24 May 2018 4:00 P.M

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 1: Rank of China's 338 Prefecture-Level Cities

Appendix 1: Rank of China’s 338 Prefecture-Level Cities © The Author(s) 2018 149 Y. Zheng, K. Deng, State Failure and Distorted Urbanisation in Post-Mao’s China, 1993–2012, Palgrave Studies in Economic History, https://doi.org/10.1007/978-3-319-92168-6 150 First-tier cities (4) Beijing Shanghai Guangzhou Shenzhen First-tier cities-to-be (15) Chengdu Hangzhou Wuhan Nanjing Chongqing Tianjin Suzhou苏州 Appendix Rank 1: of China’s 338 Prefecture-Level Cities Xi’an Changsha Shenyang Qingdao Zhengzhou Dalian Dongguan Ningbo Second-tier cities (30) Xiamen Fuzhou福州 Wuxi Hefei Kunming Harbin Jinan Foshan Changchun Wenzhou Shijiazhuang Nanning Changzhou Quanzhou Nanchang Guiyang Taiyuan Jinhua Zhuhai Huizhou Xuzhou Yantai Jiaxing Nantong Urumqi Shaoxing Zhongshan Taizhou Lanzhou Haikou Third-tier cities (70) Weifang Baoding Zhenjiang Yangzhou Guilin Tangshan Sanya Huhehot Langfang Luoyang Weihai Yangcheng Linyi Jiangmen Taizhou Zhangzhou Handan Jining Wuhu Zibo Yinchuan Liuzhou Mianyang Zhanjiang Anshan Huzhou Shantou Nanping Ganzhou Daqing Yichang Baotou Xianyang Qinhuangdao Lianyungang Zhuzhou Putian Jilin Huai’an Zhaoqing Ningde Hengyang Dandong Lijiang Jieyang Sanming Zhoushan Xiaogan Qiqihar Jiujiang Longyan Cangzhou Fushun Xiangyang Shangrao Yingkou Bengbu Lishui Yueyang Qingyuan Jingzhou Taian Quzhou Panjin Dongying Nanyang Ma’anshan Nanchong Xining Yanbian prefecture Fourth-tier cities (90) Leshan Xiangtan Zunyi Suqian Xinxiang Xinyang Chuzhou Jinzhou Chaozhou Huanggang Kaifeng Deyang Dezhou Meizhou Ordos Xingtai Maoming Jingdezhen Shaoguan -

Country Profile

Country profile COUNTRY FACTS China Capital Beijing Habitat for Humanity in China Main country facts Gained Habitat for Humanity China began operating in Yunnan province in independence 2002 and opened offices in neighboring Guangdong and Guangxi in 1949 provinces in 2004. Habitat provides simple, decent homes to low- income rural families in these regions. Chengdu, the Population Over 1.37 billion provincial capital of Sichuan, is the location of an office which was started to coordinate rebuilding work after the devastating Urbanization 57.9 percent May 2008 earthquake. In 2009, Habitat opened an office in the live in cities financial hub of Shanghai to raise awareness and create partnerships in the Yangzi delta area. Life expectancy 75.7 years The housing need in China Unemployment 4 percent China has an impressive record in reducing poverty. According to rate official data, the world’s most populous country lifted more than 790 million people out of poverty between 1981 and 2012. Rapid Population living 3.3 percent growth and urbanization and economic reforms have been central below poverty line to China’s poverty reduction in the past few decades. By 2020, six in 10 persons living in China will be urban dwellers. However, ------------------------------------------------------ inequality has increased and poverty has become concentrated in Source: World Factbook rural and minority areas, according to the World Bank. There are more than 70 million rural Chinese still living below the country’s poverty line of 2,300 yuan (over US$360) in annual income. Many HABITAT FACTS of the poor lack access to affordable housing, shut out by soaring land and house prices, and the inadequate supply of low-cost accommodation. -

