Stress Testing Governance, Risk Analytics and Instruments European Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2020

ANNUAL REPORT 2020 Content Profile 3 Statement from the board 5 Developments in the payment system 8 Activities Activities: Point-of-sale payment system 11 Activities: Online payments 14 Activities: Giro-based payments 18 Activities: Stability of Payment Chains 23 Activities: Security in the payment system 25 Appendices Appendix: Board and management 30 Appendix: Governance 31 Appendix: List of members 33 2 Annual Report 2016 Profile The payment system is the bloodstream of our economy, has many stakeholders and is of great social importance. Therefore it has the characteristics of a utility. The many parties involved, the many relevant laws and regulations, the requirements for high quality, new technological possibilities and the high number of transactions make the payment system complex and dynamic. Transparency, openness, accessibility and dialogue with all stakeholders are important prerequisites in the payment system. The Dutch Payments Association organizes the collective tasks in the Dutch payment system for its members. Our members provide payment services on the Dutch market: banks, payment institutions and electronic money institutions. The shared tasks for infrastructure, standards and common product features are assigned to the Payments Association. We aim for a socially efficient, secure, reliable and accessible payment system. To this end, we deploy activities that are of common interest to our members. We are committed, meaningful and interconnecting in everything we do, to unburden our members where and when possible. We engage representatives of end users in the payment system, including businesses and consumers. On behalf of our members, we are visibly involved and accessible and we are socially responsible. -

Does Ownership Have an Effect on Accounting Quality?

Master Degree Project in Accounting Does Ownership have an Effect on Accounting Quality? Andreas Danielsson and Jochem Groenenboom Supervisor: Jan Marton Master Degree Project No. 2013:14 Graduate School Abstract Research on accounting quality in banks has evolved around the manipulation of the Loan Loss Provision and has been discussed in terms of earnings management and income smoothing. Key variables used to explain the manipulation of Loan Loss Provisions have been investor protection, legal enforcement, financial structure and regulations. This study will extend previous research by investigating the effect of state, private, savings and cooperative ownership on accounting quality. In this study data from more than 600 major banks were collected in the European Economic Area, covering annual reports between 2005 and 2011. Similar to prevalent research, the Loan Loss Provision is used as a central indicator of accounting quality. In contrast to existent literature, accounting quality is not explained by the manipulation of the Loan Loss Provision in terms of income smoothing or earnings management. Instead, accounting quality is addressed in terms of validity and argued to be an outcome of the predictive power of the Loan Loss Provision in forecasting the actual outcome of credit losses. The findings of this study confirm that ownership has an effect on accounting quality. All but one form of ownership investigated showed significant differences. State ownership was found to have a positive effect on accounting quality, both in comparison to private banks and all other banks. On the other hand, savings ownership was shown to have a negative impact on accounting quality compared to private and other banks. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st February 2021 This document provides a list of Authorised Firms, it does not supersede the Financial Service Register which should be referred to as the most accurate and up to date source of information. Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The DF Capital Bank Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Birmingham Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

"SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V

Erkende referenten / Recognised sponsors Arbeid Regulier en Kennismigranten / Regular labour and Highly skilled migrants Naam bedrijf/organisatie Inschrijfnummer KvK Name company/organisation Registration number Chamber of Commerce "@1" special projects payroll B.V. 70880565 "SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V. 82701695 01-10 Architecten B.V. 24257403 100 Grams B.V. 69299544 10X Genomics B.V. 68933223 12Connect B.V. 20122308 180 Amsterdam BV 34117849 1908 Acquisition B.V. 60844868 2 Getthere Holding B.V. 30225996 20Face B.V. 69220085 21 Markets B.V. 59575417 247TailorSteel B.V. 9163645 24sessions.com B.V. 64312100 2525 Ventures B.V. 63661438 2-B Energy Holding 8156456 2M Engineering Limited 17172882 30MHz B.V. 61677817 360KAS B.V. 66831148 365Werk Contracting B.V. 67524524 3D Hubs B.V. 57883424 3DUniversum B.V. 60891831 3esi Netherlands B.V. 71974210 3M Nederland B.V. 28020725 3P Project Services B.V. 20132450 4DotNet B.V. 4079637 4People Zuid B.V. 50131907 4PS Development B.V. 55280404 4WEB EU B.V. 59251778 50five B.V. 66605938 5CA B.V. 30277579 5Hands Metaal B.V. 56889143 72andSunny NL B.V. 34257945 83Design Inc. Europe Representative Office 66864844 A. Hak Drillcon B.V. 30276754 A.A.B. International B.V. 30148836 A.C.E. Ingenieurs en Adviesbureau, Werktuigbouw en Electrotechniek B.V. 17071306 A.M. Best (EU) Rating Services B.V. 71592717 A.M.P.C. Associated Medical Project Consultants B.V. 11023272 A.N.T. International B.V. 6089432 A.S. Watson (Health & Beauty Continental Europe) B.V. 31035585 A.T. Kearney B.V. -

