Annual Report 2015 (English, PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case of High-Speed Ground Transportation Systems

MANAGING PROJECTS WITH STRONG TECHNOLOGICAL RUPTURE Case of High-Speed Ground Transportation Systems THESIS N° 2568 (2002) PRESENTED AT THE CIVIL ENGINEERING DEPARTMENT SWISS FEDERAL INSTITUTE OF TECHNOLOGY - LAUSANNE BY GUILLAUME DE TILIÈRE Civil Engineer, EPFL French nationality Approved by the proposition of the jury: Prof. F.L. Perret, thesis director Prof. M. Hirt, jury director Prof. D. Foray Prof. J.Ph. Deschamps Prof. M. Finger Prof. M. Bassand Lausanne, EPFL 2002 MANAGING PROJECTS WITH STRONG TECHNOLOGICAL RUPTURE Case of High-Speed Ground Transportation Systems THÈSE N° 2568 (2002) PRÉSENTÉE AU DÉPARTEMENT DE GÉNIE CIVIL ÉCOLE POLYTECHNIQUE FÉDÉRALE DE LAUSANNE PAR GUILLAUME DE TILIÈRE Ingénieur Génie-Civil diplômé EPFL de nationalité française acceptée sur proposition du jury : Prof. F.L. Perret, directeur de thèse Prof. M. Hirt, rapporteur Prof. D. Foray, corapporteur Prof. J.Ph. Deschamps, corapporteur Prof. M. Finger, corapporteur Prof. M. Bassand, corapporteur Document approuvé lors de l’examen oral le 19.04.2002 Abstract 2 ACKNOWLEDGEMENTS I would like to extend my deep gratitude to Prof. Francis-Luc Perret, my Supervisory Committee Chairman, as well as to Prof. Dominique Foray for their enthusiasm, encouragements and guidance. I also express my gratitude to the members of my Committee, Prof. Jean-Philippe Deschamps, Prof. Mathias Finger, Prof. Michel Bassand and Prof. Manfred Hirt for their comments and remarks. They have contributed to making this multidisciplinary approach more pertinent. I would also like to extend my gratitude to our Research Institute, the LEM, the support of which has been very helpful. Concerning the exchange program at ITS -Berkeley (2000-2001), I would like to acknowledge the support of the Swiss National Science Foundation. -

JEG Working Group on Reducing Energy Use in Transport

Working Group Under the Joint Expert Group on Transport and Environment Reduction of Energy Use in Transport Final Report 18.01.2006 Working Group Members T / Name Institution E-mail E Ministry of transport, Innovation and T REICHL Birgit [email protected] Technology T VANCURA Miroslav Ministry of Transport [email protected] E BENDL Jiri Ministry of Environment [email protected] Ministry of Transport and T VALLI Raisa [email protected] Communications Ministère de l'Ecologie et du [email protected] T PAIRAULT Olivier développement durable [email protected] E ZIEROCK Karl-Heinz Federal Environmental Agency [email protected] Ministry of Transport and T BASOLI Gianpaolo [email protected] Infrastructure National expert on the railways T GIARDA Monica [email protected] fields sr.policy advisor E KROON Martin [email protected] Ministerie VROM Adviser jacek.jaskiewicz@ E JASKIEWICZ Jacek Ministry of Environment mos.gov.pl Swedish Environmental Protection E HUNHAMMAR Sven [email protected] Agency Department for Environment, Food E WALLIS Alex and Rural Affairs, National Climate [email protected] Change Policy Division Department for Transport, Cleaner T BRIDGELAND Edward [email protected] Fuels and Vehicles European Commission E HODGSON Ian [email protected] DG ENV European Commission T SÖLDNER Franz Xaver [email protected] DG TREN JEG working group on reducing energy use in transport CONTENT -

