Seeking Options: Defining and Managing Risk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

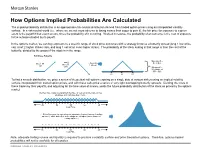

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

Intraday Volatility Surface Calibration

INTRADAY VOLATILITY SURFACE CALIBRATION Master Thesis Tobias Blomé & Adam Törnqvist Master thesis, 30 credits Department of Mathematics and Mathematical Statistics Spring Term 2020 Intraday volatility surface calibration Adam T¨ornqvist,[email protected] Tobias Blom´e,[email protected] c Copyright by Adam T¨ornqvist and Tobias Blom´e,2020 Supervisors: Jonas Nyl´en Nasdaq Oskar Janson Nasdaq Xijia Liu Department of Mathematics and Mathematical Statistics Examiner: Natalya Pya Arnqvist Department of Mathematics and Mathematical Statistics Master of Science Thesis in Industrial Engineering and Management, 30 ECTS Department of Mathematics and Mathematical Statistics Ume˚aUniversity SE-901 87 Ume˚a,Sweden i Abstract On the financial markets, investors search to achieve their economical goals while simultaneously being exposed to minimal risk. Volatility surfaces are used for estimating options' implied volatilities and corresponding option prices, which are used for various risk calculations. Currently, volatility surfaces are constructed based on yesterday's market in- formation and are used for estimating options' implied volatilities today. Such a construction gets redundant very fast during periods of high volatility, which leads to inaccurate risk calculations. With an aim to reduce volatility surfaces' estimation errors, this thesis explores the possibilities of calibrating volatility surfaces intraday using incomplete mar- ket information. Through statistical analysis of the volatility surfaces' historical movements, characteristics are identified showing sections with resembling mo- tion patterns. These insights are used to adjust the volatility surfaces intraday. The results of this thesis show that calibrating the volatility surfaces intraday can reduce the estimation errors significantly during periods of both high and low volatility. -

Binomial Trees • Stochastic Calculus, Ito’S Rule, Brownian Motion • Black-Scholes Formula and Variations • Hedging • Fixed Income Derivatives

Pricing Options with Mathematical Models 1. OVERVIEW Some of the content of these slides is based on material from the book Introduction to the Economics and Mathematics of Financial Markets by Jaksa Cvitanic and Fernando Zapatero. • What we want to accomplish: Learn the basics of option pricing so you can: - (i) continue learning on your own, or in more advanced courses; - (ii) prepare for graduate studies on this topic, or for work in industry, or your own business. • The prerequisites we need to know: - (i) Calculus based probability and statistics, for example computing probabilities and expected values related to normal distribution. - (ii) Basic knowledge of differential equations, for example solving a linear ordinary differential equation. - (iii) Basic programming or intermediate knowledge of Excel • A rough outline: - Basic securities: stocks, bonds - Derivative securities, options - Deterministic world: pricing fixed cash flows, spot interest rates, forward rates • A rough outline (continued): - Stochastic world, pricing options: • Pricing by no-arbitrage • Binomial trees • Stochastic Calculus, Ito’s rule, Brownian motion • Black-Scholes formula and variations • Hedging • Fixed income derivatives Pricing Options with Mathematical Models 2. Stocks, Bonds, Forwards Some of the content of these slides is based on material from the book Introduction to the Economics and Mathematics of Financial Markets by Jaksa Cvitanic and Fernando Zapatero. A Classification of Financial Instruments SECURITIES AND CONTRACTS BASIC SECURITIES DERIVATIVES -

Consolidated Policy on Valuation Adjustments Global Capital Markets

Global Consolidated Policy on Valuation Adjustments Consolidated Policy on Valuation Adjustments Global Capital Markets September 2008 Version Number 2.35 Dilan Abeyratne, Emilie Pons, William Lee, Scott Goswami, Jerry Shi Author(s) Release Date September lOth 2008 Page 1 of98 CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS LBEX-BARFID 0011765 Global Consolidated Policy on Valuation Adjustments Version Control ............................................................................................................................. 9 4.10.4 Updated Bid-Offer Delta: ABS Credit SpreadDelta................................................................ lO Commodities for YH. Bid offer delta and vega .................................................................................. 10 Updated Muni section ........................................................................................................................... 10 Updated Section 13 ............................................................................................................................... 10 Deleted Section 20 ................................................................................................................................ 10 Added EMG Bid offer and updated London rates for all traded migrated out oflens ....................... 10 Europe Rates update ............................................................................................................................. 10 Europe Rates update continue ............................................................................................................. -

Why and How to Trade Butterflies to Beat Any Market by Larry Gaines

Why and How to Trade Butterflies to Beat Any Market By Larry Gaines, Founder PowerCycleTrading.com, 30 Year Trading Professional Butterflies provide a low-risk high reward trading opportunity more than any other option strategy. As most traders know, markets direction can go through months and even years of higher than usual uncertainty. While there’s always some degree of uncertainty that traders and investors must accept, there can be long frustrating periods of higher than usual conflicting signals. Or often, technical analysis paints one picture, while the economic or political environment paints another picture. This can be said for both broad market direction and individual securities. Higher levels of uncertainty can be both stressful and costly for traders waiting on the sidelines. Plus, for traders who have come to rely on regular income from trading, loss of that income can cause serious lifestyle problems. These situations call for a strategy that will work no matter which direction the market heads. That’s exactly what the highly versatile Butterfly strategy does. It gives you a trading advantage in any type of market environment. This makes it a powerful strategy that every serious trader will want to add to their arsenal of skills. Power Cycle Trading© – Click Here for Weekly Unique Trade Ideas, Live Q&A with Larry, Trading Room+ Many traders have heard about the advantages of Butterfly strategies, yet they may have avoided it because of its complexity. Initially, the setup can seem overly complicated. This is because most traders try to master the Butterfly without truly understanding a few basic option trading principles first. -

