HW&Co. Industry Reader Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

R Egeneration C Onstruction

Regeneration Annual Report 2016 Construction About us Morgan Sindall Group is a leading UK construction and regeneration group. We offer support at every stage of a project’s life cycle through our six divisions of Construction & Infrastructure, Fit Out, Property Services, Partnership Housing, Urban Regeneration and Investments. Construction Regeneration Our services include design, We work in close new build construction, partnership with land infrastructure works, owners, local authorities refurbishment and property and housing associations maintenance in the commercial to regenerate cities with and public sectors. Our multi-phased, mixed-use construction teams work developments. New housing, on projects of all sizes community buildings, shops, and complexity, either leisure facilities and public standalone or through spaces help stimulate local framework agreements economies and provide and strategic alliances. long-term social benefits. FRONT COVER: The Word, a new state-of-the-art Revenue Revenue cultural centre in South Shields containing a library, exhibition space, gaming area, ‘FabLab’ with 3D printers, IT suite, café £ 2.0bn £ 0.6bn and rooftop space. Delivered by Urban Regeneration in partnership 2015: £1.9bn 2015: £0.5bn with South Tyneside Council. Find out more about the Our activities touch the lives of a wide range of stakeholders. We have therefore Group from our website decided to embark on a new approach to our annual report, integrating financial at morgansindall.com. and non-financial reporting within our operating -

Louisiana Connection United Kingdom

LOUISIANA CONNECTION UNITED KINGDOM RECENT NEWS In January 2015, Louisiana Gov. Bobby Jindal visited the United Kingdom as part of an economic development effort. While there, he also addressed the Henry Jackson Society regarding foreign policy. FOREIGN DIRECT INVESTMENT The United Kingdom is the most frequent investor in Louisiana, with 31 projects since 2003 accounting for over $1.4 billion in capital expenditure and over 2,200 jobs. UK has invested many business service projects in Louisiana. Hayward Baker, a geotechnical contractor and a subsidiary of the UK-based Keller Group, has opened a new office in New Orleans to support customers and projects along the Gulf Coast. Atkins, a design an engineering consultancy, has opened a new office in Baton Rouge, the office aims to increase the firm’s support capabilities for projects throughout Louisiana. CONTACT INFORMATION Tymor Marine, an energy consultancy company, has opened a SANCHIA KIRKPATRICK new office in Kaplan, Louisiana, The opening will serve customers Chief Representative, United Kingdom operating in the Gulf of Mexico. [email protected] T +44.0.7793222939 In June 2013, Hunting Energy Services completed a $19.6 million investment in its new Louisiana facility. JAMES J. COLEMAN, JR., OBE Great Britain Louisiana companies have also established a presence in the UK. www.gov.uk/government/work/usa Including 15 direct investments in the U.K. since 2003 that have T 504.524.4180 resulted in capital expenditures totaling $253 million and the JUDGE JAMES F. MCKAY III creation of 422 jobs. Honorary Consul, Ireland [email protected] T 504.412.6050 TRADE EXPORTS IMPORTS The U.K. -

Constructing and Regenerating

Constructing and regenerating Annual report and accounts 2011 Constructing and regenerating Morgan Sindall Group is a leading UK construction and regeneration group employing around 7,000 people. The construction, infrastructure and design services of the Group provide clients with innovative and cost-effective solutions throughout the property and infrastructure lifecycle. Working in long-term trusted partnerships, the Group’s expertise in mixed-use and housing-led regeneration is creating large-scale economic and social renewal throughout the country. Construction and Fit Out Affordable Housing Urban Regeneration Investments Infrastructure Specialises in fit out and Specialises in the design Works with landowners Facilitates project Offers national design, refurbishment projects and build, refurbishment, and public sector partners development, primarily construction and in the office, education, maintenance, regeneration to unlock value from in the public sector, by infrastructure services retail, technology and and repair of homes and under-developed assets providing flexible financing to private and public leisure sectors through communities across the UK. to bring about sustainable solutions and development sector customers. The Overbury as a national The division operates a full regeneration and urban expertise covering a wide division works on projects fit out company operating mixed-tenure model renewal through the range of markets including of all sizes across a broad through multiple creating homes for rent, delivery of mixed-use urban regeneration, range of sectors including procurement routes and shared ownership and projects typically creating education, healthcare, commercial, defence, Morgan Lovell specialising open market sale. commercial, retail, housing, emergency education, energy, in the design and build residential, leisure services, defence and healthcare, industrial, of offices in London and and public realm facilities. -

