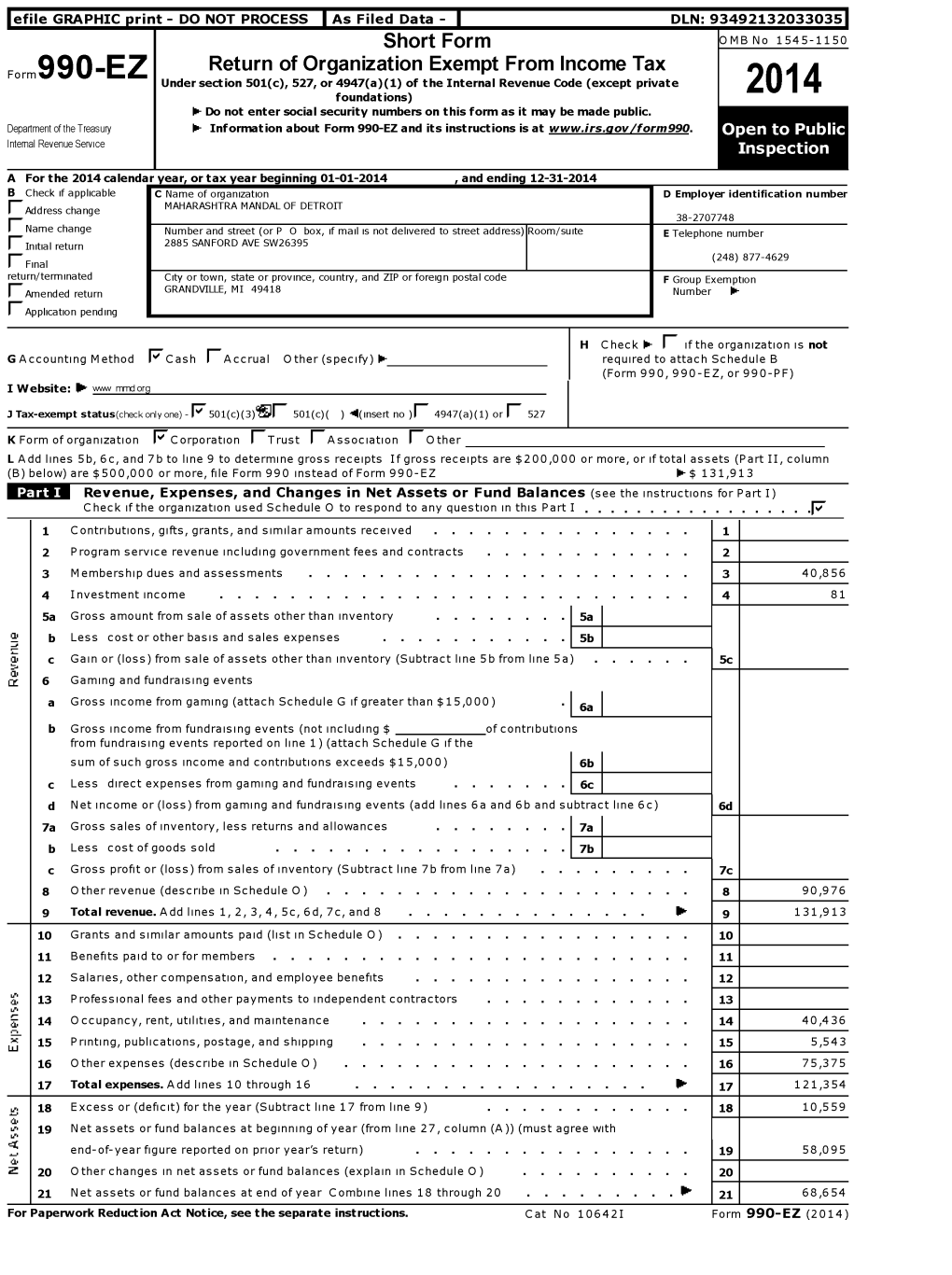

Short Form Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JICA Experts Study for the Operations and Maintenance Structure Of

