Annual Report 2018 1 CORPORATE PROFILE (CONTINUED)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Utilityoptions Trunks and Nebula

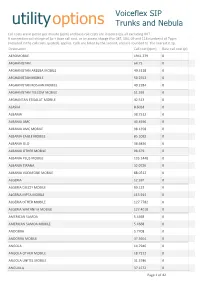

Voiceflex SIP utilityoptions Trunks and Nebula Call costs are in pence per minute (ppm) and base call costs are in pence (p), all excluding VAT. A connection call charge of 1p + base call cost, or an access charge (for 087, 084, 09 and 118 numbers) of 7ppm (included in the call costs quoted), applies. Calls are billed by the second, and are rounded to the nearest 0.1p. Destination Call cost (ppm) Base call cost (p) AEROMOBILE 1941.279 0 AFGHANISTAN 64.75 0 AFGHANISTAN AREEBA MOBILE 49.3118 0 AFGHANISTAN MOBILE 50.2552 0 AFGHANISTAN ROSHAN MOBILE 49.2284 0 AFGHANISTAN TELCOM MOBILE 51.393 0 AFGHANTAN ETISALAT MOBILE 42.513 0 ALASKA 8.6024 0 ALBANIA 38.7512 0 ALBANIA AMC 40.4596 0 ALBANIA AMC MOBILE 98.1358 0 ALBANIA EAGLE MOBILE 85.1092 0 ALBANIA OLO 38.6836 0 ALBANIA OTHER MOBILE 98.679 0 ALBANIA PLUS MOBILE 105.1448 0 ALBANIA TIRANA 32.0726 0 ALBANIA VODAFONE MOBILE 88.0512 0 ALGERIA 12.397 0 ALGERIA DJEZZY MOBILE 89.133 0 ALGERIA MPTA MOBILE 113.914 0 ALGERIA OTHER MOBILE 127.7782 0 ALGERIA WATANIYA MOBILE 127.4018 0 AMERICAN SAMOA 5.4668 0 AMERICAN SAMOA MOBILE 5.4668 0 ANDORRA 5.7708 0 ANDORRA MOBILE 37.3604 0 ANGOLA 14.7946 0 ANGOLA OTHER MOBILE 18.7312 0 ANGOLA UNITEL MOBILE 31.3746 0 ANGUILLA 37.1572 0 Page 1 of 42 Destination Call cost (ppm) Base call cost (p) ANGUILLA DIGICEL MOBILE 50.396 0 ANGUILLA MOBILE 74.2312 0 ANTARCTICA AUS 322.0664 0 ANTARCTICA GSM AQ 805.1108 0 ANTIGUA AND BARBUDA 38.3864 0 ANTIGUA AND BARBUDA MOBILE 47.2468 0 ANTIGUA DIGICEL MOBILE 53.2244 0 ARGEN BUENOS AIRES 1.34 0 ARGENTINA 7.1152 0 ARGENTINA CENTRAL -

Netvigator Application Confidential

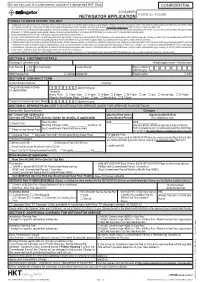

Do not pay cash to a sales person outside of a designated HKT Shop CONFIDENTIAL CONSUMER NETVIGATOR APPLICATION FORM ID: PCDRE THINGS TO KNOW BEFORE YOU BUY 1. Your Application and Service Guide set out the NETVIGATOR Services, Extra Services and/or Now TV services to which you have subscribed ("Services"), the applicable charges including your monthly charges for the Services as well as usage based and administrative and other charges which are payable in certain circumstances (such as for installation, moving and lost equipment), and the legal entity or entities responsible for providing those Services. Additional information about your Services and our shop addresses can be found on our website at http://www.hkt.com, http://nowtv.now.com/ (for Now TV services), or our Consumer Service Hotline at 1000. 2. Your Commitment Period (if any) for the Services is described in your Application in Section B. You can terminate your subscription to any Services within the Commitment Period by giving us not less than 30 days' prior written notice. If you terminate before the expiry of the Commitment Period, you will have to pay the Early Termination Charge described in Section E below (unless a Cooling-off Period is applicable), and (where applicable) compensate us for the value of any premium received by you. If you terminate your NETVIGATOR Services, your subscription to any Now TV services will also be terminated at the same time. 3. When the Commitment Period of Now TV services expires, we will continue to provide them on a month-to-month basis at the same monthly rate. -

