Here We Go Again

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

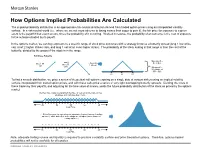

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

Top 40 Singles Top 40 Albums Senorita Lalala WHEN WE ALL FALL ASLEEP, WH

15 July 2019 CHART #2199 Top 40 Singles Top 40 Albums Senorita Lalala WHEN WE ALL FALL ASLEEP, WH... Western Stars 1 Shawn Mendes And Camila Cabello 21 Y2K And bbno$ 1 Billie Eilish 21 Bruce Springsteen Last week 1 / 3 weeks Island/Universal/SonyMusic Last week 28 / 2 weeks Columbia/SonyMusic Last week 2 / 15 weeks Platinum / Darkroom/Interscope/... Last week 12 / 4 weeks Columbia/SonyMusic Old Town Road (Remix) Never Really Over Revenge Of The Dreamers III Scorpion 2 Lil Nas X feat. Billy Ray Cyrus 22 Katy Perry 2 Dreamville 22 Drake Last week 2 / 16 weeks Platinum x2 / LilNasX/SonyMusic Last week 21 / 6 weeks Capitol/Universal Last week - / 1 weeks Dreamville/Interscope/Universal Last week 23 / 54 weeks Platinum x2 / CashMoney/Univer... Beautiful People The London Diamonds Hotel Diablo 3 Ed Sheeran feat. Khalid 23 Young Thug feat. J. Cole And Travis... 3 Elton John 23 Machine Gun Kelly Last week 4 / 2 weeks Asylum/Warner/SonyMusic Last week 20 / 7 weeks 300Entertainment/Warner Last week 6 / 52 weeks Platinum x2 / Virgin/Universal Last week - / 1 weeks BadBoy/Interscope/Universal I Don't Care Go Loko Indigo Hurts 2B Human 4 Ed Sheeran And Justin Bieber 24 YG feat. Tyga And Jon Z 4 Chris Brown 24 Pink Last week 3 / 9 weeks Platinum / Asylum/Warner Last week 23 / 8 weeks DefJam/Universal Last week 3 / 2 weeks ChrisBrownEntertainment/RCA/S... Last week 22 / 11 weeks Gold / RCA/SonyMusic Goodbyes Rescue Me 7 EP ERYS 5 Post Malone feat. Young Thug 25 OneRepublic 5 Lil Nas X 25 Jaden Last week - / 1 weeks Republic/Universal Last week 25 / 6 weeks Mosley/Interscope/Universal Last week 8 / 3 weeks Columbia/SonyMusic Last week - / 1 weeks MSFTS/RocNation/Universal Someone You Loved Wow. -

Karaoke Mietsystem Songlist

Karaoke Mietsystem Songlist Ein Karaokesystem der Firma Showtronic Solutions AG in Zusammenarbeit mit Karafun. Karaoke-Katalog Update vom: 13/10/2020 Singen Sie online auf www.karafun.de Gesamter Katalog TOP 50 Shallow - A Star is Born Take Me Home, Country Roads - John Denver Skandal im Sperrbezirk - Spider Murphy Gang Griechischer Wein - Udo Jürgens Verdammt, Ich Lieb' Dich - Matthias Reim Dancing Queen - ABBA Dance Monkey - Tones and I Breaking Free - High School Musical In The Ghetto - Elvis Presley Angels - Robbie Williams Hulapalu - Andreas Gabalier Someone Like You - Adele 99 Luftballons - Nena Tage wie diese - Die Toten Hosen Ring of Fire - Johnny Cash Lemon Tree - Fool's Garden Ohne Dich (schlaf' ich heut' nacht nicht ein) - You Are the Reason - Calum Scott Perfect - Ed Sheeran Münchener Freiheit Stand by Me - Ben E. King Im Wagen Vor Mir - Henry Valentino And Uschi Let It Go - Idina Menzel Can You Feel The Love Tonight - The Lion King Atemlos durch die Nacht - Helene Fischer Roller - Apache 207 Someone You Loved - Lewis Capaldi I Want It That Way - Backstreet Boys Über Sieben Brücken Musst Du Gehn - Peter Maffay Summer Of '69 - Bryan Adams Cordula grün - Die Draufgänger Tequila - The Champs ...Baby One More Time - Britney Spears All of Me - John Legend Barbie Girl - Aqua Chasing Cars - Snow Patrol My Way - Frank Sinatra Hallelujah - Alexandra Burke Aber Bitte Mit Sahne - Udo Jürgens Bohemian Rhapsody - Queen Wannabe - Spice Girls Schrei nach Liebe - Die Ärzte Can't Help Falling In Love - Elvis Presley Country Roads - Hermes House Band Westerland - Die Ärzte Warum hast du nicht nein gesagt - Roland Kaiser Ich war noch niemals in New York - Ich War Noch Marmor, Stein Und Eisen Bricht - Drafi Deutscher Zombie - The Cranberries Niemals In New York Ich wollte nie erwachsen sein (Nessajas Lied) - Don't Stop Believing - Journey EXPLICIT Kann Texte enthalten, die nicht für Kinder und Jugendliche geeignet sind. -

