Space Launch Market Analysis HIE- Due Diligence Support February 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Potential of Polarization/Raman Lidar to Separate Fine Dust, Coarse Dust

Atmos. Meas. Tech., 10, 3403–3427, 2017 https://doi.org/10.5194/amt-10-3403-2017 © Author(s) 2017. This work is distributed under the Creative Commons Attribution 3.0 License. Potential of polarization/Raman lidar to separate fine dust, coarse dust, maritime, and anthropogenic aerosol profiles Rodanthi-Elisavet Mamouri1,2 and Albert Ansmann3 1Cyprus University of Technology, Dep. of Civil Engineering and Geomatics, Limassol, Cyprus 2The Cyprus Institute, Energy, Environment, and Water Research Center, Nicosia, Cyprus 3Leibniz Institute for Tropospheric Research, Leipzig, Germany Correspondence to: Rodanthi-Elisavet Mamouri ([email protected]) Received: 26 April 2017 – Discussion started: 4 May 2017 Revised: 28 July 2017 – Accepted: 2 August 2017 – Published: 19 September 2017 Abstract. We applied the recently introduced polarization advantages in comparison to 355 and 1064 nm polarization lidar–photometer networking (POLIPHON) technique for lidar approaches and leads to the most robust and accurate the first time to triple-wavelength polarization lidar measure- POLIPHON products. ments at 355, 532, and 1064 nm. The lidar observations were performed at Barbados during the Saharan Aerosol Long- Range Transport and Aerosol-Cloud-Interaction Experiment (SALTRACE) in the summer of 2014. The POLIPHON 1 Introduction method comprises the traditional lidar technique to separate mineral dust and non-dust backscatter contributions and the Polarization lidar is a very powerful remote sensing tool for new, extended approach to separate even the fine and coarse aerosol and cloud research. The technique has been used for dust backscatter fractions. We show that the traditional and a long time to monitor and investigate cirrus cloud systems the advanced method are compatible and lead to a consis- (e.g., Sassen, 1991, 2005; Reichardt et al., 2002, 2008) and tent set of dust and non-dust profiles at simplified, less com- polar stratospheric cloud evolution (see, e.g., Browell et al., plex aerosol layering and mixing conditions as is the case 1990; Achtert and Tesche, 2014). -

Les Fusées-Sondes De Sud-Aviation

Les fusées-sondes de Sud-Aviation Jean-Jacques Serra Commission Histoire de la 3AF Origines : Centre national d'études des télécommunications (CNET) • Loi du 4 mai 1944, validée le 29 janvier 1945 • Demandes d'études - ministères (Guerre, Air, Marine), - Radiodiffusion française, - Comité d’action scientifique de la Défense nationale,... • Etudes sur la propagation radioélectrique plusieurs départements (Tubes et hyperfréquence, Transmission, Laboratoire national de radioélectricité) • Recherches sur la troposphère et sur l’ionosphère Programme spatial du CNET lancé en 1957 selon deux directions : • participation au lancement de fusées-sondes pour l’exploration de la haute atmosphère • traitement scientifique des données fournies par les signaux émis par les satellites artificiels Samedis de l'Histoire de la 3AF Les fusées-sondes de Sud Aviation 15/10/2011 - 2 Contexte : Fusées-sondes existantes Fusées du CASDN pour l'AGI : • Véronique AGI : dérivée des Véronique N et NA (1952-1954) 60 kg à 210 km d'altitude • Monica IV et V : dérivées des Monica I à III (1955-1956) 15 kg à 80 km ou 140 km d'altitude Fusées de l'ONERA utilisées par le CEA : • Daniel : dérivé d'Ardaltex (1957-1959) 15 kg à 125 km d'altitude • Antarès : dérivé de l'engin d'essais de rentrée (1959-1961) 35 kg à 280 km d'altitude Samedis de l'Histoire de la 3AF Les fusées-sondes de Sud Aviation 15/10/2011 - 3 Définition des besoins du CNET Envoi d'une charge utile de 32 kg à 80 km, 120 km, 400 km et 1000 km d'altitude • fusées commandées à Sud Aviation • unité mobile construite -

