Thy Investor Relations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aerosafety World November 2009

AeroSafety WORLD DOUSING THE FLAMES FedEx’s automatic system CRM FAILURE Black hole approach UPSET TRAINING Airplane beats simulators IASS REPORT 777 power rollback, more TRAGEDY AS INSPIRATION JAPAN Airlines’ safeTY CENTER THE JOURNAL OF FLIGHT SAFETY FOUNDATION NOVEMBER 2009 “Cessna is committed to providing the latest safety information to our customers, and that’s why we provide each new Citation owner with an FSF Aviation Department Tool Kit.” — Will Dirks, VP Flight Operations, Cessna Aircraft Co. afety tools developed through years of FSF aviation safety audits have been conveniently packaged for your flight crews and operations personnel. These tools should be on your minimum equipment list. The FSF Aviation Department Tool Kit is such a valuable resource that Cessna Aircraft Co. provides each new Citation owner with a copy. One look at the contents tells you why. Templates for flight operations, safety and emergency response manuals formatted for easy adaptation Sto your needs. Safety-management resources, including an SOPs template, CFIT risk assessment checklist and approach-and-landing risk awareness guidelines. Principles and guidelines for duty and rest schedul- ing based on NASA research. Additional bonus CDs include the Approach and Landing Accident Reduction Tool Kit; Waterproof Flight Operations (a guide to survival in water landings); Operator’sMEL Flight Safety Handbook; item Turbofan Engine Malfunction Recognition and Response; and Turboprop Engine Malfunction Recognition and Response. Here’s your all-in-one collection of flight safety tools — unbeatable value for cost. FSF member price: US$750 Nonmember price: US$1,000 Quantity discounts available! For more information, contact: Namratha Apparao, + 1 703 739-6700, ext. -

12.1Bn 705M 402M

2nd Interim Report January – June 2008 2 12.1bn EUR revenue 705m EUR operating result 402m EUR net profi t for the period To our Shareholders I Interim management report I Interim financial statements I Notes to the financial statements Lufthansa Group overview Key data 1) January – June January – June Change 2008 2007 in % Revenue and result Revenue €m 12,056 10,089 19.5 - of which traffic revenue €m 9,721 7,739 25.6 Operating result €m 705 486 45.1 EBIT €m 592 833 – 28.9 EBITDA €m 1,317 1,381 – 4.6 Net profit for the period €m 402 992 – 59.5 Key balance sheet and cash flow statement figures Total assets €m 23,632 21,170 11.6 Equity ratio % 29.1 27.1 2.0 pts. Net liquidity 2) €m 916 703 30.1 Cash flow from operating activities €m 1,753 1,074 63.2 Capital expenditure €m 1,231 852 44.5 Key profitability and value creation figures Adjusted operating margin 3) % 6.1 5.2 0.9 pts. EBITDA margin % 10.9 13.7 – 2.8 pts. The Lufthansa share Share price at half year end € 13.70 20.76 – 34.0 Earnings per share € 0.88 2.17 – 59.4 Traffic figures 4) Passengers thousands 34,840 26,949 29.3 thousand Freight/mail tonnes 983 877 12.1 Passenger load factor % 78.3 78.5 – 0.2 pts. Cargo load factor % 65.3 68.5 – 3.2 pts. Available tonne-kilometres millions 17,171 13,380 28.3 Revenue tonne-kilometres millions 12,394 9,957 24.5 Overall load factor % 72.2 74.4 – 2.2 pts. -

