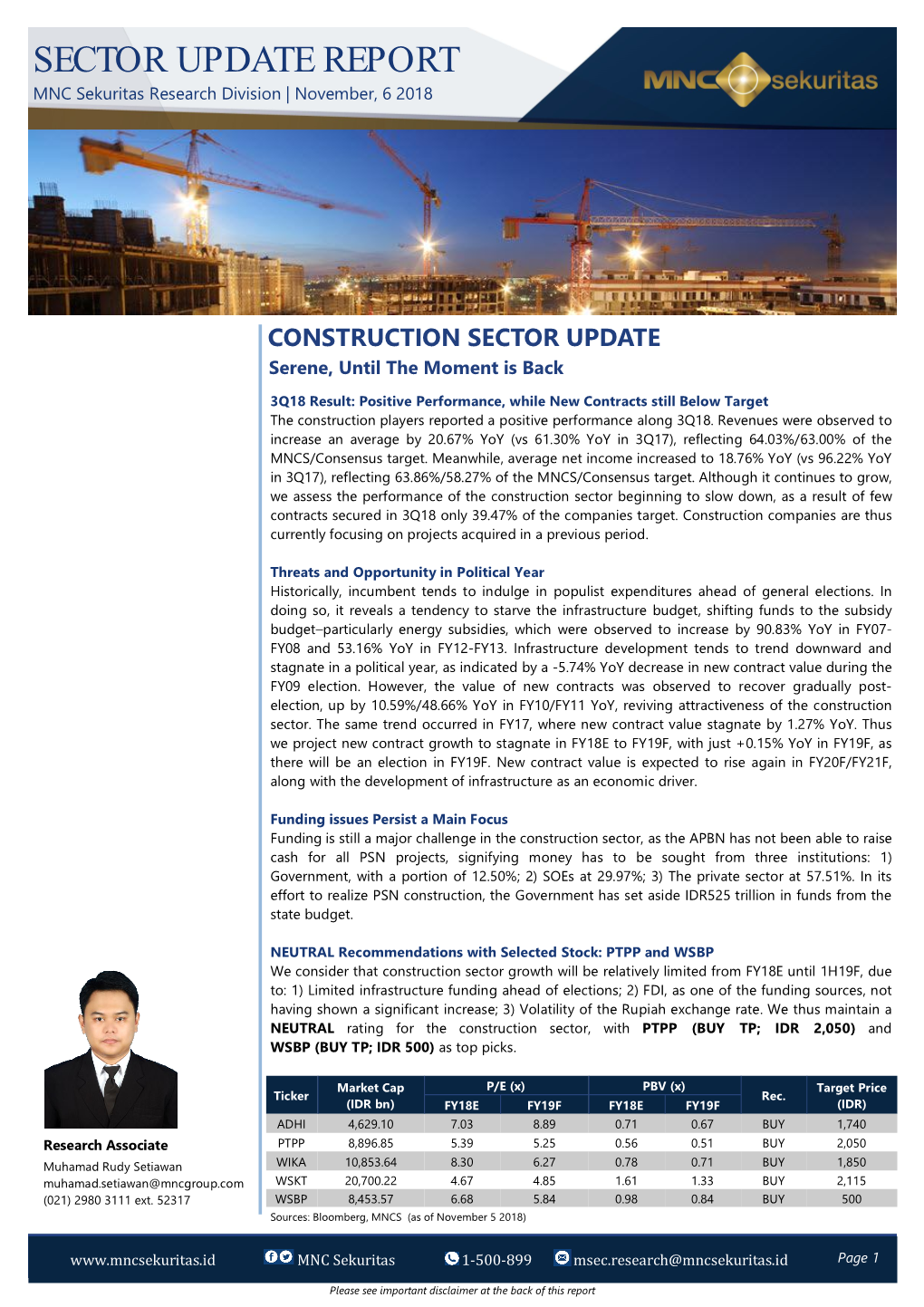

CONSTRUCTION SECTOR UPDATE Serene, Until the Moment Is Back

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wakatobi - World Marine Heritage | 1 Welcome to WAKATOBI

