Options Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Up to EUR 3,500,000.00 7% Fixed Rate Bonds Due 6 April 2026 ISIN

Up to EUR 3,500,000.00 7% Fixed Rate Bonds due 6 April 2026 ISIN IT0005440976 Terms and Conditions Executed by EPizza S.p.A. 4126-6190-7500.7 This Terms and Conditions are dated 6 April 2021. EPizza S.p.A., a company limited by shares incorporated in Italy as a società per azioni, whose registered office is at Piazza Castello n. 19, 20123 Milan, Italy, enrolled with the companies’ register of Milan-Monza-Brianza- Lodi under No. and fiscal code No. 08950850969, VAT No. 08950850969 (the “Issuer”). *** The issue of up to EUR 3,500,000.00 (three million and five hundred thousand /00) 7% (seven per cent.) fixed rate bonds due 6 April 2026 (the “Bonds”) was authorised by the Board of Directors of the Issuer, by exercising the powers conferred to it by the Articles (as defined below), through a resolution passed on 26 March 2021. The Bonds shall be issued and held subject to and with the benefit of the provisions of this Terms and Conditions. All such provisions shall be binding on the Issuer, the Bondholders (and their successors in title) and all Persons claiming through or under them and shall endure for the benefit of the Bondholders (and their successors in title). The Bondholders (and their successors in title) are deemed to have notice of all the provisions of this Terms and Conditions and the Articles. Copies of each of the Articles and this Terms and Conditions are available for inspection during normal business hours at the registered office for the time being of the Issuer being, as at the date of this Terms and Conditions, at Piazza Castello n. -

Mergers and Acquisitions - Collar Contracts

Mergers and Acquisitions - Collar Contracts An Chen University of Bonn joint with Christian Hilpert (University of Bonn) Seminar at the Institute of Financial Studies Chengdu, June 2012 Introduction Model setup and valuation Value change through WA Welfare analysis Traditional M&A deals Traditional M&A deals: two main payment methods to the target all cash deals: fixed price deal stock-for-stock exchange: fixed ratio deal Risks involved in traditional M&A transactions: Pre-closing risk: the possibility that fluctuations of bidder and target stock prices will affect the terms of the deal and reduce the likelihood the deal closes. Post-closing risk: after the closing the possible failure of the target to perform up to expectations, thus resulting in overpayment ⇒ major risk for the shareholders of the bidder An Chen Mergers and Acquisitions - Collar Contracts 2 Introduction Model setup and valuation Value change through WA Welfare analysis Pre-closing instruments: Collars Collars were introduced to protect against extreme price fluctuations in the share prices of bidder and target: Fixed price collars and fixed ratio collars Collar-tailored M&A deals have both characteristics of traditional all-cash or stock-for-stock deals. Collars can be used by bidders to cap the payout to selling shareholders An Chen Mergers and Acquisitions - Collar Contracts 3 Introduction Model setup and valuation Value change through WA Welfare analysis Fixed price collar (taken from Officer (2004)) First Community Banccorp Inc. - Banc One Corp., 1994, with K = 31.96$, U = 51$, L = 47$, a = 0.6267, and b = 0.68. 34 33 32 Payoff 31 30 29 44 46 48 50 52 54 Bidder stock price An Chen Mergers and Acquisitions - Collar Contracts 4 Introduction Model setup and valuation Value change through WA Welfare analysis Fixed ratio collar (taken from Officer (2004)) BancFlorida Financial Corp. -

Tracking and Trading Volatility 155

ffirs.qxd 9/12/06 2:37 PM Page i The Index Trading Course Workbook www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page ii Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Aus- tralia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Trading series features books by traders who have survived the market’s ever changing temperament and have prospered—some by reinventing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. For a list of available titles, visit our web site at www.WileyFinance.com. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iii The Index Trading Course Workbook Step-by-Step Exercises and Tests to Help You Master The Index Trading Course GEORGE A. FONTANILLS TOM GENTILE John Wiley & Sons, Inc. www.rasabourse.com ffirs.qxd 9/12/06 2:37 PM Page iv Copyright © 2006 by George A. Fontanills, Tom Gentile, and Richard Cawood. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. -

