Form 990, Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Word Template for Authors

COMMITTEE ON STATISTICS Nineteenth meeting UNWTO Headquarters, Madrid, Spain 26-27 February 2019 INFORMATION NOTE 1. Venue and dates The nineteenth meeting of the Committee on Statistics will be held at UNWTO headquarters in Madrid, from 26 to 27 February 2019. 2. How to get to UNWTO headquarters (from Madrid-Barajas Adolfo Suárez Airport) a. By taxi: . Taxi fare from the airport to Madrid: between 20 and 30 Euros (depending on your destination and on traffic). The address for UNWTO headquarters is: Poeta Joan Maragall, 42. b. By metro: . Subway map (below “Subway map”) Cuzco is the subway station for the UNWTO headquarters. (From the airport: Line 8: Aeropuerto – Nuevos Ministerios, then Line 10: Nuevos Ministerios – Cuzco). 3. Accommodation - List of hotels (below “Recommended hotels”) . Participants are requested to make their own hotel reservations in one of the hotels mentioned in the list attached or any other hotel of their choice. Those hotels closer to UNWTO are: Hotel Meliá Castilla (4*) and Hotel AC Cuzco (4*). Don’t forget to mention that you are coming to UNWTO for an official meeting. We also suggest that you check the online rates as these are sometimes cheaper. 4. Restaurants and supermarkets (close to UNWTO) . List and map below “Restaurants, shopping centre and supermarket” 5. Working languages . The working language of the meeting will be English. World Tourism Organization (UNWTO) - A Specialized Agency of the United Nations C/ Poeta Joan Maragall 42, 28020 Madrid, Spain. Tel: (34) 91 567 81 00 / Fax: (34) 91 571 37 33 – [email protected] / unwto.org 6. -

Shanghai Lumina Shanghai (100% Owned)

Artist’s impression LUMINA GUANGZHOU GUANGZHOU Artist’s impression Review of Operations – Business in Mainland China Progress of Major Development Projects Beijing Lakeside Mansion (24.5% owned) Branch of Beijing High School No. 4 Hou Sha Yu Primary School An Fu Street Shun Yi District Airport Hospital Hou Sha Yu Hou Sha Yu Station Town Hall Tianbei Road Tianbei Shuang Yu Street Luoma Huosha Road Lake Jing Mi Expressway Yuan Road Yuan Lakeside Mansion, Beijing (artist’s impression) Hua Li Kan Station Beijing Subway Line No.15 Located in the central villa area of Houshayu town, Shunyi District, “Lakeside Mansion” is adjacent to the Luoma Lake wetland park and various educational and medical institutions. The site of about 700,000 square feet will be developed into low-rise country-yard townhouses and high-rise apartments, complemented by commercial and community facilities. It is scheduled for completion in the third quarter of 2020, providing a total gross floor area of about 1,290,000 square feet for 979 households. Beijing Residential project at Chaoyang District (100% owned) Shunhuang Road Beijing Road No.7 of Sunhe Blocks Sunhe of Road No.6 Road of Sunhe Blocks of Sunhe Blocks Sunhe of Road No.4 Road of Sunhe Blocks Road No.10 Jingping Highway Jingmi Road Residential project at Chaoyang District, Beijing (artist’s impression) Huangkang Road Sunhe Station Subway Line No.15 Located in the villa area of Sunhe, Chaoyang District, this project is adjacent to the Wenyu River wetland park, Sunhe subway station and an array of educational and medical institutions. -

