Changing Working Environment Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Info August 2018

Investor Relations Investor Info August 2018 Lufthansa Group Month yoy Cumulative yoy Passengers in 1,000 13,755 +10.0% 94,840 +11.2% Available seat-kilometers (m) 32,925 +8.2% 232,705 +8.0% Revenue seat-kilometers (m) 28,434 +8.7% 189,951 +8.8% Total Lufthansa Group Passenger load-factor (%) 86.4 +0.5pts. 81.6 +0.6pts. Airlines Available Cargo tonne-kilometers (m) 1,416 +3.6% 10,782 +4.2% Revenue Cargo tonne-kilometers (m) 895 -0.7% 7,170 +1.7% Cargo load-factor (%) 63.2 -2.7pts. 66.5 -1.7pts. Number of flights 111,408 +10.0% 813,719 +8.7% Passengers in 1,000 6,509 +7.3% 46,708 +7.3% Available seat-kilometers (m) 18,087 +4.0% 131,537 +4.4% Lufthansa German Airlines* Revenue seat-kilometers (m) 15,571 +4.3% 107,345 +4.3% Passenger load-factor (%) 86.1 +0.3pts. 81.6 -0.1pts. Number of flights 50,832 +8.6% 383,883 +6.7% Passengers in 1,000 4,153 +5.0% 29,075 +5.0% Available seat-kilometers (m) 12,739 +1.1% 92,374 +1.8% thereof Hub FRA Revenue seat-kilometers (m) 10,982 +0.9% 75,672 +1.3% Passenger load-factor (%) 86.2 -0.2% 81.9 -0.4% Number of flights 30,902 +7.9% 226,998 +6.3% Passengers in 1,000 2,256 +11.2% 16,921 +10.9% Available seat-kilometers (m) 5,271 +11.3% 38,657 +11.0% thereof Hub MUC Revenue seat-kilometers (m) 4,538 +13.4% 31,338 +11.9% Passenger load-factor (%) 86.1 +1.6% 81.1 +0.7% Number of flights 18,620 +8.6% 147,417 +6.7% Passengers in 1,000 2,033 +10.6% 13,667 +9.4% Available seat-kilometers (m) 5,555 +9.0% 39,965 +7.7% SWISS Revenue seat-kilometers (m) 4,877 +9.4% 33,148 +9.1% Passenger load-factor (%) 87.8 +0.3pts. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Annual Report 2015

Consistently safeguarding the future Annual Report 2015 Lufthansa Group The Lufthansa Group is the world’s leading aviation group. Its portfolio of companies consists of hub airlines, point-to-point airlines and aviation service companies. Its combination of business segments makes the Lufthansa Group a globally unique aviation group whose integrated value chain not only offers financial synergies but also puts it in a superior position over its competitors in terms of know-how. Key figures Lufthansa Group 2015 2014 Change in % Revenue and result Total revenue €m 32,056 30,011 6.8 of which traffic revenue €m 25,322 24,388 3.8 EBIT1) €m 1,676 1,000 67.6 Adjusted EBIT €m 1,817 1,171 55.2 EBITDA1) €m 3,395 2,530 34.2 Net profit / loss €m 1,698 55 2,987.3 Key balance sheet and cash flow statement figures Total assets €m 32,462 30,474 6.5 Equity ratio % 18.0 13.2 4.8 pts Net indebtedness €m 3,347 3,418 – 2.1 Cash flow from operating activities €m 3,393 1,977 71.6 Capital expenditure (gross) €m 2,569 2,777 – 7.5 Key profitability and value creation figures EBIT margin % 5.2 3.3 1.9 pts Adjusted EBIT margin % 5.7 3.9 1.8 pts EBITDA margin 1) % 10.6 8.4 2.2 pts EACC €m 323 – 223 ROCE % 7.7 4.6 3.1 pts Lufthansa share Share price at year-end € 14.57 13.83 5.3 Earnings per share € 3.67 0.12 2,958.3 Proposed dividend per share € 0.50 – Traffic figures 2) Passengers thousands 107,679 105,991 1.6 Freight and mail thousand tonnes 1,864 1,924 – 3.1 Passenger load factor % 80.4 80.1 0.3 pts Cargo load factor % 66.3 69.9 – 3.6 pts Flights number 1,003,660 1,001,961 0.2 Employees Average number of employees number 119,559 118,973 0.5 Employees as of 31.12. -