Republic of India Mumbai Metro Rail Corporation JICA Experts Study for the Operations and Maintenance Structure of Mumbai Metro Line 3 Project in India Final Report October 2015 Japan International Cooperation Agency (JICA) Japan International Consultants for Transportation Co., Ltd. PADECO Co., Ltd. 4R Metro Development Co., Ltd JR 15-046 Table of Contents Chapter 1 General issues for the management of urban railways .............................. 1 1.1 Introduction ........................................................................................................................ 1 1.2 Management of urban railways ........................................................................................ 4 1.3 Construction of urban railways ...................................................................................... 12 1.4 Governing Structure ........................................................................................................ 17 1.5 Business Model ................................................................................................................. 21 Chapter 2 Present situation in metro projects ............................................................ 23 2.1 General .............................................................................................................................. 23 2.2 Metro projects in the world ............................................................................................. 23 2.3 Summary........................................................................................................................ -

M. A.II Public Economics Title English.P65

HI SHIVAJI UNIVERSITY, KOLHAPUR CENTRE FOR DISTANCE EDUCATION Public Economics (Group C - Compulsory Paper-V) For M. A. Part-II KJ Copyright © Registrar, Shivaji University, Kolhapur. (Maharashtra) First Edition 2013 Prescribed for M. A. Part-II All rights reserved. No part of this work may be reproduced in any form by mimeography or any other means without permission in writing from the Shivaji University, Kolhapur (MS) Copies : 200 Published by: Dr. D. V. Muley Registrar, Shivaji University, Kolhapur-416 004. Printed by : Superintendent, Shivaji University Press, Kolhapur-416 004 ISBN-978-81-8486-474-8 # Further information about the Centre for Distance Education & Shivaji University may be obtained from the University Office at Vidyanagar, Kolhapur-416 004, India. # This material has been produced with the developmental grant from DEC-IGNOU, New Delhi. (ii) Centre for Distance Education Shivaji University, Kolhapur I ADVISORY COMMITTEE I Prof. (Dr.) N. J. Pawar Prof. (Dr.) K. S. Rangappa Vice-Chancellor, Hon. Vice-Chancellor, Karnataka State Open Shivaji University, Kolhapur University, Mansagangotri, Mysore Prof. (Dr.) R. Krishna Kumar Prof. V. Venkaih Hon. Vice-Chancellor, Yashwantrao Chavan Director, Academic Dr. B. R. Ambedkar Maharashtra Open University, Dnyangangotri, Open University Rd. No. 46, Jubilee Hill, Near Gangapur Dam, Nasik Hyderabad-33 Andhrapradesh Dr. A. P. Gavali Dr. J. S. Patil Dean, Faculty of Arts, Dean, Faculty of Social Sciences, Shivaji University, Kolhapur Shivaji University, Kolhapur Dr. C. J. Khilare Dr. R. G. Phadatare Dean, Faculty of Science, Dean, Faculty of Commerce, Shivaji University, Kolhapur Shivaji University, Kolhapur Prof. (Dr.) A. B. Rajge Prof. (Dr.) D. V. Muley Director, B.C.U.D., Registrar, Shivaji University, Kolhapur Shivaji University, Kolhapur Dr. -

