View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEGISLATIVE COUNCIL Question on Notice

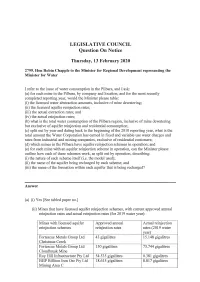

LEGISLATIVE COUNCIL Question On Notice Thursday, 13 February 2020 2799. Hon Robin Chappie to the Minister for Re ional Development representing the Minister for Water I refer to the issue of water consumption in the Pilbara, and I ask: (a) for each mine in the Pilbara, by company and location, and for the most recently completed reporting year, would the Minister please table: (i) the licensed water abstraction amounts, inclusive of mine dewatering; (ii) the licensed aquifer reinjection rates; (iii) the actual e traction rates; and (i ) the actual reinjection rates; (b) what is the total water consumption of the Pilbara region, inclusive of mine dewatering but exclusive of aquifer reinjection and residential consumption; (c) split out by year and dating back to the beginning of the 2010 reporting year, what is the total amount the Water Corporation has earned in fixed and variable use water charges and rates from industrial and mining companies, exclusi e of residential customers; (d) which mines in the Pilbara have aquifer reinjection schemes in operation; and (e) for each ine with an aquifer reinjection scheme in operation, can the Minister please outline how each of these schemes work, as split out by operation, describing: (i) the nature of each scheme itself (i.e. the model used); (ii) the name of the aquifer being recharged by each scheme; and (iii) the name of the formation within each aquifer that is being recharged? Answer (a) (i) Yes [See tabled paper no.] (ii) Mines that have licensed aquifer reinjection schemes, with current -

Welcome to Cloudbreak

Welcome to Cloudbreak This booklet provides you with the information needed to help make your stay at Cloudbreak more pleasant. Please take the time to read through the information before arriving on site. FEBRUARY 2009 Table of Contents Welcome Message ........................................................................................... 1 Foreword ..................................................................................................... 1 PART ONE: Before you depart ......................................................................... 2 The Pilbara ....................................................................................................... 3 Fortescue Metals Group Limited ...................................................................... 3 Cloudbreak....................................................................................................... 3 Packed and ready to go .................................................................................... 4 At the departure lounge ............................................................................... 4 Parking at Perth Airport ............................................................................... 5 Staying in touch ............................................................................................... 5 On Arrival ......................................................................................................... 5 At the Airstrip .............................................................................................. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Annual Report (2020)

For personal use only TERRACOM LIMITED 2020 ANNUAL REPORT Contents SECTION 1: COMPANY OVERVIEW 2 Chairman’s letter to shareholders 3 Directors 4 Management team 6 Company information 7 Current operations and project structure 8 Operations overview 9 Current mining tenements held 10 SECTION 2: COMPANY UPDATE 11 Operational summary 12 Production overview 13 Financial overview 14 Operational performance 15 SECTION 3: COMPANY OPERATIONS AND PROJECTS 16 Australia Operations and Projects 17 South Africa Operations and Projects 22 SECTION 4: JORC RESOURCES AND RESERVES STATEMENT 31 SECTION 5: FINANCIAL REPORT 39 Director’s Report 41 Auditors Independence Declaration 64 Statement of profit or loss 66 Statement of other comprehensive income 67 Statement of financial position 68 Corporate Directory Statement of changes in equity 70 Statement of cash flows 72 PEOPLE Notes to financial statements 77 Directors Wallace King AO Directors declaration 133 Craig Ransley Glen Lewis Independent Auditor’s Report 134 Shane Kyriakou SECTION 6: ASX ADDITIONAL SHAREHOLDER INFORMATION 141 Craig Lyons Matthew Hunter Additional shareholder information for listed public companies 142 Company Secretary Megan Etcell Chief Executive Officer Danny McCarthy Chief Commercial Officer Nathan Boom Download Chief Financial Officer Celeste van Tonder Scan the QR code to download CORPORATE INFORMATION a PDF of the 2020 TerraCom Registered Office Blair Athol Mine Access Road Limited Annual Report. Clermont, Queensland, 4721 Australia Telephone: +61 7 4983 2038 Contact Address -