Impact Stories from the People's Republic of China: Partnership For

Impact Stories from the People’s Republic of China Partnership for Prosperity Contents 2 Introduction Bridges Bring Boom 4 By Ian Gill The phenomenal 20% growth rate of Shanghai’s Pudong area is linked to new infrastructure— and plans exist to build a lot more. Road to Prosperity 8 By Ian Gill A four-lane highway makes traveling faster, cheaper, and safer—and brings new economic opportunities. On the Right Track 12 By Ian Gill A new railway and supporting roads have become a lifeline for one of the PRC’s poorest regions. Pioneering Project 16 By Ian Gill A model build–operate–transfer water project passes its crucial first test as the PRC encourages foreign-financed deals. Reviving a Historic Waterway 20 By Ian Gill Once smelly and black with pollution, a “grandmother” river is revived in Shanghai. From Waste to Energy 24 By Lei Kan Technology that can turn animal waste into gas is changing daily life for the better in rural PRC. From Pollution to Solution 28 By Lei Kan A project that captures and uses methane that would otherwise be released into the atmosphere during the mining process is set to become a model for thousands of coal mines across the PRC. Saving Sanjiang Wetlands 35 By Lei Kan A massive ecological preservation project is fighting to preserve the Sanjiang Plain wetlands, home to some of the richest biodiversity in the PRC . From Clean Water to Green Energy 38 By Lei Kan Two new hydropower plants in northwest PRC are providing clean, efficient energy to rural farming and herding families. -

Guanzhou-Kunming-Chengdu Optical Fiber Cable Construction Project 5

5 China Guanzhou-Kunming-Chengdu Optical Fiber Cable Construction Project A marker pole where optic cables were laid by this project (Sichuan Province) Outline of Loan Agreement Loan Amount / 5,349 million yen / 3,819 million yen Disbursed Amount Loan Agreement December 1996 Terms &Conditions Interest rate 2.3% p.a. Repayment period 30 years (Grace period 10 years) Final Disbursement June 2002 Date Project Outline Long-distance optic transmission network extending over Guangdong Province, Guangxi Zhuangzu Autonomous Region, Yunnan Province and Sichuan Province was con- structed, to accommodate the growing communication demand in these regions, as well as to improve the invest- ment environment in inland regions with a view to pro- moting economic development. Results and Evaluation Through this project, fiber optic cables (total length: 4,174km) and transmission facilities were constructed in three provinces and one ward, the total long distance switch capacity that was 770,000 lines in 1995 significant- ly grew to 1.6 million lines by 2001. Moreover, the num- ber of long-distance calls handled in the targeted regions, including mobile phones was estimated to be 14.6 billion (96% of the plan) in actual results of 2000. This project has provided a high quality communications service to a larger number of people than before through optic cables. In regard to the improvement of an environment suitable for investment in the targeted regions, it is generally rec- ognized that correlation exists between the conditions of communication infrastructures and expansion of invest- ments and economic development, and it is believed that this project has made some contributions toward industrial development, though there have been effects by third fac- tors outside the project. -

China Mortgage Rates Declined for Sixth Consecutive Month

Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute: China Mortgage Rates Declined For Sixth Consecutive Month Key Points ⚫ Mortgage rates have declined for sixth consecutive months, reaching its lowest level since 2018. ⚫ Mortgage rate adjustments among different cities vary greatly. While the mortgage rates have been slightly reduced in all first-tier cities, the situation in second-tier cities are different from one to another. ⚫ Beijing and Guangzhou were off the top 10 list of lowest mortgage rates, while Urumqi, Shenyang and Kunming joined in. ⚫ The downward trend of mortgage rates is coming to an end and in cities with a hot housing market, it may even start to rise. ⚫ The price of the real estate market remains stable. Mortgage Rates Have Declined For Sixth Consecutive Month, Reaching The Lowest Level Since 2018 The Trend of Average Mortgage Rate for First-home Loans in China Since 2018 6.50% 6.00% 5.60% 5.48% 5.43% 5.42% 5.50% 4.90% 5.00% 4.50% benchmark lending rate First home mortgage rate The Trend of Average Mortgage Rate for Second-home Loans in China Since 2018 7.00% 6.50% 5.96% 5.76% 5.81% 6.00% 5.74% 5.50% 4.90% 5.00% 4.50% benchmark lending rate The mortgage rate for second homes According to data analytics by Rong360 Jianpu Technology Inc.’s (NYSE: JT) Big Data Research Institute, the average mortgage rate for first-home loans in China was 5.42%, which is declined by 1.09%(6 basis point). The average mortgage rate for the second-home loan was 5.74%, which is 8 basis point lower than that of the previous month. -