We Help Earth Benefit from Space in Summary 2019 Contents

WE HELP EARTH BENEFIT FROM SPACE IN SUMMARY 2019 CONTENTS About this report 2019 HIGHLIGHTS This is an English summary of Swedish 3 Space Corporation’s (SSC) 2019 Annual and Sustainability Report. CEO STATEMENT The Swedish report, available at our web- 4 site, is the legally binding annual report. THIS IS SSC The report summarizes the 2019 fiscal 6 year and covers performance on issues most important to SSC's ability to deliver SSC GLOBAL PRESENCE value to stakeholders in a changing and complex business environment. This 8 summary serves as our United Nations Global Compact (UNGC) Communi- EVOLVING SPACE LANDSCAPE 9 cations on Progress. Visit: STRATEGIC APPROACH https://www.sscspace.com/about-ssc/finances/reports-archive/ 10 Copyright: Unless otherwise indicated, SSC has the copyright to images in this publication. FOCUS AREAS FOR PROFITABLE SUSTAINABLE GROWTH 12 EMPLOYEES - OUR GREATEST ASSET 14 MEET OUR PEOPLE 15 2019 HIGHLIGHTS 2019 HIGHLIGHTS 2019 was another year of exciting space missions and projects for the space sector as a whole, but also for SSC. The rapid development has allowed us to grow and take new steps to prepare for the future. MASER 14 and inauguration of SubOrbital Express as a service Our MASER 14 sounding rocket reached an altitude of approximately 250 kilometers and spent over six minutes in microgravity. The mission inaugurated SubOrbital Express, a service to enable research into microgravity applications, atmospheric physics or other scientific disciplines. In this microgravity environment, we conducted experiments on fluid drainage, X-ray radio graphy and dust formation. Read more: https://www.suborbitalexpress.com Inauguration of exciting antenna art in Inuvik The two SSC antennas at the Inuvik site are painted by the local artists Anick Jenks and Ron English. -

BAB II PENINGKATAN KAPABILITAS MILITER CHINA BAB II Akan

BAB II PENINGKATAN KAPABILITAS MILITER CHINA BAB II akan memberikan uraian penulis tentang peningkatan kapabilitas militer China dan ancaman bagi Jepang. Kapabilitas militer China tidak bisa diuraikan tanpa adanya proses-proses seperti Lompatan Jauh ke Depan, Revolusi Kebudayaan dan Reformasi Ekonomi. Keberhasilan reformasi ekonomi membuat GDP China semakin meningkat sehingga membuatnya mempunyai anggaran yang cukup untuk meningkatkan kapabilitas militernya. 2.1 Kebangkitan Ekonomi dan Sosial China RRC (Republik Rakyat China) pertama kali diproklamasikan oleh Mao Zedong pada 1 Oktober 1949 di lapangan Tiananmen. Pada masa pemerintahannya Mao menggunakan praktek Lompatan Jauh ke Depan dan Revolusi Kebudayaan. Praktek Lompatan Jauh ke Depan dilakukan Mao untuk meniru model pembangunan Uni Soviet agar terbentuk masyarakat yang terkonstruktur, tumbuhnya birokrasi dalam pemerintahan, organisasi militer profesional.1 Praktek Lompatan Jauh ke Depan dan Revolusi Kebudayaan yang dilakukan oleh Mao tersebut mengalami kegagalan. Kegagalan tersebut kemudian membuat China melakukan reformasi ekonomi yang dilakukan oleh Deng Xiaoping. Reformasi yang dilakukan oleh Deng membuat perekonomian China 1Mao Zedong 1893-19, diakses pada http://www.bbc.co.uk/history/historic_figures/mao_zedong.shtml (10/09/2016. 00:07 WIB) 21 meningkat dan juga China lebih terbuka dalam melakukan kerjasama dengan negara lain.2 2.1.1 Lompatan Jauh ke Depan Lompatan Jauh ke Depan (The Great Leap Forward) terjadi pada tahun 1958 merupakan kampanye yang bertujuan untuk membangkitkan ekonomi China melalui industrialisasi secara besar-besaran dibidang industri baja sebagai prioritas utama. Secara prinsip, Mao ingin meningkatkan produksi baja, industri ringan, dan konstruksi secara besar-besaran serta pengerahan tenaga rakyat secara besar-besaran. Rakyat disatukan menjadi komune dan disalurkan untuk bekerja di pabrik-pabrik pemerintahan. -

