Southwest Airlines You Are Now Free to Move About the Country.™

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Southwest Airlines 1996 Annual Report

1996 Annual Report TABLE OF CONTENTS Consolidated Highlights 2 Introduction 3 Letter to Shareholders 4 People and Planes 6 Southwest Spirit 8 THE Low Fare Airline 10 Productivity 12 Ontime Performance 14 Customer Satisfaction 16 Mintenance and Safety 18 What’s Next? 20 Financial Review 22 Management’s Discussion and Analysis 22 Consolidated Financial Statements 31 Report of Independent Auditors 49 Quarterly Financial Data 50 Common Stock Price Ranges and Dividends 50 Corporate Data 51 Directors and Officers 52 Ten Year Summary 55 CONSOLIDATED HIGHLIGHTS (DOLLARS IN THOUSANDS PERCENT EXCEPT PER SHARE AMOUNTS) 1996 1995 CHANGE Operating revenues $3,406,170 $2,872,751 18.6 Operating expenses $3,055,335 $2,559,220 19.4 Operating income $350,835 $313,531 11.9 Operating margin 10.3% 10.9% (0.6)pts. Net income $207,337 $182,626 13.5 Net margin 6.1% 6.4% (0.3)pts. Net income per common and common equivalent share $1.37 $1.23 11.4 Stockholders’ equity $1,648,312 $1,427,318 15.5 Return on average stockholders’ equity 13.5% 13.7% (0.2)pts. Debt as a percentage of invested capital 28.3% 31.7% (3.4)pts. Stockholders’ equity per common share outstanding $11.36 $9.91 14.6 Revenue passengers carried 49,621,504 44,785,573 10.8 Revenue passenger miles (RPMs)(000s) 27,083,483 23,327,804 16.1 Available seat miles (ASMs)(000s) 40,727,495 36,180,001 12.6 Passenger load factor 66.5% 64.5% 2.0 pts. Passenger revenue yield per RPM 12.07¢ 11.83¢ 2.0 Operating revenue yield per ASM 8.36¢ 7.94¢ 5.3 Operating expenses per ASM 7.50¢ 7.07¢ 6.1 Number of Employees at yearend 22,944 19,933 15.1 NET INCOME (in millions) $207 $179 $183 250 $154 200 $97 150 100 50 0 1992 1993 1994 1995 1996 2 NET INCOME PER SHARE $1.37 $1.22 $1.23 1.40 $1.05 1.20 1.00 $.68 0.80 0.60 0.40 0.20 0.00 1992 1993 1994 1995 1996 SOUTHWEST AIRLINES CO. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

David Neeleman

David Neeleman David Neeleman is that rarest of entrepreneurs, a man who has created and launched four successful, independent airlines, including the USA’s JetBlue and Morris Air, Canada’s WestJet and Brazil’s Azul. Azul, just seven years old, has already boarded tens of millions of customers. Born in Brazil while his father was Reuter’s São Paulo Bureau Chief, David has always had a deep love for the country. After his family moved to Utah while he was still a child, David would return to Brazil many times throughout his life. A dual citizen, David today relishes the dream before him to make flying cheaper and easier for Brazilians, giving access to air travel for many who have never experienced the opportunity before. Azul serves more than 100 destinations with an operating fleet of more than 140 aircraft, including Brazilian-built Embraer E-190 and E-195 jets, and ATR-72s. Just as JetBlue in the US before it, Azul is the first airline in Latin America to offer LiveTV inflight TV programming via satellite. It has been named Best Low Cost Airline in South America for the last five years at the Skytrax World Airline Awards. In June 2015, it was announced that the Gateway consortium, led by David, had won the bidding to acquire a stake in Portugal’s national carrier TAP. Gateway’s investment represents 50% of the airline. With the new investment, TAP is taking delivery of A330s and inaugurated new daily service from both Boston’s Logan airport and New York’s John F Kennedy International in June and July, respectively. -

