Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ideal Merchant Integration Guide

iDEAL Merchant Integration Guide Version 3.3.1 (november 2012) November 2012 Currence Copyright © Currence iDEAL B.V. All rights reserved. iDEAL Merchant Integration Guide v3.3.1 1.1 CONFIDENTIAL Terms and conditions Terms and conditions for provision of the iDEAL Merchant Integration Guide: 1 Scheme Owner Currence iDEAL B.V. provides the iDEAL Merchant Integration Guide to Acquiring banks which distribute it to (potential) Merchants and Payment Service Providers to enable them to form a good idea of what the implementation of the iDEAL product would involve and assess how any future use of iDEAL could affect their business operations. 2 Currence iDEAL B.V. reserves the right to deny access to the iDEAL Merchant Integration Guide to (potential) Merchants and Payment Service Providers on reasonable grounds, in consultation with the Acquiring bank with which the Merchant/PSP has a contract. 3 The iDEAL Merchant Integration Guide is explicitly and exclusively provided for the purpose mentioned above, and no other use is permitted. No rights can be derived from the information provided in this document or the accompanying notes. Currence iDEAL B.V. is in no way liable for the consequences of later changes to the iDEAL Standards or the iDEAL Merchant Integration Guide. If banks or other interested parties take decisions and/or make investments on the basis of the information that they obtain via the iDEAL Merchant Integration Guide, Currence iDEAL B.V. accepts no liability for this whatsoever. 4 The iDEAL Merchant Integration Guide is based on the information in the iDEAL Standards documents. In the event of any discrepancy between the iDEAL Merchant Integration Guide and the iDEAL Standards documents, the text in the iDEAL Standards documents shall prevail. -

Overzicht Beleggingen Per 31 December

Stichting Pensioenfonds Achmea is transparant over haar beleggingen Stichting Pensioenfonds Achmea geeft rekenschap van beleid en uitvoering en publiceert een overzicht van haar directe beleggingsportefeuille. In de tabellen 1 t/m 9 geeft Stichting Pensioenfonds Achmea inzicht in de directe beleggingen. Hierbij wordt zo veel als mogelijk inzichtelijk gemaakt waarin is belegd. Echter volledige transparantie is door juridische beperkingen niet altijd mogelijk. Zo is het voor fondsbeleggingen niet mogelijk de onderliggende posities kenbaar te maken. Voor deze beleggingen wordt een opsomming van beheerders en/of fondsbeleggingen gegeven. Overzicht beleggingen 2020 1 Tabel 1 Overzicht gewichtsverdeling beleggingscategorieën 31-12-2020 Beleggingscategorieën Manager/fonds Marktwaarden per ultimo 2020 in mln € Aandelen/kredietrisico Aandelen Wereld (Ontwikkelde Markten) BlackRock 2.332 Aandelen Opkomende Markten BlackRock Emerging Markets Index Fund non-lendable 568 Private Equity Interpolis Pensioenen Private Equity Fund II 2 Coller International Partners VIII 2 Mondriaan Co-Investment 1 NB Rembrandt -2020 Series 2 Vitruvian Investment Partnership IV - New Mountain Fund VI - Obligaties Opkomende Markten –HC PGIM 257 Obligaties Opkomende Markten –LC Ninety One Emerging Markets (LC) Dynamic Debt Fund 160 Achmea IM (LC) Emerging Markets Debt Fund 222 Global High Yield Achmea IM Global High Yield Fund EUR Hedged 685 Nominale rente Staatsobligaties euro Achmea IM 1.863 Niet-staatsobligaties euro M&G 931 Robeco Procyon 1.139 Hypotheken Dynamic Credit -

