1 W(A) 2020-007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ED-7311-20.Pdf

EIAJ ED-7311-20 - 1 - EIAJ ED-7311-20 - 2 - EIAJ ED-7311-20 - 3 - EIAJ ED-7311-20 - 4 - EIAJ ED-7311-20 - 5 - EIAJ ED-7311-20 - 6 - EIAJ ED-7311-20 - 7 - EIAJ ED-7311-20 - 8 - EIAJ ED-7311-20 - 9 - EIAJ ED-7311-20 - 10 - EIAJ ED-7311-20 - 11 - EIAJ ED-7311-20 - 12 - EIAJ ED-7311-20 - 13 - EIAJ ED-7311-20 - 14 - EIAJ ED-7311-20 - 15 - EIAJ ED-7311-20 - 16 - EIAJ ED-7311-20 - 17 - EIAJ ED-7311-20 - 18 - EIAJ ED-7311-20 - 19 - EIAJ ED-7311-20 - 20 - EIAJ ED-7311-20 - 21 - EIAJ ED-7311-20 - 22 - EIAJ ED-7311-20 - 23 - EIAJ ED-7311-20 - 24 - EIAJ ED-7311-20 - 25 - EIAJ ED-7311-20 - 26 - EIAJ ED-7311-20 - 27 - EIAJ ED-7311-20 - 28 - EIAJ ED-7311-20 - 29 - EIAJ ED-7311-20 - 30 - EIAJ ED-7311-20 - 31 - EIAJ ED-7311-20 - 32 - EIAJ ED-7311-20 - 33 - EIAJ ED-7311-20 - 34 - EIAJ ED-7311-20 - 35 - EIAJ ED-7311-20 - 36 - EIAJ ED-7311-20 - 37 - EIAJ ED-7311-20 - 38 - EIAJ ED-7311-20 - 39 - EIAJ ED-7311-20 - 40 - EIAJ ED-7311-20 - 41 - EIAJ ED-7311-20 - 42 - EIAJ ED-7311-20 - 43 - EIAJ ED-7311-20 - 44 - EIAJ ED-7311-20 - 45 - EIAJ ED-7311-20 - 46 - EIAJ ED-7311-20 - 47 - EIAJ ED-7311-20 - 48 - EIAJ ED-7311-20 - 49 - EIAJ ED-7311-20 - 50 - EIAJ ED-7311-20 - 51 - EIAJ ED-7311-20 - 52 - EIAJ ED-7311-20 - 53 - EIAJ ED-7311-20 - 54 - EIAJ ED-7311-20 - 55 - EIAJ ED-7311-20 - 56 - EIAJ ED-7311-20 - 57 - EIAJ ED-7311-20 - 58 - EIAJ ED-7311-20 - 59 - EIAJ ED-7311-20 - 60 - EIAJ ED-7311-20 - 61 - EIAJ ED-7311-20 - 62 - EIAJ ED-7311-20 - 63 - EIAJ ED-7311-20 - 64 - EIAJ ED-7311-20 - 65 - EIAJ ED-7311-20 - 66 - EIAJ ED-7311-20 - 67 - EIAJ ED-7311-20 - 68 - EIAJ -

