Keller Group Plc Interim Results 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

R Egeneration C Onstruction

Regeneration Annual Report 2016 Construction About us Morgan Sindall Group is a leading UK construction and regeneration group. We offer support at every stage of a project’s life cycle through our six divisions of Construction & Infrastructure, Fit Out, Property Services, Partnership Housing, Urban Regeneration and Investments. Construction Regeneration Our services include design, We work in close new build construction, partnership with land infrastructure works, owners, local authorities refurbishment and property and housing associations maintenance in the commercial to regenerate cities with and public sectors. Our multi-phased, mixed-use construction teams work developments. New housing, on projects of all sizes community buildings, shops, and complexity, either leisure facilities and public standalone or through spaces help stimulate local framework agreements economies and provide and strategic alliances. long-term social benefits. FRONT COVER: The Word, a new state-of-the-art Revenue Revenue cultural centre in South Shields containing a library, exhibition space, gaming area, ‘FabLab’ with 3D printers, IT suite, café £ 2.0bn £ 0.6bn and rooftop space. Delivered by Urban Regeneration in partnership 2015: £1.9bn 2015: £0.5bn with South Tyneside Council. Find out more about the Our activities touch the lives of a wide range of stakeholders. We have therefore Group from our website decided to embark on a new approach to our annual report, integrating financial at morgansindall.com. and non-financial reporting within our operating -

Louisiana Connection United Kingdom

LOUISIANA CONNECTION UNITED KINGDOM RECENT NEWS In January 2015, Louisiana Gov. Bobby Jindal visited the United Kingdom as part of an economic development effort. While there, he also addressed the Henry Jackson Society regarding foreign policy. FOREIGN DIRECT INVESTMENT The United Kingdom is the most frequent investor in Louisiana, with 31 projects since 2003 accounting for over $1.4 billion in capital expenditure and over 2,200 jobs. UK has invested many business service projects in Louisiana. Hayward Baker, a geotechnical contractor and a subsidiary of the UK-based Keller Group, has opened a new office in New Orleans to support customers and projects along the Gulf Coast. Atkins, a design an engineering consultancy, has opened a new office in Baton Rouge, the office aims to increase the firm’s support capabilities for projects throughout Louisiana. CONTACT INFORMATION Tymor Marine, an energy consultancy company, has opened a SANCHIA KIRKPATRICK new office in Kaplan, Louisiana, The opening will serve customers Chief Representative, United Kingdom operating in the Gulf of Mexico. [email protected] T +44.0.7793222939 In June 2013, Hunting Energy Services completed a $19.6 million investment in its new Louisiana facility. JAMES J. COLEMAN, JR., OBE Great Britain Louisiana companies have also established a presence in the UK. www.gov.uk/government/work/usa Including 15 direct investments in the U.K. since 2003 that have T 504.524.4180 resulted in capital expenditures totaling $253 million and the JUDGE JAMES F. MCKAY III creation of 422 jobs. Honorary Consul, Ireland [email protected] T 504.412.6050 TRADE EXPORTS IMPORTS The U.K. -

Constructing and Regenerating

Constructing and regenerating Annual report and accounts 2011 Constructing and regenerating Morgan Sindall Group is a leading UK construction and regeneration group employing around 7,000 people. The construction, infrastructure and design services of the Group provide clients with innovative and cost-effective solutions throughout the property and infrastructure lifecycle. Working in long-term trusted partnerships, the Group’s expertise in mixed-use and housing-led regeneration is creating large-scale economic and social renewal throughout the country. Construction and Fit Out Affordable Housing Urban Regeneration Investments Infrastructure Specialises in fit out and Specialises in the design Works with landowners Facilitates project Offers national design, refurbishment projects and build, refurbishment, and public sector partners development, primarily construction and in the office, education, maintenance, regeneration to unlock value from in the public sector, by infrastructure services retail, technology and and repair of homes and under-developed assets providing flexible financing to private and public leisure sectors through communities across the UK. to bring about sustainable solutions and development sector customers. The Overbury as a national The division operates a full regeneration and urban expertise covering a wide division works on projects fit out company operating mixed-tenure model renewal through the range of markets including of all sizes across a broad through multiple creating homes for rent, delivery of mixed-use urban regeneration, range of sectors including procurement routes and shared ownership and projects typically creating education, healthcare, commercial, defence, Morgan Lovell specialising open market sale. commercial, retail, housing, emergency education, energy, in the design and build residential, leisure services, defence and healthcare, industrial, of offices in London and and public realm facilities. -

