A Research on the Financial Models of Wuhan Rail Transit Meng Li

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Operator's Story Case Study: Guangzhou's Story

Railway and Transport Strategy Centre The Operator’s Story Case Study: Guangzhou’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from Guangzhou Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in Guangzhou, China. These notes are based upon 3 meetings on the 11th March 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece. Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. This mini case study does not attempt to provide a comprehensive picture of Guangzhou Metropolitan Corporation (GMC), but rather focuses on specific topics of interest to The Operators’ Story project. The research team thank GMC and its staff for their kind participation in this project. Comments are not attributed to specific individuals, as agreed with the interviewees and GMC. List of interviewees Meetings include the following GMC members: Mr. -

8Th Metro World Summit 201317-18 April

30th Nov.Register to save before 8th Metro World $800 17-18 April Summit 2013 Shanghai, China Learning What Are The Series Speaker Operators Thinking About? Faculty Asia’s Premier Urban Rail Transit Conference, 8 Years Proven Track He Huawu Chief Engineer Record: A Comprehensive Understanding of the Planning, Ministry of Railways, PRC Operation and Construction of the Major Metro Projects. Li Guoyong Deputy Director-general of Conference Highlights: Department of Basic Industries National Development and + + + Reform Commission, PRC 15 30 50 Yu Guangyao Metro operators Industry speakers Networking hours President Shanghai Shentong Metro Corporation Ltd + ++ Zhang Shuren General Manager 80 100 One-on-One 300 Beijing Subway Corporation Metro projects meetings CXOs Zhang Xingyan Chairman Tianjin Metro Group Co., Ltd Tan Jibin Chairman Dalian Metro Pak Nin David Yam Head of International Business MTR C. C CHANG President Taoyuan Metro Corp. Sunder Jethwani Chief Executive Property Development Department, Delhi Metro Rail Corporation Ltd. Rachmadi Chief Engineering and Project Officer PT Mass Rapid Transit Jakarta Khoo Hean Siang Executive Vice President SMRT Train N. Sivasailam Managing Director Bangalore Metro Rail Corporation Ltd. Endorser Register Today! Contact us Via E: [email protected] T: +86 21 6840 7631 W: http://www.cdmc.org.cn/mws F: +86 21 6840 7633 8th Metro World Summit 2013 17-18 April | Shanghai, China China Urban Rail Plan 2012 Dear Colleagues, During the "12th Five-Year Plan" period (2011-2015), China's national railway operation of total mileage will increase from the current 91,000 km to 120,000 km. Among them, the domestic urban rail construction showing unprecedented hot situation, a new round of metro construction will gradually develop throughout the country. -

Osprey Nest Queen Size Page 2 LC Cutting Correction

Template Layout Sheets Organizing, Bags, Foundation Papers, and Template Layout Sheets Sort the Template Layout Sheets as shown in the graphics below. Unit A, Temp 1 Unit A, Temp 1 Layout UNIT A TEMPLATE LAYOUT SHEET CUT 3" STRIP BACKGROUND FABRIC E E E ID ID ID S S S Please read through your original instructions before beginning W W W E E E Sheet. Place (2) each in Bag S S S TEMP TEMP TEMP S S S E E A-1 A-1 A-1 E W W W S S S I I I D D D E E E C TEMP C TEMP TEMP U U T T A-1 A-1 T A-1 #6, #7, #8, and #9 L L I the queen expansion set. The instructions included herein only I C C C N N U U U T T T T E E L L L I I I N N N E E replace applicable information in the pattern. E Unit A, Temp 2, UNIT A TEMPLATE LAYOUT SHEET Unit A, Temp 2 Layout CUT 3" STRIP BACKGROUND FABRIC S S S E E E The Queen Foundation Set includes the following Foundation Papers: W W W S S S ID ID ID E TEMP E TEMP E TEMP Sheet. Place (2) each in Bag A-2 A-2 A-2 E E E D D D I I TEMP I TEMP TEMP S S S A-2 A-2 A-2 W W W C E C E E S S S U C C U C U U U T T T T T T L L L L IN IN L IN I I N #6, #7, #8, and #9 E E N E E NP 202 (Log Cabin Full Blocks) ~ 10 Pages E NP 220 (Log Cabin Half Block with Unit A Geese) ~ 2 Pages NP 203 (Log Cabin Half Block with Unit B Geese) ~ 1 Page Unit B, Temp 1, ABRIC F BACKGROUND Unit B, Temp 1 Layout E E T SHEE YOUT LA TE TEMPLA A T UNI E D I D I D I S S STRIP 3" T CU S W W E W TP 101 (Template Layout Sheets for Log Cabins and Geese) ~ 2 Pages E S S E S TEMP TEMP TEMP S S S E E E 1 A- 1 A- 1 A- W W W S S S I I I D D D E E E C C Sheet. -

