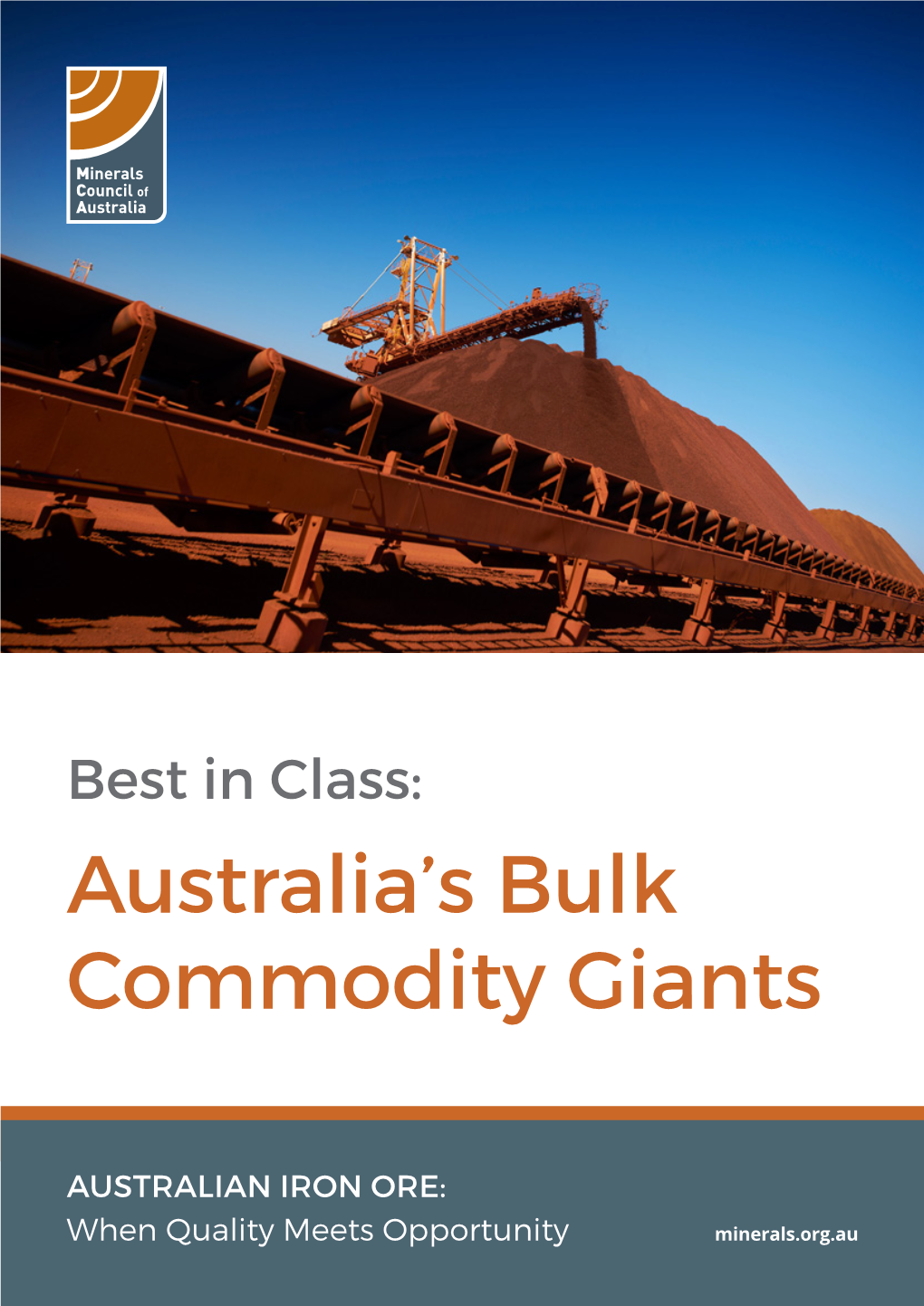

Best in Class: Australia's Bulk Commodity Giants

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welcome to Cloudbreak

Welcome to Cloudbreak This booklet provides you with the information needed to help make your stay at Cloudbreak more pleasant. Please take the time to read through the information before arriving on site. FEBRUARY 2009 Table of Contents Welcome Message ........................................................................................... 1 Foreword ..................................................................................................... 1 PART ONE: Before you depart ......................................................................... 2 The Pilbara ....................................................................................................... 3 Fortescue Metals Group Limited ...................................................................... 3 Cloudbreak....................................................................................................... 3 Packed and ready to go .................................................................................... 4 At the departure lounge ............................................................................... 4 Parking at Perth Airport ............................................................................... 5 Staying in touch ............................................................................................... 5 On Arrival ......................................................................................................... 5 At the Airstrip .............................................................................................. -

