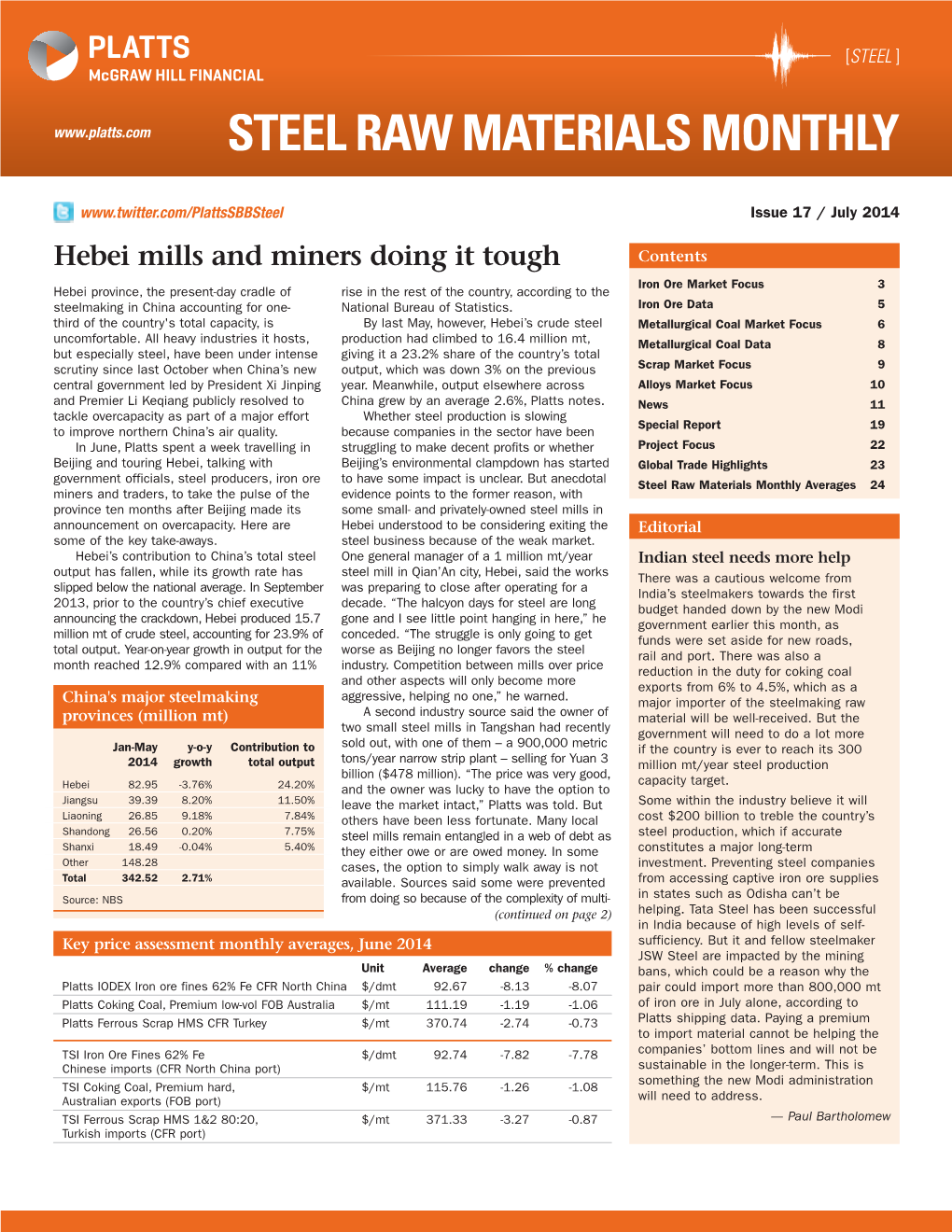

Steel Raw Materials Monthly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rutila Resources Ltd ASX