International Student Guide

Contents CHAPTER I PREPARATIONS BEFORE COMING TO CHINA 1. VISA APPLICATION (1) Introduction to the Student Visa.......................................................................2 (2) Requirements for Visa Application..................................................................2 2. WHAT TO BRING (1) Materials Required for Registration.................................................................2 (2) Other Recommended Items.............................................................................3 3. BANKING INFORMATION AND CURRENCY OPERATIONS (1) Introduction to Chinese Currency....................................................................4 (2) Foreign Currency Exchange Sites and Convertible Currencies................4 (3) Withdrawal Limits of Bank Accounts................................................................5 (4) Wire Transfer Services........................................................................................5 4. ACCOMMODATION (1) Check-in Time......................................................................................................5 (2) On-Campus Accommodation....................................................................5 (3) Off-Campus Accommodation and Nearby Hotels.......................................8 (4) Questions and Answers about Accommodation (Q&A).............................9 CHAPTER II HOW TO GET TO TIANJIN UNIVERSITY 5. HOW TO ARRIVE................................................................................................12 (1). How to Get to Weijin -

Sediment Provenance Discrimination in Northern Okinawa Trough During the Last 24 Ka and Paleoenvironmental Implication: Rare Earth Elements Evidence

JOURNAL OF RARE EARTHS, Vol. 30, No. 11, Nov. 2012, P. 1184 Sediment provenance discrimination in northern Okinawa Trough during the last 24 ka and paleoenvironmental implication: rare earth elements evidence XU Zhaokai (徐兆凯)1, LI Tiegang (李铁刚)1, CHANG Fengming (常凤鸣)1, CHOI Jinyong2, LIM Dhongil3, 4 XU Fangjian (徐方建) (1. Key Laboratory of Marine Geology and Environment, Institute of Oceanology, Chinese Academy of Sciences, Qingdao 266071, China; 2. Department of Oceanography, Kunsan National University, Kunsan 573-701, Korea; 3. South Sea Institute, Korea Ocean Research and Development Institute, Geoje 656-830, Korea; 4. School of Geo- sciences, China University of Petroleum, Qingdao 266555, China) Received 28 February 2012; revised 28 September 2012 Abstract: Rare earth elements (REE) compositions and discriminant function were successfully used to examine high resolution sediment source changes in the northern Okinawa Trough over the last 24.1 ka, especially for the influence from the Yellow River and the Tsushima Warm Current (TWC) that has not been well solved. Variations of these parameters were clearly divided into three distinct depositional units. During Interval 1 (24.1–16.0 ka BP), the paleo-Yellow River and the paleo-Yangtze River mouths were situated near the studied area and could have played major roles in the sedimentation therein. In Interval 2 (16.0–7.3 ka BP), these river mouths gradually retreated with global sea-level rise, leading to less fluvial inputs from them to the northern Okinawa Trough. Meanwhile, formation of the TWC could carry some sediment loads of Taiwan to the studied core, especially during its late phase (8.0–7.3 ka BP). -

Poly Property Group Co., Limited 保利置業集團有限公司 (Incorporated in Hong Kong with Limited Liability) (Stock Code: 119)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Poly Property Group Co., Limited 保利置業集團有限公司 (Incorporated in Hong Kong with limited liability) (Stock code: 119) RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31ST DECEMBER, 2017 RESULTS The directors (the “Directors”) of Poly Property Group Co., Limited (the “Company”) presented the audited consolidated financial statements of the Company and its subsidiaries (the “Group”) for the year ended 31st December, 2017, together with the independent auditor’s report issued by BDO Limited, as follows: – 1 – INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS OF POLY PROPERTY GROUP CO., LIMITED (incorporated in Hong Kong with limited liability) Opinion We have audited the consolidated financial statements of Poly Property Group Co., Limited and its subsidiaries (together “the Group”) set out on pages 9 to 120, which comprise the consolidated statement of financial position as at 31st December, 2017, the consolidated statement of profit or loss, the consolidated statement of comprehensive income, the consolidated statement of changes in equity and the consolidated statement of cash flows for the year then ended and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the consolidated financial statements give a true and fair view of the consolidated financial position of the Group as at 31st December, 2017 and of its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with Hong Kong Financial Reporting Standards (“HKFRSs”) issued by the Hong Kong Institute of Certified Public Accountants (“HKICPA”) and have been properly prepared in compliance with the Hong Kong Companies Ordinance. -