2016 FREE Wakatobi - World Marine Heritage | 1 Welcome to WAKATOBI There are many crystal clear sea waters in the world, but there is the clearest one amongst them. Let us introduce you to Wakatobi. Right in the heart of the World’s Coral Triangle, there is a maritime district with abundant marine wealth. With only 3% of land, Wakatobi is the only district in Indonesia where the whole area is mandated as a National Park. Be ready for the mesmerizing aerial view of Wakatobi before landing – emerald-like atolls stretching over gradation of turquoise-blue sea, under brilliant sunshine. The wooden stilt houses of Bajo people seem to float above pristine water, close to white sandy beaches. Wakatobi offers more than 50 spectacular dive sites which are easily accessible from the main islands. Its high visibility make diving in Wakatobi is possible throughout the year regardless of the weather conditions. Enjoy the underwater forest during various dives - from wall, slope, and sea mount to drift, pinnacle and channel. This un- derwater wonderland this underwater wonderland is home to more than 390 of the world. According to several studies, the reefs in the area host over 396 identified coral species Previously known as Blacksmith Archipelago, its marine and cultural diversity made Wakatobi a UNESCO World Biosphere Reserve. While mentioned as a perfect playground for divers, the culture complementing its underwa- ter world. The classical dance named Lariangi is announced as a cultural asset by Government of Indonesia. Lariangi was a dance to welcome the royal guests of Kahedupa Kingdom back in 1359. -

CADP 2.0) Infrastructure for Connectivity and Innovation

The Comprehensive Asia Development Plan 2.0 (CADP 2.0) Infrastructure for Connectivity and Innovation November 2015 Economic Research Institute for ASEAN and East Asia The findings, interpretations, and conclusions expressed herein do not necessarily reflect the views and policies of the Economic Research Institute for ASEAN and East Asia, its Governing Board, Academic Advisory Council, or the institutions and governments they represent. All rights reserved. Material in this publication may be freely quoted or reprinted with proper acknowledgement. Cover Art by Artmosphere ERIA Research Project Report 2014, No.4 National Library of Indonesia Cataloguing in Publication Data ISBN: 978-602-8660-88-4 Contents Acknowledgement iv List of Tables vi List of Figures and Graphics viii Executive Summary x Chapter 1 Development Strategies and CADP 2.0 1 Chapter 2 Infrastructure for Connectivity and Innovation: The 7 Conceptual Framework Chapter 3 The Quality of Infrastructure and Infrastructure 31 Projects Chapter 4 The Assessment of Industrialisation and Urbanisation 41 Chapter 5 Assessment of Soft and Hard Infrastructure 67 Development Chapter 6 Three Tiers of Soft and Hard Infrastructure 83 Development Chapter 7 Quantitative Assessment on Hard/Soft Infrastructure 117 Development: The Geographical Simulation Analysis for CADP 2.0 Appendix 1 List of Prospective Projects 151 Appendix 2 Non-Tariff Barriers in IDE/ERIA-GSM 183 References 185 iii Acknowledgements The original version of the Comprehensive Asia Development Plan (CADP) presents a grand spatial design of economic infrastructure and industrial placement in ASEAN and East Asia. Since the submission of such first version of the CADP to the East Asia Summit in 2010, ASEAN and East Asia have made significant achievements in developing hard infrastructure, enhancing connectivity, and participating in international production networks. -

Wakatobi Baseline Demand & Supply, Market Demand Forecasts, and Investment Needs Market Analysis and Demand Assessments to S