Annual Report (2020)

For personal use only TERRACOM LIMITED 2020 ANNUAL REPORT Contents SECTION 1: COMPANY OVERVIEW 2 Chairman’s letter to shareholders 3 Directors 4 Management team 6 Company information 7 Current operations and project structure 8 Operations overview 9 Current mining tenements held 10 SECTION 2: COMPANY UPDATE 11 Operational summary 12 Production overview 13 Financial overview 14 Operational performance 15 SECTION 3: COMPANY OPERATIONS AND PROJECTS 16 Australia Operations and Projects 17 South Africa Operations and Projects 22 SECTION 4: JORC RESOURCES AND RESERVES STATEMENT 31 SECTION 5: FINANCIAL REPORT 39 Director’s Report 41 Auditors Independence Declaration 64 Statement of profit or loss 66 Statement of other comprehensive income 67 Statement of financial position 68 Corporate Directory Statement of changes in equity 70 Statement of cash flows 72 PEOPLE Notes to financial statements 77 Directors Wallace King AO Directors declaration 133 Craig Ransley Glen Lewis Independent Auditor’s Report 134 Shane Kyriakou SECTION 6: ASX ADDITIONAL SHAREHOLDER INFORMATION 141 Craig Lyons Matthew Hunter Additional shareholder information for listed public companies 142 Company Secretary Megan Etcell Chief Executive Officer Danny McCarthy Chief Commercial Officer Nathan Boom Download Chief Financial Officer Celeste van Tonder Scan the QR code to download CORPORATE INFORMATION a PDF of the 2020 TerraCom Registered Office Blair Athol Mine Access Road Limited Annual Report. Clermont, Queensland, 4721 Australia Telephone: +61 7 4983 2038 Contact Address -

UGL Limited, Roy Hill – Western Australia

FACT SHEET UGL Limited, Roy Hill – Western Australia Roy Hill Iron Ore mine, the only independent iron ore project with CUSTOMER UGL Limited West Australian majority ownership, is a 655 million tonne per LOCATION Roy Hill, Western Australia annum iron ore mining, rail and port development in the Pilbara DESCRIPTION Penske Australia has supplied, region. Situated approximately 115 kilometres north of Newman, commissioned and managed the Roy Hill is a world-class, low phosphorus iron ore deposit. installation of three diesel-powered containerised gensets from MTU for The operation consists of a conventional open pit mine and wet the diesel power station, as part of processing plant. There is a single rail line for heavy haul cartage Alinta Energy’s power supply to the and a purpose built two-berth iron ore port facility at Port Hedland Roy Hill Iron Ore mine that is capable of stockpiling, screening and exporting mined product. OPERATIONAL DATE August 2015 Roy Hill enlisted the services of Alinta on the two-phase construction project to provide a 121 km 220 kV transmission line and substation with 6 MW diesel back-up power. Alinta partnered with Penske Australia customer UGL Engineering, under a turnkey design and construction contract. CONFIGURATION As part of the project with UGL, Penske Australia has installed and commissioned three state-of-the-art containerised gensets from MTU to deliver critical power solutions for the mine infrastructure. The generators are configured to run in various operational modes including blackstart operation, island operation and grid parallel mode. FEATURES The DP 2870 D5C diesel gensets feature the 20V 4000 G63 engine and deliver 2.5 MW prime power at 50 degrees ambient, critical for the harsh heat and aridity of the Pilbara. -

Rutila Resources Ltd ASX

Rutila Resources Ltd ASX : RTA For personal use only Investor Presentation 27 November 2013 Rutila Resources Ltd – Disclaimer This Presentation has been prepared by Rutila Resources Ltd (ABN 139 886 187) (Rutila or the Company). This Presentation contains summary information about Rutila and its subsidiaries (Rutila Group) and their activities current as at the date of this Presentation. The information in this Presentation is of general background and does not purport to be complete or to comprise all the information that a shareholder or potential investor in Rutila may require in order to determine whether to deal in Rutila shares. It should be read in conjunction with Rutila Group’s other periodic and continuous disclosure announcements lodged with the Australian Securities Exchange (ASX), which are available at www.asx.com.au. This document is not a prospectus or a product disclosure statement under the Corporations Act (Cth) 2001 (Corporations Act) and has not been lodged with the Australian Securities and Investments Commission (ASIC). Not investment or financial product advice This Presentation is for information purposes only and is not financial product or investment advice or a recommendation to acquire Rutila shares and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and seek financial, legal and taxation advice appropriate to their jurisdiction. Rutila is not licensed to provide financial product advice in respect of Rutila shares. Cooling off rights do not apply to the acquisition of Rutila shares. -

