ITV Interim Results for the Period Ending 30 June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CP-ITV3-D300 3-Axis ITV Control Panel

CP-ITV3-D300 3-Axis ITV Control Panel Telemetrics Control Panel for the Sony EVI-D30, EVI-D70, EVI-D100, EVI-HD3V, BRC-300, BRC-700 and Elmo PTC-100 Pan/Tilt Video Cameras enhances function and value for Teleconferencing, Educational, and Security Applications. P/N 92 55418 002 – 11 REV. - Page 1 6 Leighton Place Mahwah, New Jersey 07430 P: 201•848•9818 F: 201•848•9819 CP-ITV3-D300 OPERATING INSTRUCTIONS System with Daisy Chain Wiring Interconnect Cable Interconnect Cable Interconnect Cable 15’ CA-ITV-S15 15’ CA-ITV-S15 15’ CA-ITV-S15 25’ CA-ITV-S25 25’ CA-ITV-S25 25’ CA-ITV-S25 50’ CA-ITV-S50 50’ CA-ITV-S50 50’ CA-ITV-S50 Control Cable 6’ CA-ITV-DIN-6 25’ CA-ITV-DIN-25 *Extension Cable (Optional) 25’ CA-ITV-D-25 300’ CA-ITV-D-300 50’ CA-ITV-D-50 400’ CA-ITV-D-400 100’ CA-ITV-D-100 500’ CA-ITV-D-500 Video Switcher 200’ CA-ITV-D-200 Cables > 500’ use Rs422 kit Comprehensive CVG-SW61CS Control Cable Remote Panel POR T 1 PORT 3 Remote Control 10’ CA-ITV-V10 CAMERA CAMERA Cable * Remote Panel only PRES ET 25’ CA-ITV-P25 PR ES E T available with daisy PO R T 4 PORT 4 chain configuration CP-ITV3-EVI/BRC CP-ITV3-EVI/BRC * For Plenum cables, use part number CA-ITV-DP-XXX (where XXX=feet). PORT DESCRIPTION 1 SONY EVI-D100 CAMERA 2 NOT USED 3 VIDEO SWITCHER (CVG-SW61CS) 4 REMOTE PORT • Connect power, camera data, and video switcher cables to rear panel. -

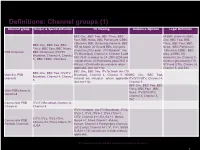

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

ITV Partners with Viewability Company Meetrics

PRESS RELEASE ITV partners with viewability company Meetrics First measurements across all channels show viewability rates above industry-wide benchmarks ITV, the UK’s biggest commercial broadcaster, announces that it has partnered with Meetrics, a leading European software company for advertising measurement and analytics, to provide enhanced advertising campaign delivery validation for VOD advertising across ITV Hub platforms. As part of the partnership, Meetrics provides video viewability data and reporting for ITV Hub on connected TV platforms and In-App (Android and iOS) as well as desktop and mobile web campaigns. This enriches the reporting capabilities for VOD campaigns run on ITV Hub and demonstrates the high quality of ITV’s ad inventory on metrics that are important to agencies and advertisers. With the partnership, ITV underlines its commitment to very high transparency standards and quality controls for the benefit of its advertising customers. Meetrics is an independent vendor accredited for various services by the Media Rating Council and committed to strict privacy rules in full accordance with GDPR. With Meetrics as a partner ITV is breaking new ground by being the first broadcaster in the world to make use of the IAB Open Measurement SDK, which is considered the most rigorous standard for In-App viewability measurement. To date, average measurement for campaigns running across ITV Hub showed a viewability rate (according to the MRC definition) of 98%, which is far beyond average, compared to industry viewability benchmarks. The new viewability measurement and reporting will give advertisers huge confidence that ITV can deliver standards on human and viewability measures that outperform the VOD market. -

Quick Reference Guide To: How to Deliver Content to ITV Your Programme Has Been Commissioned and You Have Been Asked by ITV to Deliver a Piece of Content

July 2020 Quick Reference Guide To: How to Deliver Content to ITV Your programme has been commissioned and you have been asked by ITV to deliver a piece of content. What do you need to do and who are the contacts along the journey?..... Firstly, you will need to know who your Compliance Advisor is. If you’ve not been provided with a contact then email [email protected]. Your Advisor will be able to provide you with legal advice along the journey and will be able to provide you with lots of key information such as your unique Production Number. Another key contact is your Commissioner. They may require some deliverables from you so it’s best to have that discussion directly with them. Within this guide you will find a list of frequently asked questions with links to more detailed documents. 1. My programme will be transmitted live. Does this make a difference? 2. My programme isn’t live; so what exactly am I delivering? 3. Where do I get my Production/Clock Numbers from? 4. Where can I get my tech spec to file deliver? 5. Where do I deliver my DPP AS-11 file to? 6. I need to ensure that my programme has the ITV ‘Look & Feel’. How do I make this happen? 7. Can I make amendments to my programme after I’ve delivered it to Content Delivery? 8. Where do I send my Post Productions Scripts to? 9. What do I do if I have queries around part durations and the total runtime of my programme? 10. -