Contents Introduction

Stock Market Research Platform November 2019 Could be a gem – selection Contents Introduction ............................................................................................................................ 2 ASA International Group Plc – ASAI -Asia & Africa Microfinance Bank - Could be a gem ................................................................................................................................................ 2 Clipper Logistics plc – CLG – hit alongside retail but it is e-fulfilment ............................... 4 Costain Group plc – COST – High pension risks .................................................................. 4 Forterra – FORT – depends on building market in the UK but looks good .......................... 5 Funding Circle PLC – FCH – interesting, trading at cash value but risky ............................ 6 Gem Diamonds Ltd – GEMD – interesting diamond market ................................................ 8 Georgia Capital Plc – CGEO – Interesting exposure to Georgia........................................... 8 Huntsworth plc – HNT – positive tailwinds, could be a gem, but insane............................ 12 Keller Group – KLR – Interesting business ......................................................................... 14 Menzies (John) plc – MNZS – ............................................................................................. 15 MJ Gleeson plc – GLE ......................................................................................................... 17 -

University of Groningen German Migration to Groningen And

University of Groningen German migration to Groningen and Drenthe in the 19th and early 20th century Karel, Erwin; Paping, Richardus IMPORTANT NOTE: You are advised to consult the publisher's version (publisher's PDF) if you wish to cite from it. Please check the document version below. Publication date: 2016 Link to publication in University of Groningen/UMCG research database Citation for published version (APA): Karel, E., & Paping, R. (2016). German migration to Groningen and Drenthe in the 19th and early 20th century. Paper presented at new perspectives on the history of migration in the Northern Netherlands and the Northwest of Germany , Groningen, Netherlands. Copyright Other than for strictly personal use, it is not permitted to download or to forward/distribute the text or part of it without the consent of the author(s) and/or copyright holder(s), unless the work is under an open content license (like Creative Commons). The publication may also be distributed here under the terms of Article 25fa of the Dutch Copyright Act, indicated by the “Taverne” license. More information can be found on the University of Groningen website: https://www.rug.nl/library/open-access/self-archiving-pure/taverne- amendment. Take-down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Downloaded from the University of Groningen/UMCG research database (Pure): http://www.rug.nl/research/portal. For technical reasons the number of authors shown on this cover page is limited to 10 maximum. Download date: 29-09-2021 WORK IN PROGRESS German migration to Groningen and Drenthe in the 19th and early 20th century Erwin Karel and Richard Paping (University of Groningen) Preliminary paper, presented at the Workshop: new perspectives on the history of migration in the Northern Netherlands and the Northwest of Germany (29 August 2016) 1. -

UK Annual Report 2015 (Including the Transparency Report)

Investing to become the Clear Choice UK Annual Report 2015 (including the Transparency Report) December 2015 KPMG.com/uk Highlights Strategic report Profit before tax and Revenue members’ profit shares £1,958m £383m (2014: £1,909m) (2014: £414m) +2.6% -7% 2013 2014 2015 2013 2014 2015 Average partner Total tax payable remuneration to HMRC £623k £786m (2014: £715K) (2014: £711m) -13% +11% 2013 2014 2015 2013 2014 2015 Contribution Our people UK employees KPMG LLP Annual Report 2015 Annual Report KPMG LLP 11,652 Audit Advisory Partners Tax 617 Community support Organisations supported Audit Tax Advisory Contribution Contribution Contribution £197m £151m £308m (2014: £181m) (2014: £129m) (2014: £324m) 1,049 +9% +17% –5% (2014: 878) © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Strategic report Contents Strategic report 4 Chairman’s statement 10 Strategy 12 Our business model 16 Financial overview 18 Audit 22 Solutions 28 International Markets and Government 32 National Markets 36 People and resources 40 Corporate Responsibility 46 Our taxes paid and collected 47 Independent limited assurance report Governance 52 Our structure and governance 54 LLP governance 58 Activities of the Audit & Risk Committee in the year 59 Activities of the Nomination & Remuneration Committee in the year KPMG in the UK is one of 60 Activities of the Ethics Committee in the year 61 Quality and risk management the largest member firms 2015 Annual Report KPMG LLP 61 Risk, potential impact and mitigations of KPMG’s global network 63 Audit quality indicators 66 Statement by the Board of KPMG LLP providing Audit, Tax and on effectiveness of internal controls and independence Advisory services. -