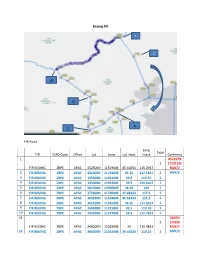

Shanghai FIR

Beijing FIR 1 2 19 15 8 11 FIR Point Long Type FIR ICAO Code Office Lat Long Lat Input Input Comment 1 452317N 1 1152115E FIR BEIJING ZBPE APAC 452500N 1151900E 45.40054 115.2947 RAN/2 2 FIR BEIJING ZBPE APAC 431500N 1173100E 43.25 117.5167 1 RAN/2 3 FIR BEIJING ZBPE APAC 395400N 1192100E 39.9 119.35 1 4 FIR BEIJING ZBPE APAC 393000N 1195200E 39.5 119.8667 1 5 FIR BEIJING ZBPE APAC 381500N 1200000E 38.25 120 1 6 FIR BEIJING ZBPE APAC 372900N 1173000E 37.48333 117.5 1 7 FIR BEIJING ZBPE APAC 363200N 1151800E 36.53333 115.3 1 8 FIR BEIJING ZBPE APAC 362100N 1145500E 36.35 114.9167 1 9 FIR BEIJING ZBPE APAC 360600N 1142100E 36.1 114.35 1 10 FIR BEIJING ZBPE APAC 345400N 1124700E 34.9 112.7833 1 11 3405N 1 11029E FIR BEIJING ZBPE APAC 340000N 1102900E 34 110.4833 RAN/2 12 FIR BEIJING ZBPE APAC 343200N 1101500E 34.53333 110.25 1 RAN/2 13 FIR BEIJING ZBPE APAC 353200N 1101800E 35.53333 110.3 1 14 FIR BEIJING ZBPE APAC 372800N 1104400E 37.46667 110.7333 1 15 FIR BEIJING ZBPE APAC 382200N 1103600E 38.36666 110.6 1 16 FIR BEIJING ZBPE APAC 384400N 1094100E 38.73333 109.6833 1 17 FIR BEIJING ZBPE APAC 402000N 1070100E 40.33333 107.0167 1 18 FIR BEIJING ZBPE APAC 404300N 1055500E 40.71667 105.9167 1 19 414451N 1 1051345E FIR BEIJING ZBPE APAC 414400N 1051300E 41.74361 105.218 RAN/2 Along political boundary to (1) Note: 1. -

7. CET-Kunming

7. CET-Kunming a. Ken Tanaka, Summer 2019 Final Report Introduction A good amount of Yalies on the Light Fellowship probably won't consider studying in Kunming. Some might not even know that Kunming exists. Others might think that Kunming, a city with a measly population of 6.2 million in far-off Yunnan province, isn't as fun to spend the summer at in comparison to glitzy Shanghai or iconic Beijing. Yet some more students might automatically choose a program like HBA - after all, HBA is abound with Yale students, and who wouldn't want to spend some time in China with people you already know from school? If you don't consider Kunming as a potential place to study at, I'm going to keep it real with you and say that you're making a big mistake. Choosing to study Chinese through CET-Kunming has been one of the greatest experiences of my college time, and I believe that CET-Kunming, while perhaps not as renown as PiB, HBA, or ICLP, is truly a hidden gem. My name is Ken Tanaka, and I'm a current junior (class of 2021) majoring in Global Affairs. I took a year of Chinese my junior year of high school (equivalent to L1 here), and then took CHNS120, CHNS 130, and CHNS140 my freshman spring through my sophomore spring. As I was not a freshman when considering studying abroad in China, I will admit that I was a little bit hesitant at first when considering study abroad - after all, many of my peers were applying for internships. -

The Kunming-Vientiane Railway: the Economic, Procurement, Labor, and Safeguards Dimensions of a Chinese Belt and Road Project