Numerical Methods in Finance

NUMERICAL METHODS IN FINANCE Dr Antoine Jacquier wwwf.imperial.ac.uk/~ajacquie/ Department of Mathematics Imperial College London Spring Term 2016-2017 MSc in Mathematics and Finance This version: March 8, 2017 1 Contents 0.1 Some considerations on algorithms and convergence ................. 8 0.2 A concise introduction to arbitrage and option pricing ................ 10 0.2.1 European options ................................. 12 0.2.2 American options ................................. 13 0.2.3 Exotic options .................................. 13 1 Lattice (tree) methods 14 1.1 Binomial trees ...................................... 14 1.1.1 One-period binomial tree ............................ 14 1.1.2 Multi-period binomial tree ............................ 16 1.1.3 From discrete to continuous time ........................ 18 Kushner theorem for Markov chains ...................... 18 Reconciling the discrete and continuous time ................. 20 Examples of models ............................... 21 Convergence of CRR to the Black-Scholes model ............... 23 1.1.4 Adding dividends ................................. 29 1.2 Trinomial trees ...................................... 29 Boyle model .................................... 30 Kamrad-Ritchken model ............................. 31 1.3 Overture on stability analysis .............................. 33 2 Monte Carlo methods 35 2.1 Generating random variables .............................. 35 2.1.1 Uniform random number generator ....................... 35 Generating uniform random -

Arbitrage Spread.Pdf

Arbitrage spreads Arbitrage spreads refer to standard option strategies like vanilla spreads to lock up some arbitrage in case of mispricing of options. Although arbitrage used to exist in the early days of exchange option markets, these cheap opportunities have almost completely disappeared, as markets have become more and more efficient. Nowadays, millions of eyes as well as computer software are hunting market quote screens to find cheap bargain, reducing the life of a mispriced quote to a few seconds. In addition, standard option strategies are now well known by the various market participants. Let us review the various standard arbitrage spread strategies Like any trades, spread strategies can be decomposed into bullish and bearish ones. Bullish position makes money when the market rallies while bearish does when the market sells off. The spread option strategies can decomposed in the following two categories: Spreads: Spread trades are strategies that involve a position on two or more options of the same type: either a call or a put but never a combination of the two. Typical spreads are bull, bear, calendar, vertical, horizontal, diagonal, butterfly, condors. Combination: in contrast to spreads combination trade implies to take a position on both call and puts. Typical combinations are straddle, strangle1, and risk reversal. Spreads (bull, bear, calendar, vertical, horizontal, diagonal, butterfly, condors) Spread trades are a way of taking views on the difference between two or more assets. Because the trading strategy plays on the relative difference between different derivatives, the risk and the upside are limited. There are many types of spreads among which bull, bear, and calendar, vertical, horizontal, diagonal, butterfly spreads are the most famous. -

Options Trading

OPTIONS TRADING: THE HIDDEN REALITY RI$K DOCTOR GUIDE TO POSITION ADJUSTMENT AND HEDGING Charles M. Cottle ● OPTIONS: PERCEPTION AND DECEPTION and ● COULDA WOULDA SHOULDA revised and expanded www.RiskDoctor.com www.RiskIllustrated.com Chicago © Charles M. Cottle, 1996-2006 All rights reserved. No part of this publication may be printed, reproduced, stored in a retrieval system, or transmitted, emailed, uploaded in any form or by any means, electronic, mechanical photocopying, recording, or otherwise, without the prior written permission of the publisher. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author or the publisher is engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers. Published by RiskDoctor, Inc. Library of Congress Cataloging-in-Publication Data Cottle, Charles M. Adapted from: Options: Perception and Deception Position Dissection, Risk Analysis and Defensive Trading Strategies / Charles M. Cottle p. cm. ISBN 1-55738-907-1 ©1996 1. Options (Finance) 2. Risk Management 1. Title HG6024.A3C68 1996 332.63’228__dc20 96-11870 and Coulda Woulda Shoulda ©2001 Printed in the United States of America ISBN 0-9778691-72 First Edition: January 2006 To Sarah, JoJo, Austin and Mom Thanks again to Scott Snyder, Shelly Brown, Brian Schaer for the OptionVantage Software Graphics, Allan Wolff, Adam Frank, Tharma Rajenthiran, Ravindra Ramlakhan, Victor Brancale, Rudi Prenzlin, Roger Kilgore, PJ Scardino, Morgan Parker, Carl Knox and Sarah Williams the angel who revived the Appendix and Chapter 10. -

Butterfly Investor Presentation

Investor Presentation November 20, 2020 1 Disclaimer This presentation is for information purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Butterfly Network, Inc. (“Butterfly”) and Longview Acquisition Corp. (“Longview”). The information contained herein does not purport to be all-inclusive, and none of Butterfly, Longview, or any of their prospective affiliates, or any of their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. Forward-Looking Statements This document includes certain statements, estimates, targets, forward-looking statements and projections (collectively, “forward-looking statements”) that reflect assumptions made by Butterfly concerning anticipated future performance of Butterfly and its industry. Such forward-looking statements are based on significant assumptions and subjective judgments concerning anticipated results, which are inherently subject to risks, variability and contingencies, many of which are beyond Butterfly’s control. Factors that could cause actual results to differ from these forward-looking statement include, but are not limited to, general economic conditions, the availability and terms of financing, the effects and uncertainties created by the ongoing COVID-19 pandemic, Butterfly’s limited operating history, changes in regulatory requirements and governmental incentives, competition, and other risks and uncertainties associated with Butterfly’s research and development activities and commercial production and sales.