(NSE), India, Using Box Spread Arbitrage Strategy

Gadjah Mada International Journal of Business - September-December, Vol. 15, No. 3, 2013 Gadjah Mada International Journal of Business Vol. 15, No. 3 (September - December 2013): 269 - 285 Efficiency of S&P CNX Nifty Index Option of the National Stock Exchange (NSE), India, using Box Spread Arbitrage Strategy G. P. Girish,a and Nikhil Rastogib a IBS Hyderabad, ICFAI Foundation For Higher Education (IFHE) University, Andhra Pradesh, India b Institute of Management Technology (IMT) Hyderabad, India Abstract: Box spread is a trading strategy in which one simultaneously buys and sells options having the same underlying asset and time to expiration, but different exercise prices. This study examined the effi- ciency of European style S&P CNX Nifty Index options of National Stock Exchange, (NSE) India by making use of high-frequency data on put and call options written on Nifty (Time-stamped transactions data) for the time period between 1st January 2002 and 31st December 2005 using box-spread arbitrage strategy. The advantages of box-spreads include reduced joint hypothesis problem since there is no consideration of pricing model or market equilibrium, no consideration of inter-market non-synchronicity since trading box spreads involve only one market, computational simplicity with less chances of mis- specification error, estimation error and the fact that buying and selling box spreads more or less repli- cates risk-free lending and borrowing. One thousand three hundreds and fifty eight exercisable box- spreads were found for the time period considered of which 78 Box spreads were found to be profit- able after incorporating transaction costs (32 profitable box spreads were identified for the year 2002, 19 in 2003, 14 in 2004 and 13 in 2005) The results of our study suggest that internal option market efficiency has improved over the years for S&P CNX Nifty Index options of NSE India. -

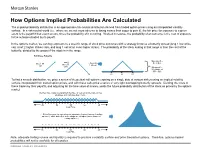

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Interest-Rate Caps, Collars, and Floors

November 1989 Interest-Rate Caps, Collars, and Floors Peter A. Abken As some of the newest interest-rate risk management instruments, caps, collars, and floors are the subject of increasing attention among both investors and analysts. This article explains how such instruments are constructed, discusses their credit risks, and presents a new approach for valuing caps, collars, and floors subject to default risk. 2 ECONOMIC REVIEW, NOVEMBER/DECEMBER 1989 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis November 1989 ince the late 1970s interest rates on all types of fixed-income securities have What Is an Interest-Rate Cap? Sbecome more volatile, spawning a va- riety of methods to mitigate the costs associ- An interest-rate cap, sometimes called a ceil- ated with interest-rate fluctuations. Managing ing, is a financial instrument that effectively interest-rate risk has become big business and places a maximum amount on the interest pay- an exceedingly complicated activity. One facet ment made on floating-rate debt. Many busi- of this type of risk management involves buying nesses borrow funds through loans or bonds on and selling "derivative" assets, which can be which the periodic interest payment varies used to offset or hedge changes in asset or according to a prespecified short-term interest liability values caused by interest-rate move- rate. The most widely used rate in both the caps ments. As its name implies, the value of a de- and swaps markets is the London Interbank rivative asset depends on the value of another Offered Rate (LIBOR), which is the rate offered asset or assets. -

Risk Management Strategies for Cattlemen

RISK MANAGEMENT STRATEGIES FOR CATTLEMEN Kurtis Ward – President/CEO www.kisokc.com As a former agricultural loan officer, I witnessed first-hand the effects that the Dairy Herd Buyout Program had on the Cattle Market of 1986. During this time, I became intrigued by cattlemen who used some form of risk management (Futures, Options, Forward Contracting, etc.) as compared to those who did nothing but speculate on the cash market. It didn’t take long to observe which group made better financial and marketing decisions (perhaps that “hedging stuff” that my college professors were teaching was really important after all). This market event caused my loan officer career to be transformed into a new profession as a commodity futures broker who specialized in risk management strategies for cattlemen. However, my naïve belief back then was that everyone else was having this “illumination” about cattle hedging at the same time. In the 1980’s, it was said that less than 5% of cattlemen were involved in risk management. Fifteen years later, things haven’t changed much which is quite surprising when you look at the total dollars now at risk in any cattle operation. After what we’ve seen during the cattle market of the past two years, I truly believe that cattlemen cannot afford to be just cattlemen any longer. Rather, they must first be “businessmen” who incidentally invest their, time, money and livelihood in a cattle operation. Therefore, the purpose of this article is to quickly review the basics of several risk management strategies in a way that is very simplistic so that the foundational hedging precepts can be easily understood. -

Caps and Floors (MMA708)

