Study of Mobile Telecommunications Markets in NZ Submission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tate Report 08-09

Tate Report 08–09 Report Tate Tate Report 08–09 It is the Itexceptional is the exceptional generosity generosity and and If you wouldIf you like would to find like toout find more out about more about PublishedPublished 2009 by 2009 by vision ofvision individuals, of individuals, corporations, corporations, how youhow can youbecome can becomeinvolved involved and help and help order of orderthe Tate of the Trustees Tate Trustees by Tate by Tate numerousnumerous private foundationsprivate foundations support supportTate, please Tate, contact please contactus at: us at: Publishing,Publishing, a division a divisionof Tate Enterprisesof Tate Enterprises and public-sectorand public-sector bodies that bodies has that has Ltd, Millbank,Ltd, Millbank, London LondonSW1P 4RG SW1P 4RG helped Tatehelped to becomeTate to becomewhat it iswhat it is DevelopmentDevelopment Office Office www.tate.org.uk/publishingwww.tate.org.uk/publishing today andtoday enabled and enabled us to: us to: Tate Tate MillbankMillbank © Tate 2009© Tate 2009 Offer innovative,Offer innovative, landmark landmark exhibitions exhibitions London LondonSW1P 4RG SW1P 4RG ISBN 978ISBN 1 85437 978 1916 85437 0 916 0 and Collectionand Collection displays displays Tel 020 7887Tel 020 4900 7887 4900 A catalogue record for this book is Fax 020 Fax7887 020 8738 7887 8738 A catalogue record for this book is available from the British Library. DevelopDevelop imaginative imaginative education education and and available from the British Library. interpretationinterpretation programmes programmes AmericanAmerican Patrons Patronsof Tate of Tate Every effortEvery has effort been has made been to made locate to the locate the 520 West520 27 West Street 27 Unit Street 404 Unit 404 copyrightcopyright owners ownersof images of includedimages included in in StrengthenStrengthen and extend and theextend range the of range our of our New York,New NY York, 10001 NY 10001 this reportthis and report to meet and totheir meet requirements. -

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

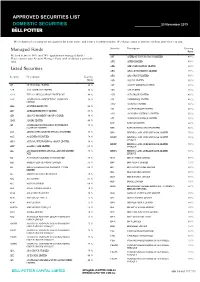

Approved Securities List

APPROVED SECURITIES LIST DOMESTIC SECURITIES 23 November 2019 The inclusion of a security on our approval list is not advice and is not a recommendation. We change ratios at any time without prior notice to you. Security Description Gearing Managed Funds Ratio We lend between 50% and 70% against most managed funds. APT AFTERPAY TOUCH GROUP LIMITED 40 % Please contact your Account Manager if you wish to discuss a particular fund. APX APPEN LIMITED 40 % Listed Securities ARB ARB CORPORATION LIMITED. 60 % ARG ARGO INVESTMENTS LIMITED 75 % Security Description Gearing ARQ ARQ GROUP LIMITED 50 % Ratio ASB AUSTAL LIMITED 50 % 3PL 3P LEARNING LIMITED.. 40 % AST AUSNET SERVICES LIMITED 65 % A2B A2B AUSTRALIA LIMITED 50 % ASX ASX LIMITED 70 % A2M THE A2 MILK COMPANY LIMITED NZ 40 % AUB AUB GROUP LIMITED 40 % AAC AUSTRALIAN AGRICULTURAL COMPANY 50 % AVJ AVJENNINGS LIMITED 40 % LIMITED. AWC ALUMINA LIMITED 70 % ABA AUSWIDE BANK LTD 40 % AX1 ACCENT GROUP LIMITED 50 % ABC ADELAIDE BRIGHTON LIMITED 65 % AYS AMAYSIM AUSTRALIA LIMITED 50 % ABP ABACUS PROPERTY GROUP STAPLED 50 % AZJ AURIZON HOLDINGS LIMITED 70 % ADH ADAIRS LIMITED 40 % BAP BAPCOR LIMITED 60 % AFI AUSTRALIAN FOUNDATION INVESTMENT 75 % COMPANY LIMITED BBN BABY BUNTING GROUP LIMITED 50 % AGI AINSWORTH GAME TECHNOLOGY LIMITED 55 % BEN BENDIGO AND ADELAIDE BANK LIMITED 70 % AGL AGL ENERGY LIMITED. 70 % BENPE BENDIGO AND ADELAIDE BANK LIMITED 70 % LPYR6UT AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. 50 % BENPF BENDIGO AND ADELAIDE BANK LIMITED 70 % AHY ASALEO CARE LIMITED 65 % LPYR6UT AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED 70 % BENPG BENDIGO AND ADELAIDE BANK LIMITED 70 % NZX LPYR3UT ALF AUSTRALIAN LEADERS FUND LIMITED 50 % BGA BEGA CHEESE LIMITED 60 % ALG ARDENT LEISURE GROUP LIMITED 55 % BHP BHP GROUP LIMITED 75 % ALI ARGO GLOBAL LISTED INFRASTRUCTURE 60 % BIN BINGO INDUSTRIES LIMITED 50 % LIMITED BKL BLACKMORES LIMITED 60 % ALL ARISTOCRAT LEISURE LIMITED 70 % BKW BRICKWORKS LIMITED 60 % ALQ ALS LIMITED 65 % BLD BORAL LIMITED. -