Rutila Resources Ltd ASX

Rutila Resources Ltd ASX : RTA For personal use only Investor Presentation 27 November 2013 Rutila Resources Ltd – Disclaimer This Presentation has been prepared by Rutila Resources Ltd (ABN 139 886 187) (Rutila or the Company). This Presentation contains summary information about Rutila and its subsidiaries (Rutila Group) and their activities current as at the date of this Presentation. The information in this Presentation is of general background and does not purport to be complete or to comprise all the information that a shareholder or potential investor in Rutila may require in order to determine whether to deal in Rutila shares. It should be read in conjunction with Rutila Group’s other periodic and continuous disclosure announcements lodged with the Australian Securities Exchange (ASX), which are available at www.asx.com.au. This document is not a prospectus or a product disclosure statement under the Corporations Act (Cth) 2001 (Corporations Act) and has not been lodged with the Australian Securities and Investments Commission (ASIC). Not investment or financial product advice This Presentation is for information purposes only and is not financial product or investment advice or a recommendation to acquire Rutila shares and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and seek financial, legal and taxation advice appropriate to their jurisdiction. Rutila is not licensed to provide financial product advice in respect of Rutila shares. Cooling off rights do not apply to the acquisition of Rutila shares. -

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

Roy Hill Celebrates Historic First Shipment

10 December 2015 Roy Hill Celebrates Historic First Shipment Hancock Prospecting Pty Ltd and Roy Hill Holdings Pty Ltd are pleased to announce the historic inaugural shipment from Port Hedland of low phosphorous iron ore from the Roy Hill mine on the MV ANANGEL EXPLORER bound for POSCO’s steel mills in South Korea. Mrs Gina Rinehart, Chairman of Hancock and Roy Hill Holdings Pty Ltd, said “The Roy Hill mega project is the culmination of hard-work from the dedicated small executive and technical teams at Hancock and more recently by the entire Roy Hill team.” “Given that the mega Roy Hill Project was a largely greenfield project that carried with it significant risks and considerable cost, it is remarkable that a relatively small company such as Hancock Prospecting has been able to take on and complete a project of this sheer size and complexity.” “The Roy Hill Project has recorded many achievements already and with the first shipment it will also hold one of the fastest construction start-ups of any major greenfield resource project in Australia. This is a considerable achievement, and although the media refer to a contractors date for shipment, it remains that the shipment still occurred ahead of what the partners schedule had planned in the detailed bankable feasibility study.” “The performance on the construction gives great confidence we can achieve performance as a player of international significance in the iron ore industry. To put the scale of the Roy Hill iron ore project into perspective in regard to Australia’s economy, when the mine is operating at its full capacity, Roy Hill will generate export revenue significantly greater than either Australia's lamb and mutton export industry or our annual wine exports. -

Solaris Core Australian Equity Fund (Performance Fee Option) (APIR: WHT0017AU) Monthly Investment Report As at 31 July 2020

Solaris Core Australian Equity Fund (Performance Fee Option) (APIR: WHT0017AU) Monthly Investment Report as at 31 July 2020 Fund Performance The fund underperformed its benchmark for the month by 0.32%. Overweight holdings in Goodman Group, Northern Star Resources Ltd and Charter Hall Group and underweight positions in AMP Limited and Australia and New Zealand Banking Group Limited made a positive contribution to relative performance. The main detractors were overweight holdings in Aurizon Holdings Limited and Woodside Petroleum Limited together with underweight positions in Afterpay Limited, Newcrest Mining Limited and Fortescue Metals Group Ltd. Rolling 3 Years 5 Years 7 Years Since Inception p.a. Returns Month FYTD 1 Year Quarter p.a. p.a. p.a. (31/08/2012) Fund Gross Return^ 0.27% 6.38% 0.27% -12.25% 5.60% 6.05% 8.34% 10.22% Benchmark Return* 0.50% 7.62% 0.50% -9.87% 5.37% 5.15% 6.78% 9.40% Active Return -0.23% -1.24% -0.23% -2.38% 0.23% 0.90% 1.56% 0.82% Fund Net Return^ 0.19% 6.12% 0.19% -13.09% 4.58% 5.03% 7.30% 9.52% Benchmark Return* 0.50% 7.62% 0.50% -9.87% 5.37% 5.15% 6.78% 9.40% Active Return (After fees) -0.32% -1.50% -0.32% -3.23% -0.79% -0.12% 0.52% 0.12% ^ Performance is for the Solaris Core Australian Equity Fund (APIR: WHT0017AU), also referred to as Class C units, and is based on month end prices before tax. Net performance is calculated after management fees and operating costs, excluding taxation. -