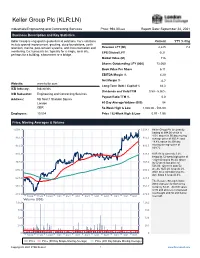

Keller Group Plc (KLR:LN)

Keller Group Plc (KLR:LN) Industrials/Engineering and Contracting Services Price: 994.00 GBX Report Date: September 24, 2021 Business Description and Key Statistics Keller Group is engaged in geotechnical solutions. Co.'s solutions Current YTY % Chg include ground improvement, grouting, deep foundations, earth retention, marine, post-tension systems, and instrumentation and Revenue LFY (M) 2,225 7.4 monitoring. Co.'s projects are typically for a single, local site, EPS Diluted LFY -0.21 perhaps for a building, a basement or a bridge. Market Value (M) 716 Shares Outstanding LFY (000) 72,060 Book Value Per Share 6.11 EBITDA Margin % 4.20 Net Margin % -0.7 Website: www.keller.com Long-Term Debt / Capital % 44.3 ICB Industry: Industrials Dividends and Yield TTM 0.59 - 5.96% ICB Subsector: Engineering and Contracting Services Payout Ratio TTM % 0.0 Address: 5th floor;1 Sheldon Square London 60-Day Average Volume (000) 54 GBR 52-Week High & Low 1,028.00 - 506.00 Employees: 10,554 Price / 52-Week High & Low 0.97 - 1.96 Price, Moving Averages & Volume 1,054.1 1,054.1 Keller Group Plc is currently trading at 994.00 which is 4.5% above its 50 day moving 982.3 982.3 average price of 950.84 and 19.8% above its 200 day 910.5 910.5 moving average price of 829.72. 838.8 838.8 KLR:LN is currently 3.3% below its 52-week high price of 1,028.00 and is 96.4% above 767.0 767.0 its 52-week low price of 506.00. -

The War and Fashion

F a s h i o n , S o c i e t y , a n d t h e First World War i ii Fashion, Society, and the First World War International Perspectives E d i t e d b y M a u d e B a s s - K r u e g e r , H a y l e y E d w a r d s - D u j a r d i n , a n d S o p h i e K u r k d j i a n iii BLOOMSBURY VISUAL ARTS Bloomsbury Publishing Plc 50 Bedford Square, London, WC1B 3DP, UK 1385 Broadway, New York, NY 10018, USA 29 Earlsfort Terrace, Dublin 2, Ireland BLOOMSBURY, BLOOMSBURY VISUAL ARTS and the Diana logo are trademarks of Bloomsbury Publishing Plc First published in Great Britain 2021 Selection, editorial matter, Introduction © Maude Bass-Krueger, Hayley Edwards-Dujardin, and Sophie Kurkdjian, 2021 Individual chapters © their Authors, 2021 Maude Bass-Krueger, Hayley Edwards-Dujardin, and Sophie Kurkdjian have asserted their right under the Copyright, Designs and Patents Act, 1988, to be identifi ed as Editors of this work. For legal purposes the Acknowledgments on p. xiii constitute an extension of this copyright page. Cover design by Adriana Brioso Cover image: Two women wearing a Poiret military coat, c.1915. Postcard from authors’ personal collection. This work is published subject to a Creative Commons Attribution Non-commercial No Derivatives Licence. You may share this work for non-commercial purposes only, provided you give attribution to the copyright holder and the publisher Bloomsbury Publishing Plc does not have any control over, or responsibility for, any third- party websites referred to or in this book. -

4.4-2 Lower Saxony WS Region.Pdf

chapter4.4_Neu.qxd 08.10.2001 16:11 Uhr Seite 195 Chapter 4.4 The Lower Saxony Wadden Sea Region 195 near Sengwarden have remained fully intact. The With the exception of the northern section’s water tower on „Landeswarfen“ west of tourist visitors, the Voslapper Groden mainly Hohenkirchen is a landmark visible from a great serves as a sea rampart for Wilhelmshaven’s distance, constructed by Fritz Höger in 1936 to commercial buildings, a function also served by serve as Wangerooge’s water supply. the Rüstersieler Groden (1960-63) and the Hep- Of the above-mentioned scattered settlements penser Groden, first laid out as a dyke line from characteristic to this region, two set themselves 1936-38, although construction only started in physically apart and therefore represent limited 1955. It remains to be seen whether the histori- forms within this landscape. cally preserved parishes of Sengwarden and Fed- Some sections of the old dyke ring whose land derwarden, now already part of Wilhelmshaven, was considered dispensable from a farming or will come to terms with the consequences of this land ownership perspective served as building and the inexorable urban growth through appro- space for erecting small homes of farm labourers priate planning. and artisans who otherwise made their homes in The cultural landscape of the Wangerland and small numbers on larger mounds. Among these the Jeverland has been able to preserve its were the „small houses“ referred to in oral tradi- unmistakable character to a considerable degree. tion north of Middoge, the Oesterdeich (an early The genesis of landscape forms is mirrored in the groden dyke), the Medernser Altendeich, the patterns of settlement, the lay of arable land and Norderaltendeich and foremost the area west of in landmark monuments. -

