12.1Bn 705M 402M

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Thy Investor Relations

TURKISH AIRLINES 1Q’19 Results Summary 1 Key Financial Data IFRS16 2017 2018 Change (USD mn) 1Q'18 1Q'19 Change Impact 10.958 12.855 17,3% Revenue 2.763 2.768 0,2% - 9.403 10.918 16,1% Passenger Revenue 2.303 2.275 -1,2% - 1.317 1.647 25,1% Cargo Revenue 386 406 5,2% - 794 1.169 47,2% Net Operating Profit / Loss 3 -203 - +9 1.022 1.191 16,5% Profit From Main Operations 41 -150 - +9 223 753 237,7% Net Income -86 -229 - -4 2,0% 5,9% 3,8 pt Net Income Margin -3,1% -8,3% -5,2 pt - 3.017 3.349 11,0% EBITDAR 528 358 -32,1% +5 27,5% 26,0% -1,5 pt EBITDAR Margin 19,1% 12,9% -6,2 pt - 2 Revenue Development (1Q’18 vs 1Q’19) (mn USD) Cargo and Other Load Factor Pax RASK Revenue (Ex- Volume Currency (Ex-Currency, Ex- Currency) -13 L/F) +51 +54 -192 +105 2.275 2.303 Passenger (%-1) Cargo (%5) 386 406 Other (%18) 74 87 ∑ 2.763 Total Revenue (%0) ∑ 2.768 1Q’18 1Q’19 3 Unit Revenue Development RASK (USc) %1,8 %10,9 6,30 6,44 6,01 5,90 5,81 5,56 1Q'18 1Q'19 1Q'19 ex-currency 2017 2018 2018 ex-currency R/Y (Usc) %5,3 %9,3 7,50 7,22 7,32 6,86 6,66 6,87 1Q'18 1Q'19 1Q'19 ex-currency 2017 2018 2018 ex-currency R/Y: Revenue Yield : Passenger Revenue / RPK (Scheduled and Unscheduled) RASK: Passenger and Cargo Revenue / ASK* (Scheduled and Unscheduled) *ASK value is adjusted for cargo operations. -

Aerosafety World November 2009

AeroSafety WORLD DOUSING THE FLAMES FedEx’s automatic system CRM FAILURE Black hole approach UPSET TRAINING Airplane beats simulators IASS REPORT 777 power rollback, more TRAGEDY AS INSPIRATION JAPAN Airlines’ safeTY CENTER THE JOURNAL OF FLIGHT SAFETY FOUNDATION NOVEMBER 2009 “Cessna is committed to providing the latest safety information to our customers, and that’s why we provide each new Citation owner with an FSF Aviation Department Tool Kit.” — Will Dirks, VP Flight Operations, Cessna Aircraft Co. afety tools developed through years of FSF aviation safety audits have been conveniently packaged for your flight crews and operations personnel. These tools should be on your minimum equipment list. The FSF Aviation Department Tool Kit is such a valuable resource that Cessna Aircraft Co. provides each new Citation owner with a copy. One look at the contents tells you why. Templates for flight operations, safety and emergency response manuals formatted for easy adaptation Sto your needs. Safety-management resources, including an SOPs template, CFIT risk assessment checklist and approach-and-landing risk awareness guidelines. Principles and guidelines for duty and rest schedul- ing based on NASA research. Additional bonus CDs include the Approach and Landing Accident Reduction Tool Kit; Waterproof Flight Operations (a guide to survival in water landings); Operator’sMEL Flight Safety Handbook; item Turbofan Engine Malfunction Recognition and Response; and Turboprop Engine Malfunction Recognition and Response. Here’s your all-in-one collection of flight safety tools — unbeatable value for cost. FSF member price: US$750 Nonmember price: US$1,000 Quantity discounts available! For more information, contact: Namratha Apparao, + 1 703 739-6700, ext. -