The Kunming-Vientiane Railway: The Economic, Procurement, Labor, and Safeguards Dimensions of a Chinese Belt and Road Project Scott Morris Abstract The Kunming-Vientiane (K-V) railway, part of the Kunming-Singapore multi-country rail network (or “Pan-Asia Railway”), is an anchor investment of the Chinese government’s Belt and Road initiative (BRI). This case study will assess the rail project along four dimensions: economic implications; procurement arrangements; labor; and environmental and social safeguards. In each of these areas, evidence from the railway project suggests that Chinese policy and practice could be better aligned with the practices of other sources of multilateral and bilateral development finance. Where the project’s standards are broadly aligned, at least in principle, there is nonetheless reason to believe that China’s approach carries heightened risks given the overall scale of financing. These risks hold for China’s global program of official finance, which has made the country the largest source of official credit in the world. In this regard, BRI policymakers should consider a more rigorous set of “best practices” that align Chinese official finance with leading multilateral standards, even if these practices don’t currently characterize many other Center for Global Development bilateral lenders. Such an approach would be consistent with the multilateral vision for BRI 2055 L Street NW espoused by Chinese officials and reflected in the framework of the annual Belt and Road Fifth Floor Forum for International Cooperation. This study considers what a stronger set of standards Washington DC 20036 would look like in the context of the four areas of focus. -

The History of Gyalthang Under Chinese Rule: Memory, Identity, and Contested Control in a Tibetan Region of Northwest Yunnan

THE HISTORY OF GYALTHANG UNDER CHINESE RULE: MEMORY, IDENTITY, AND CONTESTED CONTROL IN A TIBETAN REGION OF NORTHWEST YUNNAN Dá!a Pejchar Mortensen A dissertation submitted to the faculty at the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of History. Chapel Hill 2016 Approved by: Michael Tsin Michelle T. King Ralph A. Litzinger W. Miles Fletcher Donald M. Reid © 2016 Dá!a Pejchar Mortensen ALL RIGHTS RESERVED ii! ! ABSTRACT Dá!a Pejchar Mortensen: The History of Gyalthang Under Chinese Rule: Memory, Identity, and Contested Control in a Tibetan Region of Northwest Yunnan (Under the direction of Michael Tsin) This dissertation analyzes how the Chinese Communist Party attempted to politically, economically, and culturally integrate Gyalthang (Zhongdian/Shangri-la), a predominately ethnically Tibetan county in Yunnan Province, into the People’s Republic of China. Drawing from county and prefectural gazetteers, unpublished Party histories of the area, and interviews conducted with Gyalthang residents, this study argues that Tibetans participated in Communist Party campaigns in Gyalthang in the 1950s and 1960s for a variety of ideological, social, and personal reasons. The ways that Tibetans responded to revolutionary activists’ calls for political action shed light on the difficult decisions they made under particularly complex and coercive conditions. Political calculations, revolutionary ideology, youthful enthusiasm, fear, and mob mentality all played roles in motivating Tibetan participants in Mao-era campaigns. The diversity of these Tibetan experiences and the extent of local involvement in state-sponsored attacks on religious leaders and institutions in Gyalthang during the Cultural Revolution have been largely left out of the historiographical record. -

Studies on Ethnic Groups in China

Kolas&Thowsen, Margins 1/4/05 4:10 PM Page i studies on ethnic groups in china Stevan Harrell, Editor Kolas&Thowsen, Margins 1/4/05 4:10 PM Page ii studies on ethnic groups in china Cultural Encounters on China’s Ethnic Frontiers Edited by Stevan Harrell Guest People: Hakka Identity in China and Abroad Edited by Nicole Constable Familiar Strangers: A History of Muslims in Northwest China Jonathan N. Lipman Lessons in Being Chinese: Minority Education and Ethnic Identity in Southwest China Mette Halskov Hansen Manchus and Han: Ethnic Relations and Political Power in Late Qing and Early Republican China, 1861–1928 Edward J. M. Rhoads Ways of Being Ethnic in Southwest China Stevan Harrell Governing China’s Multiethnic Frontiers Edited by Morris Rossabi On the Margins of Tibet: Cultural Survival on the Sino-Tibetan Frontier Åshild Kolås and Monika P. Thowsen Kolas&Thowsen, Margins 1/4/05 4:10 PM Page iii ON THE MARGINS OF TIBET Cultural Survival on the Sino-Tibetan Frontier Åshild Kolås and Monika P. Thowsen UNIVERSITY OF WASHINGTON PRESS Seattle and London Kolas&Thowsen, Margins 1/7/05 12:47 PM Page iv this publication was supported in part by the donald r. ellegood international publications endowment. Copyright © 2005 by the University of Washington Press Printed in United States of America Designed by Pamela Canell 12 11 10 09 08 07 06 05 5 4 3 2 1 All rights reserved. No part of this publication may be repro- duced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any infor- mation storage or retrieval system, without permission in writ- ing from the publisher. -

