1. Shareholdings in Public and Private Companies (Including Holding

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Industry Associations & ASX Companies

Industry Associations, ASX Companies, Shareholder Interests and Lobbying CONTENTS About the Authors ........................................................................................................................ 3 ACCR ............................................................................................................................................ 3 About ISS-caer ............................................................................................................................. 3 About the Report .......................................................................................................................... 4 Foreword ...................................................................................................................................... 4 Introduction .................................................................................................................................. 5 Report Structure .......................................................................................................................... 6 PART 1 - Background ................................................................................................................... 8 What is an Industry Association? .............................................................................................. 8 Advantages and Disadvantages of Belonging to an Industry Association ........................... 10 Australian Legislation and Regulations Covering Industry Associations ............................. 11 -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

The Recycled Plastics Market: Global Analysis and Trends

MANUFACTURING www.csiro.au The Recycled Plastics Market: Global Analysis and Trends Katherine ES Locock, Jessica Deane, Edward Kosior, Hishani Prabaharan, Melissa Skidmore, Oliver E Hutt Citation Locock, KES (2017) The Recycled Plastics Market: Global Analysis and Trends. CSIRO, Australia. Copyright and disclaimer © 2017 CSIRO To the extent permitted by law, all rights are reserved and no part of this publication covered by copyright may be reproduced or copied in any form or by any means except with the written permission of CSIRO. Important disclaimer CSIRO advises that the information contained in this publication comprises general statements based on scientific research. The reader is advised and needs to be aware that such information may be incomplete or unable to be used in any specific situation. No reliance or actions must therefore be made on that information without seeking prior expert professional, scientific and technical advice. To the extent permitted by law, CSIRO (including its employees and consultants) excludes all liability to any person for any consequences, including but not limited to all losses, damages, costs, expenses and any other compensation, arising directly or indirectly from using this publication (in part or in whole) and any information or material contained in it. Contents Executive summary ....................................................................................................................................... v 1.1 Goal of study ......................................................................................................................... -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

Annual Report 2018 Graincorp Provides Contents a Diverse Range of Graincorp Overview 2 Products and Services

GrainCorp Limited Annual Report 2018 GrainCorp provides Contents a diverse range of GrainCorp Overview 2 products and services Chairman’s Statement 4 across the food and MD & CEO’s Statement 6 beverage supply chain Board of Directors 10 to customers in Executive Leadership Team 14 over 30 countries. Directors’ Report 16 Directors’ Report - Remuneration Report 30 Auditor’s Independence Declaration 43 2018 Financial Report 44 Notes to the Financial Statements 50 Directors’ Declaration 93 Independent Auditor’s Report 94 to the members of GrainCorp Shareholder Information 101 Corporate Directory IBC Annual General Meeting 20 February 2019, 10:00am Hilton Hotel, Sydney 2018 Annual Report 1 GrainCorp Overview Our International Operations Germany Grains Ukraine Grains United Kingdom Grains • Saxon Agriculture China Grains Malt Oils • Bairds Malt • Scotgrain North America • Brewers Select Grains • GrainsConnect Canada Australia & New Zealand Malt Grains • Canada Malting Company Singapore Oils Grains • Great Western Malting Malt • Country Malt Group • Barrett Burston Malting • Brewcraft USA • Cryer Malt Grains marketing oce Head oce Malt/Oils facilities Grains operations 2 2018 Annual Report GrainCorp is a leading international food ingredients and agribusiness company with an integrated business model across three main grain activities: supply chain, origination and processing. GrainCorp has operations in Australia, New Zealand, Asia, North America, Europe and the Germany United Kingdom. These markets collectively Grains represent over 50% of the international export Ukraine trade in wheat, barley and canola. Grains GrainCorp has three reporting segments: › GrainCorp Grains › GrainCorp Malt › GrainCorp Oils Our Vision United Kingdom To be a leading international agribusiness as our Grains customers’ preferred partner. • Saxon Agriculture China Grains Malt Oils • Bairds Malt Our Integrated Supply Chain • Scotgrain Accumulation – Largest regional accumulation North America • Brewers Select network in Australia. -