General Purchasing Conditions

Lufthansa Aviation Training Group General Purchasing Conditions 1. Scope 3.2 Delivery dates and particulars of delivery times are binding. For legal relations related to all ordered goods, work and Adherence to the delivery date or the delivery time depends services between the supplier and Lufthansa Aviation Training crucially on the receipt of the goods at LAT. If the contractual Group consisting of service involves the manufacture, erection or assembly of a Lufthansa Aviation Training GmbH work, its acceptance shall be crucial. The supplier shall notify Lufthansa Aviation Training Germany GmbH LAT at once of any foreseeable delay in deliveries. Partial Lufthansa Aviation Training Berlin GmbH deliveries and premature deliveries shall be subject to prior Lufthansa Aviation Training Operations Germany GmbH review with LAT. Lufthansa Aviation Training Crew Academy GmbH 3.3 In the event that the supplier defaults, LAT shall be entitled Lufthansa Aviation Training Pilot Academy GmbH to the full rights set forth in the provisions of statute. If the Lufthansa Aviation Training Austria GmbH contractor is in default with adherence to a contractually agreed delivery date, it shall pay the client a contractual (“LAT”), exclusively these General Purchasing Conditions shall penalty amounting to 0.2% of the net order sum, though max apply. These Conditions may be supplemented by additional 5.0% of the net order sum, for each working day that culpably agreements covering specific orders. Any amendments and exceeds the delivery supplements hereto shall be in writing to be effective. Contrary date. The assertion of claims going beyond this by the client is general business conditions shall not apply even if they are not not excluded; the forfeited contractual penalty shall be offset expressly rejected in a specific case. -

Sustainability 2019 2 INTRO

FACT SHEET ONLINE lufthansagroup.com/en/responsibility FACT SHEET FACT Sustainability 2019 Sustainability 2 INTRO The responsible and sustainable treatment of resources, the environment and society is a prerequisite for the long-term financial stability and attractiveness of the Lufthansa Group for its customers, employees, investors and partners. With its measures and concepts, the Lufthansa Group aims to strengthen the positive effects of its business activities and further reduce the negative impacts in order to consolidate its position as a leading player in the airline industry, including in the area of corporate responsibility. You will find further information, the strategic direction and targets in the non-financial declaration of the annual report 2019. ↗ investor-relations.lufthansagroup.com The Executive Board has been extended to include a position responsible for Customer & Corporate Responsibility since 1 January 2020. This will establish responsibility for environment, climate and society directly at the Executive Board level. The Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance since 2002. A Supplier Code of Conduct has supplemented the Code of Conduct, which has been binding for all corporate bodies, managers and employees since 2017. The Lufthansa Group supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015 and is concentrating on the seven SDGs 4, 5, 8, 9, 12, 13 and 17 due to the impacts of its business -

Thesis Supervisor Rtmaan, Graduate Program Committee

Privatization in Germany: The Case of Lufthansa by Mark R. Hutchinson B.S., Political Science Boston College, 1992 Submitted to the Department of Political Science in Partial Fulfillment cl the Requirements for the Degree of MASTER OF SCIENCE in Political Science at the Massachusetts Institute of Technology June 1995 1995 Mark R. Hutchinson All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or ip part. Signature of Author . I V Department of Political Vieke, M-ay 10, 1995 Certified by . Richard M. Locke Associate Professor of Industrial Relations and Political Science Department of Political Science Thesis Supervisor Accepted by . MASSACHUSURIL6 Barry -Posen RTMAan,Graduate Program Committee JUN 2 1995 ,%KL;HIVES 2 Privatization in Germany: The Case of Lufthansa by Mark R. Hutchinson Submitted to the Department of Political Science on May 10, 1995 in partial fulfillment of the requirements for the Degree of Master of Science in Political Science ABSTRACT Privatization has been adopted by both advanced anddeveloping states for a range of reasons. Principle theories of privatization focus on the role of economic heory, budgetary needs, ideology, party political motives to divide social democratic movements, and internationalization as the driving force behind privatization. The case of the privatization of Lufthansa is examined to test these various theories to determine which forces are most important in Germany. The case study, based on primary and secondary sources, as well as extensive interviews with corporate and union officials, indicates that a combination of budgetary crisis (due to the costs of unification) and increasing competition in the global airline industry led to the privatization of Lufthansa. -

Deutsche Lufthansa AG (DLAKY.PK)

