Italy a Mutual Guarantee Scheme: Artigianfidi Ferrara

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table of Contents

Table of contents Proposed name of the Biosphere Reserve ........................................................................................... 3 Country ................................................................................................................................................. 3 Fulfilment of the three functions of biosphere reserves ..................................................................... 3 Criteria for designation as a Biosphere Reserve .................................................................................. 6 Endorsements .................................................................................................................................... 21 Location (coordinates and maps) ....................................................................................................... 21 Area .................................................................................................................................................... 22 Biogeographical region ...................................................................................................................... 24 Land use history ................................................................................................................................. 25 Human population of proposed Biosphere Reserve .......................................................................... 28 Physical characteristics ...................................................................................................................... -

ROAD BOOK from Venice to Ferrara

FROM VENICE TO FERRARA 216.550 km (196.780 from Chioggia) Distance Plan Description 3 2 Distance Plan Description 3 3 3 Depart: Chioggia, terminus of vaporetto no. 11 4.870 Go back onto the road and carry on along 40.690 Continue straight on along Via Moceniga. Arrive: Ferrara, Piazza Savonarola Via Padre Emilio Venturini. Leave Chioggia (5.06 km). Cycle path or dual use Pedestrianised Road with Road open cycle/pedestrian path zone limited traffic to all traffic 5.120 TAKE CARE! Turn left onto the main road, 41.970 Turn left onto the overpass until it joins Gravel or dirt-track Gravel or dirt-track Gravel or dirt-track Gravel or dirt-track the SS 309 Romea. the SS 309 Romea highway in the direction of Ravenna. Information Ferry Stop Sign 5.430 Cross the bridge over the river Brenta 44.150 Take the right turn onto the SP 64 major Gate or other barrier Moorings Give way and turn left onto Via Lungo Brenta, road towards Porto Levante, over the following the signs for Ca' Lino. overpass across the 'Romea', the SS 309. Rest area, food Diversion Hazard Drinking fountain Railway Station Traffic lights 6.250 Carry on, keeping to the right, along 44.870 Continue right on Via G. Galilei (SP 64) Via San Giuseppe, following the signs for towards Porto Levante. Ca' Lino (begins at 8.130 km mark). Distance Plan Description 1 0.000 Depart: Chioggia, terminus 8.750 Turn right onto Strada Margherita. 46.270 Go straight on along Via G. Galilei (SP 64) of vaporetto no. -

The Waterway of Ferrara in the European Core Network

THE WATERWAY OF FERRARA IN THE EUROPEAN CORE NETWORK Waterways to connect Europe In October 2011, the European THEIL SISTEMAWATERWAY Commission submitted an OF FERRARA amendment proposal for the IDROVIARIO regulations governing the trans- PROJECT AS PART European transport networks PADANO-VENETOOF THE EUROPEAN (TEN-T) to the European Parliament and Council. CORE NETWORK The proposal entailed two distinct parts: Guidelines for the development of the Trans- European Transport Network and Connecting Europe Facility. In December 2013 both proposals were approved and published in the Official Journal of the European Union. The program is being developed on two levels, with the goal of improving the planning of new TEN-T networks: • A global, Comprehensive network to be completed by 2050 and intend- ed to supply the central network via regional and national connections. • A central, Core network composed of 9 corridors, to be completed and operational by 2030. It will serve the most important connections and hubs within the TEN-T network: capitals, large urban hubs, the main harbours and airports. It will be at the heart of the TEN-T network, as it will contain the areas of the global network with the highest strategic value. These are key elements paramount to achieving the general goals of the project, as well as added-value goals for the EU, such as establishing missing transborder connections, multimodal nodes, and eliminating the main bottlenecks. Within the current revision of the TEN-T network, the entire “Padano-Veneto waterway system” is part of the “Core network”. All funding is provided for studies or con- struction work contributing to the project’s global objectives. -

