Hong Kong Internet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

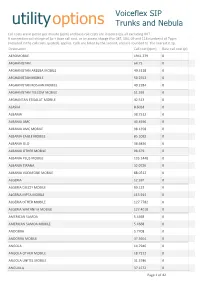

Utilityoptions Trunks and Nebula

Voiceflex SIP utilityoptions Trunks and Nebula Call costs are in pence per minute (ppm) and base call costs are in pence (p), all excluding VAT. A connection call charge of 1p + base call cost, or an access charge (for 087, 084, 09 and 118 numbers) of 7ppm (included in the call costs quoted), applies. Calls are billed by the second, and are rounded to the nearest 0.1p. Destination Call cost (ppm) Base call cost (p) AEROMOBILE 1941.279 0 AFGHANISTAN 64.75 0 AFGHANISTAN AREEBA MOBILE 49.3118 0 AFGHANISTAN MOBILE 50.2552 0 AFGHANISTAN ROSHAN MOBILE 49.2284 0 AFGHANISTAN TELCOM MOBILE 51.393 0 AFGHANTAN ETISALAT MOBILE 42.513 0 ALASKA 8.6024 0 ALBANIA 38.7512 0 ALBANIA AMC 40.4596 0 ALBANIA AMC MOBILE 98.1358 0 ALBANIA EAGLE MOBILE 85.1092 0 ALBANIA OLO 38.6836 0 ALBANIA OTHER MOBILE 98.679 0 ALBANIA PLUS MOBILE 105.1448 0 ALBANIA TIRANA 32.0726 0 ALBANIA VODAFONE MOBILE 88.0512 0 ALGERIA 12.397 0 ALGERIA DJEZZY MOBILE 89.133 0 ALGERIA MPTA MOBILE 113.914 0 ALGERIA OTHER MOBILE 127.7782 0 ALGERIA WATANIYA MOBILE 127.4018 0 AMERICAN SAMOA 5.4668 0 AMERICAN SAMOA MOBILE 5.4668 0 ANDORRA 5.7708 0 ANDORRA MOBILE 37.3604 0 ANGOLA 14.7946 0 ANGOLA OTHER MOBILE 18.7312 0 ANGOLA UNITEL MOBILE 31.3746 0 ANGUILLA 37.1572 0 Page 1 of 42 Destination Call cost (ppm) Base call cost (p) ANGUILLA DIGICEL MOBILE 50.396 0 ANGUILLA MOBILE 74.2312 0 ANTARCTICA AUS 322.0664 0 ANTARCTICA GSM AQ 805.1108 0 ANTIGUA AND BARBUDA 38.3864 0 ANTIGUA AND BARBUDA MOBILE 47.2468 0 ANTIGUA DIGICEL MOBILE 53.2244 0 ARGEN BUENOS AIRES 1.34 0 ARGENTINA 7.1152 0 ARGENTINA CENTRAL -

ZONE COUNTRIES OPERATOR TADIG CODE Calls

Calls made abroad SMS sent abroad Calls To Belgium SMS TADIG To zones SMS to SMS to SMS to ZONE COUNTRIES OPERATOR received Local and Europe received CODE 2,3 and 4 Belgium EUR ROW abroad (= zone1) abroad 3 AFGHANISTAN AFGHAN WIRELESS COMMUNICATION COMPANY 'AWCC' AFGAW 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN AREEBA MTN AFGAR 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN TDCA AFGTD 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN ETISALAT AFGHANISTAN AFGEA 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 1 ALANDS ISLANDS (FINLAND) ALANDS MOBILTELEFON AB FINAM 0,08 0,29 0,29 2,07 0,00 0,09 0,09 0,54 2 ALBANIA AMC (ALBANIAN MOBILE COMMUNICATIONS) ALBAM 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALBANIA VODAFONE ALBVF 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALBANIA EAGLE MOBILE SH.A ALBEM 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA DJEZZY (ORASCOM) DZAOT 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA ATM (MOBILIS) (EX-PTT Algeria) DZAA1 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA WATANIYA TELECOM ALGERIE S.P.A. -

