Notice of Meetings and Management Proxy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arizona State Rail Plan March 2011

Arizona State Rail Plan March 2011 Arizona Department of Transportation This page intentionally left blank Acknowledgements The State Rail Plan was made possible by the cooperative efforts of the following individuals and organizations who contributed significantly to the successful completion of the project: Rail Technical Advisory Team Cathy Norris, BNSF Railway Chris Watson, Arizona Corporation Commission Bonnie Allin, Tucson Airport Authority Reuben Teran, Arizona Game and Fish Department Zoe Richmond, Union Pacific Railroad David Jacobs, Arizona State Historic Preservation Office Jane Morris, City of Phoenix – Sky Harbor Airport Gordon Taylor, Arizona State Land Department Patrick Loftus, TTX Company Cathy Norris, BNSF Railway Angela Mogel, Bureau of Land Management ADOT Project Team Jack Tomasik, Central Arizona Association of Governments Sara Allred, Project Manager Paul Johnson, City of Yuma Kristen Keener Busby, Sustainability Program Manager Jermaine Hannon, Federal Highway Administration John Halikowski, Director Katai Nakosha, Governor’s Office John McGee, Executive Director for Planning and Policy James Chessum, Greater Yuma Port Authority Mike Normand, Director of Transit Programs Kevin Wallace, Maricopa Association of Governments Shannon Scutari, Esq. Director, Rail & Sustainability Marc Pearsall, Maricopa Association of Governments Services Gabe Thum, Pima Association of Governments Jennifer Toth, Director, Multi-Modal Planning Division Robert Bohannan, RH Bohannan & Associates Robert Travis, State Railroad Liaison Jay -

Southwest Multi-State Rail Planning Study Technical Background Report September 2014

Southwest Multi-State Rail Planning Study Technical Background Report September 2014 Table of Contents Chapter 1. Introduction .......................................................................................................................................... 7 1.1 Overview .................................................................................................................................................... 7 1.2 What is a Multi-State Rail Plan? ................................................................................................................ 7 1.3 Why the Southwest?.................................................................................................................................. 8 1.4 Geographic Scope of Study ........................................................................................................................ 9 1.5 Study Stakeholders .................................................................................................................................. 10 1.6 Guiding Principles for Southwest Multi-State Rail Network Planning ..................................................... 11 Chapter 2. Planning Context ................................................................................................................................. 12 2.1 Overview of the Study Area ..................................................................................................................... 12 2.2 Population and Travel Demand .............................................................................................................. -

Public Notice

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION News Media Information (202) 418-0500 445 12th Street, S.W., TW-A325 Fax-On-Demand (202) 418-2830 Washington, DC 20554 Internet:http://www.fcc.gov ftp.fcc.gov Report Number: 3917 E Date of Report: 03/19/2008 Wireless Telecommunications Bureau Assignment of License Authorization Applications, Transfer of Control of Licensee Applications, De Facto Transfer Lease Applications and Spectrum Manager Lease Notifications, Designated Entity Reportable Eligibility Event Applications, and Designated Entity Annual Reports Action This Public Notice contains a listing of applications that have been acted upon by the Commission. Assignment of License Authorization Applications and Transfer of Control of Licensee Applications Purpose File Number Parties Action Date Action AA 0002741900 Assignor: SELF RADIO INC 03/15/2008 M Assignee: NEXTEL OF TEXAS, INC. Partial Assignment Call Sign or Lead Call Sign: WPID574 Radio Service Code(s) YM Page 1 Purpose File Number Parties Action Date Action AM 0002921065 Assignor: Verizon New England Inc. 01/09/2008 C Assignee: Northern New England Telephone Operations Inc. Full Assignment Call Sign or Lead Call Sign: KCK72 Radio Service Code(s) IG AA 0002921107 Assignor: Verizon New England Inc. 01/09/2008 C Assignee: Northern New England Telephone Operations Inc. Partial Assignment Call Sign or Lead Call Sign: KA8049 Radio Service Code(s) IG AA 0002978601 Assignor: P & R Spectrum Resources, Inc. 03/12/2008 M Assignee: Nextel License Holdings 4, Inc. Partial Assignment Call -

