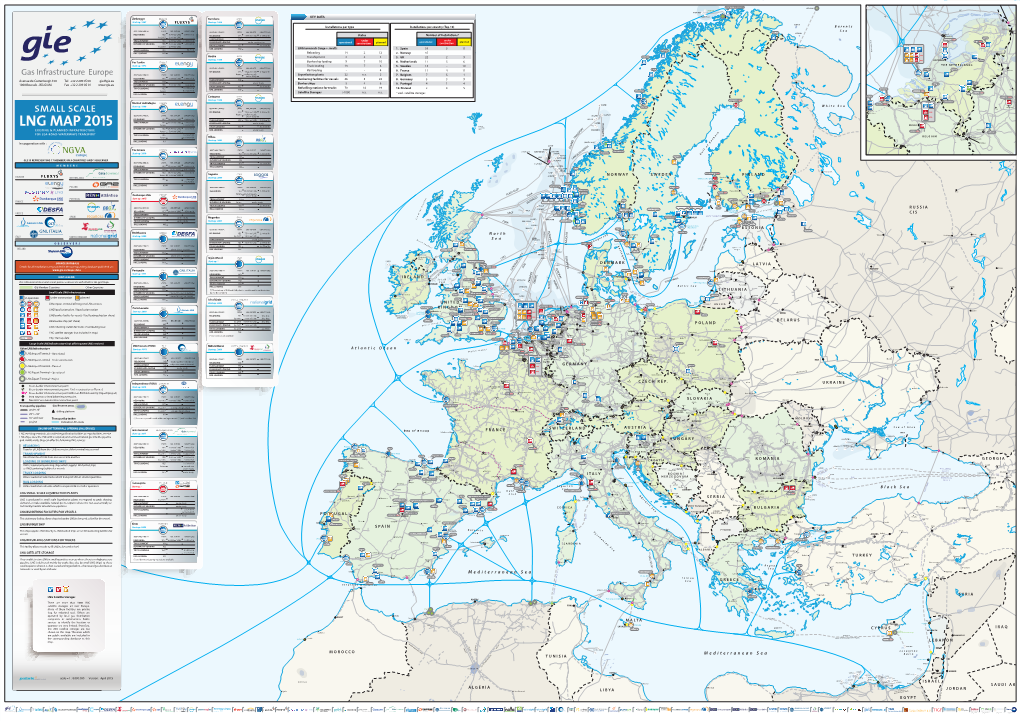

Lng Map 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Northern Sea Route Cargo Flows and Infrastructure- Present State And

Northern Sea Route Cargo Flows and Infrastructure – Present State and Future Potential By Claes Lykke Ragner FNI Report 13/2000 FRIDTJOF NANSENS INSTITUTT THE FRIDTJOF NANSEN INSTITUTE Tittel/Title Sider/Pages Northern Sea Route Cargo Flows and Infrastructure – Present 124 State and Future Potential Publikasjonstype/Publication Type Nummer/Number FNI Report 13/2000 Forfatter(e)/Author(s) ISBN Claes Lykke Ragner 82-7613-400-9 Program/Programme ISSN 0801-2431 Prosjekt/Project Sammendrag/Abstract The report assesses the Northern Sea Route’s commercial potential and economic importance, both as a transit route between Europe and Asia, and as an export route for oil, gas and other natural resources in the Russian Arctic. First, it conducts a survey of past and present Northern Sea Route (NSR) cargo flows. Then follow discussions of the route’s commercial potential as a transit route, as well as of its economic importance and relevance for each of the Russian Arctic regions. These discussions are summarized by estimates of what types and volumes of NSR cargoes that can realistically be expected in the period 2000-2015. This is then followed by a survey of the status quo of the NSR infrastructure (above all the ice-breakers, ice-class cargo vessels and ports), with estimates of its future capacity. Based on the estimated future NSR cargo potential, future NSR infrastructure requirements are calculated and compared with the estimated capacity in order to identify the main, future infrastructure bottlenecks for NSR operations. The information presented in the report is mainly compiled from data and research results that were published through the International Northern Sea Route Programme (INSROP) 1993-99, but considerable updates have been made using recent information, statistics and analyses from various sources. -