For Information 17 September 2009 Legislative Council Panel On

LC Paper No. CB(1)2582/08-09(01) For information 17 September 2009 Legislative Council Panel on Transport Subcommittee on Matters Relating to Railways Progress of the Hong Kong Section of Guangzhou-Shenzhen-Hong Kong Express Rail Link Introduction This paper briefs Members on the progress of the Hong Kong section of Guangzhou-Shenzhen-Hong Kong Express Rail Link (XRL). Background 2. On 22 April 2008, the Chief Executive-in-Council decided to invite the MTR Corporation Limited (MTRCL) to proceed with further planning and design of the Hong Kong section of XRL. Subsequently, the railway scheme was gazetted under the Railways Ordinance on 28 November and 5 December 2008 and the MTRCL started the detailed design in January 2009. To address concerns expressed by members of the public during the consultation period and to incorporate design changes, we gazetted the amendments to the railway scheme on 30 April and 8 May 2009. We also briefed this Subcommittee on the project on 14 May 2009. The XRL 3. The XRL is an express rail of about 140km long linking up Hong Kong with Guangzhou via Futian and Longhua in Shenzhen and Humen in Dongguan. Its terminus in Guangzhou (hereinafter referred to as the "New Guangzhou Passenger Station") will be located at Shibi, the centre of the Guangzhou - Foshan metropolitan area. The terminus of the Hong Kong section is located in West Kowloon, an area in vicinity of commercial and tourist areas. The Hong Kong section of the XRL will be an underground rail corridor of 26 km in length connecting the Mainland section in Huanggang. -

Rail Transport in the World's Major Cities

Feature Evolution of Urban Railways (part 2) Rail Transport in The World’s Major Cities Takao Okamoto and Norihisa Tadakoshi Many of the world’s large cities grew in development, particularly with regard to American city; and Hong Kong, Seoul and conjunction with railways, and today, the following: Tokyo representing Asian cities. large cities cannot depend only on motor • The correlation between railways and vehicles for transportation. With worries urban growth over global environmental issues, public • The location of terminals for intercity London transportation systems are increasingly and intra-city transport seen as an important way to expand and • Examination of various public transit Located in southeast England near the revitalize large cities, while consuming systems, including non-infrastructure mouth of the River Thames, London less energy and other resources. • Strategic planning of rail networks expanded during the Industrial Revolution This article looks at public transportation based on urban development trends (1760–1850) and secured its dominance systems in some major cities of the world and future models as the heart of the British Empire during and identifies similarities and differences The cities selected for this comparative the Victorian era (1837–1901). It’s in areas such as history of development, study are: London as the first city to adapt population grew from about 500,000 in railway networks, and method of rail technology to public transport; Paris, the 17th century to 4.5 million by the end operation. Our aim is to explore the future Berlin and Moscow as three major of the 19th century. The modern relationship between urban and transport European cities; New York as a North- metropolis of Greater London consists of The London Railway Network King’s Cross/St.Pancras Paddington LCY Victoria Waterloo LHR R. -

Madrid Public Transport System Metro & Regional Railways

MADRID PUBLIC TRANSPORT SYSTEM METRO & REGIONAL RAILWAYS 3rd International Seminar on Mega city: « Urban Mobility options» Mumbai, Nov ember 2014 - Presentation • INECO is a state owned company established in 1968 • The trusted consultancy to the Spanish Transport and Public Works Ministry • Independent from manufacturers/suppliers interest • World class railway engineering and consultancy company 2 - shhldhareholders INECO is a company integrated in the Ministry of PublicWorks and Transport. Its shareholders are the public companies for the complex management of Spain´s transport systems. ADIF Administrador de Infraestructuras Ferroviarias (Administrator of Railway Infraestructures) RENFE Red Nacional de Ferrocarriles Españoles (Spanish National railway) AENA Aeropuertos Españoles y Navegación Aérea (Spanish airports and airspace) Shareholders 3 - Presentation Turnover approx. Staff: 2800 300 Million EUROS employees 40 years, 55 countries , leading + 1,000 railwa y transport projects Staff: over 3,100 2,000 staff working in railway consultancy including LRTs, metros, commuter trains, freight railways and high speed railways) 4 - capabilities A global services offer. Fro m planning & design to operation Highly specialized in railways (Metro, Light Rail, Commuter, Regional and High Speed) PROJECT MANAGEMENT DESIGN • Control, supervision and technical • Conceptual and preliminary design assistance • Performance specifications • Construction Management and technical • Detailed Design advisory OPERATION AND MAINTENANCE PLANNING • Commissioning, -