28Th ECBC Plenary Meeting

28th ECBC Plenary Meeting 11–14 September 2018 | Munich, Germany supported by In collaboration with PROGRAMME OUTLINE Tuesday, 11 September 2018 Buffet Lunch 12:00 - 13:00 CBLF Label & ECBC Steering Committee members only Break Area, UniCredit Offices Covered Bond Label Foundation (CBLF) Label Committee Meeting 13:00 - 14:00 CBLF Label Committee members only Auditorium, UniCredit Offices 14:00 - 16:30 European Covered Bond Council (ECBC) Steering Committee Meeting ECBC Steering Committee members only Auditorium, UniCredit Offices 14:30 - 16:30 ECBC Covered Bond Roundtable for Authorities & Regulators Authority/Regulator representatives and guest invitees only Chicago Room, UniCredit Offices 16:30 - 17:00 Coffee Break ECBC Steering and CBLF Label Committee members, and participants in the Roundtable Break Area, UniCredit Offices 17:00 - 18:00 Joint CBLF Label Committee & Covered Bond Label Advisory Council / Regulatory Roundtable Meeting CBLF Label Committee & all CBLF Advisory Council / Roundtable participants Auditorium, UniCredit Offices Welcome Dinner hosted by UniCredit 19:30 - 22:30 Members of the ECBC Steering Committee, participants in the Roundtable, speakers in the ECBC Plenary Meeting, VIP invitees 24th Floor, UniCredit Offices Welcome Addresses: Robert Schindler, Member of the Management Board of HypoVereinsbank - UniCredit Bank AG, Commercial Banking Louis Hagen, Chairman of the Board, MünchenerHyp and President, vdp PROGRAMME OUTLINE Wednesday, 12 September 2018 8:30 - 17:00 28th European Covered Bond Council (ECBC) Plenary Meeting Registered ECBC members and guest invitees only Ballroom, The Charles Hotel The Charles Hotel Sophienstrasse 28, D-80333, Munich The complete agenda of the 28th ECBC Plenary Meeting is listed in the following pages. 17:00 - 21:30 Euromoney / ECBC Covered Bond Congress 2018 The Sponsoring Banks’ Pre-Congress Party P1 Club P1 Club Prinzregentstrasse 1, D-80538, Munich Participants in the ECBC Plenary Meeting are welcome to join this event. -

Does Ownership Have an Effect on Accounting Quality?

Master Degree Project in Accounting Does Ownership have an Effect on Accounting Quality? Andreas Danielsson and Jochem Groenenboom Supervisor: Jan Marton Master Degree Project No. 2013:14 Graduate School Abstract Research on accounting quality in banks has evolved around the manipulation of the Loan Loss Provision and has been discussed in terms of earnings management and income smoothing. Key variables used to explain the manipulation of Loan Loss Provisions have been investor protection, legal enforcement, financial structure and regulations. This study will extend previous research by investigating the effect of state, private, savings and cooperative ownership on accounting quality. In this study data from more than 600 major banks were collected in the European Economic Area, covering annual reports between 2005 and 2011. Similar to prevalent research, the Loan Loss Provision is used as a central indicator of accounting quality. In contrast to existent literature, accounting quality is not explained by the manipulation of the Loan Loss Provision in terms of income smoothing or earnings management. Instead, accounting quality is addressed in terms of validity and argued to be an outcome of the predictive power of the Loan Loss Provision in forecasting the actual outcome of credit losses. The findings of this study confirm that ownership has an effect on accounting quality. All but one form of ownership investigated showed significant differences. State ownership was found to have a positive effect on accounting quality, both in comparison to private banks and all other banks. On the other hand, savings ownership was shown to have a negative impact on accounting quality compared to private and other banks. -