Thy Investor Relations

TURKISH AIRLINES 1Q’19 Results Summary 1 Key Financial Data IFRS16 2017 2018 Change (USD mn) 1Q'18 1Q'19 Change Impact 10.958 12.855 17,3% Revenue 2.763 2.768 0,2% - 9.403 10.918 16,1% Passenger Revenue 2.303 2.275 -1,2% - 1.317 1.647 25,1% Cargo Revenue 386 406 5,2% - 794 1.169 47,2% Net Operating Profit / Loss 3 -203 - +9 1.022 1.191 16,5% Profit From Main Operations 41 -150 - +9 223 753 237,7% Net Income -86 -229 - -4 2,0% 5,9% 3,8 pt Net Income Margin -3,1% -8,3% -5,2 pt - 3.017 3.349 11,0% EBITDAR 528 358 -32,1% +5 27,5% 26,0% -1,5 pt EBITDAR Margin 19,1% 12,9% -6,2 pt - 2 Revenue Development (1Q’18 vs 1Q’19) (mn USD) Cargo and Other Load Factor Pax RASK Revenue (Ex- Volume Currency (Ex-Currency, Ex- Currency) -13 L/F) +51 +54 -192 +105 2.275 2.303 Passenger (%-1) Cargo (%5) 386 406 Other (%18) 74 87 ∑ 2.763 Total Revenue (%0) ∑ 2.768 1Q’18 1Q’19 3 Unit Revenue Development RASK (USc) %1,8 %10,9 6,30 6,44 6,01 5,90 5,81 5,56 1Q'18 1Q'19 1Q'19 ex-currency 2017 2018 2018 ex-currency R/Y (Usc) %5,3 %9,3 7,50 7,22 7,32 6,86 6,66 6,87 1Q'18 1Q'19 1Q'19 ex-currency 2017 2018 2018 ex-currency R/Y: Revenue Yield : Passenger Revenue / RPK (Scheduled and Unscheduled) RASK: Passenger and Cargo Revenue / ASK* (Scheduled and Unscheduled) *ASK value is adjusted for cargo operations. -

Edelweiss Presents New Aircraft Design

Press release Zurich Airport, 13 November 2015 Edelweiss presents new aircraft design In future, Edelweiss aircraft will be seen in a new design. The new look supports the leading Swiss leisure travel airline's growth course, and underscores its origins. As well as the new aircraft design, Edelweiss will also modernise the interior of its entire Airbus A320 fleet and install a Wireless Inflight Entertainment System. The Edelweiss aircraft will be seen in their new "clothes" in time for the airline's 20th anniversary. The current livery has remained the same since the company was founded. Bernd Bauer, CEO of Edelweiss: "We are proud of what we have achieved in the past, and we are taking this success with us into the future. We chose our new aircraft design to be an evolution, rather than a revolution." Familiar details such as the red noses on the aircraft will be left unchanged. The most eye-catching details are the oversized Edelweiss flower on the tail fin and the addition of the word "Switzerland" on the aircraft. "We want to clearly express our Swiss origins. We provide connections to the loveliest holiday destinations in Switzerland, and we delight people with Swiss quality. And we want our aircraft to reflect this," he adds. The first Airbus A320 in the new design will start travelling on the Edelweiss network at the end of November 2015. Wireless Inflight Entertainment System on the entire Airbus A320 fleet Over the coming months, Edelweiss will also convert all six of its Airbus A320s. They are all being given a new cabin, which will increase people's anticipation of their holiday as soon as they board. -