Media: Industry Overview

MEDIA: INDUSTRY OVERVIEW 7 This document is published by Practical Law and can be found at: uk.practicallaw.com/w-022-5168 Get more information on Practical Law and request a free trial at: www.practicallaw.com This note provides an overview of the sub-sectors within the UK media industry. RESOURCE INFORMATION by Lisbeth Savill, Clare Hardwick, Rachael Astin and Emma Pianta, Latham & Watkins, LLP RESOURCE ID w-022-5168 CONTENTS RESOURCE TYPE • Scope of this note • Publishing and the press Sector note • Film • Podcasts and digital audiobooks CREATED ON – Production • Advertising 13 November 2019 – Financing and distribution • Recorded music JURISDICTION • Television • Video games United Kingdom – Production • Radio – Linear and catch-up television • Social media – Video on-demand and video-sharing services • Media sector litigation SCOPE OF THIS NOTE This note provides an overview of the sub-sectors within the UK media industry. Although the note is broken down by sub-sector, in practice, many of these areas overlap in the converged media landscape. For more detailed notes on media industry sub-sectors, see: • Sector note, Recorded music industry overview. • Sector note, TV and fi lm industry overview. • Practice note, Video games industry overview. FILM Production Total UK spend on feature fi lms in 2017 was £2 billion (up 17% on 2016) (see British Film Institute (BFI): Statistical Yearbook 2018). Film production activity in the UK is driven by various factors, including infrastructure, facilities, availability of skills and creative talent and the incentive of fi lm tax relief (for further information, see Practice note, Film tax relief). UK-produced fi lms can broadly be sub-divided into independent fi lms, UK studio-backed fi lms and non-UK fi lms made in the UK. -

Itv Studios Acquires Swedish Production Company Elk Production

ITV STUDIOS ACQUIRES SWEDISH PRODUCTION COMPANY ELK PRODUCTION 21 June 2017 – ITV Studios has acquired the Swedish production company Elk Production, a subsidiary of Elk Entertainment Group. The production label is known for hit entertainment shows including quiz En Ska Bort (Odd One Out) and award-winning series Wahlgrens and Parneviks. Elk Production currently has 15 shows in production or on air across Sweden’s free to air and pay TV channels including Drömpyramiden (Stacked), Ett jobb för Berg (A Job For Berg) and Superskaparna (Supercrafters). It has also produced local versions of international formats including Ninja Warriors, Superstars and Top Chef: Just Desserts. ITV Studios’ majority stake in Elk Production will see the company combine with ITV Studios’ existing Swedish production business, with the amalgamated companies operating under the brand ITV Studios Sweden. ITV Studios Sweden has produced Come Dine With Me for TV4 since 2008 creating 19 seasons so far. It is also producing This Time Next Year for SVT. Elk Production’s current Managing Director, Anna Rydin, will lead the newly combined ITV Studios Sweden reporting to Mike Beale, Managing Director, Nordics and Global Creative Network, ITV Studios. Elk Formats is not included in the acquisition and remains part of Elk Entertainment. However, ITV Studios will be its exclusive formats partner in the Nordics with the right to produce shows, including Stacked and All Inclusive, through ITV Studios’ production companies in Sweden, Denmark, Finland and Norway. ITV Studios now represents a strong library of formats in the region encompassing ITV Studios, Talpa, Twofour and now Elk 1 Entertainment formats. -

New Brochure & Film Newbrochure &Film

week 7 / 13 February 2014 PIONEERING SPIRIT How RTL Group made entertainment history PIONEERING SPIRIT How RTL Group bmaderochu entertainmentre & history New film week 7 / 13 February 2014 PIONEERING SPIRIT How RTL Group made entertainment history PIONEERING SPIRIT How RTL Group bmaderochu entertainmentre & history New film Cover Montage with covers of the Always Close To The Audience’s brochure and DVD Publisher RTL Group 45, Bd Pierre Frieden L-1543 Luxembourg Editor, Design, Production RTL Group Corporate Communications & Marketing k before y hin ou T p r in t backstage.rtlgroup.com backstage.rtlgroup.fr backstage.rtlgroup.de QUICK VIEW Happy anniversary, Plug RTL! Plug RTL p. 8–9 90 years of entertainment – captured, documented and celebrated Simon Cowell RTL Group plans return to p.4–7 The X Factor UK FremantleMedia p. 10 Mega marketing campaign for Big Picture Game Of Thrones p.12 RTL II p. 11 PEOPLE p. 13–15 In February 1924 Radio Luxembourg took to the airwaves. 90 years later, RTL Group is marking – and celebrating – the anniversary with a new brochure and film. Titled Always Close 90 YEARS To The Audience, both productions recount the vivid and rich events that OF ENTERTAINMENT – turned a modest radio station based in tiny CAPTURED, Luxembourg into the leading European DOCUMENTED AND entertainment network. CELEBRATED Luxembourg – 13 February 2014 RTL Group Collage from the Always Close To The Audience brochure: Autographe cards & advertisements for various activities 4 Hauled up in their attic in 1924, experimenting with a single radio transmitter, the Anen brothers couldn’t have begun to imagine that their modest Radio Luxembourg would not only become one of the most-listened-to and admired radio stations of their generation but would go on to develop into Europe’s largest commercial free-to-air broadcaster. -