Dosti Greater Thane Brochure

THE CITY OF HAPPINESS CITY OF HAPPINESS Site Address: Dosti Greater Thane, Near SS Hospital, Kalher Junction 421 302. T: +91 86577 03367 Corp. Address: Adrika Developers Pvt. Ltd., Lawrence & Mayo House, 1st Floor, 276, Dr. D. N. Road, Fort, Mumbai - 400 001 • www.dostirealty.com Dosti Greater Thane - Phase 1 project is registered under MahaRERA No. P51700024923 and is available on website - https://maharerait.mahaonline.gov.in under registered projects Disclosures: (1) The artist’s impressions and stock image are used for representation purpose only. (2) Furniture, fittings and fixtures as shown/displayed in the show flat are for the purpose of showcasing only and do not form part of actual standard amenities to be provided in the flat. The flats offered for sale are unfurnished and all the amenities proposed to be provided in the flat shall be incorporated in the Agreement for Sale. (3) The plans are tentative in nature and proposed but not yet sanctioned. The plans, when sanctioned, may vary from the plans shown herein. (4) Dosti Club Novo is a Private Club House. It may not be ready and available for use and enjoyment along with the completion of Dosti Greater Thane - Phase 1 as its construction may get completed at a later date. The right to admission, use and enjoyment of all or any of the facilities/amenities in the Dosti Club Novo is reserved by the Promoters and shall be subject to payment of such admission fees, annual charges and compliance of terms and conditions as may be specified from time to time by the Promoters. -

J KUMAR INFRAPROJECTS LIMITED We Dream… So We Achieve… Safe Harbor

J KUMAR INFRAPROJECTS LIMITED We dream… So we achieve… Safe Harbor This presentation and the accompanying slides (the “Presentation”), which have been prepared by J. Kumar Infra Projects Ltd. (the “Company”), have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment whatsoever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. This presentation contains certain forward looking statements concerning the Company’s future business prospects and business profitability, which are subject to a number of risks and uncertainties and the actual results could materially differ from those in such forward looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding fluctuations in earnings, our ability to manage growth, competition (both domestic and international), economic growth in India and abroad, ability to attract and retain highly skilled professionals, time and cost over runs on contracts, our ability to manage our international operations, government policies and actions regulations, interest and other fiscal costs generally prevailing in the economy. -

India Urban Infrastructure Report 2020

Research India Urban Infrastructure knightfrank.co.in/research Report 2020 Special Focus on Mumbai Transport Infrastructure with Key Impact Markets INDIA URBAN INFRASTRUCTURE REPORT 2020 Mumbai HO Knight Frank (India) Pvt. Ltd. Paville House, Near Twin Towers Off. Veer Savarkar Marg, Prabhadevi Mumbai 400 025, India Tel: +91 22 6745 0101 / 4928 0101 Bengaluru Knight Frank (India) Pvt. Ltd. 204 & 205, 2nd Floor, Embassy Square #148 Infantry Road Bengaluru 560001, India Tel: +91 80 4073 2600 / 2238 5515 Pune Knight Frank (India) Pvt. Ltd. Unit No.701, Level 7, Pentagon Towers P4 Magarpatta City, Hadapsar Pune 411 013, India Tel: +91 20 6749 1500 / 3018 8500 Chennai Knight Frank (India) Pvt. Ltd. 1st Floor, Centre block, Sunny Side 8/17, Shafee Mohammed Road Nungambakkam, Chennai 600 006, India Tel: +91 44 4296 9000 Gurgaon Knight Frank (India) Pvt. Ltd. Office Address: 1505-1508, 15th Floor, Tower B Signature Towers South City 1 Gurgaon 122 001, India Tel: +91 124 4782 700 Hyderabad Knight Frank (India) Pvt. Ltd. SLN Terminus, Office No. 06-01, 5th Floor Survey No. 133, Gachibowli Hyderabad – 500032, India Tel: +91 40 4455 4141 Kolkata Knight Frank (India) Pvt. Ltd. PS Srijan Corporate Park Unit Number – 1202A, 12th Floor Block – EP & GP, Plot Number - GP 2 Sector – V, Salt Lake, Kolkata 700 091, India Tel: +91 33 6652 1000 Ahmedabad Knight Frank (India) Pvt. Ltd. Unit Nos. 407 & 408, Block ‘C’, The First B/H Keshav Baugh Party Plot Vastrapur, Ahmedabad – 380015 Tel: +91 79 4894 0259 / 4038 0259 www.knightfrank.co.in/research 2 INDIA URBAN INFRASTRUCTURE REPORT 2020 CONTENTS 1 2 3 The Urbanisation Challenges of Regulating Phenomenon Sustainability and Urbanisation in India Liveability Page no......................... -