Full Year Results Presentation

Dominic D Smith Senior Vice President & Company Secretary Aurizon Holdings Limited ABN 14 146 335 622 T +61 7 3019 9000 F +61 7 3019 2188 E [email protected] W aurizon.com.au Level 17, 175 Eagle Street Brisbane QLD 4000 GPO Box 456 Brisbane QLD 4001 ASX Market Announcements ASX Limited 20 Bridge Street Sydney NSW 2000 19 August 2013 BY ELECTRONIC LODGEMENT Aurizon – Full year results presentation Please find attached for immediate release to the market the Company’s full year results presentation. The presentation will be delivered to an analyst and investor briefing which will commence at 10.30am (AEST). This briefing will be web-cast and accessible via the following link: http://www.media-server.com/m/p/pwt9z573. Yours faithfully Dominic D Smith SVP & Company Secretary FY2013 Results Presentation Lance Hockridge – Managing Director & CEO Keith Neate – EVP & CFO 19 August 2013 Important notice No Reliance on this document This document was prepared by Aurizon Holdings Limited (ACN 146 335 622) (referred to as ―Aurizon‖ which includes its related bodies corporate). Whilst Aurizon has endeavoured to ensure the accuracy of the information contained in this document at the date of publication, it may contain information that has not been independently verified. Aurizon makes no representation or warranty as to the accuracy, completeness or reliability of any of the information contained in this document. Document is a summary only This document contains information in a summary form only and does not purport to be complete and is qualified in its entirety by, and should be read in conjunction with, all of the information which Aurizon files with the Australian Securities Exchange. -

20130627 D107351

Ref: O10_0347 Submission to the Economic Regulation Authority – Floor and ceiling costs proposed by The Pilbara Infrastructure (TPI) 11 June 2013 FLOOR AND CEILING COSTS PROPOSED BY THE PILBARA INFRASTRUCTURE (TPI) TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ....................................................................................................................... 2 2. CONTEXT AND PURPOSE ................................................................................................................... 2 1. Context .......................................................................................................................................... 2 2. Purpose........................................................................................................................................... 3 3. REQUIREMENTS OF THE CODE ........................................................................................................... 4 4. COMMENTS ON COSTS PROPOSED BY TPI ....................................................................................... 5 1. TPI failure to provide costs for proposed access ................................................................... 5 2. TPI failure to provide Costing Model or supporting information ......................................... 5 3. Factors to be considered in an assessment of costs ............................................................. 6 5. BROCKMAN’S ASSESSMENT OF COSTS FOR THE ROUTE .................................................................. 7 6. COMPARISON -

Aussie Mine 2016 the Next Act

Aussie Mine 2016 The next act www.pwc.com.au/aussiemine2016 Foreword Welcome to the 10th edition of Aussie Mine: The next act. We’ve chosen this theme because, despite gruelling market conditions and industry-wide poor performance in 2016, confidence is on the rise. We believe an exciting ‘next act’ is about to begin for our mid-tier miners. Aussie Mine provides industry and financial analysis on the Australian mid-tier mining sector as represented by the Mid-Tier 50 (“MT50”, the 50 largest mining companies listed on the Australian Securities Exchange with a market capitalisation of less than $5bn at 30 June 2016). 2 Aussie Mine 2016 Contents Plot summary 04 The three performances of the last 10 years 06 The cast: 2016 MT50 08 Gold steals the show 10 Movers and shakers 12 The next act 16 Deals analysis and outlook 18 Financial analysis 22 a. Income statement b. Cash flow statement c. Balance sheet Where are they now? 32 Key contributors & explanatory notes 36 Contacting PwC 39 Aussie Mine 2016 3 Plot summary The curtain comes up Movers and shakers The mining industry has been in decline over the last While the MT50 overall has shown a steadying level few years and this has continued with another weak of market performance in 2016, the actions and performance in 2016, with the MT50 recording an performances of 11 companies have stood out amongst aggregated net loss after tax of $1bn. the crowd. We put the spotlight on who these movers and shakers are, and how their main critic, their investors, have But as gold continues to develop a strong and dominant rewarded them. -

The Mineral Industry of Australia in 2012

2012 Minerals Yearbook AUSTRALIA U.S. Department of the Interior February 2015 U.S. Geological Survey THE MINERAL INDUSTRY OF AUSTRALIA By Pui-Kwan Tse Australia was subject to volatile weather in recent years Government Policies and Programs that included heavy rains and droughts. The inclement weather conditions affected companies’ abilities to expand The powers of Australia’s Commonwealth Government are their activities, such as port, rail, and road construction and defined in the Australian Constitution; powers not defined in the repair, as well as to mine, process, manufacture, and transport Constitution belong to the States and Territories. Except for the their materials. Slow growth in the economies of the Western Australian Capital Territory (that is, the capital city of Canberra developed countries in 2012 affected economic growth and its environs), all Australian States and Territories have negatively in many counties of the Asia and the Pacific region. identified mineral resources and established mineral industries. China, which was a destination point for many Australian Each State has a mining act and mining regulations that mineral exports, continued to grow its economy in 2012, regulate the ownership of minerals and the operation of mining although the rate of growth was slower than in previous years. activities in that State. The States have other laws that deal with As a result, Australia’s gross domestic product (GDP) increased occupational health and safety, environment, and planning. at a rate of 3.1% during 2012, which was higher than the All minerals in the land are reserved to the Crown; however, 2.3% rate of growth recorded in 2011.