Download (471Kb)

Pas toe of leg uit “Een onderzoek naar de toepassing van de code banken en de code verzekeraars ten aanzien van beloningsbeleid.” M.M. Scheffer Leeghwaterstraat 99 6717CX Ede Studentnummer: 2232146 [email protected] Rijksuniversiteit Groningen Faculteit economie & bedrijfskunde Accountancy & Controlling Ernst & Young Audit services Amsterdam / Utrecht 1e Begeleider RuG: Prof. dr. J.A. van Manen RA 2e Begeleider RuG: dr. O.P.G. Bik RA Begeleider E&Y: drs. M.T. Lemans RA M.M. Scheffer Pas toe of leg uit Voorwoord Voor u ligt mijn scriptie ter afronding van mijn master accountancy & controlling aan de Rijksuniversiteit Groningen. Ik heb het afgelopen jaar als zeer leerzaam en plezierig ervaren. Naast vakkennis heb ik mij in deze periode ook persoonlijk kunnen ontwikkelen. In deze scriptie staat corporate governance voor banken en verzekeraars centraal. Deze is vertaald in de code banken en de code verzekeraars. In deze scriptie is onderzoek gedaan naar de mate van naleving van de codes. Tevens is onderzocht in welke mate omvang van instellingen een rol speelt bij de naleving van de principes en tevens bij de kwaliteit van uitleg bij het niet toepassen van principes. Het onderzoek heb ik mogen uitvoeren bij mijn werkgever Ernst & Young te Utrecht. Graag wil ik mijn begeleider vanuit Ernst & Young, de heer drs. René Lémans RA, bedanken voor de begeleiding en hulp gedurende het gehele traject. Tevens wil ik de heren drs. Bob Leonards RA en mr. drs. Georges de Méris RA danken voor het meedenken en beantwoorden van mijn vakinhoudelijke vragen. Daarnaast wil ik graag mijn begeleiders vanuit de Rijksuniversiteit Groningen, de heer Prof. -