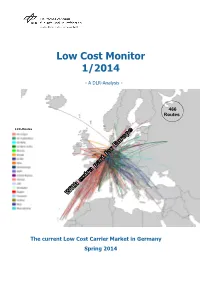

Low Cost Monitor 1/2014

Translation DE -> EN Low Cost Monitor 1/2014 - A DLR-Analysis - 466 Routes LCC-Routes The current Low Cost Carrier Market in Germany Spring 2014 Current Low Cost Carrier Market in Germany in 2013/2014 The Low Cost Carrier (LCC) market has been an inherent part of the German air transport market. The Low Cost Monitor published by DLR informs twice a year on key features of low cost carrier traffic and current developments in this market segment. These are in particular the number and relative importance of low cost carriers and their supply, including air fares, and passenger demand for low cost transport services. The description of the low cost supply in the current monitor is based on a reference week in the winter timetable 2014. Passenger data refer to the year 2013. Airlines Airlines involved in the low cost business design their offer quite differently. Due to this inhomogeneity only a few distinctive criteria can be defined for the low cost market segment, such as low fares, their general availability and direct sale via the internet. Thus, in some cases, a certain scope of discretion arises when allocating an airline to the LCC segment. Furthermore, amalgamations of business models are seen in several airlines that further complicate the accurate assignment to the low cost market segment. For this issue of the Monitor the authors classify currently a number of 19 airlines (among all airlines operating on German airports) that offer entirely or predominantly low cost offers. These are in detail (s. also Tab. 1): Aer Lingus (EI) -

Annual Report 2016 Lufthansa Group

Annual Report 2016 Lufthansa Group The Lufthansa Group is the world’s leading aviation group. Its portfolio of companies consists of network airlines, point-to-point airlines and aviation service companies. Its combination of business segments makes the Lufthansa Group a globally unique aviation group. T001 Key figures Lufthansa Group 2016 2015 Change in % Revenue and result Total revenue €m 31,660 32,056 – 1.2 of which traffic revenue 1) €m 24,661 25,506 – 3.3 EBIT €m 2,275 1,676 35.7 Adjusted EBIT €m 1,752 1,817 – 3.6 EBITDA €m 4,065 3,395 19.7 Net profit / loss €m 1,776 1,698 4.6 Key balance sheet and cash flow statement figures Total assets €m 34,697 32,462 6.9 Equity ratio % 20.6 18.0 2.6 pts Net indebtedness €m 2,701 3,347 – 19.3 Cash flow from operating activities €m 3,246 3,393 – 4.3 Capital expenditure (gross) €m 2,236 2,569 – 13.0 Key profitability and value creation figures EBIT margin % 7.2 5.2 2.0 pts Adjusted EBIT margin % 5.5 5.7 – 0.2 pts EBITDA margin % 12.8 10.6 2.2 pts EACC €m 817 323 152.9 ROCE % 9.0 7.7 + 1.3 pts Lufthansa share Share price at year-end € 12.27 14.57 – 15.8 Earnings per share € 3.81 3.67 3.8 Proposed dividend per share € 0.50 0.50 0.0 Traffic figures 2) Passengers thousands 109,670 107,679 1.8 Available seat-kilometres millions 286,555 273,975 4.6 Revenue seat-kilometres millions 226,633 220,396 2.8 Passenger load factor % 79.1 80.4 – 1.4 pts Available cargo tonne-kilometres millions 15,117 14,971 1.0 Revenue cargo tonne-kilometres millions 10,071 9,930 1.4 Cargo load factor % 66.6 66.3 0.3 pts Total available tonne-kilometres millions 43,607 40,421 7.9 Total revenue tonne-kilometres millions 32,300 29,928 7.9 Overall load factor % 74.1 74.0 0.1 pts Flights number 1,021,919 1,003,660 1.8 Employees Average number of employees number 123,287 119,559 3.1 Employees as of 31.12. -