Case Study ITV

Case Study ITV Case Study ITV “The main benefit of moving to Fujitsu and their VME services is risk mitigation. In moving to Fujitsu from our incumbent provider we get access to a very rare resource base for VME development and support. This provides us with a path enabling us to keep our critical Artist Payments System application running and allows us to keep our options open when VME as a product is end dated in 2020.” Anthony Chin, Head of Technology - Finance Systems, ITV The customer ITV is an integrated producer broadcaster and the largest commercial television network in the UK. It is the home of popular television from the biggest entertainment events, to original drama, major sport, landmark factual series and independent news. It operates a family of channels including ITV, ITVBe, ITV2, ITV3 and ITV4 and CITV, which are broadcast free-to-air, as well as the pay channel ITV Encore. ITV is also focused on delivering its programming across multiple platforms including itv.com, mobile devices, video on demand and third party platforms. ITV Studios is a global production business, creating and selling programmes and formats from offices in the UK, US, Australia, France, Germany, the Nordics and the Netherlands. It is the largest and most successful commercial production company in the UK, the largest independent non-scripted indie in the US and ITV Studios Global Entertainment is a leading international distribution The customer businesses. The challenge Country: United Kingdom ITV receives revenue from advertising, its online, pay and interactive Industry: Broadcasting business as well as from the production and sales of the programmes Founded: 1955 it creates and holds rights to. -

Annual Report and Accounts 2010 Annual Report and Accounts 2010 Accounts and Report Annual Annual Report and Accounts 2010 Welcome Aboard!

Annual report and accounts 2010 Annual report and accounts 2010 Annual report and accounts 2010 Welcome aboard! Navigating your way around this report... 01 Overview 54 Accounts 2010 Business highlights 01 Independent auditors’ report to the members easyJet at a glance 02 of easyJet plc 54 15 years of continued success 04 Consolidated income statement 55 Chairman’s statement 06 Consolidated statement of comprehensive income 56 Consolidated statement of financial position 57 Consolidated statement of changes in equity 58 Consolidated statement of cash flows 59 Notes to the accounts 60 Company statement of financial position 90 Company statement of changes in equity 91 Company statement of cash flows 92 Notes to the Company accounts 93 08 Business review 95 Other information Chief Executive’s statement 08 Five year summary 95 Strategy and KPIs 14 Glossary 96 Financial review 16 Corporate responsibility 28 34 Governance Directors’ report easyJet plc is incorporated as a public limited company and is registered in Directors’ profiles 34 England with the registered number 3959649. easyJet plc’s registered office Corporate governance 36 is Hangar 89, London Luton Airport, Bedfordshire LU2 9PF. The Directors Shareholder information 40 present the Annual report and accounts for the year ended 30 September Report on Directors’ remuneration 41 2010. References to ‘easyJet’, the ‘Group’, the ‘Company’, ‘we’, or ‘our’ are to Statement of Directors’ responsibilities 53 easyJet plc or to easyJet plc and its subsidiary companies where appropriate. Pages 01 to 53, inclusive, of this Annual report comprise the Directors’ report that has been drawn up and presented in accordance with English company law and the liabilities of the Directors in connection with that report shall be subject to the limitations and restrictions provided by such law. -

