Canara Bank Po & Esic Sso Mains Capsule

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![[Click Here and Type in Recipient's Full Name]](https://docslib.b-cdn.net/cover/4602/click-here-and-type-in-recipients-full-name-104602.webp)

[Click Here and Type in Recipient's Full Name]

MEDIA NOTES City ATP Tour PR Tennis Australia PR Sydney Brendan Gilson: [email protected] Harriet Rendle: [email protected] Brisbane Richard Evans: [email protected] Kirsten Lonsdale: [email protected] Perth Mark Epps: [email protected] Victoria Bush: [email protected] ATPCup.com, @ATPCup / ATPTour.com, @ATPTour / TennisTV.com, @TennisTV ATP CUP TALKING POINTS - MONDAY 6 JANUARY 2020 • Three of the Top 4 players in last season’s FedEx ATP Rankings are in action on Monday with World No. 1 Rafael Nadal (ESP), No. 2 Novak Djokovic (SRB) and No. 4 Dominic Thiem (AUT). Nadal and Djokovic opened with straight-set wins while Thiem lost in three sets to Borna Coric (CRO). • Group A qualification scenarios after completion of 1st round of ties of the event’s group stages: - Serbia qualifies as Group winner on Monday if Serbia defeats France and South Africa defeats Chile. - France qualifies as Group Winner on Monday if France defeats Serbia and Chile defeats South Africa. • Group F qualification scenarios after completion of 2nd round of ties of the event’s group stages - Australia have qualified for the Final 8 Sydney as Group F winners after Australia defeated Canada and Germany defeated Greece. Australia will play their Quarter-Final in the Day Session on Thursday 9 January against the Winner of Group C (Belgium, Bulgaria or Great Britain). • No teams from Groups B or E can qualify on Monday. • In Perth, five-time year-end No. 1 Nadal takes on Pablo Cuevas (URU), who is 1-4 against the Spaniard. -

Important Monthly Current Affairs Capsule – March

Important Monthly Current Affairs Capsule – March S. No Topics Page No. 1. Important Days 2 2. Important Banking News 3 3. Important Financial & Economy Affairs 11 4. Important Business News 12 5. ImportantCabinet Approval 12 6. Important State Wise National News 14 7. Important International News 22 8. Important Appointments 24 9. Important Awards and Honors 27 10. Important Committees 31 11. Important MoU 31 12. Important Summit & Conference 36 13. Important Mobile App and Web Portal 38 14. Important Defence News 40 15. Important Science And Technology 44 16. Important Schemes And Programs 46 17. Important Ranking and Indexes 47 18. ImportantBooks And Authors 51 19. Important Sports News 51 20. Important Obituaries 59 1 | P a g e Important Days Date Important days Theme March 1 Zero Discrimination Day Act to change laws that Discriminate March 1 World Civil Defence Day Children's safety, our responsibility March 3 World Wildlife Day Life below water: for people and planet March 3 World Hearing Day Check your hearing! Cultivate and sustain a safety culture for building March 4 National Safety Day nation March 8 International Women‘s Day "Think equal, build smart, innovate for change" March 10 CISF Raising Day - March 12 Corporation Bank‘s 114th Foundation Day - March 13 (2nd No Smoking Day - Wednesday of March) March 14 World Kidney Day ‗Kidney health for everyone, everywhere‘ March 14 International Pi Day - The 22nd annual International Day of Action ‗Celebration of the role of women in protecting and March 14 for Rivers managing our -