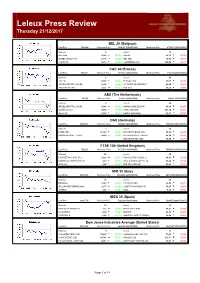

Leleux Press Review

Leleux Press Review Thursday 21/12/2017 BEL 20 (Belgium) Last Price 3994,68 Minimum Price 1046,07 (02/09/1992) Maximum Price 4759,01 (23/05/2007) Gainers 4 Losers 16 APERAM 43,85 +0,38% AGEAS 41,35 -0,79% ONTEX GROUP NV 27,75 +0,16% GBL (BE) 90,33 -0,79% COLRUYT 42,79 +0,03% COFINIMMO (BE) 110,00 -0,67% CAC 40 (France) Last Price 5352,77 Minimum Price 2693,21 (23/09/2011) Maximum Price 7347,94 (21/10/2009) Gainers 6 Losers 34 VALEO 62,09 +0,82% RENAULT SA 83,57 -0,98% ARCELORMITTAL SA (NL 26,98 +0,46% LAFARGEHOLCIM LTD (F 46,08 -0,96% VEOLIA ENV (FR) 21,27 +0,21% AXA (FR) 25,25 -0,88% AEX (The Netherlands) Last Price 547,38 Minimum Price 194,99 (09/03/2009) Maximum Price 806,41 (21/10/2009) Gainers 5 Losers 20 ARCELORMITTAL SA (NL 26,98 +0,46% KONINKLIJKE DSM NV 80,94 -0,93% GEMALTO N.V. 49,49 +0,29% ASML HOLDING 147,80 -0,90% RELX NV 19,24 +0,15% AHOLD DELHAIZE 18,33 -0,75% DAX (Germany) Last Price 13069,17 Minimum Price 7292,03 (26/11/2012) Maximum Price 13478,86 (03/11/2017) Gainers 2 Losers 28 LINDE (DE) 181,00 +0,58% DEUTSCHE BANK (DE) 16,64 -0,98% PROSIEBENSAT.1 NA O 29,00 +0,24% HEIDELBERGER ZEMENT 89,50 -0,92% DEUTSCHE TEL (DE) 15,00 -0,69% FTSE 100 (United Kingdom) Last Price 7525,22 Minimum Price 3277,50 (12/03/2003) Maximum Price 53548,10 (16/11/2009) Gainers 45 Losers 54 EASYJET PLC ORD 27 2 14,28 +0,97% ROYAL DUTCH SHELL A 24,05 -0,79% MARKS AND SPENCER GR 3,10 +0,97% ANGLO AMERICAN PLC O 14,88 -0,77% GKN (UK) 3,04 +0,91% SSE PLC ORD 50P 13,01 -0,77% MIB 30 (Italy) Last Price 22109,65 Minimum Price 12320,50 (24/07/2012) Maximum Price 48766,00 (05/04/2001) Gainers 13 Losers 26 BREMBO 12,80 +0,86% ATLANTIA SPA 26,45 -0,97% SALVATORE FERRAGAMO 21,75 +0,78% LUXOTTICA GROUP (IT) 50,95 -0,97% SAIPEM 3,63 +0,60% ENEL 5,28 -0,75% IBEX 35 (Spain) Last Price 10207,70 Minimum Price 5266,90 (10/10/2002) Maximum Price 15945,70 (08/11/2007) Gainers 15 Losers 19 BANCO DE SABADELL 1,72 +0,93% INDRA SISTEMAS 11,53 -0,98% CAIXABANK 4,00 +0,85% INDITEX 29,53 -0,92% IBERDROLA 6,58 +0,73% GAMESA CORP. -

The Netherlands

EXPORTING CORRUPTION 2020 ambassador in Nigeria shared confidential information with Shell about an investigation on THE NETHERLANDS location in Nigeria by Dutch financial police.6 The whistleblower who exposed the information, a local Limited enforcement staff member of the Netherlands embassy, was subsequently dismissed.7 Following the VimpelCom case, covered in the 3.1% of global exports Exporting Corruption Report 2018, there were three related cases in the Netherlands, two involving Investigations and cases banks and one involving an accounting and consulting firm (VimpelCom is now called VEON). In In the period 2016-2019, the Netherlands opened 16 September 2018, the NPPS settled its investigation investigations, commenced two cases and into ING Bank NV, with ING agreeing to pay €675 concluded three cases with sanctions. million (US$771 million) as a penalty and €100 million (US$114 million) as disgorgement to the Foreign bribery investigations are conducted by the NPPS.8 The FIOD had been investigating ING since Fiscal Intelligence and Investigations Service (FIOD) 2016 for suspected facilitation of international and the Netherlands Public Prosecution Service corruption and culpable money laundering.9 The (NPPS). These investigations take a long time to bank admitted “serious shortcomings” in executing conclude, due to their international and complicated policies to prevent financial crime. In July 2020, a 1 nature. group of victims won a court case requiring former In March 2019, a Shell statement on its website said ING CEO Ralph Hamers to testify about the bank’s that the NPPS was preparing charges against the role in relation to fraud by a third party, an issue company over an allegedly corrupt deal in Nigeria covered by the 2018 settlement. -