City Index Announces Kate Garraway and Clare Nasir As May’S Celebrity Trader

CITY INDEX ANNOUNCES KATE GARRAWAY AND CLARE NASIR AS MAY’S CELEBRITY TRADER. London, UK, 15th May, 2011 – City Index, a global leader in Spread Betting, Contracts for Difference (CFDs) and margined foreign exchange, are Day Breaking the markets with Morning GMTV Presenter Kate Garraway and Weather Girl Clare Nasir for April’s Celebrity Trader. Kate Garraway and Clare Nasir have been staples of daytime television for years, wowing the nation at GMTV before taking up their current roles at Daybreak. The pair are two of the hardest working presenters on TV, so just how did they find the time to be this month’s City Index celebrity traders? Was it trading teamwork, or forex feuding? Kate has been an enthusiastic trader, the start of the competition saw her dive straight off the deep end and short the FTSE after reading that the markets had begun the week with a bearish undertone that looked set to continue. Her strategy – ‘selling in strength’. Kate sold at £10 per point a, rather brave and aggressive approach, resulting however in her receiving a nearly instantaneous margin call from trusted City Index Trader Kishan Mandalia. This didn’t shake her confidence however, and she did eventually enjoy something of a rally on this trade. Over optimism was her down-fall here unfortunately though, as the UK 100 Index pushed up towards the 6000 mark, resulting in a disappointing loss as the trade crystallized £130 down. This turn in fortune for the FTSE 100 was a welcome bonus for Clare on the other-hand, as she placed the opposing trade, taking a long position on the index and successfully crystallizing a £61 profit. -

Trends in TV Production Ofcom, December 2015 Contents

Trends in TV Production Ofcom, December 2015 Contents 1. Summary 2. What were the original aims of intervention? 3. The UK production market 4. How many companies are active in the market? 5. How easy is it to enter? 6. Production sector revenue and flow of funds 7. Production sector consolidation 8. Quotas 9. Regionality 10. Historical context of the US market Summary – the questions asked This pack aims to confirm (or dispel) many of the widely held beliefs about the UK television production sector. Among the questions it seeks to answer are: • What is the intervention (regulation of the sector) meant to do? • How has commissioning developed over time? • How has the number of producers changed over time? • Is it harder to get into the market? • How do terms of trade work? • How has the sector grown? • What has consolidation looked like? • How do quotas work? • How does the sector operate regionally? 3 Summary – caveats This report was produced for Ofcom by Oliver & Ohlbaum Associates Ltd (“O&O”). The views expressed in this report are those of O&O and do not necessarily represent the views of Ofcom. While care has been taken to represent numbers in this report as accurately as possible based on available sources there may be inaccuracies and they may not correspond with Ofcom’s view of the market and cannot be taken as officially representative of Ofcom data. 4 Summary - data sources used • Oliver & Ohlbaum Producer Database, 2006-2015 ₋ BARB data supplied by Attentional and further coded by O&O to include production companies and their status as qualifying or no-qualifying producers, plus their respective turnover bands. -

2014 BAFTA TV Awards Full List of Nominations

NOMINATIONS IN 2014 LEADING ACTOR JAMIE DORNAN The Fall – BBC Two SEAN HARRIS Southcliffe – Channel 4 LUKE NEWBERRY In The Flesh – BBC Three DOMINIC WEST Burton and Taylor – BBC Four LEADING ACTRESS HELENA BONHAM CARTER Burton and Taylor – BBC Four OLIVIA COLMAN Broadchurch - ITV KERRIE HAYES The Mill – Channel 4 MAXINE PEAKE The Village – BBC One SUPPORTING ACTOR DAVID BRADLEY Broadchurch – ITV JEROME FLYNN Ripper Street – BBC One NICO MIRALLEGRO The Village – BBC One RORY KINNEAR Southcliffe – Channel 4 SUPPORTING ACTRESS SHIRLEY HENDERSON Southcliffe – Channel 4 SARAH LANCASHIRE Last Tango in Halifax – BBC One CLAIRE RUSHBROOK My Mad Fat Diary – E4 NICOLA WALKER Last Tango in Halifax – BBC One ENTERTAINMENT PERFORMANCE ANT AND DEC Ant and Dec’s Saturday Night Takeaway – ITV CHARLIE BROOKER 10 O’Clock Live – Channel 4 SARAH MILLICAN The Sarah Millican Television Programme – BBC Two GRAHAM NORTON The Graham Norton Show – BBC One FEMALE PERFORMANCE IN A COMEDY PROGRAMME FRANCES DE LA TOUR Vicious – ITV KERRY HOWARD Him & Her: The Wedding – BBC Three DOON MACKICHAN Plebs – ITV2 KATHERINE PARKINSON The IT Crowd – Channel 4 MALE PERFORMANCE IN A COMEDY PROGRAMME RICHARD AYOADE The IT Crowd – Channel 4 MATHEW BAYNTON The Wrong Mans – BBC Two JAMES CORDEN The Wrong Mans – BBC Two CHRIS O’DOWD The IT Crowd – Channel 4 Arqiva British Academy Television Awards – Nominations Page 1 SINGLE DRAMA AN ADVENTURE IN SPACE AND TIME Mark Gatiss, Matt Strevens, Terry McDonough, Caroline Skinner – BBC Wales/BBC America/BBC Two BLACK MIRROR: BE RIGHT BACK