Working Together. Delivering Results. ABN 57 002 594 872 I 2015 Annual Report the YEAR at a GLANCE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEGISLATIVE COUNCIL Question on Notice

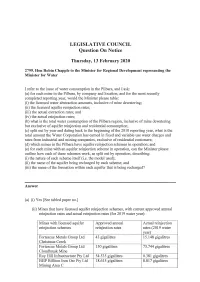

LEGISLATIVE COUNCIL Question On Notice Thursday, 13 February 2020 2799. Hon Robin Chappie to the Minister for Re ional Development representing the Minister for Water I refer to the issue of water consumption in the Pilbara, and I ask: (a) for each mine in the Pilbara, by company and location, and for the most recently completed reporting year, would the Minister please table: (i) the licensed water abstraction amounts, inclusive of mine dewatering; (ii) the licensed aquifer reinjection rates; (iii) the actual e traction rates; and (i ) the actual reinjection rates; (b) what is the total water consumption of the Pilbara region, inclusive of mine dewatering but exclusive of aquifer reinjection and residential consumption; (c) split out by year and dating back to the beginning of the 2010 reporting year, what is the total amount the Water Corporation has earned in fixed and variable use water charges and rates from industrial and mining companies, exclusi e of residential customers; (d) which mines in the Pilbara have aquifer reinjection schemes in operation; and (e) for each ine with an aquifer reinjection scheme in operation, can the Minister please outline how each of these schemes work, as split out by operation, describing: (i) the nature of each scheme itself (i.e. the model used); (ii) the name of the aquifer being recharged by each scheme; and (iii) the name of the formation within each aquifer that is being recharged? Answer (a) (i) Yes [See tabled paper no.] (ii) Mines that have licensed aquifer reinjection schemes, with current -

Welcome to Cloudbreak

Welcome to Cloudbreak This booklet provides you with the information needed to help make your stay at Cloudbreak more pleasant. Please take the time to read through the information before arriving on site. FEBRUARY 2009 Table of Contents Welcome Message ........................................................................................... 1 Foreword ..................................................................................................... 1 PART ONE: Before you depart ......................................................................... 2 The Pilbara ....................................................................................................... 3 Fortescue Metals Group Limited ...................................................................... 3 Cloudbreak....................................................................................................... 3 Packed and ready to go .................................................................................... 4 At the departure lounge ............................................................................... 4 Parking at Perth Airport ............................................................................... 5 Staying in touch ............................................................................................... 5 On Arrival ......................................................................................................... 5 At the Airstrip .............................................................................................. -

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

20130627 D107351

Ref: O10_0347 Submission to the Economic Regulation Authority – Floor and ceiling costs proposed by The Pilbara Infrastructure (TPI) 11 June 2013 FLOOR AND CEILING COSTS PROPOSED BY THE PILBARA INFRASTRUCTURE (TPI) TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ....................................................................................................................... 2 2. CONTEXT AND PURPOSE ................................................................................................................... 2 1. Context .......................................................................................................................................... 2 2. Purpose........................................................................................................................................... 3 3. REQUIREMENTS OF THE CODE ........................................................................................................... 4 4. COMMENTS ON COSTS PROPOSED BY TPI ....................................................................................... 5 1. TPI failure to provide costs for proposed access ................................................................... 5 2. TPI failure to provide Costing Model or supporting information ......................................... 5 3. Factors to be considered in an assessment of costs ............................................................. 6 5. BROCKMAN’S ASSESSMENT OF COSTS FOR THE ROUTE .................................................................. 7 6. COMPARISON -

20 September 2011 Company Announcements Office

20 September 2011 Company Announcements Office Australian Securities Exchange Limited Level 4 20 Bridge Street SYDNEY NSW 2000 RE: Thiess wins Fortescue Pilbara Iron Ore mine contract Please find attached a copy of a media release to be issued today by Thiess Pty Ltd, a wholly owned subsidiary of Leighton Holdings Limited. Yours faithfully, A.J. MOIR Company Secretary Thiess Pty Ltd A.C.N. 010 221 486 MEDIA RELEASE A.B.N. 87 010 221 486 Thiess Centre 179 Grey Street South Bank QLD 4101 20 September 2011 Locked Bag 2009 South Brisbane QLD 4101 Australia Telephone (07) 3002 9000 Facsimile (07) 3002 9009 THIESS WINS FORTESCUE PILBARA IRON ORE MINE CONTRACT Thiess has won a major $100 million contract with Fortescue Metals Group for Phase One development works on the Solomon Hub iron ore mine in Western Australia’s Pilbara region. The 18 month contract is for initial pioneering and mine establishment works such as haul roads, stockpile pads and the mining of early ore and waste. The work will establish the Solomon area for long term mining operations. Managing Director Bruce Munro said the contract represents a welcome return to the west for Thiess’ mining business and underlines the importance of Western Australia to Thiess as a whole. “Our Construction and Services businesses have long term client relationships and strong operations in the West and with the substantial iron ore reserves, there are clients we could assist in getting the best out of their mining operations” Mr Munro said. Thiess won the iron ore mine contract in a competitive process, and is now well positioned to bid for further works on the mine development and the main services contract which commences in approximately 12 months. -