Projectsmetro

MAJOR Projects Head Office 15, avenue du Centre - CS 30530 de Munich / © Egis - Xavier Boisel Jean Muller International& Paysages Istockphoto KC110617A 2016 / © Aéroport - atelier Villes Première : © Mario Renzi / Avant 702 027 376 - Photos credits Egis SA - RCS Versailles Saint-Quentin-en-Yvelines 78286 Guyancourt Cedex - France Tel. +33 (0)1 30 48 44 00 Metro Fax +33 (0)1 30 48 44 44 www.egis.fr Egis Rail www.egis-rail.fr Le Carat 170, avenue Thiers 69455 Lyon Cedex 06 - France Tel. +33 (0)4 37 72 40 50 Fax +33 (0)4 37 72 27 00 This document was printed on eco-friendly paper MAJOR Projects Metro Since delivering its first metro in UNDERGROUND WORKS & VIADUCTS 4 1978 Egis has 6 “ STATIONS & INTERCHANGES continued to add ICONIC PROJECTS 7 OPERATION & MODERNISATION 8 to its exceptional BACKTRACKING 10 showcase PROJECTS IN PROGRESS 11 ” For more than 40 years the design and construction of metros has been at the centre of our activity and is at the heart of our know-how. Egis is a pioneer in many areas: design of tunnels and other underground structures, the use of the first Slurry Shield Tunnel Boring Machine in France, new track laying techniques, the conversion of existing networks into automatic systems and the modernisation of equipment. Our extensive experience and the expertise of its engineers has made Egis the leading engineering and consulting company for metros in France and a key player worldwide. Egis’s teams are skilled both in the management of large complex projects and in the technical aspects such as track equipment, power supply, stations, operating systems, signalling, etc.) Jean-François Cazes Egis Senior Executive Vice President International & Major Projects Olivier Bouvart Egis Rail Chief Executive Officer 2 | 3 underground works and viaducts civil engineering in urban environments Today we use mostly Earth Pressure Balance or Slurry Shield Tunnel Boring Machines (TBMs). -

Mumbai Infrastructure: What Is and What Will Be?

MUMBAI INFRASTRUCTURE: WHAT IS AND WHAT WILL BE? Infrastructure development acts as a cornerstone for any city in order to determine the growth trajectory and to become an economic and real estate powerhouse. While Mumbai is the financial capital of India, its infrastructure has not been able to keep pace with the sharp rise in its demographic and economic profile. The city’s road and rail infrastructure is under tremendous pressure from serving a population of more than 25 million people. This report outlines major upcoming infrastructure projects and analyses their impact on the Mumbai real estate market. This report is interactive CBRE RESEARCH DECEMBER 2018 Bhiwandi Dahisar Towards Nasik What is Mumbai’s Virar Towards Sanjay Borivali Gandhi Thane Dombivli National current infrastructure Park framework like? Andheri Mumbai not only has a thriving commercial segment, but the residential real estate development has spread rapidly to the peripheral areas of Thane, Navi Mumbai, Vasai-Virar, Dombivli, Kalyan, Versova Ghatkopar etc. due to their affordability quotient. Commuting is an inevitable pain for most Mumbai citizens and on an average, a Mumbai resident Vashi spends at least 4 hours a day in commuting. As a result, a physical Chembur infrastructure upgrade has become the top priority for the citizens and the government. Bandra Mankhurd Panvel Bandra Worli Monorail Metro Western Suburban Central Rail Sea Link Phase 1 Line 1 Rail Network Network Wadala P D’Mello Road Harbour Rail Thane – Vashi – Mumbai Major Metro Major Railway WESTERN -