WAKATOBI BASELINE DEMAND & SUPPLY, MARKET DEMAND FORECASTS, AND INVESTMENT NEEDS MARKET ANALYSIS AND DEMAND ASSESSMENTS TO SUPPORT THE DEVELOPMENT OF INTEGRATED TOURISM DESTINATIONS ACROSS INDONESIA WORLD BANK SELECTION # 1223583 (2016-2017) ACKNOWLEDGMENTS PREPARED BY: FOR: WITH SUPPORT FROM: This work is a product of external contributions supervised by The World Bank. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. This publication has been funded by the Kingdom of the Netherlands, the Australian Government through the Department of Foreign Affairs and Trade and the Swiss Confederation through the Swiss State Secretariat for Economic Affairs (SECO). The views expressed in this publication are the author’s alone and are not necessarily the views of the Kingdom of the Netherlands, Australian Government and the Swiss Confederation. TABLE OF CONTENTS INTRODUCTION ..................................................................................................................................... 1 BASELINE DEMAND & SUPPLY ......................................................................................................... -

Airport Expansion in Indonesia

Aviation expansion in Indonesia Tourism,Aerotropolis land struggles, economic Update zones and aerotropolis projects By Rose Rose Bridger Bridger TWN Third World Network June 2017 Aviation Expansion in Indonesia Tourism, Land Struggles, Economic Zones and Aerotropolis Projects Rose Bridger TWN Global Anti-Aerotropolis Third World Network Movement (GAAM) Aviation Expansion in Indonesia: Tourism, Land Struggles, Economic Zones and Aerotropolis Projects is published by Third World Network 131 Jalan Macalister 10400 Penang, Malaysia www.twn.my and Global Anti-Aerotropolis Movement c/o t.i.m.-team PO Box 51 Chorakhebua Bangkok 10230, Thailand www.antiaero.org © Rose Bridger 2017 Printed by Jutaprint 2 Solok Sungai Pinang 3 11600 Penang, Malaysia CONTENTS Abbreviations...........................................................................................................iv Notes........................................................................................................................iv Introduction..............................................................................................................1 Airport Expansion in Indonesia.................................................................................2 Aviation expansion and tourism.........................................................................................2 Land rights struggles...........................................................................................................3 Protests and divided communities.....................................................................................5 -

5 TOURISM DESTINATIONS in EASTERN PART of INDONESIA Mandalika, Wakatobi, Morotai, Labuan Bajo, Bunaken

PROFILE OF 5 TOURISM DESTINATIONS IN EASTERN PART OF INDONESIA Mandalika, Wakatobi, Morotai, Labuan Bajo, Bunaken INDONESIA INVESTMENT COORDINATING BOARD © 2017 by Indonesia Investment Coordinating Board. All rights reserved MANDALIKA |West Nusa Tenggara Province SPECIAL ECONOMIC ZONES DESTINATION PROFILE MANDALIKA - SEZ Location Province : Lombok Regency : Central Lombok Mandalika Development Area Mandalika Facts Total Area : ± 2000 Ha Total SEZ Area : 1.035,67 Ha (Total Developer Owned Area) • The only conservation area in Indonesia which has a total of Accesiblity 5,250 hectares of ocean sand. Lombok International Airport (40 minutes to Mandalika) • Mandalika has appointed as the Best Halal Destination and The Best Honeymoon Destination in the World Halal Travel Award Accomodation 2015. 884 hotels (Regional Statistics, 2014) • Mandalika directly exposed to the Atlantic Sea. Mandalika has Kuta Beach (like in Bali) as well as soft and white sandy beach of Tanjung Aan, white sandy beaches in the bay area with the longest coastline. • Special Economic Zones (SEZ) Mandalika proposed by PT Indonesia Tourism Development Corporation (ITDC) has been established by Government Regulation No. 52 of 2014 on June 30, 2014. • Development of the SEZ Mandalika focused on the main activities of Tourism. Mandalika KEK is currently in the construction phase I. • 1035.67 ha of land acquisition has been completed and physical development that has been done is the construction of roads in the area along the 4 Km. • The government needs support to extend Lombok International Airport runway, revitalize Harbour Shee, as well as to provide Clean Water Network Management Area in Kuta Area. In 2016, there are two hotels that has been built from 2016; the Pullman Hotel and Hotel Clumbmed. -

Panorama Sentrawisata BUY Sector: Tourism (Overweight) (Unchanged) Rating Momentum*: Na