FY2008 Results Meeting

FY200FY20088 ResultsResults MeetingMeeting FY2008 : Year ended March 31, 2009 May 14, 2009 Ryosan Company, Limited Code : 8140 / Stock listings: Tokyo Stock Exchange (First Section) URL : http://www.ryosan.co.jp/eng/ Notice This presentation contains forward-looking statements regarding business performance, which may differ substantially from actual results, depending on certain risks and uncertainties, the most significant of which are listed below. z Economic conditions in key markets (Japan and the rest of Asia), rapid changes in consumption patterns and supply-demand balance for products z Sharp fluctuations in the ¥/$ exchange rate z Substantial fluctuation in prices in capital markets Consolidated results for FY 2008 FY2007 FY2008 FY2009(Forecasts) Of Total Of Total % Chg. YoY Of Total % Chg. YoY ¥ 100 million% ¥ 100 million%% ¥ 100 million %% Net sales 2,860 2,208 (22.8) 1,700 (23.0) Gross margin 251 8.8 196 8.9 (22.1) 149 8.8 (24.1) SG&A expenses 144 5.0 134 6.1 (6.8) 115 6.8 (14.7) Operating income 107 3.8 61 2.8 (42.8) 34 2.0 (44.7) Ordinary income 112 3.9 72 3.3 (35.6) 38 2.2 (47.7) Net income 67 2.4 39 1.8 (41.8) 22 1.3 (43.9) Earnings per share ¥187.15 ¥111.83 (¥75) ¥63.83 (¥48) 1 Segment results for FY2008 Unit : ¥ 100 million FY2007 FY2008 FY2009(Forecasts) OP OP OP Margin Margin % Chg. YoYMargin % Chg. YoY % % Sales 1,489 1,169 (21.5) 808 (30.9) Semiconductors Operating income 724.9% 48 4.2%(32.7) 28 3.5% (42.7) Electronic Sales 1,031 759 (26.4) 584 (23.1) Components Operating income 444.3 28 3.7 (35.9) 22 3.8 (22.1) -

Trabajo De Graduación: Valuación De Micron Technology Inc. Autor: Nicolas Vallejos DNI: 40127617 Director De Tesis: Ignacio Warnes Buenos Aires, El 11 De Mayo 2021

Universidad de San Andrés Universidad de San Andrés Escuela de Administración y Negocios Magister en Finanzas Trabajo de Graduación: Valuación de Micron Technology Inc. Autor: Nicolas Vallejos DNI: 40127617 Director de tesis: Ignacio Warnes Buenos Aires, el 11 de mayo 2021 1 Universidad de San Andrés Contenido Micron Technology 4 1. La industria de semiconductores: 8 1.1 El plan “made in China.” 9 2. Mercado de DRAM y NAND: 11 2.1 DRAM: 13 2.1.1. El mercado DRAM 13 2.1.2. Una Consolidación del mercado 16 2.1.3 Clases de DRAM: 19 2.2 NAND: 20 2.2.1. El mercado NAND 21 2.2.2. Una Consolidación del mercado 23 2.2.3. Tipos de NAND: 24 3. Análisis macroeconómico: 25 3.1 Estados Unidos: 25 3.2 Europa: 26 3.3 China: 28 4. Análisis financiero 28 4.1 Ratios de crecimiento: 28 4.2 Ratios de deuda: 35 4.3 Análisis de Dupont 35 4.4 Márgenes de Micron 37 4.5 Ratios de eficiencia: 38 5. Capex e I+D: 39 6. Manufactura: 42 7. Adquisiciones: 44 8. Patentes 45 9. Valuación por flujos descontados 46 9.1 Proyección de mercados 46 9.1.1 Mercado DRAM y NAND 46 9.1.2 Proyección cuotas de mercado Micron en DRAM 56 9.1.3 Proyección cuotas de mercado Micron en NAND 58 2 Universidad de San Andrés 9.2 Proyección inversión y desarrollo 61 9.3 Proyección de CAPEX 61 9.4. Estimación costo de los bienes vendidos 62 9.5 Estimación de depreciación y amortización 63 9.6. -

1332:Xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:Xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:Xtks Sakata Seed Corp. 3 5 2 1414:Xtks SHO-BOND Holdings Co

