Food & Beverages Made in Italy in Polonia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

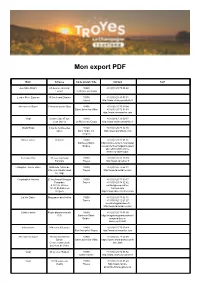

Mon Export PDF

Mon export PDF Nom Adresse Code postal / Ville Contact Tarif Aux Mille Affair's 67 Avenue Général 10440 +33 (0)3 25 75 08 62 Leclerc La Rivière-de-Corps Leader Price Express 30 Boulevard Danton 10000 +33 (0)3 25 80 03 31 Troyes http://www.casino-proximite.fr Intermarché Super 23 boulevard de Dijon 10800 +33 (0)3 25 75 39 94 Saint-Julien-les-Villas +33 (0)3 25 72 93 33 http://www.intermarche.com Vival Centre Cial, 47 rue 10440 +33 (0)9 67 33 60 17 Jean Jaurès La Rivière-de-Corps http://www.casino-proximite.fr Grand Frais 3 rue de l'entrée des 10120 +33 (0)3 25 78 32 35 antes Saint-André-les- http://www.grandfrais.com Vergers Brico Leclerc RD 619 10600 +33 (0)3 25 72 51 51 Barberey-Saint- http://www.e-leclerc.com/st-par Sulpice res-aux-tertres/magasins-speci alises/brico/info--brico- barberey-saint-sulpic Carrefour City 37, rue Raymond 10000 +33 (0)3 25 81 10 79 Poincaré Troyes http://www.carrefour.fr L'Angélus - La vie claire Halles de l'Hôtel de 10000 +33 (0)3 25 73 62 11 Ville, rue Claude Huez Troyes http://www.lavieclaire.com/ 1er étage Coopérative Hermès 23 boulevard Georges 10000 +33 (0)3 25 73 39 17 Pompidou Troyes +33 (0)3 25 78 32 82 & 127 av. Wilson contact@cooperative- 10120 St André les hermes.com Vergers http://cooperative-hermes.com La Vie Claire Mezzanine des Halles 10000 +33 (0)3 25 73 62 11 Troyes +33 (0)9 62 12 21 27 [email protected] http://www.lavieclaire.com/ Géant Casino Route départementale 10600 +33 (0)3 25 71 54 00 619 Barberey-Saint- http://magasins.geantcasino.fr/ Sulpice magasin/troyes- barberey/CG201 Intermarché -

Handel We Współczesnej Gospodarce. Nowe Wyzwania

Handel we współczesnej gospodarce. Nowe wyzwania Redaktor naukowy Maria Sławińska Poznań 2016 Monografię wydrukowano na podstawie materiałów dostarczonych przez Autorów w formie gotowej do reprodukcji, bez dokonywania zmian redakcyjnych. Recenzenci: dr hab. Paweł Dobski dr hab. Magdalena Stefańska dr hab. Tomasz Wanat, prof. nadzw. UEP Copyright by Katedra Handlu i Marketingu Uniwersytet Ekonomiczny w Poznaniu Poznań 2016 Projekt okładki: Izabela Jasiczak Druk: UNI-DRUK Wydawnictwo i Drukarnia www.uni-druk.pl 2 Spis treści Wprowadzenie ................................................................................................................... 5 CZĘŚĆ I INNOWACJE W HANDLU DETALICZNYM Wiesław Ciechomski, Robert Romanowski Innowacje technologiczne w sektorze handlu detalicznego ................................................ 9 Urszula Kłosiewicz-Górecka Innowacje w przedsiębiorstwach handlowych – postrzeganie innowacji i motywy działań innowacyjnych ....................................................................................................... 21 Barbara Kucharska Ewolucja formatów jako przejaw innowacyjności przedsiębiorstw handlowych w Polsce ............................................................................................................................... 33 Maria Sławińska Innowacje w handlu detalicznym – aspekty strategiczne .................................................... 48 Tomasz Zawadzki Innowacje technologiczne i marketingowe w tradycyjnych przedsiębiorstwach handlowych na przykładzie stacji paliw -

