Hong Kong Telecom Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Opening China's Telecommunications

Research Assessment Exercise 2020 Impact Case Study University: The Hong Kong University of Science and Technology Unit of Assessment (UoA): 22-Business Title of case study: Opening China’s Telecommunications Market for Hong Kong Investors 1. Summary of the impact Policies for the telecommunications sector within the significant Closer Economic Partnership Agreement (CEPA) cross-border trade agreement between Hong Kong and mainland China have been influenced by research by Xu Yan, linked to his earlier studies on telecommunications policy in Hong Kong and mainland China carried out at HKUST. Such work has had impact on policy by informing senior government policymakers locally and nationally through recommendations on how to liberalize the Chinese telecommunications market under CEPA, and contributed to economic impact following the opening up of this sector to Hong Kong investors under the agreement, mainly in value-added services and particularly in Guangdong Province. 2. Underpinning research Professor of Information Systems, Business Statistics and Operations Management Xu Yan (joined HKUST in 1997) has established himself as an expert on the telecommunications sector and its regulation in Hong Kong and mainland China through a series of published comparative studies that address telecommunication policy issues, in particular market liberalization. Xu’s distinctive perspective on this area draws on his in-depth east-west knowledge resulting from previous working experience in the Ministry of Posts and Telecommunications of China and its affiliated university, doctoral studies on telecommunications policy in the UK, and a dedicated research focus on telecommunications market over the past 15 years, with almost all of his publications up to 2015 centered on this area and related issues. -

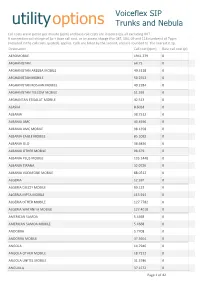

Utilityoptions Trunks and Nebula

Voiceflex SIP utilityoptions Trunks and Nebula Call costs are in pence per minute (ppm) and base call costs are in pence (p), all excluding VAT. A connection call charge of 1p + base call cost, or an access charge (for 087, 084, 09 and 118 numbers) of 7ppm (included in the call costs quoted), applies. Calls are billed by the second, and are rounded to the nearest 0.1p. Destination Call cost (ppm) Base call cost (p) AEROMOBILE 1941.279 0 AFGHANISTAN 64.75 0 AFGHANISTAN AREEBA MOBILE 49.3118 0 AFGHANISTAN MOBILE 50.2552 0 AFGHANISTAN ROSHAN MOBILE 49.2284 0 AFGHANISTAN TELCOM MOBILE 51.393 0 AFGHANTAN ETISALAT MOBILE 42.513 0 ALASKA 8.6024 0 ALBANIA 38.7512 0 ALBANIA AMC 40.4596 0 ALBANIA AMC MOBILE 98.1358 0 ALBANIA EAGLE MOBILE 85.1092 0 ALBANIA OLO 38.6836 0 ALBANIA OTHER MOBILE 98.679 0 ALBANIA PLUS MOBILE 105.1448 0 ALBANIA TIRANA 32.0726 0 ALBANIA VODAFONE MOBILE 88.0512 0 ALGERIA 12.397 0 ALGERIA DJEZZY MOBILE 89.133 0 ALGERIA MPTA MOBILE 113.914 0 ALGERIA OTHER MOBILE 127.7782 0 ALGERIA WATANIYA MOBILE 127.4018 0 AMERICAN SAMOA 5.4668 0 AMERICAN SAMOA MOBILE 5.4668 0 ANDORRA 5.7708 0 ANDORRA MOBILE 37.3604 0 ANGOLA 14.7946 0 ANGOLA OTHER MOBILE 18.7312 0 ANGOLA UNITEL MOBILE 31.3746 0 ANGUILLA 37.1572 0 Page 1 of 42 Destination Call cost (ppm) Base call cost (p) ANGUILLA DIGICEL MOBILE 50.396 0 ANGUILLA MOBILE 74.2312 0 ANTARCTICA AUS 322.0664 0 ANTARCTICA GSM AQ 805.1108 0 ANTIGUA AND BARBUDA 38.3864 0 ANTIGUA AND BARBUDA MOBILE 47.2468 0 ANTIGUA DIGICEL MOBILE 53.2244 0 ARGEN BUENOS AIRES 1.34 0 ARGENTINA 7.1152 0 ARGENTINA CENTRAL -