Official Statement

NEW ISSUE—BOOK ENTRY ONLY RATING: See “Rating” In the opinion of Orrick, Herrington & Sutcliffe LLP, Bond Counsel, based upon an analysis of existing laws, regulations, rulings and court decisions and assuming, among other matters, the accuracy of certain representations and compliance with certain covenants, interest on the Series Twenty-One C Bonds is excluded from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986, except that no opinion is expressed as to the status of interest on any Series Twenty-One C Bond for any period that such Series Twenty-One C Bond is held by a “substantial user” of the facilities refinanced by the Series Twenty- One C Bonds or by a “related person” within the meaning of Section 147(a) of the Internal Revenue Code of 1986. Bond Counsel observes, however, that interest on the Series Twenty-One C Bonds is a specific preference item for purposes of the federal individual and corporate alternative minimum taxes. In the further opinion of Bond Counsel, interest on the Series Twenty-One C Bonds is exempt from personal income taxation by the State of Oregon. Bond Counsel expresses no opinion regarding any other tax consequences related to the ownership or disposition of, or the accrual or receipt of interest on, the Series Twenty-One C Bonds. See “Tax MaTTers.” $27,685,000 THE PORT OF PORTLAND, OREGON Portland International Airport Refunding Revenue Bonds Series Twenty-One C (AMT) Dated: Date of initial delivery Base CUSIP No.: 735240 Due: July 1, as shown on inside cover The Port of Portland (the “Port”) is issuing its Portland International Airport Refunding Revenue Bonds, Series Twenty-One C (AMT) (the “Series Twenty-One C Bonds”) to refund the Port’s outstanding Portland International Airport Refunding Revenue Bonds, Series Fifteen D, to make a deposit to the SLB Reserve Account and to pay costs of issuing the Series Twenty-One C Bonds, all as described herein. -

1995 Annual Report

Southwest Airlines Co. 1995 Annual Report OUR 6 SECRETS OF SUCCESS Table of Contents Consolidated Highlights ..................................................................2 Introduction .....................................................................................3 Letter to Shareholders.....................................................................4 1. Stick To What You’re Good At ....................................................4 2. Keep It Simple .............................................................................8 3. Keep Fares Low, Costs Lower ..................................................10 4. Treat Customers Like Guests....................................................12 5. Never Stand Still .......................................................................14 6. Hire Great People .....................................................................16 Looking Ahead ..............................................................................18 Destinations ..................................................................................20 Financial Review ...........................................................................21 Management’s Discussion and Analysis .......................................21 Consolidated Financial Statements...............................................27 Report of Independent Auditors ....................................................39 Quarterly Financial Data ...............................................................40 Common Stock Price Ranges -

Adaptive Connected.Xlsx

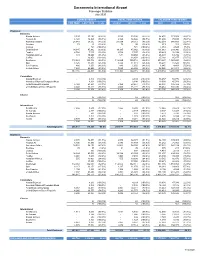

Sacramento International Airport Passenger Statistics July 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2020/21 2019/20 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 3,593 33,186 (89.2%) 3,593 33,186 (89.2%) 54,432 173,858 (68.7%) Horizon Air 6,120 14,826 (58.7%) 6,120 14,826 (58.7%) 31,298 75,723 (58.7%) American Airlines 28,089 54,512 (48.5%) 28,089 54,512 (48.5%) 162,319 348,689 (53.4%) Boutique 79 95 (16.8%) 79 95 (16.8%) 613 201 205.0% Contour - 721 (100.0%) - 721 (100.0%) 4,461 2,528 76.5% Delta Airlines 14,185 45,962 (69.1%) 14,185 45,962 (69.1%) 111,063 233,946 (52.5%) Frontier 4,768 7,107 (32.9%) 4,768 7,107 (32.9%) 25,423 38,194 (33.4%) Hawaiian Airlines 531 10,660 (95.0%) 531 10,660 (95.0%) 26,393 64,786 (59.3%) Jet Blue - 16,858 (100.0%) - 16,858 (100.0%) 25,168 85,877 (70.7%) Southwest 112,869 300,716 (62.5%) 112,869 300,716 (62.5%) 899,647 1,963,253 (54.2%) Spirit 8,425 11,318 (25.6%) 8,425 11,318 (25.6%) 38,294 15,526 146.6% Sun Country 886 1,650 (46.3%) 886 1,650 (46.3%) 1,945 4,401 (55.8%) United Airlines 7,620 46,405 (83.6%) 7,620 46,405 (83.6%) 98,028 281,911 (65.2%) 187,165 544,016 (65.6%) 187,165 544,016 (65.6%) 1,479,084 3,288,893 (55.0%) Commuters Alaska/Skywest - 4,304 (100.0%) - 4,304 (100.0%) 36,457 50,776 (28.2%) American/Skywest/Compass/Mesa - 8,198 (100.0%) - 8,198 (100.0%) 18,030 45,781 (60.6%) Delta/Skywest/Compass 5,168 23,651 (78.1%) 5,168 23,651 (78.1%) 62,894 146,422 (57.0%) United/Skywest/GoJet/Republic 4,040 16,221 (75.1%) 4,040 16,221 (75.1%) -

