Bond Futures Calendar Spread Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The TIPS-Treasury Bond Puzzle

The TIPS-Treasury Bond Puzzle Matthias Fleckenstein, Francis A. Longstaff and Hanno Lustig The Journal of Finance, October 2014 Presented By: Rafael A. Porsani The TIPS-Treasury Bond Puzzle 1 / 55 Introduction The TIPS-Treasury Bond Puzzle 2 / 55 Introduction (1) Treasury bond and the Treasury Inflation-Protected Securities (TIPS) markets: two of the largest and most actively traded fixed-income markets in the world. Find that there is persistent mispricing on a massive scale across them. Treasury bonds are consistently overpriced relative to TIPS. Price of a Treasury bond can exceed that of an inflation-swapped TIPS issue exactly matching the cash flows of the Treasury bond by more than $20 per $100 notional amount. One of the largest examples of arbitrage ever documented. The TIPS-Treasury Bond Puzzle 3 / 55 Introduction (2) Use TIPS plus inflation swaps to create synthetic Treasury bond. Price differences between the synthetic Treasury bond and the nominal Treasury bond: arbitrage opportunities. Average size of the mispricing: 54.5 basis points, but can exceed 200 basis points for some pairs. I The average size of this mispricing is orders of magnitude larger than transaction costs. The TIPS-Treasury Bond Puzzle 4 / 55 Introduction (3) What drives the mispricing? Slow-moving capital may help explain why mispricing persists. Is TIPS-Treasury mispricing related to changes in capital available to hedge funds? Answer: Yes. Mispricing gets smaller as more capital gets to the hedge fund sector. The TIPS-Treasury Bond Puzzle 5 / 55 Introduction (4) Also find that: Correlation in arbitrage strategies: size of TIPS-Treasury arbitrage is correlated with arbitrage mispricing in other markets. -

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces

DEGREE PROJECT IN MATHEMATICS, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2020 Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ENGINEERING SCIENCES Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON Degree Projects in Mathematical Statistics (30 ECTS credits) Master's Programme in Applied and Computational Mathematics (120 credits) KTH Royal Institute of Technology year 2020 Supervisor at Nasdaq Technology AB: Sebastian Lindberg Supervisor at KTH: Fredrik Viklund Examiner at KTH: Fredrik Viklund TRITA-SCI-GRU 2020:081 MAT-E 2020:044 Royal Institute of Technology School of Engineering Sciences KTH SCI SE-100 44 Stockholm, Sweden URL: www.kth.se/sci Abstract The implied volatility surface plays an important role for Front office and Risk Manage- ment functions at Nasdaq and other financial institutions which require mark-to-market of derivative books intraday in order to properly value their instruments and measure risk in trading activities. Based on the aforementioned business needs, being able to calibrate an end of day implied volatility surface based on new market information is a sought after trait. In this thesis a statistical learning approach is used to calibrate the implied volatility surface intraday. This is done by using OMXS30-2019 implied volatil- ity surface data in combination with market information from close to at the money options and feeding it into 3 Machine Learning models. The models, including Feed For- ward Neural Network, Recurrent Neural Network and Gaussian Process, were compared based on optimal input and data preprocessing steps. -

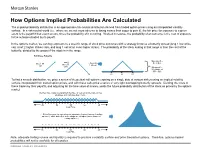

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Evidence from SME Bond Markets

Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria September 2020 September Number 1292 Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria Number 1292 - September 2020 The papers published in the Temi di discussione series describe preliminary results and are made available to the public to encourage discussion and elicit comments. The views expressed in the articles are those of the authors and do not involve the responsibility of the Bank. Editorial Board: Federico Cingano, Marianna Riggi, Monica Andini, Audinga Baltrunaite, Marco Bottone, Davide Delle Monache, Sara Formai, Francesco Franceschi, Salvatore Lo Bello, Juho Taneli Makinen, Luca Metelli, Mario Pietrunti, Marco Savegnago. Editorial Assistants: Alessandra Giammarco, Roberto Marano. ISSN 1594-7939 (print) ISSN 2281-3950 (online) Printed by the Printing and Publishing Division of the Bank of Italy ASYMMETRIC INFORMATION IN CORPORATE LENDING: EVIDENCE FROM SME BOND MARKETS by Alessandra Iannamorelli†, Stefano Nobili†, Antonio Scalia† and Luana Zaccaria‡ Abstract Using a comprehensive dataset of Italian SMEs, we find that differences between private and public information on creditworthiness affect firms’ decisions to issue debt securities. Surprisingly, our evidence supports positive (rather than adverse) selection. Holding public information constant, firms with better private fundamentals are more likely to access bond markets. Additionally, credit conditions improve for issuers following the bond placement, compared with a matched sample of non-issuers. These results are consistent with a model where banks offer more flexibility than markets during financial distress and firms may use market lending to signal credit quality to outside stakeholders. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Corporate Bonds and Debentures

