FY2008 Results Meeting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ED-7311-20.Pdf

EIAJ ED-7311-20 - 1 - EIAJ ED-7311-20 - 2 - EIAJ ED-7311-20 - 3 - EIAJ ED-7311-20 - 4 - EIAJ ED-7311-20 - 5 - EIAJ ED-7311-20 - 6 - EIAJ ED-7311-20 - 7 - EIAJ ED-7311-20 - 8 - EIAJ ED-7311-20 - 9 - EIAJ ED-7311-20 - 10 - EIAJ ED-7311-20 - 11 - EIAJ ED-7311-20 - 12 - EIAJ ED-7311-20 - 13 - EIAJ ED-7311-20 - 14 - EIAJ ED-7311-20 - 15 - EIAJ ED-7311-20 - 16 - EIAJ ED-7311-20 - 17 - EIAJ ED-7311-20 - 18 - EIAJ ED-7311-20 - 19 - EIAJ ED-7311-20 - 20 - EIAJ ED-7311-20 - 21 - EIAJ ED-7311-20 - 22 - EIAJ ED-7311-20 - 23 - EIAJ ED-7311-20 - 24 - EIAJ ED-7311-20 - 25 - EIAJ ED-7311-20 - 26 - EIAJ ED-7311-20 - 27 - EIAJ ED-7311-20 - 28 - EIAJ ED-7311-20 - 29 - EIAJ ED-7311-20 - 30 - EIAJ ED-7311-20 - 31 - EIAJ ED-7311-20 - 32 - EIAJ ED-7311-20 - 33 - EIAJ ED-7311-20 - 34 - EIAJ ED-7311-20 - 35 - EIAJ ED-7311-20 - 36 - EIAJ ED-7311-20 - 37 - EIAJ ED-7311-20 - 38 - EIAJ ED-7311-20 - 39 - EIAJ ED-7311-20 - 40 - EIAJ ED-7311-20 - 41 - EIAJ ED-7311-20 - 42 - EIAJ ED-7311-20 - 43 - EIAJ ED-7311-20 - 44 - EIAJ ED-7311-20 - 45 - EIAJ ED-7311-20 - 46 - EIAJ ED-7311-20 - 47 - EIAJ ED-7311-20 - 48 - EIAJ ED-7311-20 - 49 - EIAJ ED-7311-20 - 50 - EIAJ ED-7311-20 - 51 - EIAJ ED-7311-20 - 52 - EIAJ ED-7311-20 - 53 - EIAJ ED-7311-20 - 54 - EIAJ ED-7311-20 - 55 - EIAJ ED-7311-20 - 56 - EIAJ ED-7311-20 - 57 - EIAJ ED-7311-20 - 58 - EIAJ ED-7311-20 - 59 - EIAJ ED-7311-20 - 60 - EIAJ ED-7311-20 - 61 - EIAJ ED-7311-20 - 62 - EIAJ ED-7311-20 - 63 - EIAJ ED-7311-20 - 64 - EIAJ ED-7311-20 - 65 - EIAJ ED-7311-20 - 66 - EIAJ ED-7311-20 - 67 - EIAJ ED-7311-20 - 68 - EIAJ -

1332:Xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:Xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:Xtks Sakata Seed Corp. 3 5 2 1414:Xtks SHO-BOND Holdings Co

Symbol Code Description Current Rating New rating Diff 1332:xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:xtks Sakata Seed Corp. 3 5 2 1414:xtks SHO-BOND Holdings Co. Ltd 3 6 3 1766:xtks TOKEN Corp. 3 6 3 1801:xtks Taisei Corp. 3 5 2 1803:xtks Shimizu Corp. 3 4 1 1808:xtks Haseko Corp. 3 4 1 1812:xtks Kajima Corp. 3 5 2 1820:xtks Nishimatsu Construction Co. Ltd 3 6 3 1824:xtks Maeda Corp. 3 6 3 1833:xtks Okumura Corp. 3 6 3 1860:xtks Toda Corp. 3 5 2 1861:xtks Kumagai Gumi Co. Ltd 3 8 5 1865:xtks Asunaro Aoki Construction Co. Ltd 3 6 3 1870:xtks Yahagi Construction Co. Ltd 3 4 1 1881:xtks NIPPO Corp. 3 6 3 1883:xtks Maeda Road Construction Co. Ltd 3 6 3 1911:xtks Sumitomo Forestry Co Ltd 3 4 1 1924:xtks PanaHome Corp. 3 4 1 1925:xtks Daiwa House Industry Co. Ltd 3 4 1 1928:xtks Sekisui House Ltd 3 4 1 1934:xtks YURTEC Corp. 3 6 3 1945:xtks Tokyo Energy & Systems Inc. 3 4 1 1961:xtks Sanki Engineering Co. Ltd 3 4 1 1963:xtks JGC Corporation 3 4 1 1968:xtks Taihei Dengyo Kaisha Ltd 3 4 1 1969:xtks Takasago Thermal Engineering Co. Ltd 3 4 1 1973:xtks NEC Networks & System Integration Corp. 3 5 2 1979:xtks Taikisha Ltd 3 4 1 1983:xtks TOSHIBA PLANT SYSTEMS & SERVICES Corp. -