Hidden Cities: Reinventing the Non-Space Between Street and Subway

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations 2018 Hidden Cities: Reinventing The Non-Space Between Street And Subway Jae Min Lee University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/edissertations Part of the Architecture Commons, and the Urban Studies and Planning Commons Recommended Citation Lee, Jae Min, "Hidden Cities: Reinventing The Non-Space Between Street And Subway" (2018). Publicly Accessible Penn Dissertations. 2984. https://repository.upenn.edu/edissertations/2984 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/edissertations/2984 For more information, please contact [email protected]. Hidden Cities: Reinventing The Non-Space Between Street And Subway Abstract The connections leading to underground transit lines have not received the attention given to public spaces above ground. Considered to be merely infrastructure, the design and planning of these underground passageways has been dominated by engineering and capital investment principles, with little attention to place-making. This underground transportation area, often dismissed as “non-space,” is a by-product of high-density transit-oriented development, and becomes increasingly valuable and complex as cities become larger and denser. This dissertation explores the design of five of these hidden cities where there has been a serious effort to make them into desirable public spaces. Over thirty-two million urbanites navigate these underground labyrinths in New York City, Hong Kong, London, Moscow, and Paris every day. These in-between spaces have evolved from simple stairwells to networked corridors, to transit concourses, to transit malls, and to the financial engines for affordable public transit. -

SESSION I Metropolitan Transp Ort Planning & Policy Issues

SESSION I Metropolitan Transp ort Planning & Policy Issues T.Anantharajan Former Professor, Anna University CMA : 1189 km2 (city:176 km2) Population : 82.6 lakhs (2008) (59+66= lakhs in 2026) (2.3 lakhs/year ) CTTS :1970 (MATSU) :1993 (CMDA) :2008(CMDA) Vehicle population : 28 lakhs (2009) Bus : 40/ lack of population 2wheeler : 4 lakhs in (1991) to 22 lakhs in (2009) 11 Traffic volume exceeds road capacity/congestion Trip rate/person :0.9 in 1971 to 1.2 in 1992 to 1.6 in 2008 Vehicle/HH :0.25 to 1.26 Fatal Accident :1125 persons (42% pedestrians & 10% cyclists) 2008 Percentage of trips by mode of travel 1970 1992 2008 Bus 42 39 26 Train 12 4 5 Car/Taxi 35 6 2 wheeler 27 25 Auto ‐ 222.2 4 Rickshaw Bicycle 20 14 6 Walk 21 30 28 12 Trip length : 9.6km Walk trip : 1.55km Parking :Reduces road capacity Vehicle Emission & Air pollution – CO & SPM – More than 100% Problems • Rapid Growth of population & vehicle population ‐congestion on roads • Travel time & Trip length increases • Roads safety & Environmental Issues • Decreasing use of public Transport • Parking Management • Quality of Urban life •Safetyofroadusers 13 Vision y People occupy centre–stage in cities‐common benefit & well being y Liva ble cities –engines of economic growth. y Cities to evolve into an urban form best suited –geography , socio ‐ economic activities. y Sustainable cities ‐resources, investment & environment. y Efficient Road network‐ accessibility, mobility, Services & Utilities Policy objectives y Integrating land use & transport planning y Future growth around -