Sr 77 Corridor Profile Study

F INA L R E P OR T SR 77 Corridor H olbrook to Show Low PREPARED FOR 2018 ADOT WORK TASK N O. ADOT CONTRACT NO. MPD 0040-17 18-177972 Prepared by SR 77 CORRIDOR PROFILE STUDY HOLBROOK TO SHOW LOW ADOT WORK TASK NO. MPD-0040-17 ADOT CONTRACT NO. 18-177972 FINAL REPORT MARCH 2018 PREPARED FOR: ARIZONA DEPARTMENT OF TRANSPORTATION PREPARED BY: This report was funded in part through grants from the Federal Highway Administration, U.S. Department of Transportation. The contents of this report reflect the views of the authors, who are responsible for the facts and the accuracy of the data, and for the use or adaptation of previously published material, presented herein. The contents do not necessarily reflect the official views or policies of the Arizona Department of Transportation or the Federal Highway Administration, U.S. Department of Transportation. This report does not constitute a standard, specification, or regulation. Trade or manufacturers’ names that may appear herein are cited only because they are considered essential to the objectives of the report. The U.S. government and the State of Arizona do not endorse products or manufacturers. Table of Contents List of Figures Figure 1: Corridor Study Area ......................................................................................................... 1 EXECUTIVE SUMMARY .......................................................................................................... ES-1 Figure 2: Corridor Location and Segments .................................................................................... -

Arizona Rail Safety and Security Guide

State of Arizona Rail Safety & Security Resource Guide November 2007 Disclaimer This guide is for informational purposes only and is not intended to be an all-inclusive resource. The guide is a compilation of information from many sources and entities. The information contained herein is subject to amendment and change without notice and therefore the accuracy of the contents cannot be guaranteed. Readers are cautioned not to rely solely on the guide and should do further research to ensure accuracy of the information. Legal advice should be sought as appropriate. i Acknowledgement of Participants Arizona Corporation Commission (ACC) Arizona Department of Transportation (ADOT) Arizona Operation Lifesaver (AZOL) BNSF Railway (BNSF) Department of Homeland Security (DHS) Federal Railroad Administration (FRA-USDOT) Federal Highway Administration (FHWA-USDOT) Federal Motors Carrier Safety Administration (FMCSA) Governor’s Office of Highway Safety (GOHS) METRO (Light Rail) Transportation Safety Administration (TSA-DHS) Union Pacific Railroad (UPRR) ii Preface This plan will focus on targeted areas of railroad safety with emphasis on data driven, state specific needs identified by the “USDOT Highway-Rail Crossing Safety and Trespass Prevention Action Plan” developed by the United States Department of Transportation. Initially, the plan was developed to help guide efforts by federal and state governments, rail industry and public rail safety organizations to reduce train- vehicle collisions and trespass incidents. While the action plan does highlight specific programs and activities, it is intended to provide flexibility to the railroads, highways, public transit and communities in responding effectively to real world conditions. The action plan emphasizes a multi-modal approach for improving safety at the nation’s 277,722 highway-rail crossings, and preventing trespassing along more than 145,000 miles of track and right of way. -

Mill Closure Statistics

U.S. FORESTRY PRODUCTS INDUSTRY WAS THE SECOND MOST VALUABLE AGRICULTURE EXPORT AS LATE AS 1995 SECOND ONLY TO SOYBEANS. THE INDUSTRY WAS LISTED AS ONE OF THE INDUSTRIES OF THE FUTURE BY THE U.S. DEPARTMENT OF ENERGY AS LATE AS 2002. NOW ALMOST THE ENTIRE INDUSTRY HAS BEEN SHUTTERED, AUCTIONED, OR SITS RUSTING, WITH MANY THOUSANDS OF DIRECT AND INDIRECT RURAL AREA JOBS LOST. IT IS LIKE THE ENTIRE FOREST PRODUCTS INDUSTRIES HAVE BEEN EXPORTED. TREES CONTINUE TO GROW BUT THE USE INFRASTRUCTURE IS LARGELY PART OF THE HISTORY OF THE NATION. THIS LIST WAS COMPILED BY THE FOREST PRODUCTS WORK FORCE. IT HAS NOT BEEN MODIFIED IN ANY WAY. SIGNIFICANCE OF COLOR AND SPACING IS UNKNOWN – MAY 2013 CARBONTECH COOPERATIVE, INC. Number Number of Jobs of Jobs File Reference State City Company Location Type Mill Lost Year Shutdown Curtailed Reason for shutdown / Physical Location Contact Location 2nd File Reference Location Ketchika Ketchika AK n Ketchikan Pulp Co. n P&P 11-Feb-97 Don W Alaska Pulp AK Sitka Corporation Sitka Pulp 17-May-93 Don W Abbevill Abbeville Forest AL e Products Abbeville Sawmill 2000 Don W Abbevill AL e U.S. Forest Abbeville Sawmill 100 2001 Annette's Email Stallworth & AL Braggs Johnson Braggs Sawmill 2003 Don W Smurfit-Stone AL Brewton Container Corp. Brewton Mill 8-Aug-07 8-8-07 GP Buys this for $355 mill Dave C. Announce 6-2-11 will close three former Smurfit- Stone corrugated container plants in Corrugated the fourth quarter 3 plants listed in 1 file--closure will be completed by 4Q11— 6-2-11 Rock Birming Birmingh Container of fiscal year was stated We expect that RKT will eventually idle 20-30 Tenn 3 Corr AL ham Rock Tenn am Plant 2011 converting plants. -