History, Distribution, and Potential of the Olive Industry in China: a Review

sustainability Review History, Distribution, and Potential of the Olive Industry in China: A Review ChunJiang Su 1, Junfeng Sun 2,3,* ID , Wanze Zhu 2 and Li Peng 1 ID 1 Institute of Mountain Hazards and Environment, Chinese Academy of Sciences, # 9, Block 4, Renminnan Road, Chengdu 610041, China; [email protected] (C.S.), [email protected] (L.P.) 2 University of Chinese Academy of Sciences, #19A Yuquan Road, Beijing 100049, China; [email protected] 3 School of Tourism, History, and Culture, South West Minzu University, # 16, South Section, 1st Ring Road, Chengdu 610041, China * Correspondence: [email protected]; Tel.: +86-28-8522-5378 Received: 7 April 2018; Accepted: 2 May 2018; Published: 4 May 2018 Abstract: China, as a non-Mediterranean country with non-Mediterranean climate, is taking olive cultivation as an important part of its agricultural development. In order to highlight some important facts about the history, status, distribution, and trends of the olive industry in China, we performed analyses based on Internet databases, online GIS software, and scientific papers. Results show that the olive industries have been concentrated in several key areas in Gansu, Sichuan, Yunnan, Chongqing, and Hubei. However, the business scope of olive enterprises is still narrow, the scale of enterprises is generally small, and individual or family management of farmers plays an important role. Thus, increased investment and policies are needed to enhance their capacities of R&D and production, and Chinese investigators should carry out socio-economic studies at the microcosmic level and take the initiative to innovate the products by cooperating with people in the same professions worldwide. -

Exploring the Ethnic Art & Culture of Yunnan Province

Exploring the Ethnic Art & Culture of Yunnan Province And Kicking Off the Inaugural Denver-Kunming Sister Cities Art Exchange in Kunming A Denver Sister Cities tour supporting the first Denver-Kunming Art Exchange and focusing on traditional minority group arts such as weaving, dying, ceramics and painting in the exotic areas of Kunming, Dali, Xizhou and Shaxi 12 Days / 10 Nights October 30–November 10, 2018 Optional Beijing Add-on Tour Also Available Tour Program Summary Yunnan Province, located in Southwest China, stands distinctly apart from other regions of China. Within this single province—unmatched in the complexity and scope of its history, landscape and peoples—you will find a mix of geography, climates and nationalities that elsewhere it would take an entire continent to express. Yunnan, which translates to “South of the Clouds,” was traversed by the fabled Tea Horse Road, an important trading network that rivaled the importance of the Silk Road. Home to almost half of China's 54 minority groups, Yunnan offers a wide range of traditional culture, arts and dress. This trip coincides with the inaugural Denver-Kunming Art Exchange which kicks off November 2, 2018, with an opening reception at a Kunming gallery. The exhibit’s theme of “Women Artists of the American West” will feature acrylic paintings by women artists from the Denver-Boulder Metro area. Artists from Kunming will exhibit in Denver the following year. Beginning with several days exploring beautiful, cosmopolitan Kunming (the “City of Eternal Spring”) and enjoying the Art Exchange festivities, this guided 12-day trip will take you to several cities and towns in Yunnan, including the ancient independent Kingdom of Dali and the magical Shaxi and Xizhou towns.