Dino Trzymaj, 41,00

Dino Bloomberg: DNP PW Equity, Reuters: IPO-DIN.WA Trzymaj, 41,00 PLN 15 maja 2017 r. Inicjacja Wzrostozaurus Rex Rozpoczynamy wydawanie rekomendacji dla spółki Dino od TRZYMAJ z ceną docelową 41 Informacje PLN na akcję. Dino jest drugą pod względem tempa wzrostu siecią detaliczną w Polsce, Kurs akcji (PLN) 38,79 zarówno pod względem dynamiki przychodów ze sprzedaży (2010-2016 +36% CAGR), jak i Upside 6% wzrostu liczby sklepów (2010-2016 +33% CAGR). Na koniec 2016 r. sieć Dino liczyła 628 Liczba akcji (mn) 98,04 sklepów (+117 nowych otwarć netto w 2016 r.), a do końca 2020 r. ich liczba zbliży się do Kapitalizacja (mln PLN) 3 802,97 1,2 tys. Spółka działa w segmencie supermarketów proximity, które wraz z sieciami Free float 49% convenience zwiększają obecnie udział w rynku kosztem sklepów tradycyjnych. Powrót Free float (mln PLN) 1 863,46 inflacji cen żywności, wzrost wolumenów oraz wciąż widoczny efekt programów rządowych Free float (mln USD) 481,78 będą naszym zdaniem wspierać sprzedaż LFL w nadchodzących latach. EV (mln PLN) 4 416,74 Dług netto (mln PLN) 613,76 Wysoka dynamika nowych otwarć i silna sprzedaż LFL Motorem wzrostu wyników Dino będą trzy czynniki: (i) nowe otwarcia (średnioroczny wzrost w latach Dywidenda 2017-2020 na poziomie 135 otwarć), które w drugim roku działalności (dojrzewania) są w stanie Stopa dywidendy (%) 0,0% wygenerować wzrost przychodów o blisko 120-150% w stosunku do 1 roku działalności (mediana otwarć w sierpniu), (ii) wzrost sprzedaży LFL oraz (iii) powrót inflacji. Dino rozwija swoje sklepy na obszarach Odcięcie dywidendy - miejsko-wiejskich, poza centrami dużych miast i stanowi bezpośrednią konkurencję dla Biedronek. -

Raport Eggtrack – Jak Firmy Wycofują Jaja Z Hodowli Klatkowej

30.09.2019 r. Raport EggTrack – jak firmy wycofują jaja z hodowli klatkowej Dzisiaj (30 września) organizacja Compassion in World Farming opublikowała drugi europejski raport EggTrack, który pokazuje postępy firm w wypełnianiu zobowiązań dotyczących wycofywania jaj z hodowli klatkowej do 2025 r. Raport po raz pierwszy opublikowano także w Polsce. W ostatnich latach wiodące firmy spożywcze lawinowo ogłaszały wycofywanie ze sprzedaży jaj z hodowli klatkowej. To wynik m.in. działań organizacji Compassion Polska, która od lat aktywnie prowadzi kampanię na rzecz zakazu stosowania klatek w hodowli wszystkich zwierząt. Raport EggTrack ma na celu wspieranie firm, które podjęły publiczne zobowiązania i zachęcenie ich do informowania o corocznym postępie w kierunku bezklatkowej hodowli kur. Raportowanie umożliwi organizacji Compassion Polska zaoferowanie na czas pomocy, porad i wsparcia firmom, które przechodzą na systemy bezklatkowe. EggTrack przedstawia dane o 106 europejskich firmach, w tym: wiodących sprzedawcach detalicznych, sprzedawcach usług gastronomicznych, firmach zewnętrznych i producentach, którzy zostali wybrani na podstawie wielkości, liczby używanych jaj i ich wpływu na rynek jaj. W tym roku w raporcie znalazły się cztery polskie marki: Grycan, Wedel i Restauracje Sphinx. Pozostałe firmy uwzględnione w raporcie, które zrezygnują ze stosowania jaj klatkowych do 2025 r. w Polsce, to: Biedronka, Caffe Nero, McDonald's, Burger King, Starbuck's, Subway, Danone, Mars, Mondelez, Nestle, Unilever, Aldi, Auchan, Carrefour, Lidl, Tesco, Schiever (Bi1), Kaufland i Makro. EggTrack pokazuje postępy firm w zakresie stosowania nie tylko całych jaj, ale także produktów z nich wytworzonych i poszczególnych składników, które są równie ważne, ale często pomijane w zobowiązaniach i raportach. Dane zostały opracowane na podstawie informacji publicznie dostępnych na stronach internetowych firm w sierpniu 2019 r. -