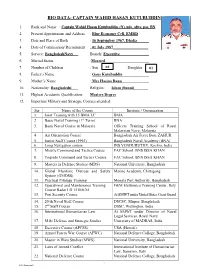

Bio Data- Captain Wahid Hasan Kutubuddin

BIO DATA- CAPTAIN WAHID HASAN KUTUBUDDIN 1. Rank and Name : Captain Wahid Hasan Kutubuddin, (N), ndc, afwc, psc, BN 2. Present Appointment and Address : Blue Economy Cell, EMRD 3. Date and Place of Birth : 16 September 1967, Dhaka 4. Date of Commission/ Recruitment : 01 July 1987__________________ 5. Service: BangladeshNavy Branch: Executive 6. Marital Status :Married 7. Number of Children : Son 02 Daughter 01 8. Father’s Name : Gaus Kutubuddin 9. Mother’s Name : Mrs Hasina Banu 10. Nationality: Bangladeshi Religion: ___Islam (Sunni)_______ 11. Highest Academic Qualification: Masters Degree 12. Important Military and Strategic Courses attended: Ser Name of the Course Institute / Organization 1. Joint Training with 15 BMA LC BMA 2. Basic Naval Training (1st Term) BNA 3. Basic Naval Course in Malaysia Officers Training School of Royal Malaysian Navy, Malaysia 4. Air Orientation Course Bangladesh Air Force Base ZAHUR 5. Junior Staff Course (1992) Bangladesh Naval Academy (BNA) 6. Long Navigation course INS VENDURUTHY, Kochin, India 7. Missile Command and Tactics Course FAC School, BNS ISSA KHAN 8. Torpedo Command and Tactics Course FAC School, BNS ISSA KHAN 9. Masters in Defence Studies (MDS) National University, Bangladesh 10. Global Maritime Distress and Safety Marine Academy, Chittagong System (GMDSS) 11. Practical Pilotage Training Mongla Port Authority, Bangladesh 12. Operational and Maintenance Training GEM Elettronica Training Center, Italy Course Radar LD 1510/6/M 13. Port Security Course At SMWT under United States Coast Guard 14. 20 th Naval Staff Course DSCSC, Mirpur, Bangladesh 15. 2nd Staff Course DSSC, Wellington, India 16. International Humanitarian Law At SMWT under Director of Naval Legal Services, Royal Navy 17. -

High Court of Punjab & Haryana at Chandigarh

HIGH COURT OF PUNJAB & HARYANA AT CHANDIGARH Result of the Preliminary Examination For The Post of Clerck - 2011 ROLL NO. WISE LIST SLNO ROLL NAME CATEGORY SUB-CATEGORY MARKS POS. NEG. TOTAL 1 100002 ASHA JOSHI GEN EXS 65.00 33.75 31.25 2 100003 MEENU SONI GEN 100.00 16.50 83.50 3 100004 VINOD KUMAR GEN 63.00 34.25 28.75 4 100006 PRABHDEEP SINGH SC 60.00 34.50 25.50 5 100007 POONAM RANI SC 87.00 16.75 70.25 6 100009 CHANDER MOHAN OBC 85.00 28.50 56.50 7 100010 RAJAN KHANNA GEN 46.00 18.50 27.50 8 100011 YADWINDER SINGH GEN 88.00 6.75 81.25 9 100012 SATISH SC 52.00 37.00 15.00 10 100013 RAKESH KUMAR GEN 51.00 23.00 28.00 11 100015 PERMINDER SINGH GEN 70.00 32.25 37.75 12 100016 JATINDER VERMA GEN 69.00 6.75 62.25 13 100017 AMANDEEP KAUSHAL GEN 98.00 23.25 74.75 14 100018 SEEMA GEN 66.00 33.50 32.50 15 100019 CHARNPREET KAUR GEN 89.00 9.00 80.00 16 100021 VICKY KUMAR GEN 55.00 20.25 34.75 17 100023 RAJESH KUMAR GEN 75.00 28.00 47.00 18 100024 AMIT KUMAR SC 72.00 22.00 50.00 19 100025 AAMOD SINGH OBC 44.00 11.25 32.75 20 100027 ROMA GEN EXS 62.00 34.25 27.75 21 100028 HEMANTI KANDPAL GEN 37.00 12.50 24.50 22 100031 ASHA CHANLA GEN 67.00 21.50 45.50 23 100034 KARAMJEET SINGH SC 100.00 23.00 77.00 24 100035 NANCY TIWARI GEN 65.00 16.75 48.25 25 100036 SONIA SC EXS 54.00 35.25 18.75 26 100038 GURINDER PAL SINGH OBC 77.00 17.50 59.50 27 100039 SUPRIYA NANDA GEN 80.00 30.00 50.00 28 100040 PRATYUSH RAMDEWAR GEN 66.00 14.00 52.00 29 100041 RAJNISH SINGH GEN 53.00 36.75 16.25 30 100044 PARMOD KUMAR GEN 110.00 21.00 89.00 31 100046 BRAHAMJEET SINGH -