Stress Testing Governance, Risk Analytics and Instruments European Dr

VISIT OUR WEBSITE: www.flemingeurope.com “Linking the credit and liquidity risks” EXPERT ADVISORY BOARD nd ANNUAL DR. ANDREA BURGTORF Deutsche Bank, Germany, Head of Stress Testing HOP Governance, Risk Analytics and Instruments EUROPEAN S DR. LINda SLEDDENS Aegon Bank, Netherlands Senior Financial Risk Manager SUsaNNE HUGHES & WORK Lloyds Banking Group, UK STRess CE Senior Manager Stress Testing N PETER QUEll E R DZ Bank, Germany, Head of Portfolio Modelling E for Market and Credit Risk TESTING EXCLUSIVE SPEAKER PANEL CONF HEIKO HEssE for Banks IMF, USA, Economist, Monetary and Capital Markets Department 23-24 October 2013, Netherlands IaIN DE WEYMARN Bank of England, UK, Head of Banking System Division, Financial Stability Radisson Blu Hotel Amsterdam CAROLINE LIESEGANG EBA, UK, Senior Stress Testing Expert JEROME HENRY CONFERENCE & WORKSHOP ECB, Germany, Head of Financial Stability Assessment Division 2 Market conditions are in turmoil and a regulatory or risk management JAVIER VIllaR BURKE no one can be sure of the reaction. perspective. Moreover, you will be European Commission – DG ECFIN One of the ways of calming things able to benchmark your processes Statistical Officer down is reassuring the Financial and methodologies with your peers, environment about your ability regulators and gather diversity of ALEXANDER VasYUTOVIch to react promptly, safeguard your insights for your internal processes Promsvyazbank, Russia, Co-Chief Risk Officer clients’ interests and cope with improvement. Head of Financial and Retail Risk Management liquidity squeeze during stressed PETER QUEll periods. By incorporating stress To practice your stress testing DZ Bank, Germany, Head of Portfolio Modeling testing into your risk management techniques, we have prepared an for Market and Credit Risk methodologies, you are taking one intensive hands-on workshop called of the more important steps of doing Scenario Analysis in Stress Ewa RENZ so. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st February 2021 This document provides a list of Authorised Firms, it does not supersede the Financial Service Register which should be referred to as the most accurate and up to date source of information. Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The DF Capital Bank Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Birmingham Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

"SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V

Erkende referenten / Recognised sponsors Arbeid Regulier en Kennismigranten / Regular labour and Highly skilled migrants Naam bedrijf/organisatie Inschrijfnummer KvK Name company/organisation Registration number Chamber of Commerce "@1" special projects payroll B.V. 70880565 "SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V. 82701695 01-10 Architecten B.V. 24257403 100 Grams B.V. 69299544 10X Genomics B.V. 68933223 12Connect B.V. 20122308 180 Amsterdam BV 34117849 1908 Acquisition B.V. 60844868 2 Getthere Holding B.V. 30225996 20Face B.V. 69220085 21 Markets B.V. 59575417 247TailorSteel B.V. 9163645 24sessions.com B.V. 64312100 2525 Ventures B.V. 63661438 2-B Energy Holding 8156456 2M Engineering Limited 17172882 30MHz B.V. 61677817 360KAS B.V. 66831148 365Werk Contracting B.V. 67524524 3D Hubs B.V. 57883424 3DUniversum B.V. 60891831 3esi Netherlands B.V. 71974210 3M Nederland B.V. 28020725 3P Project Services B.V. 20132450 4DotNet B.V. 4079637 4People Zuid B.V. 50131907 4PS Development B.V. 55280404 4WEB EU B.V. 59251778 50five B.V. 66605938 5CA B.V. 30277579 5Hands Metaal B.V. 56889143 72andSunny NL B.V. 34257945 83Design Inc. Europe Representative Office 66864844 A. Hak Drillcon B.V. 30276754 A.A.B. International B.V. 30148836 A.C.E. Ingenieurs en Adviesbureau, Werktuigbouw en Electrotechniek B.V. 17071306 A.M. Best (EU) Rating Services B.V. 71592717 A.M.P.C. Associated Medical Project Consultants B.V. 11023272 A.N.T. International B.V. 6089432 A.S. Watson (Health & Beauty Continental Europe) B.V. 31035585 A.T. Kearney B.V. -