Usage Charges for Selected Services

eye Multimedia Service - Service Charge Summary eye 多媒睇服務收費表 Item 項目 Charges 費用 Monthly Rate within Month-to-Month Rate Commitment Period 月費 承諾期內月費 Premium Kids’ Pack HK$20 x 18/ 24months HK$20 升級益智樂園 HK$20 x 18/ 24個月 MOOV on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – MOOV屋企點唱機服務 HK$30 x 18/ 24個月 Now Sports on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – Now體育頻道服務 HK$30 x 18/ 24個月 Now Adult Channel – 901 Ice Fire note 1 HK$38 x 18 months HK$38 Now 成人頻道901 – 冰火頻道備註1 HK$38 x 18個月 Now Adult Channel – 903 Channel Adult note 1 HK$48 x 18 months HK$48 Now 成人頻道 – 903成人極品台備註1 HK$48 x 18個月 Now Adult Channel Pack – Channel 901 Ice Fire & 903 Channel Adult note 1 HK$60 x 18 months HK$60 Now 成人頻道組合 – 頻道901冰火頻道及903成人極品台備註1 HK$60 x 18個月 Now Adult Channel Mini Pack A - Channel 901 & 903 note 1, Now Sports Package on eye, 100 HK$88 x 18 months HK$88 Real Time Stock Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合A – 頻道901及903備註1, Now體育頻道組合, 100個即時股價查詢備註1, 2 & 3及 通話組合 Now Adult Channel Mini Pack B - Channel 901 & 903 note 1, MOOV on eye, 200 Real Time Stock HK$88 x 18 months HK$88 Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合B – 頻道901及903備註1, MOOV屋企點唱機, 200個即時股價查詢備註1, 2 & 3及 通話組合 Real-time Stock Quote note 1 HK$0.3 per quote 即時股價查詢備註1 每個報價HK$0.3 200 Real-time Stock Quote note 1, 2 HK$30 per month HK$30 200個即時股價查詢備註1, 2 每月HK$30 500 Real-time Stock Quote note 1, 2 HK$58 per month HK$58 500個即時股價查詢備註1, 2 每月HK$58 1,000 Real-time Stock Quote note 1, 2 HK$98 per month HK$98 1,000個即時股價查詢備註1, -

Annual Report 2018 1 CORPORATE PROFILE (CONTINUED)

CONTENTS 1 Corporate Profile 3 Statement from the Chairman 4 Statement from the Group Managing Director 8 PCCW in Numbers 10 Significant Events in 2018 12 Awards 18 Board of Directors 24 Corporate Governance Report 42 Management’s Discussion and Analysis 53 Financial Information 224 Investor Relations CORPORATE PROFILE PCCW Limited is a global company headquartered in Hong Kong which holds interests in telecommunications, media, IT solutions, property development and investment, and other businesses. The Company holds a majority interest in the HKT Trust and HKT Limited, Hong Kong’s premier telecommunications service provider and leading operator in fixed-line, broadband and mobile communication services. Beyond connectivity, HKT provides innovative smart living and business services to individuals and enterprises. PCCW also owns a fully integrated multimedia and entertainment group in Hong Kong, PCCW Media. PCCW Media operates the largest local pay-TV operation, Now TV, and is engaged in the provision of OTT (over-the-top) video service under the Viu brand in Hong Kong and other places in the region. Through HK Television Entertainment Company Limited, PCCW also operates a domestic free television service in Hong Kong. Also wholly-owned by the Group, PCCW Solutions is a leading information technology outsourcing and business process outsourcing provider in Hong Kong and mainland China. In addition, PCCW holds a majority interest in Pacific Century Premium Developments Limited, and other overseas investments. Employing over 23,600 staff, PCCW maintains a presence in Hong Kong, mainland China as well as other parts of the world. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the OTC Markets Group Inc. -