Usage Charges for Selected Services

eye Multimedia Service - Service Charge Summary eye 多媒睇服務收費表 Item 項目 Charges 費用 Monthly Rate within Month-to-Month Rate Commitment Period 月費 承諾期內月費 Premium Kids’ Pack HK$20 x 18/ 24months HK$20 升級益智樂園 HK$20 x 18/ 24個月 MOOV on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – MOOV屋企點唱機服務 HK$30 x 18/ 24個月 Now Sports on eye Multimedia Service HK$30 x 18/ 24 months HK$30 eye多媒睇服務 – Now體育頻道服務 HK$30 x 18/ 24個月 Now Adult Channel – 901 Ice Fire note 1 HK$38 x 18 months HK$38 Now 成人頻道901 – 冰火頻道備註1 HK$38 x 18個月 Now Adult Channel – 903 Channel Adult note 1 HK$48 x 18 months HK$48 Now 成人頻道 – 903成人極品台備註1 HK$48 x 18個月 Now Adult Channel Pack – Channel 901 Ice Fire & 903 Channel Adult note 1 HK$60 x 18 months HK$60 Now 成人頻道組合 – 頻道901冰火頻道及903成人極品台備註1 HK$60 x 18個月 Now Adult Channel Mini Pack A - Channel 901 & 903 note 1, Now Sports Package on eye, 100 HK$88 x 18 months HK$88 Real Time Stock Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合A – 頻道901及903備註1, Now體育頻道組合, 100個即時股價查詢備註1, 2 & 3及 通話組合 Now Adult Channel Mini Pack B - Channel 901 & 903 note 1, MOOV on eye, 200 Real Time Stock HK$88 x 18 months HK$88 Quotes note 1, 2 & 3 and Voice Package HK$88 x 18個月 Now 成人頻道特選組合B – 頻道901及903備註1, MOOV屋企點唱機, 200個即時股價查詢備註1, 2 & 3及 通話組合 Real-time Stock Quote note 1 HK$0.3 per quote 即時股價查詢備註1 每個報價HK$0.3 200 Real-time Stock Quote note 1, 2 HK$30 per month HK$30 200個即時股價查詢備註1, 2 每月HK$30 500 Real-time Stock Quote note 1, 2 HK$58 per month HK$58 500個即時股價查詢備註1, 2 每月HK$58 1,000 Real-time Stock Quote note 1, 2 HK$98 per month HK$98 1,000個即時股價查詢備註1, -

Mobile Phones, Social Transformation, and the Reproduction of Power in the Philippines a Dissertation Submitted

TEXTING CAPITAL: Mobile Phones, Social Transformation, and the Reproduction of Power in the Philippines A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy at George Mason University By Cecilia S. Uy-Tioco Master of Arts The New School University, 2004 Master of Arts New York University, 1996 Bachelor of Arts Ateneo de Manila University, 1992 Director: Timothy Gibson, Associate Professor Department of Communication Summer Semester 2013 George Mason University Fairfax, VA This work is licensed under a creative commons attribution-noderivs 3.0 unported license. ii DEDICATION For my mom, Joy Uy-Tioco, who encouraged me to be curious, intellectually and otherwise, and to the memory of my dad, George Uy-Tioco, who would have loved mobile phones, text messaging, and the Internet. +AMDG iii ACKNOWLEDGEMENTS It would have been impossible to complete this degree without the support of friends, family, professors, and colleagues. I must start by thanking my dissertation chair, Tim Gibson, who has been incredibly encouraging, generous, and supportive, while being firm and constructively critical. If I could be half the professor he is, I would consider myself a success. I too am a charter member of the Tim Gibson fan club. Throughout my time at the CS program Paul Smith has always challenged me and pushed me to think more critically, and for that I am most grateful. It was during a directed reading course with Mark Sample that I really began to study new media and I am grateful for his support and insights. My scholarship has been enriched by courses and conversations with various faculty members at the GMU CS program particularly, Debra Lattanzi Shutika, Roger Lancaster, Dina Copelman, Jean-Paul Dumont, Denise Albanese, Hugh Gusterson, Debra Berghoffen, Johanna Bockman, Ellen Todd, and Scott Trafton. -