Railway Reference List

Railway Reference List Product/Solution: Mass-Spring System Client/Project Country Year Monbijoustraße, Bern Switzerland 2021 Tramway Reinighaus, Graz Austria 2021 Tramway Stettin-Szczecin, Part 6,7,8 Poland 2021 ul. Wiejskiej na Rzadz PLP40, Grudziadz Poland 2021 Gaziray - Gaziantep, HSL Turkey 2021 Refurbishment railway track Breitenrain Switzerland 2021 Münzgrabenstraße, Line 6, Graz Austria 2021 Koralmbahn, Tunnel Mittlern-Althofen Austria 2021 U2-22 City Hall, Vienna Austria 2021 U5-2 Frankhplatz, Vienna Austria 2021 Metro Tunnel Melbourne Australia 2021 U2-U23, Vienna Austria 2021 GETAFE - ADIF Tunnel, Madrid Spain 2021 Limmattalbahn, Etappe 2 Switzerland 2021 Tramway Gorzow Wielpolski, ul. Chrobrego Mieszka Poland 2020 — 2021 Rösselsbrünnle, Karlsruhe Germany 2020 Main Station Munich North Germany 2020 Tramway Angers, Ligne B France 2020 Linz Linien - Traun Austria 2020 Limmattalbahn Switzerland 2020 Baselland Transport - Section L19 Switzerland 2020 La Sagrera train station, Barcelona Spain 2020 COOP Depot, Vufflens-La-Ville Switzerland 2020 Tramway SmartCity Austria 2020 Kriegsstraße, Karlsruhe Germany 2019 Lusail Tram Qatar 2019 ulica Karmelicka, Krakow Poland 2019 Trasa Łagiewnicka, Krakow Poland 2019 Reconstruction Ostring, Bern Switzerland 2019 Tramway Reininghaus Austria 2019 Chêne Bougerie Ligne 12 Switzerland 2019 Chêne Bougerie Tram du Goulet Switzerland 2019 Tramway Dabrowa Gornica, ulicy Kasprzaka Poland 2019 Tramway ul. Kujawska, Bydgoszcz Poland 2019 Eppenberg Tunnel Switzerland 2019 ul. Podchorążych, Krakow Poland 2019 Railway Reference List Client/Project Country Year Tramway Basel - frame contract Switzerland 2018 — 2023 Tram Magdeburg (Raiffeisenstraße - Warschauer Straße) Germany 2018 Riyadh Metro line 3 Saudi Arabia 2018 Gare de Montbovon Switzerland 2018 ul. Dabrowskiego II, Lodz Poland 2018 Tram Lyon T6 France 2018 KST III Krowodrza Górka — Azory, Krakau Poland 2018 Tramway Caen France 2018 Suin Line South Korea 2018 Tramway Toulouse France 2018 Hanam Line South Korea 2018 Tramway St. -

METROS/U-BAHN Worldwide

METROS DER WELT/METROS OF THE WORLD STAND:31.12.2020/STATUS:31.12.2020 ّ :جمهورية مرص العرب ّية/ÄGYPTEN/EGYPT/DSCHUMHŪRIYYAT MISR AL-ʿARABIYYA :القاهرة/CAIRO/AL QAHIRAH ( حلوان)HELWAN-( المرج الجديد)LINE 1:NEW EL-MARG 25.12.2020 https://www.youtube.com/watch?v=jmr5zRlqvHY DAR EL-SALAM-SAAD ZAGHLOUL 11:29 (RECHTES SEITENFENSTER/RIGHT WINDOW!) Altamas Mahmud 06.11.2020 https://www.youtube.com/watch?v=P6xG3hZccyg EL-DEMERDASH-SADAT (LINKES SEITENFENSTER/LEFT WINDOW!) 12:29 Mahmoud Bassam ( المنيب)EL MONIB-( ش ربا)LINE 2:SHUBRA 24.11.2017 https://www.youtube.com/watch?v=-UCJA6bVKQ8 GIZA-FAYSAL (LINKES SEITENFENSTER/LEFT WINDOW!) 02:05 Bassem Nagm ( عتابا)ATTABA-( عدىل منصور)LINE 3:ADLY MANSOUR 21.08.2020 https://www.youtube.com/watch?v=t7m5Z9g39ro EL NOZHA-ADLY MANSOUR (FENSTERBLICKE/WINDOW VIEWS!) 03:49 Hesham Mohamed ALGERIEN/ALGERIA/AL-DSCHUMHŪRĪYA AL-DSCHAZĀ'IRĪYA AD-DĪMŪGRĀTĪYA ASCH- َ /TAGDUDA TAZZAYRIT TAMAGDAYT TAỴERFANT/ الجمهورية الجزائرية الديمقراطيةالشعبية/SCHA'BĪYA ⵜⴰⴳⴷⵓⴷⴰ ⵜⴰⵣⵣⴰⵢⵔⵉⵜ ⵜⴰⵎⴰⴳⴷⴰⵢⵜ ⵜⴰⵖⴻⵔⴼⴰⵏⵜ : /DZAYER TAMANEỴT/ دزاير/DZAYER/مدينة الجزائر/ALGIER/ALGIERS/MADĪNAT AL DSCHAZĀ'IR ⴷⵣⴰⵢⴻⵔ ⵜⴰⵎⴰⵏⴻⵖⵜ PLACE DE MARTYRS-( ع ني نعجة)AÏN NAÂDJA/( مركز الحراش)LINE:EL HARRACH CENTRE ( مكان دي مارت بز) 1 ARGENTINIEN/ARGENTINA/REPÚBLICA ARGENTINA: BUENOS AIRES: LINE:LINEA A:PLACA DE MAYO-SAN PEDRITO(SUBTE) 20.02.2011 https://www.youtube.com/watch?v=jfUmJPEcBd4 PIEDRAS-PLAZA DE MAYO 02:47 Joselitonotion 13.05.2020 https://www.youtube.com/watch?v=4lJAhBo6YlY RIO DE JANEIRO-PUAN 07:27 Así es BUENOS AIRES 4K 04.12.2014 https://www.youtube.com/watch?v=PoUNwMT2DoI -