Contents Introduction

Stock Market Research Platform November 2019 Could be a gem – selection Contents Introduction ............................................................................................................................ 2 ASA International Group Plc – ASAI -Asia & Africa Microfinance Bank - Could be a gem ................................................................................................................................................ 2 Clipper Logistics plc – CLG – hit alongside retail but it is e-fulfilment ............................... 4 Costain Group plc – COST – High pension risks .................................................................. 4 Forterra – FORT – depends on building market in the UK but looks good .......................... 5 Funding Circle PLC – FCH – interesting, trading at cash value but risky ............................ 6 Gem Diamonds Ltd – GEMD – interesting diamond market ................................................ 8 Georgia Capital Plc – CGEO – Interesting exposure to Georgia........................................... 8 Huntsworth plc – HNT – positive tailwinds, could be a gem, but insane............................ 12 Keller Group – KLR – Interesting business ......................................................................... 14 Menzies (John) plc – MNZS – ............................................................................................. 15 MJ Gleeson plc – GLE ......................................................................................................... 17 -

UK Annual Report 2015 (Including the Transparency Report)

Investing to become the Clear Choice UK Annual Report 2015 (including the Transparency Report) December 2015 KPMG.com/uk Highlights Strategic report Profit before tax and Revenue members’ profit shares £1,958m £383m (2014: £1,909m) (2014: £414m) +2.6% -7% 2013 2014 2015 2013 2014 2015 Average partner Total tax payable remuneration to HMRC £623k £786m (2014: £715K) (2014: £711m) -13% +11% 2013 2014 2015 2013 2014 2015 Contribution Our people UK employees KPMG LLP Annual Report 2015 Annual Report KPMG LLP 11,652 Audit Advisory Partners Tax 617 Community support Organisations supported Audit Tax Advisory Contribution Contribution Contribution £197m £151m £308m (2014: £181m) (2014: £129m) (2014: £324m) 1,049 +9% +17% –5% (2014: 878) © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Strategic report Contents Strategic report 4 Chairman’s statement 10 Strategy 12 Our business model 16 Financial overview 18 Audit 22 Solutions 28 International Markets and Government 32 National Markets 36 People and resources 40 Corporate Responsibility 46 Our taxes paid and collected 47 Independent limited assurance report Governance 52 Our structure and governance 54 LLP governance 58 Activities of the Audit & Risk Committee in the year 59 Activities of the Nomination & Remuneration Committee in the year KPMG in the UK is one of 60 Activities of the Ethics Committee in the year 61 Quality and risk management the largest member firms 2015 Annual Report KPMG LLP 61 Risk, potential impact and mitigations of KPMG’s global network 63 Audit quality indicators 66 Statement by the Board of KPMG LLP providing Audit, Tax and on effectiveness of internal controls and independence Advisory services. -

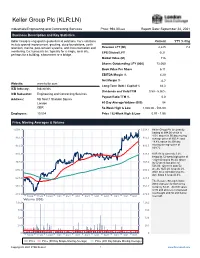

Keller Group Plc (KLR:LN)

Keller Group Plc (KLR:LN) Industrials/Engineering and Contracting Services Price: 994.00 GBX Report Date: September 24, 2021 Business Description and Key Statistics Keller Group is engaged in geotechnical solutions. Co.'s solutions Current YTY % Chg include ground improvement, grouting, deep foundations, earth retention, marine, post-tension systems, and instrumentation and Revenue LFY (M) 2,225 7.4 monitoring. Co.'s projects are typically for a single, local site, EPS Diluted LFY -0.21 perhaps for a building, a basement or a bridge. Market Value (M) 716 Shares Outstanding LFY (000) 72,060 Book Value Per Share 6.11 EBITDA Margin % 4.20 Net Margin % -0.7 Website: www.keller.com Long-Term Debt / Capital % 44.3 ICB Industry: Industrials Dividends and Yield TTM 0.59 - 5.96% ICB Subsector: Engineering and Contracting Services Payout Ratio TTM % 0.0 Address: 5th floor;1 Sheldon Square London 60-Day Average Volume (000) 54 GBR 52-Week High & Low 1,028.00 - 506.00 Employees: 10,554 Price / 52-Week High & Low 0.97 - 1.96 Price, Moving Averages & Volume 1,054.1 1,054.1 Keller Group Plc is currently trading at 994.00 which is 4.5% above its 50 day moving 982.3 982.3 average price of 950.84 and 19.8% above its 200 day 910.5 910.5 moving average price of 829.72. 838.8 838.8 KLR:LN is currently 3.3% below its 52-week high price of 1,028.00 and is 96.4% above 767.0 767.0 its 52-week low price of 506.00. -