Usage Charges for Selected Services

eye Multimedia Service - Service Charge Summary eye 多媒睇服務收費表 Item 項目 Charges 費用 Monthly Rate within Month-to-Month Rate Commitment Period 月費 承諾期內月費 Premium Kids’ Pack HK$20 x 18/ 24months HK$20 升級益智樂園 HK$20 x 18/ 24個月 MOOV on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – MOOV屋企點唱機服務 HK$30 x 18/ 24個月 Now Sports on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – Now體育頻道服務 HK$30 x 18/ 24個月 Now Adult Channel – 901 Ice Fire note 1 HK$38 x 18 months HK$38 Now 成人頻道901 – 冰火頻道備註1 HK$38 x 18個月 Now Adult Channel – 903 Channel Adult note 1 HK$48 x 18 months HK$48 Now 成人頻道 – 903成人極品台備註1 HK$48 x 18個月 Now Adult Channel Pack – Channel 901 Ice Fire & 903 Channel Adult note 1 HK$60 x 18 months HK$60 Now 成人頻道組合 – 頻道901冰火頻道及903成人極品台備註1 HK$60 x 18個月 Now Adult Channel Mini Pack A - Channel 901 & 903 note 1, Now Sports Package on eye, 100 HK$88 x 18 months HK$88 Real Time Stock Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合A – 頻道901及903備註1, Now體育頻道組合, 100個即時股價查詢備註1, 2 & 3及 通話組合 Now Adult Channel Mini Pack B - Channel 901 & 903 note 1, MOOV on eye, 200 Real Time Stock HK$88 x 18 months HK$88 Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合B – 頻道901及903備註1, MOOV屋企點唱機, 200個即時股價查詢備註1, 2 & 3及 通話組合 Real-time Stock Quote note 1 HK$0.3 per quote 即時股價查詢備註1 每個報價HK$0.3 200 Real-time Stock Quote note 1, 2 HK$30 per month HK$30 200個即時股價查詢備註1, 2 每月HK$30 500 Real-time Stock Quote note 1, 2 HK$58 per month HK$58 500個即時股價查詢備註1, 2 每月HK$58 1,000 Real-time Stock Quote note 1, 2 HK$98 per month HK$98 1,000個即時股價查詢備註1, -

China Mobile (Hong Kong) Limited

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 20-F ® © REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ®X© ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Ñscal year ended December 31, 2000 OR ® © TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Ñle number 1-14696 China Mobile (Hong Kong) Limited (Exact Name of Registrant as SpeciÑed in Its Charter) N/A (Translation of Registrant's Name into English) Hong Kong, China (Jurisdiction of Incorporation or Organization) 60th Floor, The Center 99 Queen's Road Central Hong Kong, China (Address of Principal Executive OÇces) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Ordinary shares, par value HK$0.10 per share New York Stock Exchange, Inc.* * Not for trading, but only in connection with the listing on the New York Stock Exchange, Inc. of American depositary shares representing the ordinary shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. As of December 31, 2000, 18,605,312,241 ordinary shares, par value HK$0.10 per share, were issued and outstanding. -