UNO Template

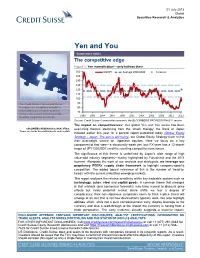

01 July 2013 Global Securities Research & Analytics Yen and You Connections Series The competitive edge Figure 1: Yen 'normalisation'—only halfway there 160 USDJPY Average 1990-2008 Forecast 150 140 130 120 110 100 The Credit Suisse Connections Series 90 leverages our exceptional breadth of 80 macro and micro research to deliver 70 incisive cross-sector and cross-border 1990 1992 1994 1997 1999 2001 2004 2006 2008 2011 2013 thematic insights for our clients. Source: Credit Suisse Commodities research, the BLOOMBERG PROFESSIONAL™ service The impact on competitiveness: Our global Yen and You series has been SECURITIES RESEARCH & ANALYTICS examining themes stemming from the 'shock therapy' the Bank of Japan Please see inside for contributors to each section initiated earlier this year. In a parallel report published today (Global Equity Strategy - Japan: The sun is still rising), our Global Equity Strategy team revisit their overweight stance on Japanese equities. Here we focus on a key component of that view—a structurally weak yen (our FX team has a 12-month target of JPY120/USD1) and the resulting competitiveness issues. The significance of this theme is underlined by Japan's wide range of high value-add industry segments—starkly highlighted by Fukushima and the 2011 tsunami. Alongside the work of our analysts and strategists, we leverage our proprietary PEERs supply chain framework to highlight company-specific competition. The added topical relevance of this is the number of 'head-to- heads' with the current embattled emerging markets. This report analyses the relative sensitivity within key tradeable sectors such as technology, autos, steel and capital goods. -

Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon)

F INANCIAL S TATEMENTS, M ANAGEMENT’ S D ISCUSSION AND A NALYSIS AND S UPPLEMENTAL S CHEDULES Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon) Division of Investment Department of the Treasury State of New Jersey Pension Fund Financial Statements June 30, 2009 and 2008 Contents Independent Auditors’ Report ..........................................................................................................1 Management’s Discussion and Analysis .........................................................................................3 Basic Financial Statements: Statements of Net Assets .................................................................................................................7 Statements of Changes in Net Assets...............................................................................................8 Notes to Financial Statements ..........................................................................................................9 Supplemental Schedules: Schedule 1 – Combining Schedule of Net Assets ..........................................................................31 Schedule 2 – Combining Schedule of Changes in Net Assets .......................................................32 Schedule 3 – Portfolio of Investments – Common Fund A ...........................................................33 Schedule 4 – Portfolio of Investments – Common Fund B ...........................................................57 -