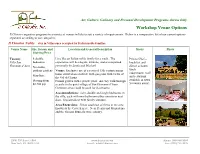

Comparative Venue Sheet

Art, Culture, Culinary and Personal Development Programs Across Italy Workshop Venue Options Il Chiostro organizes programs in a variety of venues in Italy to suit a variety of requirements. Below is a comparative list of our current options separated according to our categories: Il Chiostro Nobile – stay in Villas once occupied by Italian noble families Venue Name Size, Season and Location and General Description Meals Photo Starting Price Tuscany 8 double Live like an Italian noble family for a week. The Private Chef – Villa San bedrooms experience will be elegant, intimate, and accompanied breakfast and Giovanni d’Asso No studio, personally by Linda and Michael. dinner at home; outdoor gardens Venue: Exclusive use of a restored 13th century manor lunch house situated on a hillside with gorgeous with views of independent (café May/June and restaurant the Val di Chiana. Starting from Formal garden with a private pool. An easy walk through available in town $2,700 p/p a castle to the quiet village of San Giovanni d’Asso. 5 minutes away) Common areas could be used for classrooms. Accommodations: twin, double and single bedrooms in the villa, each with own bathroom either ensuite or next door. Elegant décor with family antiques. Area/Excursions: 30 km southeast of Siena in the area known as the Crete Senese. Near Pienza and Montalcino and the famous Brunello wine country. 23 W. 73rd Street, #306 www.ilchiostro.com Phone: 800-990-3506 New York, NY 10023 USA E-mail: [email protected] Fax: (858) 712-3329 Tuscany - 13 double Il Chiostro’s Autumn Arts Festival is a 10-day celebration Abundant Autumn Arts rooms, 3 suites of the arts and the Tuscan harvest. -

The North-South Divide in Italy: Reality Or Perception?

CORE Metadata, citation and similar papers at core.ac.uk EUROPEAN SPATIAL RESEARCH AND POLICY Volume 25 2018 Number 1 http://dx.doi.org/10.18778/1231-1952.25.1.03 Dario MUSOLINO∗ THE NORTH-SOUTH DIVIDE IN ITALY: REALITY OR PERCEPTION? Abstract. Although the literature about the objective socio-economic characteristics of the Italian North- South divide is wide and exhaustive, the question of how it is perceived is much less investigated and studied. Moreover, the consistency between the reality and the perception of the North-South divide is completely unexplored. The paper presents and discusses some relevant analyses on this issue, using the findings of a research study on the stated locational preferences of entrepreneurs in Italy. Its ultimate aim, therefore, is to suggest a new approach to the analysis of the macro-regional development gaps. What emerges from these analyses is that the perception of the North-South divide is not consistent with its objective economic characteristics. One of these inconsistencies concerns the width of the ‘per- ception gap’, which is bigger than the ‘reality gap’. Another inconsistency concerns how entrepreneurs perceive in their mental maps regions and provinces in Northern and Southern Italy. The impression is that Italian entrepreneurs have a stereotyped, much too negative, image of Southern Italy, almost a ‘wall in the head’, as also can be observed in the German case (with respect to the East-West divide). Keywords: North-South divide, stated locational preferences, perception, image. 1. INTRODUCTION The North-South divide1 is probably the most known and most persistent charac- teristic of the Italian economic geography. -

Ferrara, in the Basilica of Saint Mary in Vado, Bull of Eugene IV (1442) on Easter Sunday, March 28, 1171

EuFERRARcharistic MiraAcle of ITALY, 1171 This Eucharistic miracle took place in Ferrara, in the Basilica of Saint Mary in Vado, Bull of Eugene IV (1442) on Easter Sunday, March 28, 1171. While celebrating Easter Mass, Father Pietro John Paul II pauses before the ceiling vault in Ferrara da Verona, the prior of the basilica, reached the moment of breaking the consecrated Church of Saint Mary in Vado, Ferrara Host when he saw blood gush from it and stain the ceiling Interior of the basilica vault above the altar with droplets. In 1595 the vault was enclosed within a small Bodini, The Miracle of the Blood. Painting on the ceiling shrine and is still visible today near the shrine in the monumental Basilica of Santa Maria in Vado. Detail of the ceiling vault stained with Blood Shrine that encloses the Holy Ceiling Vault (1594). The ceiling vault stained with Blood Right side of the cross n March 28, 1171, the prior of the Canons was rebuilt and expanded on the orders of Duke Miraculous Blood.” Even today, on the 28th day Regular Portuensi, Father Pietro da Verona, Ercole d’Este beginning in 1495. of every month in the basilica, which is currently was celebrating Easter Mass with three under the care of Saint Gaspare del Bufalo’s confreres (Bono, Leonardo and Aimone). At the regarding Missionaries of the Most Precious Blood, moment of the breaking of the consecrated Host, thisThere miracle. are Among many the mostsources important is the Eucharistic Adoration is celebrated in memory of It sprung forth a gush of Blood that threw large Bull of Pope Eugene IV (March 30, 1442), the miracle. -