Corporate Bonds and Debentures FCS Vinita Nair Vinod Kothari Company Kolkata: New Delhi: Mumbai: 1006-1009, Krishna A-467, First Floor, 403-406, Shreyas Chambers 224 AJC Bose Road Defence Colony, 175, D N Road, Fort Kolkata – 700 017 New Delhi-110024 Mumbai Phone: 033 2281 3742/7715 Phone: 011 41315340 Phone: 022 2261 4021/ 6237 0959 Email: [email protected] Email: [email protected] Email: [email protected] Website: www.vinodkothari.com 1 Copyright & Disclaimer . This presentation is only for academic purposes; this is not intended to be a professional advice or opinion. Anyone relying on this does so at one’s own discretion. Please do consult your professional consultant for any matter covered by this presentation. The contents of the presentation are intended solely for the use of the client to whom the same is marked by us. No circulation, publication, or unauthorised use of the presentation in any form is allowed, except with our prior written permission. No part of this presentation is intended to be solicitation of professional assignment. 2 About Us Vinod Kothari and Company, company secretaries, is a firm with over 30 years of vintage Based out of Kolkata, New Delhi & Mumbai We are a team of qualified company secretaries, chartered accountants, lawyers and managers. Our Organization’s Credo: Focus on capabilities; opportunities follow 3 Law & Practice relating to Corporate Bonds & Debentures 4 The book can be ordered by clicking here Outline . Introduction to Debentures . State of Indian Bond Market . Comparison of debentures with other forms of borrowings/securities . Types of Debentures . Modes of Issuance & Regulatory Framework . -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

Corporate Bond Market Dysfunction During COVID-19 and Lessons

Hutchins Center Working Paper # 69 O c t o b e r 2 0 2 0 Corporate Bond Market Dysfunction During COVID-19 and Lessons from the Fed’s Response J. Nellie Liang* October 1, 2020 Abstract: Changes in the financial sector since the global financial crisis appear to have increased dramatically the demand for liquidity by holders of corporate bonds beyond the ability of the markets to provide it in stress events. The March market turmoil revealed the costs of liquidity mismatch in open-end bond mutual funds. The surprisingly large redemptions of investment-grade corporate bond funds added to stresses in both the corporate bond and Treasury markets. These conditions led to unprecedented Fed interventions, which significantly reduced risk spreads and improved market functioning, with much of the improvements occurring right after the initial announcement. The improved conditions allowed companies to issue bonds, which helped them to maintain employees and investment spending. The episode suggests several areas for further study and possible reforms. * J. Nellie Liang, Hutchins Center on Fiscal and Monetary Policy, Brookings Institution ([email protected]). I would like to thank Darrell Duffie, Bill English, Anil Kashyap, Donald Kohn, Patrick Parkinson, Jeremy Stein, Adi Sunderam, David Wessel, and Alex Zhou for helpful comments and insights, and Manuel Alcalá Kovalski for excellent research assistance. THIS PAPER IS ONLINE AT https://www.brookings.edu/research/corporate- bond-market-dysfunction-during-covid-19-and- lessons-from-the-feds-response/ 1. Introduction As concerns about the pandemic’s effect on economic activity in early March escalated, asset prices began to move in unusual ways—including the prices of investment-grade corporate bonds. -