Virgin Media Consolidated Financial Statements

Consolidated Financial Statements December 31, 2018 VIRGIN MEDIA INC. 1550 Wewatta Street, Suite 1000 Denver, Colorado 80202 United States VIRGIN MEDIA INC. TABLE OF CONTENTS Page Number Part I: Forward-looking Statements...................................................................................................................................... I - 1 Business ..................................................................................................................................................................... I - 3 Management............................................................................................................................................................... I - 21 Principal Shareholder................................................................................................................................................. I - 23 Risk Factors ............................................................................................................................................................... I - 24 Part II: Independent Auditors’ Report.................................................................................................................................... II - 1 Consolidated Balance Sheets as of December 31, 2018 and 2017 ............................................................................ II - 3 Consolidated Statements of Operations for the Years Ended December 31, 2018, 2017 and 2016 .......................... II - 5 Consolidated Statements of Comprehensive -

HKT Trust HKT Limited

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. HKT Trust (a trust constituted on November 7, 2011 under the laws of Hong Kong and managed by HKT Management Limited) and HKT Limited (incorporated in the Cayman Islands with limited liability) (Stock Code: 6823) CONTINUING CONNECTED TRANSACTIONS WITH THE PCCW GROUP The HKT Limited Group entered into various transactions with the PCCW Group for operational needs as described in the Prospectus which constituted continuing connected transactions of the Company under the Listing Rules. Such transactions and their respective annual caps will expire on December 31, 2013. It is anticipated that the existing continuing connected transactions with the PCCW Group will continue beyond December 31, 2013. The Directors propose to renew these continuing connected transactions and enter into new continuing connected transaction and set new Annual Caps as described in this announcement for the three financial years ending December 31, 2014 to 2016. PCCW is the controlling holder of the Share Stapled Units. Accordingly, the PCCW Group is a connected person of the Company under the Listing Rules. As the applicable percentage ratios (as defined in the Listing Rules) in respect of the relevant Annual Caps, in each case (or on an aggregated basis, as described below), of the continuing connected transactions, which are categorised according to the providers of the relevant service, exceed 0.1% but are less than 5%, the continuing connected transactions are subject to the reporting and announcement requirements under Rules 14A.45 to 14A.47 of the Listing Rules, but are exempt from the independent shareholders’ approval requirement under Rule 14A.34 of the Listing Rules. -

HKT's Proposed Acquisition Of

HKT’s proposed acquisition of CSL An economic analysis of competitive effects for the CA Final report Public Version April 2014 About London Economics London Economics is one of Europe's leading specialist economics and policy consultancies and has its head office in London. We also have offices in Brussels, Dublin, Cardiff and Budapest, and associated offices in Paris and Valletta. We advise clients in both the public and private sectors on economic and financial analysis, policy development and evaluation, business strategy, and regulatory and competition policy. Our consultants are highly-qualified economists with experience in applying a wide variety of analytical techniques to assist our work, including cost-benefit analysis, multi-criteria analysis, policy simulation, scenario building, statistical analysis and mathematical modelling. We are also experienced in using a wide range of data collection techniques including literature reviews, survey questionnaires, interviews and focus groups. Head Office: 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ, United Kingdom. w: londoneconomics.co.uk e: [email protected] : @LondonEconomics t: +44 (0)20 7866 8185 f: +44 (0)20 7866 8186 Authors Paula Ramada, David Lewin, Sion Jones (+44 (0) 20 7866 8185; [email protected]) Wherever possible London Economics uses paper sourced from sustainably managed forests using production processes that meet the EU eco-label requirements. Copyright © 2014 London Economics. Except for the quotation of short passages for the purposes -