8Th Metro World Summit 201317-18 April

30th Nov.Register to save before 8th Metro World $800 17-18 April Summit 2013 Shanghai, China Learning What Are The Series Speaker Operators Thinking About? Faculty Asia’s Premier Urban Rail Transit Conference, 8 Years Proven Track He Huawu Chief Engineer Record: A Comprehensive Understanding of the Planning, Ministry of Railways, PRC Operation and Construction of the Major Metro Projects. Li Guoyong Deputy Director-general of Conference Highlights: Department of Basic Industries National Development and + + + Reform Commission, PRC 15 30 50 Yu Guangyao Metro operators Industry speakers Networking hours President Shanghai Shentong Metro Corporation Ltd + ++ Zhang Shuren General Manager 80 100 One-on-One 300 Beijing Subway Corporation Metro projects meetings CXOs Zhang Xingyan Chairman Tianjin Metro Group Co., Ltd Tan Jibin Chairman Dalian Metro Pak Nin David Yam Head of International Business MTR C. C CHANG President Taoyuan Metro Corp. Sunder Jethwani Chief Executive Property Development Department, Delhi Metro Rail Corporation Ltd. Rachmadi Chief Engineering and Project Officer PT Mass Rapid Transit Jakarta Khoo Hean Siang Executive Vice President SMRT Train N. Sivasailam Managing Director Bangalore Metro Rail Corporation Ltd. Endorser Register Today! Contact us Via E: [email protected] T: +86 21 6840 7631 W: http://www.cdmc.org.cn/mws F: +86 21 6840 7633 8th Metro World Summit 2013 17-18 April | Shanghai, China China Urban Rail Plan 2012 Dear Colleagues, During the "12th Five-Year Plan" period (2011-2015), China's national railway operation of total mileage will increase from the current 91,000 km to 120,000 km. Among them, the domestic urban rail construction showing unprecedented hot situation, a new round of metro construction will gradually develop throughout the country. -

Announcement of Unaudited Results for the Six Months Ended 30 June 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. MTR CORPORATION LIMITED 香港鐵路有限公司 (the “Company”) (Incorporated in Hong Kong with limited liability) (Stock code: 66) ANNOUNCEMENT OF UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2020 RESULTS Six months ended 30 June HK$ million 2020 2019 Change Revenue from recurrent businesses 21,592 28,272 -23.6% Profit from recurrent businesses^ 433 2,665 -83.8% Profit from property development 5,200 775 +571.0% Investment property revaluation (loss) / gain (5,967) 2,066 n/m Net (loss) / profit attributable to shareholders of the Company (334) 5,506 n/m ^ : including share of profit /( loss) of associates and joint venture n/m : not meaningful - Interim ordinary dividend of HK$0.25 per share declared (with scrip dividend alternative) HIGHLIGHTS Hong Kong Businesses - Hong Kong transport operations, station commercial and property rental businesses have been significantly and adversely affected as a result of the COVID-19 pandemic. Various relief measures have been offered to our passengers as well as tenants to ease their financial burden during the pandemic - In spite of the pandemic, train service delivery and passenger journeys on-time in our heavy rail remained at 99.9% world-class level - Tuen Ma Line Phase 1 was opened in February 2020. -

China Railway Signal & Communication Corporation

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. China Railway Signal & Communication Corporation Limited* 中國鐵路通信信號股份有限公司 (A joint stock limited liability company incorporated in the People’s Republic of China) (Stock Code: 3969) ANNOUNCEMENT ON BID-WINNING OF IMPORTANT PROJECTS IN THE RAIL TRANSIT MARKET This announcement is made by China Railway Signal & Communication Corporation Limited* (the “Company”) pursuant to Rules 13.09 and 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and the Inside Information Provisions (as defined in the Listing Rules) under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). From July to August 2020, the Company has won the bidding for a total of ten important projects in the rail transit market, among which, three are acquired from the railway market, namely four power integration and the related works for the CJLLXZH-2 tender section of the newly built Langfang East-New Airport intercity link (the “Phase-I Project for the Newly-built Intercity Link”) with a tender amount of RMB113 million, four power integration and the related works for the XJSD tender section of the newly built -