Eighth Annual Market Monitoring Working Document March 2020

Eighth Annual Market Monitoring Working Document March 2020 List of contents List of country abbreviations and regulatory bodies .................................................. 6 List of figures ............................................................................................................ 7 1. Introduction .............................................................................................. 9 2. Network characteristics of the railway market ........................................ 11 2.1. Total route length ..................................................................................................... 12 2.2. Electrified route length ............................................................................................. 12 2.3. High-speed route length ........................................................................................... 13 2.4. Main infrastructure manager’s share of route length .............................................. 14 2.5. Network usage intensity ........................................................................................... 15 3. Track access charges paid by railway undertakings for the Minimum Access Package .................................................................................................. 17 4. Railway undertakings and global rail traffic ............................................. 23 4.1. Railway undertakings ................................................................................................ 24 4.2. Total rail traffic ......................................................................................................... -

Railway Liberalisation Is Bearing Fruit

editorial About managing risk solutions for intermodal logistics www.hupac.ch July 2006 What to do, when something suddenly no longer works? The closure of the Gotthard motor- way in June 2006 revealed a divided transport market. On one Railway liberalisation is bearing fruit side were companies already set up for rail transport. On The Swiss Hupac Ltd – European market leader in combined transport through Switzerland – is making the other side were hauliers successful use of the liberalisation of the railways. On the occasion of the General Meeting on 12.5.2006 entirely dependent on roads. While the former shifted their in Lugano, Board Chairman Hans-Jörg Bertschi named competition in railway freight transport through in-house modal split in favour Switzerland as the main reason for Hupac’s traffic growth. of rail during the closure of the Gotthard motorway, the latter Last year Hupac shifted 520,000 had no alternative to the traffic road consignments to the railways. jams. Hupac’s unaccompanied This represents an increase of intermodal transport had suffi- 15.9% compared to the previous cient capacity available. Anyone year. The strong growth has contrib- who had suitable equipment uted to a break in the trend: Since could switch over to rail without 2000 the number of lorries involved any problems. There was less in transalpine transport has fallen on offer on the Rolling Highway (-14%), while combined transport at the Gotthard. Only a limited on the railways has been increasing amount of rolling stock is avail- in volume (+50%). Political means able. Space on night trains was of controlling transport such as the in strong demand, and was Swiss Heavy Vehicles Fee (LSVA) therefore rapidly allocated, while and the 40 tons limit are reasons for there was limited demand for the this. -

Rail Annexes to the Fifth Annual Market Monitoring Report

IRG-Rail (17) 1a Independent Regulators’ Group – Rail Annexes to the fifth Annual Market Monitoring Report March 2017 Index Annex 1 – Definitions .............................................................................................................................. 3 Annex 2 – Main developments in 2015 ................................................................................................... 5 Annex 3 – Competition rules ................................................................................................................. 12 Annex 4 – List of regulatory decisions in 2015 ...................................................................................... 15 Annex 5 – Revenue of railway undertakings ......................................................................................... 23 IRG-Rail Market Monitoring Report - Annexes 2 Annex 1 – Definitions Undertakings providing services for the transport of goods and / or passengers and /or others on rail networks as defined in Directive 2012/34/EU. Exclude from Active railway perimeter undertakings having provided no service during the year.1 undertaking The nationality of railway undertakings refers to the country that delivered the railway undertaking license. Commercial service or All passenger services that do not fall within the scope of services provided under non-PSO service public service obligations (2015/1100/EC). Consecutive lines and nodes as a whole between a defined source and target Electrified route that allows railway vehicles to use electricity -