Creating Trust in Critical Network Infrastructures: Korean Case Study

INTERNATIONAL TELECOMMUNICATION UNION ITU WORKSHOP ON Document: CNI/05 CREATING TRUST IN CRITICAL 20 May 2002 NETWORK INFRASTRUCTURES Seoul, Republic of Korea — 20 - 22 May 2002 CREATING TRUST IN CRITICAL NETWORK INFRASTRUCTURES: KOREAN CASE STUDY Creating trust in critical network infrastructures: Korean case study This case study has been prepared by Dr. Chaeho Lim <[email protected]>. Dr Cho is Visiting Professor at the Korean Institute of Advanced Science & Technology, in the Infosec Education and Hacking, Virus Research Centre. This case study, Creating Trust in Critical Network Infrastructures: Korean Case Study, is part of a series of Telecommunication Case Studies produced under the New Initiatives programme of the Office of the Secretary General of the International Telecommunication Union (ITU). Other country case studies on Critical Network Infrastructures can be found at <http://www.itu.int/cni>. The opinions expressed in this study are those of the author and do not necessarily reflect the views of the International Telecommunication Union, its membership or the Korean Government. The author wishes to acknowledge Mr Chinyong Chong <[email protected]> of the Strategy and Policy Unit of ITU for contributions to the paper. The paper has been edited by the ITU secretariat. The author gratefully acknowledges the generous assistance of all those who have contributed information for this report. In particular, thanks are due to staff of Ministry of Information and Communication and Korean Information Security Agency for their help and suggestions. 2/27 Creating trust in critical network infrastructures: Korean case study TABLE OF CONTENTS Executive summary ......................................................................................................................................................... 4 1. Introduction............................................................................................................................................................. -

Interim Report on the Asian Telecom Connectivity Market

Asian Telecom Connectivity Market: Executive Summary (Research conducted 2005) The following is a summary of the findings of the Telecommunications Research Project University of Hong Kong NOTE1 The original research was undertaken for a private client in 2005 and the detailed report and recommendations are therefore not publicly available, but the following Executive Summary was made available at the time to companies who provided information and their opinions. In respect of demand and supply, the research goes beyond the data and analysis provided by TeleGeography (an industry benchmark publication) by estimating various rates of growth of demand against estimates of capacity lit and capacity used, thereby projecting various dates of capacity exhaustion. Unity Cable Since this research the 10,000 km Unity Cable connecting Japan and the USA has been announced (2008) consisting of carriers SingTel, Bharti- Airtel and KDDI, together with Internet companies Google, Pacnet and Global Transit (subsidiary of Malaysian network exchange company, AIMS). 1 This Executive Summary also appears as Appendix 2 in John Ure (ed.) Telecommunications Development in Asia, HKU Press, April 2008 1 Asian Telecom Connectivity Market: Executive Summary2 Between June and August 2005, the Telecommunications Research Project (TRP) at the University of Hong Kong undertook an extensive look at the regional bandwidth market. The research study was undertaken with intent to understand both the supply (and pricing) and demand sides of the equation, based upon feedback direct from carriers and experts, on the one hand, and from those directly purchasing bandwidth on the other. It quickly became apparent that the supply and demand of bandwidth represent two distinct stories which, not only are not necessarily in alignment (obvious enough to anyone who has been watching the market over the last 10 years), but are at times quite seriously disconnected in their fundamental drivers. -

KDDI Global ICT Brochure

https://global.kddi.com KDDI-Global Networks and IT Solutions Networking, Colocation, System Integration around the world BUILDING YOUR BUSINESS TOGETHER KDDI solutions are at the cutting-edge in all fields of information and communications KDDI, a Fortune Global 500 company, is one of Asia’s largest telecommunications providers, with approximately US$48 billion in annual revenue and a proven track record extending over many years and around the world. We deliver all-round services, from mobile phones to fixed-line communications, making us your one-stop solution provider for telecommunications and IT environments. The high praise and trust enjoyed by our TELEHOUSE data centers positioned around the world have kept us at the forefront of service and quality. Since our establishment in 1953, we have expanded our presence into 28 countries and 60 cities, with over 100 offices around the world supporting the success of our international customers through our high quality services. KDDI’s mobile telephone brand “au” has achieved significant market share in Japan, one of the world’s most comprehensive KDDI Quick Facts communications markets. KDDI’s relationship with over 600 carriers worldwide enables us to provide high-quality international network services in over 190 countries. Our exciting ventures, built on extensive experience, include investment in the “South-East Asia Japan 2 Cable”, which connects 11 locations in 9 countries and territories in Asia. Moreover, as the world moves toward the age of IoT and 5G, KDDI is taking steps to promote IoT business, such as connected cars, support for companies engaged in global business, and the creation of new value for our society. -