Bill Payment Payee List – Telecommunication Services

Bill Payment Payee List – Telecommunication Services Merchant Category Merchant Name Bill Account Description Bill Type Bill Type Description Telecommunication 1010 Bill Account Number 77 (Not to be provided by customers) Services 1579 Account Number 1628 Account Number 01 IDD Bill 1628 Account Number 02 Prepaid Card accessyou.com Bill Account Number China Mobile Hong Kong Company Limited PPS Payment No. on your Invoice 01 Monthly Invoice Charges - Monthly Service Plan China Mobile Hong Kong Company Limited 8-digit stored value SIM card mobile - Stored Value SIM Card number China Unicom (Hong Kong) Operations 11-digit Account Number 01 Unicom Express Card Fee Limited China Unicom (Hong Kong) Operations 11-digit Account Number 02 Mobile Monthly Fee Limited China Unicom (Hong Kong) Operations 11-digit Account Number 03 16400 IDD Postpaid Service Limited China Unicom (Hong Kong) Operations 11-digit Account Number 04 Other Services Limited China-Hongkong Telecom Limited Account Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 01 Recharge Stored-Value SIM Card Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 02 GMCC Card Service Charges Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 03 IDD & Call Forwarding Services Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 04 Internet and Pnets Service Charges Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 05 Mobile Phone Services Mobile Phone Number ComNet Telecom (HK) Limited 8 Digit Account Number 01 IDD 0050 ComNet Telecom (HK) Limited 8 Digit Account Number 02 ComNet Phone csl (one2free) Account Number 1 Bill Payment Payee List – Telecommunication Services Merchant Category Merchant Name Bill Account Description Bill Type Bill Type Description Telecommunication CSL Mobile Limited Account No. -

Mobile Operators' Measures in Preventing Mobile Bill Shock

Mobile Operators’ Measures in Preventing Mobile Bill Shock Disclaimer: This document sets out the Mobile Operators’ Measures in Preventing Mobile Bill Shock in Hong Kong. It contains data and information submitted by the relevant operators to, and compiled by the Office of the Communications Authority (OFCA), and is published for public information only. This document will be updated periodically upon advice by mobile operators on new or enhanced initiatives they have taken on board. The mobile operators’ measures are voluntary in nature and the mobile operators may adjust their service packages and revise their measures from time to time. Therefore, consumers are strongly advised to consult individual mobile operators directly on their latest initiatives, service terms and conditions, as well as charging schemes and methods and other pertinent details prior to committing themselves to any mobile data services. While OFCA has endeavoured to ensure that the information in this document is correct, no warranty or guarantee, express or implied, is given as to its accuracy. The Government of the Hong Kong Special Administrative Region (HKSAR), the Communications Authority (CA) and OFCA shall not be responsible and accept no liability for any error, omission or inaccuracy in the materials and reserve the right to omit, suspend or edit any materials submitted. The Government of HKSAR, the CA and OFCA shall not be liable for any direct, indirect, special or consequential losses or damages (including, without limitation, damages for loss of business or loss of profits) arising in contract, tort or otherwise from the use of or inability to use this document, or any material contained in it, or from any action or decision taken as a result of using this document or any material contained in it. -

General Conditions of “My HKT” Portal

General Conditions of “My HKT” Portal 1. These General Conditions a. This “My HKT” portal (My HKT website: https://cs.hkt.com; mobile app: My HKT App) and any of its webpages and applications (collectively, “Portal”) are provided and managed by us, HKT CSP Limited. The Portal is a self-service integrated platform for you to manage your My HKT account and information of your Subscribed Services (“My HKT Account”) through a single login, and for us to register and manage your My HKT Account on the Portal as your agent. You will also be able to view certain electronic bills of those eligible Subscribed Services on your My HKT Account (“View Bill Service”) and access other services via the Portal. b. By registering a My HKT Account, you unconditionally agree to all terms and conditions in connection with the Portal, including the prevailing version of these General Conditions, the Personal Information Collection Statement(s) made available to you at the time of your download or registration of the Portal and/or your use of the various services under the Portal (collectively, “PICS”), the HKT Privacy Statement (available at My HKT website) and such other terms and conditions made available to you at the time of your download, registration and/or use of the Portal, as they may be modified and/or supplemented from time to time, with or without prior notice to you (collectively, “Contract T&Cs”). Please check the relevant webpages regularly to see if there have been any modifications and/or supplements which may have been made. -

Movicel: We Are Delivering Superior Value to Our Customers an Interview with Movicel CEO Yon Junior

