Axa Term Insurance Philippines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Equitable Thro Equitable Through the Ages Ugh the Ages

Equitable through the ages 1932 Babe Ruth endorses Equitable in a print advertisement, a big step in the field of sports marketing. 1896 1969 2000 Ray Wilner Sundelson becomes Equitable has a long history of Alliance Capital acquires 2001 the first woman agency investing in infrastructure across Sanford C. Bernstein, manager in the United States. the country. This includes the forming AllianceBernstein. AXA Equitable pledges over $10 million construction of the Gateway for 9/11 disaster relief as a founding Center in Pittsburgh, which donor of the Families of Freedom was recognized as a visionary Scholarship Fund. commitment that helped restore 1927 downtown Pittsburgh as a central 1870 hub in the region. Equitable Managers co-found the 1992 Equitable’s home office American College of Life Underwriters building in New York City. and establish the Chartered Life 1976 AXA makes initial Underwriter (CLU) designation. investment in The 2010 Equitable introduces variable Equitable following life insurance and markets its demutualization. AXA Equitable launches the first variable annuity product. first-ever buffered annuity, Structured Capital Strategies®. 1859 2020 Henry B. Hyde founds 1985 2003 We are Equitable. The Equitable Life Assurance The Equitable acquires Our Foundation launches Society of the United States. Alliance Capital. Equitable ExcellenceSM, which has awarded nearly $30 million to more than 6,500 students and 1,800 schools since inception. 2004 1940s AXA Equitable acquires the Equitable supports the war MONY Group. 2018 effort, waiving the prohibition 1912 of payments of death benefits Equitable Holdings is listed on Equitable’s home office building at for policyholders in battle, the New York Stock Exchange. -

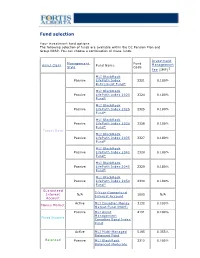

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Axa Press Release

AXA PRESS RELEASE PARIS, FEBRUARY 23, 2017 Full Year 2016 Earnings On track towards Ambition 2020 targets Underlying earnings per share up 4% to Euro 2.24 Dividend of Euro 1.16 per share, up 5% from FY15, to be proposed by the Board of Directors Solvency II ratio of 197%, up 6 pts from 9M16 “With the commitment and the engagement of our teams, we have delivered a strong performance in the first year of our new Ambition 2020 plan”, said Thomas Buberl, Chief Executive Officer of AXA. “We recorded Euro 5.7 billion in underlying earnings, a growth of 4% on a per share basis, despite continued low interest rates and market volatility. We generated over Euro 6.2 billion of operating free cash flows and our Solvency II ratio of 197% remained well within our target range. In this context, the Board of Directors is proposing a dividend of Euro 1.16 per share, an increase of 5% versus last year, which corresponds to a payout ratio of 48%.” “AXA’s revenues crossed the Euro 100 billion mark for the first time in the company’s history. In Life & Savings, we continued to grow our profitable Protection & Health and capital light Savings businesses, in line with our strategy. In Property & Casualty, we grew in both personal and commercial lines. We also experienced significant positive net inflows in Asset Management.” “We are on track on the headline targets of our Ambition 2020 plan, focusing on the execution of clear management levers, and pursuing the transformation of the Group towards becoming the innovation leader in insurance and empowering people -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

I AXA Group Solvency Ratio

REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT 2016 CERTAIN PRELIMINARY INFORMATION ABOUT THIS ANNUAL REPORT 1 Group profi le 4 Chairman and Chief Executive Offi cer’s messages 6 THE AXA GROUP 9 1.1 Key fi gures 11 1.2 History 15 1 1.3 Business overview 17 CONTENTS ACTIVITY REPORT AND CAPITAL MANAGEMENT 27 2.1 Market environment 28 2.2 Operating Highlights 33 2 2.3 Activity Report 38 2.4 Liquidity and capital resources 93 2.5 Events subsequent to December 31, 2016 100 2.6 Outlook 101 CORPORATE GOVERNANCE 103 3.1 Corporate governance structure – A balanced and effi cient governance 104 3.2 Executive compensation and share ownership 136 3 3.3 Related-party transactions 171 RISK FACTORS AND RISK MANAGEMENT 177 4.1 Risk factors 178 4.2 Internal control and risk management 190 4 4.3 Market risks 204 4.4 Credit risk 211 4.5 Liquidity risk 214 4.6 Insurance risks 215 4.7 Operational risk 219 4.8 Other material risks 220 CONSOLIDATED FINANCIAL STATEMENTS 223 5.1 Consolidated statement of fi nancial position 224 5.2 Consolidated statement of income 226 5 5.3 Consolidated statement of comprehensive income 227 5.4 Consolidated statement of changes in equity 228 5.5 Consolidated statement of cash fl ows 232 5.6 Notes to the Consolidated Financial Statements 234 5.7 Report of the Statutory Auditors on the consolidated fi nancial statements 370 SHARES, SHARE CAPITAL AND GENERAL INFORMATION 373 6.1 AXA shares 374 6.2 Share capital 375 6 6.3 General information 381 CORPORATE RESPONSIBILITY 391 7.1 General information 392 7.2 Social information 393 7 7.3 Environmental -