Rutila Resources Ltd ASX : RTA For personal use only Investor Presentation 27 November 2013 Rutila Resources Ltd – Disclaimer This Presentation has been prepared by Rutila Resources Ltd (ABN 139 886 187) (Rutila or the Company). This Presentation contains summary information about Rutila and its subsidiaries (Rutila Group) and their activities current as at the date of this Presentation. The information in this Presentation is of general background and does not purport to be complete or to comprise all the information that a shareholder or potential investor in Rutila may require in order to determine whether to deal in Rutila shares. It should be read in conjunction with Rutila Group’s other periodic and continuous disclosure announcements lodged with the Australian Securities Exchange (ASX), which are available at www.asx.com.au. This document is not a prospectus or a product disclosure statement under the Corporations Act (Cth) 2001 (Corporations Act) and has not been lodged with the Australian Securities and Investments Commission (ASIC). Not investment or financial product advice This Presentation is for information purposes only and is not financial product or investment advice or a recommendation to acquire Rutila shares and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and seek financial, legal and taxation advice appropriate to their jurisdiction. Rutila is not licensed to provide financial product advice in respect of Rutila shares. Cooling off rights do not apply to the acquisition of Rutila shares. -

Integrated Rail Network Closure Plan

Report Integrated Rail Network Closure Plan Long Term Mine Planning 7 June 2018 R-PL-EN-0041 Rev 0 CLOSURE GUIDELINE CHECKLIST Report This closure plan addresses the progressive rehabilitation and closure of rail infrastructure projects associated with the Railway and Port (The Pilbara Infrastructure Pty Ltd) Agreement Act 2004. In the absence of regulatory guidelines for inland infrastructure projects, this closure plan follows the report structure described within the Guidelines for Preparing Mine Closure Plans May 2015 published by the Government of Western Australia Department of Mines and Petroleum (now the Department of Mines, Industry Regulation and Safety) and Environmental Protection Authority. The closure of mining operations, including quarries, is not within the scope of this closure plan. Closure Plan (CP) checklist Y/N Page Comments 1 Has the Checklist been endorsed by a senior Y 2 Report has been endorsed using representative within the tenement holder/operating standard Fortescue processes. company? Public Availability 2 Are you aware that from 2015 all CPs will be made N/A This report is not subject to mine closure publicly available? conditions under the Mining Act. 3 Is there any information in the CP that should not be N publicly available? 4 If “Yes” to Q3, has confidential information been N/A submitted in a separate document/section? Cover Page, Table of Contents 5 Does the CP cover page include: Y 1 This report is provided for information • Project Title only. • Company Name • Contact Details (including telephone numbers and email addresses) • Document ID and version number • Date of submission (needs to match the date of this checklist) Scope and Purpose 6 State why the CP is submitted Y 11 This plan has been provided to support the Eliwana Rail Project Public Environmental Review. -

Application for Declaration of the Mt Newman Railway, FMG Response To

FORTESCUE METALS GROUP LIMITED RESPONSE DATED 6 MAY 2005 IN RESPONSE TO THE ISSUES PAPER RELEASED BY THE NATIONAL COMPETITION COUNCIL DATED 11 MARCH 2005 2 RESPONSE BY FORTESCUE METALS GROUP LIMITED TO THE ISSUES PAPER RELEASED BY THE NATIONAL COMPETITION COUNCIL DATED 11 MARCH 2005 1. INTRODUCTION 1.1 Fortescue Metals Group Limited (“Fortescue”) refers to: (1) Fortescue’s Application under Part IIIA of the Trade Practices Act for Declaration of the service provided by BHP Billiton Iron Ore Pty Ltd dated 11 June 2004 (“Declaration Application”); (2) Fortescue’s Supplementary Submissions dated 8 July 2004 (“Supplementary Submissions”); and (3) Fortescue’s Submissions dated 4 October 2004 (“Preliminary Issues Paper Submissions”). 1.2 Fortescue also refers to the Issues Paper dated 11 March 2005 issued by the National Competition Council (“NCC”). In its Issues Paper, the NCC sought comments on what it considered to be the principal issues in considering Fortescue’s Declaration Application for declaration of the Service (described as the use of that part of the Mount Newman railway line specified in Fortescue’s Declaration Application). 1.3 Specifically, the NCC sought comments on the following questions: What is an appropriate duration for declaration of the Mount Newman Railway Service and why? Are there any reasonably foreseeable factors which may materially affect the NCC’s assessment of Fortescue’s Application for declaration? What is the time frame for the realization of such factors? 1.4 The NCC cannot recommend that a service be declared unless it believes all the criteria set out in section 44G(2) of the Trade Practices Act have been satisfied. -