The Mineral Industry of Australia in 2012

2012 Minerals Yearbook AUSTRALIA U.S. Department of the Interior February 2015 U.S. Geological Survey THE MINERAL INDUSTRY OF AUSTRALIA By Pui-Kwan Tse Australia was subject to volatile weather in recent years Government Policies and Programs that included heavy rains and droughts. The inclement weather conditions affected companies’ abilities to expand The powers of Australia’s Commonwealth Government are their activities, such as port, rail, and road construction and defined in the Australian Constitution; powers not defined in the repair, as well as to mine, process, manufacture, and transport Constitution belong to the States and Territories. Except for the their materials. Slow growth in the economies of the Western Australian Capital Territory (that is, the capital city of Canberra developed countries in 2012 affected economic growth and its environs), all Australian States and Territories have negatively in many counties of the Asia and the Pacific region. identified mineral resources and established mineral industries. China, which was a destination point for many Australian Each State has a mining act and mining regulations that mineral exports, continued to grow its economy in 2012, regulate the ownership of minerals and the operation of mining although the rate of growth was slower than in previous years. activities in that State. The States have other laws that deal with As a result, Australia’s gross domestic product (GDP) increased occupational health and safety, environment, and planning. at a rate of 3.1% during 2012, which was higher than the All minerals in the land are reserved to the Crown; however, 2.3% rate of growth recorded in 2011. -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

Annual Report, Including the Financial Report, for the Year Ended 30 June 2015

APPENDIX 4E For the year ended 30 June 2015 This information should be read in conjunction with Fortescue’s Annual Report, including the Financial Report, for the year ended 30 June 2015. Name of entity Fortescue Metals Group Limited ABN 57 002 594 872 Results for announcement to the market US$ million Revenue from ordinary activities down 27% to 8,574 Profit from ordinary activities after tax attributable to members down 88% to 317 Net profit attributable to members down 88% to 317 Amount Franked amount Dividends per security per security Financial year ended 30 June 2015: Interim – ordinary A$0.03 A$0.03 Final – ordinary A$0.02 A$0.02 Previous corresponding period: Interim – ordinary A$0.10 A$0.10 Final – ordinary A$0.10 A$0.10 Ex-dividend date of final dividend 3 September 2015 Record date of final dividend 7 September 2015 Payment date of final dividend 5 October 2015 Dividend Reinvestment Plan Net tangible asset backing The Company operates a Dividend Reinvestment Plan (the Plan) which Net tangible asset backing per ordinary shares: US$2.41 allows eligible shareholders to elect to invest dividends in ordinary (previous corresponding period: US$2.41). shares which rank equally with the ordinary shares of the Company. The allocation of price for shares under the Plan will be calculated as the average of the daily volume weighted average market price of all Previous corresponding period Fortescue shares traded on the Australian Securities Exchange during the period of ten trading days commencing on the second day after the The previous corresponding period is the 12 months ended 30 June 2014. -

2018 Annual Report

Minerals Council of Australia ANNUAL REPORT 2018 There’s more to Australian Mining Minerals Council of Australia ANNUAL REPORT 2018 Contents Chair’s review 04 Chief Executive Officer’s report 06 Industry snapshot 08 About the MCA 10 Industry positioning campaign 11 Principal achievements 12 Special report: Minerals Week 2019 15 In pictures: Minerals Week 2019 16 Minerals Tertiary Education Council 18 MCA Victoria: Looking beyond 2018 20 MCA NT: Prospects strong for NT mining 21 Future focus for committees 22 MCA committees 24 Board of Directors 25 MCA member companies 25 Financial report 26 Modern Mining p.16 Innovation Showcase Robogals Maria, Jane and Emily demonstrated robotics at February’s Modern Mining Innovation Showcase at Parliament House. The MCA is a proud partner of Robogals, a student-run organisation inspiring young women to study engineering and related science and mathematic fields. Chair’s review ‘We’re creating the jobs of the future’ Dr Vanessa Guthrie Chair, Minerals Council of Australia The last 12 months have seen the industry’s strong performance in setting Today we are seeing the creation of new Australian minerals industry continue its record exports and profits has also and exciting jobs that are transforming the remarkable contribution to our economy, supported the Australian Government’s careers of our people in the resources with further expansion of production to objective of returning the budget to surplus. industry – jobs which require higher skills meet global demand. and are more challenging and rewarding. In 2017-18, Australian mining paid $18.6 Australia’s minerals industry has now billion in company tax – even higher than We are attracting and retaining more underpinned 27 years of uninterrupted the $15.4 billion paid in 2011-12 during the people with technical qualifications that growth in output and incomes across peak of the resources construction boom. -