Eurocity Band 2 Tabellen

Tabelle 1.2. EuroCity-Züge im Sommerfahrplan 1999 (ab dem 30. Mai 1999) Tabelle 1.2. EuroCity-Züge im Sommerfahrplan 1999 (ab dem 30. Mai 1999) – Fortsetzung Zugnummer Name Laufweg Distanz (km) Fahrzeit Reisegeschwindigkeit (km/h) Zugnummer Name Laufweg Distanz (km) Fahrzeit Reisegeschwindigkeit (km/h) EC 2 Rembrandt Chur – Basel SBB – Amsterdam C.S. 994 10 h 38 93,5 EC 31 Romulus Wien Süd – Roma Termini 1 203 13 h 29 89 EC 3 Rembrandt Amsterdam C.S. – Basel SBB – Chur 994 10 h 49 92 EC 31 Christian Morgenstern Hamburg Hbf – København 354 4 h 30 79 EC 4 Verdi Milano Centrale – Dortmund Hbf 1 017 11 h 57 85 EC 32 Christian Morgenstern København – Hamburg Hbf 354 4 h 24 80,5 EC 5 Verdi Dortmund Hbf – Milano Centrale 1 017 11 h 57 85 EC 33 Thomas Mann Hamburg – København Hbf 354 4 h 30 79 EC 8 Tiziano Milano Centrale – Hamburg Altona 1 362 14 h 59 91 EC 34 Bertel Thorvaldsen København – Hamburg Hbf 354 4 h 24 80,5 EC 9 Tiziano Hamburg Altona – Milano Centrale 1 362 15 h 02 91 EC 35 Bertel Thorvaldsen Hamburg Hbf – København 354 4 h 30 79 EC 10 Mimara Zagreb – Ljubljana – Berlin Ostbf 1 306 16 h 47 78 EC 36 Karen Blixen København – Hamburg Hbf 354 4 h 21 81 EC 11 Mimara Berlin Ostbf – Ljubljana – Zagreb 1 306 16 h 50 78 EC 37 Karen Blixen Hamburg Hbf – København 354 4 h 30 79 EC 13/14 Leonardo da Vinci Dortmund Hbf – München – Milano Centrale 1 321 14 h 46 89 EC 38 Hamlet København – Hamburg Hbf 354 4 h 21 81 EC 15/12 Leonardo da Vinci Milano Centrale – München – Dortmund Hbf 1 321 14 h 44 90 EC 39 Hamlet Hamburg Hbf – København 362 4 h 30 -

Report on the Semmering Railway (Austria) Mission 20 - 23 April, 2010

ICOMOS INTERNATIONAL COUNCIL ON MONUMENTS AND SITES REPORT ON THE SEMMERING RAILWAY (AUSTRIA) MISSION 20 - 23 APRIL, 2010 20th June 2010 2 TABLE OF CONTENTS ACKNOWLEDGEMENTS – page 3 EXECUTIVE SUMMARY AND LIST OF RECOMMENDATIONS – page 4 1 BACKGROUND TO THE MISSION Inscription history – page 4 Criteria and World Heritage values – page 5 Examination of the State of Conservation by the World Heritage Committee and its Bureau – page 5 Justification of the mission (terms of reference, programme, composition of mission team) see Annex – page 5 2 NATIONAL POLICY FOR THE PRESERVATION AND MANAGEMENT OF THE WORLD HERITAGE PROPERTY Protected area legislation – page 6 Institutional framework – page 6 Management structure – page 6 Response to the recognition of values under international treaties and programmes (World Heritage, Biosphere Reserve designation) – page 7 3 IDENTIFICATION AND ASSESSMENT OF ISSUES Management – page 7 Factors affecting the property – page 7 (3.1 Introduction – page 7 / 3.2 Principes for the preservation of historical raiway monuments – page 8 / 3.3 The Semmering base tunnel project as part of European transport Policy - page 9 / 3.4 Influence of the permanent base tunnel installations on the World Heritage Site – page 10 / 3.6 Proceedings – page 14) 4 ASSESSMENT OF THE STATE OF CONSERVATION OF THE SITE Review whether the values, on the basis of which the property was entered on to the World Heritage List, are being maintained – page 14 5 CONCLUSIONS AND RECOMMENDATIONS 5.1 Introduction - page 15 / 5.2 Appraisal – page 15 / 5.3 New base tunnel line – page 16 / 5.4 Historical line – page 16 / Concluding remark – page 17 6 ANNEXES Terms of reference – page 18 Itinerary and programme – page 18 Composition of mission team - page 19 Maps – pages 2 – 20 (special document) Photographs - page 21 (special document) 3 REPORT ACKNOWLEDGEMENTS ICOMOS International appointed Toni Häfliger, Arch. -