JUN 2013 VOL. 15 ● NO. 3 ● ISSUE 146 A Universal Architecture for Small CMHK Partners with ZTE for LTE ZTE: Leading R&D on 100G 20 Cell Backhaul Radio 31 Microwave Backhaul Deployment 35 and Beyond VIP Voices Movicel: We Are Delivering Superior Value to Our Customers An interview with Movicel CEO Yon Junior Telefonica UK: Moving Beyond Traditional Services An interview with Peter Bailey, messaging and voice business manager, and Leon Veiro, LBS messaging architect of Telefonica UK Special Topic: Microwave Backhaul A Flexible Unified Architecture for Point-to-Point Digital Microwave Radios Tech Forum Using Cloud Radio to Deliver Promises in the 4G Era ZTE TECHNOLOGIES Editorial Board CONTENTS Chairman: Pang Shengqing Vice Chairmen: Chen Jane, Zhao Xianming, Zhu Jinyun Members: Chen Jian, Feng Haizhou, Heng Yunjun, Huang Liqing, Huang Xinming, Jiang Hua, Li Aijun, Li Guangyong, Lin Rong, Li Weipu, Lu Ping, Lu Wei, Lv Abin, Sun Zhenge, Wang Shouchen, Wang Xiaoming, Wang Xiyu, Xin Shengli, Xu Ming, Ye Ce, Yu Yifang, Zhang Shizhuang Sponsor: ZTE Corporation Movicel: Edited By Shenzhen Editorial Office, Strategy Planning Department Editor-in-Chief: Jiang Hua We Are Delivering Executive Deputy Editor-in-Chief: Huang Xinming Editorial Director: Liu Yang Superior Value Executive Editor: Yue Lihua Editors: Jin Ping, Paul Sleswick to Our Customers Circulation Manager: Wang Pingping Movicel is a leading mobile operator in Angola. Its networks cover 18 provinces all over the Angola. Today, one third of population is using Movicel’s voice or Editorial Office data services. ZTE Technologies recently interviewed Movicel CEO Yon Junior. Address: NO. 55, Hi-tech Road South, He talked about the cooperation with ZTE, the challenges of operating in Shenzhen, P.R.China Angola, and Movicel’s strategy. -

Pacific Century Regional Developments Limited

Pacific Century Regional Developments Limited Century Developments Regional Pacific Pacific Century Regional Developments Limited 50 Raffles Place, #35-01 Singapore Land Tower, Singapore 048623 Tel: (65) 6438 2366 Fax: (65) 6230 8777 Company Registration No. 196300381N Annual Report 2016 Annual Report Annual Report 2016 Pacific Century Regional Developments Limited Contents Corporate Profile 01 Message from the Executive Chairman 02 Corporate Structure 03 Board of Directors 04 Business Review 06 Financial Highlights 10 Corporate Information 12 Financial Statements 13 Report on Corporate Governance 74 Shareholding Statistics 88 Notice of 53rd Annual General Meeting 91 Notes to the Proxy Form 98 Proxy Form Corporate Profile Pacific Century Regional Developments Limited (PCRD), a Singapore-based company listed on the Singapore Exchange Securities Trading Limited (SES: P15), with interests in telecommunications, media, IT solutions, logistics and property development and investment, in the Asia-Pacific region. PCRD’s most significant investment is its stake in Hong Kong-listed PCCW Limited (PCCW) (SEHK: 0008; American Depositary Receipts on the OTC Markets Group Inc. in the US: PCCWY). PCRD is 89% owned by the Pacific Century Group, which was founded in 1993. The Pacific Century Group acquired control of PCRD in September 1994. Pacific Century Regional Developments Limited 01 Annual Report 2016 Message from the Executive Chairman I am pleased to present the annual report of PCRD for the The overseas property projects of PCCW’s subsidiary, financial year ended 31 December 2016. Pacific Century Premium Developments (PCPD), progressed as scheduled. In particular, Pacific Century Place Jakarta, PCRD’s most significant asset, PCCW Limited (PCCW), reported the 40-storey Premium Grade A office building in Indonesia, a steady performance for 2016. -

Interim Report 2010 1 KEY FIGURES

CONTENTS 1 Corporate Profile 2 Key Figures 3 Statement from the Chairman 4 Statement from the Group Managing Director 6 Board of Directors 11 Management’s Discussion and Analysis 20 Consolidated Income Statement 21 Consolidated Statement of Comprehensive Income 22 Consolidated and Company Balance Sheets 24 Consolidated Statement of Changes in Equity 25 Condensed Consolidated Cash Flow Statement 26 Notes to the Unaudited Condensed Consolidated Interim Financial Information 36 General Information 44 Investor Relations CORPORATE PROFILE PCCW Limited (PCCW or the Company) is the holding company of HKT Group Holdings Limited (HKT), Hong Kong’s premier telecommunications provider and a world-class player in Information and Communications Technologies. PCCW also holds a majority interest in Pacific Century Premium Developments Limited, and overseas investments including the wholly-owned UK Broadband Limited. As the provider of Hong Kong’s first quadruple-play experience, PCCW/HKT offers a range of innovative media content and services across four platforms – fixed-line, broadband Internet access, TV and mobile. In addition, the Group meets the sophisticated needs of the local and international business community, while supporting network operators with cutting-edge technical services and handling large-scale IT outsourcing projects for public and private sector organizations. Employing approximately 18,700 staff, PCCW is headquartered in Hong Kong and maintains a presence in Europe, the Middle East, Africa, the Americas and mainland China, as well as other parts of Asia. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the Pink OTC Markets in the U.S. -

NETVIGATOR Service Guide

NETVIGATOR Service Guide About this Service Guide: This NETVIGATOR Service Guide provides further information relating to NETVIGATOR Services (which includes NETVIGATOR and Fiber-to-the-Home Services), the Service Plans and options in your NETVIGATOR Application. Please read this Service Guide carefully as the Service entitlements, eligibility criteria and other important information applies to the Services and Now TV services, MOOV services, Now Sports Online or MEDIA.now.com services you may additionally subscribe under your NETVIGATOR Application. All capitalized terms used in this Service Guide shall have the same meanings ascribed to them in the General Conditions and the applicable Special Conditions, unless the context may otherwise require or unless specied otherwise in this Service Guide. PART I Important Information (collectively, "My HKT"), as well as HKT CSP Limited to register and manage your My HKT account on My relevant Service Provider(s) if the provision of the relevant service(s) is/are required. You are required to pay or Replacement of Equipment. bandwidth of 1.5Mbps / 3Mbps / 6Mbps / 8Mbps / 18Mbps / 30Mbps / 100Mbps and maximum dedicated Service Providers (only applicable to the service HKT as your agent, subject to the applicable terms and conditions. us the Early Termination Charge and other Cancellation Charges (if any) specied for all such Services, Now ■ MOVING HOME?: If you move your home and the NETVIGATOR, Now TV, New Media and other Services upstream bandwidth of 640Kbps / 640Kbps / 640Kbps / 800Kbps/ 1Mbps -

Hong Kong Internet

Hong Kong peering scene and network infrastructure Peering Asia 1.0, 1st Nov, 2017 Kyoto, Japan Self-Introduction • Kams Yeung • Network Architect, Akamai • Robin Kong • Interconnection Manager, Facebook Agenda • Hong Kong Overview • Hong Kong Telecommunications Overview • Internet Exchanges • Data Centers • Submarine Cables & Cable Landing Stations • Transit Carriers / Cloud Providers Hong Kong Overview Demography • Population: 7.325 millions • Households: 2.832 millions Area • 1,106 square km Official Languages • Chinese (Cantonese) • English Hong Kong Telecommunications Overview •Internet service providers •Internet access •Mobile services •Local loop / metro network operators •External telecommunications providers 226 Internet Services Providers • Major fixed broadband providers • PCCW Netvigator • Hong Kong Broadband (HKBN) • Hutchison Global Communications (HGC) • i-Cable • Major business broadband providers • WTT HK (formerly Wharf T&T) • PCCW Business Netvigator • Hutchison Global Communications (HGC) • Hong Kong Broadband (HKBN) Internet access Fixed broadband services FTTB FTTH • 2.63 million, 93% of households • 72.3% FTTH/B household penetration rate • 40.3% Fibre-to-the-home • 32.0% Fiber-to-the-building • Up to 10G for fixed broadband services Wi-Fi • 47,652 public Wi-Fi hotspots • free Wi-Fi in 603 government premises Average Connection Speed: 21.9Mbps • Source: Akamai Q1 2017 State of the Internet Report (SOTI) Average Peak Connection Speed: 129Mbps • Source: Akamai Q1 2017 State of the Internet Report (SOTI) Mobile Services