Binomial Trees • Stochastic Calculus, Ito’S Rule, Brownian Motion • Black-Scholes Formula and Variations • Hedging • Fixed Income Derivatives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FINANCIAL DERIVATIVES SAMPLE QUESTIONS Q1. a Strangle Is an Investment Strategy That Combines A. a Call and a Put for the Same

FINANCIAL DERIVATIVES SAMPLE QUESTIONS Q1. A strangle is an investment strategy that combines a. A call and a put for the same expiry date but at different strike prices b. Two puts and one call with the same expiry date c. Two calls and one put with the same expiry dates d. A call and a put at the same strike price and expiry date Answer: a. Q2. A trader buys 2 June expiry call options each at a strike price of Rs. 200 and Rs. 220 and sells two call options with a strike price of Rs. 210, this strategy is a a. Bull Spread b. Bear call spread c. Butterfly spread d. Calendar spread Answer c. Q3. The option price will ceteris paribus be negatively related to the volatility of the cash price of the underlying. a. The statement is true b. The statement is false c. The statement is partially true d. The statement is partially false Answer: b. Q 4. A put option with a strike price of Rs. 1176 is selling at a premium of Rs. 36. What will be the price at which it will break even for the buyer of the option a. Rs. 1870 b. Rs. 1194 c. Rs. 1140 d. Rs. 1940 Answer b. Q5 A put option should always be exercised _______ if it is deep in the money a. early b. never c. at the beginning of the trading period d. at the end of the trading period Answer a. Q6. Bermudan options can only be exercised at maturity a. -

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Section 1256 and Foreign Currency Derivatives

Section 1256 and Foreign Currency Derivatives Viva Hammer1 Mark-to-market taxation was considered “a fundamental departure from the concept of income realization in the U.S. tax law”2 when it was introduced in 1981. Congress was only game to propose the concept because of rampant “straddle” shelters that were undermining the U.S. tax system and commodities derivatives markets. Early in tax history, the Supreme Court articulated the realization principle as a Constitutional limitation on Congress’ taxing power. But in 1981, lawmakers makers felt confident imposing mark-to-market on exchange traded futures contracts because of the exchanges’ system of variation margin. However, when in 1982 non-exchange foreign currency traders asked to come within the ambit of mark-to-market taxation, Congress acceded to their demands even though this market had no equivalent to variation margin. This opportunistic rather than policy-driven history has spawned a great debate amongst tax practitioners as to the scope of the mark-to-market rule governing foreign currency contracts. Several recent cases have added fuel to the debate. The Straddle Shelters of the 1970s Straddle shelters were developed to exploit several structural flaws in the U.S. tax system: (1) the vast gulf between ordinary income tax rate (maximum 70%) and long term capital gain rate (28%), (2) the arbitrary distinction between capital gain and ordinary income, making it relatively easy to convert one to the other, and (3) the non- economic tax treatment of derivative contracts. Straddle shelters were so pervasive that in 1978 it was estimated that more than 75% of the open interest in silver futures were entered into to accommodate tax straddles and demand for U.S. -

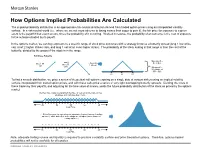

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........ -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

11 Option Payoffs and Option Strategies

11 Option Payoffs and Option Strategies Answers to Questions and Problems 1. Consider a call option with an exercise price of $80 and a cost of $5. Graph the profits and losses at expira- tion for various stock prices. 73 74 CHAPTER 11 OPTION PAYOFFS AND OPTION STRATEGIES 2. Consider a put option with an exercise price of $80 and a cost of $4. Graph the profits and losses at expiration for various stock prices. ANSWERS TO QUESTIONS AND PROBLEMS 75 3. For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at expiration, what will be the profit or loss? At what stock price (or prices) will the straddle have a zero profit? With a stock price at $80 at expiration, neither the call nor the put can be exercised. Both expire worthless, giving a total loss of $9. The straddle breaks even (has a zero profit) if the stock price is either $71 or $89. 4. A call option has an exercise price of $70 and is at expiration. The option costs $4, and the underlying stock trades for $75. Assuming a perfect market, how would you respond if the call is an American option? State exactly how you might transact. How does your answer differ if the option is European? With these prices, an arbitrage opportunity exists because the call price does not equal the maximum of zero or the stock price minus the exercise price. To exploit this mispricing, a trader should buy the call and exercise it for a total out-of-pocket cost of $74. -

Straddles and Strangles to Help Manage Stock Events

Webinar Presentation Using Straddles and Strangles to Help Manage Stock Events Presented by Trading Strategy Desk 1 Fidelity Brokerage Services LLC ("FBS"), Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 690099.3.0 Disclosures Options’ trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options, and call 800-544- 5115 to be approved for options trading. Supporting documentation for any claims, if applicable, will be furnished upon request. Examples in this presentation do not include transaction costs (commissions, margin interest, fees) or tax implications, but they should be considered prior to entering into any transactions. The information in this presentation, including examples using actual securities and price data, is strictly for illustrative and educational purposes only and is not to be construed as an endorsement, or recommendation. 2 Disclosures (cont.) Greeks are mathematical calculations used to determine the effect of various factors on options. Active Trader Pro PlatformsSM is available to customers trading 36 times or more in a rolling 12-month period; customers who trade 120 times or more have access to Recognia anticipated events and Elliott Wave analysis. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. -