European Train Names: a Historic Outline Christian Weyers

ONOMÀSTICA BIBLIOTECA TÈCNICA DE POLÍTICA LINGÜÍSTICA European Train Names: a Historic Outline* Christian Weyers DOI: 10.2436/15.8040.01.201 Abstract This paper gives a first overview of the onomastic category of train names, searches to classify the corpus and reviews different stages of their productivity. Apart from geographical names (toponyms, choronyms, compass directions) generally indicating points of origin and destination of the trains in question, a considerable number of personal names have entered this category, of classical literary authors, musicians and scientists, but also of many fictional or non-fictional characters taken from literature or legendary traditions. In some cases also certain symbolic attributes of these persons and finally even heraldic figures have given their names to trains. In terms of their functionality, train names originally were an indicator of exclusiveness and high grade of travel quality, but they developed gradually, as they dispersed over the European continent, into a rather unspecific, generalized appellation, also for regional and local trains. After two periods of prosperity after 1950, the privatisation of railway companies starting in the 1990s had again a very positive effect on the category, as the number of named trains initially reached a new record in this decade. ***** The first train names appeared in England in the 1860s in addition to names for steam locomotives, and on two different levels. The Special Scotch Express between London King’s Cross and Edinburgh (inaugurated in 1862) was called by the public The Flying Scotsman from the 1870s, but it succeeded as the official name not before 1924. Also the names of the German diesel trainsets Der Fliegende Hamburger and Der Fliegende Kölner were colloquial name creations, as were the Train Bleu and the Settebello operated from 1922 and 1953 but officially named in 1947 and 1958, respectively. -

20 Jahre Intercity in Österreich

Herbert Kröll: 20 Jahre Intercity in Österreich 20 Jahre Intercity in Österreich Intercity, 20 Jahre danach Der „Intercity“ steht in Österreich im unmittelbaren Zusammenhang mit der Einführung des NAT 91 (Neuer Austrotakt-Takt 91). Mit 2. Juni 1991 trat der seit Jahrzehnten umfangreichste Fahrplan der ÖBB in Kraft, der die erste Etappe eines integrierten Taktsystems im Rahmen des Vorhabens „Neue Bahn“ verwirklichen sollte. 20 Jahre danach kann vom Scheitern dieses Zieles gesprochen werden. Einige damals im Takt verkehrenden Nebenstrecken wurden Opfer der Nebenbahneinstellungen und auch innerösterreichische ehemalige Taktlinien wie Wien-Zell am See-Innsbruck, Graz-Linz, Graz-Salzburg und Graz- Innsbruck existieren nicht mehr bzw. werden nur mehr durch einzelne Züge bedient. Politischer Unwille, eine aufgeblähte Bürokratie, engstirniges Denken, komplizierte eigenständige Verkehrsverbünde und der vorgeschobene wirtschaftliche Sparzwang, haben zu teilweise katastrophalen Zuständen im österreichischen Fernverkehr der Bahn geführt. Ab Dezember 2011 wird Graz, die zweitgrößte Stadt Österreichs, im österreichischen Bahnfernverkehr nur mehr mit Wien und 3 Mal täglich mit Salzburg verbunden sein. Die Verbindung nach Klagenfurt erfolgt mit Intercity-Bus auf der Autobahn, ebenso sollen Linz und Salzburg eventuell mit dem Intercity-Bus auf der Autobahn eingebunden werden. Als Ersatz haben bereits 3 Busbetreiber um eine Konzession für Graz-Salzburg angesucht. Der 2-geleisige Ausbau St.Michael-Selzthal zur Hochleistungsstrecke sowie Ausbauten der Pyhrn- und Ennstalstrecke werden somit zu Fehlinvestitionen, da der Zugverkehr immer mehr eingeschränkt wird. Auch die Tagesverbindungen über Tarvisio nach Venedig wurden von Bahn auf Intercitybus umgestellt. Im Sommer verkehren am Wochenende sogar 5 Buskurse zwischen Klagenfurt und Venedig. Vom ehrgeizigen Ziel der Vertaktung einer vernetzten Bahninfrastruktur ist nicht mehr viel übrig. -

Branding Brussels Musically: Cosmopolitanism and Nationalism in the Interwar Years

