A Better Financial Future Starts Here

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fund Selection

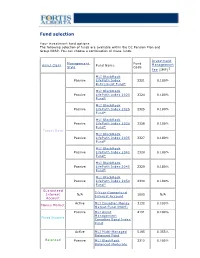

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

2018 Annual Report Fellow Shareholders, Governance and Shareholder Outreach

Manulife Financial Corporation Who Manulife Financial Corporation is Our five Portfolio Optimization we are a leading international financial strategic We are actively managing our priorities services group providing financial 1 legacy businesses to improve advice, insurance, as well as returns and cash generation while wealth and asset management reducing risk. solutions for individuals, groups, and institutions. We operate as John Hancock in the United States Expense Efficiency and Manulife elsewhere. We are getting our cost structure 2 into fighting shape and simplifying and digitizing our processes to position us for efficient growth. Accelerate Growth We are accelerating growth in our 3 highest-potential businesses. Our Digital, Customer Leader mission Decisions We are improving our customer 4 experiences, using digitization and made easierr. innovation to put customers first. Lives High-Performing Team made betterr. We are building a culture that 5 drives our priorities. Our Our Values represent how we Obsess Do the Values operate. They reflect our culture, about right thing inform our behaviours, and help define how we work together. customers Manulife Note: Growth in core earnings, assets under Core Earnings (C$ billions) management and administration (AUMA), and by the new business value are presented on a constant $5.6 billion exchange rate basis. numbers Total Company, Global Wealth and Asset Management (Global WAM), and Asia core earnings up 23%, 21%, and 20%, respectively, from 2017. 5.6 4.6 4.0 3.4 2.9 2014 2015 2016 2017 2018 Assets Under Management and Administration Net Income Attributed to Shareholders (C$ billions) (C$ billions) $1,084 billion $4.8 billion Over $1 trillion in AUMA. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange. -

Manulife's Investor Day 2017 in Hong Kong-Slides-Day 1

June 21, 2017 Hong Kong Agenda Time Speaker Presentation 9:05 am Donald Guloien Delivering on commitments, driving shareholder value & preparing for the future 9:20 am Roy Gori A compelling opportunity and clear priorities to win 9:40 am Steve Roder Commitment to shareholder value creation 10:10 am Q&A Session 10:45 am Roy Gori & Phil Witherington Executing on our Asia opportunity 11:30 am Q&A Session 11:55 am Various Labs 12:25 pm Lunch with Guest Speaker 1:40 pm Linda Mantia Driving Customer Centricity and Innovation 2:10 pm Q&A Session 2:25 pm Various Labs 3:05 pm Kai Sotorp A global wealth and asset management platform with solid growth momentum 3:35 pm Q&A Session 3:50 pm Various Labs Caution regarding forward-looking statements From time to time, MFC makes written and/or oral forward-looking statements, including in this presentation. In addition, our representatives may make forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbour” provisions of Canadian provincial securities laws and the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this presentation include, but are not limited to, statements with respect to demographic and market trends and their expected benefit, core ROE expansion over the medium term and the drivers of such expansion, our expected dividend payout ratio, annual core earnings per share growth over the medium term and dividend growth over time. The forward-looking statements in this presentation -

Bestweek World's Largest Insurers

www.bestweek.com BESTWEEK BESTWEEKWeekly Insurance Newsletter January 2012 Weekly Insurance Newsletter Top Insurers Ranked by Assets, Net Premiums Aegon N.V. Chairman and Chief Executive: World’s Largest Insurers Alex Wynaendts Ranked by Non-Banking Assets Aegon is a public company specializing 2010 in life insurance, pensions and long- Total Non- term savings and investment products. Country of Banking Assets % It has 28,000 employees serving 40 AMB Company Name Domicile USD (000) Change* million clients in 20 countries. 1 Japan Post Insurance Co. Ltd. Japan 1,089,463,948 -5.26 www.aegon.com Wynaendts 2 Axa S.A. France 920,476,513 3.27 3 Allianz SE Germany 807,486,736 8.23 Allianz Societas Europae 4 MetLife Inc. US 730,906,000 35.53 Chairman and Chief Executive: 5 American International Group Inc. US 683,443,000 -19.37 Michael Diekmann 6 Aviva plc UK 572,208,859 4.45 Allianz is a public company specializing 7 Assicurazioni Generali S.p.A. Italy 559,858,937 -0.33 in property/casualty and life/health 8 Prudential Financial Inc. US 539,854,000 12.42 insurance, asset management and Nippon Life Insurance Co. Japan 527,095,201 6.20 banking. It has approximately 151,000 9 employees serving more than 76 mil- 10 Legal & General Group plc UK 501,063,918 9.03 lion clients in about 70 countries. Diekmann 11 National Mut Ins Fed of Agricultural Co-ops Japan 488,175,304 3.30 Rating: A.M. Best currently rates the financial strength of 12 Aegon N.V. -