Roaming User Guide

Data Roaming Tips Singtel helps you stay seamlessly connected with data roaming overseas while avoiding bill shock from unexpected roaming charges. The information below can help you make smart data roaming decisions, allowing you to enjoy your trip with peace of mind. 1. Preferred Network Operators and LTE Roaming ...................................................................................... 2 2. USA Data Roaming Plan Coverage .......................................................................................................... 13 3. Network Lock .............................................................................................................................................. 14 4. My Roaming Settings................................................................................................................................. 16 5. Data Roaming User Guide ......................................................................................................................... 16 1. Preferred Network Operators and LTE Roaming The following table lists our preferred operators offering Singtel data roaming plans and indicates their handset display names. Country Roaming Plans Operator Handset Display Albania Daily Vodafone (LTE) VODAFONE AL / voda AL / AL-02 / 276-02 Anguilla Daily Cable & Wireless C&W / 365 840 Antigua and Daily Cable & Wireless C&W / 344 920 Barbuda CLARO Argentina / CTIARG / AR310 / Claro (LTE) Claro AR Argentina Daily Telefonica (LTE) AR 07 / 722 07 / unifon / movistar Armenia Daily VEON (LTE) -

Annual Report 2018 1 CORPORATE PROFILE (CONTINUED)

CONTENTS 1 Corporate Profile 3 Statement from the Chairman 4 Statement from the Group Managing Director 8 PCCW in Numbers 10 Significant Events in 2018 12 Awards 18 Board of Directors 24 Corporate Governance Report 42 Management’s Discussion and Analysis 53 Financial Information 224 Investor Relations CORPORATE PROFILE PCCW Limited is a global company headquartered in Hong Kong which holds interests in telecommunications, media, IT solutions, property development and investment, and other businesses. The Company holds a majority interest in the HKT Trust and HKT Limited, Hong Kong’s premier telecommunications service provider and leading operator in fixed-line, broadband and mobile communication services. Beyond connectivity, HKT provides innovative smart living and business services to individuals and enterprises. PCCW also owns a fully integrated multimedia and entertainment group in Hong Kong, PCCW Media. PCCW Media operates the largest local pay-TV operation, Now TV, and is engaged in the provision of OTT (over-the-top) video service under the Viu brand in Hong Kong and other places in the region. Through HK Television Entertainment Company Limited, PCCW also operates a domestic free television service in Hong Kong. Also wholly-owned by the Group, PCCW Solutions is a leading information technology outsourcing and business process outsourcing provider in Hong Kong and mainland China. In addition, PCCW holds a majority interest in Pacific Century Premium Developments Limited, and other overseas investments. Employing over 23,600 staff, PCCW maintains a presence in Hong Kong, mainland China as well as other parts of the world. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the OTC Markets Group Inc. -

Broadband Infrastructure in the ASEAN-9 Region

BroadbandBroadband InfrastructureInfrastructure inin thethe ASEANASEAN‐‐99 RegionRegion Markets,Markets, Infrastructure,Infrastructure, MissingMissing Links,Links, andand PolicyPolicy OptionsOptions forfor EnhancingEnhancing CrossCross‐‐BorderBorder ConnectivityConnectivity Michael Ruddy Director of International Research Terabit Consulting www.terabitconsulting.com PartPart 1:1: BackgroundBackground andand MethodologyMethodology www.terabitconsulting.com ProjectProject ScopeScope Between late‐2012 and mid‐2013, Terabit Consulting performed a detailed analysis of broadband infrastructure and markets in the 9 largest member countries of ASEAN: – Cambodia – Indonesia – Lao PDR – Malaysia – Myanmar – Philippines – Singapore – Thailand – Vietnam www.terabitconsulting.com ScopeScope (cont(cont’’d.)d.) • The data and analysis for each country included: Telecommunications market overview and analysis of competitiveness Regulation and government intervention Fixed‐line telephony market Mobile telephony market Internet and broadband market Consumer broadband pricing Evaluation of domestic network connectivity International Internet bandwidth International capacity pricing Historical and forecasted total international bandwidth Evaluation of international network connectivity including terrestrial fiber, undersea fiber, and satellite Evaluation of trans‐border network development and identification of missing links www.terabitconsulting.com SourcesSources ofof DataData • Terabit Consulting has completed dozens of demand studies for -