Gresham Mining & Infrastructure Services Quarterly

Gresham Mining & Infrastructure Services Quarterly We are pleased to present Edition 25 of the Gresham Mining and Infrastructure Services Quarterly (GMISQ), a snapshot of the performance, news and trends across the resources and infrastructure services sectors. The Gresham Mining and Infrastructure Services Index (GMISI) rose 7% during the December 2019 quarter, while the broader equity market finished flat over the period. The index appreciation was driven by the GMISI’s larger constituents, with 18 of the top 25 companies by market capitalisation posting share price increases. In contrast, 18 of the lower 25 companies went backwards during the quarter. The index has softened in the opening weeks of 2020, following the announcement of operating issues at several companies and concerns around the potential impact of the coronavirus on resources activity. At the end of the December quarter, the sector’s median FY20 EV/EBIT and EV/EBITDA multiples were 8.8x and 5.6x respectively, both above long term averages. While equity markets were generally strong over 2019, IPO activity remained subdued, as a number of potential new listings in the sector were withdrawn or deferred late in the quarter. However, it was a busy period for M&A, with major announced transactions including Ventia’s acquisition of Broadspectrum, the sale of Lendlease’s Engineering business to Acciona and NRW’s purchase of BGC Contracting. In this edition we take a snapshot of some highlights from 2019, including corporate transactions and the biggest movers in the index. The data shows that the largest share price changes were primarily observed in small-caps that have reported material earnings changes. -

1301986159-FDI Strategic Weekly Analysis

5 April 2011 | Vol. 2, № 12. From the Editor’s Desk Dear FDI supporters, Once again FDI’s Indian Ocean Research World Bank funding for water management in programme held a roundtable in Perth. It Indonesia while Jesse Pillay investigates considered “China’s Role in the Indian Ocean” Indonesia’s naval expansion. and was an important step in progressing the programmes research in to future scenarios in In the past week FDI welcomed the latest the Indian Ocean. In the next two weeks similar addition to our internship programme. University of WA student, Annika Aitken, is roundtables will be held in Sydney and assisting research manager Leighton Luke in Canberra. the Indian Ocean Research Programme. Roundtables form a fundamental part of the research that is carried out by FDI and we are Keep an eye out in the coming days for the Strategic Analysis Paper which provides a really thankful for the ongoing support we get from Associates in Australia and internationally summary of the recent FDI Global Land in making this a success. We believe that it Availability roundtable as well as a fascinating study on water surplus countries. Another provides FDI with a unique research edge. paper, due for release in the next few days will In this issue of the Strategic Weekly Analysis consider Pilbara Prospects. we get a first taste into what we can look forward to from our new strategic analyst Liam If you know of anyone that will benefit from McHugh. He considers a decision by Hancock our research or who should be considered as an FDI Associate, please give the FDI office a Prospecting to allow third party access to its rail network and what it will mean for smaller call on +61(08) 9486 1046 or email miners. -

Goldsworthy Railway

Goldsworthy Railway Application for declaration of a service provided by the Goldsworthy Railway under section 44F(1) of the Trade Practices Act 1974 Final Recommendation 29 August 2008 Table of Contents Abbreviations and glossary of terms ............................................................................... 7 1 Council processes and final recommendation ............................................................. 13 Final recommendation ............................................................................................................ 15 2 The application .......................................................................................................... 16 The application and applicant................................................................................................. 16 The service sought to be declared .......................................................................................... 16 The facility ............................................................................................................................... 17 The service provider ............................................................................................................... 18 The decision maker ................................................................................................................. 18 Other Pilbara railway applications .......................................................................................... 19 Issues regarding the application ............................................................................................ -

View Annual Report

[ 2 ANNUAL REPORT 2012 ANNUAL FORTESCUE METALS GROUP FORTESCUE METALS 4 Chairman’s Statement 48 Remuneration Report 6 Chief Executive Officer’s 65 Auditor’s Independence Statement Declaration 8 Operations Report 66 Financial Statements 10 Reserves and Resources 113 Directors’ Declaration 2 Report 114 Independent Auditor’s 12 Corporate Social Report to the Members Responsibility 117 Shareholder Information 28 Corporate Governance 118 Tenement Report 38 Financial Report 123 Corporate Directory 39 Directors’ Report ANNUAL REPORT 2012 ANNUAL FORTESCUE METALS GROUP FORTESCUE METALS 3 3 CHAIRMAN’S STATEMENT who has left Fortescue for their invaluable contribution. Whenever the opportunity arises you will always be welcome back and, in any event, I trust that your time with us helps spring board your future career. It has been a challenging year in many other ways. With the 4 complex and competitive rigours of construction happening right inside complex operations, our teams have still thrived and complemented each other. In true It has been an honour to Fortescue spirit, the Cloudbreak and Christmas Creek teams chair your company over recovered from two cyclones that the last 12 months as we closed the Port Hedland port in the have built our massive iron March quarter, to still deliver mined The heaviest haul volumes of 19.2 million tonnes in railway in the world. ore presence. Allow me the June quarter, up 41 per cent ANNUAL REPORT 2012 ANNUAL some observations on how from the prior period. During the June quarter we also gathered our customers view us. in Port Hedland to celebrate the of dollars in royalties, taxes and opening of our third berth at Herb government fees. -