Arizona Rail Fast Facts for 2019 Freight Railroads …

Freight Railroads in Arizona Rail Fast Facts For 2019 Freight railroads ….............................................................................................................................................................11 Freight railroad mileage …..........................................................................................................................................1,759 Freight rail employees …...............................................................................................................................................2,837 Average wages & benefits per employee …...................................................................................................$126,970 Railroad retirement beneficiaries …......................................................................................................................9,700 Railroad retirement benefits paid ….....................................................................................................................$245 million U.S. Economy: According to a Towson University study, in 2017, America's Class I railroads supported: Sustainability: Railroads are the most fuel efficient way to move freight over land. It would have taken approximately 7.3 million additional trucks to handle the 131.6 million tons of freight that moved by rail in Arizona in 2019. Rail Traffic Originated in 2019 Total Tons: 3.1 million Total Carloads: 65,100 Commodity Tons (mil) Carloads Metallic Ores 0.6 6,900 Intermodal 0.5 37,300 Glass and Stone 0.4 4,200 -

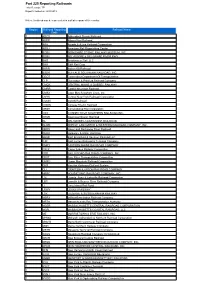

Part 225 Reporting Railroads.Pdf

Part 225 Reporting Railroads Total Records: 771 Report Created on: 4/30/2019 Notes: A railroad may be represented in multiple regions of the country. Region Railroad Reporting Railroad Name Code 1 ADCX Adirondack Scenic Railroad 1 APRR Albany Port Railroad 1 ARA Arcade & Attica Railroad Corporation 1 ARDJ American Rail Dispatching Center 1 BCRY BERKSHIRE SCENIC RAILWAY MUSEUM, INC. 1 BDRV BELVEDERE & DELAWARE RIVER RWY 1 BHR Brookhaven Rail, LLC 1 BHX B&H Rail Corp 1 BKRR Batten Kill Railroad 1 BSOR BUFFALO SOUTHERN RAILROAD, INC. 1 CDOT Connecticut Department Of Transportation 1 CLP Clarendon & Pittsford Railroad Company 1 CMQX CENTRAL MAINE & QUEBEC RAILWAY 1 CMRR Catskill Mountain Railroad 1 CMSX Cape May Seashore Lines, Inc. 1 CNYK Central New York Railroad Corporation 1 COGN COGN Railroad 1 CONW Conway Scenic Railroad 1 CRSH Consolidated Rail Corporation 1 CSO CONNECTICUT SOUTHERN RAILROAD INC. 1 DESR Downeast Scenic Railroad 1 DL DELAWARE LACKAWANNA RAILROAD 1 DLWR DEPEW, LANCASTER & WESTERN RAILROAD COMPANY, INC. 1 DRRV Dover and Rockaway River Railroad 1 DURR Delaware & Ulster Rail Ride 1 EBSR East Brookfield & Spencer Railroad LLC 1 EJR East Jersey Railroad & Terminal Company 1 EMRY EASTERN MAINE RAILROAD COMPANY 1 FGLK Finger Lakes Railway Corporation 1 FRR FALLS ROAD RAILROAD COMPANY, INC. 1 FRVT Fore River Transportation Corporation 1 GMRC Green Mountain Railroad Corporation 1 GRS Pan Am Railways/Guilford System 1 GU GRAFTON & UPTON RAILROAD COMPANY 1 HRRC HOUSATONIC RAILROAD COMPANY, INC. 1 LAL Livonia, Avon & Lakeville Railroad Corporation 1 LBR Lowville & Beaver River Railroad Company 1 LI Long Island Rail Road 1 LRWY LEHIGH RAILWAY 1 LSX LUZERNE & SUSQUEHANNA RAILWAY 1 MBRX Milford-Bennington Railroad Company 1 MBTA Massachusetts Bay Transportation Authority 1 MCER MASSACHUSETTS CENTRAL RAILROAD CORPORATION 1 MCRL MASSACHUSETTS COASTAL RAILROAD, LLC 1 ME MORRISTOWN & ERIE RAILWAY, INC. -