EDITION: U.S. SIGN IN REGISTER Search News & Quotes HOME BUSINESS MARKET S WORLD POLIT ICS T ECH OPINION BREAKINGVIEWS MONEY LIFE PICT URES VIDEO Profile: Deutsche Lufthansa AG (DLAKY.PK) Related Topics: ST OCKS ST OCK SCREENER INDUST RIALS AIRLINES OVERVIEW NEWS KEY DEVELOPMENT S PEOPLE CHART S FINANCIALS ANALYST S RESEARCH PULSE DLAKY.PK o n OT C Price Change (% chg) Prev Close Day's High Volume 52-wk High Market s Gro up $17.61 $17.76 7,698 $27.89 $0.15 (+0.85%) 17.76USD Open Day's Low Avg. Vol 52-wk Low 5 Sep 20 14 $17.70 $17.68 36,072 $16.27 SEARCH ST OCKS Ent er co mpany name o r Symbo l FULL DESCRIPT ION Deutsche Lufthansa AG is an aviation company with global operations and a total of more than 400 subsidiaries and associated companies. The Company is engaged in passenger transport, airfreight and airline services. The Lufthansa Group operates in five major business segments: scheduled passenger air traffic (Passenger Airline Group) consists of Deutsche Lufthansa AG, Lufthansa CityLine GmbH, Swiss International Air Lines AG, Austrian Airlines AG, Air Dolomiti S.p.A., Eurowings Luftverkehrs AG and Germanwings GmbH; scheduled airfreight services (Logistics) consists of the Lufthansa Cargo group; maintenance, repair and overhaul (MRO) consists of the Lufthansa Technik group; information technology (IT Services) consists of the Lufthansa Systems group, and catering (Catering) consists of the LSG Lufthansa Sky Chefs group. On April 20, 2012, the Company announced the divestiture of British Midland Ltd. (bmi) to International Consolidated Airlines Group COMPANY ADDRESS SA. -

Seiner Exzellenz Herrn Heiko Maas Bundesminister Des Auswärtigen - Werderscher Markt 1D-11017 Berlin

EUROPEAN COMMISSION Brussels, 25.6.2020 C(2020) 4372 final In the published version of this decision, PUBLIC VERSION some information has been omitted, pursuant to articles 30 and 31 of Council This document is made available for Regulation (EU) 2015/1589 of 13 July 2015 information purposes only. laying down detailed rules for the application of Article 108 of the Treaty on the Functioning of the European Union, concerning non-disclosure of information covered by professional secrecy. The omissions are shown thus […] Subject: State Aid SA.57153 (2020/N) – Germany – COVID-19 - Aid to Lufthansa Excellency, 1 PROCEDURE (1) Following pre-notification contacts,1 by electronic notification of 12 June 2020, Germany notified aid in the form of a recapitalisation of Deutsche Lufthansa AG (“DLH”) (“the Measure”). DLH is the parent company of Lufthansa Group (“LH Group”), which comprises, among others, the airlines Brussels Airlines 1 The German authorities informed the Commission of the planned recapitalisation on 27 April 2020; on 1 May 2020 the German authorities submitted a first draft term sheet. This draft and its further amendments (shared by the German authorities with the Commission services on 6 , 24, 25, 27 and 29 May 2020) were discussed between the German authorities and the Commission services in the context of several calls and written exchanges, including requests for information of 28 and 30 April 2020, 2, 3, 10, 11, 13 and 18 May 2020, to which the German authorities replied on 29 and 30 April 2020, 1, 7, 12, 17 and 20 May 2020, 8, 9 and 11 June 2020. -

Press Release

Press release All Lufthansa Group airlines to use Lufthansa Systems solutions for navigation Ten-year contract signed for Lido/RouteManual, Lido/mPilot, Lido/eRouteManual, Lido/AMDB, Lido/AMM and DVMS navigation solutions Raunheim, November 27, 2018 – Lufthansa Systems today announced that all airlines in the Lufthansa Group will use its entire portfolio of navigation solutions over the next ten years. This includes the Lido/mPilot and Lido/eRouteManual electronic map solutions based on the Lido/RouteManual paper maps, the dynamic Lido/AMM airport moving map with the high-precision Lido/AMDB airport mapping database, and a solution for document management (DVMS). “As the process owner, we sat down with our Lufthansa Systems colleagues very early on and constructively fleshed out the arrangement that now benefits all of us,” said Robert Nyenhuis, Vice President Flight Operations Standards & Projects Lufthansa Group Airlines. Many airlines in the Lufthansa Group were already using the Lido/eRouteManual electronic navigation maps. The different individual contracts with these airlines have now been harmonized. Lufthansa Aviation Training will also employ the electronic navigation maps in the future so that pilots in training can use the same solution they will later find on the flight deck. This harmonization will reduce both administrative effort and costs. Up until now, only Lufthansa Passage pilots have benefited from the high-precision Lido/AMDB data. A master agreement for Lido/AMDB now offers other companies the opportunity to use the product as well. “Despite the airlines’ different needs, we were able to quickly find solutions based on pragmatic, constructive collaboration,” said Dr. Bernd Jurisch, Head of Flight & Navigation Products & Solutions at Lufthansa Systems. -