HUAWEI Smartcare®

White Paper AIOps – Automated Dissatisfied CX Analysis May 2019 Mark Geere, Jing Hao, Chiu-Chung Yue, Derek Chen HUAWEI SmartCare® HUAWEI TECHNOLOGIES CO., LTD. Copyright © Huawei Technologies Co., Ltd. 2019. All rights reserved 1. Executive Summary Artificial Intelligence and Machine Learning has spread to all industries and all parts of those industries. Whether we are talking about Enterprise adaption within the Automated Cars, the Health industries etc. or within the consumer world where it is now embedded within everyone’s phones to help them take a better picture or more efficiently use their battery power. The point is that AI is now ubiquitous throughout our lives at work, home and within the products and services we consume. So it is no surprise that the Telecoms industry is also looking at how they can use AI to (1) improve internal efficiencies across their organizations, as well as (2) drive better customer engagement to enhance customer experience on the services they deliver (Figure 1). The “Automated Dissatisfied CX Analysis” use case is a part of the AIOps catalyst which links Hong Kong Telecom (HKT) with Huawei’s SmartCare® Customer experience solution to deliver on these 2 key areas. The focus of the use case is to investigate how customer complaints at the point of reporting can be intelligently analyzed in order to deliver the following benefits: Support network optimization: By aggregating affected users and problem dimensions, this use case supports network problem optimization based on user experience assurance and improves O&M efficiency. Support proactive care: Provides proactive care for identified affected users to improve customer satisfaction. -

Mobile Operators' Measures in Preventing Mobile Bill Shock

Mobile Operators’ Measures in Preventing Mobile Bill Shock Disclaimer: This document sets out the Mobile Operators’ Measures in Preventing Mobile Bill Shock in Hong Kong. It contains data and information submitted by the relevant operators to, and compiled by the Office of the Communications Authority (OFCA), and is published for public information only. This document will be updated periodically upon advice by mobile operators on new or enhanced initiatives they have taken on board. The mobile operators’ measures are voluntary in nature and the mobile operators may adjust their service packages and revise their measures from time to time. Therefore, consumers are strongly advised to consult individual mobile operators directly on their latest initiatives, service terms and conditions, as well as charging schemes and methods and other pertinent details prior to committing themselves to any mobile data services. While OFCA has endeavoured to ensure that the information in this document is correct, no warranty or guarantee, express or implied, is given as to its accuracy. The Government of the Hong Kong Special Administrative Region (HKSAR), the Communications Authority (CA) and OFCA shall not be responsible and accept no liability for any error, omission or inaccuracy in the materials and reserve the right to omit, suspend or edit any materials submitted. The Government of HKSAR, the CA and OFCA shall not be liable for any direct, indirect, special or consequential losses or damages (including, without limitation, damages for loss of business or loss of profits) arising in contract, tort or otherwise from the use of or inability to use this document, or any material contained in it, or from any action or decision taken as a result of using this document or any material contained in it. -

“Relationship Between Trading at Ask Price and the End-Of-Day Effect in Hong Kong Stock Exchange”

“Relationship between Trading at Ask Price and the End-of-Day Effect in Hong Kong Stock Exchange” AUTHORS Alex W.H. Chan Alex W.H. Chan (2005). Relationship between Trading at Ask Price and the End- ARTICLE INFO of-Day Effect in Hong Kong Stock Exchange. Investment Management and Financial Innovations, 2(4) RELEASED ON Monday, 05 December 2005 JOURNAL "Investment Management and Financial Innovations" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org 124 Investment Management and Financial Innovations, 4/2005 Relationship between Trading at Ask Price and the End-of- Day Effect in Hong Kong Stock Exchange Alex W.H. Chan1 Abstract This paper presents an empirical study on the intraday trading behavior of Hang Seng In- dex constituent stocks in Hong Kong Stock Exchange. We use LOGIT model to analyze the prob- ability of a trade occurring at the ask price and investigate its relationship with the end-of-day ef- fect. We find some systematic patterns of trading at ask price over different trading time intervals. This systematic pattern of trading at ask price can explain around one-third of the abnormal return from the end-of-day effect. JEL classification: G10, G12, G15 Key words: Intraday Return, Trade at Ask, End-of-Day Effect. 1. Introduction Many empirical investigations on the U.S. stock market document systematic patterns for the intraday stock price generating process (e.g. Wood, McInish and Ord (1985), Harris (1986) and Jain and Joh (1988)) and systematic intraday trading behavior of investors. -