Asiamoney’s Corporate Flash 2013 Best Domestic Equity House 3 March 8 August 2017 2016 Panorama Sentrawisata BUY Sector: Tourism (Overweight) (Unchanged) Rating momentum*: na Michael W Setjoadi Price:IDR720–TP:IDR1,000 (from: IDR925) E-mail: [email protected] TP/consensus: na; TP momentum*: na Phone: +6221 250 5081 ext. 3620 JCI: 5,391 Worth a detour Exhibit 1. Company information Indonesia’s biggest tourism play embarking on value-accretive deals Market cap (IDRtn/USDbn) : 0.9/0.06 PANR, Indonesia’s largest tourism company, has embarked on deals at its 3M avg.daily t.o.(IDRbn/USDmn) : 3.1/0.2 Bloomberg code : PANR IJ subsidiary level, which is likely to bring synergies and financial support. We Source: Bloomberg believe this will allow for value creation at the holding company level. PANR is Exhibit 2. Shareholders information currently trading at an attractive 30% discount based on our SOTP valuation Panorama Tirta Anugerah (%) : 64.3 (exhibit 5). Established in 1972, PANR has four major business segments: Est. free float (%) : 35.7 Source: Bloomberg travel & leisure (76.2% of net revenue), inbound tours (21.4%), media Exhibit 3. Key forecasts and valuations (1.2%) and hotel (1.2%). In the inbound tour segment, Panorama group has 2015 2016 2017F 2018F a separate listed company, Panorama Destination (PDES IJ), with European Revenues (IDRb) 1,919 2,011 2,340 2,701 tourists as their main customers. For its travel & leisure segment, revenue EBIT (IDRb) 110 165 180 208 drivers are domestic/international tours, airline ticket sales and hotel voucher Net profit (IDRb) 50 55 272 101 Bahana/cns. -

Gapura Annual Report 2017

2017 Laporan Tahunan Annual Report PERFORMANCE THROUGH SERVICE & OPERATIONS EXCELLENCE DAFTAR ISI Table of Contents PERFORMANCE THROUGH SERVICE & PEMBAHASAN DAN ANALISA MANAJEMEN OPERATIONS EXCELLENCE 1 Management Discussion & Analysis 56 Tinjauan Bisnis dan Operasional IKHTISAR 2017 Business & Operational Review 58 2017 Highlights 2 Tinjauan Pendukung Bisnis Business Support Review 64 Kinerja 2017 Tinjauan Keuangan 2017 Performance 2 Financial Review 80 Ikhtisar Keuangan Financial Highlights 4 TATA KELOLA PERUSAHAAN LAPORAN MANAJEMEN Corporate Governance 92 Management Report 6 Rapat Umum Pemegang Saham General Shareholders Meeting 103 Laporan Dewan Komisaris Dewan Komisaris Report from the Board of Commissioners 8 Board of Commissioners 104 Laporan Direksi Direksi Report from the Board of Directors 14 Board of Directors 109 Komite Audit PROFIL PERUSAHAAN Audit Committee 119 Company Profile 22 Sekretaris Perusahaan Identitas Perusahaan Corporate Secretary 121 Company Identity 24 Manajemen Risiko Sekilas Gapura Risk Management 126 Gapura in Brief 26 Kode Etik Perusahaan Visi dan Misi Company Code of Conduct 130 Vision & Mission 28 Komposisi Pemegang Saham TANGGUNG JAWAB SOSIAL PERUSAHAAN Shareholders Composition 30 Corporate Social Responsibility 136 Jejak Langkah Milestones 32 Bidang Usaha LAPORAN KEUANGAN Field of Business 36 Financial Statements 153 Produk dan Jasa Products & Services 38 DATA PERUSAHAAN Wilayah Operasi Corporate Data 207 Operational Area 40 Pertumbuhan GSE 2014-2018 Struktur Organisasi GSE Growth 2014-2018 208 Organizational -

Lifestyle and Tourism Industry Culinary & Cafe | Cinemas | Fashion | Spa & Sport Center | Digital Industry | 10 Tourism Destinations