ANNUAL REPORT 2017 Letter from the Executive Board

ANNUAL REPORT 2017 lufthansagroup.com lufthansagroup.com/investor-relations Business segments NETWORK AIRLINES T002 NETWORK AIRLINES 2017 Change The Network Airlines segment comprises in % Lufthansa German Airlines, SWISS and Revenue €m 23,317 6.6 Austrian Airlines. With their multi-hub strategy, of which traffic revenue €m 21,538 6.6 the Network Airlines offer their passengers Adjusted EBIT €m 2,263 45.5 a premium product and a comprehensive route Adjusted EBIT margin % 9.7 2.6 pts network combined with the highest level of Adjusted ROCE % 17.1 6.0 pts travel flexibility. EACC €m 1,622 48.9 Segment capital expenditure €m 1,738 19.7 Employees as of 31.12. number 50,190 0.4 POINT-TO-POINT AIRLINES T003 POINT-TO-POINT AIRLINES 2017 Change The Point-to-Point Airlines segment is made in % up of the flight operations of the Eurowings Revenue €m 4,041 96.2 group (Eurowings, Germanwings, Eurowings of which traffic revenue €m 3,927 91.7 Europe) as well as Brussels Airlines and the Adjusted EBIT €m 94 equity investment in SunExpress. The Point- Adjusted EBIT margin % 2.3 7.3 pts to-Point Airlines provide an innovative and Adjusted ROCE % 4.2 12.2 pts competitive offering for price-sensitive and EACC €m – 63 – 49.2 service-oriented customers in the growing Segment capital expenditure €m 939 134.2 direct traffic segment. Employees as of 31.12. number 7,501 114.7 C01 Business segments’ share of Group external revenue in % Additional Businesses and Group Functions 0.8 Logistics 7.0 Catering 7.2 MRO 10.0 Point-to-Point Airlines 11.4 63.6 Network Airlines 2017 figures LOGISTICS T004 LOGISTICS 2017 Change Lufthansa Cargo is the logistics specialist in % 35.6 within the Lufthansa Group. -

3Rd Interim Report January – September 2015 Lufthansa Group Overview

3rd Interim Report January – September 2015 Lufthansa Group overview Key figures Lufthansa Group Jan. – Sept. Jan. – Sept. 1) Change July – Sept. July – Sept. 1) Change 2015 2014 in % 2015 2014 in % Revenue and result Total revenue €m 24,304 22,624 7.4 8,939 8,458 5.7 of which traffic revenue €m 19,387 18,460 5.0 7,264 6,994 3.9 EBIT1) €m 1,663 1,048 58.7 1,200 832 44.2 Adjusted EBIT €m 1,693 988 71.4 1,225 810 51.2 EBITDA1) €m 2,932 2,111 38.9 1,616 1,199 34.8 Net profit / loss for the period €m 1,748 482 262.7 794 561 41.5 Key balance sheet and cash flow statement figures Total assets €m 33,159 30,961 7.1 – – – Equity ratio % 18.6 15.2 3.4 pts – – – Net indebtedness €m 2,346 2,262 3.7 – – – Cash flow from operating activities €m 3,160 2,052 54.0 633 308 105.5 Capital expenditure (gross) €m 1,931 2,235 – 13.6 433 687 – 37.0 Key profitability and value creation figures EBIT margin % 6.8 4.6 2.2 pts 13.4 9.8 3.6 pts Adjusted EBIT margin % 7.0 4.4 2.6 pts 13.7 9.6 4.1 pts EBITDA margin % 12.1 9.3 2.8 pts 18.1 14.2 3.9 pts Lufthansa share Share price at the quarter-end € 12.43 12.51 – 0.6 – – – Earnings per share € 3.78 1.05 261.3 1.72 1.22 41.0 Traffic figures 2) Passengers thousands 83,017 81,157 2.3 32,093 31,270 2.6 Passenger load factor % 81.2 80.6 0.6 pts 86.0 85.0 1.0 pts thousand Freight and mail tonnes 1,387 1,416 – 2.0 459 482 – 4.8 Cargo load factor % 65.8 69.2 – 3.4 pts 62.5 67.3 – 4.8 pts Available tonne-kilometres millions 32,320 31,414 2.9 11,748 11,457 2.5 Revenue tonne-kilometres millions 24,178 23,751 1.8 9,066 8,944 1.4 Overall load factor % 74.8 75.6 – 0.8 pts 77.2 78.1 – 0.9 pts Flights number 764,376 762,961 0.2 273,522 271,572 0.7 Employees Employees as of 30.9. -