Symbol Code Description Current Rating New rating Diff 1332:xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:xtks Sakata Seed Corp. 3 5 2 1414:xtks SHO-BOND Holdings Co. Ltd 3 6 3 1766:xtks TOKEN Corp. 3 6 3 1801:xtks Taisei Corp. 3 5 2 1803:xtks Shimizu Corp. 3 4 1 1808:xtks Haseko Corp. 3 4 1 1812:xtks Kajima Corp. 3 5 2 1820:xtks Nishimatsu Construction Co. Ltd 3 6 3 1824:xtks Maeda Corp. 3 6 3 1833:xtks Okumura Corp. 3 6 3 1860:xtks Toda Corp. 3 5 2 1861:xtks Kumagai Gumi Co. Ltd 3 8 5 1865:xtks Asunaro Aoki Construction Co. Ltd 3 6 3 1870:xtks Yahagi Construction Co. Ltd 3 4 1 1881:xtks NIPPO Corp. 3 6 3 1883:xtks Maeda Road Construction Co. Ltd 3 6 3 1911:xtks Sumitomo Forestry Co Ltd 3 4 1 1924:xtks PanaHome Corp. 3 4 1 1925:xtks Daiwa House Industry Co. Ltd 3 4 1 1928:xtks Sekisui House Ltd 3 4 1 1934:xtks YURTEC Corp. 3 6 3 1945:xtks Tokyo Energy & Systems Inc. 3 4 1 1961:xtks Sanki Engineering Co. Ltd 3 4 1 1963:xtks JGC Corporation 3 4 1 1968:xtks Taihei Dengyo Kaisha Ltd 3 4 1 1969:xtks Takasago Thermal Engineering Co. Ltd 3 4 1 1973:xtks NEC Networks & System Integration Corp. 3 5 2 1979:xtks Taikisha Ltd 3 4 1 1983:xtks TOSHIBA PLANT SYSTEMS & SERVICES Corp. -

PART I ITEM 1. BUSINESS Industry We Are

PART I ITEM 1. BUSINESS Industry We are the world’s largest semiconductor chip maker, based on revenue. We develop advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. Integrated circuits are semiconductor chips etched with interconnected electronic switches. We also develop platforms, which we define as integrated suites of digital computing technologies that are designed and configured to work together to provide an optimized user computing solution compared to ingredients that are used separately. Our goal is to be the preeminent provider of semiconductor chips and platforms for the worldwide digital economy. We offer products at various levels of integration, allowing our customers flexibility to create advanced computing and communications systems and products. We were incorporated in California in 1968 and reincorporated in Delaware in 1989. Our Internet address is www.intel.com. On this web site, we publish voluntary reports, which we update annually, outlining our performance with respect to corporate responsibility, including environmental, health, and safety compliance. On our Investor Relations web site, located at www.intc.com, we post the following filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC): our annual, quarterly, and current reports on Forms 10-K, 10-Q, and 8-K; our proxy statements; and any amendments to those reports or statements. All such filings are available on our Investor Relations web site free of charge. The SEC also maintains a web site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. -

Micron Technology Inc

MICRON TECHNOLOGY INC FORM 10-K (Annual Report) Filed 10/25/11 for the Period Ending 09/01/11 Address 8000 S FEDERAL WAY PO BOX 6 BOISE, ID 83716-9632 Telephone 2083684000 CIK 0000723125 Symbol MU SIC Code 3674 - Semiconductors and Related Devices Industry Semiconductors Sector Technology Fiscal Year 08/30 http://www.edgar-online.com © Copyright 2011, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 1, 2011 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-10658 Micron Technology, Inc. (Exact name of registrant as specified in its charter) Delaware 75-1618004 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 8000 S. Federal Way, Boise, Idaho 83716-9632 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code (208) 368-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $.10 per share NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

UNO Template

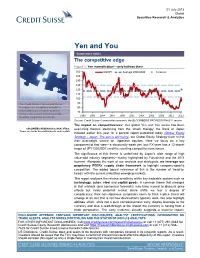

01 July 2013 Global Securities Research & Analytics Yen and You Connections Series The competitive edge Figure 1: Yen 'normalisation'—only halfway there 160 USDJPY Average 1990-2008 Forecast 150 140 130 120 110 100 The Credit Suisse Connections Series 90 leverages our exceptional breadth of 80 macro and micro research to deliver 70 incisive cross-sector and cross-border 1990 1992 1994 1997 1999 2001 2004 2006 2008 2011 2013 thematic insights for our clients. Source: Credit Suisse Commodities research, the BLOOMBERG PROFESSIONAL™ service The impact on competitiveness: Our global Yen and You series has been SECURITIES RESEARCH & ANALYTICS examining themes stemming from the 'shock therapy' the Bank of Japan Please see inside for contributors to each section initiated earlier this year. In a parallel report published today (Global Equity Strategy - Japan: The sun is still rising), our Global Equity Strategy team revisit their overweight stance on Japanese equities. Here we focus on a key component of that view—a structurally weak yen (our FX team has a 12-month target of JPY120/USD1) and the resulting competitiveness issues. The significance of this theme is underlined by Japan's wide range of high value-add industry segments—starkly highlighted by Fukushima and the 2011 tsunami. Alongside the work of our analysts and strategists, we leverage our proprietary PEERs supply chain framework to highlight company-specific competition. The added topical relevance of this is the number of 'head-to- heads' with the current embattled emerging markets. This report analyses the relative sensitivity within key tradeable sectors such as technology, autos, steel and capital goods. -