HW&Co. Industry Reader Template

EUROPEAN UPDATE INDUSTRY UPDATE │ SUMMER 2015 www.harriswilliams.com www.harriswilliams.de Harris Williams & Co. Ltd is a private limited company incorporated under English law having its registered office at 5th Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered with the Registrar of Companies for England and Wales under company number 7078852. Directors: Mr. Christopher Williams, Mr. Ned Valentine, Mr. Paul Poggi and Mr. Thierry Monjauze, authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. Ltd Niederlassung Frankfurt (German branch) is registered in the Commercial Register (Handelsregister) of the Local Court (Amtsgericht) of Frankfurt am Main, Germany, under registration number HRB 96687, having its business address at Bockenheimer Landstrasse 33-35, 60325 Frankfurt am Main, Germany. Permanent Representative (Ständiger Vertreter) of the Branch Niederlassung: Mr. Jeffery H. Perkins. EUROPEAN UPDATE INDUSTRY UPDATE │ SUMMER 2015 HARRIS WILLIAMS & CO. CONTACTS CONTENTS Thierry Monjauze Managing Director QUARTERLY QUICK READ 63 Brook Street London W1K 4HS United Kingdom EUROPEAN ECONOMIC CLIMATE Phone: +44 20 7518 8901 [email protected] EUROPEAN M&A ENVIRONMENT Red Norrie Managing Director EUROPEAN INBOUND M&A ENVIRONMENT 63 Brook Street London W1K 4HS United Kingdom AEROSPACE, DEFENCE & GOVERNMENT SERVICES Phone: +44 20 7518 8906 [email protected] BUSINESS SERVICES Jeffery Perkins Managing Director CONSUMER Bockenheimer Landstr. 33-35 60325 Frankfurt Germany ENERGY & POWER Phone: +49 69 3550638 00 [email protected] HEALTHCARE & LIFE SCIENCES LONDON OFFICE 63 Brook Street INDUSTRIALS London W1K 4HS United Kingdom Phone: +44 20 7518 8900 TECHNOLOGY, MEDIA & TELECOM FRANKFURT OFFICE Bockenheimer Landstrasse TRANSPORTATION & LOGISTICS 33-35 60325 Frankfurt am Main Germany FEATURED THEME Phone: +49 69 3650638 00 FEATURED THEME – MOMENTUM IN ACQUISITIONS BY STRATEGIC BUYERS1 . -

“Keller” Or “The Group”), the World’S Largest Geotechnical Specialist Contractor, Announces Its Results for the Year Ended 31 December 2019

3 March 2020 Keller Group plc Audited Preliminary Results for the year ended 31 December 2019 Keller Group plc (“Keller” or “the group”), the world’s largest geotechnical specialist contractor, announces its results for the year ended 31 December 2019. Strong H2 delivers results in line with expectations Constant 2019 2019 2018 currency IFRS 16 basis1 IAS 17 basis IAS 17 basis % change % change £m £m £m IAS 17 basis IAS 17 basis Revenue 2,300.5 2,300.5 2,224.5 3% 2% Underlying operating profit2 103.8 101.8 96.6 5% 2% Underlying profit before tax2 81.3 83.6 80.5 4% - Underlying diluted earnings per share2 81.3p 83.5p 79.1p 6% 2% Net debt 289.8 213.1 286.2 (26)% (25)% Dividend per share 40.0p 40.0p 35.9p +11% n/a Statutory operating profit 74.1 25.0 Statutory profit before tax 51.6 8.4 Statutory diluted earnings per share 29.7p (20.6)p 1The group adopted IFRS 16 on 1 January 2019 and comparative financial measures have not been restated. The 2019 preliminary results prepared on the basis of IAS 17, the previous leasing standard, as well as under IFRS 16 have been presented and commented upon to allow meaningful comparison to prior periods 2 Underlying operating profit and underlying diluted earnings per share are non-statutory measures which provide readers of this preliminary announcement with a balanced and comparable view of the group’s performance by excluding the impact of non-underlying items, as disclosed in note 8 of the preliminary consolidated financial statements Highlights Results in line with expectations following a strong -

Annual Report 2020 Bodycote Plc Strategic Report Report Governance Financial Statements Additional Information