Title of Report

Regional Economic Assessment & Strategy for Coal-Impacted Navajo and Apache Counties, Arizona June 24, 2018 Prepared for: Navajo County, Arizona Economic and Workforce Development P.O. Box 668 Holbrook, Arizona 86025-0668 Prepared by Highland Economics 2344 NE 59th Avenue Portland, Oregon www.highlandeconomics.com With funding from the U.S. Economic Development Administration’s Assistance to Coal Communities program, Arizona Public Service Electric Company, Real Arizona Development Council, and Navajo County. TABLE OF CONTENTS ES Executive Summary .................................................................................................................................. 5 ES.1 Current Economic and Demographic Conditions .............................................................................. 6 ES.2 Type and Magnitude of Coal-Related Economic Impacts ................................................................. 8 ES.3 Regional and Community Strategies for Mitigating Economic Impact ............................................. 9 ES. 3.1 Community Visioning .............................................................................................................. 10 ES. 3.2 Quality of Life .......................................................................................................................... 11 ES. 3.3 Branding and Regional Marketing ........................................................................................... 12 ES. 3.4 Business Environment ............................................................................................................ -

Total Employment by State, Class of Employer and Last Railroad Employer Calendar Year 2013

Statistical Notes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | U.S. Railroad Retirement Board Bureau of the Actuary www.rrb.gov No. 2 - 2015 March 2015 Total Employment by State, Class of Employer and Last Railroad Employer Calendar Year 2013 The attached table shows total employment by State, class of employer and last railroad employer in the year. Total employment includes all employees covered by the Railroad Retirement and Railroad Unemployment Insurance Acts who worked at least one day during calendar year 2013. For employees shown under Unknown for State, either no address is on file (2.0 percent of all employees) or the employee has a foreign address such as Canada (0.2 percent). TOTAL EMPLOYMENT BY STATE, CLASS OF EMPLOYER AND LAST RAILROAD EMPLOYER CALENDAR YEAR 2013 CLASS OF 1 STATE EMPLOYER RAILROAD EMPLOYER NUMBER Unknown 1 BNSF RAILWAY COMPANY 1,803 Unknown 1 CSX TRANSPORTATION INC 1,889 Unknown 1 DAKOTA MINNESOTA & EASTERN RAILROAD CORPORATION 2 Unknown 1 ILLINOIS CENTRAL RR CO 12 Unknown 1 NATIONAL RAILROAD PASSENGER CORP (AMTRAK) 532 Unknown 1 NORFOLK SOUTHERN CORPORATION 12 Unknown 1 SOO LINE RAILROAD COMPANY 3 Unknown 1 UNION PACIFIC RAILROAD COMPANY 2 Unknown 2 CANADIAN PACIFIC RAILWAY COMPANY 152 Unknown 2 FLORIDA EAST COAST RAILWAY, LLC 47 Unknown 2 IOWA INTERSTATE RAILROAD LTD 44 Unknown 2 MONTANA RAIL LINK INC 1 Unknown 2 SPRINGFIELD TERMINAL RY CO VERMONT 21 Unknown 3 ARCELORMITTAL CLEVELAND WORKS RAILWAY, INC 9 Unknown 3 ARCELORMITTAL SOUTH CHICAGO & INDIANA HARBOR RAILWAY, INC 4 Unknown 3 BELT RAILWAY COMPANY OF CHICAGO 8 Unknown 3 BOMBARDIER TRANSPORTATION SERVICES USA CORPORTATION 7 Unknown 3 CANADIAN NATIONAL RAILWAY INC - NOYES DIVISION 438 Unknown 3 CHICAGO TERMINAL RAILROAD COMPANY 34 Unknown 3 CLOQUET TERMINAL RAILROAD COMPANY INC 10 Unknown 3 COAST BELLE RAIL, LLC 4 Unknown 3 COLORADO AND WYOMING RAILWAY COMPANY 8 Unknown 3 CONSOLIDATED RAIL CORPORATION 1 Unknown 3 COPPER BASIN RY INC 6 Unknown 3 DAKOTA MISSOURI VALLEY & WESTERN RR INC 6 Unknown 3 DELTA SOUTHERN RAILROAD, INC. -