Atp Head2head: Sunday Singles Final

OPEN 13 PROVENCE – ATP MEDIA NOTES DAY 7 – SUNDAY 14 MARCH 2021 Palais de Sports | Marseille, France | 8-14 March 2021 ATP Tour Tournament Media ATPTour.com Open13.fr Stephanie Natal: [email protected] (ATP PR) @ATPTour @Open13 Eli Weinstein: [email protected] (Media Desk) #ThisIsTennis #Open13Provence TV & Radio: TennisTV.com Frenchmen in Marseille finals 2021 Pierre-Hugues Herbert 2009 Jo-Wilfried Tsonga (Champion) 2018 Lucas Pouille (Finalist) 2009 Michael Llodra (Finalist) 2017 Jo-Wilfried Tsonga (Champion) 2007 Gilles Simon (Champion) 2017 Lucas Pouille (Finalist) 2006 Arnaud Clement (Champion) 2015 Gilles Simon (Champion) 2002 Nicolas Escude (Finalist) 2015 Gael Monfils (Finalist) 2001 Sebastien Grosjean (Finalist) 2014 Jo-Wilfried Tsonga (Finalist) 1999 Fabrice Santoro (Champion) 2013 Jo-Wilfried Tsonga (Champion) 1999 Arnaud Clement (Finalist) 2012 Michael Llodra (Finalist) 1996 Guy Forget (Champion) 2010 Michael Llodra (Champion) 1996 Cedric Pioline (Finalist) 2010 Julien Benneteau (Finalist) 1994 Arnaud Boetsch (Finalist) ATP HEAD2HEAD: SUNDAY SINGLES FINAL CENTRAL [1] Daniil Medvedev (RUS) vs Pierre-Hugues Herbert (FRA) Series tied 1-1 18 Rotterdam (Netherlands) Hard R16 Daniil Medvedev 3-6 7-6(2) 6-4 19 Roland Garros (France) Clay R128 Pierre-Hugues Herbert 4-6 4-6 6-3 6-2 7-5 Other Meeting 15 Marseille (France) Hard Q2 Pierre-Hugues Herbert 6-4 6-3 Daniil Medvedev | Age: 25 | World No. 3 | Career-High No. 3 | Career: 172-88 (9 Titles) | Marseille 6-2 (’17, ’20 QF) > Achieved career-high No. 3 after reaching 2021 Australian Open final, becoming highest-ranked Russian since No. 3 Davydenko in 2007. > Won his last 10 matches of 2020 and his 1st 10 matches of 2021, including 12 victories against 8 different Top-10 opponents and titles at ATP Masters 1000 Paris and Nitto ATP Finals. -

ANNELIES ILENA Upon Arrival in the Port of Ijmuiden Last Friday – Photo : Piet Sinke (C)

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2013 – 146 Number 146 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Sunday 26-05-2013 News reports received from readers and Internet News articles copied from various news sites. The ISKES tug SATURNUS assisting worlds largest stern trawler the KW 174 ANNELIES ILENA upon arrival in the port of Ijmuiden last Friday – photo : Piet Sinke (c) Distribution : daily to 25900+ active addresses 26-05-2013 Page 1 DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2013 – 146 Your feedback is important to me so please drop me an email if you have any photos or articles that may be of interest to the maritime interested people at sea and ashore PLEASE SEND ALL PHOTOS / ARTICLES TO : [email protected] If you don't like to receive this bulletin anymore : To unsubscribe click here (English version) or visit the subscription page on our website. http://www.maasmondmaritime.com/uitschrijven.aspx?lan=en-US EVENTS, INCIDENTS & OPERATIONS 24-05-2013 : Celebrity cruises ship CELEBRITY MILLENNIUM outbound in Vancouver harbour Photo : Robert Etchell (c) Maersk rate hikes hitting the high notes Do we sense a touch of desperation from the executive corridors of Maersk Line as the Triple-E delivery dates approach? Maersk Line boss Nils Smedegaard Andersen was in a confident mood after his carrier posted a decent US$204 million profit in the first quarter. Making a profit when Asia-Europe is a disaster and many other carriers are wallowing in red ink is impressive enough, but the Maersk CEO raised eyebrows when he addressed the rates issue. He told Reuters he had "no doubt" the carrier could increase rates from their current level of $730 to $1,481 per TEU on July 1. -

International Cricket Council

TMUN INTERNATIONAL CRICKET COUNCIL FEBRUARY 2019 COMITTEEE DIRECTOR VICE DIRECTORS MODERATOR MRUDUL TUMMALA AADAM DADHIWALA INAARA LATIFF IAN MCAULIFFE TMUN INTERNATIONAL CRICKET COUNCIL A Letter from Your Director 2 Background 3 Topic A: Cricket World Cup 2027 4 Qualification 5 Hosting 5 In This Committee 6 United Arab Emirates 7 Singapore and Malaysia 9 Canada, USA, and West Indies 10 Questions to Consider 13 Topic B: Growth of the Game 14 Introduction 14 Management of T20 Tournaments Globally 15 International Tournaments 17 Growing The Role of Associate Members 18 Aid to Troubled Boards 21 Questions to Consider 24 Topic C: Growing Women’s Cricket 25 Introduction 25 Expanding Women’s T20 Globally 27 Grassroots Development Commitment 29 Investing in More Female Umpires and Match Officials 32 Tying it All Together 34 Questions to Consider 35 Advice for Research and Preparation 36 Topic A Key Resources 37 Topic B Key Resources 37 Topic C Key Resources 37 Bibliography 38 Topic A 38 Topic B 40 Topic C 41 1 TMUN INTERNATIONAL CRICKET COUNCIL A LETTER FROM YOUR DIRECTOR Dear Delegates, The International Cricket Council (ICC) is the governing body of cricket, the second most popular sport worldwide. Much like the UN, the ICC brings representatives from all cricket-playing countries together to make administrative decisions about the future of cricket. Unlike the UN, however, not all countries have an equal input; the ICC decides which members are worthy of “Test” status (Full Members), and which are not (Associate Members). While the Council has experienced many successes, including hosting the prestigious World Cup and promoting cricket at a grassroots level, it also continues to receive its fair share of criticism, predominantly regarding the ICC’s perceived obstruction of the growth of the game within non- traditionally cricketing nations and prioritizing the commercialization of the sport over globalizing it. -

List of Indian Athletes Qualified for Tokyo Olympics 2020 Archery 1

List of Indian Athletes Qualified for Tokyo Olympics 2020 Archery 1. Tarundeep Rai, Men’s Recurve 2. Atanu Das, Men’s Recurve 3. Pravin Jadhav, Men’s Recurve 4. Deepika Kumari, Women's Recurve Badminton 1. PV Sindhu, Women’s singles 2. B Sai Praneeth, Men’s singles 3. Satwiksairaj Rankireddy and Chirag Shetty, Men’s doubles Athletics 1. KT Irfan, Men's 20km race walking 2. Sandeep Kumar, Men's 20km race walking 3. Rahul Rohilla, Men's 20km race walking 4. Gurpreet Singh, Men's 50km race walking 5. Bhawna Jat, Women's 20km race walking 6. Priyanka Goswami, Women's 20km race walking 7. Avinash Sable, Men's 3000m steeplechase 8. Murali Sreeshankar, Men's long jump 9. MP Jabir, Men's 400m hurdles 10. Neeraj Chopra, Men's javelin throw 11. Shivpal Singh, Men's javelin throw 12. Annu Rani, Women's javelin throw 13. Tajinderpal Singh Toor, Men's shot put 14. Dutee Chand, Women's 100m and 200m 15. Kamalpreet Kaur, Women's discus throw 16. Seema Punia, Women's discus throw 17. Alex Antony, Sarthak Bhambri, Revathi Veeramani, Subha Venkatesan - 4x400m Mixed Relay 18. Amoj Jacob, P Naganathan, Arokia Rajiv, Noah Nirmal Tom, Muhammed Anas Yahiya - Men's 4x400m Relay Boxing 1. Vikas Krishan (Men's, 69kg) 2. Lovlina Borgohain (Women's, 69kg) 3. Ashish Kumar (Men's, 75kg) 4. Pooja Rani (Women's, 75kg) 5. Satish Kumar (Men's, 91kg) 6. Mary Kom (Women's, 51kg) 7. Amit Panghal (Men's, 52kg) 8. Manish Kaushik (Men's, 63kg) 9. Simranjit Kaur (Women's, 60kg) Fencing 1. -

2018 Women's Doubles Results

⇧ 2019 Back to Badzine Results Page ⇩ 2017 2018 Women's Doubles Results Gold Silver Bronze Bronze World Championships Mayu Matsumoto / Wakana Nagahara Yuki Fukushima / Sayaka Hirota Greysia Polii / Apriyani Rahayu Shiho Tanaka / Koharu Yonemoto Level 2-4 (formerly Superseries) Malaysia Masters (Super 500) Christinna Pedersen / Kamilla Rytter Juhl Chen Qingchen / Jia Yifan Yuki Fukushima / Sayaka Hirota Lee So Hee / Shin Seung Chan Indonesia Masters (Super 500) Misaki Matsutomo / Ayaka Takahashi Greysia Polii / Apriyani Rahayu Lee So Hee / Shin Seung Chan Christinna Pedersen / Kamilla Rytter Juhl India Open (Super 500) Greysia Polii / Apriyani Rahayu Jongkolphan Kititharakul / Rawinda Prajongjai Christinna Pedersen / Kamilla Rytter Juhl Du Yue / Li Yinhui All England (Super 1000) Christinna Pedersen / Kamilla Rytter Juhl Yuki Fukushima / Sayaka Hirota Shiho Tanaka / Koharu Yonemoto Mayu Matsumoto / Wakana Nagahara Malaysia Open (Super 750) Misaki Matsutomo / Ayaka Takahashi Chen Qingchen / Jia Yifan Kim Hye Rin / Kong Hee Yong Della Destiara Haris / Rizki Amelia Pradipta Indonesia Open (Super 1000) Yuki Fukushima / Sayaka Hirota Mayu Matsumoto / Wakana Nagahara Chen Qingchen / Jia Yifan Misaki Matsutomo / Ayaka Takahashi Thailand Open (Super 500) Greysia Polii / Apriyani Rahayu Misaki Matsutomo / Ayaka Takahashi Jongkolphan Kititharakul / Rawinda Prajongjai Shiho Tanaka / Koharu Yonemoto Singapore Open (Super 500) Ayako Sakuramoto / Yukiko Takahata Nami Matsuyama / Chiharu Shida Jongkolphan Kititharakul / Rawinda Prajongjai Isabel Herttrich -

Capsule for Rrb Po/Asst & Niacl (Mains)

aa Is Now In CHENNAI | MADURAI | TRICHY | SALEM | COIMBATORE | CHANDIGARH | BANGALORE |ERODE | NAMAKKAL | PUDUCHERRY |THANJAVUR |TRIVANDRUM | ERNAKULAM |TIRUNELVELI |VELLORE | www.raceinstitute.in | www.bankersdaily.in CAPSULE FOR RRB PO/ASST & NIACL (MAINS). GENERAL AWARENESS & STATIC GK Exclusively prepared for RACE students Chennai: #1, South Usman Road, T Nagar. | Madurai: #24/21, Near MapillaiVinayagar Theatre, Kalavasal. | Trichy: opp BSNL office, Juman Center, 43 Promenade Road, Cantonment. | Salem: #209, Sonia Plaza / Muthu Complex, Junction Main Rd, State Bank Colony, Salem. | Coimbatore #545, 1st floor, Adjacent to SBI (DB Road Branch),DiwanBahadur Road, RS Puram, Coimbatore| Chandigarh| Bangalore|Erode |Namakkal |Puducherry |Thanjavur| Trivandrum| Ernakulam|Tirunelveli | Vellore | H.O: 7601808080 / 9043303030 | www.raceinstitute.in Chennai RACE Coaching Institute Pvt Ltd CAPSULE FOR RRB PO/ASST & NIACL (MAINS) BANKING & FINANCIAL AWARENESS RESERVE BANK OF INDIA (RBI) Third Bi-Monthly Monetary Policy Statement, 2018-19: Resolution of the Monetary Policy Committee (MPC): Reserve Bank of India Policy Rate Current Rate Previous Rate Repo Rate 6.50% 6. 25% Reverse Repo Rate 6.25% 6. 00% Marginal Standing 6.75% 6. 50% Facility Rate Bank Rate 6.75% 6. 50% CRR 4% (Unchanged) 4% SLR 19. 5% 19. 5% (Unchanged) ➢ The six-member monetary policy committee (MPC) of the Reserve Bank of India (RBI) has decided to increase the repo rate by 25 basis points to 6.5% due to inflation concerns. ➢ According to the RBI Annual Report, it was mentioned due to the evolving economic conditions, real GDP growth for 2018-19 is expected to increase to 7.4% from 6.7% in the previous year. -