Vedic Sanskrit Anuswar

Vaidika Vowels and Consonants Proposed Unicode Value: U+0880 Unicode name: INDO IRANIAN AVESTA LETTER SAREKHA CANDRA LONG A Sources: 1. Avesta The Sacred Scripture of the Parsees Part 1, Yasna & Visparat Edited by M. F. Kanga and N. S. Sontakke Shake 1884 Published by N. S. Sontakke and C. G. Kashikar Vaidic Sanshodhan Mandal, Tilak Maharashtra Vidyapeeth, Pune Printed by Samarth Bharat Press, Poona 1962 Page: 139, Line: 6 Notes: Centre for Development of Advanced Computing October 2007/ 24 Vaidika Vowels and Consonants Proposed Unicode Value: U+0881 Unicode name: INDO IRANIAN AVESTA VOWEL SIGN SAREKHA CANDRA LONG A Sources: 1. Avesta The Sacred Scripture of the Parsees Part 1, Yasna & Visparat Edited by M. F. Kanga and N. S. Sontakke Shake 1884 Published by N. S. Sontakke and C. G. Kashikar Vaidic Sanshodhan Mandal, Tilak Maharashtra Vidyapeeth, Pune Printed by Samarth Bharat Press, Poona 1962 Page: 139, Line: 6 Notes: Centre for Development of Advanced Computing October 2007/ 25 Vaidika Vowels and Consonants Proposed Unicode Value: U+0882 Unicode name: INDO IRANIAN AVESTA LETTER LONG AAOO Sources: 1. Avesta The Sacred Scripture of the Parsees Part 1, Yasna & Visparat Edited by M. F. Kanga and N. S. Sontakke Shake 1884 Published by N. S. Sontakke and C. G. Kashikar Vaidic Sanshodhan Mandal, Tilak Maharashtra Vidyapeeth, Pune Printed by Samarth Bharat Press, Poona 1962 Page: 138, Line: 5 Notes: Centre for Development of Advanced Computing October 2007/ 26 Vaidika Vowels and Consonants Proposed Unicode Value: U+0883 Unicode name: INDO IRANIAN AVESTA VOWEL SIGN LONG AAOO Sources: 1. Avesta The Sacred Scripture of the Parsees Part 1, Yasna & Visparat Edited by M.