Dave Hunter DATE: September 18, 2020 SUBJECT: SIB Meeti

Executive Summary - Informational TO: State Investment Board FROM: Dave Hunter DATE: September 18, 2020 SUBJECT: SIB Meeting Materials – September 25, 2020 Our September board meeting will focus on Callan’s annual investment performance review of SIB client returns as of June 30, 2020. RIO will also share board education and manager research on in-state investment programs administered by other state plans, invite BND to provide an investment update & highlight recent legislative committee presentations. 1. Asset and Performance Overview – RIO will refresh the Asset and Performance Overview shared with the Board last month noting that 94% of our SIB clients generated net returns which exceeded their approved policy benchmarks for the 5 years ended June 30, 2020. All SIB Pension Pool clients generated net returns which exceeded their respective policy benchmarks for the 1, 3 and 5 year periods ended June 30, 2020. The Pension Pool, which includes PERS and TFFR, generated a net return of 8.4% for the 10 years ended June 30, 2020, exceeding its Policy Benchmark of 7.94% and their actuarial long-term return assumptions (of 7.00% to 7.25%). The NDSIB Pension Pool was also ranked in the top 25% of Callan’s Public Fund Sponsor Database for the 10-years ended June 30, 2020. 2. Callan Annual Investment Review – The SIB engages Callan to provide quarterly and annual investment performance reviews which include a reconciliation of RIO’s reported investment returns and asset valuations with those reported by Northern Trust, noting that Northern Trust serves as our primary custodian and record keeper for SIB client investments. -

Manulife Japan Company Profile English Version

About Manulife History Manulife Financial Corporation is a Canada-based leading international financial services group established in 1887. Starts life insurance business as Manulife Century Insurance Company with the transfer of 1999 ● goodwill from Daihyaku Mutual Life Insurance Company. Introduces a unique consulting system called "PlanRight". 2000 ● Completes the collective transfer of the policies and related assets of Daihyaku Mutual ● 2001 Life Insurance Company to Manulife. Changes name to Manulife Life Insurance Company. ● Press Conference in 1999 Manulife becomes the first Japanese insurance company to adopt the "Company Adopting ● 2003 Commitees System". (Now also known as “Company with Nomination Committee) Establishes Manulife Asset Management (Japan) Limited (formerly MFC Global Investment ● 2004 Management Japan Co., Ltd.) as a subsidiary. Establishes Manulife Investments Japan Limited as a subsidiary. Corporate Profile of Manulife Financial Corporation 2007 ● Manulife Financial Corporation provides a variety of products and services tailored to each Donates the rst and the second "Manulife Waku Waku Rooms," which are special playrooms ● fi market in order to respond to the changing needs of our customers. 2008 designed to improve the quality of life of children undergoing hospital treatment. Becomes the 2010 sponsor of the Pacific Baseball League. 2010 ● Manulife Waku Waku Rooms at Osaka Company Name Manulife Financial Corporation General Medical Center Introduces Japan's rst non-smoker rate for medical coverage as "ManuFlex" and "ManuMed". ● fi Head Office Toronto, Ontario, Canada (Excluding cancer-related special contracts. As of January 1, 2015; research conducted by Manulife Japan.) Year Established 1887 CORPORATE Becomes the main sponsor of the final tournament of the National High School Financial Quiz. -

