Essays on Strategic Behavior in the U.S. Airline Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WORLD AVIATION Yearbook 2013 EUROPE

WORLD AVIATION Yearbook 2013 EUROPE 1 PROFILES W ESTERN EUROPE TOP 10 AIRLINES SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 R ANKING CARRIER NAME SEATS Lufthansa 1 Lufthansa 1,739,886 Ryanair 2 Ryanair 1,604,799 Air France 3 Air France 1,329,819 easyJet Britis 4 easyJet 1,200,528 Airways 5 British Airways 1,025,222 SAS 6 SAS 703,817 airberlin KLM Royal 7 airberlin 609,008 Dutch Airlines 8 KLM Royal Dutch Airlines 571,584 Iberia 9 Iberia 534,125 Other Western 10 Norwegian Air Shuttle 494,828 W ESTERN EUROPE TOP 10 AIRPORTS SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 Europe R ANKING CARRIER NAME SEATS 1 London Heathrow Airport 1,774,606 2 Paris Charles De Gaulle Airport 1,421,231 Outlook 3 Frankfurt Airport 1,394,143 4 Amsterdam Airport Schiphol 1,052,624 5 Madrid Barajas Airport 1,016,791 HE EUROPEAN AIRLINE MARKET 6 Munich Airport 1,007,000 HAS A NUMBER OF DIVIDING LINES. 7 Rome Fiumicino Airport 812,178 There is little growth on routes within the 8 Barcelona El Prat Airport 768,004 continent, but steady growth on long-haul. MostT of the growth within Europe goes to low-cost 9 Paris Orly Field 683,097 carriers, while the major legacy groups restructure 10 London Gatwick Airport 622,909 their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt ... ... On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. -

Southwest Airlines 1996 Annual Report

1996 Annual Report TABLE OF CONTENTS Consolidated Highlights 2 Introduction 3 Letter to Shareholders 4 People and Planes 6 Southwest Spirit 8 THE Low Fare Airline 10 Productivity 12 Ontime Performance 14 Customer Satisfaction 16 Mintenance and Safety 18 What’s Next? 20 Financial Review 22 Management’s Discussion and Analysis 22 Consolidated Financial Statements 31 Report of Independent Auditors 49 Quarterly Financial Data 50 Common Stock Price Ranges and Dividends 50 Corporate Data 51 Directors and Officers 52 Ten Year Summary 55 CONSOLIDATED HIGHLIGHTS (DOLLARS IN THOUSANDS PERCENT EXCEPT PER SHARE AMOUNTS) 1996 1995 CHANGE Operating revenues $3,406,170 $2,872,751 18.6 Operating expenses $3,055,335 $2,559,220 19.4 Operating income $350,835 $313,531 11.9 Operating margin 10.3% 10.9% (0.6)pts. Net income $207,337 $182,626 13.5 Net margin 6.1% 6.4% (0.3)pts. Net income per common and common equivalent share $1.37 $1.23 11.4 Stockholders’ equity $1,648,312 $1,427,318 15.5 Return on average stockholders’ equity 13.5% 13.7% (0.2)pts. Debt as a percentage of invested capital 28.3% 31.7% (3.4)pts. Stockholders’ equity per common share outstanding $11.36 $9.91 14.6 Revenue passengers carried 49,621,504 44,785,573 10.8 Revenue passenger miles (RPMs)(000s) 27,083,483 23,327,804 16.1 Available seat miles (ASMs)(000s) 40,727,495 36,180,001 12.6 Passenger load factor 66.5% 64.5% 2.0 pts. Passenger revenue yield per RPM 12.07¢ 11.83¢ 2.0 Operating revenue yield per ASM 8.36¢ 7.94¢ 5.3 Operating expenses per ASM 7.50¢ 7.07¢ 6.1 Number of Employees at yearend 22,944 19,933 15.1 NET INCOME (in millions) $207 $179 $183 250 $154 200 $97 150 100 50 0 1992 1993 1994 1995 1996 2 NET INCOME PER SHARE $1.37 $1.22 $1.23 1.40 $1.05 1.20 1.00 $.68 0.80 0.60 0.40 0.20 0.00 1992 1993 1994 1995 1996 SOUTHWEST AIRLINES CO. -