Arizona State Rail Plan Update Draft Plan

ARIZONA STATE RAIL PLAN UPDATE DRAFT PLAN FEBRUARY 2021 Arizona State Rail Plan Draft Executive Summary February 2021 Executive Summary INTRODUCTION The purpose of the Arizona State Rail Plan (SRP) is to guide the advancement of the state’s rail system. The SRP provides a current assessment of the rail system and serves as a practical roadmap for future rail investment and policies in Arizona. The SRP is structured as follows. Chapter/Title Description of Content Executive Summary 1. The Role of Describes the role of rail within the State’s Rail in transportation system and how Arizona Statewide state and local government entities are Transportation organized to support rail development. 2. The State’s Describes the Arizona rail system, its Existing Rail current condition, and environmental and System economic impacts on the State. Identifies past and future trends that have impacted or will impact the Arizona rail system. 3. Proposed Identifies passenger rail service needs and Passenger Rail opportunities. Describes improvements and Improvements investments that have been put forward to and address passenger rail service needs and Investments opportunities. 4. Proposed Identifies freight rail service needs and Freight Rail opportunities. Describes improvements and Improvements investments that have been put forward to and address freight rail service needs and Investments opportunities. 5. The State’s Presents ADOT’s vision for railroad Rail Service transportation, projects and strategies to and meet that vision, summary of impacts that Investment would result from the projects and Program strategies, and a discussion of probable financing scenarios. 6. Coordination Descriptions of outreach and coordination and Review efforts in developing the SRP. -

Railroads of Arizona (2002) Includes Abandoned Lines & Historical Line Surveys

Railroads of Arizona (2002) Includes Abandoned Lines & Historical Line Surveys Black Mesa Mine Loadout Mead Lake Las Vegas Generating Black Mesa Mine Station Boulder City P&M Mine Searchlight Peach Springs Chloride Seligman Darling / Winona Ash Fork Coronado Jct. Camp Navajo Clarkdale Proposed Fence Lake Mine Skull Extension Lake Mary Valley SRP/BNSF (2005) Mayer Snowflake Poland Coronado Rice Tepco 1910-1915 Mogollon Rim Congress Crown King Prescott & Phoenix Swansea Shortline Railroad / SPRR Survey McNary Springerville 1895-1905 Black Canyon Arizona Mineral City Belt Railroad White Mountain Survey Scenic Railroad Aguila Roosevelt Lake 1964-1976 Glendale Blythe Palo Verde NGS Inspiration Mine Mesa Ripley Buckeye Superior Globe Ray Mine 1920-1923 Out Of Service Southern Pacific Hayden Morenci Mine Since 1997 Survey 1880 Maricopa Coolidge Southern Pacific Roll Survey Duncan 1905 – 1915 EP&SW Survey 1880 San Southern Manuel Pacific Survey Bowie New Cornelia Mine Patagonia (ROCKY POINT) Bisbee 2002 Naco Map by Marc Pearsall – 2002 – Use Permission Granted Railroads of Arizona (2002) LEGEND: Includes Abandoned Lines & Historical Line Surveys Compiled by Marc Pearsall ± 2002 - Use Permission Granted Union Pacific Railroad Burlington Northern Santa Fe Railway Arizona & California Railroad (Rail America Corp) Arizona Eastern Railroad (Rail America Corp) Grand Canyon Railway San Pedro & Southwestern Railroad (Rail America Corp) Copper Basin Railway (Rail Management Corp) Black Mesa & Lake Powell Railroad (Navajo Nation / Salt River Project)