Introduction to Miyagi's Investment Environment March 23 (FRI), 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 Annual Report Pursuing Our Unlimited Potential Annual Report 2012

For the year ended March 31, 2012 Pursuing Our Unlimited Potential Annual Report 2012 Annual Report 2012 EAST JAPAN RAILWAY COMPANY JR East’s Strengths 1 AN OVERWHELMINGLY SOLID AND ADVANTAGEOUS RAILWAY NETWORK The railway business of the JR East Being based in the Tokyo metro- Group covers the eastern half of politan area is a major source of our Honshu island, which includes the strength. Routes originating in the Tokyo metropolitan area. We provide Kanto area (JR East Tokyo Branch transportation services via our Office, Yokohama Branch Office, Shinkansen network, which connects Hachioji Branch Office, Omiya Tokyo with regional cities in five Branch Office, Takasaki Branch directions, Kanto area network, and Office, Mito Branch Office, and intercity and regional networks. Our Chiba Branch Office) account for JR EAST’S SERVICE AREA networks combine to cover 7,512.6 68% of transportation revenue. kilometers and serve 17 million Japan’s total population may be people daily. We are the largest declining, but the population of the railway company in Japan and one of Tokyo metropolitan area (Tokyo, TOKYO the largest in the world. Kanagawa Prefecture, Saitama Prefecture, and Chiba On a daily basis, about 17million passengers travel a network of 70 train lines stretching 7,512.6 operating kilometers An Overwhelmingly Solid and Advantageous Railway Network Annual Report 2012 SECTION 1 OVERALL GROWTH STRATEGY Prefecture) continues to rise, mean- OPERATING REVENUES OPERATING INCOME ing our railway networks are sup- For the year ended March 31, 2012 For the year ended March 31, 2012 ported by an extremely sturdy Others 7.9% Transportation Others 6.1% Transportation operating foundation. -

Shinkansen - Wikipedia 7/3/20, 10�48 AM

Shinkansen - Wikipedia 7/3/20, 10)48 AM Shinkansen The Shinkansen (Japanese: 新幹線, pronounced [ɕiŋkaꜜɰ̃ seɴ], lit. ''new trunk line''), colloquially known in English as the bullet train, is a network of high-speed railway lines in Japan. Initially, it was built to connect distant Japanese regions with Tokyo, the capital, in order to aid economic growth and development. Beyond long-distance travel, some sections around the largest metropolitan areas are used as a commuter rail network.[1][2] It is operated by five Japan Railways Group companies. A lineup of JR East Shinkansen trains in October Over the Shinkansen's 50-plus year history, carrying 2012 over 10 billion passengers, there has been not a single passenger fatality or injury due to train accidents.[3] Starting with the Tōkaidō Shinkansen (515.4 km, 320.3 mi) in 1964,[4] the network has expanded to currently consist of 2,764.6 km (1,717.8 mi) of lines with maximum speeds of 240–320 km/h (150– 200 mph), 283.5 km (176.2 mi) of Mini-Shinkansen lines with a maximum speed of 130 km/h (80 mph), and 10.3 km (6.4 mi) of spur lines with Shinkansen services.[5] The network presently links most major A lineup of JR West Shinkansen trains in October cities on the islands of Honshu and Kyushu, and 2008 Hakodate on northern island of Hokkaido, with an extension to Sapporo under construction and scheduled to commence in March 2031.[6] The maximum operating speed is 320 km/h (200 mph) (on a 387.5 km section of the Tōhoku Shinkansen).[7] Test runs have reached 443 km/h (275 mph) for conventional rail in 1996, and up to a world record 603 km/h (375 mph) for SCMaglev trains in April 2015.[8] The original Tōkaidō Shinkansen, connecting Tokyo, Nagoya and Osaka, three of Japan's largest cities, is one of the world's busiest high-speed rail lines. -