Aerosafety World November 2009

AeroSafety WORLD DOUSING THE FLAMES FedEx’s automatic system CRM FAILURE Black hole approach UPSET TRAINING Airplane beats simulators IASS REPORT 777 power rollback, more TRAGEDY AS INSPIRATION JAPAN Airlines’ safeTY CENTER THE JOURNAL OF FLIGHT SAFETY FOUNDATION NOVEMBER 2009 “Cessna is committed to providing the latest safety information to our customers, and that’s why we provide each new Citation owner with an FSF Aviation Department Tool Kit.” — Will Dirks, VP Flight Operations, Cessna Aircraft Co. afety tools developed through years of FSF aviation safety audits have been conveniently packaged for your flight crews and operations personnel. These tools should be on your minimum equipment list. The FSF Aviation Department Tool Kit is such a valuable resource that Cessna Aircraft Co. provides each new Citation owner with a copy. One look at the contents tells you why. Templates for flight operations, safety and emergency response manuals formatted for easy adaptation Sto your needs. Safety-management resources, including an SOPs template, CFIT risk assessment checklist and approach-and-landing risk awareness guidelines. Principles and guidelines for duty and rest schedul- ing based on NASA research. Additional bonus CDs include the Approach and Landing Accident Reduction Tool Kit; Waterproof Flight Operations (a guide to survival in water landings); Operator’sMEL Flight Safety Handbook; item Turbofan Engine Malfunction Recognition and Response; and Turboprop Engine Malfunction Recognition and Response. Here’s your all-in-one collection of flight safety tools — unbeatable value for cost. FSF member price: US$750 Nonmember price: US$1,000 Quantity discounts available! For more information, contact: Namratha Apparao, + 1 703 739-6700, ext. -

Capital Markets Day 2019

Capital Markets Day 2019 24th June 2019 Frankfurt Agenda Capital Markets Day 2019 11.00 am – 11.05 am 12.30 am – 01.30 pm 02.35 pm – 03.00 pm Welcome by Dennis Weber, Lunch Presentation Ulrik Svensson, Head of Investor Relations Chief Financial Officer 01.30 pm – 02.10 pm 11.05 am – 11.55 am Presentation Thorsten Dirks, 03.00 pm – 04.00 pm Presentation Carsten Spohr, Chief Executive Officer Eurowings Q&A Chairman of the Executive Board & Chief Executive Officer 02.10 pm – 02.35 pm 04.00 pm – 06.30 pm Presentation Dr. Detlef Kayser, First-hand Product Experience, 11.55 am – 12.30 am Chief Officer Airline Resources Simulator Experience / Cabin Training / Presentation Harry Hohmeister, & Operations Standards Product Stands / Networking Chief Commercial Officer Network Airlines 06.30 pm End of event Capital Markets Day 2019 Group Strategy Carsten Spohr, Chairman of the Executive Board and CEO 24th June 2019 Frankfurt #1 for all stakeholders – committed to drive sustainably higher returns . ROCE doubled since 2014; further improvement through the cycle . Free Cash Flow to exceed EUR 1bn medium-term Shareholders . Dividend payout increased to 20% to 40% of net income #1 #THEREISNOBETTER Customers Employees #THEREISNOBETTER WAYTOFLY PLACETOWORK CMD 2019 Group Strategy Page 2 Lufthansa Group has become a structurally more profitable company 7to1 program Key achievements Adj. EBIT margin & Adj. ROCE started 2014 Customer centricity and quality focus Lufthansa: Europe’s first 5 Star Airline New concepts 14.2% for growth Eurowings: #3 P2P carrier in Europe ~ x2 Effective and lean organization Removal of an entire management level 7.9% Innovation and Digitalization of key operational and 7.1% digitalization customer processes Culture and Performance culture: 3.9% leadership Bonus 100% linked to financials Value based steering Doubling of Adj. -

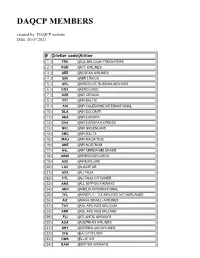

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Investor Info March 2016

Beispiel, keine realistischen Zahlen Investor Info March 2016 Lufthansa Group Month yoy (%) Cumulative yoy (%) Passengers in 1,000 8,418 +4.0 22,331 +3.6 Available seat-kilometers (m) 22,682 +6.8 62,785 +6.6 Revenue seat-kilometers (m) 17,350 +5.4 47,032 +5.2 Total Passenger load-factor (%) 76.5 -1.0pts. 74.9 -0.9pts. Lufthansa Group Available Cargo tonne-kilometers (m) 1,243 -3.8 3,425 -1.2 Airlines Revenue Cargo tonne-kilometers (m) 826 -10.5 2,264 -6.2 Cargo load-factor (%) 66.4 -5.0pts. 66.1 -3.5pts. Number of flights 82,536 +1.9 232,437 +2.8 Passengers in 1,000 4,937 +4.2 13,277 +3.1 Available seat-kilometers (m) 15,089 +6.0 41,531 +5.2 Lufthansa Passenger Revenue seat-kilometers (m) 11,537 +5.1 31,224 +4.2 Airlines Passenger load-factor (%) 76.5 -0.6pts. 75.2 -0.7pts. Number of flights 44,410 +1.7 126,188 +2.0 Passengers in 1,000 1,364 -0.6 3,698 -0.6 Available seat-kilometers (m) 4,053 +1.9 11,658 +2.1 SWISS Revenue seat-kilometers (m) 3,141 -2.9 8,848 -1.7 Passenger load-factor (%) 77.5 -3.8pts. 75.9 -2.9pts. Number of flights 13,541 +2.9 38,905 +3.3 Passengers in 1,000 819 +3.9 2,053 +3.7 Available seat-kilometers (m) 1,828 +8.7 4,926 +8.3 Austrian Airlines Revenue seat-kilometers (m) 1,341 +5.4 3,506 +5.4 Passenger load-factor (%) 73.3 -2.3pts. -