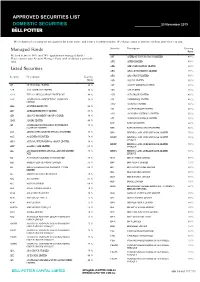

Approved Securities List

APPROVED SECURITIES LIST DOMESTIC SECURITIES 23 November 2019 The inclusion of a security on our approval list is not advice and is not a recommendation. We change ratios at any time without prior notice to you. Security Description Gearing Managed Funds Ratio We lend between 50% and 70% against most managed funds. APT AFTERPAY TOUCH GROUP LIMITED 40 % Please contact your Account Manager if you wish to discuss a particular fund. APX APPEN LIMITED 40 % Listed Securities ARB ARB CORPORATION LIMITED. 60 % ARG ARGO INVESTMENTS LIMITED 75 % Security Description Gearing ARQ ARQ GROUP LIMITED 50 % Ratio ASB AUSTAL LIMITED 50 % 3PL 3P LEARNING LIMITED.. 40 % AST AUSNET SERVICES LIMITED 65 % A2B A2B AUSTRALIA LIMITED 50 % ASX ASX LIMITED 70 % A2M THE A2 MILK COMPANY LIMITED NZ 40 % AUB AUB GROUP LIMITED 40 % AAC AUSTRALIAN AGRICULTURAL COMPANY 50 % AVJ AVJENNINGS LIMITED 40 % LIMITED. AWC ALUMINA LIMITED 70 % ABA AUSWIDE BANK LTD 40 % AX1 ACCENT GROUP LIMITED 50 % ABC ADELAIDE BRIGHTON LIMITED 65 % AYS AMAYSIM AUSTRALIA LIMITED 50 % ABP ABACUS PROPERTY GROUP STAPLED 50 % AZJ AURIZON HOLDINGS LIMITED 70 % ADH ADAIRS LIMITED 40 % BAP BAPCOR LIMITED 60 % AFI AUSTRALIAN FOUNDATION INVESTMENT 75 % COMPANY LIMITED BBN BABY BUNTING GROUP LIMITED 50 % AGI AINSWORTH GAME TECHNOLOGY LIMITED 55 % BEN BENDIGO AND ADELAIDE BANK LIMITED 70 % AGL AGL ENERGY LIMITED. 70 % BENPE BENDIGO AND ADELAIDE BANK LIMITED 70 % LPYR6UT AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. 50 % BENPF BENDIGO AND ADELAIDE BANK LIMITED 70 % AHY ASALEO CARE LIMITED 65 % LPYR6UT AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED 70 % BENPG BENDIGO AND ADELAIDE BANK LIMITED 70 % NZX LPYR3UT ALF AUSTRALIAN LEADERS FUND LIMITED 50 % BGA BEGA CHEESE LIMITED 60 % ALG ARDENT LEISURE GROUP LIMITED 55 % BHP BHP GROUP LIMITED 75 % ALI ARGO GLOBAL LISTED INFRASTRUCTURE 60 % BIN BINGO INDUSTRIES LIMITED 50 % LIMITED BKL BLACKMORES LIMITED 60 % ALL ARISTOCRAT LEISURE LIMITED 70 % BKW BRICKWORKS LIMITED 60 % ALQ ALS LIMITED 65 % BLD BORAL LIMITED. -

Annual Report Year Ended 30 June 2019

Annual Report Year Ended 30 June 2019 This annual report is dated 14 August 2019 and is signed on behalf of the Board of directors of SkyCity Entertainment Group Limited (SkyCity or the company and, together with its subsidiaries, the Group) by: Rob Campbell Bruce Carter Chair Deputy Chair An electronic copy of this annual report is available in the Investor Centre section of the company’s website at www.skycityentertainmentgroup.com ABOUT THIS ANNUAL REPORT Unless otherwise stated, all dollar amounts in this annual report are expressed in New Zealand dollars. Where appropriate, information is also provided in relation to activities that have occurred after 30 June 2019, but prior to publication of this annual report. The non-financial information in this annual report has been informed by the principles and disclosures of the Global Reporting Initiative’s (GRI) Sustainability Reporting Standards. Ernst & Young has undertaken limited assurance (in accordance with the International Standard on Assurance Engagements (New Zealand)) over disclosures associated with selected performance data included in the Sustainability section included in this annual report. A GRI reference index based on the GRI Sustainability Reporting Standards is included on pages 178–181 of this annual report. Normalised numbers are a non-GAAP financial measure. A reconciliation of reported and normalised earnings and description of the differences are provided on pages 174–177. GENERAL Year in Review 4 Creating Value 6 Performance 8 Diversity Snapshot 12 Chair’s Review -

Balanced Style Investing — Winning by Not Losing September 2020

Insights Active Quantitative Equity (AQE) Balanced Style Investing — Winning by Not Losing September 2020 Bruce Apted Head of Portfolio Management Australia Active Quantitative Equity Human emotions and biases affect all investors. Left unchecked, these emotions can sabotage financial decisions and generate suboptimal investment outcomes. However, by understanding how human emotions and behaviour impacts our decision making we can unlock opportunities for investors. The key to unlocking these opportunities is: • understanding how financial markets interact with human behaviour; and • finding an investment style to exploit these biases. Emotions are the Financial markets have the ability to generate and destroy wealth. They are complex and Enemy for Investors volatile and evoke significant emotions. Figure 1 depicts an all too common emotional roller coaster for investors. The worst case scenario is letting your emotions drive your investment decisions — buying a security near the high or capitulating and selling near the low. How can investors avoid the mistakes of mass psychology and turn emotional short comings into opportunity? Be risk averse when the market is overly optimistic (Euphoria) and risk seeking when the market is overly pessimistic (Panic and Capitulation). 10 Figure 1 Euphoria Market Becomes Expensive — Greatest Financial Risk The Emotional Roller Coaster of Investing 8 Thrill Anxiety Denial Excitment 6 Fear Optimism Optimism 4 Panic Relief 2 Hope Market Becomes Cheap — Greatest Financial Opportunity Capitulation Depression 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Source: State Street Global Advisors. The information contained above is for illustrative purposes only. Over the last 20 years, there are many examples of Euphoria followed by Fear and Capitulation (see Figure 2).