Nber Working Paper Series Facts and Fantasies About

NBER WORKING PAPER SERIES FACTS AND FANTASIES ABOUT COMMODITY FUTURES TEN YEARS LATER Geetesh Bhardwaj Gary Gorton Geert Rouwenhorst Working Paper 21243 http://www.nber.org/papers/w21243 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 June 2015 The paper has benefited from comments by seminar participants at the 2015 Bloomberg Global Commodity Investment Roundtable, the 2015 FTSE World Investment Forum, and from Rajkumar Janardanan, Kurt Nelson, Ashraf Rizvi, and Matthew Schwab. Gorton has nothing to currently disclose. He was a consultant to AIG Financial Products from 1996-2008. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. At least one co-author has disclosed a financial relationship of potential relevance for this research. Further information is available online at http://www.nber.org/papers/w21243.ack NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2015 by Geetesh Bhardwaj, Gary Gorton, and Geert Rouwenhorst. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Facts and Fantasies about Commodity Futures Ten Years Later Geetesh Bhardwaj, Gary Gorton, and Geert Rouwenhorst NBER Working Paper No. 21243 June 2015 JEL No. G1,G11,G12 ABSTRACT Gorton and Rouwenhorst (2006) examined commodity futures returns over the period July 1959 to December 2004 based on an equally-weighted index. -

VERTICAL SPREADS: Taking Advantage of Intrinsic Option Value

Advanced Option Trading Strategies: Lecture 1 Vertical Spreads – The simplest spread consists of buying one option and selling another to reduce the cost of the trade and participate in the directional movement of an underlying security. These trades are considered to be the easiest to implement and monitor. A vertical spread is intended to offer an improved opportunity to profit with reduced risk to the options trader. A vertical spread may be one of two basic types: (1) a debit vertical spread or (2) a credit vertical spread. Each of these two basic types can be written as either bullish or bearish positions. A debit spread is written when you expect the stock movement to occur over an intermediate or long- term period [60 to 120 days], whereas a credit spread is typically used when you want to take advantage of a short term stock price movement [60 days or less]. VERTICAL SPREADS: Taking Advantage of Intrinsic Option Value Debit Vertical Spreads Bull Call Spread During March, you decide that PFE is going to make a large up move over the next four months going into the Summer. This position is due to your research on the portfolio of drugs now in the pipeline and recent phase 3 trials that are going through FDA approval. PFE is currently trading at $27.92 [on March 12, 2013] per share, and you believe it will be at least $30 by June 21st, 2013. The following is the option chain listing on March 12th for PFE. View By Expiration: Mar 13 | Apr 13 | May 13 | Jun 13 | Sep 13 | Dec 13 | Jan 14 | Jan 15 Call Options Expire at close Friday, -

A Glossary of Securities and Financial Terms

A Glossary of Securities and Financial Terms (English to Traditional Chinese) 9-times Restriction Rule 九倍限制規則 24-spread rule 24 個價位規則 1 A AAAC see Academic and Accreditation Advisory Committee【SFC】 ABS see asset-backed securities ACCA see Association of Chartered Certified Accountants, The ACG see Asia-Pacific Central Securities Depository Group ACIHK see ACI-The Financial Markets of Hong Kong ADB see Asian Development Bank ADR see American depositary receipt AFTA see ASEAN Free Trade Area AGM see annual general meeting AIB see Audit Investigation Board AIM see Alternative Investment Market【UK】 AIMR see Association for Investment Management and Research AMCHAM see American Chamber of Commerce AMEX see American Stock Exchange AMS see Automatic Order Matching and Execution System AMS/2 see Automatic Order Matching and Execution System / Second Generation AMS/3 see Automatic Order Matching and Execution System / Third Generation ANNA see Association of National Numbering Agencies AOI see All Ordinaries Index AOSEF see Asian and Oceanian Stock Exchanges Federation APEC see Asia Pacific Economic Cooperation API see Application Programming Interface APRC see Asia Pacific Regional Committee of IOSCO ARM see adjustable rate mortgage ASAC see Asian Securities' Analysts Council ASC see Accounting Society of China 2 ASEAN see Association of South-East Asian Nations ASIC see Australian Securities and Investments Commission AST system see automated screen trading system ASX see Australian Stock Exchange ATI see Account Transfer Instruction ABF Hong