Indictment Presented to the International Military Tribunal (Nuremberg, 18 October 1945)

Indictment presented to the International Military Tribunal (Nuremberg, 18 October 1945) Caption: On 18 October 1945, the International Military Tribunal in Nuremberg accuses 24 German political, military and economic leaders of conspiracy, crimes against peace, war crimes and crimes against humanity. Source: Indictment presented to the International Military Tribunal sitting at Berlin on 18th October 1945. London: Her Majesty's Stationery Office, November 1945. 50 p. (Cmd. 6696). p. 2-50. Copyright: Crown copyright is reproduced with the permission of the Controller of Her Majesty's Stationery Office and the Queen's Printer for Scotland URL: http://www.cvce.eu/obj/indictment_presented_to_the_international_military_tribunal_nuremberg_18_october_1945-en- 6b56300d-27a5-4550-8b07-f71e303ba2b1.html Last updated: 03/07/2015 1 / 46 03/07/2015 Indictment presented to the International Military Tribunal (Nuremberg, 18 October 1945) INTERNATIONAL MILITARY TRIBUNAL THE UNITED STATES OF AMERICA, THE FRENCH REPUBLIC, THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND, AND THE UNION OF SOVIET SOCIALIST REPUBLICS — AGAINST — HERMANN WILHELM GÖRING, RUDOLF HESS, JOACHIM VON RIBBENTROP, ROBERT LEY, WILHELM KEITEL, ERNST KALTEN BRUNNER, ALFRED ROSENBERG, HANS FRANK, WILHELM FRICK, JULIUS STREICHER, WALTER FUNK, HJALMAR SCHACHT, GUSTAV KRUPP VON BOHLEN UND HALBACH, KARL DÖNITZ, ERICH RAEDER, BALDUR VON SCHIRACH, FRITZ SAUCKEL, ALFRED JODL, MARTIN BORMANN, FRANZ VON PAPEN, ARTUR SEYSS INQUART, ALBERT SPEER, CONSTANTIN VON NEURATH, AND HANS FRITZSCHE, -

Comparative Analysis of the Historical Circumstances Surrounding the Emergence and Activities of the Czechoslovak, Slovenian and Croatian Orel/Orao Movements

UDK: 796:061.1(497.5)‘‘18/19‘‘ 929 Merz, I. Izvorni znanstveni članak Received: June 21, 2013 Accepted: October 10, 2013 COMPARATIVE ANALYSIS OF THE HISTORICAL CIRCUMSTANCES SURROUNDING THE EMERGENCE AND ACTIVITIES OF THE CZECHOSLOVAK, SLOVENIAN AND CROATIAN OREL/ORAO MOVEMENTS Saša CERAJ* Th e beginnings of the Orel movement can be found in the Czech lands and Slovakia at the end of the nineteenth and early twentieth centuries, where it was a response to liberal trends and the Sokol organization, but also a move- ment founded in the Slav/cultural discourse which aspired to Orel mutual- ism, cultural unity and equal status as creators of European thought and socio-cultural renewal. Th e Orel movement came via Slovenia to Croatia, where the unifi ed orientation of the Croatian Orao movement was deter- mined by Ivan Merz through the introduction of the a specifi c course for the Croatian Orao movement, particularly apparent in the guidelines set forth in the encyclical Ubi Arcano Dei: political neutrality, a new approach to physical culture and comprehensive personal growth. Th is article ana- lyzes the activity of the Orel/Orao movement in Czechoslovakia, Slovenia and Croatia and ascertains the specifi c aspects of the Croatian Orao Fed- eration, summarizing them under the term Croatian Orao specifi cum. Key words: Czechoslovak Orel movement, Slovenian Orel movement, Croatian Orao movement, Croatian Orao Federation, Croatian Orao spe- cifi cum. ∗ Saša Ceraj, Ph.D., Croatian Olympic Academy, Zagreb, Croatia. 77 S. CERAJ, Comparative Analysis of the Historical Circumstances Surrounding the Emergence and Activities Introduction Th e beginnings of the Orel/Orao (‘eagle’) movement can be found in the Czech at the end of the nineteenth and very early twentieth centuries, where it constituted something of a response to the appearance and infl uence of liberal trends and the Sokol organization, and it began to spread to Slovenia, whence it also made its way to Croatia, where, under the infl uence of Dr. -