Jaarverslag Currence 2018 Inhoudsopgave Inhoudsopgave Kerncijfers Jaarverslag

Jaarverslag 2018 Inhoudsopgave Kerncijfers Jaarverslag Hoe werkt dit bestand? Het Currence jaarverslag is een interactieve PDF. Bovenaan elke pagina ziet u de navigatiebalk. Deze navigatiebalk bestaat uit een drietal icoontjes en daarnaast drie gekleurde kaders. De 3 kaders zijn directe links (verwijzingen) naar de hoofdonderdelen van dit jaarverslag. De Inhoudsopgave, de Kerncijfers en het Jaarverslag zijn zo snel bereikbaar, en u kunt zo ook snel terug navigeren naar het begin van een van deze onderdelen. Tevens zijn de hoofdstukken van de inhoudsopgave interactief. Hiermee kunt u ook naar de verschillende onderdelen van het jaarverslag navigeren. Klikt u op dit icoontje dan opent de webbrowser en gaat u automatisch naar de homepage van Currence. Heeft u een vraag of opmerking voor ons? Klikt u dan op dit icoontje. U opent hiermee automatisch uw e-mailprogramma en er wordt direct een nieuw e-mailbericht aangemaakt met ons e-mailadres. Klikt u op dit icoontje dan kunt u het jaarverslag printen. Let op: Als u dit bestand hebt geopend met Adobe Reader dan zal de navigatiebalk bij het printen van het bestand niet afgedrukt worden. Andere software voor het lezen van een PDF-bestand ondersteunt deze functionaliteit wellicht niet. Inhoudsopgave Kerncijfers Jaarverslag Inhoudsopgave 2 Profiel Currence 3 Organisatie en kerncijfers 2018 10 Bericht van de Raad van Commissarissen 12 Verslag van de Directie 16 De producten van Currence 16 iDEAL 30 iDIN 36 Incassomachtigen 38 Acceptgiro 40 Toelichting op de structuur, organisatie en governance van de onderneming Currence is geen bestaand woord, maar heeft wel associaties met ‘currency’ (valuta; betaalmiddel) en ‘current’ (actueel; stroom). -

Download (471Kb)

Pas toe of leg uit “Een onderzoek naar de toepassing van de code banken en de code verzekeraars ten aanzien van beloningsbeleid.” M.M. Scheffer Leeghwaterstraat 99 6717CX Ede Studentnummer: 2232146 [email protected] Rijksuniversiteit Groningen Faculteit economie & bedrijfskunde Accountancy & Controlling Ernst & Young Audit services Amsterdam / Utrecht 1e Begeleider RuG: Prof. dr. J.A. van Manen RA 2e Begeleider RuG: dr. O.P.G. Bik RA Begeleider E&Y: drs. M.T. Lemans RA M.M. Scheffer Pas toe of leg uit Voorwoord Voor u ligt mijn scriptie ter afronding van mijn master accountancy & controlling aan de Rijksuniversiteit Groningen. Ik heb het afgelopen jaar als zeer leerzaam en plezierig ervaren. Naast vakkennis heb ik mij in deze periode ook persoonlijk kunnen ontwikkelen. In deze scriptie staat corporate governance voor banken en verzekeraars centraal. Deze is vertaald in de code banken en de code verzekeraars. In deze scriptie is onderzoek gedaan naar de mate van naleving van de codes. Tevens is onderzocht in welke mate omvang van instellingen een rol speelt bij de naleving van de principes en tevens bij de kwaliteit van uitleg bij het niet toepassen van principes. Het onderzoek heb ik mogen uitvoeren bij mijn werkgever Ernst & Young te Utrecht. Graag wil ik mijn begeleider vanuit Ernst & Young, de heer drs. René Lémans RA, bedanken voor de begeleiding en hulp gedurende het gehele traject. Tevens wil ik de heren drs. Bob Leonards RA en mr. drs. Georges de Méris RA danken voor het meedenken en beantwoorden van mijn vakinhoudelijke vragen. Daarnaast wil ik graag mijn begeleiders vanuit de Rijksuniversiteit Groningen, de heer Prof. -