Of the Environmental Protection Act 1986. EPA

FORM REFERRAL Referral of a Proposal by the Proponent to the Environmental Protection Authority under PROPONENT Section 38(1) of the Environmental Protection Act 1986. EPA PURPOSE OF THIS FORM Section 38(1) of the Environmental Protection Act 1986 (EP Act) provides that where a development proposal is likely to have a significant effect on the environment, a proponent may refer the proposal to the Environmental Protection Authority (EPA) for a decision on whether or not it requires assessment under the EP Act. This form sets out the information requirements for the referral of a proposal by a proponent. Proponents are encouraged to familiarise themselves with the EPA’s General Guide on Referral of Proposals [see Environmental Impact Assessment/Referral of Proposals and Schemes] before completing this form. A referral under section 38(1) of the EP Act by a proponent to the EPA must be made on this form. A request to the EPA for a declaration under section 39B (derived proposal) must be made on this form. This form will be treated as a referral provided all information required by Part A has been included and all information requested by Part B has been provided to the extent that it is pertinent to the proposal being referred. Referral documents are to be submitted in two formats – hard copy and electronic copy. The electronic copy of the referral will be provided for public comment for a period of 7 days, prior to the EPA making its decision on whether or not to assess the proposal. CHECKLIST Before you submit this form, please check that you have: Yes No Completed all the questions in Part A (essential). -

Roy Hill Celebrates Historic First Shipment

10 December 2015 Roy Hill Celebrates Historic First Shipment Hancock Prospecting Pty Ltd and Roy Hill Holdings Pty Ltd are pleased to announce the historic inaugural shipment from Port Hedland of low phosphorous iron ore from the Roy Hill mine on the MV ANANGEL EXPLORER bound for POSCO’s steel mills in South Korea. Mrs Gina Rinehart, Chairman of Hancock and Roy Hill Holdings Pty Ltd, said “The Roy Hill mega project is the culmination of hard-work from the dedicated small executive and technical teams at Hancock and more recently by the entire Roy Hill team.” “Given that the mega Roy Hill Project was a largely greenfield project that carried with it significant risks and considerable cost, it is remarkable that a relatively small company such as Hancock Prospecting has been able to take on and complete a project of this sheer size and complexity.” “The Roy Hill Project has recorded many achievements already and with the first shipment it will also hold one of the fastest construction start-ups of any major greenfield resource project in Australia. This is a considerable achievement, and although the media refer to a contractors date for shipment, it remains that the shipment still occurred ahead of what the partners schedule had planned in the detailed bankable feasibility study.” “The performance on the construction gives great confidence we can achieve performance as a player of international significance in the iron ore industry. To put the scale of the Roy Hill iron ore project into perspective in regard to Australia’s economy, when the mine is operating at its full capacity, Roy Hill will generate export revenue significantly greater than either Australia's lamb and mutton export industry or our annual wine exports. -

Bidder's Statement Hancock Prospecting Pty Ltd Riversdale Res E ' Limited

HANCOCK PROSPECTING PTY LTD Bidder's Statement containing a Cash Offer by Hancock Prospecting Pty Ltd ACN 008 676 417 through its wholly-owned subsidiary Hancock Corporation Pty Ltd ACN 615 809 7 40 to acquire all of your shares in D7€/0, Aycock_ Riversdale Res e ' Limited cog PO AT1) Fr] LSD ACN 152 669 291 27[/1] for $2.20 per share (which will increase to $2.50 per share if Hancock Corporation's voting power in Riversdale exceeds 50% prior to the end of the Offer Period) subject to the terms and conditions of the Offer. ACCEPT THIS CASH OFFER This is an important document and requires your attention. If you are in any doubt about how to deal with this document, you should contact your broker, financial adviser or legal adviser. Further Information If you have any queries in relation to the Offer, please contact the Offer information line on +618 9429 8222 between 12.00pm and 8.00pm (Sydney time) Monday to Friday. 3446-0556-6732v22 Contents 1 Important information 4 1.1 Key Dates 4 1.2 How to Accept the Offer 4 1.3 Important notice 4 1.4 Further Information 4 1.5 Defined terms 4 1.6 Investment decisions 5 1.7 Disclaimer as to forward looking statements 5 1.8 Notice to foreign Riversdale Shareholders 5 1.9 Information on Riversdale 5 1.10 Privacy 5 1.11 Internet 6 Director's Letter 7 2 Features of the Offer 10 3 Why Riversdale Shareholders should ACCEPT the Offer 12 3.1 Founding Shareholders' Statements of Intent support the Offer 12 3.2 The Offer Price represents a compelling premium to recent issue prices 12 3.3 The Offer provides shareholders -