Annual Report 2020 Bodycote plc Strategic report report Governance Financial statements Additional information Contents Strategic report Governance 01 Understanding Bodycote 44 Board of Directors 02 Our markets and technologies 46 Corporate governance statement 04 Our global network 54 Directors’ report 06 Highlights 56 Report of the Nomination Committee 08 The investment case 59 Report of the Audit Committee 10 Chair’s statement 64 Board report on remuneration 11 Chief Executive’s review 76 Directors’ responsibilities statement 14 Strategy and objectives 15 Our business model Financial statements 16 Measuring progress 77 Independent auditors’ report 18 Our stakeholders 86 Consolidated income statement 19 Component journey – Dosing device 87 Consolidated balance sheet 20 Section 172 88 Consolidated cash flow statement 22 Business review 89 Consolidated statement of 24 Component journey – changes in equity Luxury watchmaking 90 Group accounting policies 25 Chief Financial Officer’s report 98 Notes to the consolidated 28 Component journey – Pinion gear financial statements 29 Principal risks and uncertainties 134 Five year summary 34 Viability statement 135 Company statement of financial position 35 Component journey – Aluminium dies 136 Company statement of changes 36 Environment, social and governance in equity 137 Company accounting policies 140 Notes to the company financial statements Additional information 145 Subsidiary undertakings 148 Shareholder enquiries 150 Company information www.bodycote.com/investors for more information In preparing this Strategic report, the Directors have complied with s414C of the Companies Act 2006. This Strategic report has been prepared for the Group as a whole and therefore gives greater emphasis to those matters which are significant to Bodycote plc and its subsidiary undertakings when viewed as a whole. -

Epoc 2014 European Powers of Construction

EPoC 2014 European Powers of Construction June 2015 EPoC is an annual publication produced by Deloitte and distributed free of charge Director Javier Parada, partner in charge of the Infrastructure Industry, Spain Coordinated by Margarita Velasco Martín Alurralde Serra Beltrán Fernández de Pinedo Published by CIBS Contact Infrastructure Department, Deloitte Madrid Plaza Pablo Ruiz Picasso, S/N Torre Picasso 28020 Madrid, Spain Phone + 34 91 514 50 00 Fax + 34 91 514 51 80 June 2015 Contents 4 Introduction 5 Ranking of listed European construction companies 6 Top 50 EPoC – ranking by sales 7 Top 20 EPoC – ranking by market capitalisation 8 Outlook for the construction industry in the EU 13 Top 20 EPoC strategies: internationalisation and diversification 17 EPoC 2014 financial performance 28 Internationalisation: Business opportunities 36 Diversification of the EPoC 2014 39 Financing of EPoC 2014 41 Performance of non-European construction companies 49 Top 20 EPoC – Company profiles Introduction The twelfth edition of European Powers of Construction examines the performance of the major listed European construction groups in terms of revenue, market capitalisation, internationalisation, diversification, indebtedness and other financial ratios. We are pleased to present European Powers of percentage points, reaching 52.1% of total sales, while Construction 2014, our annual publication in which non-construction activity increased by 0.7 percentage we identify and outline the major listed European points to 26.2%. Additionally, we have again taken a construction groups. This publication examines the look at the main non-European construction groups, in market position and performance of the main players in order to draw comparisons with the figures and financial the industry in terms of revenue, market capitalisation, ratios recorded by our EPoC. -

Keller Group Plc Annual Report and Accounts

Keller Group plc Annual Report and Accounts 2009 02 Keller at a glance 04 Year at a glance 06 Chairman’s statement 08 Operating review 10 US 14 CEMEA 18 Australia 20 UK 22 Financial review 25 Social responsibility 30 The Board 32 Directors’ report 34 Remuneration report 40 Corporate governance 44 Statement of Directors’ responsibilities 45 Independent Auditors’ report 46 Consolidated financial statements 46 Income statement 46 Statement of comprehensive income 47 Balance sheet 48 Statement of changes in equity 49 Cash flow statement 50 Notes to the consolidated financial statements 71 Company financial statements 71 Balance sheet 72 Notes to the Company financial statements 77 Financial record 78 Notice of Annual General Meeting 84 Principal offices IBC Secretary and advisers Forward-looking statements This report contains forward-looking statements. These have been made by the Directors in good faith based on the information available to them up to the time of their approval of this report. The Directors can give no assurance that these expectations will prove to have been correct. Due to the inherent uncertainties, including both economic and business risk factors underlying such forward-looking information, actual results may differ materially from those expressed or implied by these forward-looking statements. Except as required by law or regulation, the Directors undertake no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise. Keller Group plc 01 We are the world’s largest independent ground engineering contractor, renowned for providing technically advanced and cost-effective foundation solutions. Our reputation is built on engineering excellence and a commitment to continual innovation.