive 28-May-10 18 CHI Chiron Corporation Part of Novartis Inactive 28-May-10 19 CON Connaught acquired by Merieux Inactive 28-May-10 21 DVC DynPort Vaccine Company, LLC Active 28-May-10 22 EVN Evans Medical Limited Part of Novartis Inactive 28-May-10 23 GEO GeoVax Labs, Inc. -

United States Securities and Exchange Commission Form 10-K Shire Pharmaceuticals Group

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 1999 អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 0-29630 SHIRE PHARMACEUTICALS GROUP PLC (Exact name of registrant as specified in its charter) England and Wales (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) N.A. East Anton, Andover, Hampshire SP10 5RG England (Address of principal executive offices) (Zip Code) 44 1264 333455 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered American Depository Shares, each representing Nasdaq National Market 3 Ordinary Shares, 5 pence nominal value per share Securities registered pursuant to Section 12(g) of the Act: None (Title of class) Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ፤ No អ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K. -

Dyax Corp. 300 Technology Square Cambridge, MA 02139 617 225-2500

Dyax Corp. 300 Technology Square Cambridge, MA 02139 617 225-2500 www.dyax.com Other Offices Dyax SA, Liege, Belgium ADVANCING NOVEL THERAPEUTIC PRODUCTS Dyax Corp. Annual Report 2003 Corporate Information Dyax Achievements 2003 Dyax Goals 2004 Directors Executive Officers and Stock Listing Henry E. Blair Key Employees Common stock has been traded on the Nasdaq Stock Market Advances in Clinical Development Clinical Development Chairman, President and Henry E. Blair* under the symbol DYAX since our initial public offering in Milestones Chief Executive Officer, Chairman, President and August 14, 2000. DX-88/Hereditary Angioedema Dyax Corp. Chief Executive Officer DX-88/Hereditary Constantine E. Stephen S. Galliker, CPA* The following table gives the quarterly high and low sales G Completed 9-patient Phase II trial, met primary endpoints Angioedema Anagnostopoulos, Ph.D. EVP Finance and prices of our common stock for the last three years. G Genzyme Corporation joined Dyax as joint venture partner Managing General Partner, Administration and G Complete Phase II 2001 2002 2003 G Gateway Associates, LP Chief Financial Officer Completed 3 of 4 dose cohorts in 48-patient Phase II EDEMA1 trial EDEMA1 study High Low High Low High Low G Susan B. Bayh, J.D. Lynn G. Baird, Ph.D.* Initiated Phase II EDEMA2 trial G Periodically observe James W. Fordyce SVP Development First Quarter $20.94 $6.56 $11.38 $3.10 $2.25 $1.52 G Orphan Drug designation granted in U.S. and Europe effects of repeat dosing in Phase II EDEMA2 Managing Partner, Robert C. Ladner, Ph.D. Second Quarter $19.99 $6.81 $ 4.68 $3.20 $4.90 $1.67 Fordyce & Gabrielson, LLC SVP and Chief DX-88/On-Pump Open Heart Surgery (CABG) study Third Quarter $21.24 $6.05 $ 4.20 $1.65 $7.50 $2.58 Mary Ann Gray, Ph.D.