Emilia-Romagna & San Marino

© Lonely Planet 425 Emilia-Romagna & San Marino Emilia-Romagna has long been overlooked as little more than a stepping stone between the Veneto and Tuscany. But take time to explore this underrated region and you’ll discover an area rich in art and culture, an area of mouthwatering food and robust wine, of cosmopolitan EMILIA-ROMAGNA & SAN MARINO resorts and quiet backwaters. Much of its medieval architecture dates to the Renaissance, when a handful of power ful families set up court here: the Farnese in Parma and Piacenza, the Este in Ferrara and Modena, and the Bentivoglio in Bologna. The regional capital, Bologna, is one of Italy’s unsung joys. A foodie city with a hedonistic approach to life, it’s home to Europe’s oldest university and a stunning medieval centre. A short hop to the northwest, Modena boasts a superb Romanesque cathedral and a hint of the gourmet delights that await in Parma, the city that gifted the world prosciutto crudo (cured ham, popularly known as Parma ham) and parmigiano reggiano (Parmesan). In the countryside to the south, castles pepper hilltops as flat plains give way to the Apennine peaks. Ferrara and Ravenna are the highlights of Romagna (the eastern half of Emilia-Romagna). Both are within easy distance of Bologna and both merit a visit – Ferrara for its beautiful Renaissance centre, Ravenna for its sensational Byzantine mosaics. If, after all that high culture, you need a break, head to Rimini where the crowded beaches and cutting-edge clubs promise more earthy pleasures, or San Marino where armies of day-trippers enjoy vast views. -

The Ghibelline Globalists of the Techno-Structure: on the Current Destinies of Empire and Church

Afterword The Ghibelline Globalists of the Techno-Structure: On the Current Destinies of Empire and Church For the past fifty years, the definitive establishment of the great Asian-Amer- ican-European federation and its unchallenged domination over scattered leftovers of inassimilable barbarousness, in Oceania or in Central Africa, had accustomed all peoples, presently clustered into provinces, to the bliss of a uni- versal, and thenceforth imperturbable, peace. No fewer than one hundred and fifty years of wars were needed to achieve this marvelous development […]. Contrary to public proclamations, it wasn’t a vast democratic republic that emerged from the aggregation. Such an eruption of pride could not but raise a new throne, the highest, the strongest, the most radiant there ever was. Gabriel Tarde, Fragment d’histoire future (1896)1 ean Stone’s New World Order (NWO) tells the story of a “Deep State,” of an extraneous apparatus within the American Federation. This foreign entity, which acts in inconspicuous ways, i.e., through Sextremely exclusive lodges and clubs, appears to be bent on taking over the wholesome strata of America, her exceptional manpower and resourc- es, and harnessing them to a vast design of centralized, planetary domina- tion. This “extraneous body” is typically an oligarchic mindset of unmis- takable British make. Professedly “democratic” and “Liberal,” this English drive is, in fact, ferociously elitist and exploitative. To date, it represents the most sophisticated conception of imperial management. Technical- ly, it uses finance and commerce as its consuetudinary instruments of rent- and resource-extraction; politically, it keeps public opinion “in flux” by playing (i.e., scripting) both sides of the electoral spectrum (Left vs. -

Ferrara Di Ferrara

PROVINCIA COMUNE DI FERRARA DI FERRARA Visit Ferraraand its province United Nations Ferrara, City of Educational, Scientific and the Renaissance Cultural Organization and its Po Delta Parco Urbano G. Bassani Via R. Bacchelli A short history 2 Viale Orlando Furioso Living the city 3 A year of events CIMITERO The bicycle, queen of the roads DELLA CERTOSA Shopping and markets Cuisine Via Arianuova Viale Po Corso Ercole I d’Este ITINERARIES IN TOWN 6 CIMITERO EBRAICO THE MEDIAEVAL Parco Corso Porta Po CENTRE Via Ariosto Massari Piazzale C.so B. Rossetti Via Borso Stazione Via d.Corso Vigne Porta Mare ITINERARIES IN TOWN 20 Viale Cavour THE RENAISSANCE ADDITION Corso Ercole I d’Este Via Garibaldi ITINERARIES IN TOWN 32 RENAISSANCE Corso Giovecca RESIDENCES Piazza AND CHURCHES Trento e Trieste V. Mazzini ITINERARIES IN TOWN 40 Parco Darsena di San Paolo Pareschi WHERE THE RIVER Piazza Travaglio ONCE FLOWED Punta della ITINERARIES IN TOWN 46 Giovecca THE WALLS Via Cammello Po di Volano Via XX Settembre Via Bologna Porta VISIT THE PROVINCE 50 San Pietro Useful information 69 Chiesa di San Giorgio READER’S GUIDE Route indications Along with the Pedestrian Roadsigns sited in the Historic Centre, this booklet will guide the visitor through the most important areas of the The “MUSEO DI QUALITÀ“ city. is recognised by the Regional Emilia-Romagna The five themed routes are identified with different colour schemes. “Istituto per i Beni Artistici Culturali e Naturali” Please, check the opening hours and temporary closings on the The starting point for all these routes is the Tourist Information official Museums and Monuments schedule distributed by Office at the Estense Castle. -