Trade Finance Program Confirming Banks List As of 31 December 2015

Trade Finance Program Confirming Banks List As of 31 December 2015 AFGHANISTAN Bank Alfalah Limited (Afghanistan Branch) 410 Chahri-e-Sadarat Shar-e-Nou, Kabul, Afghanistan National Bank of Pakistan (Jalalabad Branch) Bank Street Near Haji Qadeer House Nahya Awal, Jalalabad, Afghanistan National Bank of Pakistan (Kabul Branch) House No. 2, Street No. 10 Wazir Akbar Khan, Kabul, Afghanistan ALGERIA HSBC Bank Middle East Limited, Algeria 10 Eme Etage El-Mohammadia 16212, Alger, Algeria ANGOLA Banco Millennium Angola SA Rua Rainha Ginga 83, Luanda, Angola ARGENTINA Banco Patagonia S.A. Av. De Mayo 701 24th floor C1084AAC, Buenos Aires, Argentina Banco Rio de la Plata S.A. Bartolome Mitre 480-8th Floor C1306AAH, Buenos Aires, Argentina AUSTRALIA Australia and New Zealand Banking Group Limited Level 20, 100 Queen Street, Melbourne, VIC 3000, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch - Trade and Supply Chain) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch - Trade and Supply Chain) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Perth Branch) Level 6, 77 St Georges Terrace, Perth, Australia Australia and New Zealand Banking Group Limited (Perth Branch -

CIMSOLUTIONS in Finance

CIMSOLUTIONS in Finance Team Leader Corporate ICT Ian Kho (right) of Robeco with Web Developers Özkan Ulu (left) and Arno van Hout (centre) of CIMSOLUTIONS. CIMSOLUTIONS provides high quality professional ICT con- of legislation in the area of accounting and reporting, such as sulting services and software development solutions in the Basel and IFRS, our financial clients are actively organising the areas of Business, Administrative and Industrial Automation. business processes to improve efficiency. This takes place both Our expertise covers all phases of the software life-cycle from internally, by thinking up generic solutions, as well as externally, specification and feasibility through design, development, by an improved integration in the chain. In both cases, Internet test & implementation, to maintenance, support and project technology and open standards like web services and XML are management of both tailor-made as well as standard increasingly used. Financial systems must be designed and applications, systems, hardware and networks. developed to function absolutely flawlessly. This accounts for the increasing attention for structured testing. CIMSOLUTIONS Business serves the market sectors: • Government CIMSOLUTIONS specifies, designs, develops, manages and tests, • Finance in close co-operation with our clients in the Financial sector, high • Healthcare quality (Internet) systems such as: globally used automatic col- • Trade & Transport lection software for multinationals, exchange of client information • Energy, Telecom & Utilities -

A Better European Architecture to Fight Money Laundering

POLICY BRIEF crescendo in 2018 with the liquidation of ABLV Bank in 18-25 A Better Latvia, the reopening of criminal investigations into Danske Bank in Denmark and Estonia, and the imposition of the European largest AML fine in European history against ING Bank in the Netherlands. Added together, these cases—large and Architecture to Fight small—have underlined the serious shortcomings of the European Union’s AML regime.2 Reports have pointed to Money Laundering a variety of bad actors as participants in these schemes, with linkages to organized crime, corruption, and North Korea Joshua Kirschenbaum and Nicolas Véron among others. The common thread, though, seems to be the December 2018 predominance of money originating in the former Soviet Union. Joshua Kirschenbaum is a senior fellow at the German Marshall A major problem lies in the fact that AML supervi- Fund. Nicolas Véron is a senior fellow at the Peterson Institute sion of banks and other firms rests largely with the national for International Economics and Bruegel (Brussels). Véron authorities of individual EU member states, in increasing is also an independent nonexecutive director at the Global Trade Repository arm of the Depository Trust & Clearing tension with the legal framework for centralized prudential Corporation (DTCC), including DTCC Derivatives Repository supervision3 within the euro area and the European single plc (London), which is supervised by the European Securities and Markets Authority. market. This division of responsibilities is susceptible to political influence and regulatory capture. The system Authors’ Note: We are grateful for the insight and feedback of depends heavily on small, lower-capacity jurisdictions Jesper Berg, Sarah Boiteux, Per Callesen, Martin Chorzempa, Maria Demertzis, Panicos Demetriades, Juan Luis Díez to provide the first line of defense against illicit financial Gibson, Charlotte Dijkstra, Markus Forsman, Michael Gibson, practices, encouraging illicit actors to seek out weak links. -