Supported by: Indonesia Investment Opportunities in Lifestyle and Tourism Industry Culinary & Cafe | Cinemas | Fashion | Spa & Sport Center | Digital Industry | 10 Tourism Destinations Provided for Regional Investment Forum (RIF), Yogyakarta –Indonesia, 14-15 March 2018 INDONESIA ECONOMIC OUTLOOK WHY INDONESIA GDP Ranking 2016 GDP Ranking 2016, PPP Growth of lifestyle, digital era & tourism (in US$ billion) (in US$ billion) among the rise of Middle Class United States 18,624 China 21,451 President of Indonesia, China 11,199 United States 18,624 Joko Widodo reiterated Japan 4,940 India 8,718 that nowadays Indonesia is Germany 3,478 Japan 5,267 entering lifestyle and digitalization era. Lifestyle United… 2,648 Germany 4,041 era is driven by the rise of France 2,465 Russian Federation 3,397 middle class, in the world India 2,264 Brazil 3,147 and Indonesia. Italy 1,859 Indonesia 3,037 According to McKinsey, by 2030 Indonesia will be home to an Brazil 1,796 United Kingdom 2,828 estimated 90 million additional consumers with considerable Canada 1,530 France 2,774 spending power, enabling Indonesia’s consuming class stronger Korea, Rep. 1,411 Italy 2,324 than any other countries in the world apart from China and India. Russian… 1,283 Mexico 2,280 These is a signal for international business to consider new Spain 1,237 Turkey 1,941 opportunities in Indonesia. Australia 1,205 Korea, Rep. 1,832 World Bank also highlighted that following a massive reduction in Mexico 1,047 Saudi Arabia 1,760 Indonesia’s poverty rate in the last two decades, one in every five Indonesia 932 Spain 1,693 Indonesians now belongs to the middle-class group. -

Aerotropolis Update

Aviation expansion in Indonesia Tourism,Aerotropolis land struggles, economic Update zones and aerotropolis projects By Rose Rose Bridger Bridger TWN Third World Network June 2017 Aviation Expansion in Indonesia Tourism, Land Struggles, Economic Zones and Aerotropolis Projects Rose Bridger TWN Global Anti-Aerotropolis Third World Network Movement (GAAM) Aviation Expansion in Indonesia: Tourism, Land Struggles, Economic Zones and Aerotropolis Projects is published by Third World Network 131 Jalan Macalister 10400 Penang, Malaysia www.twn.my and Global Anti-Aerotropolis Movement c/o t.i.m.-team PO Box 51 Chorakhebua Bangkok 10230, Thailand www.antiaero.org © Rose Bridger 2017 Printed by Jutaprint 2 Solok Sungai Pinang 3 11600 Penang, Malaysia CONTENTS Abbreviations...........................................................................................................iv Notes........................................................................................................................iv Introduction..............................................................................................................1 Airport Expansion in Indonesia.................................................................................2 Aviation expansion and tourism.........................................................................................2 Land rights struggles...........................................................................................................3 Protests and divided communities.....................................................................................5 -

Air Transportation Investment Proposition

Air Transportation Investment Proposition 30th August 2016 Badan Koordinasi Penanaman Modal Why Canadian firms are investing in Indonesia Indonesia has the 4th Indonesia is very cost Indonesia is one of the largest population in effective - the average fastest growing the world (261 million monthly wage is $161 economies in the world as of August 2016) in the world (>5% p.a. 2012-16) Indonesia’s GDP will Access to the $2.5 increase by over 150% trillion ASEAN market to $2.2 trillion by 2025 with a population of 620 million Indonesia Investment Coordinating Board What Canadian investors say about Indonesia invested by of Canadian investors of Canadian investors Canadian firms in Indonesia are in Indonesia would in Indonesia planning to recommend other re-invest in Indonesia Canadian companies (WAVTEQ, June 2016 survey) to invest in Indonesia (WAVTEQ, June 2016 survey) Indonesia Investment Coordinating Board Why invest in Indonesia’s air transportation sector? Booming sector New air passengers Track record $ 28% p.a. 183 million $14.3 billion growth in air additional air passengers Transport, Storage & transportation in forecast by 2034 Communication FDI in Indonesia (2005-14) Indonesia (2011-15) Global importance Growth in freight New airports #6 in world 50% p.a. planned Indonesia is expected to be growth in air cargo by 2025 with 24 the 6th largest market for expected a s a result of 45 air travel by 2034 the 2015 ASEAN Open new airports planned Skies Policy by 2017 Indonesia’s competitive strengths for air transportation investment Word’s fourth largest population of 260 million with rapid GDP growth *5%+ p.a.) Huge growth in air transportation with 45 new airports planned Labour costs nearly half of China and lower than India for skilled positions Better availability of scientists & engineers than China or India Effective corporate tax less than half China and India Indonesia Investment Coordinating Board Demand for air transportation in Indonesia 1. -