Media Release 18 June 2018 OFFER TO

Media Release 18 June 2018 OFFER TO ACQUIRE SHARES IN ATLAS IRON LIMITED Redstone Corporation Pty Ltd (Redstone), a wholly‐owned subsidiary of Hancock Prospecting Pty Ltd (Hancock), is pleased to announce an all‐cash offer to acquire all of the ordinary shares in Atlas Iron Limited (Atlas) in which Redstone does not already have a relevant interest, at a price of $0.042 per share (Offer). The Offer represents a superior value proposal for Atlas shareholders relative to the previously announced proposal from Mineral Resources Limited (MRL Proposal). Specifically, the Redstone offer represents a 41% premium to the implied value of that MRL Proposal as at close of trading on 15 June 20181. As the Offer is all cash, it is not subject to variations in the price of any other listed securities and therefore provides Atlas shareholders with certainty regarding the value of the consideration which they are being offered. The Offer is unconditional other than for the usual “prescribed occurrences”, as detailed in the Bidder’s Statement released today. As such, Atlas shareholders should have a high degree of certainty that they will receive the Offer consideration for their Atlas shares, should they choose to accept the Offer. Importantly, the Offer is not subject to any minimum acceptance condition. The directors of Redstone consider that the all‐cash Offer, with its premium pricing and low conditionality, represents a significantly superior proposition to the MRL Proposal and that the Offer should therefore be viewed as a compelling opportunity for Atlas shareholders. Tad Watroba, Executive Director of Hancock, said that the Atlas’ assets have long‐term synergies with other assets in Hancock’s portfolio. -

Mining Area C SRE Invertebrate Fauna Impact Assessment

Mining Area C SRE Invertebrate Fauna Impact Assessment Mining Area C - Life of Project Environmental Management Plan Revision 6 Environmental Impact Assessment of Short-range Endemic Invertebrates BHP Billiton Iron Ore Pty Ltd June 2015 Page | 0 Mining Area C SRE Invertebrate Fauna Impact Assessment Mining Area C Life of Project Environmental Management Plan Revision 6 Environmental Impact Assessment of Short-range Endemic Invertebrates DOCUMENT STATUS Version Review / Approved for Approved for Issue to Author No. Issue Name Date E. Drain (BHP 1 S. Callan, B. Durrant M. O'Connell 08/12/2014 Billiton Iron Ore) 2 S. Callan B. Durrant E. Drain 14/01/2015 3 S. Callan B. Durrant E. Drain 27/01/2015 Final S. Callan B. Durrant E. Drain 26/06/2015 IMPORTANT NOTE Apart from fair dealing for the purposes of private study, research, criticism, or review as permitted under the Copyright Act, no part of this report, its attachments or appendices may be reproduced by any process without the written consent of Biologic Environmental Survey Pty Ltd (“Biologic”). All enquiries should be directed to Biologic. We have prepared this report for the sole purposes of BHP Billiton Iron Ore Pty Ltd (“Client”) for the specific purpose only for which it is supplied. This report is strictly limited to the Purpose and the facts and matters stated in it do not apply directly or indirectly and will not be used for any other application, purpose, use or matter. In preparing this report we have made certain assumptions. We have assumed that all information and documents provided to us by the Client or as a result of a specific request or enquiry were complete, accurate and up-to-date. -