WPŁYW ZRÓŻNICOWANIA DOCHODÓW KONSUMENTÓW NA ROZWÓJ PRZEDSIĘBIORSTW HANDLOWYCH BRANŻY FMCG (Fast Moving Consumer Goods) W POLSCE

UNIWERSYTET W BIAŁYMSTOKU WYDZIAŁ EKONOMII I ZARZĄDZANIA Mgr Andrzej Kondej WPŁYW ZRÓŻNICOWANIA DOCHODÓW KONSUMENTÓW NA ROZWÓJ PRZEDSIĘBIORSTW HANDLOWYCH BRANŻY FMCG (Fast Moving Consumer Goods) W POLSCE Praca doktorska napisana pod kierunkiem dr hab. Anny Chmielak BIAŁYSTOK 2017 2 SPIS TREŚCI WSTĘP 5 ROZDZIAŁ 1. CHARAKTERYSTYKA ROZWOJU HANDLU DETALICZNEGO 13 BRANŻY FMCG W POLSCE 1.1. Pojęcia, formy i formaty handlu detalicznego 13 1.2. Czynniki rozwoju handlu detalicznego 20 1.3. Teorie handlu detalicznego 25 1.4. Zarys rozwoju handlu detalicznego 44 1.5. Tendencje rozwoju handlu detalicznego w Polsce 50 1.6. Zmiany strukturalne w sektorze handlu detalicznego branży FMCG 55 ROZDZIAŁ 2. ISTOTA ZRÓŻNICOWANIA DOCHODÓW KONSUMENTÓW 65 2.1. Dochody jako główne źródło siły nabywczej konsumentów 65 2.2. Dochodowe uwarunkowania popytu konsumpcyjnego 93 2.3. Udział wydatków konsumpcyjnych w dochodach 99 2.4. Udział wydatków na żywność w dochodach 107 ROZDZIAŁ 3. ZRÓŻNICOWANIE DOCHODÓW W UJĘCIU HISTORYCZNYM A 120 ROZWÓJ PRZEDSIĘBIORSTW HANDLOWYCH 3.1. Zmiany dochodów a przekształcenia strukturalne w sektorze handlu spożywczego 120 3.2. Zróżnicowanie dochodów a rozwój sklepów małoformatowych 138 3.3. Zróżnicowanie dochodów a rozwój dyskontów 152 3.4. Zróżnicowanie dochodów a rozwój supermarketów 161 3.5. Zróżnicowanie dochodów a rozwój hipermarketów 167 ROZDZIAŁ 4. PRZESTRZENNE ZRÓŻNICOWANIE DOCHODÓW 174 KONSUMENTÓW A STRUKTURA HANDLU DETALICZNEGO BRANŻY FMCG 4.1 Przestrzenne zróżnicowanie dochodów konsumentów a struktura handlu 174 detalicznego 4.2. Przestrzenne zróżnicowanie dochodów konsumentów a rozwój sklepów 181 małoformatowych 4.3. Przestrzenne zróżnicowanie dochodów konsumentów a rozwój dyskontów 191 4.4. Przestrzenne zróżnicowanie dochodów konsumentów a rozwój supermarketów 202 4.5. Przestrzenne zróżnicowanie dochodów konsumentów a rozwój hipermarketów 212 3 ROZDZIAŁ 5. -

Good Farm Animal Welfare Awards 2020 – Winners

GOOD FARM ANIMAL WELFARE AWARDS 2020 – WINNERS INFORMATION – GOOD EGG AWARDS 2020 Good Egg Award Winners (12) Aldi UK (Retailer, UK) CH&CO (Food Service, UK) Coraya (Manufacturer/Producer, France) Fattoria Roberti (Manufacturer/Producer, Italy) Fresystem (Manufacturer/Italy) Flunch (Food Service, France) Hippopotamus (Food Service, France) Lidl UK (Retailer, UK) Marr (Food Service, Italy) Noble Foods (Manufacturer/Producer, UK) Système U (Retailer, France) Taco Bell (Food Service, US) Aldi Award Name: Good Egg Award Award category: Whole eggs or shell eggs; Egg product (liquid or powder) Policy status: Commitment Country: UK One of the UK’s fastest‐growing supermarket chains that recently opened its 870th store with plans to have 1,200 stores by 2025. Animal Welfare is an important part of being a responsible business and Aldi is committed to continuously drive welfare improvements for its food and non‐food products. It is an important consideration for their customers and their Good Egg Award enables Aldi to demonstrate their commitment to cage‐free shell and ingredients eggs. This award will potentially benefit over 4 million hens per year. CH&CO Award Name: Good Egg Award Award category: Shell eggs and egg products Policy status: Commitment Country: UK CH&CO is a contract caterer made up of a group of chefs, nutritionists and people with a shared passion operating at over 750 locations in the UK and Ireland. They strive to take a more thoughtful, mindful approach to the food they source, prepare and present and advocate local and seasonal produce. Their focus on poultry not only includes committing to sourcing only cage free eggs, but CH&CO have also recently signed up to the European Chicken Commitment which covers all of their broiler chicken meat. -