Quarterly Investment Update Antares High Growth Shares Fund – June 2021

Quarterly Investment Update Antares High Growth Shares Fund – June 2021 For adviser use only Highlights for the quarter Performance: The Fund returned 9.6% (net of fees) for the June quarter, outperforming its benchmark by 1.3%. Contributors to performance: Positive contributors – Aristocrat Leisure, Telix Pharmaceuticals, Megaport, Boral, Woodside (not owned); Negative contributors – Incitec Pivot, Qantas, ANZ, Resmed (not owned) and Altium (not owned). Stock activity: Buys/additions – Ansell, Downer and TPG Telecom ; Sells/reductions – BlueScope Steel, Boral, Endeavour Group and Worley Fund snapshot Inception date 7 December 1999 Benchmark S&P/ASX 200 Total Return Index To outperform the benchmark (after fees) over rolling Investment objective 5-year periods Investment returns as at 30 June 20211 Period 3 months 1 year 3 years pa 5 years pa 10 years pa Since inception pa Net return2 % 9.6 39.9 9.2 12.6 10.0 11.0 Gross return3 % 9.9 41.9 10.5 13.9 11.2 12.5 Benchmark return % 8.3 27.8 9.6 11.2 9.3 8.5 Net excess return % 1.3 12.1 -0.4 1.4 0.7 2.5 Gross excess return % 1.6 14.1 0.9 2.7 1.9 4.0 1 Past performance is not a reliable indicator of future performance. Returns are not guaranteed and actual returns may vary from any target returns described in this document. 2 Investment returns are based on exit prices, and are net of management fees and assume reinvestment of all distributions. Contributors to performance Pleasingly the Fund enjoyed another strong quarter, returning 9.6% (net of fees) vs the benchmark return of 8.3%. -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

Australian Equity Microcap Insights

UBS Asset Management For professional / qualified / institutional investors only. May 2020 Australian Equity Microcap Insights Opportunities abound in Microcap space As the economy moves into the post COVID-19 recovery phase, UBS Microcap Fund Portfolio Manager Joel Fleming expects microcap companies to be an important contributor to the recovery, Joel Fleming with many smaller firms driving high levels Portfolio Manager Yarra Capital Management of growth as they take advantage of the lasting changes caused by the pandemic. There are a large number of common misconceptions Microcap recap about the contribution made by Australia’s smaller firms to Microcaps offer the largest investable universe by number the domestic economy. Some of Joels’s favourites include: on the ASX. With no ETF or passive products, a more constrained liquidity profile compared to large caps, and a • “Micro companies are largely in retail and service vast investable universe, Microcap investing is all about sectors and employ relatively few people in active management. comparison to larger firms” The index represents opportunity, with many examples of • “Micro and small companies tend to not be profitable. companies that have delivered on an idea and transitioned Profits in Australia are driven by large firms in the into the sphere of Australia’s Top 100 listed companies. mining, banks, supermarket and health care sectors” Think Afterpay, A2 Milk, Domino’s Pizza or TPG Telecom. • “Micro companies pay small dividends and have low While much of the universe will deliver poor returns, operating margins. Investing in the space is all about despite the hype and promise, the success stories can capital growth” deliver many multiples of an initial investment. -