Review of the Development and Reform of the Telecommunications Sector in China”, OECD Digital Economy Papers, No

Please cite this paper as: OECD (2003-03-13), “Review of the Development and Reform of the Telecommunications Sector in China”, OECD Digital Economy Papers, No. 69, OECD Publishing, Paris. http://dx.doi.org/10.1787/233204728762 OECD Digital Economy Papers No. 69 Review of the Development and Reform of the Telecommunications Sector in China OECD Unclassified DSTI/ICCP(2002)6/FINAL Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development 13-Mar-2003 ___________________________________________________________________________________________ English text only DIRECTORATE FOR SCIENCE, TECHNOLOGY AND INDUSTRY COMMITTEE FOR INFORMATION, COMPUTER AND COMMUNICATIONS POLICY Unclassified DSTI/ICCP(2002)6/FINAL REVIEW OF THE DEVELOPMENT AND REFORM OF THE TELECOMMUNICATIONS SECTOR IN CHINA text only English JT00140818 Document complet disponible sur OLIS dans son format d'origine Complete document available on OLIS in its original format DSTI/ICCP(2002)6/FINAL FOREWORD The purpose of this report is to provide an overview of telecommunications development in China and to examine telecommunication policy developments and reform. The initial draft was examined by the Committee for Information, Computer and Communications Policy in March 2002. The report benefited from discussions with officials of the Chinese Ministry of Information Industry and several telecommunication service providers. The report was prepared by the Korea Information Society Development Institute (KISDI) under the direction of Dr. Inuk Chung. Mr. Dimitri Ypsilanti from the OECD Secretariat participated in the project. The report benefited from funding provided mainly by the Swedish government. KISDI also helped in the financing of the report. The report is published on the responsibility of the Secretary-General of the OECD. -

CSL Acquisition FCF Accretive: Prefer HKT Among HK Telcos

March 11, 2014 Hong Kong: Telecom Services Equity Research CSL acquisition FCF accretive: Prefer HKT among HK telcos HKT’s pending acquisition of CSL signals industry consolidation The HK mobile industry stands to benefit from HKT’s proposed US$2.4bn HONG KONG TELECOM VALUATION COMPS acquisition of CSL in the longer term, in our view, as it would reduce 12-Mo. Market Up/Down Total Name Ticker Rating Tgt Px Price Side Return competitive intensity in Asia’s highest penetrated mobile market. The deal PCCW 0008.HK Neutral 3.60 3.75 -4% 2% HKT Trust 6823.HK Neutral 8.90 8.25 8% 14% is pending regulatory approval after receiving PCCW and HKT HTHK 0215.HK Neutral 2.60 2.61 0% 4% SmarTone 0315.HK Neutral 10.00 9.20 9% 12% shareholders’ approval (99.98%) at the EGM on Feb 28. The acquisition P/E EV/EBITDA Div Yld could also potentially remove the overhang of the upcoming spectrum re- Name 2014E 2015E 2014E 2015E 2014E 2015E PCCW 13.0x 11.5x 5.6x 5.2x 6.0% 6.8% auction, which we would see as an industry-wide positive. HKT HKT Trust 22.7x 16.5x 8.9x 8.5x 5.9% 6.0% HTHK 15.6x 15.6x 6.4x 6.3x 4.8% 4.8% management estimates 10%-15% opex synergy on the combined mobile SmarTone 15.8x 16.3x 4.5x 4.5x 3.8% 3.7% business after full integration, or US$596mn-934mn in savings by our ROE ROIC CROCI Name 2014E 2015E 2014E 2015E 2014E 2015E estimate, which we believe is achievable for an in-market consolidation.