Value at Risk for Linear and Non-Linear Derivatives

Value at Risk for Linear and Non-Linear Derivatives by Clemens U. Frei (Under the direction of John T. Scruggs) Abstract This paper examines the question whether standard parametric Value at Risk approaches, such as the delta-normal and the delta-gamma approach and their assumptions are appropriate for derivative positions such as forward and option contracts. The delta-normal and delta-gamma approaches are both methods based on a first-order or on a second-order Taylor series expansion. We will see that the delta-normal method is reliable for linear derivatives although it can lead to signif- icant approximation errors in the case of non-linearity. The delta-gamma method provides a better approximation because this method includes second order-effects. The main problem with delta-gamma methods is the estimation of the quantile of the profit and loss distribution. Empiric results by other authors suggest the use of a Cornish-Fisher expansion. The delta-gamma method when using a Cornish-Fisher expansion provides an approximation which is close to the results calculated by Monte Carlo Simulation methods but is computationally more efficient. Index words: Value at Risk, Variance-Covariance approach, Delta-Normal approach, Delta-Gamma approach, Market Risk, Derivatives, Taylor series expansion. Value at Risk for Linear and Non-Linear Derivatives by Clemens U. Frei Vordiplom, University of Bielefeld, Germany, 2000 A Thesis Submitted to the Graduate Faculty of The University of Georgia in Partial Fulfillment of the Requirements for the Degree Master of Arts Athens, Georgia 2003 °c 2003 Clemens U. Frei All Rights Reserved Value at Risk for Linear and Non-Linear Derivatives by Clemens U. -

Payoffs from Neutral Option Strategies: a Study of USD-INR Market

Journal of Economics, Management and Trade 21(12): 1-11, 2018; Article no.JEMT.44988 ISSN: 2456-9216 (Past name: British Journal of Economics, Management & Trade, Past ISSN: 2278-098X) Payoffs from Neutral Option Strategies: A Study of USD-INR Market Avneet Kaur1*, Sandeep Kapur1 and Mohit Gupta1 1School of Business Studies, Punjab Agricultural University, India. Authors’ contributions This work was carried out in collaboration between all authors. Authors AK and SK designed the study. Authors AK and MG performed the statistical analysis. Author AK wrote the protocol and wrote the first draft of the manuscript. Authors AK, SK and MG managed the analyses of the study. Author AK managed the literature searches. All authors read and approved the final manuscript. Article Information DOI: 10.9734/JEMT/2018/44988 Editor(s): (1) Dr. Afsin Sahin, Professor, Department of Banking School of Banking and Insurance, Ankara Haci Bayram Veli University, Turkey. Reviewers: (1) Imoisi Anthony Ilegbinosa, Edo University, Iyamho, Nigeria. (2) R. Shenbagavalli, India. Complete Peer review History: http://www.sciencedomain.org/review-history/27321 Received 05 September 2018 Original Research Article Accepted 07 November 2018 Published 20 November 2018 ABSTRACT Aims: The present study has tried to assess the profitability of payoffs from adopting neutral option strategies on USD-INR. Study Design: The study was carried out using daily closing values of the US Dollar-Indian Rupee current future rate available on National Stock Exchange of India (NSE) for the period starting from 29th October 2010 (the start of currency options market in NSE) to 30th June 2016. Methodology: The present study has tried to fill the gap of assessing the profitability of payoffs from adopting neutral options strategies on USD-INR. -

Enns for Corporate and Sovereign CDS and FX Swaps

ENNs for Corporate and Sovereign CDS and FX Swaps by Lee Baker, Richard Haynes, Madison Lau, John Roberts, Rajiv Sharma, and Bruce Tuckman1 February, 2019 I. Introduction The sizes of swap markets, and the sizes of market participant footprints in swap markets, are most often measured in terms of notional amount. It is widely recognized, however, that notional amount is a poor metric of both size and footprint. First, when calculating notional amounts, the long and short positions between two counterparties are added together, even though longs and shorts essentially offset each other. Second, notional calculations add together positions with very different amounts of risk, like a relatively low-risk 3-month interest rate swap (IRS) and a relatively high-risk 30- year IRS. The use of notional amount to measure size distorts understanding of swap markets. A particularly powerful example arose around Lehman Brothers’ bankruptcy in September, 2008. At that time, there were $400 billion notional of outstanding credit default swaps (CDS) on Lehman, and Lehman’s debt was trading at 8.6 cents on the dollar. Many were frightened by the prospect that sellers of protection would soon have to pay buyers of protection a total of $400 billion x (1 – 8.6%), or about $365 billion. As it turned out, however, a large amount of protection sold had been offset by protection bought: in the end, protection sellers paid protection buyers between $6 and $8 billion.2 In January, 2018, the Office of the Chief Economist at the Commodity Futures Trading Commission (CFTC) introduced ENNs (Entity-Netted Notionals) as a metric of size in IRS markets.3 To compute IRS ENNs, all notional amounts are expressed in terms of the risk of a 5-year IRS, and long and short positions are netted when they are between the same pair of legal counterparties and denominated in the same currency.