Financial Instruments Intermediary Service Providers As of August 31, 2021

Financial Instruments Intermediary Service Providers As of August 31, 2021 Jurisdiction Registration numbers Name JCN Address Telephone Affiliation financial instruments firm Hokkaido Local Finance Ace Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.8 Masanori Watari(Financial Partners) - 4-5,Kamedamachi,Hakodate-shi, Hokkaido 0138-76-1692 Bureau Superfund Japan Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.26 Crest Consulting 4430001031195 324-46, Shinkou-cho, Otaru-shi, Hokkaido 011-231-5888 SBI Securities Co., Ltd. au Kabucom Hokkaido Local Finance Bureau(FIISP) No.30 JACCS CO., LTD. 2440001001001 2-5, Wakamatsu-cho, Hakodate-shi, Hokkaido 0138-26-4136 Securities Co., Ltd. Akatsuki Securities,Inc. Hokkaido Local Finance Bureau(FIISP) No.40 Yoshiko Ishii(Akashiya Kikaku) - 1-10-104, Minami12-jo Nishi23-chome, Chuo-ku, Sapporo-shi, Hokkaido 011-561-6596 Ace Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.43 Hokkaidousougoukeieikennkyuusyo Co., Ltd. 5430001007434 4-3, Minami12-jo Nishi15-chome, Chuo-ku, Sapporo-shi, Hokkaido 011-551-7050 SBI Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.44 Hadashi Company Limited 8430001029896 1-28, Kita4-jo Nishi12-chome, Chuo-ku, Sapporo-shi, Hokkaido 011-219-1955 Ace Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.46 Financialfacilitators Company Limited 4430001046292 2-5-102, Minami3-jo Nishi25-chome, Chuo-ku, Sapporo-shi, Hokkaido 011-215-7901 Ace Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.47 Ogawa Kazuya(Mclinic) - 6-10-6, Kita27-jo Nishi11-chome, Kita-ku, Sapporo-shi, Hokkaido 090-6999-0417 Ace Securities Co., Ltd. Hokkaido Local Finance Bureau(FIISP) No.52 Shigeki Sasaki - 1-15, Kita1-jo Nishi7-chome, Chuo-ku, Sapporo-shi, Hokkaido 011-596-9817 Ace Securities Co., Ltd. -

JRTR No.64 Topics

Topics January–July 2014 January 23— Kawasaki Heavy Industries announced delivery of three trainsets (33 carriages) including first sets of new subway cars (R188) to New York City Transport from Kawasaki’s 1— Single-engine light aircraft made emergency landing on local US affiliate (KRC); delivery included 23 new and 10 highway in Bronx, New York, USA, injuring pilot and three refurbished cars as part of 2011 contract option for 103 passengers new and 370 refurbished cars to be delivered in stages 5— Small two-engine jet aircraft crashed and burned on by late 2015 landing at Aspen Airport in Colorado, USA, killing one 24— Industry group composed of Itochu Trading, Kinki Rolling person and injuring two others Stock and Kawasaki Heavy Industries announced order 5— Saudi Arabian Airways 767 landed safely on one set of worth ¥14.8 billion from Hong Kong MTR for refurbishment undercarriage wheels at Medina Airport, Saudi Arabia, of 348 existing cars and supply of 36 new passenger cars injuring 29 people onboard to extend new routes using existing and new tracks to new specifications 6— Japanese National Police Agency announced 13th consecutive annual drop in 2013 road deaths to 4373 24— MLIT announced supervisory order based on Act on (down 38 year-on-year) but increase in road deaths to Passenger Railway Companies and Japan Freight 2303 of people aged 65 and over (up 39 year-on-year) Railway Company as well as business improvement order for the first time in 12 years following Railway Business Act targeting JR Hokkaido following exposure -