Public Competition Assessment 19 December 2005

Public Competition Assessment 19 December 2005 RIO TINTO - PROPOSED ACQUISITION OF A 50% INTEREST IN THE HOPE DOWNS IRON ORE PROJECT INTRODUCTION 1. On 10 November 2005, the Australian Competition and Consumer Commission (the ACCC) announced that it had decided that the proposal by Hamersley WA Pty Ltd (Hamersley), a wholly owned subsidiary of Rio Tinto Ltd (Rio Tinto), to acquire a 50% interest in the Hope Downs Iron Ore project (the Hope Downs Project) would not have the effect, or be likely to have the effect, of substantially lessening competition in the relevant markets in contravention of section 50 of the Trade Practices Act 1974 (the Act). 2. The ACCC made its decision on the basis of the information provided by the parties and information arising from its market inquiries. This Public Competition Assessment outlines the basis on which the ACCC has reached its decision on the proposed transaction, subject to confidentiality considerations. PUBLIC COMPETITION ASSESSMENTS 3. To provide an enhanced level of transparency and procedural fairness in its decision making process, the ACCC issues a Public Competition Assessment for all transaction proposals where: a merger is rejected; a merger is subject to enforceable undertakings; the merger parties seek such disclosure; or a merger is approved but raises important issues that the ACCC considers should be made public. 4. This Public Competition Assessment has been issued because the proposed acquisition by Hamersley, a wholly owned subsidiary of Rio Tinto, of a 50% interest in the Hope Downs Project raises important issues relating to the role of key transport infrastructure as a barrier to entry in the iron ore industry. -

Fortescue Marsh Management Strategy 2018-2024 Sept 2018

Fortescue Marsh Management Strategy 2018–24 GOVERNMENT OF WESTERN AUSTRALIA Department of Biodiversity, Conservation and Attractions Lot 3 Anderson Road Karratha Industrial Estate KARRATHA WA 6714 Phone (08) 9182 2000 dbca.wa.gov.au © State of Western Australia 2018 This work is copyright. All content in this strategy may be downloaded, displayed, printed and reproduced in unaltered form for personal use, non-commercial use or use within your organisation. Apart from any use as permitted under the Copyright Act, all other rights are reserved. Requests and enquiries concerning reproduction and rights should be addressed to the Department of Biodiversity, Conservation and Attractions. This management strategy was prepared by the Department of Biodiversity, Conservation and Attractions. Questions regarding this strategy should be directed to: Pilbara Region Parks and Wildlife Service Department of Biodiversity, Conservation and Attractions Lot 3 Anderson Road Karratha Industrial Estate KARRATHA WA 6714 Phone: (08) 9182 2000 The recommended reference for this publication is: Department of Biodiversity, Conservation and Attractions, 2018, Fortescue Marsh Management Strategy, 2018–24, Department of Biodiversity, Conservation and Attractions, Karratha. This document is available in alternative formats on request. Cover (main) Fortescue Marsh. Photo – Steve Dillon/DBCA Inset cover (left to right): Perentie. Photo – Hamish Robertson/DBCA. Tecticornia medusa. Photo – Kevin Thiele/DBCA. Yellow-billed spoonbill. Photo – Adrienne Markey/DBCA Back cover Coondiner Pool. Photo – Hamish Robertson/DBCA Executive Summary The Fortescue Marsh (the Marsh) is the largest and most important wetland in the Pilbara region, located on the Fortescue River north of Newman in Western Australia (WA). This management strategy covers 180,000 hectares of unallocated Crown land (UCL), excised from four pastoral leases in 2015 and encompassing most of the Marsh Land System (the strategy area). -