Joint Barents Transport Plan Proposals for Development of Transport Corridors for Further Studies

Joint Barents Transport Plan Proposals for development of transport corridors for further studies September 2013 Front page photos: Kjetil Iversen, Rune N. Larsen and Sindre Skrede/NRK Table of Contents Table Summary 7 1 Introduction 12 1.1 Background 12 1.2 Objectives and members of the Expert Group 13 1.3 Mandate and tasks 14 1.4 Scope 14 1.5 Methodology 2 Transport objectives 15 2.1 National objectives 15 2.2 Expert Group’s objective 16 3 Key studies, work and projects of strategic importance 17 3.1 Multilateral agreements and forums for cooperation 17 3.2 Multilateral projects 18 3.4 National plans and studies 21 4 Barents Region – demography, climate and main industries 23 4.1 Area and population 23 4.2 Climate and environment 24 4.3 Overview of resources and key industries 25 4.4 Ores and minerals 25 4.5 Metal industry 27 4.6 Seafood industry 28 4.7 Forest industry 30 4.8 Petroleum industry 32 4.9 Tourism industry 35 4.10 Overall transport flows 37 4.11 Transport hubs 38 5 Main border-crossing corridors in the Barents Region 40 5.1 Corridor: “The Bothnian Corridor”: Oulu – Haparanda/Tornio - Umeå 44 5.2 Corridor: Luleå – Narvik 49 5.3 Corridor: Vorkuta – Syktyvkar – Kotlas – Arkhangelsk - Vartius – Oulu 54 5.4 Corridor: “The Northern Maritime Corridor”: Arkhangelsk – Murmansk – The European Cont. 57 5.5 Corridor: “The Motorway of the Baltic Sea”: Luleå/Kemi/Oulu – The European Continent 65 5.6 Corridor: Petrozavodsk – Murmansk – Kirkenes 68 5.7 Corridor: Kemi – Salla – Kandalaksha 72 5.8 Corridor: Kemi – Rovaniemi – Kirkenes 76 -

MARITIME ACTIVITY in the HIGH NORTH – CURRENT and ESTIMATED LEVEL up to 2025 MARPART Project Report 1

MARITIME ACTIVITY IN THE HIGH NORTH – CURRENT AND ESTIMATED LEVEL UP TO 2025 MARPART Project Report 1 Authors: Odd Jarl Borch, Natalia Andreassen, Nataly Marchenko, Valur Ingimundarson, Halla Gunnarsdóttir, Iurii Iudin, Sergey Petrov, Uffe Jacobsen and Birita í Dali List of authors Odd Jarl Borch Project Leader, Nord University, Norway Natalia Andreassen Nord University, Norway Nataly Marchenko The University Centre in Svalbard, Norway Valur Ingimundarson University of Iceland Halla Gunnarsdóttir University of Iceland Iurii Iudin Murmansk State Technical University, Russia Sergey Petrov Murmansk State Technical University, Russia Uffe Jakobsen University of Copenhagen, Denmark Birita í Dali University of Greenland 1 Partners MARPART Work Package 1 “Maritime Activity and Risk” 2 THE MARPART RESEARCH CONSORTIUM The management, organization and governance of cross-border collaboration within maritime safety and security operations in the High North The key purpose of this research consortium is to assess the risk of the increased maritime activity in the High North and the challenges this increase may represent for the preparedness institutions in this region. We focus on cross-institutional and cross-country partnerships between preparedness institutions and companies. We elaborate on the operational crisis management of joint emergency operations including several parts of the preparedness system and resources from several countries. The project goals are: • To increase understanding of the future demands for preparedness systems in the High North including both search and rescue, oil spill recovery, fire fighting and salvage, as well as capacities fighting terror or other forms of destructive action. • To study partnerships and coordination challenges related to cross-border, multi-task emergency cooperation • To contribute with organizational tools for crisis management Project characteristics: Financial support: -Norwegian Ministry of Foreign Affairs, -the Nordland county Administration -University partners. -