Domestic Airline Competition, Legacy Carrier Consolidation and the Rise of the Low-Cost Carrier

DOMESTIC AIRLINE COMPETITION, LEGACY CARRIER CONSOLIDATION AND THE RISE OF THE LOW-COST CARRIER A Thesis submitted to the Faculty of the Graduate School of Arts and Sciences of Georgetown University in partial fulfillment of the requirements for the degree of Master of Public Policy in Public Policy By Christian T. Ueland, B.S. Washington, DC April 13, 2017 Copyright 2017 by Christian T. Ueland All Rights Reserved ii The research and writing of this thesis is dedicated to my family and friends. Many thanks, Christian Ueland iii DOMESTIC AIRLINE COMPETITION, LEGACY CARRIER CONSOLIDATION AND THE RISE OF THE LOW-COST CARRIER Christian T. Ueland, B.S. Thesis Advisor: Terry Kennedy, Ph.D. ABSTRACT In the past eight years, the airline market in the United States has gone through a string of bankruptcies, some brought on by the severe economic recession in 2008 and 2009. These financial difficulties provided the impetus for four giant airline mergers, causing concern that market concentration had exceeded a healthy limit. This paper examines the competitive landscape of domestic air travel through an analysis of the relationship between airline fares and different levels of competition in the domestic airline market. Taking US Department of Transportation data from 2008 and 2016, I use an ordinary least squares (OLS) regression model to determine the relationship between average market fares and the type/number of competing airlines in each airport-pair market. The results for each year represent the strength of competitive forces, which I then compare to determine the manner in which competition has changed over the eight-year period. -

APR 2009 Stats Rpts

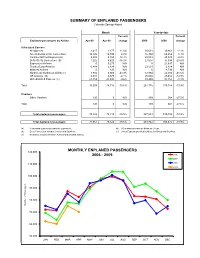

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

1995 Annual Report

Southwest Airlines Co. 1995 Annual Report OUR 6 SECRETS OF SUCCESS Table of Contents Consolidated Highlights ..................................................................2 Introduction .....................................................................................3 Letter to Shareholders.....................................................................4 1. Stick To What You’re Good At ....................................................4 2. Keep It Simple .............................................................................8 3. Keep Fares Low, Costs Lower ..................................................10 4. Treat Customers Like Guests....................................................12 5. Never Stand Still .......................................................................14 6. Hire Great People .....................................................................16 Looking Ahead ..............................................................................18 Destinations ..................................................................................20 Financial Review ...........................................................................21 Management’s Discussion and Analysis .......................................21 Consolidated Financial Statements...............................................27 Report of Independent Auditors ....................................................39 Quarterly Financial Data ...............................................................40 Common Stock Price Ranges -

Office of Fiscal & Monitoring Services Bureau of County Finance And

Office of Fiscal & Monitoring Services Bureau of County Finance and Technical Assistance County Points of Contact for BCFTA Help Desk REGION 1 COUNTY SERVICE LOCATION LAST NAME FIRST NAME E‐MAIL CONTACT Champaign LAA11, LAC11, LAP11 Bacon Martha [email protected] Stewart Holly [email protected] LAC21 Bowens Joyce [email protected] Delaware Gray Adeana [email protected] LAA21, LAP21 Schonauer Jacqueline [email protected] Walters Jacqueline [email protected] Fairfield LAA23, LAC23, LAP23 Brown Carri [email protected] McCoy Amy [email protected] Fayette LAA24, LAC24, LAP24 Cave Abby [email protected] Williamson Faye [email protected] Franklin LAC25 Jittkarunrat Sirina [email protected] Okafor Emeka [email protected] Knox LAA42, LAC42, LAP42 Feltman Andrea [email protected] Myers Jacqueline [email protected] LAC45 Bryan Cynthia [email protected] Licking LAA45, LAP45 Mitchell Erica [email protected] Spangler Jamie [email protected] LAA46, LAC46 Fay Sandra [email protected] Logan Fogle Cheryl [email protected] LAP46 Nease Shoan [email protected] Pugh Kathy [email protected] Madison LAA49, LAC49, LAP49 Kaifas Steve [email protected] Vickers Donna [email protected] LAA51, LAC51 Chapman Melissa [email protected] Marion Harless Julie [email protected] LAP51 Downes Patrick [email protected] Spencer Becky [email protected] Morrow LAA59, LAC59, LAP59 Keeran -