Thinktv FACT PACK NEW ZEALAND

ThinkTV FACT PACK JAN TO DEC 2017 NEW ZEALAND TV Has Changed NEW ZEALAND Today’s TV is a sensory experience enjoyed by over 3 million viewers every week. Powered by new technologies to make TV available to New Zealanders anywhere, any time on any screen. To help advertisers and agencies understand how TV evolved over the last year, ThinkTV has created a Fact Pack with all the stats for New Zealand TV. ThinkTV’s Fact Pack summarises the New Zealand TV marketplace, in-home TV viewing, timeshifted viewing and online video consumption. And, because we know today’s TV is powered by amazing content, we’ve included information on some top shows, top advertisers and top adverts to provide you with an insight into what was watched by New Zealanders in 2017. 2017 THE NEW ZEALAND TV MARKETPLACE BIG, SMALL, MOBILE, SMART, CONNECTED, 1. HD-capable TV sets are now in CURVED, VIRTUAL, 3D, virtually every home in New Zealand DELAYED, HD, 4K, 2. Each home now has on average ON-DEMAND, CAST, 7.6 screens capable of viewing video STREAM… 3. Almost 1 in every 3 homes has a internet-connected smart TV THE TV IS AS CENTRAL TO OUR ENTERTAINMENT AS IT’S EVER BEEN. BUT FIRST, A QUICK PEAK INSIDE NEW ZEALAND’S LIVING ROOMS • In 2015 New Zealand TV celebrated 55 years of broadcast with the first transmission on 1 June, 1960 • Today’s TV experience includes Four HD Free-to-air channels Two Commercial Free-to-Air broadcasters One Subscription TV provider • Today’s TV is DIGITAL in fact, Digital TV debuted in 2006 followed by multi-channels in 2007 • In its 58th year, New Zealand TV continues to change and evolve. -

Bryan Donnell • Director of Photography [email protected] • Website Bryandonnell.Com • 213.321.3909 M

Bryan Donnell • Director of Photography [email protected] • website bryandonnell.com • 213.321.3909 m DOCUMENTARY TELEVISION E.P./PRODUCER/DIRECTOR NETWORK/CO. Untitled doc feature Chai Vasarhelyi/Jimmy Chin HBO/Little Monsters Untitled doc feature Erin Lee Carr Netflix/Story Syndicate This Is Life w/ Lisa Ling (multiple eps) Lisa Ling/multiple CNN/Part2 We’re Here Peter Logreco HBO/IPC • nominee best doc series Emmy, IDA, Independent Spirit Untitled doc series Nikki Calabrese HBO/WoW Rick James biopic Steve Rivo/Sacha Jenkins Showtime/Mass Appeal The Con Star Price ABC/IPC Empires of New York (add’l) Matthew Galkin CNBC/IPC The Witnesses Matt Testa Oxygen/Herzog Broken Steve Rivo Netflix/ZeroPointZero The Redemption Project w/ Van Jones Jason Cohen CNN/Citizen Jones Murder Mountain Jon Chinn/Matt Testa/Joshua Zeman Netflix/Lightbox QB1 Peter Berg/Rachel Libert Netflix/Film45 Kids Behind Bars Peter Logreco A&E/IPC Afflicted Peter Logreco Netflix/Doc Shop Criminal Confessions Dick Wolf/Adam Kassen Oxygen/Shed Media Religion of Sports Tom Brady/Sam French Dish/Dirty Robber Invisible Killers Steve Rivo/BJ Perlmutt Discovery/Doc Group Hot Girls Wanted: Turned On Peter Logreco Netflix/Herzog Truth and Power Brian Knappenberger Pivot/Luminant Media DB Cooper: Case Closed? Ted Skillman History Channel truInside: Iconic Comedies Lisa Kalikow, Meri Haitkin, et al. truTV/left/right Morgan Spurlock: Inside Man Morgan Spurlock/Matt Galkin CNN/Warrior Poets • IDA AWARD, best doc series Living in Secret Sarah Skibitzke LMN/Brownstone Years of Living Dangerously (add’l) James Cameron/Joel Bach Showtime/Years Project • EMMY AWARD, best doc series Summer Dreams Jonathan Chinn/Ted Skillman CBS/Mandalay Sport in America (add’l) Adam del Deo/James Stern HBO/Endgame 30 for 30: The Dotted Line Morgan Spurlock/Matt Galkin ESPN/Warrior Poets Intervention Dan Partland A&E/GRB • EMMY AWARD, best reality series • EMMY NOM, best cinematography (for me) 30 Days: Animal Rights Morgan Spurlock/Jonathan Chinn FX/Actual Reality DOCUMENTARY FILMS PRODUCER/DIRECTOR DISTRIBUTOR/PROD. -