Queensland Exploration Council Qupex Lunch | 9 Feb 2021

QUEENSLAND EXPLORATION COUNCIL QUPEX LUNCH | 9 FEB 2021 QEC Chair, Kim Wainwright QEC Deputy Chair, Stephen Kelemen QEC MEMBERS QEC SPONSORS 91 MEMBERS World-leading Industry experts resources across a range companies of fields 2 QEC MEMBERS Aberdare Collieries Pty Ltd Aeris Resources Limited Anglo American Aquila Resources Ltd Armour Energy Arrow Energy AustChina Holdings Limited Austex Mining Australia Pacific LNG Australian Drilling Industry AXIS Minerals Pty Ltd Baralaba Coal BDO Bengal Coal Pty Ltd Association Ltd Company Ltd Bengal Energy BHP Billiton Mitsubishi Alliance Blue Energy Bowen Coking Coal Ltd Bruce Resource Chinova Resources ConocoPhillips Consultants Copper Mountain Mining Pty Coronado Curragh Pty Ltd Glencore Coal Department of Resources Diatreme Resources Evolution Mining EY Ltd Limited Fitzroy Australia Resources GeoDrill Australia Incitec Pivot Limited Glencore Copper Glencore Zinc Golding Contractors Pty Ltd GVK HSE Mining Pty Ltd Idemitsu Australia Resources Pty Marubeni Coal Pty Ltd ITOCHU Minerals and Energy Jellinbah Resources Pty KBI Pty Ltd Kestrel Coal Resources Pty Ltd Ltd - Ensham Resources of Australia Ltd Laramide Resources Ltd Map to Mine Mitsui Coal Holdings Pty Ltd Mastermyne Group Limited McCullough Robertson Metro Mining Limited Michael O'Flynn Resource Consulting Pty Ltd Millmerran Power Mitsubishi Development Pty Ltd Nitro Solutions Pty Ltd MMG Limited Morgans Financial Multicom Resources Ltd New Century Reso urces Management Pty Ltd Limited New Hope Group Ltd Newmont Australia QEM Noosa Mining -

The Material Handling Sector in South East Asia

Material Handling in South East Asia Prepared for Invest Northern Ireland July 2018 © 2018 Orissa International The Material Handling Sector Singapore | Malaysia | Indonesia | Thailand | Philippines Prepared for INVEST NORTHEN IRELAND July 2018 Orissa International Pte Ltd 1003 Bukit Merah Central #05-06 Inno Center, Singapore 159836 Tel: +65 6225 8667 | Fax: +65 6271 9791 [email protected] Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. Orissa International Pte Ltd accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Orissa International Pte Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained. Copyright Notice: © 2018 Orissa International. All Rights Reserved. Permission to Reproduce is Required. Material Handling in South East Asia – July 2018 Table of Contents 1.0 KEY TRENDS IN THE MATERIAL HANDLING EQUIPMENT SECTOR .............................. 9 2.0 SINGAPORE .............................................................................................. 15 2.1 Singapore Country Profile ....................................................................................... 15 2.2 Overview of the Infrastructure / Building & Construction Sector .............................. 16 2.3 Overview of the -

Integrated Rail Network Closure Plan

Report Integrated Rail Network Closure Plan Long Term Mine Planning 7 June 2018 R-PL-EN-0041 Rev 0 CLOSURE GUIDELINE CHECKLIST Report This closure plan addresses the progressive rehabilitation and closure of rail infrastructure projects associated with the Railway and Port (The Pilbara Infrastructure Pty Ltd) Agreement Act 2004. In the absence of regulatory guidelines for inland infrastructure projects, this closure plan follows the report structure described within the Guidelines for Preparing Mine Closure Plans May 2015 published by the Government of Western Australia Department of Mines and Petroleum (now the Department of Mines, Industry Regulation and Safety) and Environmental Protection Authority. The closure of mining operations, including quarries, is not within the scope of this closure plan. Closure Plan (CP) checklist Y/N Page Comments 1 Has the Checklist been endorsed by a senior Y 2 Report has been endorsed using representative within the tenement holder/operating standard Fortescue processes. company? Public Availability 2 Are you aware that from 2015 all CPs will be made N/A This report is not subject to mine closure publicly available? conditions under the Mining Act. 3 Is there any information in the CP that should not be N publicly available? 4 If “Yes” to Q3, has confidential information been N/A submitted in a separate document/section? Cover Page, Table of Contents 5 Does the CP cover page include: Y 1 This report is provided for information • Project Title only. • Company Name • Contact Details (including telephone numbers and email addresses) • Document ID and version number • Date of submission (needs to match the date of this checklist) Scope and Purpose 6 State why the CP is submitted Y 11 This plan has been provided to support the Eliwana Rail Project Public Environmental Review.