2ND INTERIM REPORT JANUARY – JUNE 2018 1 Letter from the Executive Board

2ND INTERIM REPORT January – June 2018 All Lufthansa Group airlines achieve substantial growth in the first half of 2018 | Adjusted EBIT for the Lufthansa Group of EUR 1,008m only just below prior-year period despite substantially higher fuel costs | Full-year unit revenue projection raised and earnings forecast reaffirmed: Adjusted EBIT only slightly below previous year lufthansagroup.com lufthansagroup.com/investor-relations WorldReginfo - 45d53c5c-029f-4df2-9bf9-1174bd36a5c9 Lufthansa Group KEY FIGURES LUFTHANSA GROUP Jan – Jun Jan – Jun Change Apr – Jun Apr – Jun Change 2018 2017 in % 2018 2017 in % Revenue and result Total revenue in €m 16,938 16,951 – 0.1 9,298 9,260 0.4 of which traffic revenue in €m 13,156 13,293 – 1.0 7,371 7,485 – 1.5 Adjusted EBITDA in €m 1,906 1,889 0.9 1,435 1,443 – 0.6 Adjusted EBIT in €m 1,008 1,042 – 3.3 982 1,017 – 3.4 EBIT in €m 1,010 1,031 – 2.0 983 1,015 – 3.2 Net profit / loss in €m 677 672 0.7 734 740 – 0.8 Key balance sheet and cash flow statement figures Total assets in €m 39,258 37,901 3.6 – – Equity ratio % 25.0 19.4 5.6 pts – – Net indebtedness in €m 2,554 1,139 124.2 – – Pension provisions in €m 5,418 8,127 – 33.3 – – Cash flow from operating activities in €m 3,018 3,226 – 6.4 1,393 1,578 – 11.7 Capital expenditure (gross) 1) in €m 1,927 1,397 37.9 1,213 642 88.9 Free cash flow in €m 977 2,100 – 53.5 187 1,006 – 81.4 Key profitability and value creation figures Adjusted EBITDA margin % 11.3 11.1 0.2 pts 15.4 15.6 – 0.2 pts Adjusted EBIT margin % 6.0 6.1 – 0.1 pts 10.6 11.0 – 0.4 pts EBIT margin -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

Sustainability 2019 2 INTRO

FACT SHEET ONLINE lufthansagroup.com/en/responsibility FACT SHEET FACT Sustainability 2019 Sustainability 2 INTRO The responsible and sustainable treatment of resources, the environment and society is a prerequisite for the long-term financial stability and attractiveness of the Lufthansa Group for its customers, employees, investors and partners. With its measures and concepts, the Lufthansa Group aims to strengthen the positive effects of its business activities and further reduce the negative impacts in order to consolidate its position as a leading player in the airline industry, including in the area of corporate responsibility. You will find further information, the strategic direction and targets in the non-financial declaration of the annual report 2019. ↗ investor-relations.lufthansagroup.com The Executive Board has been extended to include a position responsible for Customer & Corporate Responsibility since 1 January 2020. This will establish responsibility for environment, climate and society directly at the Executive Board level. The Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance since 2002. A Supplier Code of Conduct has supplemented the Code of Conduct, which has been binding for all corporate bodies, managers and employees since 2017. The Lufthansa Group supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015 and is concentrating on the seven SDGs 4, 5, 8, 9, 12, 13 and 17 due to the impacts of its business