AIRLINES Monthly

AIRLINES monthly OTP SEPTEMBER 2017 Contents GLOBAL AIRLINES GLOBAL RANKING Top and bottom Regional airlines Latin North EMEA ASPAC American and America Caribbean Notes: % On-Time is percentage of flights that depart or Update: Status coverage as of September 2017 will only arrive within 15 minutes of schedule. be based on actual gate times rather than estimated times. Source: OAG flightview. Any reuse, publication or distribution This may result in some airlines/airports being excluded from of report data must be attributed to OAG flightview. this report. Global OTP rankings are assigned to all airlines/ Global OTP rankings are assigned to all Airports airports where OAG has status coverage for at least 80% where OAG has status coverage for at least 80% of the of scheduled flights. If you would like to review your flight scheduled flights. status feed with OAG please [email protected] AIRLINE MONTHLY OTP – SEPTEMBER 2017 Global airlines – top and bottom BOTTOM AIRLINE ON-TIME TOP AIRLINE ON-TIME FLIGHTS On-time performance On-time performance FLIGHTS Airline Arrivals Rank Flights Rank Airline Arrivals Rank Flights Rank HR Hahn Air 100.0% 1 18 395 JY Intercaribbean Airways Ltd 32.3% 156 1,187 245 DVR Divi Divi Air 94.7% 2 344 324 9V AVIOR Airlines 44.0% 155 798 277 Q6 Volaris Costa Rica 94.7% 3 228 346 ME Middle East Airlines 47.5% 154 2,319 181 JH Fuji Dream Airlines 93.6% 4 2,040 188 3H Air Inuit 49.2% 153 1,495 227 HA Hawaiian Airlines 93.5% 5 7,742 86 ZH Shenzhen Airlines 49.9% 152 20,137 29 HX Hong Kong Airlines 92.4% 6 3,173 150 D7 Airasia X 52.2% 151 1,648 216 SATA International-Azores TW T'way Air 92.0% 7 1,847 208 S4 55.9% 150 791 278 Airlines S.A. -

Lufthansa/ Sn Airholding Regulation (Ec)

EN This text is made available for information purposes only. A summary of this decision is published in all Community languages in the Official Journal of the European Union. Case No COMP/M.5335- LUFTHANSA/ SN AIRHOLDING Only the English text is authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 8 (2) Date: 22/06/2009 COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 22.06.2009 C (2009) 4608 final PUBLIC VERSION COMMISSION DECISION of 22.6.2009 declaring a concentration to be compatible with the common market and the EEA Agreement (Case No COMP/M.5335 – Lufthansa/ SN Airholding) 2 Commission Decision of 22.6.2009 declaring a concentration to be compatible with the common market and the EEA Agreement (Case No COMP/M.5335 – Lufthansa/ SN Airholding) (Only the English text is authentic) (Text with EEA relevance) THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Community, Having regard to the Agreement on the European Economic Area, and in particular Article 57 thereof, Having regard to the bilateral Agreement between the European Community and the Swiss Confederation on Air Transport,1 Having regard to Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of 2 concentrations between undertakings, and in particular Article 8(2) thereof, Having regard to the Commission's decision of 26 January 2009 to initiate proceedings in this case, 1 OJ L 114, 30.4.2002, p. 73. 2 OJ L 24, 29.1.2004, p. 1. 3 Having given the undertakings concerned the opportunity to make known -

Annual Report 2019 Lufthansagroup.Com Lufthansagroup.Com/Investor-Relations the Lufthansa Group