Highlights in Space 2010

International Astronautical Federation Committee on Space Research International Institute of Space Law 94 bis, Avenue de Suffren c/o CNES 94 bis, Avenue de Suffren UNITED NATIONS 75015 Paris, France 2 place Maurice Quentin 75015 Paris, France Tel: +33 1 45 67 42 60 Fax: +33 1 42 73 21 20 Tel. + 33 1 44 76 75 10 E-mail: : [email protected] E-mail: [email protected] Fax. + 33 1 44 76 74 37 URL: www.iislweb.com OFFICE FOR OUTER SPACE AFFAIRS URL: www.iafastro.com E-mail: [email protected] URL : http://cosparhq.cnes.fr Highlights in Space 2010 Prepared in cooperation with the International Astronautical Federation, the Committee on Space Research and the International Institute of Space Law The United Nations Office for Outer Space Affairs is responsible for promoting international cooperation in the peaceful uses of outer space and assisting developing countries in using space science and technology. United Nations Office for Outer Space Affairs P. O. Box 500, 1400 Vienna, Austria Tel: (+43-1) 26060-4950 Fax: (+43-1) 26060-5830 E-mail: [email protected] URL: www.unoosa.org United Nations publication Printed in Austria USD 15 Sales No. E.11.I.3 ISBN 978-92-1-101236-1 ST/SPACE/57 *1180239* V.11-80239—January 2011—775 UNITED NATIONS OFFICE FOR OUTER SPACE AFFAIRS UNITED NATIONS OFFICE AT VIENNA Highlights in Space 2010 Prepared in cooperation with the International Astronautical Federation, the Committee on Space Research and the International Institute of Space Law Progress in space science, technology and applications, international cooperation and space law UNITED NATIONS New York, 2011 UniTEd NationS PUblication Sales no. -

Spaceflight, Inc. General Payload Users Guide

Spaceflight, Inc. SF‐2100‐PUG‐00001 Rev F 2015‐22‐15 Payload Users Guide Spaceflight, Inc. General Payload Users Guide 3415 S. 116th St, Suite 123 Tukwila, WA 98168 866.204.1707 spaceflightindustries.com i Spaceflight, Inc. SF‐2100‐PUG‐00001 Rev F 2015‐22‐15 Payload Users Guide Document Revision History Rev Approval Changes ECN No. Sections / Approved Pages CM Date A 2011‐09‐16 Initial Release Updated electrical interfaces and launch B 2012‐03‐30 environments C 2012‐07‐18 Official release Updated electrical interfaces and launch D 2013‐03‐05 environments, reformatted, and added to sections Updated organization and formatting, E 2014‐04‐15 added content on SHERPA, Mini‐SHERPA and ISS launches, updated RPA CG F 2015‐05‐22 Overall update ii Spaceflight, Inc. SF‐2100‐PUG‐00001 Rev F 2015‐22‐15 Payload Users Guide Table of Contents 1 Introduction ........................................................................................................................... 7 1.1 Document Overview ........................................................................................................................ 7 1.2 Spaceflight Overview ....................................................................................................................... 7 1.3 Hardware Overview ......................................................................................................................... 9 1.4 Mission Management Overview .................................................................................................... 10 2 Secondary -