Babies' First Forenames: Births Registered in Scotland in 2007

Babies' first forenames: births registered in Scotland in 2007 Information about the basis of the list can be found via the 'Babies' First Names' page on the National Records of Scotland website. Boys Girls Position Name Number of babies Position Name Number of babies 1 Lewis 735 1 Sophie 653 2 Jack 726 2 Emma 508 3 Ryan 517 3 Lucy 438 4 James 489 4 Katie 435 5 Callum 441 5 Ellie 415 6 Cameron 428 6 Erin 414 7 Daniel 424 7 Emily 407 8 Liam 406 8 Amy 405 9 Matthew 386 9 Chloe 387 10 Jamie 385 10 Olivia 386 11 Logan 374 11 Hannah 371 12 Finlay 370 12 Jessica 318 13 Kyle 369 13 Grace 300 14 Adam 355 14 Ava 282 15 Alexander 322 15 Rebecca 274 16 Andrew 311 16 Isla 249 17 Aiden 309 17 Brooke 234 18 Ben 308 18 Eva 227 19 Connor 307 19 Niamh 220 20 Dylan 305 20 Megan 215 21 Aaron 300 21 Eilidh 213 22 Thomas 290 22= Abbie 206 23 Joshua 260 22= Mia 206 24 David 251 24 Aimee 201 25 Luke 243 25= Lauren 199 26 Nathan 232 25= Ruby 199 27 Ross 231 27 Skye 198 28 Charlie 219 28= Anna 197 29 Aidan 214 28= Holly 197 30 Ethan 212 30= Freya 196 31 John 210 30= Rachel 196 32 Michael 205 32= Caitlin 190 33 Samuel 202 32= Sarah 190 34 Calum 199 34= Keira 183 35= Kieran 197 34= Leah 183 35= Scott 197 36 Lily 180 37 Fraser 196 37 Millie 167 38= Josh 191 38 Charlotte 162 38= William 191 39 Molly 159 40 Oliver 185 40= Abigail 157 41 Rhys 183 40= Zoe 157 42 Harry 178 42 Eve 156 43 Sean 177 43 Kayla 154 44= Owen 175 44 Iona 144 44= Sam 175 45 Cara 137 46= Christopher 173 46 Ella 136 46= Robert 173 47 Evie 122 48 Euan 169 48 Nicole 117 49= Jake 164 49 Morgan 114 49= -

Overview and Trends

9310-01 Chapter 1 10/12/99 14:48 Page 15 1 M Overview and Trends The Transportation Research Board (TRB) study committee that pro- duced Winds of Change held its final meeting in the spring of 1991. The committee had reviewed the general experience of the U.S. airline in- dustry during the more than a dozen years since legislation ended gov- ernment economic regulation of entry, pricing, and ticket distribution in the domestic market.1 The committee examined issues ranging from passenger fares and service in small communities to aviation safety and the federal government’s performance in accommodating the escalating demands on air traffic control. At the time, it was still being debated whether airline deregulation was favorable to consumers. Once viewed as contrary to the public interest,2 the vigorous airline competition 1 The Airline Deregulation Act of 1978 was preceded by market-oriented administra- tive reforms adopted by the Civil Aeronautics Board (CAB) beginning in 1975. 2 Congress adopted the public utility form of regulation for the airline industry when it created CAB, partly out of concern that the small scale of the industry and number of willing entrants would lead to excessive competition and capacity, ultimately having neg- ative effects on service and perhaps leading to monopolies and having adverse effects on consumers in the end (Levine 1965; Meyer et al. 1959). 15 9310-01 Chapter 1 10/12/99 14:48 Page 16 16 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY spurred by deregulation now is commonly credited with generating large and lasting public benefits. -

MAR 2009 Stats Rpts

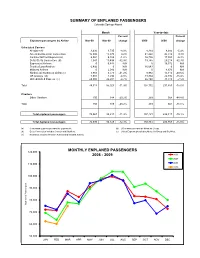

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Pinnacle Airlines, Inc. CRJ200 124 CRJ900 16