Annual Report 2018 Annual Report 2018 3 Awards & Accolades

Stock Code: 12 ANNUAL REPORT 2 0 18 Corporate Profile Founded in 1976 by its Chairman, Dr The Honourable Lee Shau Kee, GBM, Henderson Land Development Company Limited is a leading property group with a focus on Hong Kong and mainland China. Its core businesses comprise property development and property investment. In addition, it has direct equity interests in a listed subsidiary, Henderson Investment Limited, and three listed associates, The Hong Kong and China Gas Company Limited (which in turn has equity stakes in a listed subsidiary, Towngas China Company Limited), Hong Kong Ferry (Holdings) Company Limited and Miramar Hotel and Investment Company, Limited. Henderson Land has been listed in Hong Kong since 1981 where it is one of the largest property groups. As at 31 December 2018, Henderson Land had a market capitalisation of HK$172 billion and the combined market capitalisation of the Company, its listed subsidiary and its associates was about HK$453 billion. The Company is vertically integrated, with project management, construction, property management, and financial services supporting its core businesses. In all aspects of its operations, Henderson Land strives to add value for its shareholders, customers and the community through its commitment to excellence in product quality and service delivery as well as a continuous focus on sustainability and the environment. Contents Inside front Corporate Profile 2 Land Bank – Hong Kong and Mainland China 4 Awards & Accolades 6 Group Structure 7 Highlights of 2018 Final Results 10 Chairman’s -

Transportation Systems 2018 – 2020

Transportation Systems 2018 – 2020 DE | EN | FR Liebherr-Transportation Systems News from the Company | p. 12 - 31 Locations Partners in Rapid Development | p. 20 The Liebherr Group Insights | p. 38 ff. From left to right: Holger Dörre, Adrian Gunis, Stefan Pachowsky, Dirk Junghans Dear reader, In the face of growing environmental awareness worldwide plus, for the first time, series-ready cold vapor systems using and the increasing changes in mobility, it seems likely that the CO2 as the refrigerant. transport of passengers and freight by rail will continue to play a significant role as part of the overall transportation systems of The outlook for our Hydraulics division is also very positive. the future. However, the demands made in terms of reliability, In this sector, Liebherr has been able to expand its product efficiency and environmental compatibility are also increasing portfolio considerably once again, including dampers for level in parallel. The rail system must therefore be continuously regulation systems. In addition, we are also working within the further developed and made fit for purpose for the future so framework of a research project with partners in the UK on that it can survive in the long term as part of an integrated the development of a system for the active radial suspension. transportation network. The aim of this project is to considerably reduce wear on rails and wheels. Liebherr-Transportation Systems is ready to face the associ- ated challenges, and is consistently pushing forward with the We have also further expanded our customer service activities, development of innovative technologies and products with a and not only in the well developed markets of Europe and North high customer benefit in all product areas. -

Here You Can Taste Wuhan Featured Food

Contents Basic Mandarin Chinese Words and Phrases............................................... 2 Useful Sayings....................................................................................... 2 In Restaurants....................................................................................... 3 Numbers................................................................................................3 Dinning and cafes..........................................................................................5 Eating Out in Wuhan.............................................................................5 List of Restaurants and Food Streets (sort by distance).......................6 4 Places Where You Can Taste Wuhan Featured Food.........................7 Restaurants and cafes in Walking Distance........................................11 1 Basic Mandarin Chinese Words and Phrases Useful Sayings nǐ hǎo Hello 你 好 knee how zài jiàn Goodbye 再 见 zi gee’en xiè xiè Thank You 谢 谢! sheh sheh bú yòng le, xiè xiè No, thanks. 不 用 了,谢 谢 boo yong la, sheh sheh bú yòng xiè You are welcome. 不 用 谢 boo yong sheh wǒ jiào… My name is… 我 叫… wore jeow… shì Yes 是 shr bú shì No 不 是 boo shr hǎo Good 好 how bù hǎo Bad 不 好 boo how duì bù qǐ Excuse Me 对 不 起 dway boo chee wǒ tīng bù dǒng I do not understand 我 听 不 懂 wore ting boo dong duō shǎo qián How much? 多 少 钱? dor sheow chen Where is the xǐ shǒu jiān zài nǎ lǐ See-sow-jian zai na-lee washroom? 洗 手 间 在 哪 里 2 In Restaurants In China, many people call a male waiter as handsome guy and a female waitress as beautiful girl. It is also common to call “fú wù yuan” for waiters of both genders. cài dān Menu 菜 单 tsai dan shuài gē Waiter(Handsome) 帅 哥 shuai ge měi nǚ Waitress(Beautiful) 美 女 may nyu fú wù yuán Waiter/Waitress 服 务 员 fu woo yuan wǒ xiǎng yào zhè ge 我 I would like this. -