Conley KPII Interior V3 Netherl

– 69 – Case Study The Netherlands The Netherlands might not come to mind as the most obvious candidate for a study on Russian influence in Europe. A founding NATO and EU member, it actively participates in NATO military operations and maintains a strong stance on sanctions against Russia. It has suffered greatly at the hands of Russian actions, from the tragic shootdown of flight MH17 that killed 193 Dutch citizens in July 2014 to a cyberattack in April 2018 against the Organization for the Prohibition of Chemical Weapons (OPCW) based in The Hague. Notwithstanding these recent developments, the Netherlands’ commercial relationship with Russia dates back to the nineteenth century when “Dutch entrepreneurs were willing to invest in Russian ventures and part of foreign Russian gold reserve was kept in the Netherlands. By January 1, 1914, Russian foreign investments in the Netherlands had amounted to 8 million gold roubles.”1 A century later, the bilate ral economic relationship serves the same purpose, making the Netherlands a largely unnoticed, unappreciated, and therefore underestimated enabler for Russian influence and its oligarchs, particularly in the provision of services on tax avoidance through in corporation. Dutch central bank members of a special committee of the International Monetary Fund have indeed highlighted the country’s prominent role in international corporate tax avoidance.2 The Netherlands is a free and open democracy with an independent judiciary and a strong legal framework for anticorruption. It is vocal on the deterioration of human rights and civil society in Russia. It is consistently ranked one of the “cleanest” countries in Transparency International’s Corruption Perception Index, though its score has de creased slightly since 2009.3 However, when it does occur, corruption is not heavily pro secuted in the Netherlands and the penalties in the legislation for corruption do not act as a strong deterrent. -

Uitvoering Wet Toezicht Kredietwezen 1992 (‘Wtk 1992’)

DE NEDERLANDSCHE BANK Uitvoering Wet toezicht kredietwezen 1992 (‘Wtk 1992’) Verklaringen van geen bezwaar op grond van artikel 26 Wtk 1992 In de verslag periode zijn op grond van artikel 26 Wtk 1992 door de Nederlandsche Bank NV, vanwege de Minister van Financiën, de volgende verklaringen van geen bezwaar verleend of ingetrokken. Aanvragende instelling: Soort aanvraag: Betrokken instelling: Datum afgifte of inschrijving in intrekking van de het Wtk-register: verklaring van geen bezwaar: Artikel 23, eerste lid sub a; vermindering eigen vermogen DSB Bank N.V. 10-03-2004 Achmea Hypotheekbank N.V. 12-03-2004 KAS Bank N.V. 18-03-2004 KAS Bank N.V. Intrekking 30-03-2004 Artikel 23, eerste lid sub b; deelnemingen F. van Lanschot Bankiers N.V. 100% Middellijk Bernice Investments A.V.V. 02-03-2004 F. van Lanschot Bankiers N.V. 100% Middellijk Dinal Trading A.V.V. 02-03-2004 F. van Lanschot Bankiers N.V. 100% Middellijk Intos Holding A.V.V. 02-03-2004 F. van Lanschot Bankiers N.V. 100% Middellijk Prodo Holding A.V.V. 02-03-2004 SNS Bank N.V. Intrekking Davida Beleggingsmaatschappij B.V. 08-03-2004 SNS Bank N.V. Intrekking SNS Options B.V. 08-03-2004 Kempen & Co N.V. 100%-rechtstreeks Kempen Custody Services N.V. 09-03-2004 Kempen & Co N.V. 100% rechtstreeks, onder Kempen Deelnemingen B.V. 09-03-2004 intrekking vorige verklaring van geen bezwaar Kempen & Co N.V. 100% onder intrekking vorige Arceba B.V. 09-03-2004 verklaring van geen bezwaar Kempen & Co N.V.