Delaware, 1:11-Cv-00770

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE HSM PORTFOLIO LLC AND § TECHNOLOGY PROPERTIES § LIMITED LLC, § § Plaintiffs, § § v. § C.A. No. 1:11-cv-00770-RGA § FUJITSU LIMITED, § JURY TRIAL DEMANDED FUJITSU AMERICA, INC., § FUJITSU SEMICONDUCTOR § AMERICA, INC., § § ADVANCED MICRO DEVICES, INC., § § QUALCOMM INCORPORATED, § § ELPIDA MEMORY, INC., § ELPIDA MEMORY (USA) INC., § § SK HYNIX INC., § SK HYNIX AMERICA INC., § HYNIX SEMICONDUCTOR § MANUFACTURING AMERICA INC., § § MICRON TECHNOLOGY, INC., § § PROMOS TECHNOLOGIES INC., § § SANDISK CORPORATION, § § SONY CORPORATION, § SONY CORPORATION OF AMERICA, § SONY ELECTRONICS INC., § SONY COMPUTER § ENTERTAINMENT INC., § SONY COMPUTER § ENTERTAINMENT AMERICA LLC, § § STMICROELECTRONICS N.V., § STMICROELECTRONICS, INC., § § PAGE 1 TOSHIBA CORPORATION, § TOSHIBA AMERICA, INC., § TOSHIBA AMERICA ELECTRONIC § COMPONENTS, INC., § § ON SEMICONDUCTOR § CORPORATION, § § ZORAN CORPORATION, § § Defendants. § PLAINTIFFS’ THIRD AMENDED COMPLAINT Plaintiffs HSM Portfolio LLC and Technology Properties Limited LLC (collectively “Plaintiffs”) by and through their undersigned counsel, file this Third Amended Complaint against Defendants Fujitsu Limited, Fujitsu America, Inc., Fujitsu Semiconductor America, Inc. (collectively “Fujitsu”), Advanced Micro Devices, Inc. (“AMD”), Qualcomm Incorporated (“Qualcomm”), Elpida Memory, Inc., Elpida Memory (USA) Inc. (collectively “Elpida”),1 SK Hynix Inc., SK Hynix America Inc., Hynix Semiconductor Manufacturing America Inc. (collectively “SK Hynix”), -

2008 International Symposium on Semiconductor Manufacturing

2008 International Symposium on Semiconductor Manufacturing (ISSM 2008) Tokyo, Japan 27 – 29 October 2008 IEEE Catalog Number: CFP08SSM-PRT ISBN: 978-1-61284-948-5 ISSM 2008 Program Schedule The 1st day (Monday, October 27) Tutorial Session Room: Century A/B 9:30 Tutorial Session AEC/APC Introduction of AEC/APC's history Mr. Toshihiko Osada, Senior Manager, Fujitsu Microelectronics Limited Manufacturing engineering and AEC/APC Mr. Kensuke Uriga, CEO/President, Dura Systems Corporation Application of control theory for AEC/APC in semiconductor fabrication Mr. Hiroshi Shimizu, Director/Advanced Solution Department, Advance Automation Company, Yamatake Corporation 9:00 Tutorial Session ESH SUSTAINABILITY AND ESH ASPECTS OF ADVANCED SEMICONDUCTOR MANUFACTURING Prof. Farhang Shadman, Regents Professor of Chemical and Environmental Engineering, the University of Arizona Opening Remarks Room: Century 13:00 Keynote Speech Session Room: Century 13:20 Challenges in The DRAM Business Mr.Yukio Sakamoto, President&CEO, Elpida Memory,Inc. 14:10 The New Dynamics of Semiconductor Industry Dr. Tien Wu, Chief Operating Officer, Board of Directors, Advanced Semiconductor Engineering Inc.(ASE) 15:00 Break Oral Session Room: Century A Highlight Session <Advanced Lithography Session> 15:10 PE-O-097 Phenomenology of ArF Photoresist Shrinkage Trends ..........................................................3 Benjamin Bunday, ISMI 15:30 PE-O-044 Lithography Hotspot Discovery at 70nm DRAM 300mm Fab : Process Window Qualification Using Design Based Binning...............................................................................7 -

Top 300 Organizations Granted U.S. Patents in 2007

Top 300 Organizations Granted U.S. Patents in 2007 NOTE: IPO DOES NOT INTEND TO ENCOURAGE MORE PATENTING IN U.S. This annual report listing the organizations that received the most U.S. utility patents is being published by fO kramedarT & tnetaP .S.U eht morf deniatbo atad no desab si tI .raey evitucesnoc ht52 eht rof OPI rof eht ht52 evitucesnoc .raey tI si desab no atad deniatbo morf eht .S.U tnetaP & kramedarT fO fi .ec Patents granted to parent and subsidiary companies are combined in some instances. See the end notes for background on how the report was prepared. IPO does not intend for this report to encourage or discourage patenting. Some critics believe companies are applying for too many patents. In 2007 the U.S. Patent & Trademark Office announced that it would no longer publish its own report on organizations receiving the most patents, because it wanted to discour- age “any perception that we believe more is better.” IPO has opted to continue publishing this IPO report, however, because the number of patents granted is one of the few objective measures of the patent system as a whole and the patenting activities of individual industries and companies. IPO and others are study- ing ways to develop more reliable measures of patent quality. May 21, 2008 Contents: Numerical Listing . 2 Alphabetical Listing . 6 Notes . 10 © Copyright 2008 Intellectual Property Owners Association 1 2007 Patent Owners Numerical Listing Rank Organization Patent Rank Organization Patent 1 International Business Machines Corp. 3,125 45 Sanyo Electric Co., Ltd. 454 2 Samsung Electronics Co., Ltd. -