Argus Nefte Transport

Argus Nefte Transport Oil transportation logistics in the former Soviet Union Volume XVI, 5, May 2017 Primorsk loads first 100,000t diesel cargo Russia’s main outlet for 10ppm diesel exports, the Baltic port of Primorsk, shipped a 100,000t cargo for the first time this month. The diesel was loaded on 4 May on the 113,300t Dong-A Thetis, owned by the South Korean shipping company Dong-A Tanker. The 100,000t cargo of Rosneft product was sold to trading company Vitol for delivery to the Amsterdam-Rotter- dam-Antwerp region, a market participant says. The Dong-A Thetis was loaded at Russian pipeline crude exports berth 3 or 4 — which can handle crude and diesel following a recent upgrade, and mn b/d can accommodate 90,000-150,000t vessels with 15.5m draught. 6.0 Transit crude Russian crude It remains unclear whether larger loadings at Primorsk will become a regular 5.0 occurrence. “Smaller 50,000-60,000t cargoes are more popular and the terminal 4.0 does not always have the opportunity to stockpile larger quantities of diesel for 3.0 export,” a source familiar with operations at the outlet says. But the loading is significant considering the planned 10mn t/yr capacity 2.0 addition to the 15mn t/yr Sever diesel pipeline by 2018. Expansion to 25mn t/yr 1.0 will enable Transneft to divert more diesel to its pipeline system from ports in 0.0 Apr Jul Oct Jan Apr the Baltic states, in particular from the pipeline to the Latvian port of Ventspils. -

Years of Sustainable Development

Years of Sustainable 20 Development NOVATEK Sustainability Report for 2014 CONTENTS Letter from the Chief Executive Officer 3 Preserving Cultural Heritage 52 Sports 52 Report and Reporting Process 6 Volunteering 53 NOVATEK`s Social Reporting Development 6 NOVATEK-Veteran Program 53 Principles for Defining Report Content 6 Report Boundary 8 Employment Practices 55 NOVATEK Group’s Structure Changes 8 Personnel 55 Corporate Technical Competency Assessment System 58 Company Profile 10 Personnel Training and Development 58 The Company’s Scope and Key Lines of Business 10 Trade Union Relations 59 Geography 10 Social Policy 59 The Company’s Structure as at 31 December 2014 13 Our Business Model 14 Procurement Practices 64 Share Capital 15 Key Approaches 64 Membership in Trade Associations 16 Supply Chain Management 64 Awards 16 Import Substitution Policy 64 Key Performance Indicators 16 Occupational Health and Safety 66 Sustainability Strategy 18 Occupational Health and Safety Goals and Objectives 66 Special Assessment of Working Conditions 66 Stakeholder Engagement 21 Operational Control 66 Basics of Stakeholder Engagement 21 Fire Safety 68 Stakeholder Engagement Matrix 23 Accidents and Incidents 68 Corporate Governance 29 Contractor Engagement 68 Corporate Governance Principles 29 Workplace Injury Rate 68 Corporate Governance Structure 29 OHS Training 68 BoD and Management Board Remuneration Packages 34 Environmental Protection 70 Internal Control and Audit 35 Environmental Vision 70 Risk Management 36 Environmental Monitoring and Industrial -

Russia and the Arctic: the New Great Game 1 Dr Mark a Smith

Advanced Research and Assessment Group Russi an Series 07/26 Defence Academy of the United Kingdom The Last Dash North Dr Mark A Smith & Keir Giles Contents Russia and the Arctic: The New Great Game 1 Dr Mark A Smith Looking North 10 Keir Giles Key Points * The belief that the North Pole region could contain large quantities of oil and gas is one of the major forces driving Russian policy. The North Pole expedition of July-August 2007 is laying the ground for submitting a claim to the UN Commission on the Limits of the Continental Shelf that the Lomonosov Ridge belongs to Russia. * Russia’s claims will be challenged by Canada, the USA and Denmark. The Arctic region is likely to become a region of geopolitical competition later in the 21st century as the ice cap melts. * There is a widespread view in Russia that its claim to Arctic territory is not speculative, but rightful compensation for territorial losses in Europe. * Any foreign interest in the area, government, commercial or environmental, is seen as hostile intent. * Armed action by NATO to contest Russia’s Arctic claims is discussed as a serious possibility. * Reports of the death of the Russian North are greatly exaggerated, as they take no account of commercial rebirth based on the oil industry. * Russia has a well-developed commercial and transport infrastructure to take advantage of opportunities offered by the retreating icecap, in contrast to other littoral states. * Naval re-armament and increased military activity mean the same applies to capacity for military action. This map has been supplied courtesy of the University of Texas Libraries, The Univeristy of Texas at Austin. -