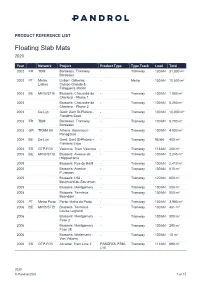

Floating Slab Mats 2020

PRODUCT REFERENCE LIST Floating Slab Mats 2020 Year Network Project Product Type Type Track Load Total 2002 FR TBM Bordeaux: Tramway - Tramway 100 kN 31,000 m² Bordeaux 2002 PT Metro Lisbon: Odivelas, - Metro 100 kN 10,000 m² Lisboa Campo Grande & Falagueira station 2003 BE MIVB/STIB Brussels: Chaussée de - Tramway 100 kN 1,800 m² Charleroi - Phase 1 2003 Brussels: Chaussée de - Tramway 100 kN 5,250 m² Charleroi - Phase 2 2003 De Lijn Gent: Gent St-Pieters - - Tramway 100 kN 10,000 m² Flanders Expo 2003 FR TBM Bordeaux: Tramway - Tramway 130 kN 9,700 m² Bordeaux 2003 GR TRAM SA Athens: Kasamouli - - Tramway 100 kN 4,000 m² Panagitsas 2004 BE De Lijn Gent: Gent St-Pieters - - Tramway 95 kN 400 m² Flanders Expo 2004 ES GTP-FGV Valencia: Tram Valencia - Tramway 113 kN 200 m² 2005 BE MIVB/STIB Brussels: Avenue de - Tramway 100 kN 2,245 m² l'Hippodrome 2005 Brussels: Rue du Bailli - Tramway 100 kN 2,410 m² 2005 Brussels: Avenue - Tramway 100 kN 610 m² P.Janson 2005 Brussels: L94 - - Tramway 120 kN 600 m² Boulevard du Souverain 2005 Brussels: Montgomery - Tramway 100 kN 250 m² 2005 Brussels: Terminus - Tramway 100 kN 550 m² Boondael 2005 PT Metro Porto Porto: Metro do Porto - Tramway 100 kN 3,900 m² 2006 BE MIVB/STIB Brussels: Terminus - Tramway 130 kN 481 m² Louise Legrand 2006 Brussels: Montgomery - Tramway 100 kN 300 m² Fase 2 2006 Brussels: Montgomery - Tramway 100 kN 290 m² Fase 2E 2006 Brussels: Wielemans - - Tramway 100 kN 15 m² Van Volxem 2006 ES GTP-FGV Alicante: Tram Line 2 PANDROL FSM- Tramway 113 kN 690 m² L10 2020 © Pandrol 2020 -