Evolution of Urban Rail Signaling System Technology in China

Evolution of Urban Rail Signaling System Technology in China Mr. Dongjie Li Traffic Control Technology Co., Ltd. July-2019 Overview of China Rail 01 Transit Development CONTENTS Evolution of Signaling 02 System Technology of TCT « Overview of China Rail 01 Transit Development Overview of China Rail Transit Development 1969 2018 2020 We are experiencing a rapid development stage The first rail 132 urban rail 6000km transit line in lines China Beijing Subway Line 1 83% adopt By 2020, the total « built in July, 1965 and CBTC system, with operation mileage opened in January, operation mileage will be up to 6000km. 1971, with 10.7km. 4354.30km « Evolution of Signaling 02 System Technology of TCT Evolution of Signaling System product of TCT 2019 Intelligent rail transportation system 40 years R&D of signaling system 2018 Interoperable Fully automatic operation system Cloud Platform for urban rail systems 2017 Train Intelligent Detection System Rail transit 2016 Vehicle-vehicle communication based Train Trans-disciplinary control system Multi-field LTE based DCS system LCF-500 2015 Interoperable signalling system for network LCF-400 2014 Fully automatic operation 2011 Train operation centred Integrated automation Signaling System 2009 Information security LCF-300 2008 STM CBTC Pilot plant test LCF-200 2002-09 LCF-100 Beijing BaTong Line 1 LCF-200 Passenger dedicated Railway LCF-100 2004 CBTC R&D Subject communication device 1998 LCF-100 through appraisal Product 1996 Urban rail R&D ATP 1993 SJ-93 communication device Railway test 1990"Eighth -

5G for Trains

5G for Trains Bharat Bhatia Chair, ITU-R WP5D SWG on PPDR Chair, APT-AWG Task Group on PPDR President, ITU-APT foundation of India Head of International Spectrum, Motorola Solutions Inc. Slide 1 Operations • Train operations, monitoring and control GSM-R • Real-time telemetry • Fleet/track maintenance • Increasing track capacity • Unattended Train Operations • Mobile workforce applications • Sensors – big data analytics • Mass Rescue Operation • Supply chain Safety Customer services GSM-R • Remote diagnostics • Travel information • Remote control in case of • Advertisements emergency • Location based services • Passenger emergency • Infotainment - Multimedia communications Passenger information display • Platform-to-driver video • Personal multimedia • In-train CCTV surveillance - train-to- entertainment station/OCC video • In-train wi-fi – broadband • Security internet access • Video analytics What is GSM-R? GSM-R, Global System for Mobile Communications – Railway or GSM-Railway is an international wireless communications standard for railway communication and applications. A sub-system of European Rail Traffic Management System (ERTMS), it is used for communication between train and railway regulation control centres GSM-R is an adaptation of GSM to provide mission critical features for railway operation and can work at speeds up to 500 km/hour. It is based on EIRENE – MORANE specifications. (EUROPEAN INTEGRATED RAILWAY RADIO ENHANCED NETWORK and Mobile radio for Railway Networks in Europe) GSM-R Stanadardisation UIC the International -

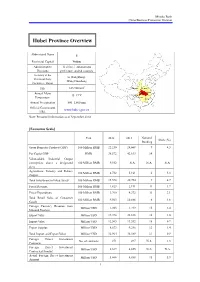

Hubei Province Overview

Mizuho Bank China Business Promotion Division Hubei Province Overview Abbreviated Name E Provincial Capital Wuhan Administrative 12 cities, 1 autonomous Divisions prefecture, and 64 counties Secretary of the Li Hongzhong; Provincial Party Wang Guosheng Committee; Mayor 2 Size 185,900 km Shaanxi Henan Annual Mean Hubei Anhui 15–17°C Chongqing Temperature Hunan Jiangxi Annual Precipitation 800–1,600 mm Official Government www.hubei.gov.cn URL Note: Personnel information as of September 2014 [Economic Scale] Unit 2012 2013 National Share (%) Ranking Gross Domestic Product (GDP) 100 Million RMB 22,250 24,668 9 4.3 Per Capita GDP RMB 38,572 42,613 14 - Value-added Industrial Output (enterprises above a designated 100 Million RMB 9,552 N.A. N.A. N.A. size) Agriculture, Forestry and Fishery 100 Million RMB 4,732 5,161 6 5.3 Output Total Investment in Fixed Assets 100 Million RMB 15,578 20,754 9 4.7 Fiscal Revenue 100 Million RMB 1,823 2,191 11 1.7 Fiscal Expenditure 100 Million RMB 3,760 4,372 11 3.1 Total Retail Sales of Consumer 100 Million RMB 9,563 10,886 6 4.6 Goods Foreign Currency Revenue from Million USD 1,203 1,219 15 2.4 Inbound Tourism Export Value Million USD 19,398 22,838 16 1.0 Import Value Million USD 12,565 13,552 18 0.7 Export Surplus Million USD 6,833 9,286 12 1.4 Total Import and Export Value Million USD 31,964 36,389 17 0.9 Foreign Direct Investment No.