The Export of European Films on SVOD Outside Europe

The export of European films on SVOD services outside Europe Christian Grece September 2019 A publication of the European Audiovisual Observatory Table of Contents Overview of 79 SVOD services in 21 countries worldwide Analysis by region and country ▪ North America – Canada and USA ▪ Latin America – Argentina, Brazil and Mexico ▪ South East Asia – Indonesia, Malaysia, Philippines, Singapore and Thailand ▪ East Asia – China and Japan ▪ India ▪ Oceania –Australia and New Zealand ▪ Middle East – The United Arab Emirates, Egypt and Saudi Arabia ▪ Individual countries - Russian Federation, South Africa and Turkey Introduction The aim of this report is to give a picture on the export of EU films on SVOD services outside of the European Union. 79 SVOD services in 21 countries worldwide are part of the sample. The report looks at the circulation of unique film titles and the volume/occurrences of films available on these services, on a regional and service basis. The first part gives a snapshot of the availability of EU films around the globe after which a overview for each region is provided. Methodology The analysis has been carried out based on data provided by Ampere Analysis and comprehends SVOD catalogue data collected in June 2019. A film is defined as a feature film, fiction film, documentary or other film content available in the “Film” / “Movie” section of the SVOD catalogues part of the sample. For the origin of a film, only the first country of production is taken into account. The production countries are based on data collected from the Observatory’s LUMIERE database on admissions to films in Europe, IMDb and the Movie database. -

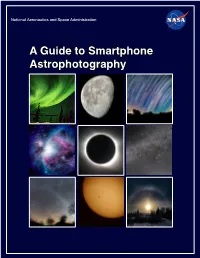

A Guide to Smartphone Astrophotography National Aeronautics and Space Administration

National Aeronautics and Space Administration A Guide to Smartphone Astrophotography National Aeronautics and Space Administration A Guide to Smartphone Astrophotography A Guide to Smartphone Astrophotography Dr. Sten Odenwald NASA Space Science Education Consortium Goddard Space Flight Center Greenbelt, Maryland Cover designs and editing by Abbey Interrante Cover illustrations Front: Aurora (Elizabeth Macdonald), moon (Spencer Collins), star trails (Donald Noor), Orion nebula (Christian Harris), solar eclipse (Christopher Jones), Milky Way (Shun-Chia Yang), satellite streaks (Stanislav Kaniansky),sunspot (Michael Seeboerger-Weichselbaum),sun dogs (Billy Heather). Back: Milky Way (Gabriel Clark) Two front cover designs are provided with this book. To conserve toner, begin document printing with the second cover. This product is supported by NASA under cooperative agreement number NNH15ZDA004C. [1] Table of Contents Introduction.................................................................................................................................................... 5 How to use this book ..................................................................................................................................... 9 1.0 Light Pollution ....................................................................................................................................... 12 2.0 Cameras ................................................................................................................................................ -