Numerical.Pdf

DTC PARTICPANT REPORT (Numerical Sort ) Month Ending - July 31, 2021 NUMBER PARTICIPANT ACCOUNT NAME 0 SERIES 0005 GOLDMAN SACHS & CO. LLC 0010 BROWN BROTHERS HARRIMAN & CO. 0013 SANFORD C. BERNSTEIN & CO., LLC 0015 MORGAN STANLEY SMITH BARNEY LLC 0017 INTERACTIVE BROKERS LLC 0019 JEFFERIES LLC 0031 NATIXIS SECURITIES AMERICAS LLC 0032 DEUTSCHE BANK SECURITIES INC.- STOCK LOAN 0033 COMMERZ MARKETS LLC/FIXED INC. REPO & COMM. PAPER 0045 BMO CAPITAL MARKETS CORP. 0046 PHILLIP CAPITAL INC./STOCK LOAN 0050 MORGAN STANLEY & CO. LLC 0052 AXOS CLEARING LLC 0057 EDWARD D. JONES & CO. 0062 VANGUARD MARKETING CORPORATION 0063 VIRTU AMERICAS LLC/VIRTU FINANCIAL BD LLC 0065 ZIONS DIRECT, INC. 0067 INSTINET, LLC 0075 LPL FINANCIAL LLC 0076 MUFG SECURITIES AMERICAS INC. 0083 TRADEBOT SYSTEMS, INC. 0096 SCOTIA CAPITAL (USA) INC. 0099 VIRTU AMERICAS LLC/VIRTU ITG LLC 100 SERIES 0100 COWEN AND COMPANY LLC 0101 MORGAN STANLEY & CO LLC/SL CONDUIT 0103 WEDBUSH SECURITIES INC. 0109 BROWN BROTHERS HARRIMAN & CO./ETF 0114 MACQUARIE CAPITAL (USA) INC. 0124 INGALLS & SNYDER, LLC 0126 COMMERZ MARKETS LLC 0135 CREDIT SUISSE SECURITIES (USA) LLC/INVESTMENT ACCOUNT 0136 INTESA SANPAOLO IMI SECURITIES CORP. 0141 WELLS FARGO CLEARING SERVICES, LLC 0148 ICAP CORPORATES LLC 0158 APEX CLEARING CORPORATION 0161 BOFA SECURITIES, INC. 0163 NASDAQ BX, INC. 0164 CHARLES SCHWAB & CO., INC. 0166 ARCOLA SECURITIES, INC. 0180 NOMURA SECURITIES INTERNATIONAL, INC. 0181 GUGGENHEIM SECURITIES, LLC 0187 J.P. MORGAN SECURITIES LLC 0188 TD AMERITRADE CLEARING, INC. 0189 STATE STREET GLOBAL MARKETS, LLC 0197 CANTOR FITZGERALD & CO. / CANTOR CLEARING SERVICES 200 SERIES 0202 FHN FINANCIAL SECURITIES CORP. 0221 UBS FINANCIAL SERVICES INC. -

Industry Rankings

11 INDUSTRY RANKINGS The U.S. life insurance industry in 2018 is made up of 773 companies with sales and operations across the country. Many of these companies are stand-alone entities, with no life insurer affiliate or subsidiary operating in the United States. Others are organized into groups or fleets of affiliates and subsidiaries. This chapter presents rankings of the 25 largest life insurance groups (counting stand-alone companies as a group of one) based on assets, premiums and annuity considerations, and life insurance coverage. Table 11.1 Largest Life Insurers, by Total Assets, 2018 (thousands) Prudential Financial $577,911,428 MetLife, Inc. 409,620,949 New York Life 324,780,964 TIAA-CREF 316,037,954 American International Group 284,995,635 Northwestern Mutual 272,266,151 Lincoln Financial 255,642,921 Massachusetts Mutual 254,871,959 Manulife Financial 247,572,347 Jackson National 236,988,672 Transamerica Corporation 201,204,255 AXA Financial 194,993,598 Voya Financial 189,367,712 Principal Financial 185,009,858 Brighthouse Holdings Group 179,295,297 Nationwide 170,472,992 Allianz 145,153,116 Pacific Life 135,579,228 Hopmeadow Holdings Group 117,913,970 Ameriprise Financial 104,112,139 Thrivent Financial For Lutherans 94,229,633 Sammons Financial 85,245,189 Athene Group 83,783,502 State Farm 78,026,036 Guardian 75,591,936 Source: ACLI tabulations of National Association of Insurance Commissioners (NAIC) data, used by permission. Notes: NAIC does not endorse any analysis or conclusions based on use of its data. Group totals represent a collection of life insurers based on organizational structure. -

Benefit Summary

Benefits Booklet Maritime Resident Doctors Group Policy Number: G0066597 Class: B - Maritime Resident Doctors Office Staff Table Of Contents Introduction Dental Extended Health Care Benefit Health Care Spending Account (HCSA) Health for Life® - Resources to help you and your family maintain overall good health and wellness Health Service Navigator® Long-Term Disability Life Insurance Survivor Benefit Conversion Option FollowMeTM Health A message from your plan sponsor Maritime Resident Doctors is pleased to be able to offer you medical and financial security by sponsoring your group benefits program. We have selected Manulife Financial as a partner to help us deliver the program. They are committed to providing excellent service for us. At this point, you will have received some basic information about how you can connect with Manulife Financial and how to submit claims. Now, I would encourage you to spend a few moments reviewing our plan's coverage so you can better understand what's available. You'll learn about not only the more routine things, but also about some of the benefits available that you may need to draw on in a time of crisis. Your plan is here to offer you some support in the event you encounter unforeseen circumstances in the future. After reviewing the coverage, if you have any questions, check in with our plan administrator. Sincerely, Leanne Bryan Benefits Coordinator Your Group Benefit Program Core Coverage and Services Your plan sponsor has chosen to offer the following benefits to form the coverage in this program: