ANNELIES ILENA Upon Arrival in the Port of Ijmuiden Last Friday – Photo : Piet Sinke (C)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

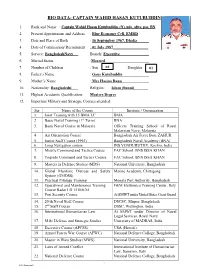

Bio Data- Captain Wahid Hasan Kutubuddin

BIO DATA- CAPTAIN WAHID HASAN KUTUBUDDIN 1. Rank and Name : Captain Wahid Hasan Kutubuddin, (N), ndc, afwc, psc, BN 2. Present Appointment and Address : Blue Economy Cell, EMRD 3. Date and Place of Birth : 16 September 1967, Dhaka 4. Date of Commission/ Recruitment : 01 July 1987__________________ 5. Service: BangladeshNavy Branch: Executive 6. Marital Status :Married 7. Number of Children : Son 02 Daughter 01 8. Father’s Name : Gaus Kutubuddin 9. Mother’s Name : Mrs Hasina Banu 10. Nationality: Bangladeshi Religion: ___Islam (Sunni)_______ 11. Highest Academic Qualification: Masters Degree 12. Important Military and Strategic Courses attended: Ser Name of the Course Institute / Organization 1. Joint Training with 15 BMA LC BMA 2. Basic Naval Training (1st Term) BNA 3. Basic Naval Course in Malaysia Officers Training School of Royal Malaysian Navy, Malaysia 4. Air Orientation Course Bangladesh Air Force Base ZAHUR 5. Junior Staff Course (1992) Bangladesh Naval Academy (BNA) 6. Long Navigation course INS VENDURUTHY, Kochin, India 7. Missile Command and Tactics Course FAC School, BNS ISSA KHAN 8. Torpedo Command and Tactics Course FAC School, BNS ISSA KHAN 9. Masters in Defence Studies (MDS) National University, Bangladesh 10. Global Maritime Distress and Safety Marine Academy, Chittagong System (GMDSS) 11. Practical Pilotage Training Mongla Port Authority, Bangladesh 12. Operational and Maintenance Training GEM Elettronica Training Center, Italy Course Radar LD 1510/6/M 13. Port Security Course At SMWT under United States Coast Guard 14. 20 th Naval Staff Course DSCSC, Mirpur, Bangladesh 15. 2nd Staff Course DSSC, Wellington, India 16. International Humanitarian Law At SMWT under Director of Naval Legal Services, Royal Navy 17. -

A Professional Journal of National Defence College Volume 16

A Professional Journal of National Defence College Volume 16 Number 1 June 2017 National Defence College Bangladesh EDITORIAL BOARD Chief Patron Lieutenant General Chowdhury Hasan Sarwardy, BB, SBP, BSP, ndc, psc, PhD Editor-in-Chief Air Vice Marshal M Sanaul Huq, GUP, ndc, psc, GD(P) Editor Colonel A K M Fazlur Rahman, afwc, psc Associate Editors Group Captain Md Mustafizur Rahman, GUP, afwc, psc, GD(P) Lieutenant Colonel A N M Foyezur Rahman, psc, Engrs Assistant Editors Lecturer Farhana Binte Aziz Assistant Director Md Nazrul Islam ISSN: 1683-8475 All rights reserved. No part of this publication may be reproduced, stored in retrieval system, or transmitted in any form, or by any means, electrical, photocopying, recording, or otherwise, without the prior permission of the publisher. Published by the National Defence College, Bangladesh Design & Printed by : ORNATE CARE 87, Mariam Villah (2nd floor), Nayapaltan, Dhaka-1000, Bangladesh Cell: 01911546613, E mail: [email protected] DISCLAIMER The analysis, opinions and conclusions expressed or implied in this Journal are those of the authors and do not necessarily represent the views of the NDC, Bangladesh Armed Forces or any other agencies of Bangladesh Government. Statement, fact or opinion appearing in NDC Journal are solely those of the authors and do not imply endorsement by the editors or publisher. III CONTENTS Page College Governing Body vi Vision, Mission and Objectives of the College vii Foreword viii Editorial ix Faculty and Staff x Abstracts xi Population of Bangladesh: Impact -

Brings the Latest Technology and Capabilities to the 7Th Fleet

SURFACE SITREP Page 1 P PPPPPPPPP PPPPPPPPPPP PP PPP PPPPPPP PPPP PPPPPPPPPP Volume XXXI, Number 2 August 2015 “Rebalance” Brings the Latest Technology and Capabilities to the 7th Fleet An Interview with RDML Charlie Williams, USN Commander, Logistics Group Western Pacific / Commander, Task Force 74 (CTF 73) / Singapore Area Coordinator Conducted by CAPT Edward Lundquist, USN (Ret) What’s important about the Asia-Pacific area of operations (AOR), country we tailor what we bring in CARAT to the needs and capacity and how does your command fit into the “rebalance” to the Pa- of our partners. Here in Singapore, CARAT Singapore is a robust cific, or the so-called “Pacific Pivot.” varsity-level exercise. It typically features live-fire, surface-to-air Looking strategically at the AOR, the Indo-Asia-Pacific region is on missiles and ASW torpedo exercises and we benefit and gain great the rise; it’s become the nexus of the global economy. Almost 60 value from these engagements. With other CARAT partner na- percent of the world’s GDP comes from the Indo-Asia-Pacific na- tions, we focus our training on maritime interdiction operations, or tions, amounting to almost half of global trade, and most of that humanitarian assistance and disaster response, and make it more commerce runs through the vital shipping lanes of this region. applicable to the country’s needs and desires. Another exercise that compliments CARAT, yet Moreover, more than 60 with a very different focus, is percent of the world’s SEACAT (Southeast Asia Co- population lives in the operation And Training). -

Full Page Photo

Jack Hunter From: Carl Grossman <[email protected]> Sent: Friday, September 14, 2012 6:20 AM To: Jack Hunter Subject: Re: JARVIS Stories On Thu, Sep 13, 2012 at 1:31 PM, Jack Hunter <[email protected]> wrote: This is your chance to share the history with the CO. Jack: Here is a Jarvis story: We were out in Guam on a West Pac. The Captain and about 15 to 20 of the crew had to go to Honolulu for a drug trial, for a drug bust we made on our previous patrol. (Another interesting story). The last thing the Captain told the XO get the ship underway tomorrow and take the Jarvis to Midway and we will meet you there. Simple enough order. Shortly after getting underway, the Exxon Valdez ran aground. The cutter (forgot which one) that was doing a North Pac fishing law enforcement patrol was diverted to be On-Seen-Commander. Meanwhile Jarvis was diverted to finish the fishery patrol leaving the Captain and others Stranded in Honolulu. Luckily they did not head to Midway before the diversion. The QM's scrambled to get our Alaskan charts up to date, as well as the rest of the ship getting ready for cold Alaska not the warm waters of the tropical Pacific. Ten days later, the Captain and crew met up with the ship in Adak, The Captain said to the XO "Can I have my ship back." An interesting highlight was the Jewish personnel prepared A Passover Seder. About 15 people Jewish and Non-Jewish attended the event. -

Car Loan Final List of Officer by LPR Seniority.Xlsx

RESTRICTED LIST OF OFFICERS LT CDR & ABOVE ( SENIORITY AS PER DATE OF RETIREMENT Wef-27 JULY 2020) Ser Rank & Name P No Billet / Appointment Age Limit 1 Lt Cdr M Golam Farooq, (SD)(R), BN 1563 BNS HAJI MOHSIN / EO 8/1/2020 2 Cdre Mohammad Rashed Ali, (TAS), NGP, ndc, psc, BN 535 BNS HAJI MOHSIN / CHINA FRIGATE (TYPE 053H3) / Proj Offr&Overall IC 25-08-2020 3 Cdre Syed Maksumul Hakim, (ND), BSP, ndc, ncc, psc, BN 464 BNS HAJI MOHSIN / Embassy of Bangladesh / Defense Advisor-Sri Lanka 27-08-2020 4 Cdre Mohammed Jahangir Alam, (E), NUP, ndc, psc, BN 465 BNS HAJI MOHSIN / Payra Port Authority / Chairman-PPA 18-09-2020 5 Cdre Mohammad Monirul Islam, (S), OSP, PCGMS, psc, BN 513 BNS HAJI MOHSIN / Defense and Strategic Studies Course, China 29-09-2020 6 Cdr Mohammad Shahed Karim, (C), BN 780 BNS HAJI MOHSIN / Embassy of Bangladesh / Asst Defense Attache-China 10/25/2020 7 Lt Cdr G Uttam Kumar, (SD)(R), BN 1722 BNS TITUMIR / MTO 10/30/2020 8 Cdre Abu Mohammad Quamrul Huq, (ND), NGP, ndc, afwc, psc, BN 473 BNS HAJI MOHSIN / Bangabandhu Sheikh Mujibur Rahman Maritime University / Treasurer 01-12-2020 9 Cdre Sheikh Mahmudul Hassan, (H), NPP, aowc, psc, BN 539 BNS ISSA KHAN / CHO & BNHOC / Chief Hydrographer 31-12-2020 10 Capt Masuq Hassan Ahmed, (G), PPM, psc, BN 590 BNS ISSA KHAN / Marine Fisheries Academy / Principal 31-12-2020 11 Instr Cdr Sharif Mostafa Shamim, (G), BN 1372 BNS HAJI MOHSIN / NHQ/DNAI&S / Additional 01-01-2021 12 Cdr Mohammad Ismail, (S), BN 787 BNS SHEIKH MUJIB / ADMIN DHAKA / Principal- Anchorage 04-01-2021 13 Lt Cdr Ferdous -

Canara Bank Po & Esic Sso Mains Capsule

aa Is Now In CHENNAI | MADURAI | TRICHY | SALEM | COIMBATORE | CHANDIGARH | BANGALORE |ERODE | NAMAKKAL | PUDUCHERRY |THANJAVUR |TRIVANDRUM | ERNAKULAM |TIRUNELVELI |VELLORE | www.raceinstitute.in | www.bankersdaily.in CANARA BANK PO & ESIC SSO MAINS CAPSULE Exclusively prepared for RACE students Chennai: #1, South Usman Road, T Nagar. | Madurai: #24/21, Near MapillaiVinayagar Theatre, Kalavasal. | Trichy: opp BSNL office, Juman Center, 43 Promenade Road, Cantonment. | Salem: #209, Sonia Plaza / Muthu Complex, Junction Main Rd, State Bank Colony, Salem. | Coimbatore #545, 1st floor, Adjacent to SBI (DB Road Branch),DiwanBahadur Road, RS Puram, Coimbatore| Chandigarh| Bangalore|Erode |Namakkal |Puducherry |Thanjavur| Trivandrum| Ernakulam|Tirunelveli | Vellore | H.O: 7601808080 / 9043303030 | www.raceinstitute.in Chennai RACE Coaching Institute Pvt Ltd CANARA & ESIC MANINS CAPSULE S.NO TOPICS PAGE NO 1. BANKING & BUSINESS 1 2. RANKING & INDEXES TAKEN BY VARIOUS ORGANISATIONS 27 3. NATIONAL NEWS 39 4. NATIONAL SUMMITS 76 5. STATES IN NEWS 88 6. INTERNATIONAL NEWS 115 7. LIST OF AGREEMENTS / MOU’S SIGNED BY 130 INDIA WITH VARIOUS COUNTRIES 8. INTERNATIONAL SUMMITS 137 9. APPOINTMENTS IN NATIONAL & INTERNATIONAL 146 10. AWARDS & HONOURS 163 R.A.C.E 11. LIST OF VARIOUS COMMITTEES AND ITS HEAD 189 12. LOAN SANCTIONED BY NATIONAL AND INTERNATIONAL BANK 195 (APRIL – NOVEMBER 2018) 13. MILITARY, AIR, NAVY EXERCISES CONDUCTED BY 198 VARIOUS COUNTRIES 14. SPORTS NEWS 200 15. BOOKS AND AUTHORS 243 16. IMPORTANT EVENTS OF THE DAYS 246 17. OBITUARY -

SPECIAL ISSUE Ratheon II/2016 II/2016

II/2016 1610 SPECIAL ISSUE Ratheon II/2016 II/2016 40 “Indian Army in Full 70 The IONS : 92 The Inseparable Readiness” future outlook Twins 1610 SPECIAL ISSUE Cover : US Army soldier at Ranikhet during Air Marshal Brijesh D Jayal urges a Exercise Yudh Abhyas 2014 (photo: Angad Singh) robust defence industry and modern defence management so as to meet Admiral Arun Prakash, addressing the the cherished goal of self reliance, as Indian Ocean Naval Symposium at articulated by Indian policy makers Dhaka, focused on growing importance EDITORIAL PANEL since independence of the country. of the Indian Ocean, its unifying factor, MANAGING EDITOR In his interview, Chief of the Army potential ‘hotspots’, sea power and Vikramjit Singh Chopra Staff General Dalbir Singh, reviews economies and the future outlook for The World of UAVs the Army’s achievements and various IONS. This is an extract from his talk. 96 EDITORIAL ADVISOR initiatives taken for enhancing the Admiral Arun Prakash capability of the Indian Army. As the COAS said during Army Day, “The 78 ‘Submersible EDITORIAL PANEL Indian Army has the capability to Destroyers’ : 110 Pushpindar Singh undertake any action if it is aimed years of Russia’s at protecting the interests of the Air Marshal Brijesh Jayal submarine prowess Dr. Manoj Joshi country”. Lt. Gen. Kamal Davar Compiled from various reports on Lt. Gen. BS Pawar 51 Indian Army Aviation : the global UAV market, this sector is Air Marshal M. Matheswaran Arm of the Future ? estimated as reaching $7 billion in 2015 with steady growth forecast over the Gp Capt JC Malik next years. -

IONS Guidelines for HADR Version 3.1

IONS Guidelines for HADR Version 3.1 (December 2017) Document Disclaimer This document suggests working guidelines for conduct of HADR operations as part of the IONS in the IOR. The ground level operating procedures would be based on the situation, ROEs and directions promulgated by the MNF Coordinator in consultation with the host country. This publication is promulgated on the terms and understanding that the content remains dynamic and lessons learnt will continuously be incorporated. The reader may contact the IONS Secretariat for any query with respect to the contents of the publication. IONS Guidelines for HADR Version 3.1 Members Australia Bangladesh France India Indonesia Iran Kenya Maldives Mauritius Mozambique Myanmar Oman Pakistan Saudi Seychelles Singapore South Sri Lanka Arabia Africa Tanzania Thailand Timor UAE UK Leste Observers IONS Guidelines for HADR Version 3.1 Page 2 of 42 IONS Guidelines for HADR Version 3.1 TABLE OF CONTENTS Glossary................................................................................................................. 5 Acronyms & Abbreviations...................................................................................... 7 1.0 Introduction 1.1 General................................................................................................. 9 1.2 Aim....................................................................................................... 9 1.3 Scope................................................................................................... 9 2.0 Principles, -

La Nouvelle Marine Bangladaise

TRIBUNE n° 882 La nouvelle marine bangladaise Nicolas Picciotto Membre du pôle « Études » du Centre d’études stratégiques de la Marine (CESM). e 12 mars 2017, le Bangladesh a admis au service actif 2 sous- L marins conventionnels classe Ming, type 035G, achetés à la Chine, rallongeant ainsi la liste des pays disposant d’une force sous-marine. Image d’un sous-marin type 035G visible L’arrivée des deux bâtiments, le sur le site officiel de la Bangladesh Navy BNS Nobojatra (« Renouveau ») et le BNS Joyjatra (« Voyage »), marque une étape importante dans une modernisation plus globale de la marine bangla- daise, aux ambitions jusqu’à présent plutôt littorales. Protéger le littoral Enclavé entre l’Inde et la Birmanie, le Bangladesh dispose cependant d’une ouverture, restreinte (580 km), sur le golfe du Bengale qui lui assure à la fois un espace maritime et un accès à des ressources marines. Longtemps donc, la doctrine d’emploi des forces navales du Bangladesh a placé au premier plan la protection de cette ZEE modeste mais d’un grand apport pour ce pays pauvre et fortement peu- plé. Les limites de cette zone ont été l’objet de disputes entre Dacca et ses voisins. Seule subsiste une contestation avec la Birmanie pour une région où des gisements de gaz et de pétrole ont été découverts en 2006 : aucun des deux États ne veut céder et les accrochages en mer sont encore fréquents. Depuis plusieurs années, les pays riverains du golfe du Bengale se livrent à une course aux armements, attisée par la lutte d’influence entre l’Inde et la Chine dans la région. -

JULY Issue 2020.Indd

ISSN 1010-9536 POTENTIAL OF NEW BUSINESS CORRIDORS 227 State, Nationality and Political Elites: The Politics of Nationalism in Myanmar Abu Salah Md. Yousuf D. Purushothaman 249 Changing Nature and the Role of Actors in Confronting Terrorism Md. Jahan Shoieb Lam-ya Mostaque 269 Maritime Security Challenges for Bangladesh: Response Options Moutusi Islam 291 Sub-regional Cooperation in South Asia: Issues, Challenges and Policy Implications Saddam Hosen 311 The United States, Iran and the New Conundrum in the Middle East A.K.M. Anisur Rahman Volume 40 Number 3 2019 I BIISS JOURNAL, VOL. 40, NO. 3, JULY 2019 Contacts Designation Telephone (Office) E-mail Chairman 88-02-9347914 [email protected] Director General 88-02-8312609 [email protected] Research Director-1 88-02-9331977 [email protected] Research Director-2 88-02-9347984 [email protected] VOLUME 40 NUMBER 3 JULY 2019 Disclaimer This is a double-blind peer reviewed journal. The views and opinions expressed in this Journal are solely of the authors and do not necessarily reflect the official policy or position of the Bangladesh Institute of International and Strategic Studies (BIISS). Bangladesh Institute of International and Strategic Studies (BIISS) Dhaka BIISS JOURNAL, VOL. 40, NO. 3, JULY 2019 Chief Editor Sheikh Masud Ahmed Editor Sheikh Masud Ahmed Associate Editor Mahfuz Kabir Assistant Editors Mohammad Jasim Uddin ASM Tarek Hassan Semul Shanjida Shahab Uddin EDITORIAL ADVISORY BOARD Stephen P. Cohen Brookings Institution, Washington, D.C. Pervaiz I. Cheema National Defence University, Islamabad Muchkund Dubey Council for Social Development, New Delhi Dipak Gyawali Royal Nepal Academy of Science and Tech, Kathmandu Takako Hirose Kuboki Daito-bunka, University of Tokyo, Tokyo Talukder Maniruzzaman National Professor of Bangladesh A. -