Wykaz Bankomatów

MIEJSCOWOŚĆ KOD POCZTOWY ULICA MIEJSCE NAZWA BANKU Abramow 21-143 22 lipca 8A Bank Bank Spoldzielczy w Lubartowie Adamow 21-412 Plac Sniegockich 1 21-412 Adamow filia BS Trzebieszow Adamow 22-442 Adamow 8D Filia BS Tomaszow Lubelski Adamow 21-412 Kleeberga 5 Bank Bank Spoldzielczy w Adamowie Albigowa 37-122 Albigowa 478 Bank bankomat BS w Lancucie Aleksandrow 26-337 Aleksandrow 43B Sklep Groszek SGB - BS Piotrkow Trybunalski Aleksandrow 23-408 Aleksandrow 380 BS w Ksiezpolu bankomat BS w Ksiezpolu Aleksandrow Kujawski 87-700 ul. Ogrodowa 1-3 MIEJSCE SGB - KBS Aleksandrow Kujawski Aleksandrow Kujawski 87-700 ul. Szkolna 13 MIEJSCE SGB -KDBS Wloclawek Aleksandrow Kujawski 87-700 ul. Szkolna 13 Filia KDBS Wloclawek Aleksandrow Lodzki 95-070 Senatorska 2A Bank bankomat BS w Aleksandrowie Lodzkim Aleksandrow Lodzki 95-070 Ogrodowa 14 Bank bankomat BS w Aleksandrowie Lodzkim Aleksandrow Lodzki 95-070 Wojska Polskiego 65 67 Bank bankomat BS w Aleksandrowie Lodzkim Aleksandrow-Kujawski 87-700 Slowackiego28A Oddzial Banku Planet Cash ALWERNIA 32-566 GESIKOWSKIEGO 7 BS CHRZANOW PK BS CHRZANOW PUNKT KASOWY Alwernia 32-566 Mickiewicza 15A Bank bankomat BS w Chrzanowie Andrespol 95-020 ul. Rokocinska 130A 95-020 Andrespoloddzial BS Andrespol Andrychow 34-120 Legionow 17 Salonik Prasowy obok kantora BANKOMAT PLANET CASH Andrychow 34-120 Lenartowicza 36G Bank bankomat BS w Andrychowie Andrychow 34-120 Krakowska 112 Bank bankomat BS w Andrychowie Andrzejewo 07-320 Warszawska 52 Bank Bank Spoldzielczy w Ostrowi Mazowieckiej Annopol 23-235 Partyzantow 22 -