School of Education, Culture and Communication Tutor: Jan Röman Caps and Floors (MMA708) Authors: Chiamruchikun Benchaphon 800530-4129 Klongprateepphol Chutima 820708-6722 Pongpala Apiwat 801228-4975 Suntayodom Thanasunun 831224-9264 December 2, 2008 Västerås CONTENTS Abstract…………………………………………………………………………. (i) Introduction…………………………………………………………………….. 1 Caps and caplets……………………………………………………………...... 2 Definition…………………………………………………………….……. 2 The parameters affecting the cap price…………………………………… 6 Strategies …………………………………………………………………. 7 Advantages and disadvantages..…………………………………………. 8 Floors and floorlets..…………………………………………………………… 9 Definition ...……………………………………………………………….. 9 Advantages and disadvantages ..………………………………………….. 11 Black’s model for valuation of caps and floors……….……………………… 12 Put-call parity for caps and floors……………………..……………………… 13 Collars…………………………………………..……….……………………… 14 Definition ...……………………………………………………………….. 14 Advantages and disadvantages ..………………………………………….. 16 Exotic caps and floors……………………..…………………………………… 16 Example…………………………………………………………………………. 18 Numerical example.……………………………………………………….. 18 Example – solved by VBA application.………………………………….. 22 Conclusion………………………………………………………………………. 26 Appendix - Visual Basic Code………………………………………………….. 27 Bibliography……………………………………………………………………. 30 ABSTRACT The behavior of the floating interest rate is so complicate to predict. The investor who lends or borrows with the floating interest rate will have the risk to manage his asset. The interest rate caps and floors are essential tools -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Energy-Related Commodity Futures

Universit¨atUlm Institut f¨urFinanzmathematik Energy-Related Commodity Futures Statistics, Models and Derivatives Dissertation zur Erlangung des Doktorgrades Dr. rer. nat. der Fakult¨at f¨urMathematik und Wirtschaftswissenschaften an der Universit¨at Ulm RSITÄT V E U I L N M U · · S O C I D E N N A D R O U · C · D O O C D E N vorgelegt von Dipl.-Math. oec. Reik H. B¨orger, M. S. Ulm, Juni 2007 ii . iii . Amtierender Dekan: Professor Dr. Frank Stehling 1. Gutachter: Professor Dr. R¨udiger Kiesel, Universit¨at Ulm 2. Gutachter: Professor Dr. Ulrich Rieder, Universit¨atUlm 3. Gutachter: Professor Dr. Ralf Korn, Universit¨at Kaiserslautern Tag der Promotion: 15.10.2007 iv Acknowledgements This thesis would not have been possible without the financial and scientific support by EnBW Trading GmbH. In particular, I received instructive input from Dr. Gero Schindlmayr. He suggested many of the problems that have been covered in this work. In numerous discussions he gave insight into physical and financial details of commodities and commodity markets. I also benefited from his suggestions on aspects of the mathematical models and their applicability to practical questions. I take the opportunity to thank my academic advisor Professor Dr. R¨udiger Kiesel who initiated the collaboration with EnBW from the university’s side and who supported my studies in every possible respect. I highly appreciate his confidence in my work and his encouragement which resulted in an enjoyable working environment that goes far beyond the usual conditions. I thank the members of the Institute of Financial Mathematics at Ulm University, in particular Gregor Mummenhoff, Clemens Prestele and Matthias Scherer, for the many mathematical and non-mathematical activities that enriched my time in Ulm. -

11 Option Payoffs and Option Strategies

11 Option Payoffs and Option Strategies Answers to Questions and Problems 1. Consider a call option with an exercise price of $80 and a cost of $5. Graph the profits and losses at expira- tion for various stock prices. 73 74 CHAPTER 11 OPTION PAYOFFS AND OPTION STRATEGIES 2. Consider a put option with an exercise price of $80 and a cost of $4. Graph the profits and losses at expiration for various stock prices. ANSWERS TO QUESTIONS AND PROBLEMS 75 3. For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at expiration, what will be the profit or loss? At what stock price (or prices) will the straddle have a zero profit? With a stock price at $80 at expiration, neither the call nor the put can be exercised. Both expire worthless, giving a total loss of $9. The straddle breaks even (has a zero profit) if the stock price is either $71 or $89. 4. A call option has an exercise price of $70 and is at expiration. The option costs $4, and the underlying stock trades for $75. Assuming a perfect market, how would you respond if the call is an American option? State exactly how you might transact. How does your answer differ if the option is European? With these prices, an arbitrage opportunity exists because the call price does not equal the maximum of zero or the stock price minus the exercise price. To exploit this mispricing, a trader should buy the call and exercise it for a total out-of-pocket cost of $74.