The European Natural Gas Network

SHTOKMAN SNØHVIT Pechora Sea ASKELADD MELKØYA TRADING POINTS / MARKET AREAS KEYS ALBATROSS Hammerfest Salekhard (DK) (IE) Nr Location System Operators : logos Barents 400 NPTF 407 IBP 01 Trading Points / Market Areas KILDIN N (CH-IT) Sea (DK) (FR-N) 027 Griespass (CH) / Passo Gries (IT) 401 GTF (Bilateral Trading Point) 408 PEG NORD Cross-border interconnection point Cross-border Europe 001 1A 1A within Europe Under construction or Planned MURMAN (NL) (IT) FluxSwiss Snam Rete Gas Y B 11,349 11,349 402 TTF 411 PSV 634,7 001 Cross-border interconnection point Cross-border third country import/export Swissgas Snam Rete Gas N B 11,349 11,349 with third country (import/export) Under construction or Planned (DE) (ES) Min Max Pomorskiy 403 VHP GASPOOL 412 PVB System Operators Capacity Flow GCV 001 LNG Terminals’ entry point LNG Import Terminal 1C Strait (HU) intro transmission system Under construction or Planned Murmansk 413 MGP Capacity 622,6 Max. technical physical capacity in GWh/d LNG Export Terminal 1C LNG Export Terminal (AT ) Under construction or Planned Where dierent Maximum Technical Capacities are dened by the neighbouring 414 CEGH TSOs for the same Interconnection Point, the lesserREYKJAVIK rule is applied. Small scale LNG liquefaction plant Small scale LNG liquefaction plant If capacity information is available only on one side of the border (BE) 415 ZTP (Zeebrugge Trading Point H-Zone) Under construction or Planned due to condentiality reasons, the available gure is selected for publication. Interconnections shown on map only -

Development of the Russian Sea Port Infrastructure. Automotive Logistics

Development of the Russian Sea Port Infrastructure. Automotive Logistics. Container Logistics in Russia. ɝ. ɋɚɧɤɬ-ɉɟɬɟɪɛɭɪɝ, ɭɥ. ɉɨɥɢɬɟɯɧɢɱɟɫɤɚɹ, ɞ. 29 Ɍɟɥɟɮɨɧ: (812) 333-13-10, Ɏɚɤɫ: (812) 333-13-11 e-mail: [email protected] www.morproekt.ru 1 Morstroytechnology, LLC (MST for short) Our engineering background contributes to the approach to logistic analysis. We focus on: Pre-Design Research: Feasibility Study, Business Planning, Development Concepts etc. ; Engineering and Design: • universal and dedicated port terminals (general cargo, container, dry bulk, liquid bulk etc.); • logistic centers and related infrastructure; • optimization of hydraulic constructions Supervision; General Design; Consulting and Engineering; Berths and Buildings Survey; Engineering Survey; Marketing Research, traffic forecasting; Logistic Strategy; Logistic Optimization; Feasibility Study http://www.morproekt.ru/ 2 Plan Changes in Logistic and Infrastructure. Transformation of the Soviet Transport System «Renaissance» of Port Construction in 1990-2000. Growth Factors Review of Cargo Flows. Modal Split Russian Transport System Geography Baltic Sea. Throughput of the Baltic Sea Ports Main Development Projects in the Inner Harbors of St. Petersburg St. Petersburg Outer Ports Development Projects Ports Ust-Luga, Vysotsk, Kaliningrad Russian Transport System Geography – Arctic. Throughput of the Arctic Ports Murmansk Transport Node. Development of SCP Murmansk, Lavna, Sabetta Terminal at Cape Kamenniy – Branch of Sabetta Port Black and Azov Seas. Ports’ Throughput Ports Taman, Novorossiysk Caspian Sea. Ports’ Throughput Far Eastern Ports. Ports’ Throughput Coal terminals at the Far East – Vostochny, Vanino, others Oil and oil products terminals on the Far East of Russia Disproportion of Sea Port and Railway Infrastructure Russian Automotive Logistics Market Russian Container Market http://www.morproekt.ru/ 3 Long-period Changes in Logistic and Infrastructure. -