Micron: Changes for Continued Success Rachel Rice [email protected]

University of Nebraska at Omaha DigitalCommons@UNO Theses/Capstones/Creative Projects University Honors Program 5-2018 Micron: Changes for Continued Success Rachel Rice [email protected] Follow this and additional works at: https://digitalcommons.unomaha.edu/ university_honors_program Part of the Business Administration, Management, and Operations Commons Recommended Citation Rice, Rachel, "Micron: Changes for Continued Success" (2018). Theses/Capstones/Creative Projects. 5. https://digitalcommons.unomaha.edu/university_honors_program/5 This Dissertation/Thesis is brought to you for free and open access by the University Honors Program at DigitalCommons@UNO. It has been accepted for inclusion in Theses/Capstones/Creative Projects by an authorized administrator of DigitalCommons@UNO. For more information, please contact [email protected]. DECEMBER 11, 2017 MICRON CHANGES FOR CONTINUED SUCCESS RACHEL RICE UNIVERSITY OF NEBRASKA AT OMAHA Kayser Hall 208, 6001 Dodge Street, Omaha, NE 68182 Table of Contents Executive Summary 3 Introduction 5 Figure 1 5 History 6 Product Offerings 6 Figure 2 7 Management Changes 8 Acquisitions, Partnerships & Physical Expansion 9 Problem Statement 11 Figure 3 11 Internal Analysis 12 Figure 4 12 Figure 5 13 External Analysis 13 PESTEL 14 Porter’s Five Forces 17 Figure 6 17 Recommendation 18 Figure 7 19 Recommendation Implementation 21 Conclusion 22 References 23 2 Executive Summary Strategy is important for every industry, and to succeed in such a competitive industry as the technology industry, it becomes imperative. As the following describes in great detail, Micron Technology, Inc. (Micron) is one of the companies in the technology industry that must have a strategic plan such as this. The first step to developing this plan for Micron was to analyze the strategy that Micron has employed so far through a detailed description of their previous developments. -

Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon)

F INANCIAL S TATEMENTS, M ANAGEMENT’ S D ISCUSSION AND A NALYSIS AND S UPPLEMENTAL S CHEDULES Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon) Division of Investment Department of the Treasury State of New Jersey Pension Fund Financial Statements June 30, 2009 and 2008 Contents Independent Auditors’ Report ..........................................................................................................1 Management’s Discussion and Analysis .........................................................................................3 Basic Financial Statements: Statements of Net Assets .................................................................................................................7 Statements of Changes in Net Assets...............................................................................................8 Notes to Financial Statements ..........................................................................................................9 Supplemental Schedules: Schedule 1 – Combining Schedule of Net Assets ..........................................................................31 Schedule 2 – Combining Schedule of Changes in Net Assets .......................................................32 Schedule 3 – Portfolio of Investments – Common Fund A ...........................................................33 Schedule 4 – Portfolio of Investments – Common Fund B ...........................................................57 -

Micron Technology Inc

MICRON TECHNOLOGY INC FORM 10-K (Annual Report) Filed 10/26/10 for the Period Ending 09/02/10 Address 8000 S FEDERAL WAY PO BOX 6 BOISE, ID 83716-9632 Telephone 2083684000 CIK 0000723125 Symbol MU SIC Code 3674 - Semiconductors and Related Devices Industry Semiconductors Sector Technology Fiscal Year 03/10 http://www.edgar-online.com © Copyright 2010, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 2, 2010 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-10658 Micron Technology, Inc. (Exact name of registrant as specified in its charter) Delaware 75 -1618004 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 8000 S. Federal Way, Boise, Idaho 83716 -9632 (Address of principal executive offices) (Zip Code) Registrant ’s telephone number, including area code (208) 368 -4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $.10 per share NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Delaware, 1:11-Cv-00770