As of 11/29/2012 1 SCHEDULE for the U.S. COMPANIES U.S.-JAPAN

As of 11/29/2012 SCHEDULE FOR THE U.S. COMPANIES U.S.-JAPAN RENEWABLE ENERGY ROUNDTABLE AND TOUHOKU TOUR Monday, December 3, 2012 7:00 am Breakfast on your own 8:00 am Delegation Briefing Location: Kensington Terrace, South Wing 12F, Hotel Okura 2-10-4 Toranomon, Minato-ku, Tokyo 105-0001 Coffee and tea will be served. 9:30 am Check in at the Roundtable Location: Hotel Okura, Orchard Room, 2F South Wing 10:00 am Roundtable Begins 12:30 pm Lunch Break 5:30 pm Roundtable Ends 7 – 9 pm Reception at the Ambassador’s Residence Location: 1-10-5 Akasaka, Minato-ku, Tokyo 107-8420 (across the street from Hotel Okura) Tuesday, December 4, 2012 7:00 am Breakfast on your own 8:00 am Check out of Hotel Okura (you can store your luggage if you plan to return later in the week) 8:30 am Board Bus at the Main Entrance of the Hotel Okura for Site Visit at Yokohama Smart City Project 8:50 am Board Bus at the Main Entrance of the Hotel Okura for Site Visit at TEPCO Ukishima PV Power Plant 9:30 – 11:30 am Site Visits to Solar and Smart Grid Facilities . Solar TEPCO Ukishima PV Power Plant in Kawasaki: This mega solar power plant, which began operations in August 2011, was built in the coastal area of the city of Kawasaki and is operated jointly by Kawasaki City and TEPCO. Kawasaki City provides the site (Ukishima) and 1 As of 11/29/2012 conducts public awareness and educational campaigns on solar PV power generation. -

A Prosperous Future Starts Here

A prosperous future starts here 100% of this paper was made using recycled paper 2018.4 (involved in railway construction) Table of Lines Constructed by the JRTT Contents Tsukuba Tokyo Area Lines Constructed by JRTT… ……………………… 2 Sassho Line Tsukuba Express Line Asahikawa Uchijuku JRTT Main Railway Construction Projects……4 Musashi-Ranzan Signal Station Saitama Railway Line Maruyama Hokkaido Shinkansen Saitama New Urban Musashino Line Tobu Tojo Line Urawa-Misono Kita-Koshigaya (between Shin-Hakodate-Hokuto Transit Ina Line Omiya Nemuro Line Shinrin-Koen and Sapporo) ■ Comprehensive Technical Capacity for Railway Sapporo Construction/Research and Plans for Railway Tobu Isesaki Line Narita SKY ACCESS Line Construction… ………………………………………………6 Hatogaya (Narita Rapid Rail Acess Line) Shiki Shin-Matsudo Hokuso Railway Hokuso Line ■ Railway Construction Process… …………………………7 Takenotsuka Tobu Tojo Line Shin-Kamagaya Komuro Shin-Hakodatehokuto Seibu Wako-shi Akabane Ikebukuro Line Imba Nihon-Idai Sekisho Line Higashi-Matsudo Narita Airport Hakodate …… Kotake-Mukaihara Toyo Rapid Construction of Projected Shinkansen Lines 8 Shakujii-Koen Keisei-Takasago Hokkaido Shinkansen Aoto Nerima- Railway Line Nerima Takanodai Ikebukuro Keisei Main Line (between Shin-Aomori and Shin-Hakodate-Hokuto) Hikifune Toyo- Tsugaru-Kaikyo Line Seibu Yurakucho Line Tobu Katsutadai ■ Kyushu Shinkansen… ………………………………………9 Tachikawa Oshiage Ueno Isesaki Line Keio Line Akihabara Nishi-Funabashi Shinjuku … ………………………………… Odakyu Odawara Line Sasazuka ■ Hokuriku Shinkansen 10 Yoyogi-Uehara -