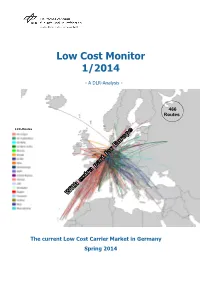

Low Cost Monitor 1/2014

Translation DE -> EN Low Cost Monitor 1/2014 - A DLR-Analysis - 466 Routes LCC-Routes The current Low Cost Carrier Market in Germany Spring 2014 Current Low Cost Carrier Market in Germany in 2013/2014 The Low Cost Carrier (LCC) market has been an inherent part of the German air transport market. The Low Cost Monitor published by DLR informs twice a year on key features of low cost carrier traffic and current developments in this market segment. These are in particular the number and relative importance of low cost carriers and their supply, including air fares, and passenger demand for low cost transport services. The description of the low cost supply in the current monitor is based on a reference week in the winter timetable 2014. Passenger data refer to the year 2013. Airlines Airlines involved in the low cost business design their offer quite differently. Due to this inhomogeneity only a few distinctive criteria can be defined for the low cost market segment, such as low fares, their general availability and direct sale via the internet. Thus, in some cases, a certain scope of discretion arises when allocating an airline to the LCC segment. Furthermore, amalgamations of business models are seen in several airlines that further complicate the accurate assignment to the low cost market segment. For this issue of the Monitor the authors classify currently a number of 19 airlines (among all airlines operating on German airports) that offer entirely or predominantly low cost offers. These are in detail (s. also Tab. 1): Aer Lingus (EI) -

Business Model Changes of an Incumbent Player in the European Airline Industry a Case of the Lufthansa Group

Business Model Changes of an Incumbent Player in the European Airline Industry A Case of the Lufthansa Group Author: Julian Dombrowski University of Twente P.O. Box 217, 7500AE Enschede The Netherlands [email protected] ABSTRACT The purpose of this paper is to investigate in how far influencing environmental factors have caused developments and adaptions to a dominant incumbent player of the European airline industry in the last decade. As a representative for these various incumbents the Lufthansa Group with its flagship airline Lufthansa has been chosen as a unit of analysis. Developments within the group were analyzed by using Osterwalder’s business model canvas framework. Subsequently, these developments were not only reported but also put into context of macro- environmental and competitive forces that may have caused them in the first place. The data and information have been gathered via a desk research approach, analyzing majorly annual reports, press releases and newspaper articles of influential papers. Results from the research indicate that the Lufthansa Group made majorly small-scale, incremental adaptions to its practices over the last decade that may have been caused by social, economical and technological forces in the macro- environment, as well as by competition of low-cost entrants in the European short-haul market. A drastic revolution in their business model has just emerged within the last couple of years, when a restructuring of the group started. The key development, is the decision to move most short-haul operations to the low-cost subsidiary Germanwings, having Lufthansa’s focus on the medium-and long-haul market. -

Company Name Job Title AAR Corp Syst

Company Name Job Title AAR Corp Syst. Prog. Analyst AAR Corp Manager IT ACT Airlines IT Director ACT Airlines Deputy IT Manager ACT Airlines software engineer ADSoftware Sales Director ADT-Wings Software Professional Services Director ADT-Wings Software Wings Mobility Solutions Aer Lingus Engineering Data Services Manager Aer Lingus Avionic Engineer Aerogility COO Aerogility Consultant Aerogility Consultant Aerosoft Systems President & CEO Aerosoft Systems Vice President, Product Management, Support & Implementation Aerosoft Systems Director Systems and Technologies Afriqiyah Airways IOSA Program Manager Afriqiyah Airways Pilot rated A320 & flight safety officer Afriqiyah Airways Flight safety engineer Afriqiyah Airways Aircraft Maintenance Engineer Air Atlanta Icelandic Manager Flight Dispatch & Performance Air Europa IT Project Manager Air Europa Research & Innovation Engineer Air Europa Continuous Improvement, Innovation & Transformation Manager Air Europa IFEC Engineer Air Europa Research & Innovation Engineer Air Europa Planning Engineer Air Europa Continuous Improvement, Innovation & Transformation Engineer Air Europa Quality Engineer Air Europa IT Corporate Manager Air France Program Manager Air France Project Manager Flight Operations Support. Air France Business Analyst at Air France Air France Project Manager - Innovation, New Technologies and Materials Air France – KLM Group IT Project Manager Air France KLM Group Data Scientist Air France KLM Group Predictive maintenance Expert Air France KLM Group Group Manager E&M IT Architecture