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE HSM PORTFOLIO LLC AND § TECHNOLOGY PROPERTIES § LIMITED LLC, § § Plaintiffs, § § v. § C.A. No. 1:11-cv-00770-RGA § FUJITSU LIMITED, § JURY TRIAL DEMANDED FUJITSU AMERICA, INC., § FUJITSU SEMICONDUCTOR § AMERICA, INC., § § ADVANCED MICRO DEVICES, INC., § § QUALCOMM INCORPORATED, § § ELPIDA MEMORY, INC., § ELPIDA MEMORY (USA) INC., § § SK HYNIX INC., § SK HYNIX AMERICA INC., § HYNIX SEMICONDUCTOR § MANUFACTURING AMERICA INC., § § MICRON TECHNOLOGY, INC., § § PROMOS TECHNOLOGIES INC., § § SANDISK CORPORATION, § § SONY CORPORATION, § SONY CORPORATION OF AMERICA, § SONY ELECTRONICS INC., § SONY COMPUTER § ENTERTAINMENT INC., § SONY COMPUTER § ENTERTAINMENT AMERICA LLC, § § STMICROELECTRONICS N.V., § STMICROELECTRONICS, INC., § § PAGE 1 TOSHIBA CORPORATION, § TOSHIBA AMERICA, INC., § TOSHIBA AMERICA ELECTRONIC § COMPONENTS, INC., § § ON SEMICONDUCTOR § CORPORATION, § § ZORAN CORPORATION, § § Defendants. § PLAINTIFFS’ THIRD AMENDED COMPLAINT Plaintiffs HSM Portfolio LLC and Technology Properties Limited LLC (collectively “Plaintiffs”) by and through their undersigned counsel, file this Third Amended Complaint against Defendants Fujitsu Limited, Fujitsu America, Inc., Fujitsu Semiconductor America, Inc. (collectively “Fujitsu”), Advanced Micro Devices, Inc. (“AMD”), Qualcomm Incorporated (“Qualcomm”), Elpida Memory, Inc., Elpida Memory (USA) Inc. (collectively “Elpida”),1 SK Hynix Inc., SK Hynix America Inc., Hynix Semiconductor Manufacturing America Inc. (collectively “SK Hynix”), -

2008 International Symposium on Semiconductor Manufacturing

2008 International Symposium on Semiconductor Manufacturing (ISSM 2008) Tokyo, Japan 27 – 29 October 2008 IEEE Catalog Number: CFP08SSM-PRT ISBN: 978-1-61284-948-5 ISSM 2008 Program Schedule The 1st day (Monday, October 27) Tutorial Session Room: Century A/B 9:30 Tutorial Session AEC/APC Introduction of AEC/APC's history Mr. Toshihiko Osada, Senior Manager, Fujitsu Microelectronics Limited Manufacturing engineering and AEC/APC Mr. Kensuke Uriga, CEO/President, Dura Systems Corporation Application of control theory for AEC/APC in semiconductor fabrication Mr. Hiroshi Shimizu, Director/Advanced Solution Department, Advance Automation Company, Yamatake Corporation 9:00 Tutorial Session ESH SUSTAINABILITY AND ESH ASPECTS OF ADVANCED SEMICONDUCTOR MANUFACTURING Prof. Farhang Shadman, Regents Professor of Chemical and Environmental Engineering, the University of Arizona Opening Remarks Room: Century 13:00 Keynote Speech Session Room: Century 13:20 Challenges in The DRAM Business Mr.Yukio Sakamoto, President&CEO, Elpida Memory,Inc. 14:10 The New Dynamics of Semiconductor Industry Dr. Tien Wu, Chief Operating Officer, Board of Directors, Advanced Semiconductor Engineering Inc.(ASE) 15:00 Break Oral Session Room: Century A Highlight Session <Advanced Lithography Session> 15:10 PE-O-097 Phenomenology of ArF Photoresist Shrinkage Trends ..........................................................3 Benjamin Bunday, ISMI 15:30 PE-O-044 Lithography Hotspot Discovery at 70nm DRAM 300mm Fab : Process Window Qualification Using Design Based Binning...............................................................................7