Informacja Z Wyników Kontroli Oznakowania Warzyw I

INFORMACJA CZĄSTKOWA Z WYNIKÓW DODATKOWYCH KONTROLIŚWIEŻYCH OWOCÓW I WARZYW POD WZGLĘDEM ZNAKOWANIA KRAJEM POCHODZENIA Warszawa, lipiec 2019 INFORMACJA Z KONTROLI INFORMACJA CZĄSTKOWA Z WYNIKÓW DODATKOWYCH KONTROLIŚWIEŻYCH OWOCÓW I WARZYW POD WZGLĘDEM ZNAKOWANIA KRAJEM POCHODZENIA W związku z licznymi sygnałami dotyczącymi Stwierdzone nieprawidłowości pod względem znakowania nieprawidłowego oznakowania świeżych owoców i warzyw krajem pochodzenia w miejscu sprzedaży konsumentom lub w sieciach handlowych informacją o kraju pochodzenia na opakowaniu jednostkowym polegały na: Polska, Prezes Urzędu Ochrony Konkurencji i Konsumentów » stosowaniu oznaczeń wprowadzających w błąd co do zlecił Inspekcji Handlowej przeprowadzenie dodatkowych kraju pochodzenia, co dotyczyło 61 partii (5,2 proc. kontroli w tym zakresie. ocenianych), w tym: W lipcu 2019 roku na terenie całego kraju skontrolowano a) 48 partii pochodzących z importu (UE lub łącznie 96 placówek należących do sieci: Aldi, Auchan, spoza UE) oznakowanych błędnie innym krajem Biedronka, Carrefour, Dino, Delikatesy Centrum, E. Leclerc, pochodzenia niż wynikający z dowodów dostaw lub Frapo Dystrybucja, Hipermarket Bi1, Intermarché, Kaufland, opakowań zbiorczych, w tym 31 partii oznakowanych Lewiatan, Lidl, Netto, Polo Market, Stokrotka, Społem PSS i niegodnie z prawdą jako pochodzące z Polski. Tesco. Przykłady: Nieprawidłowości stwierdzono w 31 placówkach (32,3 proc. skontrolowanych), należących do sieci: Aldi, Auchan, • na wywieszce podano „Polska”, podczas gdy w Biedronka, Dino, Hipermarket Bi1, Intermarché, Kaufland, oparciu o opakowanie zbiorcze (brak dowodu Lewiatan, Lidl, Netto, Polo Market, Stokrotka i Tesco. dostawy) ustalono, że kraj pochodzenia to Egipt, Ocenie poddano ogółem 1 162 partie świeżych owoców • na wywieszce podano „Polska”, podczas gdy w i warzyw, kwestionując w rezultacie 118 partii (10,2 proc. oparciu o opakowanie zbiorcze i dowód dostawy ocenianych). -

Analysis of the Potential of Virtual Stores for German Online Grocery Retailing

Analysis of the Potential of Virtual Stores for German Online Grocery Retailing Bastian Thelen Project submitted as partial requirement for the conferral of Master in Marketing Supervisor: Ph. D. Nebojsa S. Davcik, ISCTE Business School September 2015 Analysis of the Potential of Virtual Stores For German Online Grocery Retailing - Spine - Analysis of the Potential of Virtual Stores for German Online Grocery Retailing Bastian Thelen i Analysis of the Potential of Virtual Stores For German Online Grocery Retailing Acknowledgements This dissertation would not have been possible without the help and support of my supervisor, my family, fellow students and friends. At this point, I would like to thank everybody, who made it possible for me to graduate from ISCTE IUL with an MSc. Marketing degree. As regards the support of this Master Thesis, I want to thank Prof. Nebojsa S. Davcik for his support and feedback. In spite of adverse conditions, he accepted the supervision of my thesis and gave me confidence and motivation to go through with my project. I also want to thank Professor Ph. D. Paulo Rita and Professor Susana Marques for their advices on the early stages of the development of this thesis. The delivery of this Master Thesis also means the end of overall six years of study career. Therefore, I want to thank my parents and my brother for all the care and support they gave me especially in the last two years. Thank you, for inspiring and encouraging me to strive for the best kind graduation, for enabling me to study all over Europe and allowing me to get the best preconditions to prevail on the job market. -

Meythet : Casino Annecy Brogny : Carrefour

Caisses locales Magasins MEYTHET Epagny : Auchan - La Balme : Casino - Meythet : Casino ANNECY-PARMELAN Annecy Brogny : Carrefour - Groisy : Carrefour Market LA ROCHE-SUR-FORON La Roche : Lidl - Amancy : Intermarché - Carrefour Market St Julien : Intermarché - Carrefour Amedee - Mossingen : Upress GENEVOIS Vulbens : Intermarché - Viry : Shopi - Valleiry : Dia - Neydens : Migros SEYSSEL Carrefour Market BONNEVILLE Marignier : Super U - Bonneville : Carrefour Market - Dia Sallanches : Carrefour - Intermarché - Monoprix - Carrefour Contact MONT-BLANC Magland : Super U - Passy : Super U FRANGY Carrefour Contact REIGNIER Reignier : Carrefour ALBY-SUR-CHERAN Hyper U - Carrefour Market - Aldi - Intermarché ANNECY-LES-FINS Pringy : Super U Annemasse : Carrefour Florissant - Carrefour Contact Etoile - Géant Casino - Leclerc - Leader Price - Carrefour Market Route de Bonneville - Lidl - Monoprix - Onala Vie - Satoriz - Carrefour ANNEMASSE Market Perrier Etrembieres : Migros - Lidl - Pers-Jussy : Casino - Bonne : Super U - Vetraz : Intermarché RUMILLY Hyper U - Carrefour Market - Aldi - Intermarché CRUSEILLES Carrefour Market - Utile FAVERGES Faverves : Carrefour Market - Intermarché GAILLARD Intermarché - Casino - Spar ANNECY SAINT-FRANCOIS Annecy Brogny: Carrefour - Groisy : Monopix courrier - Intermarché Loverchy ANNECY-LE-VIEUX Carrefour Market - Super Casino EVIAN-LES-BAINS Amphion : Cora - Super U - Evian : Casino - Lidl THÔNES Carrefour - Lidl - Market City - Intermarché BOEGE CLUSES Cluses : Carrefour - Scionzier : Carrefour Market - Lidl -