Transportation Guide & Maps

TRANSPORTATION GUIDE & MAPS (Keep an electronic copy of this on your internet-enabled devices to access the links. Electronic copy of this guide is downloadable at neaef.org/young-leaders-program) From Tokyo Narita Airport to Sendai Station IMPORTANT: Take a picture of your train ticket showing the fare for reimbursement purposes. In most cases, your ticket will be collected in the train. From Narita Airport, take the Skyliner going to Keisei Ueno Station. You can purchase the ticket online in advance using this link: http://www.keisei.co.jp/keisei/tetudou/skyliner/e-ticket/en/ticket/skyliner-ticket/index.php Fare: 2,470 yen Time: Approximately 47 minutes from Narita Airport Terminal 1 Approximately 43 minutes from Narita Airport Terminal 2 From the Ueno Station, take the Komachi or Hayabusa (Tohoku Shinkansen) going to Sendai Station. It would be best to buy the ticket at Ueno Station because online reservation requires exact time of boarding. Fare: 10,790 yen (one way) Time: 86-88 minutes (Komachi) & 86-89 minutes (Hayabusa) • NARITA AIRPORT FLOOR MAP: https://www.narita- airport.jp/en/map/?map=4&terminal=1 • JR-EAST TRAIN TIMETABLE (TOKYO TO SENDAI): https://www.eki- net.com/pc/jreast-shinkansen- reservation/English/wb/common/timetable/e_tohoku_d/index.html • JR-EAST TRAIN TIMETABLE (SENDAI TO TOKYO): https://www.eki- net.com/pc/jreast-shinkansen- reservation/English/wb/common/timetable/e_tohoku_d/index.html For time-specific detailed steps using your GPS on your phone, please download/use Google Maps: https://www.google.com/maps From Tokyo Haneda Airport to Sendai Station IMPORTANT: Take a picture of your train ticket showing the fare for reimbursement purposes. -

Transportation Guide & Maps

TRANSPORTATION GUIDE & MAPS (Keep an electronic copy of this on your internet-enabled devices to access the links. Electronic copy of this guide is downloadable at neaef.org/young-leaders-program) From Tokyo Narita Airport to Sendai Station IMPORTANT: Take a picture of your train ticket showing the fare for reimbursement purposes. In most cases, your ticket will be collected in the train. From Narita Airport, take the Skyliner going to Keisei Ueno Station. You can purchase the ticket online in advance using this link: http://www.keisei.co.jp/keisei/tetudou/skyliner/e-ticket/en/ticket/skyliner-ticket/index.php Fare: 2,470 yen Time: Approximately 47 minutes from Narita Airport Terminal 1 Approximately 43 minutes from Narita Airport Terminal 2 From the Ueno Station, take the Komachi or Hayabusa (Tohoku Shinkansen) going to Sendai Station. It would be best to buy the ticket at Ueno Station because online reservation requires exact time of boarding. Fare: 10,790 yen (one way) Time: 86-88 minutes (Komachi) & 86-89 minutes (Hayabusa) • NARITA AIRPORT FLOOR MAP: https://www.narita- airport.jp/en/map/?map=4&terminal=1 • JR-EAST TRAIN TIMETABLE (TOKYO TO SENDAI): https://www.eki- net.com/pc/jreast-shinkansen- reservation/English/wb/common/timetable/e_tohoku_d/index.html • JR-EAST TRAIN TIMETABLE (SENDAI TO TOKYO): https://www.eki- net.com/pc/jreast-shinkansen- reservation/English/wb/common/timetable/e_tohoku_d/index.html For time-specific detailed steps using your GPS on your phone, please download/use Google Maps: https://www.google.com/maps From Tokyo Haneda Airport to Sendai Station IMPORTANT: Take a picture of your train ticket showing the fare for reimbursement purposes. -