February 19, 2013 Meeting Materials

ACUPUNCTURE BOARD 1747 N. Market Blvd, Suite 180, Sacramento, CA 95834 P (916) 515-5200 F (916) 928-2204 www.acupuncture.ca.gov Draft ACUPUNCTURE BOARD MEETING MINUTES DCA Headquarters 2, Sacramento FULL BOARD MEETING November 15, 2012 Members Present Staff Present AnYork Lee, L.Ac., Chair Terri Thorfinnson, Executive Officer Charles Kim, Public Member, Vice Chair Spencer Walker, Staff Counsel Michael Shi, Public Member Paul Weisman, Public Member Guest List on File George Wedemeyer, Public Member 1. Call Meeting to Order and Establishment of Quorum Quorum was established. Meeting called to order at 8:45 am. 2. Pledge of Allegiance was said 3.Approval of August 9, 2012 Meeting Minutes A. MOTION WAS MADE BY PAUL WEISMAN AND SECONDED BY VICE CHAIR KIM TO APPROVE THE AUGUST 9, 2012 MINUTES WITH THE FOLLOWING CORRECTIONS/AMENDMENTS 5-0-0 MOTION CARRIED. B. CORRECTIONS: Page 9 correct ACOM to ACAOM C. CORRECTION: Page 7 correct pinion to pinyin 4. DCA Budget Officer and DCA Update- Taylor Schick, Budget Officer- Gave an update on a BCP that was submitted by the Executive Officer (EO) for inclusion in the fiscal year 2013-2014 Governor’s Budget. Due to the constraints of the budget building process and the guidelines set forth by Department of Finance, that BCP did not meet the deadline set forth by the Department of Finance and was not submitted for inclusion in the Governor’s Budget. Our recommendation to the Board would be continue to develop the BCP and prepare for fiscal year 14/15 governor’s budget building process. -

Development of High-Speed Rail in the People's Republic of China

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Haixiao, Pan; Ya, Gao Working Paper Development of high-speed rail in the People's Republic of China ADBI Working Paper Series, No. 959 Provided in Cooperation with: Asian Development Bank Institute (ADBI), Tokyo Suggested Citation: Haixiao, Pan; Ya, Gao (2019) : Development of high-speed rail in the People's Republic of China, ADBI Working Paper Series, No. 959, Asian Development Bank Institute (ADBI), Tokyo This Version is available at: http://hdl.handle.net/10419/222726 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc-nd/3.0/igo/ www.econstor.eu ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. -

Safety-First Culture Bringing MTR to Continuous & Global Excellence

Safety-First Culture Bringing MTR to Continuous & Global Excellence Dr. Jacob Kam Managing Director – Operations & Mainland Business 23 October 2017 Agenda ▪ Introducing MTR ▪ Safety First Culture ▪ Global Operational Safety ▪ Future Challenges MTR Corporation 1/15/2018 Page 2 MTR Operations in Hong Kong Heavy Rail Airport Express Light Rail Intercity Guangzhou-Shenzhen- Bus Hong Kong Express Rail Link To be opened in Q3 2018 MTR Corporation 1/15/2018 Page 3 MTR Network in HK is Expanding 1980 * 2016 Total Route Length in HK 14.8x 15.6 km 230.9 km MTR established in 1975 2 rail projects completed in 2016; MTR is present in all 18 districts in Hong Kong 2 rail projects totally 43km under construction * First network (Modified Initial System) commenced Source: MTR Sustainability Report in 1979 with its full line opening in 1980. MTR Corporation 1/15/2018 Page 4 MTR Network in HK is Expanding Source: MTR Annual Report 2016 MTR Corporation 1/15/2018 Page 5 MTR Network outside HK is also Expanding 2004 2016 Global Network 13.5x 88 km 1,192 km Stockholm Metro (MTR Tunnelbanen) MTR Tech (renamed from TBT) London Crossrail Stockholm Commuter Rail (MTR Pendeltågen) EM Tech AB South Western Railway MTR Express Beijing Line 4 Beijing Daxing Line Beijing Line 14 Beijing Line 16 (Phase 2 Sweden under construction) UK Beijing Hangzhou Line 1 + Extension Hangzhou Hangzhou Line 5 (being constructed) Shenzhen Shenzhen Line 4 Sydney Sydney Metro Northwest Melbourne As of 30 Jun 2017 Average Weekday Patronage Route Length (in operation) Mainland of China & Metro Trains Melbourne 5.79 M >2,000 km* International MTR Corporation 1/15/2018 Page 6 MTR Corporation 1/15/2018 Page 7 MTR Runs Very Well in HK – Safety Performance achieved a high level and continuous improvement in Operational Safety worse Fatalities per Billion Passenger Journeys better include suicide, accidents & illegal activities, 10-year average Source : CoMET 2016 Interim KPI Database AS – Asian Metros NA – North American Metros (2015 data).