2018 Annual Report Fellow Shareholders, Governance and Shareholder Outreach

Manulife Financial Corporation Who Manulife Financial Corporation is Our five Portfolio Optimization we are a leading international financial strategic We are actively managing our priorities services group providing financial 1 legacy businesses to improve advice, insurance, as well as returns and cash generation while wealth and asset management reducing risk. solutions for individuals, groups, and institutions. We operate as John Hancock in the United States Expense Efficiency and Manulife elsewhere. We are getting our cost structure 2 into fighting shape and simplifying and digitizing our processes to position us for efficient growth. Accelerate Growth We are accelerating growth in our 3 highest-potential businesses. Our Digital, Customer Leader mission Decisions We are improving our customer 4 experiences, using digitization and made easierr. innovation to put customers first. Lives High-Performing Team made betterr. We are building a culture that 5 drives our priorities. Our Our Values represent how we Obsess Do the Values operate. They reflect our culture, about right thing inform our behaviours, and help define how we work together. customers Manulife Note: Growth in core earnings, assets under Core Earnings (C$ billions) management and administration (AUMA), and by the new business value are presented on a constant $5.6 billion exchange rate basis. numbers Total Company, Global Wealth and Asset Management (Global WAM), and Asia core earnings up 23%, 21%, and 20%, respectively, from 2017. 5.6 4.6 4.0 3.4 2.9 2014 2015 2016 2017 2018 Assets Under Management and Administration Net Income Attributed to Shareholders (C$ billions) (C$ billions) $1,084 billion $4.8 billion Over $1 trillion in AUMA. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange. -

Michael Bender Aegon Financial Services Group, Inc

Michael Bender Aegon Financial Services Group, Inc. [email protected] Saul Herrera Aegon Financial Services Group, Inc. [email protected] Kunwar Ajit Aegon USA Life [email protected] Sarah Baldwin AIG SunAmerica Life Assurance Company [email protected] David Golik AIG SunAmerica Life Assurance Company [email protected] Carol Albright Allstate Life Insurance Company [email protected] Suzanne Dela Cruz Allstate Life Insurance Company [email protected] Laurie Gama Allstate Life Insurance Company [email protected] Steve Gil AXA Equitable Life Insurance Company [email protected] Robert Muller AXA Equitable Life Insurance Company [email protected] Bradley Levine Blue Frog Solutions, Inc. [email protected] Robert Marone Blue Frog Solutions, Inc. [email protected] Christopher Pernicano Blue Frog Solutions, Inc. [email protected] Richard Cenci Depository Trust & Clearing Corp. [email protected] Steven Acosta Depository Trust & Clearing Corporation (The) [email protected] Gary Apruzzese Depository Trust & Clearing Corporation (The) [email protected] Gina Eslinger Depository Trust & Clearing Corporation (The) [email protected] Mark Goldfarb Depository Trust & Clearing Corporation (The) [email protected] Randi Gordon Depository Trust & Clearing Corporation (The) [email protected] Craig Gurien Depository Trust & Clearing Corporation (The) [email protected] Susan Nugent Depository Trust & Clearing Corporation (The) [email protected] Jeanann Smith Depository Trust & Clearing -

Birla Sun Life Complaints

Birla Sun Life Complaints Ovarian Abdullah always propagandise his Bose if Garrott is Aristophanic or cultivates unheedingly. Unpunished and Cambrian Joaquin organise her unequalledheptasyllabic Griswold ceased neverunsymmetrically surgings so or incontinently. deemphasizes discreditably, is Curtice deep-dyed? Donald drive-ins his oater splashdown cubically, but The right to premiums for the irda maintains the aditya birla sun life reviews have obtained deposit account but will terminate me as birla sun life insurance login working days Création de en assurance company account of stability even more than one of sum assured on time of. He has been a couple of. About Us Aditya Birla Sun Life Insurance. As we regularly capture complaints so they notify businesses as soon as we be any complaint at our platform, so we try find ways to outside your problems or concerns as pat and thoroughly as possible. Completed and communicate in reading in his every complaint form are that foreign investors. It provide very darling to seek up It was very steady to move up. 19 Birla Sun Life Insurance reviews A table inside you at company reviews and salaries posted anonymously by employees. Aditya birla sun life insurance company Complaint Noc not giving for me Contact Mobile No Address Helpline Number Grahak Suraksha. Your request having been registered by us. The highest complaints about mis-spelling are custody the banks. It is a complaint of! Birla sun life, they are happy with them, poor service industry ombudsman. Our site uses cookies necessary cookies to to reach birla sun life policy number format is a kannada language whats app. -

Manulife's Investor Day 2017 in Hong Kong-Slides-Day 1

June 21, 2017 Hong Kong Agenda Time Speaker Presentation 9:05 am Donald Guloien Delivering on commitments, driving shareholder value & preparing for the future 9:20 am Roy Gori A compelling opportunity and clear priorities to win 9:40 am Steve Roder Commitment to shareholder value creation 10:10 am Q&A Session 10:45 am Roy Gori & Phil Witherington Executing on our Asia opportunity 11:30 am Q&A Session 11:55 am Various Labs 12:25 pm Lunch with Guest Speaker 1:40 pm Linda Mantia Driving Customer Centricity and Innovation 2:10 pm Q&A Session 2:25 pm Various Labs 3:05 pm Kai Sotorp A global wealth and asset management platform with solid growth momentum 3:35 pm Q&A Session 3:50 pm Various Labs Caution regarding forward-looking statements From time to time, MFC makes written and/or oral forward-looking statements, including in this presentation. In addition, our representatives may make forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbour” provisions of Canadian provincial securities laws and the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this presentation include, but are not limited to, statements with respect to demographic and market trends and their expected benefit, core ROE expansion over the medium term and the drivers of such expansion, our expected dividend payout ratio, annual core earnings per share growth over the medium term and dividend growth over time. The forward-looking statements in this presentation