Railway Construction Civil Engineering

Passing down inherited Technologies to Future Generations 2015 CORPORATE REPORT The motifs of our corporate logo are the letter “T”, which is the initial of our company name, and the structure of a building. Starting from left, the three squares represent the future, people and love, and the universe, while the large square at the bottom symbolizes the earth. The red symbolizes our determination and passion, while the blue represents creativity. This logo reflects Tekken Corporation’s willingness to create an environment that is rich in humanity. Published in November 2015 Corporate Report 2015 Tekken Corporate Report 2015 INDEX Company Codes and Management Philosophy 1 Tekken Corporation was established on February 1, 1944 as Message from the President 3 Tetsudou Kensetsu Kogyo K.K. and began as a company To remain a company that consistently helps to engaged in social infrastructure development, with a focus create the future and contribute to society on railroad-related work. Since its foundation, we have established relationship of trust with customers and other ■Implementation of the Corporate Activity Guidelines stakeholders, and have fostered a style of management rooted in our technological capabilities. This sound Tekken’s CSR framework 5 approach has helped us grow and develop into a general construction company. ●Seven Principles of the Corporate Activity Guidelines We will continue to actively enter new fields with a Customer-first principle 7 determined spirit, and work to contribute to the prosperity Social contribution 9 of society in line with our company codes of “trust and technologies.” Pursuit of safety 11 Communication with stakeholders 12 Company Codes Fair, sound corporate activities 13 Trust and technologies Preservation and improvement of global environment 14 Management Philosophy Human resource development and creation of vibrant workplaces 15 Working in line with our company codes of “trust and technologies,” we create safe and high-quality social ■Our businesses 17 infrastructure that satisfies our customers. -

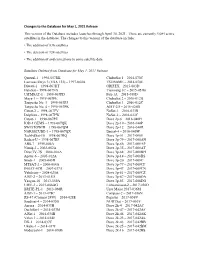

Changes to the Database for May 1, 2021 Release This Version of the Database Includes Launches Through April 30, 2021

Changes to the Database for May 1, 2021 Release This version of the Database includes launches through April 30, 2021. There are currently 4,084 active satellites in the database. The changes to this version of the database include: • The addition of 836 satellites • The deletion of 124 satellites • The addition of and corrections to some satellite data Satellites Deleted from Database for May 1, 2021 Release Quetzal-1 – 1998-057RK ChubuSat 1 – 2014-070C Lacrosse/Onyx 3 (USA 133) – 1997-064A TSUBAME – 2014-070E Diwata-1 – 1998-067HT GRIFEX – 2015-003D HaloSat – 1998-067NX Tianwang 1C – 2015-051B UiTMSAT-1 – 1998-067PD Fox-1A – 2015-058D Maya-1 -- 1998-067PE ChubuSat 2 – 2016-012B Tanyusha No. 3 – 1998-067PJ ChubuSat 3 – 2016-012C Tanyusha No. 4 – 1998-067PK AIST-2D – 2016-026B Catsat-2 -- 1998-067PV ÑuSat-1 – 2016-033B Delphini – 1998-067PW ÑuSat-2 – 2016-033C Catsat-1 – 1998-067PZ Dove 2p-6 – 2016-040H IOD-1 GEMS – 1998-067QK Dove 2p-10 – 2016-040P SWIATOWID – 1998-067QM Dove 2p-12 – 2016-040R NARSSCUBE-1 – 1998-067QX Beesat-4 – 2016-040W TechEdSat-10 – 1998-067RQ Dove 3p-51 – 2017-008E Radsat-U – 1998-067RF Dove 3p-79 – 2017-008AN ABS-7 – 1999-046A Dove 3p-86 – 2017-008AP Nimiq-2 – 2002-062A Dove 3p-35 – 2017-008AT DirecTV-7S – 2004-016A Dove 3p-68 – 2017-008BH Apstar-6 – 2005-012A Dove 3p-14 – 2017-008BS Sinah-1 – 2005-043D Dove 3p-20 – 2017-008C MTSAT-2 – 2006-004A Dove 3p-77 – 2017-008CF INSAT-4CR – 2007-037A Dove 3p-47 – 2017-008CN Yubileiny – 2008-025A Dove 3p-81 – 2017-008CZ AIST-2 – 2013-015D Dove 3p-87 – 2017-008DA Yaogan-18 -