Toward the Great Ocean—2, Or Russia's Breakthrough to Asia

Moscow, February 2014 valdaiclub.com Toward the Great Ocean—2, or Russia’s Breakthrough to Asia Valdai Discussion Club Report Toward the Great Ocean—2, or Russia’s Breakthrough to Asia Valdai Discussion Club Report Moscow, February 2014 valdaiclub.com Executive Editor and Head Authors of the Authors’ Group Igor Makarov Sergei Karaganov principal author, lecturer at the Department of Dean of the Faculty of World Economy World Economy, National Research University and International Affairs at the National Higher School of Economics; Research University — Higher School of Ph.D. in Economics Economics; Honorary Chairman of the Presidium of the Council on Foreign and Oleg Barabanov Defense Policy (CFDP); D.Sc. in History Head of the Department of Policy and Functioning of the European Union and the European Council, Moscow State Institute of International Relations; professor at the Project scientific supervisors Department of International Affairs, National Research University — Higher School of Sergei Karaganov Economics; D.Sc. in Political Science Dean of the Faculty of World Economy and International Affairs at the National Timofei Bordachev Research University — Higher School of Director of the Center for Comprehensive Economics; Honorary Chairman of the European and International Studies, National Presidium of the Council on Foreign and Research University — Higher School of Defense Policy (CFDP); D.Sc. in History Economics; Ph.D. in Political Science Victor Larin Evgeny Kanaev Director of the Institute of History, professor at the Department of International Archaeology and Ethnography of the Affairs, National Research University — Higher Peoples of the Far East, Far Eastern School of Economics; D.Sc. in History Branch of the Russian Academy of Sciences; D.Sc. -

DEVELOPMENT of MARINE RUSSIAN-NORWEGIAN TRADE FACILITIES in NORTHERN NORWAY Prefeasibility Study

DEVELOPMENT OF MARINE RUSSIAN-NORWEGIAN TRADE FACILITIES IN NORTHERN NORWAY Prefeasibility study Akvaplan-niva AS Report: 4673-01 This page is intentionally left blank Cover page photo: Yenisey – newly built ice-class tanker of Norilsk Nickel in Murmansk port on her way to Dudinka, October 2011. Photo by Bjørn Franzen, Bioforsk Svanhovd. Akvaplan-niva AS Rådgivning og forskning innen miljø og akvakultur Org.nr: NO 937 375 158 MVA Framsenteret, 9296 Tromsø, Norge Tlf: +47 7775 0300, Fax: +47 7775 0301 www.akvaplan.niva.no Report title Development of marine Russian-Norwegian trade facilities in Northern Norway. Prefeasibility study Author(s) Akvaplan-niva report number Alexei Bambulyak, Akvaplan-niva 4673-01 Rune Rautio, Akvaplan-niva Mikhail Grigoriev, Gecon Date 07.03.2012 No. of pages 48 Distribution open Client Client’s reference Norwegian Barents Secretariat Rune Rafaelsen Maritimt Forum Nord SA Tor Husjord Summary This report presents the results of the preliminary evaluations of feasibilities and a potential for development of trade and transport communication between Russia and Norway with focus on possibilities and needs for increased marine infrastructure and harbors in the Northern Norway for transshipment of oil, coal and metals for international markets, and establishment of a hub for trading the goods internationally. This project discusses different aspects of establishing trade port facilities in the Northern Norway which may be of interest and benefit for all stakeholders – Russian, Norwegian and international businesses. Project manager Quality controller __________________________ __________________________ Alexei Bambulyak Salve Dahle © 2012 Akvaplan-niva AS & Clients. This report may only be copied as a whole. Copying of part of this report (sections of text, illustrations, tables, conclusions, etc.) and/or reproduction in other ways, is only permitted with written consent from Akvaplan-niva AS and Clients.