Southwest Airlines Corporation: a Domestic Industry Analysis & Recommendation for Expansion

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Supervised Undergraduate Student Research Chancellor’s Honors Program Projects and Creative Work 5-2006 Southwest Airlines Corporation: A Domestic Industry Analysis & Recommendation for Expansion Joel LaSharon Thomas University of Tennessee-Knoxville Follow this and additional works at: https://trace.tennessee.edu/utk_chanhonoproj Part of the Marketing Commons Recommended Citation Thomas, Joel LaSharon, "Southwest Airlines Corporation: A Domestic Industry Analysis & Recommendation for Expansion" (2006). Chancellor’s Honors Program Projects. https://trace.tennessee.edu/utk_chanhonoproj/1019 This is brought to you for free and open access by the Supervised Undergraduate Student Research and Creative Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chancellor’s Honors Program Projects by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Southwest Airlines Corporation: A Domestic Industry Analysis & Recommendation for Expansion Joel L. Thomas Chancellor's Honors Program University of Tennessee Senior Project May 2,2006 Joel L. Thomas Senior Honors Project Southwest Airlines May 2, 2006 2 Executive Summary After almost thirty years of service, Southwest Airlines has emerged as one of the world's premier airlines. The Southwest approach to business and the industry at large have enabled the company to continue to grow at profit in times of true economic downturn. Presently, the market for air carriers is saturated and highly fragmented. Overcapacity has led the major United States airlines to compete with Southwest's low fare pricing strategy. However, due to the company's brand image of efficient and effective low fare service, Southwest has been able to ward off its competitors (e.g. -

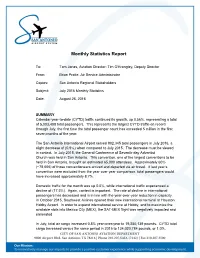

Monthly Statistics Report

Monthly Statistics Report To: Tom Jones, Aviation Director; Tim O’Krongley, Deputy Director From: Brian Pratte, Air Service Administrator Copies: San Antonio Regional Stakeholders Subject: July 2016 Monthly Statistics Date: August 26, 2016 SUMMARY Calendar year-to-date (CYTD) traffic continued its growth, up 0.56%, representing a total of 5,003,408 total passengers. This represents the largest CYTD traffic on record through July, the first time the total passenger count has exceeded 5 million in the first seven months of the year. The San Antonio International Airport served 802,345 total passengers in July 2016, a slight decrease of (0.9%) when compared to July 2015. The decrease must be viewed in context. In July 2015, the General Conference of Seventh-day Adventist Church was held in San Antonio. This convention, one of the largest conventions to be held in San Antonio, brought an estimated 65,000 attendees. Approximately 60% (~78,000) of those conventioneers arrived and departed via air travel. If last year’s convention were excluded from the year over year comparison, total passengers would have increased approximately 8.7%. Domestic traffic for the month was up 0.5%, while international traffic experienced a decline of (17.5%). Again, context is important. The rate of decline in international passengers has decreased and is in line with the year-over-year reduction in capacity. In October 2015, Southwest Airlines opened their new international terminal at Houston Hobby Airport. In order to expand international service at Hobby, and to maximize the available slots into Mexico City (MEX), the SAT-MEX flight was negatively impacted and eliminated. -