BRANDING BRUSSELS MUSICALLY: COSMOPOLITANISM AND NATIONALISM IN THE INTERWAR YEARS Catherine A. Hughes A dissertation submitted to the faculty at the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of Music. Chapel Hill 2015 Approved by: Annegret Fauser Mark Evan Bonds Valérie Dufour John L. Nádas Chérie Rivers Ndaliko © 2015 Catherine A. Hughes ALL RIGHTS RESERVED ii ABSTRACT Catherine A. Hughes: Branding Brussels Musically: Cosmopolitanism and Nationalism in the Interwar Years (Under the direction of Annegret Fauser) In Belgium, constructions of musical life in Brussels between the World Wars varied widely: some viewed the city as a major musical center, and others framed the city as a peripheral space to its larger neighbors. Both views, however, based the city’s identity on an intense interest in new foreign music, with works by Belgian composers taking a secondary importance. This modern and cosmopolitan concept of cultural achievement offered an alternative to the more traditional model of national identity as being built solely on creations by native artists sharing local traditions. Such a model eluded a country with competing ethnic groups: the Francophone Walloons in the south and the Flemish in the north. Openness to a wide variety of music became a hallmark of the capital’s cultural identity. As a result, the forces of Belgian cultural identity, patriotism, internationalism, interest in foreign culture, and conflicting views of modern music complicated the construction of Belgian cultural identity through music. By focusing on the work of the four central people in the network of organizers, patrons, and performers that sustained the art music culture in the Belgian capital, this dissertation challenges assumptions about construction of musical culture. -

Quels Transports Durables Pour Franchir Les Alpes En

QUELS TRANSPORTS DURABLES POUR FRANCHIR LES ALPES EN 2020 ? DOSSIER DES RESUMES COLLOQUE DU 13 OCTOBRE 2005 1 SOMMAIRE Matin: 9h00-12h30 1. OUVERTURE P 3 Accueil de Louis BESSON, Ancien Ministre, Maire de Chambéry Intervention de Messieurs: Jean-Pierre VIAL, Président du Conseil Général de la Savoie Jean-Jack QUEYRANNE, Président de la Région Rhône-Alpes Interventions de Messieurs les Ministres: Dominique PERBEN, Ministre français des Transports, de l'Equipement, du Tourisme et de la Mer Pietro LUNARDI, Ministre italien des Infrastructures et des Transports 2. ETAT DES LIEUX, ENJEUX ET PRIORITES: LES ALPES MALADES DES TRANSPORTS ? P 3 Séquence animée par Claude HAEGI, Président de la FEDRE (Fondation Européenne pour le Développement des Régions): Présentation du colloque par Claude HAEGI Introduction par Marie-Line MEAUX, Secrétaire Générale de la Mission des Alpes et des Pyrénées (Ministère chargé des Transports) et Présidente du Groupe Transport de la Convention Alpine. 2.1. Quatre priorités à traiter P 7 Maîtriser la croissance des trafics et leur répartition dans l'espace alpin Jean-Claude METEYER, Direction des Affaires Economiques et Internationales au Ministère des Transports, de l'Equipement, du Tourisme et de la Mer, France. p 7 Préserver le patrimoine environnemental Ruggero SCHLEICHER-TAPPESER, Secrétaire Général de la Convention Alpine. p 9 Sécuriser les ouvrages et les systèmes de transport transalpins Helmut ADELSBERGER, Chef du Département "Réseaux Internationaux et Programme Cadre en matière de Transports" au Ministère des Transports, de l'Innovation et de la Technologie, Autriche. p 11 Réguler le trafic routier par une coopération renforcée entre pays alpins W illy BURGUNDER, Directeur suppléant à l'Office Fédéral des Transports, Suisse. -

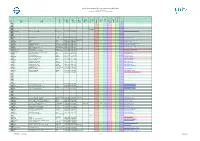

List of Numeric Codes for Railway Companies

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/spip.php?article311 code short name full name country request date allocation date modified date beginof validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0001 0002 0003 0004 0005 01/02/2011 0006 StL Holland Stena Line Holland BV Netherlands 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0007 0008 0009 0010 VR VR-Yhtymä Oy Finland 30/06/1999 30/06/1999 x http://www.vr.fi/fi/ 0011 0012 TF Transfesa Spain 30/06/1999 30/06/1999 10/09/2013 x http://www.transfesa.com/ 0013 OSJD OSJD Poland 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits France 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance United Kingdom 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA Switzerland 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd United Kingdom 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA Belgium 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited United Kingdom 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' Russia 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways Belarus 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi Ukraine 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova Moldova 30/06/1999 30/06/1999