Eliwana Railway Project

Report and recommendations of the Environmental Protection Authority Eliwana Railway Project Fortescue Metals Group Limited Report 1633 April 2019 Environmental impact assessment process timelines Date Progress stages Time (weeks) 21/08/17 EPA decides to assess – level of assessment set 21/12/17 EPA approved Environmental Scoping Document 18 08/08/18 EPA accepted Environmental Review Document 33 27/08/18 Environmental Review Document released for public 3 review 25/09/18 Public review period for Environmental Review Document 4 closed 05/11/18 Supplementary public review period for Native Title 6 Holders closed 15/02/19 EPA accepted Proponent Response to Submissions 15 18/02/19 EPA received final information for assessment 1 21/03/19 EPA completed its assessment 5 24/04/19 EPA provided report to the Minister for Environment 5 29/04/19 EPA report published 3 days 13/05/19 Close of appeals period 2 Timelines for an assessment may vary according to the complexity of the proposal and are usually agreed with the proponent soon after the EPA decides to assess the proposal and records the level of assessment. In this case, the Environmental Protection Authority met its timeline objective to complete its assessment and provide a report to the Minister. Dr Tom Hatton Chairman 16 April 2019 ISSN 1836-0483 (Print) ISSN 1836-0491 (Online) Assessment No. 2129 Fortescue Metals Group Limited Contents Page Executive Summary ................................................................................................. 5 1. Introduction ....................................................................................................... 6 1.1 EPA procedures ......................................................................................... 6 1.2 Assessment on behalf of Commonwealth .................................................. 6 2. The proposal ..................................................................................................... 7 2.1 Proposal summary ..................................................................................... 7 3. -

EPBC Act Referral) • Construction of the Frederick Rail Spur Including Bulk Earthworks (Embankment) and Rail Formation

Submission #2604 - Eliwana Railway Project Title of Proposal - Eliwana Railway Project Section 1 - Summary of your proposed action Provide a summary of your proposed action, including any consultations undertaken. 1.1 Project Industry Type Mining 1.2 Provide a detailed description of the proposed action, including all proposed activities. Fortescue Metals Group Ltd (Fortescue) is proposing to develop the Eliwana Railway Project (the Project) in the Pilbara region of Western Australia. Fortescue currently owns and operates a number of mining and infrastructure projects in the Pilbara; including the Cloudbreak, Solomon and Christmas Creek iron ore mines along with the Fortescue rail network and the Anderson Point port facility. The Project comprises the construction of the Eliwana Railway: a 120 km railway corridor linking the Proposed Eliwana Iron Ore Mine (the subject of a separate referral) with the existing Fortescue rail network. While preliminary planning for the location of these components and associated infrastructure has been undertaken, detailed design of the Eliwana Railway Project is still underway. To accommodate refinements in Project layout during the design process, the Project area has been defined through the use of a development envelope. Fortescue proposes clearing of up to 3,960 ha of native vegetation from within the 57,000 ha Rail Development Envelope. As a component of the referred Project, approximately 1,500 ha of disturbance will be rehabilitated following the completion of construction activities. Proposed infrastructure -

Best in Class: Australia's Bulk Commodity Giants

Best in Class: Australia’s Bulk Commodity Giants AUSTRALIAN IRON ORE: When Quality Meets Opportunity minerals.org.au Author: Dr Allon Brent Disclaimer Allon is the Principal of Global Minerals Marketing, having founded the In preparing this report, the author has sourced and relied upon consultancy after retiring as iron ore Marketing Manager from BHP in third party information. This information has been assumed to be 2016. He has over 35 years experience in the international minerals correct by the author and has not been independently verified. and metallurgical industries, having held senior management roles in While the author has used best endeavours in preparing this report, Marketing, Technology/R&D, Business Development and Operations. conclusions which are dependent on the third party information are As Iron Ore Marketing Manager for BHP, Allon played a leading role not warranted or guaranteed. in the development and implementation of marketing strategies for This report was commissioned by the Minerals Council of Australia BHP’s US$25 billion Iron Ore growth projects between 2005 and 2016. (MCA). The fee payable by the MCA was not contingent on the He has international experience in Africa, North and South America, outcome of the report. Europe, Australia and Asia. The author accepts no liability or responsibility whatsoever in respect of any use of, or reliance upon this report by any third party. 2 Best in Class: Australia’s Bulk Commodity Giants Australia is truly in a unique position on iron ore – not only does it have proximity to the largest and fastest growing markets, but it is also endowed with vast, low cost, high quality iron ore resources.