Legend Magazine

LEGEND MAGAZINE (SEPTEMBER- 2018) Current Affairs and Quiz, English, Banking Awareness, Simplification Exclusively prepared for RACE students Issue: 13 | Page : 56 | Topic : Legend of September | Price: Not for Sale LEGEND OF SEPTEMBER 2018 MAGAZINE - INDEX S. NUMBER TOPICS PAGE NUMBER 1 NATIONAL AFFAIRS 1 2 STATES IN NEWS 6 3 INTERNATIONAL NEWS 9 4 BANKING AND BUSINESS 13 5 APPOINTMENTS 17 6 AWARDS & HONOURS 18 7 BOOKS AND AUTHORS 19 8 SPORTS 20 9 IMPORTANT DAYS / OBITUARY 24 10 CURRENT AFFAIRS QUIZ 25 11 ENGLISH VOCABULARY 32 12 BANKING AWARENESS 44 13 SIMPLIFICATION 51 CURRENT AFFAIRS Gajendra Singh, Director (Marketing) from Bi-Annual Talks between Indian and GAIL (India) Limited. NATIONAL AFFAIRS Bangladeshi Border Forces Begin in New Environment Ministry Releases India‘s Delhi: ICAR organized conference on Motivating & National REDD+ Strategy: The bi-annual talks between Indian and Attracting Youth in Agriculture (MAYA) : The national Reducing Emissions from Bangladeshi border forces will begin in New The Indian Council of Agricultural Deforestation and Forest Degradation Delhi. Research, ICAR hasorganized a two-day (REDD+) strategy for India prepared Director General of Border Security Force conference on Motivating & Attracting Youth by Indian Council of Forestry and (BSF) KK Sharma will represent the Indian side in Agriculture (MAYA) . Education, Dehradun for the Government was while Director General of Border Guard Under this scheme, special efforts are being released in New Delhi by Union Minister for Bangladesh (BGB) Major General Md Shafeenul taken up to attract the rural youth under the Environment, Forest and Climate Change Islam will lead the Bangladeshi side in the talks. -

Qatar 'One of the Safest Countries in the World'

BUSINESS | Page 1 SPORT | Page 9 Hales leads England to victory in INDEX DOW JONES QE NYMEX QATAR 2 – 9, 28 COMMENT 26, 27 QFCA chief executive REGION 10 BUSINESS 1 – 5, 15 – 20 second 16,131.00 9,683.62 30.89 ARAB WORLD 10, 11 CLASSIFIED 6 – 15 expects non-oil share in -197.00 +196.91 -0.83 INTERNATIONAL 12 – 25 SPORTS 1 – 12 -1.21% +2.08% -2.62% Qatar GDP to be at 70% one-dayer Latest Figures published in QATAR since 1978 SUNDAY Vol. XXXVI No. 9991 February 7, 2016 Rabia II 28, 1437 AH GULF TIMES www. gulf-times.com 2 Riyals Record win for Nasser al-Attiyah Qatar ‘one In brief of the safest ARAB WORLD | Terrorism Tunisia completes barrier with Libya Tunisia yesterday completed the countries construction of a barrier along its border with Libya, months after attacks on its national museum and a beach resort that killed dozens of tourists. Defence Minister Farhat Horchani told reporters in Tunis in the world’ that the construction of berms and water-filled trenches marks “an For the past five years, Qatar has Shamal security areas also recorded important day” for Tunisia in its stood first in terms of security a decline of 18% in crime rates. struggle against “terrorism”. Two among the nations of the Middle Last year, the authorities have attacks claimed by the Islamic State East region in the Global Peace been able to tackle the phenomenon group last year killed 59 foreign Index of begging by capturing 590 people, tourists, with Tunisian off icials most of them coming from outside saying the assailants had trained atar has further consolidated the country.