Respondents(Eng)

JCGR JCGIndex Survey 2008 List of 252 responding firms Mining (1) House Foods Corporation (03)(05)(06) INPEX Corporation (07) (07) Nichirei Corporation (02)(03)(04)(05)(06) Construction (13) (07) Taisei Corporation (05)(06)(07) Fujicco Co., Ltd. ((07) OBAYASHI CORPORATION (04)(05)(06) (07) Textiles & Apparel (6) HASEKO Corporation Gunze Limited (02)(03)(04)(05)(06)(07) KAJIMA Corporation Japan Wool Textile Co., Ltd. (04)(05) Maeda Corporation (02)(03)(04)(05)(06) (06)(07) (07) Teijin Limited (03)(04)(05)(06)(07) Totetsu Kogyo Co., Ltd. (04)(05)(06)(07) Toray Industries, Inc. (03)(05)(06) TOA CORPORATION Japan Vilene Company, Ltd. (05)(07) Daiwa House Industry Co., Ltd. (05)(06) Wacoal Holdings Corp. (02)(04)(05)(06) (07) (07) Sekisui House, Ltd. (05)(06)(07) Nippon Densetsu Kogyo Co., Ltd. (04) Pulp and Paper (2) (05)(07) Rengo Co., Ltd. (02)(04)(05)(06)(07) Takasago Thermal Engineering Co., Ltd. The Pack Corporation (06) DAI-DAN Co., Ltd. (04)(05)(06) Chemicals (20) Toyo Engineering Corporation Asahi Kasei Corporation (05)(06)(07) Showa Denko K.K (04)(05)(06)(07) Foods (10) Nippon Soda Co., Ltd. (03)(04)(05)(06) Morozoff Limited (07) (07) NH Foods Ltd. (04)(05)(06)(07) Tokuyama Corpo (02)(04)(05)(06)(07) Asahi Breweries, Ltd. (02)(03)(04)(05) Kanto Denka Kogyo Co., Ltd. (04)(05)(06) (06)(07) (07) The Nisshin OilliO Group, Ltd. (05)(06) Shin-Etsu Chemical Co., Ltd. (05)(06) (07) Mitsubishi Chemical Holdings Fuji Oil Co., Ltd. (03)(04) Corporation (04)(05)(06) Kikkoman Corporation (07) JSR Corporation (04)(05)(06)(07) Ajinomoto Co., Inc. -

Green Fab1—Requirements for a Good Semiconductor Factory

HIGHLIGHT Roundtable Meeting with Stakeholders Green Fab1—Requirements for a Good Semiconductor Factory On June 27, 2007, we invited some of our stakeholders to a roundtable meeting to discuss the requirements for a good semiconductor factory. Specifically, we invited representatives of the fol- lowing companies engaged in the upstream and downstream semiconductor manufacturing processes: semiconductor manufacturers, relevant equipment and component manufacturers, and a company engaged in the design and construction of clean rooms. 1. Green Fab: Meaning a factory/manufacturing process that is comprehensively environment-conscious Collaboration from the Upstream through manufacturers. However, when we have the rare opportunity to visit Downstream Processes Is Essential the factory of a semiconductor manufacturer, we often find room Mr. Honma: I would like to comment in my capacity as someone for improvement at the factory, something which only component engaged in building semiconductor factories and production manufacturers would be able to see. For example, the pipe on a systems. As a result of the shift from 200-millimeter wafers to 300- freezer might be too long and coiled up. Although the freezer is millimeter wafers, the power consumed by semiconductor produc- working hard to keep the temperature below zero, the long pipe is tion equipment is increasing, and we are now required to save even continuously giving out heat beside the freezer. Reducing this type more energy. For the environment, it is important to eliminate of waste would help reduce the environmental impact of the factory, HIGHLIGHT duplication and waste in semiconductor factories from a compre- and roundtable meetings like this one are very useful for this hensive viewpoint, but the environmental efficiency of individual purpose. -