Annual Report 2019 CREATING SUSTAINABLE VALUE lufthansagroup.com lufthansagroup.com/investor-relations The Lufthansa Group The Lufthansa Group is the leading European airline group. It is composed of the segments Network Airlines, Eurowings and Aviation Services. T001 KEY FIGURES LUFTHANSA GROUP 1) 2019 2018 Change 2019 figures in % Revenue and result Total revenue €m 36,424 35,542 2 of which traffic revenue €m 28,136 27,801 1 Operating expenses €m 37,124 35,164 6 Adjusted EBITDA €m 4,718 5,016 – 6 Adjusted EBIT €m 2,026 2,836 – 29 36,424 EBIT €m 1,857 2,974 – 38 Revenue in EUR m Net profit/loss €m 1,213 2,163 – 44 Key balance sheet and cash flow statement figures Total assets €m 42,659 38,213 12 Equity ratio % 24.0 25.1 – 1.1 pts Net indebtedness €m 6,662 3,489 91 2,026 Pension provisions €m 6,659 5,865 14 Adjusted EBIT in EUR m Cash flow from operating activities €m 4,030 4,109 – 2 Capital expenditure (gross) 2) €m 3,559 3,757 – 5 Adjusted free cash flow €m 203 288 – 30 Key profitability and value creation figures 5.6 Adjusted EBITDA margin % 13.0 14.1 – 1.1 pts in % Adjusted EBIT margin % 5.6 8.0 – 2.4 pts Adjusted EBIT margin EBIT margin % 5.1 8.4 – 3.3 pts ROCE % 6.1 11.1 – 5.0 pts Adjusted ROCE % 6.6 10.6 – 4.0 pts Lufthansa share 3,559 Share price at year-end € 16.41 19.70 – 17 Capital expenditure in EUR m Earnings per share € 2.55 4.58 – 44 Proposed dividend per share € – 0.80 – 100 Traffic figures 3) Flights number 1,177,315 1,163,565 1 Passengers thousands 145,190 141,935 2 203 Available seat-kilometres millions 359,567 349,391 -

Deutsche Lufthansa Ag Company Report

“DEUTSCHE LUFTHANSA AG” COMPANY REPORT A Work Project, presented as part of the requirements for the Award of a Master Degree in Finance from the NOVA – School of Business and Economics. Lufthansa Flying Low Diogo Alberto Campos Cantante Ferreira & 29837 A Project carried out on the Master in Finance Program, under the supervision of: Rosário André 02/01/2020 Page 1/32 “DEUTSCHE LUFTHANSA AG” COMPANY REPORT Abstract The purpose of this report is to determine, within a reasonable margin of error, a target price for Deutsch Lufthansa AG and to provide an investment recommendation. To this end, I conducted a thorough analysis of the company in order to best forecast future cash flows. The methodology followed to value the company was the DCF method. It was accompanied by a multiples analysis and a sensitivity analysis. I reached a hold recommendation and I expect Lufthansa’s stock to be worth 15.87€ in 31st December 2020. Keywords: Target-price, DCF, multiples analysis, sensitivity analysis This work used infrastructure and resources funded by Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, Project 22209), POR Lisboa (LISBOA-01-0145-FEDER-007722 and Social Sciences DataLab, Project 22209) and POR Norte (Social Sciences DataLab, Project 22209). Page 2/32 “DEUTSCHE LUFTHANSA AG” COMPANY REPORT DEUTSCHE LUFTHANSA AG COMPANY REPORT AVIATION INDUSTRY 3 JANUARY 2019 STUDENT: DIOGO FERREIRA [email protected] Lufthansa Flying Low European price war squeezes profits ▪ After a careful evaluation, our investment recommendation for Recommendation: Hold Lufthansa AG is HOLD, with a target price of 15.87€. -