Hong Kong Telecom Sector

China / Hong Kong Industry Focus Hong Kong Telecom Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 5 June 2018 Ringing a different tone HSI : 30,998 Expect higher residential broadband ARPU upside as low-ARPU subs contracted during the price war A N ALYST two years ago are due to renew their service Chris KO CFA, +852 2971 1707 [email protected] plans at higher prices in 2018 Tsz Wang TAM CFA, +852 2971 1772 Residential broadband operators are focusing on [email protected] raising revenue per customer by offering more services Mobile roaming market becoming a new arena Recommendation & valuation for price competition HKBN is our top pick in the sector as it benefits Company Price T arget Rec Mk t Cap F Y19F the most from a tariff hike in the residential Price Yield broadband market HK$ HK$ US$m % HKBN 11.08 13.90 BUY 1,426 6.7 Renew ing low-ARPU residential broadband subs at higher (1310 HK) HKT Trust prices. We expect the low-ARPU residential broadband subs 9.91 12.80 BUY 9,599 6.7 contracted in 2016 (when there was a price war) to renew (6823 HK) their service plans at a higher price in 2018, supporting an Hutchison Telecom 2.81 3.10 HOLD 1,732 2.0 industry tariff hike. Moreover, the duopoly players HKT (6823 (215 HK) HK, BUY) and HKBN (1310 HK, BUY) are also focusing on Smartone Telecom 8.65 7.80 HOLD 1,245 4.4 increasing their revenue per customer by bundling and selling (315 HK) more value-added services. -

SMS Coverage

7/26/2018 Centro De Mensajes :: Send Single SMS SMS Coverage Covering 651 Operators in 228 Countries. Country Operator Cost Comments Afghan Wireless Communication Company 0.0108 Dynamic Alphanumeric (AWCC) Afghanistan (+93) Roshan 0.0105 Alpha Sender Only Afghanistan (+93) MTN Afghanistan 0.0077 Senders are being Replaced Afghanistan (+93) Etisalat Afghanistan 0.0286 Dynamic Alphanumeric Afghanistan (+93) Salaam Afghan Telecom 0.0101 Dynamic Alphanumeric Afghanistan (+93) Albania Telekom Albania 0.0108 Dynamic Alphanumeric (+355) Albania Vodafone Albania 0.0116 Dynamic Alphanumeric (+355) Albania Eagle Mobile 0.0093 Dynamic Alphanumeric (+355) Algeria Algerie Telecom (Mobilis) 0.0178 Dynamic Alphanumeric (+213) Algeria Orascom Telecom (Djezzy) 0.0101 Dynamic Alphanumeric (+213) Algeria Ooredoo Algeria 0.0155 Dynamic Alphanumeric (+213) American Blue Sky Communications 0.0657 Dynamic Alphanumeric Samoa (+1684) Andorra Andorra Telecom (Servei De Tele. DAndorra) 0.0077 Dynamic Alphanumeric (+376) Angola Unitel Angola 0.0101 Dynamic Alphanumeric (+244) Angola Movicel Angola 0.0139 Dynamic Alphanumeric (+244) Anguilla Weblinks 0.0302 Dynamic Alphanumeric (+1264) Anguilla Wireless Ventures Anguilla (Digicel) 0.0302 Dynamic Alphanumeric (+1264) Anguilla Cable & Wireless Anguilla 0.0131 Dynamic Alphanumeric (+1264) Antigua and APUA PCS 0.0232 Dynamic Alphanumeric Barbuda (+1268) Antigua and FLOW Antigua (LIME - CWC) 0.0302 Dynamic Alphanumeric Barbuda (+1268) Antigua and Digicel Antigua 0.0099 Dynamic Alphanumeric Barbuda (+1268) Argentina Nextel