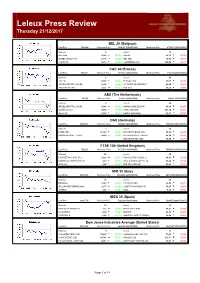

Leleux Press Review

Leleux Press Review Thursday 21/12/2017 BEL 20 (Belgium) Last Price 3994,68 Minimum Price 1046,07 (02/09/1992) Maximum Price 4759,01 (23/05/2007) Gainers 4 Losers 16 APERAM 43,85 +0,38% AGEAS 41,35 -0,79% ONTEX GROUP NV 27,75 +0,16% GBL (BE) 90,33 -0,79% COLRUYT 42,79 +0,03% COFINIMMO (BE) 110,00 -0,67% CAC 40 (France) Last Price 5352,77 Minimum Price 2693,21 (23/09/2011) Maximum Price 7347,94 (21/10/2009) Gainers 6 Losers 34 VALEO 62,09 +0,82% RENAULT SA 83,57 -0,98% ARCELORMITTAL SA (NL 26,98 +0,46% LAFARGEHOLCIM LTD (F 46,08 -0,96% VEOLIA ENV (FR) 21,27 +0,21% AXA (FR) 25,25 -0,88% AEX (The Netherlands) Last Price 547,38 Minimum Price 194,99 (09/03/2009) Maximum Price 806,41 (21/10/2009) Gainers 5 Losers 20 ARCELORMITTAL SA (NL 26,98 +0,46% KONINKLIJKE DSM NV 80,94 -0,93% GEMALTO N.V. 49,49 +0,29% ASML HOLDING 147,80 -0,90% RELX NV 19,24 +0,15% AHOLD DELHAIZE 18,33 -0,75% DAX (Germany) Last Price 13069,17 Minimum Price 7292,03 (26/11/2012) Maximum Price 13478,86 (03/11/2017) Gainers 2 Losers 28 LINDE (DE) 181,00 +0,58% DEUTSCHE BANK (DE) 16,64 -0,98% PROSIEBENSAT.1 NA O 29,00 +0,24% HEIDELBERGER ZEMENT 89,50 -0,92% DEUTSCHE TEL (DE) 15,00 -0,69% FTSE 100 (United Kingdom) Last Price 7525,22 Minimum Price 3277,50 (12/03/2003) Maximum Price 53548,10 (16/11/2009) Gainers 45 Losers 54 EASYJET PLC ORD 27 2 14,28 +0,97% ROYAL DUTCH SHELL A 24,05 -0,79% MARKS AND SPENCER GR 3,10 +0,97% ANGLO AMERICAN PLC O 14,88 -0,77% GKN (UK) 3,04 +0,91% SSE PLC ORD 50P 13,01 -0,77% MIB 30 (Italy) Last Price 22109,65 Minimum Price 12320,50 (24/07/2012) Maximum Price 48766,00 (05/04/2001) Gainers 13 Losers 26 BREMBO 12,80 +0,86% ATLANTIA SPA 26,45 -0,97% SALVATORE FERRAGAMO 21,75 +0,78% LUXOTTICA GROUP (IT) 50,95 -0,97% SAIPEM 3,63 +0,60% ENEL 5,28 -0,75% IBEX 35 (Spain) Last Price 10207,70 Minimum Price 5266,90 (10/10/2002) Maximum Price 15945,70 (08/11/2007) Gainers 15 Losers 19 BANCO DE SABADELL 1,72 +0,93% INDRA SISTEMAS 11,53 -0,98% CAIXABANK 4,00 +0,85% INDITEX 29,53 -0,92% IBERDROLA 6,58 +0,73% GAMESA CORP. -