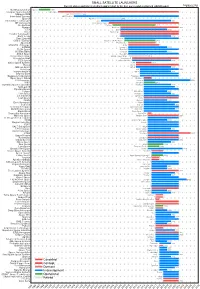

Small Satellite Launchers

SMALL SATELLITE LAUNCHERS NewSpace Index 2020/04/20 Current status and time from development start to the first successful or planned orbital launch NEWSPACE.IM Northrop Grumman Pegasus 1990 Scorpius Space Launch Demi-Sprite ? Makeyev OKB Shtil 1998 Interorbital Systems NEPTUNE N1 ? SpaceX Falcon 1e 2008 Interstellar Technologies Zero 2021 MT Aerospace MTA, WARR, Daneo ? Rocket Lab Electron 2017 Nammo North Star 2020 CTA VLM 2020 Acrux Montenegro ? Frontier Astronautics ? ? Earth to Sky ? 2021 Zero 2 Infinity Bloostar ? CASIC / ExPace Kuaizhou-1A (Fei Tian 1) 2017 SpaceLS Prometheus-1 ? MISHAAL Aerospace M-OV ? CONAE Tronador II 2020 TLON Space Aventura I ? Rocketcrafters Intrepid-1 2020 ARCA Space Haas 2CA ? Aerojet Rocketdyne SPARK / Super Strypi 2015 Generation Orbit GoLauncher 2 ? PLD Space Miura 5 (Arion 2) 2021 Swiss Space Systems SOAR 2018 Heliaq ALV-2 ? Gilmour Space Eris-S 2021 Roketsan UFS 2023 Independence-X DNLV 2021 Beyond Earth ? ? Bagaveev Corporation Bagaveev ? Open Space Orbital Neutrino I ? LIA Aerospace Procyon 2026 JAXA SS-520-4 2017 Swedish Space Corporation Rainbow 2021 SpinLaunch ? 2022 Pipeline2Space ? ? Perigee Blue Whale 2020 Link Space New Line 1 2021 Lin Industrial Taymyr-1A ? Leaf Space Primo ? Firefly 2020 Exos Aerospace Jaguar ? Cubecab Cab-3A 2022 Celestia Aerospace Space Arrow CM ? bluShift Aerospace Red Dwarf 2022 Black Arrow Black Arrow 2 ? Tranquility Aerospace Devon Two ? Masterra Space MINSAT-2000 2021 LEO Launcher & Logistics ? ? ISRO SSLV (PSLV Light) 2020 Wagner Industries Konshu ? VSAT ? ? VALT -

The Annual Compendium of Commercial Space Transportation: 2012

Federal Aviation Administration The Annual Compendium of Commercial Space Transportation: 2012 February 2013 About FAA About the FAA Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 51 United States Code, Subtitle V, Chapter 509 (formerly the Commercial Space Launch Act). FAA AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA AST’s website: http://www.faa.gov/go/ast Cover art: Phil Smith, The Tauri Group (2013) NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. • i • Federal Aviation Administration’s Office of Commercial Space Transportation Dear Colleague, 2012 was a very active year for the entire commercial space industry. In addition to all of the dramatic space transportation events, including the first-ever commercial mission flown to and from the International Space Station, the year was also a very busy one from the government’s perspective. It is clear that the level and pace of activity is beginning to increase significantly. -

Launcherone Success Opens New Space Access Gateway Guy Norris January 22, 2021

1/22/21 7:05 1/6 LauncherOne Success Opens New Space Access Gateway Guy Norris January 22, 2021 With San Nicolas Island far below, LauncherOne headed for polar orbit. Credit: Virgin Orbit Virgin Orbit had barely tweeted news of the successful Jan. 17 space debut of its LauncherOne vehicle on social media when new launch contracts began arriving in the company’s email inbox. A testament to the pent-up market demand for small-satellite launch capability, the speedy reaction to the long-awaited demonstration of the new space-access vehicle paves the way for multiple follow-on Virgin Orbit missions by year-end and a potential doubling of the rate in 2022. First successful privately developed air-launched, liquid-fueled rocket Payloads deployed for NASA’s Venture Class Launch Services program The glitch-free !ight of LauncherOne on its second demonstration test was a critical and much-welcomed milestone for the Long Beach, California-based company. Coming almost nine years a"er the air-launch concept was #rst unveiled by Virgin founder Richard Branson, and six years a"er the start of full-scale development, the !ight followed last May’s #rst demonstration mission, which ended abruptly when the rocket motor shut o$ a"er just 4 sec. 1/22/21 7:05 2/6 A"er an exhaustive analysis and modi#cations to beef up the oxidizer feed line at the heart of the #rst !ight failure, the path to the Launch Demo 2 test was then delayed until January 2021 by the COVID-19 pandemic. With the LauncherOne system now proven, design changes veri#ed and the #rst 10 small satellites placed in orbit, Virgin Orbit is already focusing on the next steps to ramp up its production and launch-cadence capabilities. -