Edition 2019

YEAR-END EDITION 2019 Global Headquarters Republic Records 1755 Broadway, New York City 10019 © 2019 Mediabase 1 REPUBLIC #1 FOR 6TH STRAIGHT YEAR UMG SCORES TOP 3 -- AS INTERSCOPE, CAPITOL CLAIM #2 AND #3 SPOTS For the sixth consecutive year, REPUBLIC is the #1 label for Mediabase chart share. • The 2019 chart year is based on the time period from November 11, 2018 through November 9, 2019. • All spins are tallied for the full 52 weeks and then converted into percentages for the chart share. • The final chart share includes all applicable label split-credit as submitted to Mediabase during the year. • For artists, if a song had split-credit, each artist featured was given the same percentage for the artist category that was assigned to the label share. REPUBLIC’S total chart share was 19.2% -- up from 16.3% last year. Their Top 40 chart share of 28.0% was a notable gain over the 22.1% they had in 2018. REPUBLIC took the #1 spot at Rhythmic with 20.8%. They were also the leader at Hot AC; where a fourth quarter surge landed them at #1 with 20.0%, that was up from a second place 14.0% finish in 2018. Other highlights for REPUBLIC in 2019: • The label’s total spin counts for the year across all formats came in at 8.38 million, an increase of 20.2% over 2018. • This marks the label’s second highest spin total in its history. • REPUBLIC had several artist accomplishments, scoring three of the top four at Top 40 with Ariana Grande (#1), Post Malone (#2), and the Jonas Brothers (#4). -

Intraday Volatility Surface Calibration

INTRADAY VOLATILITY SURFACE CALIBRATION Master Thesis Tobias Blomé & Adam Törnqvist Master thesis, 30 credits Department of Mathematics and Mathematical Statistics Spring Term 2020 Intraday volatility surface calibration Adam T¨ornqvist,[email protected] Tobias Blom´e,[email protected] c Copyright by Adam T¨ornqvist and Tobias Blom´e,2020 Supervisors: Jonas Nyl´en Nasdaq Oskar Janson Nasdaq Xijia Liu Department of Mathematics and Mathematical Statistics Examiner: Natalya Pya Arnqvist Department of Mathematics and Mathematical Statistics Master of Science Thesis in Industrial Engineering and Management, 30 ECTS Department of Mathematics and Mathematical Statistics Ume˚aUniversity SE-901 87 Ume˚a,Sweden i Abstract On the financial markets, investors search to achieve their economical goals while simultaneously being exposed to minimal risk. Volatility surfaces are used for estimating options' implied volatilities and corresponding option prices, which are used for various risk calculations. Currently, volatility surfaces are constructed based on yesterday's market in- formation and are used for estimating options' implied volatilities today. Such a construction gets redundant very fast during periods of high volatility, which leads to inaccurate risk calculations. With an aim to reduce volatility surfaces' estimation errors, this thesis explores the possibilities of calibrating volatility surfaces intraday using incomplete mar- ket information. Through statistical analysis of the volatility surfaces' historical movements, characteristics are identified showing sections with resembling mo- tion patterns. These insights are used to adjust the volatility surfaces intraday. The results of this thesis show that calibrating the volatility surfaces intraday can reduce the estimation errors significantly during periods of both high and low volatility. -

Binomial Trees • Stochastic Calculus, Ito’S Rule, Brownian Motion • Black-Scholes Formula and Variations • Hedging • Fixed Income Derivatives

Pricing Options with Mathematical Models 1. OVERVIEW Some of the content of these slides is based on material from the book Introduction to the Economics and Mathematics of Financial Markets by Jaksa Cvitanic and Fernando Zapatero. • What we want to accomplish: Learn the basics of option pricing so you can: - (i) continue learning on your own, or in more advanced courses; - (ii) prepare for graduate studies on this topic, or for work in industry, or your own business. • The prerequisites we need to know: - (i) Calculus based probability and statistics, for example computing probabilities and expected values related to normal distribution. - (ii) Basic knowledge of differential equations, for example solving a linear ordinary differential equation. - (iii) Basic programming or intermediate knowledge of Excel • A rough outline: - Basic securities: stocks, bonds - Derivative securities, options - Deterministic world: pricing fixed cash flows, spot interest rates, forward rates • A rough outline (continued): - Stochastic world, pricing options: • Pricing by no-arbitrage • Binomial trees • Stochastic Calculus, Ito’s rule, Brownian motion • Black-Scholes formula and variations • Hedging • Fixed income derivatives Pricing Options with Mathematical Models 2. Stocks, Bonds, Forwards Some of the content of these slides is based on material from the book Introduction to the Economics and Mathematics of Financial Markets by Jaksa Cvitanic and Fernando Zapatero. A Classification of Financial Instruments SECURITIES AND CONTRACTS BASIC SECURITIES DERIVATIVES -