Forward-Looking Statement The use of words, such as “may”, “might”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “intends”, “future”, “potential” or “continue”, the negative of these terms and other comparable terminology are intended to identify forward-looking statements. These statements are only predictions based on our current expectations and projections about future events. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In this regard, you should specifically consider the numerous risks outlined in our registration statement in the section entitled, “Risk Factors.” 1 Phil Trenary President and CEO 2 About Pinnacle Airlines Corp. Holding company with two operating subsidiaries: Pinnacle Airlines, Inc. and Colgan Air, Inc. Regional Airline Partnerships with Continental Airlines, Delta Air Lines, Northwest Airlines, United Airlines and US Airways Over 5,000 Employees Current fleet of 138 CRJ200 and 2 CRJ900 next generation regional jets, 42 Saab 340B and 7 Beech 1900D turboprop aircraft 14 additional CRJ900s on order for delivery by February 2009 15 Q-400 next generation turboprops on order. Deliveries start in December 2007, completed by June 30, 2008. 3 Guiding Principles – Pinnacle Airlines Never Compromise Safety Respect for All Pinnacle People We recognize safety as our highest We recognize the value of all People. priority in all aspects of the Airline. We will train our People in the areas of diversity and leadership, giving them the Commitment to Communications tools necessary to ensure relationships We will communicate timely and effectively any are based on the principle of mutual respect. -

Special Rates for Your Group

Special rates for your group. Group travel discounts include: 5% off the lowest applicable fare For reservations, call 1-800-433-1790, and refer to the authorization number below: AN# A8799AQ Now Book your Discount Fares Directly Online To take advantage of a 5% discount on AA, American Eagle and AmericanConnections. It's simple! After you have selected your flight(s) under the "Enter Passenger Details" tab, go to the "AA.com Promotion Code" field and enter in your Authorization Code without the leading “A”. Go directly to www.aa.com to book your flights. Discount Fares are valid for travel on American Airlines, American Eagle®, AmericanConnection®, oneworld Alliance, and codeshare partners from anywhere to your meeting destination. Reservations and Ticketing For reservations and ticketing information, call AmericanAirlines Meeting Services Desk, or have your travel professional call 1-800-433-1790 from anywhere in the United States or Canada, seven days a week, from 6:00 a.m. to 12:00 midnight (Central Time), and reference the authorization number shown above. Reservations for the hearing and speech impaired are also available at 1-800-543-1586. There is a $20.00USD reservations service fee for tickets issued through AA reservations, and a $30.00USD ticketing fee for tickets issued at the airport. Frequent Flyer Miles Earn AAdvantage® miles for your trip. The AAdvantage program was the first airline frequent traveler program, and for more than 20 years has offered members the most innovative ways to earn travel awards. Enroll online at www.aa.com. *Seats are limited. American Airlines, American Eagle, AmericanConnection, American Airlines Group & Meeting Travel and AAdvantage are marks of American Airlines, Inc. -

Flying the Line Flying the Line the First Half Century of the Air Line Pilots Association

Flying the Line Flying the Line The First Half Century of the Air Line Pilots Association By George E. Hopkins The Air Line Pilots Association Washington, DC International Standard Book Number: 0-9609708-1-9 Library of Congress Catalog Card Number: 82-073051 © 1982 by The Air Line Pilots Association, Int’l., Washington, DC 20036 All rights reserved Printed in the United States of America First Printing 1982 Second Printing 1986 Third Printing 1991 Fourth Printing 1996 Fifth Printing 2000 Sixth Printing 2007 Seventh Printing 2010 CONTENTS Chapter 1: What’s a Pilot Worth? ............................................................... 1 Chapter 2: Stepping on Toes ...................................................................... 9 Chapter 3: Pilot Pushing .......................................................................... 17 Chapter 4: The Airmail Pilots’ Strike of 1919 ........................................... 23 Chapter 5: The Livermore Affair .............................................................. 30 Chapter 6: The Trouble with E. L. Cord .................................................. 42 Chapter 7: The Perils of Washington ........................................................ 53 Chapter 8: Flying for a Rogue Airline ....................................................... 67 Chapter 9: The Rise and Fall of the TWA Pilots Association .................... 78 Chapter 10: Dave Behncke—An American Success Story ......................... 92 Chapter 11: Wartime.............................................................................