FY20 Main Stats- Adaptive Connected.Xlsx

Sacramento International Airport Passenger Statistics April 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2019/20 2018/19 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 254 28,618 (99.1%) 224,058 220,143 1.8% 47,617 78,326 (39.2%) Horizon Air 930 9,009 (89.7%) 83,551 91,930 (9.1%) 19,285 37,628 (48.7%) American Airlines 5,310 48,633 (89.1%) 409,920 487,335 (15.9%) 107,335 187,996 (42.9%) Boutique 33 - 0.0% 749 - 0.0% 265 - 0.0% Contour - 356 (100.0%) 12,339 356 3366.0% 4,461 356 1153.1% Delta Airlines 3,279 32,727 (90.0%) 326,111 320,143 1.9% 80,412 114,168 (29.6%) Frontier 377 4,882 (92.3%) 57,938 38,146 51.9% 17,415 15,939 9.3% Hawaiian Airlines - 10,114 (100.0%) 88,524 76,513 15.7% 25,862 33,152 (22.0%) Jet Blue 200 10,670 (98.1%) 108,591 118,825 (8.6%) 24,751 38,730 (36.1%) Southwest 17,308 288,513 (94.0%) 2,416,279 2,754,196 (12.3%) 650,717 1,066,115 (39.0%) Spirit 306 - 0.0% 95,033 - 0.0% 27,531 - 0.0% Sun Country - - 0.0% 13,538 - 0.0% 526 - 0.0% United Airlines 1,694 44,250 (96.2%) 328,432 409,471 (19.8%) 81,057 141,974 (42.9%) 29,691 477,772 (93.8%) 4,165,063 4,517,058 (7.8%) 1,087,234 1,714,384 (36.6%) Commuters Alaska/Skywest 1,124 8,489 (86.8%) 74,773 85,618 (12.7%) 30,401 33,050 (8.0%) American/Skywest/Compass/Mesa 17 5,226 (99.7%) 62,461 66,389 (5.9%) 18,030 21,698 (16.9%) Delta/Skywest/Compass 1,669 20,212 (91.7%) 178,479 198,099 (9.9%) 49,697 74,471 (33.3%) United/Skywest/GoJet/Republic 616 15,458 (96.0%) 111,450 135,979 (18.0%) 28,937 53,523 (45.9%) 3,426 49,385 -

Breeze Airways Announces Debut

UNDER STRICT EMBARGO UNTIL MAY 21, 2021 AT 8AM ET: Breeze Airways Announces Debut Service from 16 Cities including Tampa Bay, Charleston, Norfolk and New Orleans; 95% of New Breeze Routes are Without Existing Nonstop Service Today -- New “Low Fare, High Flex” Airline is David Neeleman’s Fifth Airline Start-up, 20 Years After JetBlue’s Launch -- Salt Lake City, UT (May 21, 2021) – Breeze Airways, the new “Seriously Nice” U.S. carrier from JetBlue founder David Neeleman, today unveiled its debut network, comprising 39 nonstop routes between 16 cities in the Southwest, Midwest, Southeast and Eastern US. The first flights will operate between Charleston, SC, Tampa, FL and Hartford, CT, starting May 27, with remaining destinations to be added each week through July 22, 2021. Flights are now on sale at www.flybreeze.com and the Breeze app, starting at just $39* one way. Breeze is Mr Neeleman’s fifth airline start-up, after JetBlue, Brazil’s Azul, Canada’s WestJet, and Utah-based Morris Air, which was later purchased by Southwest Airlines. Headquartered in Salt Lake City, UT, Breeze will focus most flights from four main airports: Tampa, FL; Charleston, SC; New Orleans, LA; and Norfolk, VA. Joined by an experienced team of industry veterans, Mr Neeleman set out to build an airline that offers a great experience, with low fares and high flexibility: “Together, we created Breeze as a new airline merging technology with kindness. Breeze provides nonstop service between underserved routes across the U.S. at affordable fares. A staggering 95 percent of Breeze routes currently have no airline serving them nonstop. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Redalyc.Engineering and Strategy: Returning to the Case of Southwest

Revista Escuela de Administración de Negocios ISSN: 0120-8160 [email protected] Universidad EAN Colombia Berrío Zapata, Cristian Engineering and strategy: returning to the case of southwest airlines, an analysis in production and technology management Revista Escuela de Administración de Negocios, núm. 73, julio-diciembre, 2012, pp. 209-217 Universidad EAN Bogóta, Colombia Available in: http://www.redalyc.org/articulo.oa?id=20625032013 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative Casos empresariales ENGINEERING AND STRATEGY: RETURNING TO THE CASE OF SOUTHWEST AIRLINES, AN ANALYSIS IN PRODUCTION AND TECHNOLOGY MANAGEMENT Cristian Berrío Zapata 1. INTRODUCTION ome company cases let us see what was a network that makes every part of it shake, when any done to produce business model innovation component is touched. This network, immersed into Sthat creates ruptures in the market, changing the environment evolution, is a complete systemic the rules of competition. One of these cases is the unit, where paradigm changes must be supported with story of Southwest Airlines (SWA). This article tries to operational actions so innovation becomes a living demonstrate that engineering operational excellence is force that changes competing profiles. This virtuous fruitless without a compatible moving in other conceptual cycle between thought and action, when successful axes like service, finances, administration and human in producing adaptative and innovative competing resources. The areas of a company are bounded into structures, revolves the markets and generates new rules for competition.