The Polish Grocery Retail Market in 2010-2020 Proximity Supermarkets and Convenience Segments Will Benefit from Slower Growth of Discounters

THE POLISH GROCERY RETAIL MARKET IN 2010-2020 PROXIMITY SUPERMARKETS AND CONVENIENCE SEGMENTS WILL BENEFIT FROM SLOWER GROWTH OF DISCOUNTERS November, 2016 2 Grocery retail in Poland 2010-2020 – detailed analysis of convenience and proximity supermarkets segments Contents 1 Grocery retail market 5 2 Customer trends 13 3 Regulations 15 3 Grocery retail in Poland 2010-2020 – detailed analysis of convenience and proximity supermarkets segments Foreword We are happy to present the extended version of The Polish grocery retail market in 2010-2020 report published by Roland Berger in August 2016. The report gained noticeable market traction with number of articles in the most opinion shaping portals and newspapers. After thorough analysis and interviews with key market stakeholders we have decided to update and enrich the report with new conclusions. Major differences vs previous report are in market segmentation and forecast projection. We have distinguished soft franchise segment and divided supermarkets into large and proximity supermarkets. The reason for the change is different drivers behind those segments and therefore possible blurring of some market trends and dynamics. We have also updated the forecast as for major players in terms of LFL sales 2016 is much more lucrative than 2014 and 2015, inflationary perspective for Poland has changed and we have taken into account the impact of minimum wage. The results of the more detailed segmentation shine a new light on the market dynamics and the conclusions presented in the report describe deeper the perspectives for the future grocery market development. We encourage you to read the report carefully and wish you a pleasant lecture. -

1/Organisation 2/Acteurs GALEC / LECLERC 16

Profil de la grande distribution française 1/Organisation Intégrée Indépendante Carrefour Auchan / Simply Market Leclerc* Casino (Géant) Intermarché (ITM) Cora / Match Système U Monoprix Société nationale *Magasin indépendant possède (structure de société possédée et dirigée par un ses magasins dirigés par des PDG) directeurs salariés se regroupent en (quelques magasins indépendants affiliés, structures régionales d’achat ou de logistique) structure d’achat et logistique régionale (SCA - Soca) puis en groupe d’achat national (GALEC) GT vin (groupe de travail) à chaque niveau Pour U et ITM, même principe avec des plateformes Supérettes 150 à 400 m2 régionales et des files locales d’achat Supermarchés ≤ 2 500 m2 Hypermarchés > 2 500 m2 2/Acteurs GALEC / LECLERC 16 SCA régionales : Scaso (sud ouest), Cestas - 33 Scapalsace (Coop Alsace), Colmar St Louis - 68 Scalandes, Mont de Marsan - 40 Scapest, Saint-Martin-sur-le-Pré - 51 Socamil, (Midi Pyrénées - Languedoc), Toulouse Scapartois, Tilloy-lès-Mofflaines - 62 Lecasud (sud est), Le Luc - 83 Scachap (Charentes Poitou), Ruffec - 16 Socara (Rhône Alpes), St-Quentin-Fallavier - 38 Scaouest, Saint-Etienne-de-Montluc - 44 Scacentre, Yseure - 03 Scarmor (Bretagne), Landerneau - 29 Scapnor (nord), Bruyères-sur-Oise - 95 Socamaine, Champagné - 72 Scadif (Ile de France), Savigny-le-Temple - 77 Scanormande, Lisieux - 14 Enseignes : 645 magasins 587 hyper et supermarchés Leclerc (avec 584 Leclerc drive) 458 superettes Leclerc express Carrefour France Structures affiliées : Provencia Ed - Dia France