Consolidated Policy on Valuation Adjustments Global Capital Markets

Global Consolidated Policy on Valuation Adjustments Consolidated Policy on Valuation Adjustments Global Capital Markets September 2008 Version Number 2.35 Dilan Abeyratne, Emilie Pons, William Lee, Scott Goswami, Jerry Shi Author(s) Release Date September lOth 2008 Page 1 of98 CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS LBEX-BARFID 0011765 Global Consolidated Policy on Valuation Adjustments Version Control ............................................................................................................................. 9 4.10.4 Updated Bid-Offer Delta: ABS Credit SpreadDelta................................................................ lO Commodities for YH. Bid offer delta and vega .................................................................................. 10 Updated Muni section ........................................................................................................................... 10 Updated Section 13 ............................................................................................................................... 10 Deleted Section 20 ................................................................................................................................ 10 Added EMG Bid offer and updated London rates for all traded migrated out oflens ....................... 10 Europe Rates update ............................................................................................................................. 10 Europe Rates update continue ............................................................................................................. -

Why and How to Trade Butterflies to Beat Any Market by Larry Gaines

Why and How to Trade Butterflies to Beat Any Market By Larry Gaines, Founder PowerCycleTrading.com, 30 Year Trading Professional Butterflies provide a low-risk high reward trading opportunity more than any other option strategy. As most traders know, markets direction can go through months and even years of higher than usual uncertainty. While there’s always some degree of uncertainty that traders and investors must accept, there can be long frustrating periods of higher than usual conflicting signals. Or often, technical analysis paints one picture, while the economic or political environment paints another picture. This can be said for both broad market direction and individual securities. Higher levels of uncertainty can be both stressful and costly for traders waiting on the sidelines. Plus, for traders who have come to rely on regular income from trading, loss of that income can cause serious lifestyle problems. These situations call for a strategy that will work no matter which direction the market heads. That’s exactly what the highly versatile Butterfly strategy does. It gives you a trading advantage in any type of market environment. This makes it a powerful strategy that every serious trader will want to add to their arsenal of skills. Power Cycle Trading© – Click Here for Weekly Unique Trade Ideas, Live Q&A with Larry, Trading Room+ Many traders have heard about the advantages of Butterfly strategies, yet they may have avoided it because of its complexity. Initially, the setup can seem overly complicated. This is because most traders try to master the Butterfly without truly understanding a few basic option trading principles first. -

Numerical Methods in Finance

NUMERICAL METHODS IN FINANCE Dr Antoine Jacquier wwwf.imperial.ac.uk/~ajacquie/ Department of Mathematics Imperial College London Spring Term 2016-2017 MSc in Mathematics and Finance This version: March 8, 2017 1 Contents 0.1 Some considerations on algorithms and convergence ................. 8 0.2 A concise introduction to arbitrage and option pricing ................ 10 0.2.1 European options ................................. 12 0.2.2 American options ................................. 13 0.2.3 Exotic options .................................. 13 1 Lattice (tree) methods 14 1.1 Binomial trees ...................................... 14 1.1.1 One-period binomial tree ............................ 14 1.1.2 Multi-period binomial tree ............................ 16 1.1.3 From discrete to continuous time ........................ 18 Kushner theorem for Markov chains ...................... 18 Reconciling the discrete and continuous time ................. 20 Examples of models ............................... 21 Convergence of CRR to the Black-Scholes model ............... 23 1.1.4 Adding dividends ................................. 29 1.2 Trinomial trees ...................................... 29 Boyle model .................................... 30 Kamrad-Ritchken model ............................. 31 1.3 Overture on stability analysis .............................. 33 2 Monte Carlo methods 35 2.1 Generating random variables .............................. 35 2.1.1 Uniform random number generator ....................... 35 Generating uniform random -

Arbitrage Spread.Pdf

Arbitrage spreads Arbitrage spreads refer to standard option strategies like vanilla spreads to lock up some arbitrage in case of mispricing of options. Although arbitrage used to exist in the early days of exchange option markets, these cheap opportunities have almost completely disappeared, as markets have become more and more efficient. Nowadays, millions of eyes as well as computer software are hunting market quote screens to find cheap bargain, reducing the life of a mispriced quote to a few seconds. In addition, standard option strategies are now well known by the various market participants. Let us review the various standard arbitrage spread strategies Like any trades, spread strategies can be decomposed into bullish and bearish ones. Bullish position makes money when the market rallies while bearish does when the market sells off. The spread option strategies can decomposed in the following two categories: Spreads: Spread trades are strategies that involve a position on two or more options of the same type: either a call or a put but never a combination of the two. Typical spreads are bull, bear, calendar, vertical, horizontal, diagonal, butterfly, condors. Combination: in contrast to spreads combination trade implies to take a position on both call and puts. Typical combinations are straddle, strangle1, and risk reversal. Spreads (bull, bear, calendar, vertical, horizontal, diagonal, butterfly, condors) Spread trades are a way of taking views on the difference between two or more assets. Because the trading strategy plays on the relative difference between different derivatives, the risk and the upside are limited. There are many types of spreads among which bull, bear, and calendar, vertical, horizontal, diagonal, butterfly spreads are the most famous.