Public-Private Partnership Monitor

Public–Private Partnership Monitor The first edition of the Public–Private Partnership Monitor tracks the development of the public–private partnership (PPP) business environment and the challenges of doing PPPs in nine of the Asian Development Bank’s developing member countries (DMCs): Bangladesh, the People’s Republic of China, India, Indonesia, Kazakhstan, Papua New Guinea, the Philippines, Thailand, and Viet Nam. It is divided into four main categories: Regulatory Framework, Institutional Capacity for Implementation, PPP Market Maturity, and Financial Facilities. The publication aims to increase the level and quality of private sector participation in infrastructure in the DMCs by serving as an active platform for dialogue between the public and private sectors. About the Asian Development Bank ADB’s vision is an Asia and Pacific region free of poverty. Its mission is to help its developing member countries reduce poverty and improve the quality of life of their people. Despite the region’s many successes, it remains home to a large share of the world’s poor. ADB is committed to reducing poverty through inclusive economic growth, environmentally sustainable growth, and regional integration. Monitor Partnership Public–Private Based in Manila, ADB is owned by 67 members, including 48 from the region. Its main instruments for helping its developing member countries are policy dialogue, loans, equity investments, guarantees, grants, and technical assistance. PUBLIC–PRIVATE PARTNERSHIP MONITOR ASIAN DEVELOPMENT BANK 6 ADB Avenue, Mandaluyong City 1550 Metro Manila, Philippines ASIAN DEVELOPMENT BANK www.adb.org Public–PrivATE PARTNERSHIP MONITOR ASIAN DEVELOPMENT BANK Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) © 2017 Asian Development Bank 6 ADB Avenue, Mandaluyong City, 1550 Metro Manila, Philippines Tel +63 2 632 4444; Fax +63 2 636 2444 www.adb.org Some rights reserved. -

Investment Opportunities in Indonesia

CANADA–INDONESIA TRADE AND TPSA PRIVATE SECTOR ASSISTANCE PROJECT Report May 2017 Investment Opportunities in Indonesia: Services Investment Opportunities in Indonesia: Services Prepared by WAVTEQ WAVTEQ is a global consulting and technology company focused on helping governments worldwide attract foreign direct investment (FDI). About the TPSA Project The Canada–Indonesia Trade and Private Sector Assistance (TPSA) Project is a five-year, C$12-million project funded by the Government of Canada through Global Affairs Canada. The project is executed by The Conference Board of Canada, and the primary implementation partner is the Directorate General for National Export Development, Indonesian Ministry of Trade. TPSA is designed to provide training, research, and technical assistance to Indonesian government agencies, the private sector (particularly small- and medium-sized enterprises, or SMEs), academics, and civil-society organizations on trade-related information, trade policy analysis, regulatory reforms, and trade and investment promotion by Canadian, Indonesian, and other experts from public and private organizations. The overall objective of TPSA is to support greater sustainable economic growth and reduce poverty in Indonesia through increased trade and trade-enabling investment between Indonesia and Canada. TPSA is intended to increase sustainable and gender-responsive trade and investment opportunities, particularly for Indonesian SMEs, and to increase the use of trade and investment analysis by Indonesian stakeholders for expanded