2011 UNAM Reconnaissance

2011 Tohoku-Taiheiyo-oki Earthquake UNAM Team Reconnaissance Plan AIJ Disaster Committee June 22, 2011 - June 29, 2011 (8 days) UNAM Team: Dr. Gerardo Aguilar Ramos Associate Professor, Department of Structures and Materials, Institute of Engineering, UNAM Address: Edificio 2, Piso 3, Cubículo 407, Circuito Escolar, Ciudad Universitaria, México DF 04510, México Email: [email protected] Dr. Jorge Aguirre González Professor, Chair of the Mexican Association of Earthquake Engineering Head of the Department of Seismologic Engineering, Institute of Engineering, UNAM Address: Torre de Ingeniería, Circuito Escolar, Ciudad Universitaria, México DF 04510, México Email: [email protected] Dr. Jorge Arturo Ávila Rodríguez Associate Professor, Department of Structures and Materials, Institute of Engineering, UNAM Address: Edificio 2, Piso 3, Cubículo 404, Circuito Escolar, Ciudad Universitaria, México DF 04510, México Email: [email protected] Dr. Eduardo Botero Jaramillo Associate Professor, Department of Geotechnical, Institute of Engineering, UNAM Address: Edificio 4, Cubículo 217, Circuito Escolar, Ciudad Universitaria, México DF 04510, México Email: [email protected] Dr. David Murià-Vila Professor, Head of the Department of Structures and Materials, Reconnaissance Team Coordinator, Institute of Engineering, UNAM Address: Edificio 2, Piso 3, Cubículo 406, Circuito Escolar, Ciudad Universitaria, México DF 04510, México Email: [email protected] 1 Japanese Hosts: Prof. Hitoshi Shiohara Secretary of AIJ Disaster Committee Associate Professor, Dept. of Architectural Engineering, FACI University of Tokyo 7-3-1 Hongo, Bunkyo-ku, Tokyo 113-8656, Japan Email: [email protected] Prof. Masato Motosaka Chair of AIJ Disaster Committee, AIJ Tohoku Chapter Professor, Director of Disaster Control Research Center, Tohoku University Sendai, Japan Email: [email protected] [email protected] (secretary) Prof. -

Senz Anlin E

ty of Sendai ; Tourism Section, City of Yamagata Yamagata of City Section, Tourism ; Sendai of ty Ci Office, Promotion Collaboration Regional Tohoku by: Published Model Courses Senzan Line History Flavors of the Senzan Line Story of 1929 Opening of Senzan East Line Sendai - Ayashi Section (15.2 km) [New Stations] Kita-Sendai, Rikuzen-Ochiai, Ayashi Rail Route 19 3 1 Extension of Ayashi -Sakunami Section (13.5 km) 9 Ayashi map C Get your fill in Jogi the [New Stations] Rikuzen-Shirasawa, Kumagane , Sakunami Your heart will pound Tohoku Fukushi University Railway Museum & Learning Center ○About a 40 min. ride from Ayashiekimae bus stop to the final stop on the bus to Jogi 19 3 3 Opening of Senzan West Line Uzen-Chitose - Yamadera *Open hours are subject to change depending on the season, weather, etc. as you cross this railway Next to Tohoku Fukushidai Mae Section (9.3 km) Senzan Line [New Stations] Tateyama, Yamadera bridge 50 meters above This museum is operated by Tohoku Fukushi the water! University. They conduct three special exhibits a 19 3 6 Senzan Tunnel (5361m) Completed 19 3 7 Extension and full opening of Senzan Line year on themes such as the history and culture Fully Opened on November 10, 1937 DC electrification of Sakunami -Yamadera Section (20.0 km) Sendai Sta. of rail transport, as well as the connection [New Stations] Oku-Nikkawa mapC 1 A railroad connecting Sendai and Yamagata had been a [New Temporary Platforms] Yatsumori, Omoshiroyama ⑦ Senzan Line 12 min. between railway and the regions it serves. ◯ Admission: Free wish of the people of Miyagi and Yamagata prefectures 19 5 0 [New Stations] Takase Jogi Tofu Shop ◯ Exhibit Room Tuesday - Saturday 10:00 - 16:00 Tohoku Fukushidai Mae since the Meiji Era.