Relation Among Geochemical Elements in Soil and Red Chicory As a Tool for Geographical Origin Identification

EGU21-15266 https://doi.org/10.5194/egusphere-egu21-15266 EGU General Assembly 2021 © Author(s) 2021. This work is distributed under the Creative Commons Attribution 4.0 License. Relation among geochemical elements in soil and red chicory as a tool for geographical origin identification. Elena Marrocchino1, Serena Di Sarcina2, Carlo Ragazzi3, and Carmela Vaccaro1,4 1University of Ferrara, Department of Physics and Earth Science, via Saragat, 1 44121 Ferrara, Italy ([email protected]) 2University of Ferrara, Department of Department of Life Sciences and Biotechnology, via L. Borsari 46 44121, Ferrara, Italy ([email protected]) 3Consorzio Uomini di Massenzatica, via Indipendenza 39/a,44026 Massenzatica (Ferrara), Italy ([email protected]) 4ISAC-CNR Institute of Atmospheric Sciences and Climate of the National Research Council of Italy, Via Piero Gobetti, 101, 40129 Bologna, Italy ([email protected]) The identification of the geographical origin of food products is important for both consumers and producers to ensure quality and avoid label falsifications. Determination and authentication of the geographical origin of food products throughout scientific research have become recently relevant in investigations against frauds for consumer protection. Advances in methods and analytical techniques led to an increase in the application of fingerprinting analysis of foods for identification of geographical origin. Since in organic material the inorganic component is more stable than the organic one, several studies examined -

Borso D'este, Venice, and Pope Paul II

I quaderni del m.æ.s. – XVIII / 2020 «Bon fiol di questo stado» Borso d’Este, Venice, and pope Paul II: explaining success in Renaissance Italian politics Richard M. Tristano Abstract: Despite Giuseppe Pardi’s judgment that Borso d’Este lacked the ability to connect single parts of statecraft into a stable foundation, this study suggests that Borso conducted a coherent and successful foreign policy of peace, heightened prestige, and greater freedom to dispose. As a result, he was an active participant in the Quattrocento state system (Grande Politico Quadro) solidified by the Peace of Lodi (1454), and one of the most successful rulers of a smaller principality among stronger competitive states. He conducted his foreign policy based on four foundational principles. The first was stability. Borso anchored his statecraft by aligning Ferrara with Venice and the papacy. The second was display or the politics of splendor. The third was development of stored knowledge, based on the reputation and antiquity of Estense rule, both worldly and religious. The fourth was the politics of personality, based on Borso’s affability, popularity, and other virtues. The culmination of Borso’s successful statecraft was his investiture as Duke of Ferrara by Pope Paul II. His success contrasted with the disaster of the War of Ferrara, when Ercole I abandoned Borso’s formula for rule. Ultimately, the memory of Borso’s successful reputation was preserved for more than a century. Borso d’Este; Ferrara; Foreign policy; Venice; Pope Paul II ISSN 2533-2325 doi: 10.6092/issn.2533-2325/11827 I quaderni del m.æ.s. -

9. Chapter 2 Negotiation the Wedding in Naples 96–137 DB2622012

Chapter 2 Negotiation: The Wedding in Naples On 1 November 1472, at the Castelnuovo in Naples, the contract for the marriage per verba de presenti of Eleonora d’Aragona and Ercole d’Este was signed on their behalf by Ferrante and Ugolotto Facino.1 The bride and groom’s agreement to the marriage had already been received by the bishop of Aversa, Ferrante’s chaplain, Pietro Brusca, and discussions had also begun to determine the size of the bride’s dowry and the provisions for her new household in Ferrara, although these arrangements would only be finalised when Ercole’s brother, Sigismondo, arrived in Naples for the proxy marriage on 16 May 1473. In this chapter I will use a collection of diplomatic documents in the Estense archive in Modena to follow the progress of the marriage negotiations in Naples, from the arrival of Facino in August 1472 with a mandate from Ercole to arrange a marriage with Eleonora, until the moment when Sigismondo d’Este slipped his brother’s ring onto the bride’s finger. Among these documents are Facino’s reports of his tortuous dealings with Ferrante’s team of negotiators and the acrimonious letters in which Diomede Carafa, acting on Ferrante’s behalf, demanded certain minimum standards for Eleonora’s household in Ferrara. It is an added bonus that these letters, together with a small collection of what may only loosely be referred to as love letters from Ercole to his bride, give occasional glimpses of Eleonora as a real person, by no means a 1 A marriage per verba de presenti implied that the couple were actually man and wife from that time on.