A Decade of Growth

A publication of The Orbital Debris Program Office NASA Johnson Space Center Houston, Texas 77058 October 2000 Volume 5, Issue 4. NEWS A Decade of Growth P. Anz-Meador and Globalstar commercial communication of the population. For example, consider the This article will examine changes in the spacecraft constellations, respectively. Given peak between 840-850 km (Figure 1’s peak low Earth orbit (LEO) environment over the the uncertain future of the Iridium constellation, “B”). This volume is populated by the period 1990-2000. Two US Space Surveillance the spike between 770 and 780 km may change Commonwealth of Independent State’s Tselina- Network (SSN) catalogs form the basis of our drastically or even disappear over the next 2 spacecraft constellation, several US Defense comparison. Included are all unclassified several years. Less prominent is the Orbcomm Meteorological Support Program (DMSP) cataloged and uncataloged objects in both data commercial constellation, with a primary spacecraft, and their associated rocket bodies sets, but objects whose epoch times are “older” concentration between 810 and 820 km altitude and debris. While the region is traversed by than 30 days were excluded from further (peak “A” in Figure 1). Smaller series of many other space objects, including debris, consideration. Moreover, the components of satellites may also result in local enhancements these satellites and rocket boosters are in near the Mir orbital station are 3.0E-08 circular orbits. Thus, any “collectivized” into one group of spacecraft whose object so as not to depict a orbits are tightly January 1990 plethora of independently- 2.5E-08 maintained are capable of orbiting objects at Mir’s A January 2000 producing a spike similar altitude; the International B to that observed with the Space Station (ISS) is 2.0E-08 commercial constellations. -

ESPI Insights Space Sector Watch

ESPI Insights Space Sector Watch Issue 16 May 2021 THIS MONTH IN THE SPACE SECTOR… MARS LANDING CEMENTS CHINA’S POSITION AS MAJOR SPACE POWER ................................................................ 1 POLICY & PROGRAMMES .................................................................................................................................... 2 ESA awards €150 million in contracts to continue development of Prometheus and Phoebus .......... 2 European Commission targets second study for its space-based secure connectivity project .......... 2 South Korea joins Artemis accords and strengthens partnership with the U.S. ..................................... 2 May marks busy month in UK space sector................................................................................................... 3 NASA temporarily suspends SpaceX’s HLS contract following protests on the award ........................ 3 Spain eyes creation of a National Space Agency .......................................................................................... 3 Space Force awards $228 million GPS contract extension to Raytheon Intelligence and Space ...... 4 China officially establishes company to develop and operate broadband mega constellation ........... 4 Lithuania signs Association Agreement with ESA ........................................................................................ 4 CNES and Bundeswehr University Munich (UniBw) launch SpaceFounders accelerator ..................... 4 The Brazilian Space Agency selects Virgin Orbit -

The European Launchers Between Commerce and Geopolitics

The European Launchers between Commerce and Geopolitics Report 56 March 2016 Marco Aliberti Matteo Tugnoli Short title: ESPI Report 56 ISSN: 2218-0931 (print), 2076-6688 (online) Published in March 2016 Editor and publisher: European Space Policy Institute, ESPI Schwarzenbergplatz 6 • 1030 Vienna • Austria http://www.espi.or.at Tel. +43 1 7181118-0; Fax -99 Rights reserved – No part of this report may be reproduced or transmitted in any form or for any purpose with- out permission from ESPI. Citations and extracts to be published by other means are subject to mentioning “Source: ESPI Report 56; March 2016. All rights reserved” and sample transmission to ESPI before publishing. ESPI is not responsible for any losses, injury or damage caused to any person or property (including under contract, by negligence, product liability or otherwise) whether they may be direct or indirect, special, inciden- tal or consequential, resulting from the information contained in this publication. Design: Panthera.cc ESPI Report 56 2 March 2016 The European Launchers between Commerce and Geopolitics Table of Contents Executive Summary 5 1. Introduction 10 1.1 Access to Space at the Nexus of Commerce and Geopolitics 10 1.2 Objectives of the Report 12 1.3 Methodology and Structure 12 2. Access to Space in Europe 14 2.1 European Launchers: from Political Autonomy to Market Dominance 14 2.1.1 The Quest for European Independent Access to Space 14 2.1.3 European Launchers: the Current Family 16 2.1.3 The Working System: Launcher Strategy, Development and Exploitation 19 2.2 Preparing for the Future: the 2014 ESA Ministerial Council 22 2.2.1 The Path to the Ministerial 22 2.2.2 A Look at Europe’s Future Launchers and Infrastructure 26 2.2.3 A Revolution in Governance 30 3.