Brutrends 2016

Contents BRUtrends 2016 www.brusselsairport.be Brutrends 2016 | 1 Preface Brussels Airport handled 21.8 million passengers in 2016, down 7 % on the record year 2015. The fall in passenger traffic is due to the terror events at the airport on 22 March; the airport was closed for 12 days and then only gradually resumed operations. Cargo traffic at Brussels Airport rose by 1.1% compared to 2015. In the past year, Brussels Airport welcomed 21,818,418 passengers. The number of passengers is 7% lower than in the record year 2015, when the airport handled 23.5 million passengers. The decrease is the direct result of the terror events at the airport on 22 March 2016. Prior to the attack, Brussels Airport was recording growth figures in passenger transport. After the attack, no passenger flights were possible at Brussels Airport for 12 days. Flights were gradually resumed as from early April to reach 100% capacity in June. Belly cargo transport was also affected by the closure and gradual capacity increase, closing 2016 with a decrease of 12.6% for belly cargo compared to 2015. Total cargo transport at Brussels Airport closed 2016 with a growth of 1.1% compared to 2015. Despite the set-back in traffic, 2016 finishes in the top three of years with the highest number of passengers in the history of Brussels Airport. The last two months of the year, and also continuing in 2017, Brussels Airport registered once again record passenger numbers. Brutrends 2016 Contents 2 Movements 2 Per month (2015-2016) Evolution (2004-2016) 3 Per type of traffic 4 Per area: Europe vs. -

Thy Investor Relations

3Q’20 RESULTS SUMMARY Key Financial Data 3Q'19 3Q'20 Change (USD mn) 9M'19 9M'20 Change 3.999 1.528 -61,8% Revenue 9.948 4.962 -50,1% 3.488 809 -76,8% Passenger Revenue 8.459 2.916 -65,5% 418 668 59,8% Cargo Revenue 1.217 1.881 54,6% 641 -59 - Net Operating Profit / Loss 448 -591 - 675 75 -88,9% Profit From Main Operations 540 -367 - 655 -132 - Net Income 452 -786 - 16,4% -8,6% -25,0 pt Net Income Margin 4,5% -15,8% -20,4 pt 1.295 617 -52,3% EBITDAR 2.214 1.177 -46,8% 32,4% 40,4% 8,0 pt EBITDAR Margin 22,3% 23,7% 1,5 pt 2 Revenue Development (3Q’19 vs 3Q’20) (mn USD) Cargo and Other Pax RASK Revenue (Ex-Currency, Ex- Load Factor (Ex-Currency) L/F) Currency Volume +6 -23 +155 -193 -2.415 3.488 Passenger (-77%) 809 Cargo (60%) 418 668 93 Other (-45%) 51 ∑ 3.999 Total Revenue (-62%) ∑ 1.528 3Q'19 3Q'20 3 Revenue Development (9M’19 vs 9M’20) (mn USD) Cargo and Pax RASK Other Revenue (Ex-Currency, (Ex-Currency) Currency Ex-L/F) Load Factor Volume -81 -92 +579 -326 -5.066 8.459 Passenger (-66%) 2.916 1.217 Cargo (55%) 1.881 272 Other (-39%) 165 ∑ 9.948 Total Revenue (-50%) ∑ 4.962 9M'19 9M'20 4 Unit Revenue Development RASK (USc) -8,8% -1,2% 6,73 6,02 6,14 6,11 5,90 6,04 3Q'19 3Q'20 3Q'20 ex-currency 9M'19 9M'20 9M'20 ex-currency Passenger RASK (USc) -22,2% -11,6% 6,73 6,02 5,07 5,23 5,17 5,32 3Q'19 3Q'20 3Q'20 ex-currency 9M'19 9M'20 9M'20 ex-currency Revenue Yield (R/Y) (Usc) -3,9% -1,7% 8,04 7,73 7,50 7,39 7,05 7,26 3Q'19 3Q'20 3Q'20 ex-currency 9M'19 9M'20 9M'20 ex-currency Revenue Yield (R/Y) Total Passenger Revenue / RPK Passenger RASK: Total Passenger Revenue / ASK 5 RASK: Total Passenger and Cargo Revenue / ASK* *ASK value is adjusted for cargo operations adding Cargo Available Ton Km.