Ci Australian Equities Fund

CI AUSTRALIAN EQUITIES FUND QUARTERLY COMMENTARY REPORT Cooper Investors Pty Limited AFS Licence Number 221794 ABN 26 100 409 890 For current performance information please refer to the Monthly Performance Report. JUNE 2021 “Wise men speak because they have something to say: fools because they have to say something.” Plato “Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.” John Kenneth Galbraith **PORTFOLIO #BENCHMARK VALUE ADDED ROLLING 3 MONTH 9.13% 8.29% 0.84% ROLLING 1 YEAR 28.02% 27.80% 0.22% ROLLING 3 YEAR 10.82% 9.58% 1.24% ROLLING 5 YEAR 11.76% 11.16% 0.60% ROLLING 7 YEAR 11.32% 8.79% 2.53% ROLLING 10 YEAR 12.59% 9.26% 3.33% SINCE INCEPTION* 12.55% 8.98% 3.57% SINCE INCEPTION^ 844.84% 411.66% 433.18% *Annualised ^Cumulative (4 July 2002) **Before fees and expenses #S&P ASX 200 Accumulation Index Past performance is not necessarily a reliable indicator of future performance CI Australian Equities Fund - Gross of Fees $1,000 Invested Since Inception $9,800 $8,800 $7,800 $6,800 $5,800 $4,800 $3,800 $2,800 $1,800 $800 CI Australian Equities Fund S&P ASX 200 Accumulation Index Source: NAB Asset Servicing 1 CI AUSTRALIAN EQUITIES FUND QUARTERLY COMMENTARY REPORT Cooper Investors Pty Limited AFS Licence Number 221794 ABN 26 100 409 890 For current performance information please refer to the Monthly Performance Report. JUNE 2021 CI Australian Equities vs ASX200 (since inception to 30-Jun 2021) 16% CI Australian Equities 12% S&P 500 ASX 200 Acc. -

1. Shareholdings in Public and Private Companies (Including Holding

Form A 3 March 2020 Surname: Mclachlan Other names: Andrew State/Territory: SA Date: 3/03/2020 1. Shareholdings in public and private companies (including holding companies) indicating the name of the company or companies (Note: It is NOT necessary to declare the size or value of the shareholding) Name of company – (including holding and subsidiary companies if applicable) OATMILL HOLDINGS PTY LTD AUSTOFIX GROUP LTD VITRO SOFTWARE HOLDINGS (Designated Activity Company) ALUMINA LIMITED ANTIPODES GLOBAL INVESTMENT COMPANY LTD ANZ BANKING GROUP LIMITED AP EAGERS LIMITED ARISTOCRAT LEISURE LIMITED BHP GROUP LIMITED BORAL LIMITED CLEANAWAY WASTE MANAGEMENT LTD COMMONWEALTH BANK OF AUSTRALIA CORPORATE TRAVEL MANAGEMENT LIMITED COSTA GROUP HOLDINGS LIMITED GRAINCORP LIMITED ILUKA RESOURCES LIMITED LI LONG SHORT FUND LIMITED MACQUARIE GROUP LIMITED MINERAL RESOURCES LIMITED Form A NAOS EMERG OPP CO LTD NINE ENTERTAINMENT co HLDGS LTD OOH!MEDIA LIMITED ORIGIN ENERGY LIMITED ORORA LIMITED QBE INSURANCE GROUP LIMITED QUBE HOLDINGS LIMITED RELIANCE WORLDWIDE CORPORATION LIMITED SIMS LIMITED SONIC HEALTHCARE LIMITED SOUTH32 LIMITED S32 THE STAR ENTERTAINMENT GROUP LTD TPG TELECOM LIMITED TPM WAM LEADERS LIMITED WAM MICROCAP LIMITED WESFARMERS LIMITED WESTPAC BANKING CORPORATION WOODSIDE PETROLEUM LIMITED WORLEY LIMITED NATIONAL STORAGE REIT STPLD SEC AMCOR PLC JANUS HENDERSON GROUP PLC SPARK NEW ZEALAND LIMITED VIRGIN MONEY UK PLC ANZ BANK UNSEC NON-CUM PARADICE GLOBAL SMALL CAP FUND PLATINUM EUROPEAN FUND WESTPAC CAPITAL NOTES 2. Family and business