Ideal Merchant Integration Guide (EN)

iDEAL Merchant Integration Guide (EN) Copyright © Currence iDEAL B.V. All rights reserved. Page 1 of 63 Version: 3.6 PDF export EN/NL 9 okt. 2020 Push the icon with drie dots to the upper right Choose "Export to PDF" Wait until the PDF Export is done Push Download to download the PDF Terms and conditions Terms and conditions for provision of the iDEAL Merchant Integration Guide: 1. Scheme Owner Currence iDEAL B.V. provides the iDEAL Merchant Integration Guide to Acquiring banks which distribute it to (potential) Merchants and Payment Service Providers to enable them to form a good idea of what the implementation of the iDEAL product would involve and assess how any future use of iDEAL could affect their business operations. 2. Currence iDEAL B.V. reserves the right to deny access to the iDEAL Merchant Integration Guide to (potential) Merchants and Payment Service Providers on reasonable grounds, in consultation with the Acquiring bank with which the Merchant /PSP has a contract. 3. The iDEAL Merchant Integration Guide is explicitly and exclusively provided for the purpose mentioned above, and no other use is permitted. No rights can be derived from the information provided in this document or the accompanying notes. Currence iDEAL B.V. is in no way liable for the consequences of later changes to the iDEAL Standards or the iDEAL Merchant Integration Guide. If banks or other interested parties take decisions and/or make investments on the basis of the information that they obtain via the iDEAL Merchant Integration Guide, Currence iDEAL B.V. -

Nibc Covered Bond Presentation

NIBC COVERED BOND PRESENTATION September 2021 1 EXECUTIVE SUMMARY Addressing the challenges from Covid-19 ▪ Focused mid-market corporate and retail franchise with differentiated approach ▪ Net profit of EUR 91 million in H1 2021 (EUR 3 million in H1 2020) ▪ Net interest margin of 1.87% in H1 2021 (1.92% in 2020) NIBC ▪ Impairment ratio of 0.16% in H1 2021 (from 0.80% in 2020) ▪ Cost-to-income ratio at 46% in H1 2021 (50% in 2020) ▪ Strong capital position, with fully-loaded CET 1 ratio at 20.0% and leverage ratio of 8.6% at H1 2021 ▪ AAA/AAA (S&P/Fitch) rated Conditional Pass-Through Covered Bonds ▪ Law-based programme, registered with the Dutch Central Bank Covered Bond ▪ Favorable regulatory treatment Programme ▪ Documented minimum overcollateralisation of 15% ▪ Cover pool of prime Dutch residential mortgage loans ▪ Total residential mortgage book of EUR 9.2 billion1 ▪ Despite Covid-19 the Dutch housing market remains resilient: NPLs remain low and credit loss expenses for H1 2021 Mortgage Business were negative EUR 2 million ▪ Origination via independent intermediaries, underwriting criteria fully controlled by NIBC ▪ In-house arrears and foreclosure management 1: Excludes buy-to-let exposure of EUR 0.9 billion and (off-balance sheet) originate-to-manage exposure of EUR 8.7 billion 2 TABLE OF CONTENTS 1. NIBC BUSINESS AND FINANCIAL UPDATE H1 2021 4 2. DUTCH HOUSING AND MORTGAGE MARKET 24 3. RETAIL CLIENT OFFERING AND ASSET QUALITY 27 4. CONDITIONAL PASS-THROUGH COVERED BOND PROGRAMME 32 APPENDIX I MORTGAGE BUSINESS AT NIBC 36 APPENDIX II MAIN UNDERWRITING CRITERIA 39 APPENDIX III ASSET COVER TEST 42 APPENDIX IV CONDITIONAL PASS-THROUGH SCENARIOS 44 APPENDIX V INVESTOR REPORTING AND LEGAL FRAMEWORK 46 3 NIBC BUSINESS AND FINANCIAL UPDATE H1 2021 4 NIBC PERFORMANCE IN H1 2021 ▪ NIBC had a strong half year, with operating income benefitting from positive results of the equity investment portfolio and an increase in fee income ▪ Interest income equals EUR 188 million (-9%), following development of both portfolio volumes and spreads.