Netzroller Das Eventmagazin Der Saar.Lor.Lux Badminton Open Sa

DIE WELT ZU GAST IM SAARLAND Präsentiert von NETZROLLER DAS EVENTMAGAZIN DER SAAR.LOR.LUX BADMINTON OPEN SA. 03.11.2018 Vereinigte Volksbank eG Europa Allee 32 · 54343 Föhren · www.triacs.de | 03. November 2018 | Netzroller | 1 | Präsentiert von DIE WELT ZU GAST IM SAARLAND INHALTSVERZEICHNIS Grußwort Seite 3-6: Tagesbericht Freitag Sehr geehrte Damen und Herren, Seite 8-9: Hintergrund: Lin Dan liebe Sportfreundinnen und Sport- Seite 10: Spiele im Fokus freunde, anlässlich der SaarLorLux Open DAS NETZROLLER-TEAM vom 30. Oktober bis 4. November 2018 in der Saarbrücker Saarland- Berichte, Interviews: halle heiße ich Sie als Minister für Thomas Fuchs, Julian Schwarzhoff, Jil Heinz-Schwitzgebel Inneres, Bauen und Sport des Saar- Fotos: Sven Heise landes herzlich willkommen. Titelfoto: Sven Heise Layout: www.designfreundin.de Wiederholt wird das Saarland im Satz: mw sportkommunikation Michael Weber Fokus des Badmintonsports ste- Druck: repa-Druck, Ensheim hen. Spielerinnen und Spieler aus aller Welt werden zu Gast sein. Die SaarLorLux Open setzen somit ihre Erfolgsgeschichte fort. Erneut können wir ein Highlight auf hohem internationa- lem Niveau im Sportland Saarland erleben. Alle Informationen für Fans, Spieler und Helfer Das vom Badminton Weltverband (BWF) neueingeteilte BWF auf der offiziellen Turnier-Homepage: Tour Super 100 Turnier, welches mit 75.000 US Dollar dotiert https://www.saarlorlux-open.de ist, wird die zahlreichen Zuschauerinnen und Zuschauer durch die Faszination und Dynamik des Badmintonsports begeistern. Die SaarLorLux Badminton Open auf Facebook: Die hervorragende Organisation, der reibungslose Turnierab- https://www.facebook.com/SaarLorLuxBadmintonOpen/ lauf und selbstverständlich eine gastfreundliche Aufnahme las- News, Bilder, Videos und Berichte – alles rund um das Turnier. -

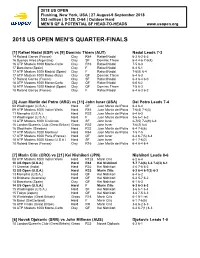

2018 Us Open Men's Quarter-Finals

2018 US OPEN Flushing, New York, USA | 27 August-9 September 2018 $53 million | S-128, D-64 | Outdoor Hard MEN’S QF & POTENTIAL SF HEAD-TO-HEADS www.usopen.org 2018 US OPEN MEN’S QUARTER-FINALS [1] Rafael Nadal (ESP) vs [9] Dominic Thiem (AUT) Nadal Leads 7-3 14 Roland Garros (France) Clay R64 Rafael Nadal 6-2 6-2 6-3 16 Buenos Aires (Argentina) Clay SF Dominic Thiem 6-4 4-6 7-6(4) 16 ATP Masters 1000 Monte-Carlo Clay R16 Rafael Nadal 7-5 6-3 17 Barcelona (Spain) Clay F Rafael Nadal 6-4 6-1 17 ATP Masters 1000 Madrid (Spain) Clay F Rafael Nadal 7-6(8) 6-4 17 ATP Masters 1000 Rome (Italy) Clay QF Dominic Thiem 6-4 6-3 17 Roland Garros (France) Clay SF Rafael Nadal 6-3 6-4 6-0 18 ATP Masters 1000 Monte-Carlo Clay QF Rafael Nadal 6-0 6-2 18 ATP Masters 1000 Madrid (Spain) Clay QF Dominic Thiem 7-5 6-3 18 Roland Garros (France) Clay F Rafael Nadal 6-4 6-3 6-2 [3] Juan Martin del Potro (ARG) vs [11] John Isner (USA) Del Potro Leads 7-4 08 Washington (U.S.A.) Hard QF Juan Martin del Potro 6-4 6-4 09 ATP Masters 1000 Indian Wells Hard R16 Juan Martin del Potro 7-6(4) 7-6(3) 11 Memphis (U.S.A.) Hard R32 Juan Martin del Potro 6-4 6-3 13 Washington (U.S.A.) Hard F Juan Martin del Potro 3-6 6-1 6-2 13 ATP Masters 1000 Cincinnati Hard SF John Isner 6-7(5) 7-6(9) 6-3 16 London/Queen's Club (Great Britain) Grass R32 John Isner 7-6(2) 6-4 16 Stockholm (Sweden) Hard R32 Juan Martin del Potro 6-4 7-6(6) 17 ATP Masters 1000 Montreal Hard R64 Juan Martin del Potro 7-5 7-5 17 ATP Masters 1000 Paris (France) Hard QF John Isner 6-4 6-7(5) 6-4 18 ATP Masters