News Release

News Release INCJ Announces Appointment of CEO of Japan Display TOKYO, November 15, 2011—Innovation Network Corporation Japan (“INCJ”) announced today the appointment of Shuichi Otsuka as CEO of Japan Display Inc. (“Japan Display”), a new company scheduled for establishment in Spring of 2012 that will specialize in the development and production of small- and medium-sized displays for the global market. Japan Display is being formed through the integration of display businesses currently being operated by subsidiaries of Hitachi, Sony and Toshiba, with capital backing and management control by INCJ. Shuichi Otsuka will formally assume the position of CEO following completion of the required procedures, until which time he will maintain his present role as a senior advisor to the INCJ engaged in preparations for the launch of Japan Display. Background of Shuichi Otsuka 1980 Joined Texas Instruments Japan K.K. 1998 Joined Sony Corporation 2002 Joined Elpida Memory, Inc. 2004 Appointed COO, Elpida Memory, Inc. 2011 Resigned as director, Elpida Memory, Inc. Appointed CEO, Japan Display Inc. (designated) Comments on leadership announcement Shuichi Otsuka, CEO (designated), Japan Display Inc. “All of us participating in this integration have a shared sense of its significance and a strong determination to ensure that it succeeds. I see it as my mission to channel that ambition, through decisive leadership from a neutral and balanced perspective, to develop Japan Display into a world leader in small- and medium-sized displays.” Kimikazu Noumi, CEO, Innovation Network Corporation Japan “Shuichi Otsuka has extensive experience in developing cutting-edge technology and making major investment decisions at global corporations. -

STATEMENT of INVESTMENTS Dreyfus Premier Total Return Advantage Fund July 31, 2007 (Unaudited)

STATEMENT OF INVESTMENTS Dreyfus Premier Total Return Advantage Fund July 31, 2007 (Unaudited) Coupon Maturity Principal Bonds and Notes--103.6% Rate (%) Date Amount ($) Value ($) Asset-Backed Ctfs./Auto Receivables--4.6% Capital One Auto Finance Trust, Ser. 2005-C, Cl. A3 4.61 7/15/10 57,941 57,806 Chase Manhattan Auto Owner Trust, Ser. 2003-C, Cl. A4 2.94 6/15/10 47,229 47,018 Daimler Chrysler Auto Trust, Ser. 2004-A, Cl. A4 2.58 4/8/09 40,568 40,391 Harley-Davidson Motorcycle Trust, Ser. 2004-1, Cl. A2 2.53 11/15/11 58,861 57,503 Honda Auto Receivables Owner Trust, Ser. 2005-5, Cl. A4 4.69 2/15/11 140,000 139,153 Household Automotive Trust, Ser. 2003-2, Cl. A4 3.02 12/17/10 49,853 49,489 USAA Auto Owner Trust, Ser. 2004-3, Cl. A4 3.53 6/15/11 100,000 98,865 WFS Financial Owner Trust, Ser. 2004-2, Cl. A4 3.54 11/21/11 62,435 61,869 552,094 Asset-Backed Ctfs./Credit Cards--3.3% Capital One Multi-Asset Execution Trust, Ser. 2005-A2, Cl. A2 4.05 2/15/11 100,000 99,216 Chase Issuance Trust, Ser. 2005-A10, Cl. A10 4.65 12/17/12 100,000 98,732 Citibank Credit Card Issuance Trust, Ser. 2003-A8, Cl. A8 3.50 8/16/10 100,000 98,317 MBNA Master Credit Card Trust, Ser. 2000-L, Cl. A 6.50 4/15/10 100,000 100,382 396,647 Asset-Backed Ctfs./Home Equity Loans--2.5% MASTR Asset-Backed Securities Trust, Ser. -

EUROPEAN COMMISSION Brussels, PROVISIONAL NON

EUROPEAN COMMISSION Brussels, PROVISIONAL NON CONFIDENTIAL VERSION OF THE COMMISSION DECISION of 19 May 2010 relating to a proceeding under Article 101 of the Treaty on the Functioning of the European Union and Article 53 of the EEA Agreement (COMP/38511 – DRAMs) N.B.: This is a provisional non confidential version. Confidentiality claims are still underdiscussion. The definitive non confidential version will be published as soon as it is available. (Only the English text is authentic) (Text with EEA relevance) - 1 - TABLE OF CONTENTS 1. INTRODUCTION.......................................................................................................6 2. PROCEDURE .............................................................................................................7 3. THE INDUSTRY SUBJECT TO THE PROCEEDINGS...........................................8 3.1. The product concerned by the cartel .................................................................8 3.2. The companies subject to the proceedings ........................................................9 3.2.1. Micron .................................................................................................9 3.2.2. Infineon................................................................................................9 3.2.3. Hynix ...................................................................................................9 3.2.4. Samsung ..............................................................................................9 3.2.5. NEC .....................................................................................................9