Population by Area/Community Churches

Ostfriesen Genealogical Society of America OGSA PO Box 50919 Mendota, MN 55150 651-269-3580 www.ogsa.us 1875 Ostfriesland Census Detail The 1875 census provided insights into the communities and neighborhoods across Ostfriesland. The following table is sorted by Amt (Church district) and Kirchspiel (Church community) or location if the enumerated area does not have its own Church. Region Religion Town/Area Denomination Amt Kirchspiel / Location Lutheran Reformed Catholic Other Jewish Total Christian Aurich Lutheran, Aurich Aurich 3,569 498 282 106 364 4,819 Reformed, Catholic Plaggenburg Lutheran Aurich Aurich 529 40 4 573 Dietrichsfeld Aurich Aurich 201 6 207 Egels Aurich Aurich 235 1 7 243 Ertum Aurich Aurich 337 8 345 Georgßfeld Aurich Aurich 88 4 2 94 Hartum Aurich Aurich 248 18 9 275 Ihlow Aurich Weene 6 6 Kirchdorf Aurich Aurich 527 15 1 3 546 Meerhusen Aurich Aurich 9 9 Pfalsdorf Aurich Aurich 119 41 160 Popens Aurich Aurich 127 4 131 Rahe Aurich Aurich 268 25 3 296 Sandhorst Aurich Aurich 643 48 8 7 706 Tannenhausen Aurich Aurich 337 16 353 © 2018: Ostfriesen Genealogical Society of America 1 1875 Ostfriesland Census Detail Region Religion Town/Area Denomination Amt Kirchspiel / Location Lutheran Reformed Catholic Other Jewish Total Christian Walle Aurich Aurich 779 33 812 Wallinghausen Aurich Aurich 408 17 425 Ostgroßefehn Lutheran Aurich Aurich, Oldendorf 1,968 33 1 28 7 2,037 Aurich-Oldendorf Lutheran Aurich Aurich-Oldendorf 754 4 1 4 1 764 Spetzerfehn Lutheran Aurich Aurich-Oldendorf, 988 1 989 Bagband, Strackholt Bagband -

Danaher—The Making of a Conglomerate

UVA-BP-0549 Rev. Dec. 9, 2013 DANAHER—THE MAKING OF A CONGLOMERATE After joining Danaher Corporation (Danaher) in 1990, CEO H. Lawrence Culp helped transform the company from an $845 million industrial goods manufacturer to a $12.6 billion global conglomerate. Danaher’s 25-year history of acquisition-driven expansion had produced healthy stock prices as well as above average growth and profitability for more than 20 years (Exhibits 1 and 2); however, Wall Street had questioned the scalability of the company’s corporate strategy and its reliance on acquisitions since mid-2007. Prudential Equity Group had downgraded Danaher to underweight status, citing concerns over its inadequate organic growth. Company History (1984–91) In 1984, Steven and Mitchell Rales had formed Danaher by investing in undervalued manufacturing companies. The Rales brothers built Danaher by targeting family-owned or privately held companies with established brands, proprietary technology, high market share, and room for improvement in operating performance. Averaging 12 acquisitions per year (Exhibit 3), by 1986, Danaher was listed as a Fortune 500 company and held approximately 600 small and midsize companies. Acquisitions were concentrated in four areas: precision components (Craftsman hand tools), automotive and transportation (mechanics’ tools, tire changers), instrumentation (retail petrol pumps), and extruded products (vinyl siding). As these businesses grew and gained critical mass, Danaher used the term business unit to define any collection of similar businesses. Exhibit 4 provides a brief history of each of the original four businesses. Restructuring George Sherman was brought from Black & Decker as Danaher’s CEO following the crash of the LBO market in 1988.