The Efficient Improvement of Original Magnetite in Iron Ore Reduction

minerals Article The Efficient Improvement of Original Magnetite in Iron Ore Reduction Reaction in Magnetization Roasting Process and Mechanism Analysis by In Situ and Continuous Image Capture Bing Zhao 1,2, Peng Gao 1,2,*, Zhidong Tang 1,2 and Wuzhi Zhang 1,2 1 School of Resources and Civil Engineering, Northeastern University, Shenyang 110819, China; [email protected] (B.Z.); [email protected] (Z.T.); [email protected] (W.Z.) 2 National-Local Joint Engineering Research Center of High-Efficient Exploitation Technology for Refractory Iron Ore Resources, Shenyang 110819, China * Correspondence: [email protected]; Tel.: +86-024-8368-8920 Abstract: Magnetization roasting followed by magnetic separation is considered an effective method for recovering iron minerals. As hematite and magnetite are the main concomitant constituents in iron ores, the separation index after the magnetization roasting will be more optimized than with only hematite. In this research, the mechanism of the original magnetite improving iron ore reduction during the magnetization roasting process was explored using ore fines and lump ore samples. Under optimum roasting conditions, the iron grade increased from 62.17% to 65.22%, and iron recovery increased from 84.02% to 92.02% after separation, when Fe in the original magnetite content increased from 0.31% to 8.09%, although the Fe masses in each sample were equal. For lump ores with magnetite and hematite intergrowth, the method of in situ and continuous image capture Citation: Zhao, B.; Gao, P.; Tang, Z.; for microcrack generation and the evolution of the magnetization roasting process was innovatively Zhang, W. -

Recovery of Magnetite-Hematite Concentrate from Iron Ore Tailings

E3S Web of Conferences 247, 01042 (2021) https://doi.org/10.1051/e3sconf/202124701042 ICEPP-2021 Recovery of magnetite-hematite concentrate from iron ore tailings Mikhail Khokhulya1,*, Alexander Fomin1, and Svetlana Alekseeva1 1Mining Institute of Kola Science Center of Russian Academy of Sciences, Apatity, 184209, Russia Abstract. The research is aimed at study of the probable recovery of iron from the tailings of the Olcon mining company located in the north-western Arctic zone of Russia. Material composition of a sample from a tailings dump was analysed. The authors have developed a separation production technology to recover magnetite-hematite concentrate from the tailings. A processing flowsheet includes magnetic separation, milling and gravity concentration methods. The separation technology provides for production of iron ore concentrate with total iron content of 65.9% and recovers 91.0% of magnetite and 80.5% of hematite from the tailings containing 20.4% of total iron. The proposed technology will increase production of the concentrate at a dressing plant and reduce environmental impact. 1 Introduction The mineral processing plant of the Olcon JSC, located at the Murmansk region, produces magnetite- At present, there is an important problem worldwide in hematite concentrate. The processing technology the disposal of waste generated during the mineral includes several magnetic separation stages to produce production and processing. Tailings dumps occupy huge magnetite concentrate and two jigging stages to produce areas and pollute the environment. However, waste hematite concentrate from a non-magnetic fraction of material contains some valuable components that can be magnetic separation [13]. used in various industries. In the initial period of plant operation (since 1955) In Russia, mining-induced waste occupies more than iron ore tailings were stored in the Southern Bay of 300 thousand hectares of lands. -

Banded Iron Formations

Banded Iron Formations Cover Slide 1 What are Banded Iron Formations (BIFs)? • Large sedimentary structures Kalmina gorge banded iron (Gypsy Denise 2013, Creative Commons) BIFs were deposited in shallow marine troughs or basins. Deposits are tens of km long, several km wide and 150 – 600 m thick. Photo is of Kalmina gorge in the Pilbara (Karijini National Park, Hamersley Ranges) 2 What are Banded Iron Formations (BIFs)? • Large sedimentary structures • Bands of iron rich and iron poor rock Iron rich bands: hematite (Fe2O3), magnetite (Fe3O4), siderite (FeCO3) or pyrite (FeS2). Iron poor bands: chert (fine‐grained quartz) and low iron oxide levels Rock sample from a BIF (Woudloper 2009, Creative Commons 1.0) Iron rich bands are composed of hematitie (Fe2O3), magnetite (Fe3O4), siderite (FeCO3) or pyrite (FeS2). The iron poor bands contain chert (fine‐grained quartz) with lesser amounts of iron oxide. 3 What are Banded Iron Formations (BIFs)? • Large sedimentary structures • Bands of iron rich and iron poor rock • Archaean and Proterozoic in age BIF formation through time (KG Budge 2020, public domain) BIFs were deposited for 2 billion years during the Archaean and Proterozoic. There was another short time of deposition during a Snowball Earth event. 4 Why are BIFs important? • Iron ore exports are Australia’s top earner, worth $61 billion in 2017‐2018 • Iron ore comes from enriched BIF deposits Rio Tinto iron ore shiploader in the Pilbara (C Hargrave, CSIRO Science Image) Australia is consistently the leading iron ore exporter in the world. We have large deposits where the iron‐poor chert bands have been leached away, leaving 40%‐60% iron.